Economic, financial and monetary developments

Overview

On 8 September 2022 the Governing Council decided to raise the three key ECB interest rates by 75 basis points. This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will ensure the timely return of inflation to the Governing Council’s 2% medium-term target. Based on the Governing Council’s updated assessment, over the next several meetings it expects to raise interest rates further to dampen demand and guard against the risk of a persistent upward shift in inflation expectations. The Governing Council will regularly re-evaluate its policy path in light of incoming information and the evolving inflation outlook. Its future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

The Governing Council took this decision, and expects to raise interest rates further, because inflation remains far too high and is likely to stay above its target for an extended period. According to Eurostat’s flash estimate, inflation reached 9.1% in August. Soaring energy and food prices, demand pressures in some sectors owing to the reopening of the economy, and supply bottlenecks are still driving up inflation. Price pressures have continued to strengthen and broaden across the economy and inflation may rise further in the near term. As the current drivers of inflation fade over time and the normalisation of monetary policy works its way through to the economy and price-setting, inflation will come down. Looking ahead, ECB staff have significantly revised up their inflation projections and inflation is now expected to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024.

After a rebound in the first half of 2022, recent data point to a substantial slowdown in euro area economic growth, with the economy expected to stagnate later in the year and in the first quarter of 2023. Very high energy prices are reducing the purchasing power of people’s incomes and, although supply bottlenecks are easing, they are still constraining economic activity. In addition, the adverse geopolitical situation, especially Russia’s unjustified aggression towards Ukraine, is weighing on the confidence of businesses and consumers. This outlook is reflected in the latest staff projections for economic growth, which have been revised down markedly for the remainder of the current year and throughout 2023. Staff now expect the economy to grow by 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024.

The lasting vulnerabilities caused by the pandemic still pose a risk to the smooth transmission of monetary policy. The Governing Council will therefore continue applying flexibility in reinvesting redemptions coming due in the pandemic emergency purchase programme (PEPP) portfolio, with a view to countering risks to the transmission mechanism related to the pandemic.

Economic activity

High inflation, tighter financial conditions and lingering supply-related headwinds are taking their toll on economic activity worldwide. Survey data signal a broad-based moderation in economic activity. According to the September 2022 ECB staff macroeconomic projections, the global growth outlook is subdued, with global real GDP (excluding the euro area) projected to grow by 2.9% in 2022, 3.0% in 2023 and 3.4% in 2024. This outlook is weaker than that described in the June 2022 Eurosystem staff macroeconomic projections and implies that the global economy is expected to grow at a rate slightly below its long-term average this year and next year, as economic activity slows across advanced and emerging market economies. A weaker demand outlook and improved supply have helped to alleviate supply chain pressures, though they are still present. In line with global growth, the outlook for global trade and euro area foreign demand has also deteriorated compared with the June projections. Global inflationary pressures remain broad and elevated amid commodity price spikes, lingering supply constraints, still relatively robust demand and tight labour markets. These pressures are, however, expected to decline as commodity markets stabilise and growth weakens. In an environment of high uncertainty, the balance of risks around the baseline projections is tilted to the downside for global growth and to the upside for global inflation.

The euro area economy grew by 0.8% in the second quarter of 2022, mainly owing to strong consumer spending on contact-intensive services, as a result of the lifting of pandemic-related restrictions. Over the summer, as people travelled more, countries with large tourism sectors benefited especially. At the same time, businesses suffered from high energy costs and continued supply bottlenecks, although the latter have been gradually easing. While buoyant tourism has been supporting economic growth during the third quarter, the Governing Council expects the economy to slow down substantially over the remainder of this year. There are four main reasons behind this. First, high inflation is dampening spending and production throughout the economy, and these headwinds are reinforced by gas supply disruptions. Second, the strong rebound in demand for services that came with the reopening of the economy will lose steam in the coming months. Third, the weakening in global demand, also in the context of tighter monetary policy in many major economies, and the worsening terms of trade will mean less support for the euro area economy. Fourth, uncertainty remains high and confidence is falling sharply.

At the same time, the labour market has remained robust, supporting economic activity. Employment increased by more than 600,000 people in the second quarter of 2022 and the unemployment rate stood at a historical low of 6.6% in July. Total hours worked increased further, by 0.6%, in the second quarter of 2022 and have surpassed their pre-pandemic levels. Looking ahead, the slowing economy is likely to lead to some increase in the unemployment rate.

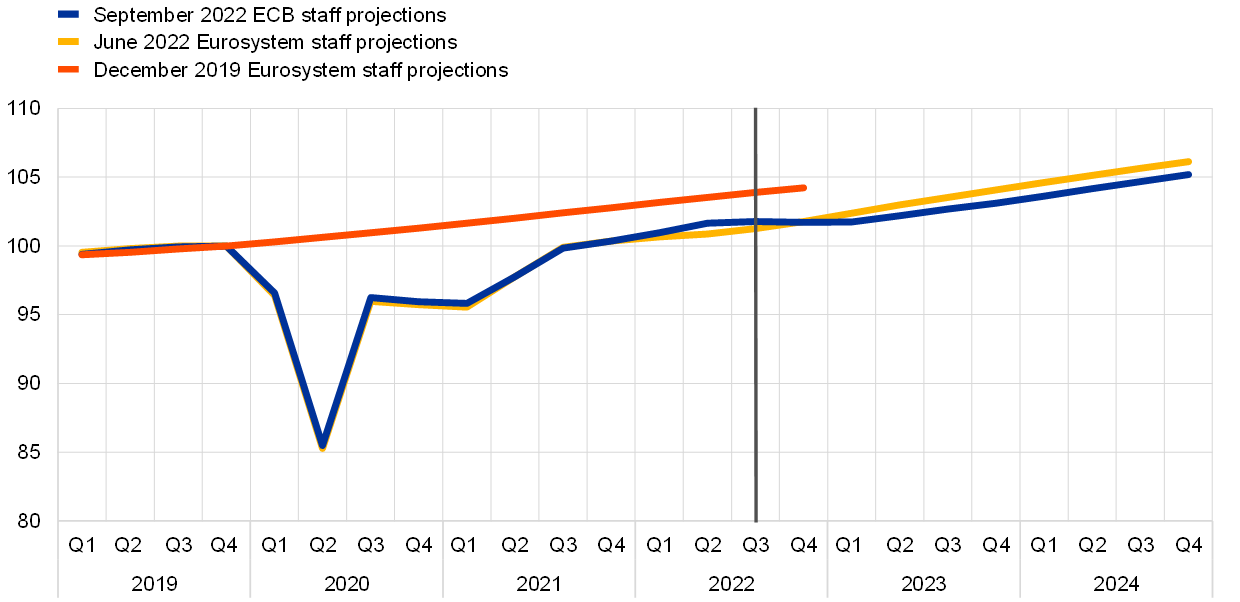

The euro area baseline scenario of the September 2022 ECB staff macroeconomic projections rests on the assumptions that gas demand will be tempered by high prices and precautionary energy saving measures (following the recent EU agreement to reduce gas demand by up to 15%) and that no major rationing of gas will be needed. Nevertheless, some production cuts are assumed to be necessary in the winter in countries that are heavily dependent on imports of Russian natural gas and at risk of a shortfall in supply. Although supply bottlenecks have recently eased somewhat faster than had been expected, they are still weighing on activity and are assumed to dissipate only gradually. Over the medium term as the energy market rebalances, uncertainty declines, supply bottlenecks are resolved and real incomes improve, growth is expected to rebound, despite less favourable financing conditions. The labour market is expected to weaken following the slowdown in economic activity, though remaining overall rather resilient. Overall, according to the September 2022 ECB staff projections, annual average real GDP growth is expected to stand at 3.1% in 2022, to slow down markedly to 0.9% in 2023 and to rebound to 1.9% in 2024. Compared with the June 2022 Eurosystem staff projections, the outlook for GDP growth has been revised up by 0.3 percentage points for 2022, following positive surprises in the first half of the year, and revised down by 1.2 percentage points for 2023 and by 0.2 percentage points for 2024, mainly owing to the impact of energy supply disruptions, higher inflation and the related fall in confidence.

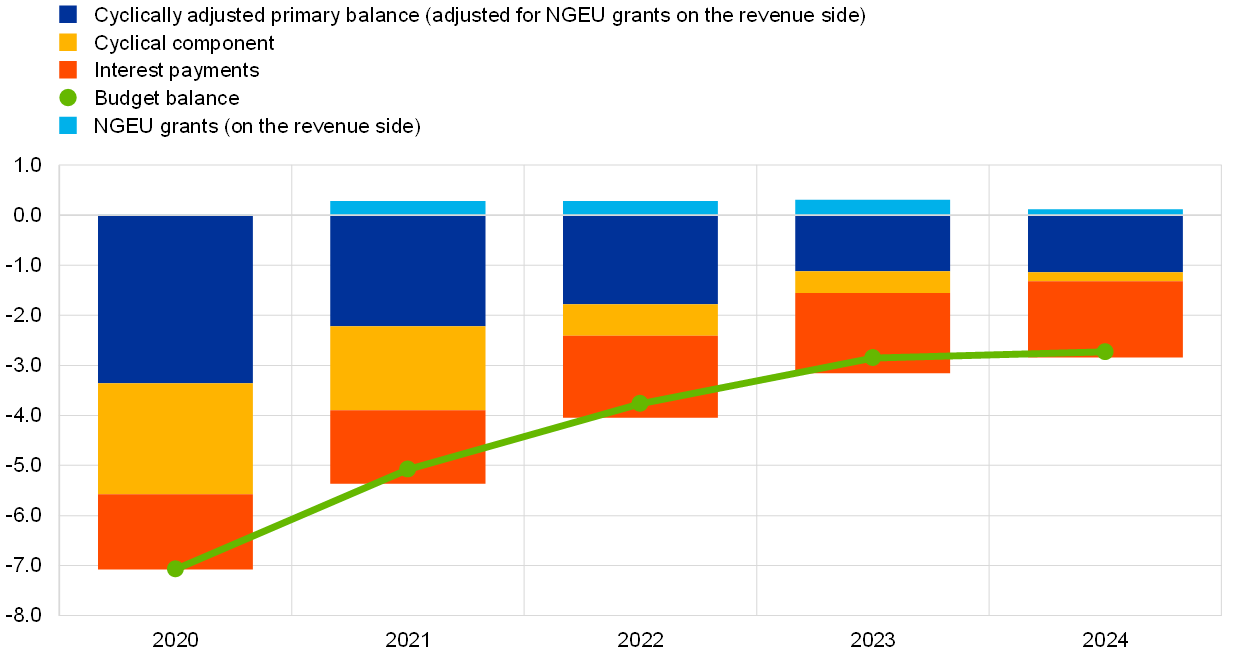

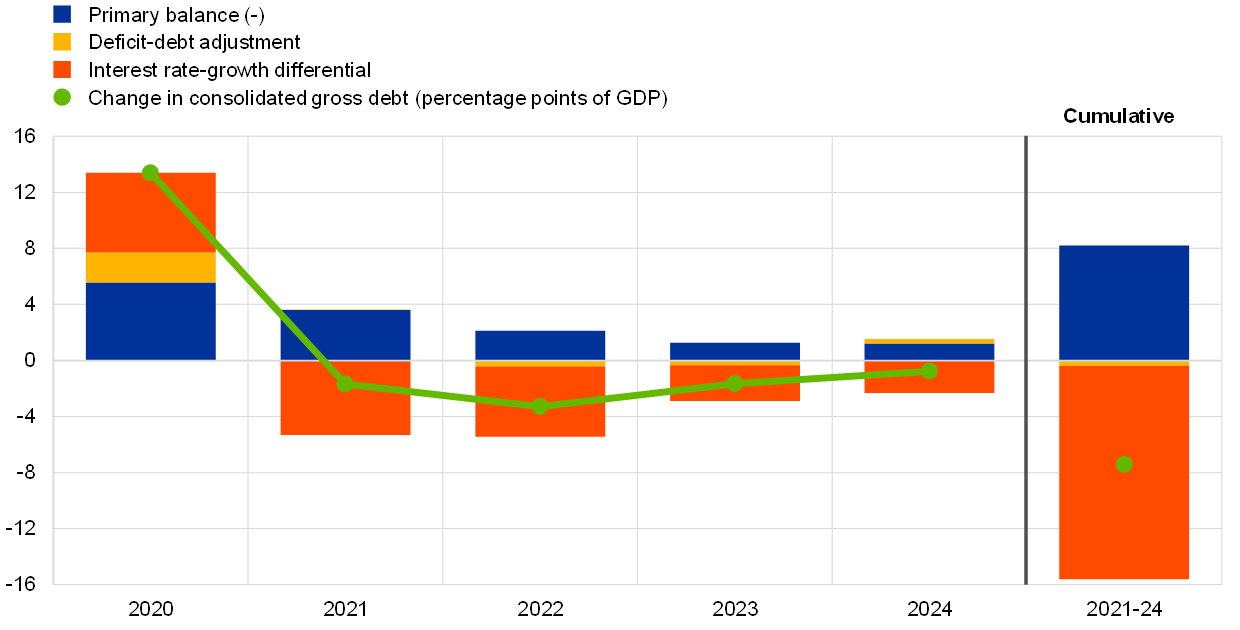

According to the September 2022 ECB staff macroeconomic projections, the euro area budget balance is projected to improve steadily in the period up to 2024, although by somewhat less than foreseen in the June projections. However, the fiscal projections continue to be surrounded by high levels of uncertainty, mainly related to the war in Ukraine and developments in energy markets that could lead governments to adopt additional fiscal stimulus measures. Such fiscal support measures have been largely aimed at countering the rising cost of living for consumers, particularly in relation to energy. Moreover, the financing of new defence capacities and support for refugees from Russia’s war in Ukraine have also played a role. Nevertheless, the euro area government budget deficit is expected to continue to fall, declining from 5.1% of GDP in 2021 to 3.8% in 2022 and then to 2.7% by the end of the forecast horizon. Following the strong fiscal loosening in response to the coronavirus (COVID-19) crisis in 2020, the fiscal stance tightened last year and is projected to continue to tighten somewhat, in particular in 2023, and to be neutral in 2024. In a context of heightened uncertainty and downside risks to the economic outlook in the light of the war in Ukraine, as well as energy price increases and continued supply chain disturbances, on 23 May 2022 the European Commission recommended extending the general escape clause of the Stability and Growth Pact to the end of 2023. This would allow fiscal policies to adjust to changing circumstances if necessary. At the same time, with fiscal imbalances still exceeding their pre-pandemic levels and inflation exceptionally high, fiscal policy needs to be increasingly selective and targeted in order to avoid adding to medium-term inflationary pressures, while ensuring fiscal sustainability over the medium term.

Fiscal support measures to cushion the impact of higher energy prices should be temporary and targeted at the most vulnerable households and firms to limit the risk of fuelling inflationary pressures, to enhance the efficiency of public spending and to preserve debt sustainability. Structural policies should aim at raising the euro area’s growth potential and supporting its resilience

Inflation

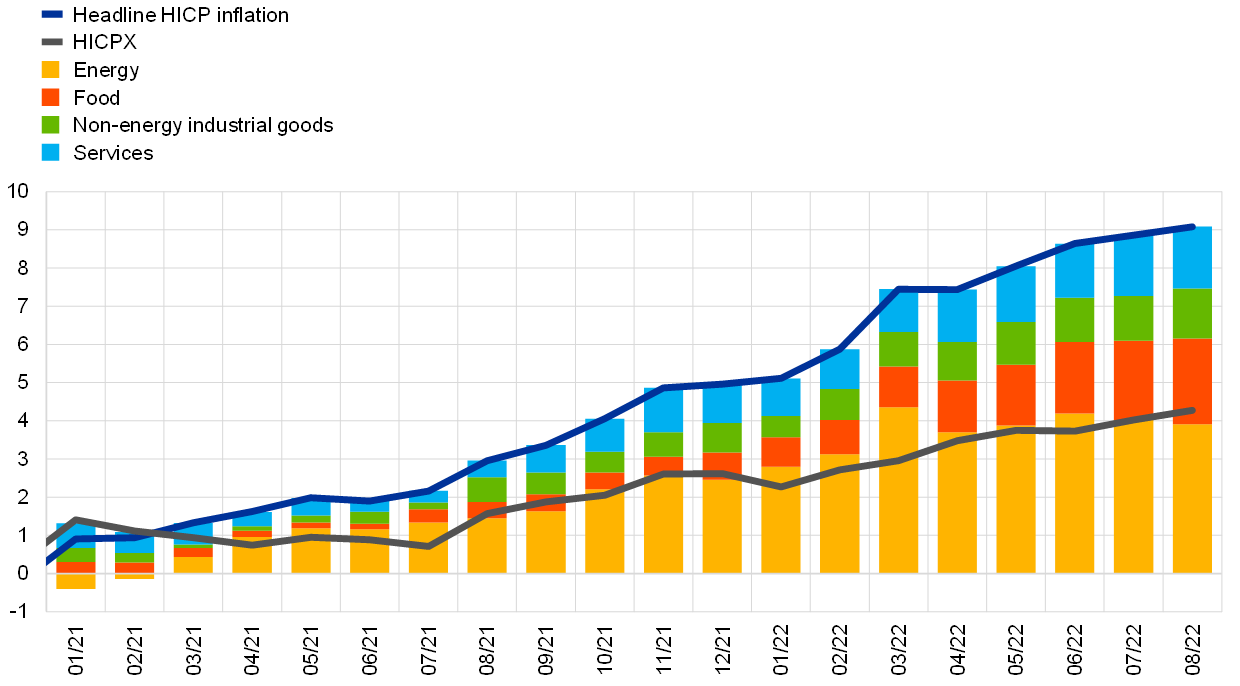

Inflation rose further to 9.1% in August. Energy price inflation remained extremely elevated, at 38.3%, and it was again the dominant component of overall inflation. Market-based indicators suggest that, in the near term, oil prices will moderate, while wholesale gas prices will stay extraordinarily high. Food price inflation also rose in August, to 10.6%, partly reflecting higher input costs related to energy, disruptions of trade in food commodities and adverse weather conditions. While supply bottlenecks have been easing, these continue to gradually feed through to consumer prices and are putting upward pressure on inflation, as is recovering demand in the services sector. The depreciation of the euro has also added to the build-up of inflationary pressures. Price pressures are spreading across more and more sectors, in part owing to the impact of high energy costs across the whole economy. Accordingly, measures of underlying inflation remain at elevated levels and the latest staff projections see inflation excluding food and energy reaching 3.9% in 2022, 3.4% in 2023 and 2.3% in 2024. Resilient labour markets and some catch-up to compensate for higher inflation are likely to support growth in wages. At the same time, incoming data and recent wage agreements indicate that wage dynamics remain contained overall. Most measures of longer-term inflation expectations currently stand at around 2%, although recent above-target revisions to some indicators warrant continued monitoring.

Inflation continues to surge on the back of further large supply shocks, which are feeding through to consumer prices at a faster pace than in the past. According to the September 2022 ECB staff macroeconomic projections, Headline HICP inflation is expected to stay above 9% for the rest of 2022 owing to extremely elevated energy and food commodity prices, as well as upward pressures from the reopening of the economy, supply shortages and tight labour markets. The expected decline in inflation from an average of 8.1% in 2022 to 5.5% in 2023 and 2.3% in 2024 mainly reflects a sharp decline in energy and food price inflation as a result of negative base effects and an assumed decline in commodity prices, in line with futures prices. HICP inflation excluding energy and food is seen to remain at unprecedented high levels until the middle of 2023 but is also expected to decline thereafter as the effects of the reopening of the economy subside and as supply bottlenecks and energy input cost pressures ease. Headline inflation is expected to remain above the ECB’s target of 2% in 2024. This is due to lagged effects of high energy prices on the non-energy components of inflation, the recent depreciation of the euro, robust labour markets and some effects of inflation compensation on wages, which are expected to grow at rates well above historical averages. Compared with the June 2022 Eurosystem staff projections, headline inflation has been revised up substantially for 2022 (by 1.3 percentage points) and 2023 (2.0 percentage points), and slightly for 2024 (0.2 percentage points), reflecting recent data surprises, dramatic increases in the assumptions for wholesale gas and electricity prices, stronger wage growth and the recent depreciation of the euro. These effects more than offset the downward impact of the recent decline in food commodity prices, less severe than previously assumed supply bottlenecks and the weaker growth outlook.

Risk assessment

In the context of the slowing global economy, risks to growth are primarily on the downside, in particular in the near term. As reflected in the downside scenario in the staff projections, a long-lasting war in Ukraine remains a significant risk to growth, especially if firms and households faced rationing of energy supplies. In such a situation, confidence could deteriorate further and supply-side constraints could worsen again. Energy and food costs could also remain persistently higher than expected. A further deterioration in the global economic outlook could be an additional drag on euro area external demand.

The risks to the inflation outlook are primarily on the upside. In the same way as for growth, the major risk in the short term is a further disruption of energy supplies. Over the medium term, inflation may turn out to be higher than expected because of a persistent worsening of the production capacity of the euro area economy, further increases in energy and food prices, a rise in inflation expectations above the Governing Council’s target, or higher than anticipated wage rises. However, if energy costs were to decline or demand were to weaken over the medium term, it would lower pressures on prices.

Financial and monetary conditions

Market interest rates have increased in anticipation of further monetary policy normalisation in response to the inflation outlook. Credit to firms has become more expensive over recent months, and bank lending rates for households now stand at their highest levels in more than five years. In terms of volumes, bank lending to firms has so far remained strong, in part reflecting the need to finance high production costs and inventory building. Mortgage lending to households is moderating because of tightening credit standards, rising borrowing costs and weak consumer confidence.

Monetary policy decisions

Based on its current assessment, the Governing Council decided to raise the three key ECB interest rates by 75 basis points. Accordingly, the interest rate on the main refinancing operations and the interest rates on the marginal lending facility and the deposit facility were increased to 1.25%, 1.50% and 0.75% respectively, with effect from 14 September 2022. This major step frontloads the transition from the prevailing highly accommodative level of policy rates towards levels that will support a timely return of inflation to the Governing Council’s 2% medium-term target. The Governing Council took this decision, and expects to raise interest rates further, because inflation remains far too high and is likely to stay above its target for an extended period. Future policy rate decisions will continue to be data-dependent and follow a meeting-by-meeting approach.

Following the raising of the deposit facility rate to above zero, the two-tier system for the remuneration of excess reserves is no longer necessary. The Governing Council therefore decided at its meeting on 8 September 2022 to suspend the two-tier system by setting the multiplier to zero.

The Governing Council intends to continue reinvesting, in full, the principal payments from maturing securities purchased under the asset purchase programme for an extended period of time past the date when it started raising the key ECB interest rates and, in any case, for as long as necessary to maintain ample liquidity conditions and an appropriate monetary policy stance. As concerns the PEPP, the Governing Council intends to reinvest the principal payments from maturing securities purchased under the programme until at least the end of 2024. In any case, the future roll-off of the PEPP portfolio will be managed to avoid interference with the appropriate monetary policy stance. Redemptions coming due in the PEPP portfolio are being reinvested flexibly, with a view to countering risks to the monetary policy transmission mechanism related to the pandemic.

The Governing Council will continue to monitor bank funding conditions and ensure that the maturing of operations under the third series of targeted longer-term refinancing operations (TLTRO III) does not hamper the smooth transmission of its monetary policy. It will also regularly assess how targeted lending operations are contributing to its monetary policy stance.

To preserve the effectiveness of monetary policy transmission and safeguard orderly market functioning, on 8 September 2022 the Governing Council decided to temporarily remove the 0% interest rate ceiling for remunerating government deposits. Instead, the ceiling will temporarily remain at the lower of either the Eurosystem’s deposit facility rate or the euro short-term rate (€STR), also under a positive deposit facility rate. The measure is intended to remain in effect until 30 April 2023. This change will prevent an abrupt outflow of deposits into the market, at a time when some segments of the euro area repo markets are showing signs of collateral scarcity, and will allow for an in-depth assessment of how money markets are adjusting to the return to positive interest rates.

The Governing Council stands ready to adjust all of its instruments within its mandate to ensure that inflation stabilises at its 2% target over the medium term. The Transmission Protection Instrument is available to counter unwarranted, disorderly market dynamics that pose a serious threat to the transmission of monetary policy across all euro area countries, thus allowing the Governing Council to more effectively deliver on its price stability mandate.

1 External environment

High inflation, tighter financial conditions and lingering supply bottlenecks are taking their toll as global economic activity is slowing down. According to the September 2022 ECB staff macroeconomic projections, the global growth outlook is subdued, with global real GDP – excluding the euro area – projected to grow by 2.9% in 2022, 3.0% in 2023 and 3.4% in 2024. This outlook is weaker than that described in the June 2022 Eurosystem staff macroeconomic projections and implies that the global economy is expected to grow at a rate slightly below its long-term average this year and next, as economic activity slows across advanced and emerging market economies. A weaker demand outlook and improved supply have helped to alleviate supply chain pressures, though these are still present. The outlook for global trade and euro area foreign demand has also deteriorated compared with the June projections. Global price pressures remain broad-based and elevated amid commodity price spikes, lingering supply constraints, still relatively robust demand and tight labour markets. These pressures are, however, expected to decline as commodity markets stabilise and growth weakens. In an environment of high uncertainty, the balance of risks around the baseline projections is tilted to the downside for global growth and to the upside for global price pressures.

The world economy is slowing down, as high inflation, tighter financial conditions and lingering supply bottlenecks take their toll on economic activity. The war in Ukraine has pushed energy commodity prices higher and disrupted global food supply chains, fuelling inflationary pressures worldwide and raising concerns about global food security. In China, the economic recovery from the spring lockdowns in key provinces has stalled recently. This is due to weaker demand as a result of the strict containment measures introduced to tackle small-scale coronavirus (COVID-19) outbreaks, production cuts in some energy-intensive sectors and a deepening recession in the residential real estate sector. The sustained easing of pandemic restrictions across major advanced economies since the spring has helped to support consumption in the travel and hospitality sectors. However, the exceptionally strong inflationary pressures that have forced central banks to tighten monetary policy are weighing on disposable income and savings accumulated during the pandemic.

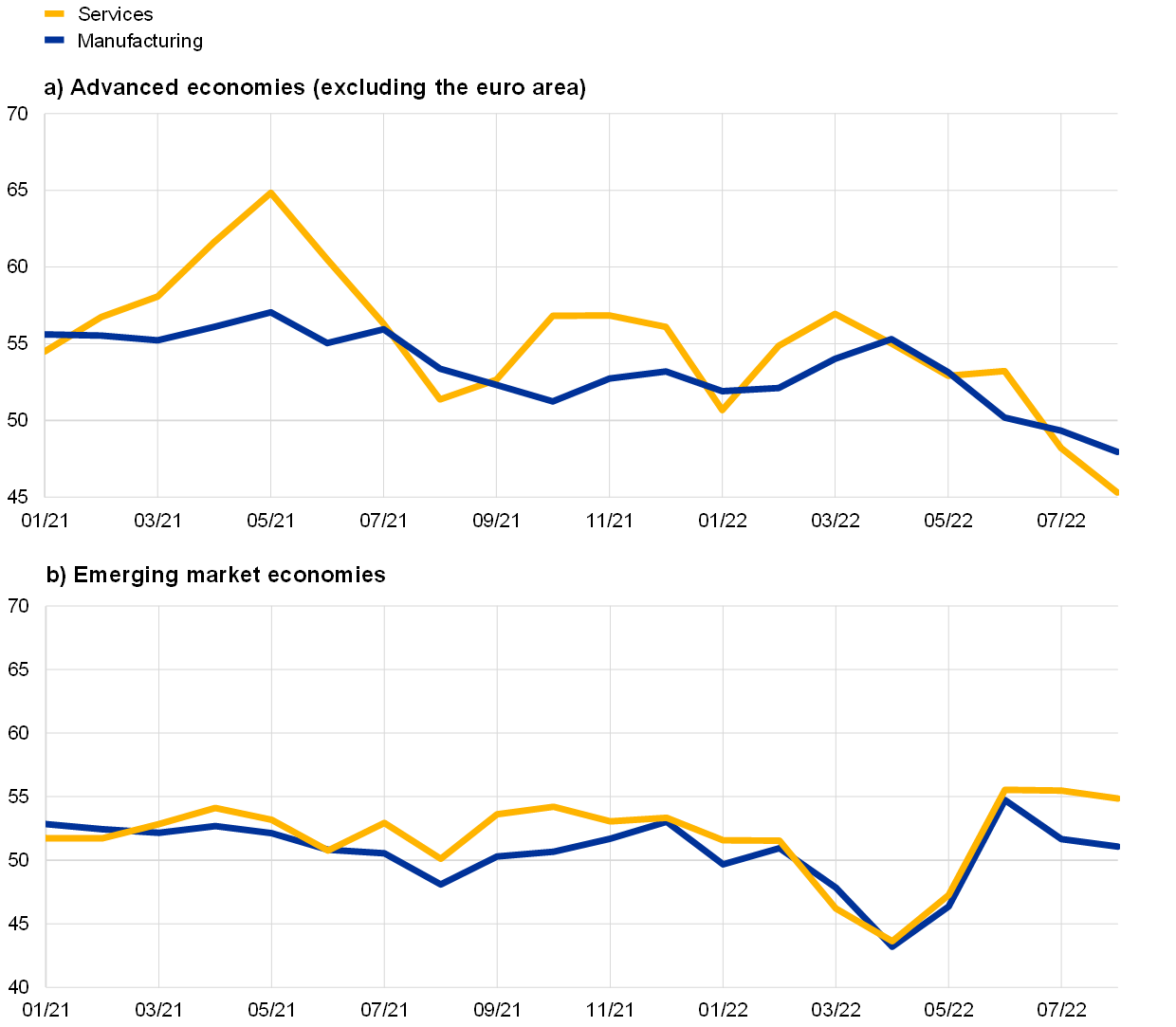

Survey data signal a broad-based moderation in economic activity. Manufacturing output in advanced and emerging market economies deteriorated further in August 2022 (Chart 1). Similar developments are also visible in the services sector, especially for advanced economies. The activity tracker for global real GDP (excluding the euro area), which is based on a broad range of indicators, confirms survey-based evidence and points to a continued loss of momentum in economic activity over the course of August. These developments align with the estimated contraction in the second quarter of 2022, as global real GDP growth (excluding the euro area) stood at -0.6%. Compared with the June projections, this more negative outturn reflects weaker than previously projected growth in China, Japan, the United Kingdom and the United States.

Chart 1

PMI output by sector and economy type

(diffusion indices)

Sources: S&P Global and ECB staff calculations.

Note: The latest observations are for August 2022.

The global growth outlook is subdued, with global real GDP (excluding the euro area) projected to grow by 2.9% in 2022, 3.0% in 2023 and 3.4% in 2024. Overall, the global economy is expected to grow at a rate slightly below its long-term average this year and next, as economic activity slows down across advanced and emerging market economies. Compared with the June 2022 Eurosystem staff macroeconomic projections, global real GDP growth (excluding the euro area) has been revised down by 0.1 percentage points for 2022, 0.4 percentage points for 2023 and 0.2 percentage points for 2024. Worsening outlooks for China and the United States explain most of the downward revisions to growth over the projection horizon. In the United Kingdom, the sharp rise in energy prices is expected to significantly weigh on activity, which is projected to start declining by the turn of the year. The downward revisions to growth for this year have been partly offset by a somewhat milder than previously envisaged recession in a Russia that has so far proved more resilient to economic sanctions than originally anticipated, and by stronger than previously expected activity in some large emerging market economies, such as Brazil, Mexico and Turkey.

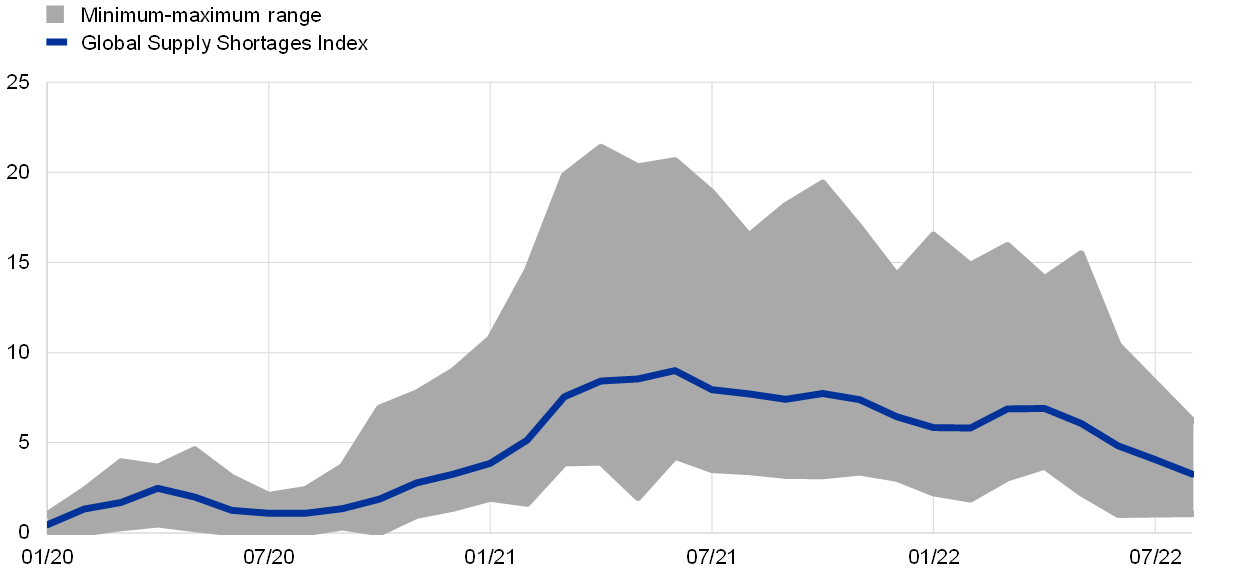

Weaker activity in global manufacturing is weighing on trade that already started to decelerate in spring this year. Notwithstanding the supply disruptions brought about by the strict lockdowns in key Chinese provinces this spring, a loss in trade momentum is clearly visible in global goods trade, as private demand for goods gradually normalises from high levels across advanced economies. Moreover, the prospects for global goods trade continue to deteriorate, as indicated by new export orders in manufacturing, which remained in contractionary territory in August for the second consecutive month. Against this backdrop, suppliers’ delivery times shortened, though they still remain above their previous levels in some key economies such as the United Kingdom and the United States. Supply shortages also eased across a broad range of items in the manufacturing sector, helping, together with moderating demand, to alleviate some of the global supply pressures (Chart 2). Even so, some supply bottlenecks still remain.

Chart 2

Global Supply Shortages Index

(index)

Sources: S&P Global and ECB staff calculations.

Notes: The Global Supply Shortages Index measures how many selected items have been in short supply against their long-run average for each month. The long-run average refers to value 1 of the index. The shaded minimum-maximum range refers to the 5th-95th percentile range across 20 items. The latest observations are for August 2022.

The global trade outlook has also deteriorated. Global imports (excluding the euro area) are expected to grow by 4.6% in 2022, 2.7% in 2023 and 3.4% in 2024, while euro area foreign demand is projected to be somewhat weaker, especially in 2023. Compared with the June projections, the outlooks for global trade and for euro area foreign demand have been revised down for the later years of the projection horizon. For this year, however, both have been revised up on the back of stronger than previously expected trade dynamics across advanced economies in early 2022, especially in the United Kingdom and European countries outside the euro area.

Global price pressures remain broad-based and elevated. They reflect commodity price spikes, lingering supply constraints, still relatively robust demand and tight labour markets, although inflationary pressures are expected to ease gradually as commodity markets stabilise and growth weakens. Annual headline inflation in OECD countries – excluding Turkey – declined slightly to 8.0% in July from 8.1% in June, as an increase in core inflation was more than compensated for by a lower contribution from energy and food inflation.[1] Meanwhile, inflation momentum remains strong and well above the level prevailing in mid-2021 when demand recovered strongly as economies reopened (Chart 3).

Increasing inflationary pressures are also evident from the rising export prices of euro area competitors. These prices (in national currencies) have been revised upwards compared with the June projections, as the impact of slightly lower oil and non-energy commodity price assumptions is outweighed by more intense domestic and global pipeline price pressures. However, the anticipated decline in commodity prices in line with their futures, coupled with the deterioration in global growth, is projected to dampen inflationary pressures in the medium term.

Chart 3

OECD consumer price inflation

(year-on-year percentage changes and three-month-on-three-month annualised percentage changes)

Sources: OECD and ECB calculations.

Notes: The OECD aggregates reported in the panels are calculated excluding Turkey. In Turkey, annual headline and core inflation stood at 79.6% and 63.8% respectively. Annual headline and core inflation in July for OECD countries including Turkey (not shown in the panels) were 10.2% and 6.8% respectively, compared with 10.3% and 6.5% in June. Core inflation excludes energy and food. The latest observations are for July 2022.

Oil and non-energy commodity prices declined compared with the June projections, while European gas prices shot up further. The downward pressure on oil prices was related to the prospect of oil demand easing, brought about by the worsening global economic outlook and increases in world oil production. In July world oil production reached its highest level since January 2020. Russian oil supply has so far proven more resilient than expected, but this is in large part down to Russia diverting its oil exports to India, Turkey and China. While oil prices have declined recently, gas prices have risen further, mainly on the back of Russian supply cuts. Most notably, the 80% reduction in gas deliveries to Germany via the Nord Stream 1 pipeline in July and the more recent announcement that these gas flows would be interrupted again indefinitely have heightened fears that Russian gas supplies to western Europe will be completely cut off. The price of industrial metals declined amid concerns over Chinese demand and, more generally, the deteriorating global economic outlook. Food prices also fell, mainly owing to trilateral deals agreed by Turkey and the United Nations with Russia and Ukraine to establish a safe corridor for Ukrainian grain shipments.

Developments in global financial conditions have been mixed since the previous projections. Initially, financial conditions tightened. High and rising inflation led to faster monetary policy normalisation than previously expected, higher bond yields and a correction in risky assets. However, as the growth outlook weakened, a significant part of this tightening has recently gone into reverse, especially in emerging market economies and to a lesser extent the United States and other advanced economies. This loosening counteracts some of the impact of actions taken by central banks while they generally signalled that much still needs to be done to rein in record-high inflation. Given the data-dependent nature of monetary policy, financial conditions remain sensitive to new inflation and macroeconomic developments.

In the United States, real GDP contracted again in the second quarter of 2022, as household spending weakened and investment declined. Rising mortgage rates and high cost pressures led to a fall in residential investment as housing starts continue to drop. Private consumption decelerated amid deteriorating consumer confidence and falling real disposable income owing to high inflation. Looking ahead, real GDP growth is projected to turn positive as of the third quarter, although it is expected to remain subdued overall. Headline inflation eased more than expected in July, following an acceleration in June. Annual headline consumer price inflation declined to 8.5% in July, as energy prices decreased, while core inflation remained unchanged at 5.9%.

The Chinese economy rebounded in June 2022, but the recovery stalled in July. Economic activity contracted sharply in the second quarter of 2022 as a result of the strict containment measures implemented under China’s zero-COVID strategy in response to outbreaks in key provinces. The economy is forecast to return to growth in the second half of this year, under the assumption of enhanced policy support and limited incidence of COVID-19 outbreaks. Accordingly, compared with the June projections, the growth outlook for China has been revised down markedly for this year and somewhat less for the remainder of the projection horizon. Consumer price pressures in China remain moderate, though.

In Japan, the recovery in economic activity resumed, supported by the reopening of the economy. After a contraction in the first quarter of 2022, the economic recovery resumed in the second quarter, supported by a rebound in domestic demand following an easing of COVID-19 restrictions. The economy is expected to remain on a moderate recovery path. Annual CPI inflation is projected to stay above the Japanese central bank’s 2% target this year and to fall below it thereafter.

In the United Kingdom, growth momentum is set to weaken further, as a decline in household disposable income weighs on consumer spending. Real GDP growth slowed in the second quarter of 2022 and is expected to decrease further in the coming quarters. Given the sharp rise in inflation, which is projected to increase further, economic activity is expected to start declining by the turn of the year. The labour market remains tight, while broad wage pressures are adding to the persistently high domestic inflation. High commodity prices are also expected to continue to push up consumer price inflation over the rest of this year.

In Russia, recent data signal the onset of a recession which is likely to be less severe than previously expected. In the second quarter of 2022, real GDP declined by 5.8% compared with the previous quarter, suggesting that the projected recession this year is likely to be less pronounced than indicated in the June 2022 Eurosystem staff projections. Nevertheless, economic activity is projected to decline significantly, as both domestic demand and international trade are being increasingly hit by unprecedented international sanctions. These sanctions have led to higher import prices and supply disruptions, both of which are exerting upward pressure on inflation. However, some of this pressure has recently been offset by a stronger rouble and weaker consumer demand.

2 Economic activity

The euro area economy grew by 0.8% in the second quarter of 2022. This mainly reflected the dynamism of the services sector, as the lifting of pandemic-related restrictions supported consumer spending in contact-intensive services. Travel increased, which particularly helped those countries with a large tourism industry. By contrast, the manufacturing sector suffered from high energy costs, reductions in gas supplies and continued, albeit declining, supply bottlenecks. Looking ahead, the economic consequences of the war in Ukraine are continuing to unfold and to darken the euro area outlook. In the third quarter, economic activity is expected to slow substantially. While a dynamic tourism sector was still supporting euro area economic growth in the summer months, the boosting effect of the reopening of the economy is fading. Moreover, all sectors of the economy are being negatively affected by high inflation and persistent uncertainty, notably related to gas supply disruptions and the broader geopolitical repercussions of a long-lasting war. The same factors are expected to continue to weigh on euro area activity during the winter of 2022/23. On the upside, fiscal measures aimed at cushioning the impact of higher energy prices, overall resilient labour markets and accumulated savings should help support economic activity. Beyond the near term, as the energy market rebalances, uncertainty declines, supply bottlenecks are resolved and real incomes improve, euro area economic growth is expected to gradually recover.

This assessment is broadly reflected in the September 2022 ECB staff macroeconomic projections for the euro area, which foresee annual real GDP growth at 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024. Compared with the June 2022 Eurosystem staff macroeconomic projections, the outlook was revised upwards for 2022 and downwards for 2023 and 2024.

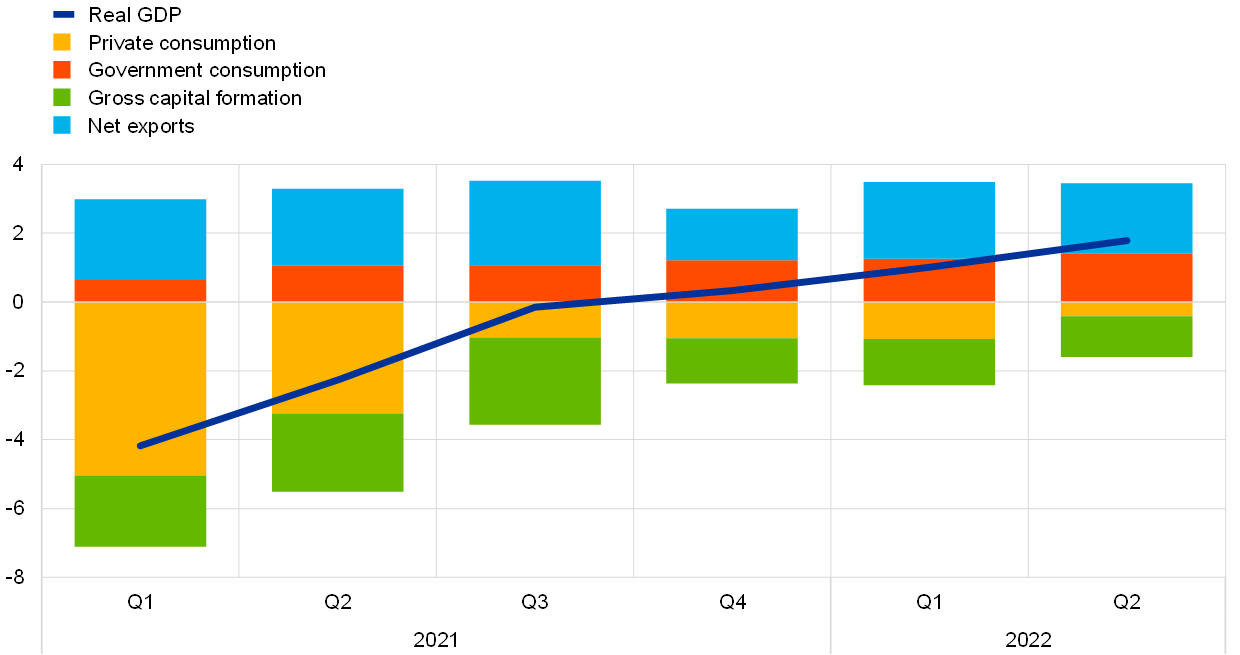

Economic activity in the euro area benefited from the reopening of the economy in the second quarter of 2022. Real GDP increased by 0.8% quarter on quarter, driven by a positive contribution from domestic demand, whereas net trade had a small negative impact. Private consumption and investment rose strongly in the second quarter, while government consumption displayed a more modest increase (Chart 4). Most of the unexpectedly robust growth in the second quarter was due to strong activity in the services sector following the lifting of most pandemic-related restrictions. Available country data and short-term indicators point to a shift in private consumption away from goods and towards services, especially the most contact-intensive services. Consumer spending on tourism and hospitality-related services was already remarkably strong in the spring, which particularly benefited countries with a large tourism industry, like Spain, Italy and France.

Chart 4

Euro area real GDP and its components

(percentage changes since the fourth quarter of 2019; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the second quarter of 2022.

Looking ahead, there are clear signs of a continued slowdown in economic activity against a background of high inflation and persistent uncertainty related to the war in Ukraine and energy-related developments. Incoming survey data point to a downward growth momentum affecting all sectors of the economy in the third quarter of 2022. The composite Purchasing Managers’ Index (PMI) decreased in August to an 18-month low, standing in contractionary territory for the second consecutive month. This further decline continues to be driven by the manufacturing sector, which is suffering from high energy costs, continued, albeit declining, supply bottlenecks and falling demand (Chart 5, panel a). The services PMI fell in August to a level indicating stagnation in activity. This suggests that the positive effects of the post-pandemic rebound in consumer spending on services are waning, dampened by cost-of-living pressures, despite the still favourable impact of tourism activity in the summer months. In addition, bottlenecks related to labour shortages have considerably intensified in the services sector. The most recent confidence indicators also point to slowing growth dynamics across sectors in the third quarter. The further fall in the European Commission’s Economic Sentiment Indicator (ESI) in August was largely driven by a significant weakening of confidence in industry and, to a lesser extent, in services (Chart 5, panel b). Consumer confidence improved somewhat in August from its record low in July. Nevertheless, it remains below its previous trough reached at the beginning of the coronavirus (COVID-19) crisis. These latest developments reflect households’ ongoing concerns about high energy and food prices amid elevated uncertainty surrounding the impact of the war in Ukraine.

Chart 5

Survey indicators across sectors of the economy

(panel a: percentage balances; panel b: percentage balances, February 2020 = 100)

Sources: S&P Global (panel a), European Commission and ECB calculations (panel b).

Notes: “Contact-intensive services” refers to accommodation, food and beverage services. The latest observations are for August 2022.

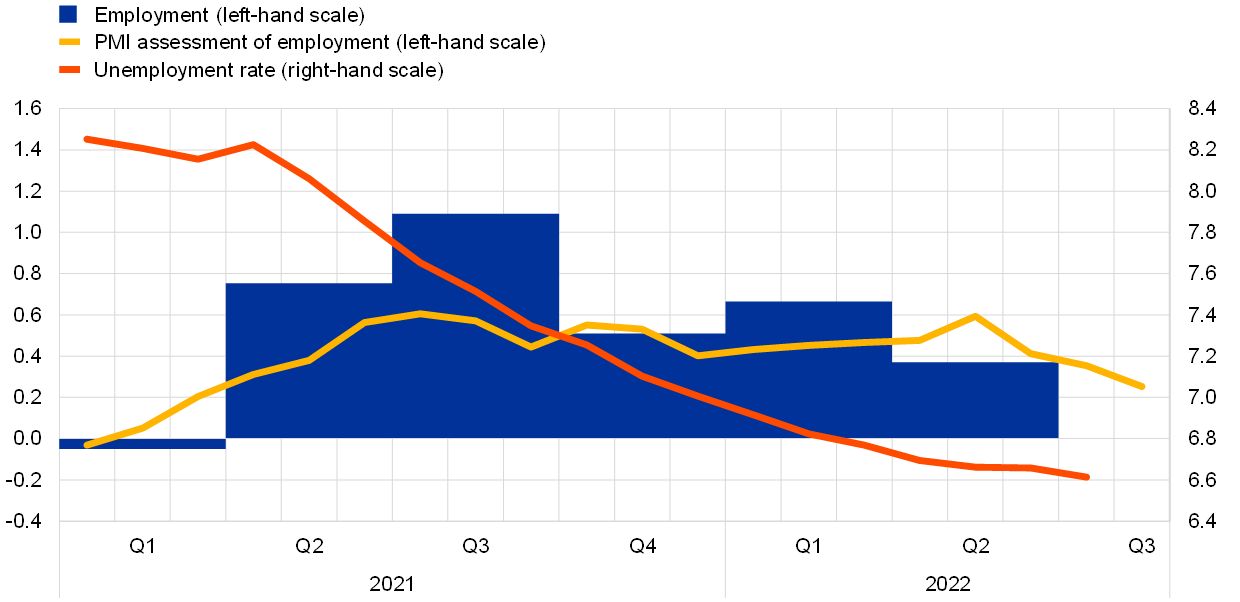

At the same time, the labour market has remained robust, supporting economic activity. Total employment increased by 0.4% quarter on quarter in the second quarter of 2022, following an increase of 0.7% in the first quarter. This implies an increase in the number of people in employment of 2.7 million between the fourth quarter of 2019 and the second quarter of 2022. The level of total employment is now in line with what would be implied by its historical relationship with real GDP. Hours worked increased by 0.6% in the second quarter of 2022 and now stands 0.6% higher than the pre-pandemic level in the fourth quarter of 2019. The unemployment rate stood at 6.6% in July 2022, which was slightly (0.1 percentage points) lower than in June and around 0.8 percentage points lower than the pre-pandemic level observed in February 2020 (Chart 6). Recourse to job retention schemes also continued to decline and was estimated at 0.9% of the labour force in the second quarter of 2022, down from 1.4% in the first quarter. This compares with more than 15% of the labour force in job retention schemes in the second quarter of 2020. The euro area labour market has strengthened considerably since the onset of the pandemic. Notably, in the first quarter of 2022 there was one job vacancy for every three unemployed workers, and in July 2022 more than 33% of euro area firms reported that labour shortages were limiting their production. This development was broad-based across sectors.

Chart 6

Euro area employment, the PMI employment indicator and the unemployment rate

(left-hand scale: quarter-on-quarter percentage changes, diffusion index; right-hand scale: percentages of the labour force)

Sources: Eurostat, S&P Global and ECB calculations.

Notes: The two lines indicate monthly developments; the bars show quarterly data. The PMI is expressed as a deviation from 50 divided by 10. The latest observations are for the second quarter of 2022 for employment, August 2022 for the PMI and July 2022 for the unemployment rate.

Short-term labour market indicators point to continued employment growth, despite some weakening signals. The monthly composite PMI employment indicator stood at 52.5 in August, decreasing by one point in comparison to July, but still remaining above the threshold level of 50 that indicates an expansion in employment. The PMI employment indicator has been in expansionary territory since February 2021. Looking at developments across different sectors, the PMI employment indicator points to continued, albeit weaker, employment growth in the industry and services sectors and to a decrease in employment in construction.

After the rebound in the second quarter, private consumption is facing significant headwinds from high inflation and elevated uncertainty. Private consumption grew by 1.3% in the second quarter, supported by the reopening of contact-intensive sectors. However, consumption of goods remained weak as it continued to be affected by high inflation and supply constraints. Retail sales fell by 0.8% in the second quarter of 2022, following a drop of 0.6% in the first quarter of the year, and new car registrations remained significantly (31.4%) below their pre-pandemic level in the second quarter. Consumption of goods is likely to remain weak in the third quarter after retail sales in July were 0.2% lower than their monthly average in the second quarter. Consumer confidence has declined further in the third quarter, reflecting households’ ongoing economic concerns. In contrast to goods, spending on services was strong in the second quarter amid eased pandemic restrictions and the reopening of contact-intensive sectors, including tourism. However, the positive effects of the reopening on private consumption growth appear to be waning. The European Commission’s latest consumer and business surveys indicate that demand for accommodation, food and travel services is expected to expand more slowly in the third quarter.

Household savings are helping to partly cushion the impact of very high inflation. By the first quarter of 2022, accumulated savings in excess of pre-pandemic levels amounted to around €850 billion. These savings should help to smooth consumption to some extent in the face of a drop in real incomes. However, households in lower income groups have accumulated relatively small savings and may need to reduce their current saving or dissave. These households are strongly exposed to the energy and food price shock, notwithstanding fiscal income support. In contrast, medium to high-income households might use their accumulated savings for spending purposes. However, the ECB’s Consumer Expectations Survey from July suggests that households have strongly revised up their perceived need for a precautionary savings buffer. Furthermore, the elevated inflation is expected to lead to a faster erosion of the accumulated stock of savings in real terms.

Business investment is expected to slow, after a robust increase in the second quarter of 2022 driven by the transport equipment component. Non-construction investment increased by 1.8% quarter on quarter in the second quarter as manufacturing of motor vehicles recovered against the background of a gradual easing of supply bottlenecks. Non-construction investment increased in the second quarter in all large euro area countries except Spain. In spite of a recent slight decline, euro area capital goods producers still hold a large stock of outstanding orders, as indicated by European Commission order book and outstanding business indicators, which remained well above average until August. European Commission survey data suggest that the main factor limiting production, in spite of some recent improvement, remains lack of material and/or equipment, while demand is not seen as a constraint. However, uncertainty related to the Ukraine war, higher energy prices, increased cost of financing and the risk of gas rationing all imply a substantial slowdown in the third quarter of 2022. In July, the manufacturing PMI and the PMI new order indicator (i.e. the new order flow) for capital goods continued to decline and stood firmly in contractionary territory. Although financing conditions are still favourable, the cost of borrowing for companies has risen strongly since the start of the Ukraine war. Business investment is expected to return to dynamic growth in the course of 2023, supported in part by Next Generation EU (NGEU) funds.

Housing investment declined slightly in the second quarter of 2022 and is likely to remain weak in the near term. Housing investment fell by 0.4% in the second quarter of 2022 compared with the first quarter, when it rose by 2.8% quarter on quarter. The European Commission’s indicator of recent construction activity continued to decline on average in July and August compared with the second quarter, while the PMI for residential construction fell further into negative growth territory. Company order books still appear to be well filled, as indicated by the European Commission’s survey up to August, which should support construction activity in the months ahead. However, firms are continuing to suffer significantly from supply shortages, as perceived production limits due to labour shortages reached a new all-time high in August, while equipment and material bottlenecks eased only slightly. Moreover, households’ short-term intentions to renovate and buy or build a home fell again in the third quarter, indicating weaker demand. This is also reflected in a further increase in the share of companies reporting insufficient demand as a factor limiting production alongside the continued decline in new orders, as indicated by the construction PMI. The weakening of demand is taking place against the backdrop of heightened uncertainty, significantly higher construction costs, falling real incomes and more restrictive financing conditions (Box 4), all of which should increasingly weigh on housing investment going forward.

Euro area trade lost some momentum as extra-euro area exports slowed, while the outlook points to subdued trade owing to weakened demand for manufacturing and services exports. In June, nominal extra-euro area goods exports decreased after having strongly expanded the month before, while growth in extra-euro area imports slowed in both months. The euro area deficit in trade in goods stabilised, while the seasonally adjusted current account returned to surplus, supported by an increase in the services trade balance. The strong export performance in May and the slowdown in June were mainly driven by chemical exports to the United States, which was probably due to temporary restocking by US importers. Short-term shipping and survey indicators suggest that supply bottlenecks – while remaining at elevated levels – may be easing. Nonetheless, the short-term outlook points to further deterioration in euro area trade owing to simultaneous declines in demand for manufacturing and services exports, as indicated by PMI new export orders, which stood in contractionary territory for both sectors in July and August. Momentum for the recovery in trade in services, while still supported by a strong tourism season, moderated as labour shortages and declines in real incomes became a more binding constraint on activity.

Beyond the near term, euro area economic growth is expected to gradually pick up after the headwinds weighing on activity during the winter of 2022/23 dissipate. The uncertainty surrounding this outlook remains large. The September 2022 ECB staff macroeconomic projections foresee annual real GDP growth at 3.1% in 2022, 0.9% in 2023 and 1.9% in 2024 (Chart 7). Compared with the June 2022 Eurosystem staff macroeconomic projections, the growth outlook was revised upwards for 2022 and downwards for 2023 and 2024. Quarterly year-on-year real GDP growth is projected to be 1.4% in the fourth quarter of 2022, 1.4% in the fourth quarter of 2023 and 2% in fourth quarter of 2024. This shows that the projected average real GDP growth rate for 2022 is strongly influenced by positive carry-over effects from the dynamic first half of the year, while the projected average real GDP growth rate for 2023 is strongly influenced by the expected slowdown in the second half of 2022.

Chart 7

Euro area real GDP (including projections)

(index: fourth quarter of 2019 = 100, seasonally and working day-adjusted quarterly data)

Sources: Eurostat and the article entitled “ECB staff macroeconomic projections for the euro area, September 2022”, published on the ECB’s website on 8 September 2022.

Note: The vertical line indicates the start of the September 2022 ECB staff macroeconomic projections.

3 Prices and costs

Inflation rose further to 9.1% in August, with energy price inflation remaining the dominant component of overall inflation. Soaring energy and food prices, supply bottlenecks and demand pressures in some sectors owing to the reopening of the economy are still driving up inflation. Price pressures have continued to strengthen and broaden across the economy, and inflation may rise further in the near term. As the current drivers of inflation fade over time and the normalisation of monetary policy works its way through the economy and price-setting, inflation will come down. Looking ahead, inflation has been revised up significantly in the September 2022 ECB staff projections and is now expected to average 8.1% in 2022, 5.5% in 2023 and 2.3% in 2024. Inflation excluding energy and food is expected to reach 3.9% in 2022, 3.4% in 2023 and 2.3% in 2024. Most measures of longer-term inflation expectations currently stand at around 2%, although recent above-target revisions to some indicators warrant continued monitoring.

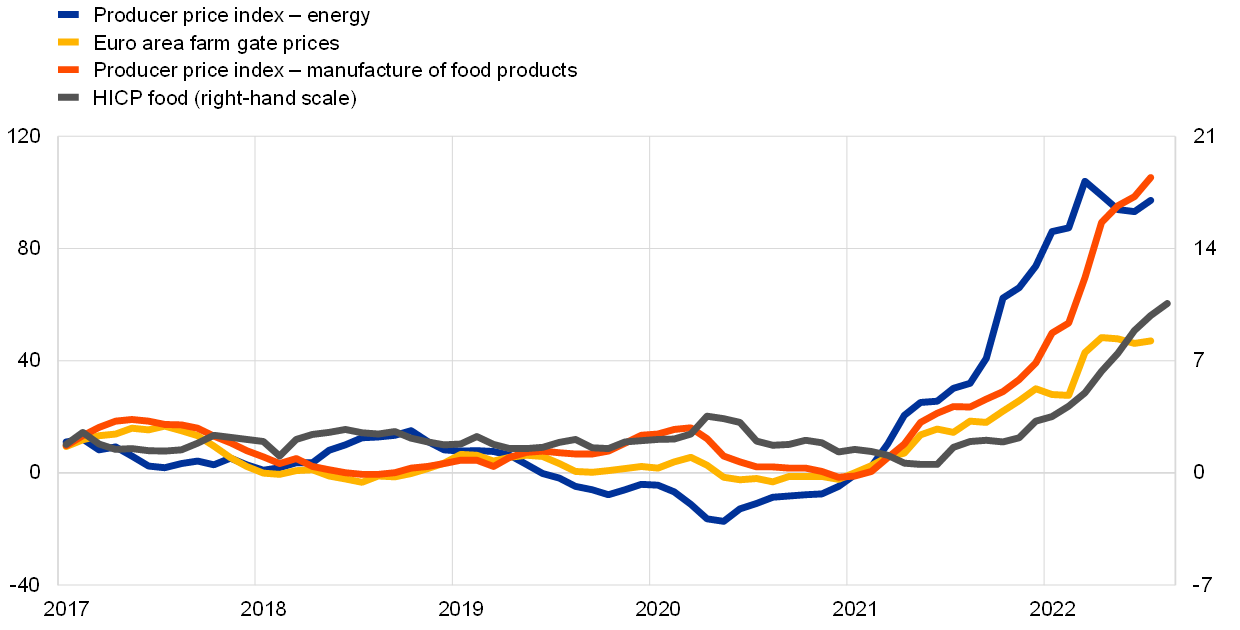

According to Eurostat’s flash estimate for August, HICP inflation rose again to 9.1% from 8.9% in July. The increase in August was mainly driven by further rises in HICP food inflation and HICP inflation excluding energy and food. The annual rate of change in HICP energy inflation edged down, but remained exceptionally high at 38.3%. This component of the basket continued to account for almost half of overall inflation. Energy inflation remained elevated due to the high levels of oil, gas and electricity prices, together with abnormally high refining margins for diesel and distribution margins for private transport fuels. Market-based indicators suggest that, in the near term, oil prices will moderate, while wholesale gas prices will stay extraordinarily high. Food inflation rose substantially, from 9.8% in July to 10.6% in August, reflecting high global food commodity prices and euro area farm gate prices. The pressures on food prices are increasingly being driven by higher input costs for energy and fertilisers – as is also visible in producer price dynamics (Chart 8) – as well as by disruptions in trade in food commodities and adverse weather conditions.

Chart 8

Energy and food input cost pressure

(annual percentage changes)

Source: Eurostat.

Note: The latest observations are for August 2022 for HICP food (flash estimate) and July 2022 for the remaining items.

HICP inflation excluding energy and food (HICPX) increased further in August, to 4.3%, reflecting both higher non-energy industrial goods (NEIG) and services inflation (Chart 9). Here, too, higher input costs stemming from the surge in energy prices remained a prominent factor. NEIG inflation reached a new high, in part still reflecting ongoing global supply disruptions. Services inflation also rose, with the impact of energy prices on items such as transport being aggravated by the impact of surging food prices on items such as catering services and of reopening effects on items such as accommodation. These effects have more than offset the temporary downward impact of government measures such as the €9 public transport ticket in Germany (that expired in August).

Chart 9

Headline inflation and its main components

(annual percentage changes; percentage point contributions)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for August 2022 (flash estimate).

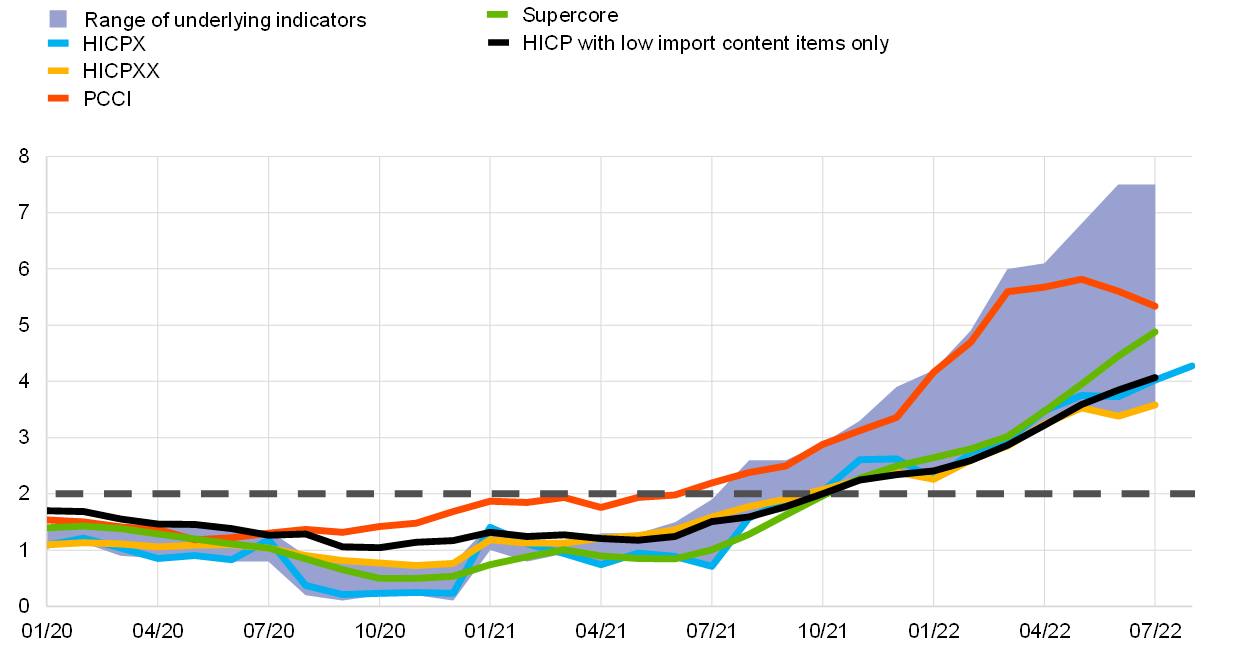

Measures of underlying inflation remain at elevated levels (Chart 10). This reflects the spreading of price pressures to more and more sectors and HICP items, owing in part to the impact of high energy costs across the whole economy. Within the wide range of indicators, most exclusion-based measures continued to increase. HICPX inflation rose from 4.0% in July 2022 to 4.3% in August. Other measures are only available up to July. HICPXX inflation (which excludes energy, food, travel-related items, clothing and footwear) had edged up to 3.6% in July after declining in the previous month. The Supercore indicator, which comprises cyclically sensitive HICP items, had risen to 4.9%, from 4.5% in June, while the model-based Persistent and Common Component of Inflation (PCCI) had declined further, to 5.3%, in July. Month-on-month rates of the PCCI have been moving broadly sideways. Still, persistently high month-on-month PCCI rates continue to indicate strong upward dynamics of underlying inflation up to July. The indicator of domestic inflation, which represents price developments of HICP items with lower import content, had increased further and surpassed 4% in July.[2] It is likely that the temporary €9 public transport ticket in Germany had a downward impact on measures of underlying inflation like HICPX from June to August, which can be expected to reverse in September. At the same time, it remains uncertain how persistent the elevated levels of these different measures and indicators will be. A large part of the upward push in underlying inflation dynamics can be attributed to indirect effects from the surge in energy and food prices and from exceptional developments in the balance between supply and demand related to the pandemic and the Russian invasion of Ukraine.

Chart 10

Indicators of underlying inflation

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Notes: The range of indicators of underlying inflation includes HICP excluding energy, HICP excluding energy and unprocessed food, HICPX (HICP excluding energy and food), HICPXX (HICP excluding energy, food, travel-related items, clothing and footwear), the 10% and 30% trimmed means and the weighted median. The latest observations are for August 2022 (flash estimate) for the HICPX and July 2022 for the remaining items.

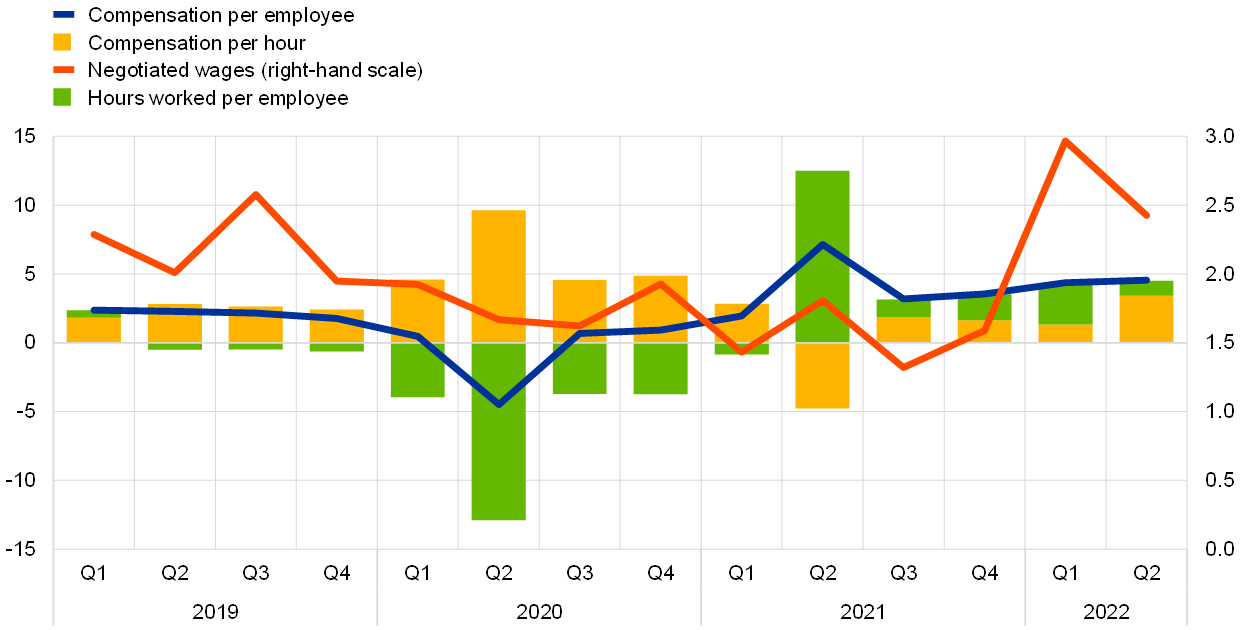

The latest data on negotiated wages continue to point to relatively moderate wage dynamics (Chart 11). Growth in negotiated wages declined to 2.4% in the second quarter of 2022, compared with 3.0% in the previous quarter. However, this downward movement is not fully indicative of the underlying dynamics as wage agreements also comprise one-off payments that can lead to substantial volatility in annual growth rates. The decline in negotiated wage growth in the second quarter was mainly driven by developments in Germany and base effects from large one-off payments disbursed in June 2021. More recent information on wage agreements concluded since the start of 2022 point to some strengthening in wage dynamics, although wage growth remains contained compared with current inflation rates. Actual wage developments as measured by compensation per employee strengthened further in the second quarter of 2022, increasing to 4.6% compared with 4.4% in the previous quarter. This was driven by a strong increase in the annual growth rate of compensation per hour, which stood at 3.4% in the second quarter compared with 1.3% in the first quarter of 2022 (driven by base effects). Rising average hours worked continued to support compensation per employee growth. Pandemic-related distortions to these indicators are declining as the effects of government measures related to job retention schemes have continued to decrease.

Chart 11

Breakdown of compensation per employee into compensation per hour and hours worked

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for the second quarter of 2022.

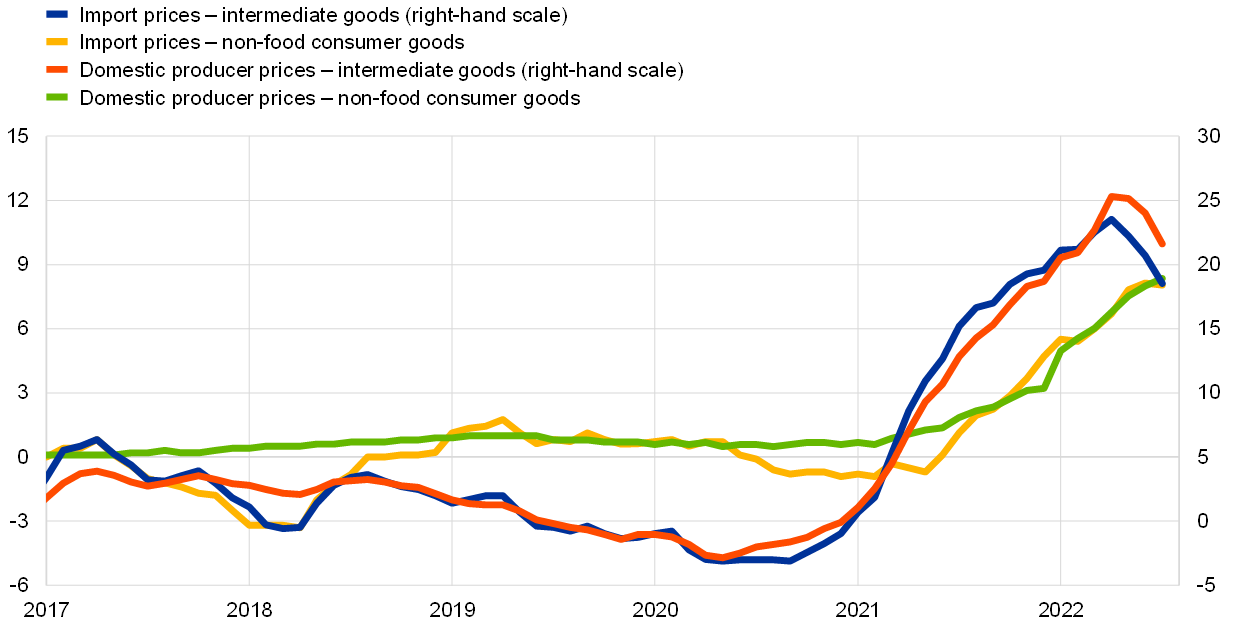

Pipeline pressures on NEIG inflation remain strong, and the pass-through of costs to prices has likely become faster (Chart 12). Data for July suggest that while pressures in the earlier stages of the pricing chain for NEIG eased, they increased further in the later stages. The annual growth rate of import prices for intermediate goods declined for the second consecutive time since mid-2020 to 18.5% in July 2022 from 20.7% in June. The annual growth rate of producer prices for domestic sales of intermediate goods declined further in July 2022, to 21.6%, down from 23.8% in the previous month. The growth rates of import and domestic producer prices for non-food consumer goods showed somewhat mixed signals: import prices declined slightly, to 8.0% in July, while producer prices increased to 8.3%. This remains exceptionally high when compared with the average annual rate of 0.5% over the period from 2001 to 2019. Import price dynamics remain elevated, in part reflecting the build-up of inflationary pressures due to the depreciation of the euro. An updated analysis of the pass-through of producer prices for non-food consumer goods suggests that this is currently faster than in the past and that NEIG inflation may face further upward pressure this year.[3] This is in line with the data on selling-price expectations for consumer goods, which remain elevated despite moderating somewhat over the past four months.

Chart 12

Indicators of pipeline pressures

(annual percentage changes)

Sources: Eurostat and ECB calculations.

Note: The latest observations are for July 2022.

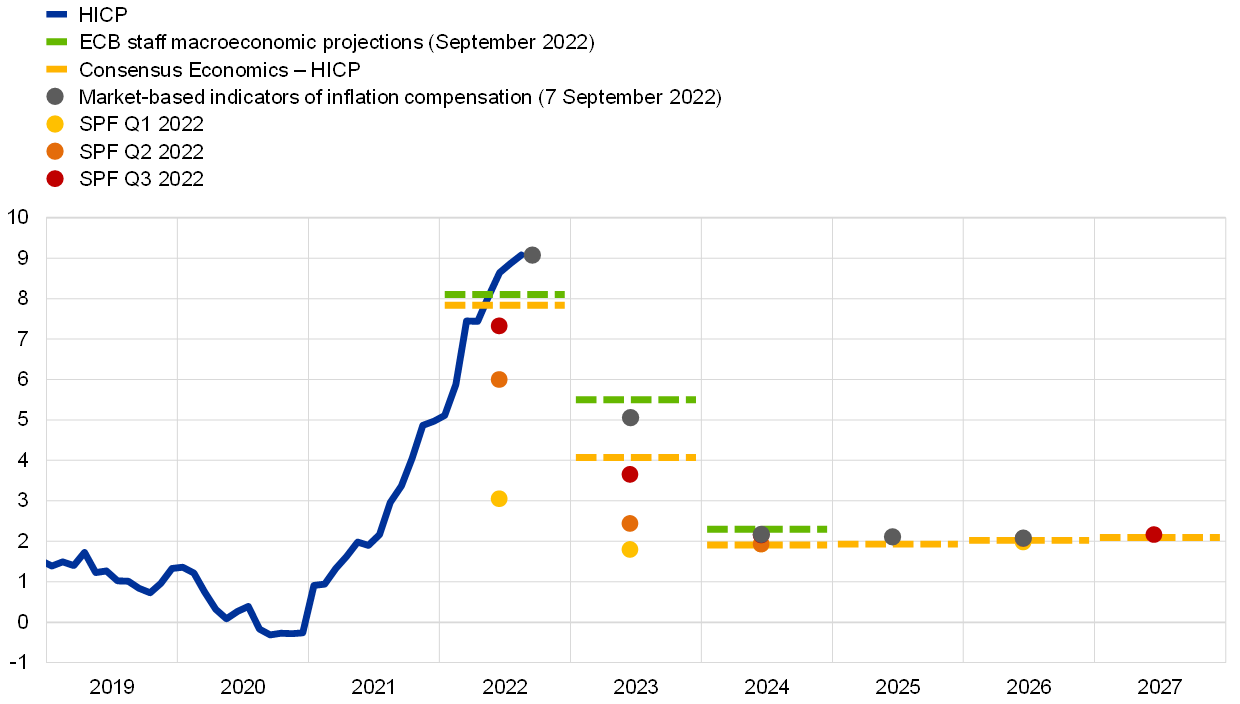

Most measures of longer-term inflation expectations currently stand at around 2%, although recent above-target revisions to some indicators warrant continued monitoring. Survey-based measures of longer-term inflation expectations continued to increase gradually, reaching levels around or slightly above 2%, while market-based measures declined beyond the very near-term maturities, amid significant volatility (Chart 13). According to the ECB’s Survey of Professional Forecasters (SPF) from July 2022, longer-term inflation expectations (for 2026) rose further, to 2.2%, while those of Consensus Economics stood at 2.1% in July, up from 1.9% in the previous quarter. At the same time, both the median and the mode expectation in the SPF survey remained at 2.0%. In the latest ECB Survey of Monetary Analysts, the medium- to long-term inflation expectations remained unchanged at 2.0% in July. The ECB’s Consumer Expectations Survey showed that the longer-term (three years ahead) inflation expectations of households increased further in July.[4] During the review period, market-based measures of inflation compensation (based on HICP excluding tobacco) ultimately fell beyond the very near-term maturities, amid firming expectations of further monetary policy normalisation and concerns about a slowdown in economic growth ahead. The declines in inflation compensation measures mask substantial volatility over the review period. Near-term maturities in particular were volatile, as they spiked following soaring electricity costs, before falling back on news about EU policy initiatives to contain the energy crisis. According to these market-based measures, inflation is now expected to return to around 2% over the course of 2024 and remain close to that level thereafter, with the five-year forward inflation-linked swap rate five years ahead standing at 2.2%. Importantly, market-based measures of inflation compensation are not a direct measure of market participants’ actual inflation expectations, since they contain inflation risk premia to compensate for inflation uncertainty. The relative stability of survey-based measures of long-term inflation expectations, which are free of inflation risk premia, suggests that the current volatility in long-term market-based measures predominantly reflects variation in inflation risk premia.

Chart 13

Survey-based indicators of inflation expectations and market-based indicators of inflation compensation

(annual percentage changes)

Sources: Eurostat, Refinitiv, Consensus Economics, Survey of Professional Forecasters (SPF), ECB staff macroeconomic projections for the euro area and ECB calculations.

Notes: The market-based indicators of inflation compensation series is based on the one-year spot inflation rate, the one-year forward rate one year ahead, the one-year forward rate two years ahead, the one-year forward rate three years ahead and the one-year forward rate four years ahead. The latest observations for market-based indicators of inflation compensation are for 7 September 2022. The SPF for the third quarter of 2022 was conducted between 1 and 5 July 2022. The cut-off date for the Consensus Economics long-term forecasts was July 2022 for 2024, 2025, 2026 and 2027 and August 2022 for 2022 and 2023. The cut-off date for data included in the ECB staff macroeconomic projections was 25 August 2022. The latest observation for HICP is for August 2022 (flash estimate).

The September 2022 ECB staff macroeconomic projections for the euro area foresee headline inflation remaining elevated in the near term, before falling back to averages of 5.5% in 2023 and 2.3% in 2024 (Chart 14). Looking at the annual growth rate of inflation in the fourth quarter of the year, it is expected to be 9.2% in 2022, 3.3% in 2023 and 2.2% in 2024. Inflation is continuing to surge on the back of further large supply shocks which are feeding through to consumer prices at a faster pace than in the past. Headline HICP inflation is expected to stay above 9% for the rest of 2022, owing to extremely elevated energy and food commodity prices, together with upward pressures from the reopening of the economy, supply shortages and tight labour markets. The expected decline in inflation from an average of 8.1% in 2022 to 5.5% in 2023 and 2.3% in 2024 mainly reflects a sharp decline in energy and food price inflation as a result of negative base effects and an assumed decline in commodity prices, in line with futures prices. HICP inflation excluding energy and food is seen to remain at unprecedented high levels until the middle of 2023; that said, it is also expected to decline thereafter as the effects of the reopening of the economy subside and supply bottlenecks and energy input cost pressures ease. Headline inflation is expected to remain above the ECB’s target of 2% in 2024. This is due to lagged effects from high energy prices on the non-energy components of inflation, the recent depreciation of the euro, robust labour markets and some effects of inflation compensation on wages, which are expected to grow at rates well above historical averages. Compared with the June 2022 Eurosystem staff projections, headline inflation has been revised up substantially for 2022 (by 1.3 percentage points) and 2023 (2.0 percentage points), and slightly for 2024 (0.2 percentage points). This reflects recent data surprises, dramatic increases in the assumptions for wholesale gas and electricity prices, stronger wage growth and the recent depreciation of the euro. These effects more than offset the downward impact of the recent decline in food commodity prices, supply bottlenecks proving less severe than previously assumed and the weaker growth outlook.

Chart 14

Euro area HICP inflation and HICPX (including projections)

(annual percentage changes)

Sources: Eurostat and ECB staff macroeconomic projections for the euro area (September 2022).

Notes: The vertical line indicates the start of the projection horizon. The latest observations are for the second quarter of 2022 (data) and the fourth quarter of 2024 (projections). The cut-off date for data included in the projections was 25 August 2022. Historical data for HICP inflation and HICPX are at quarterly frequency. Forecast data are at quarterly frequency for HICP inflation and annual frequency for HICPX.

4 Financial market developments

Over the review period (9 June to 7 September 2022) euro area asset prices were volatile as market participants pondered the implications of the high inflationary pressures and the risk of recession on the expected future course of central bank rate policy. Ultimately, euro area risk-free rates rose as market participants revised their expectations towards a faster and more pronounced monetary policy tightening. Long-term risk-free rates likewise rose. Sovereign bond yields increased in lockstep with risk-free rates, as sovereign spreads saw little change while displaying some volatility in selected countries. The higher rates and deteriorating growth outlook weighed on risky corporate assets, with European corporate bond spreads wider and equity prices lower on balance. The euro depreciated further in trade-weighted terms owing to euro area growth concerns, with the EUR/USD exchange rate slightly below parity.

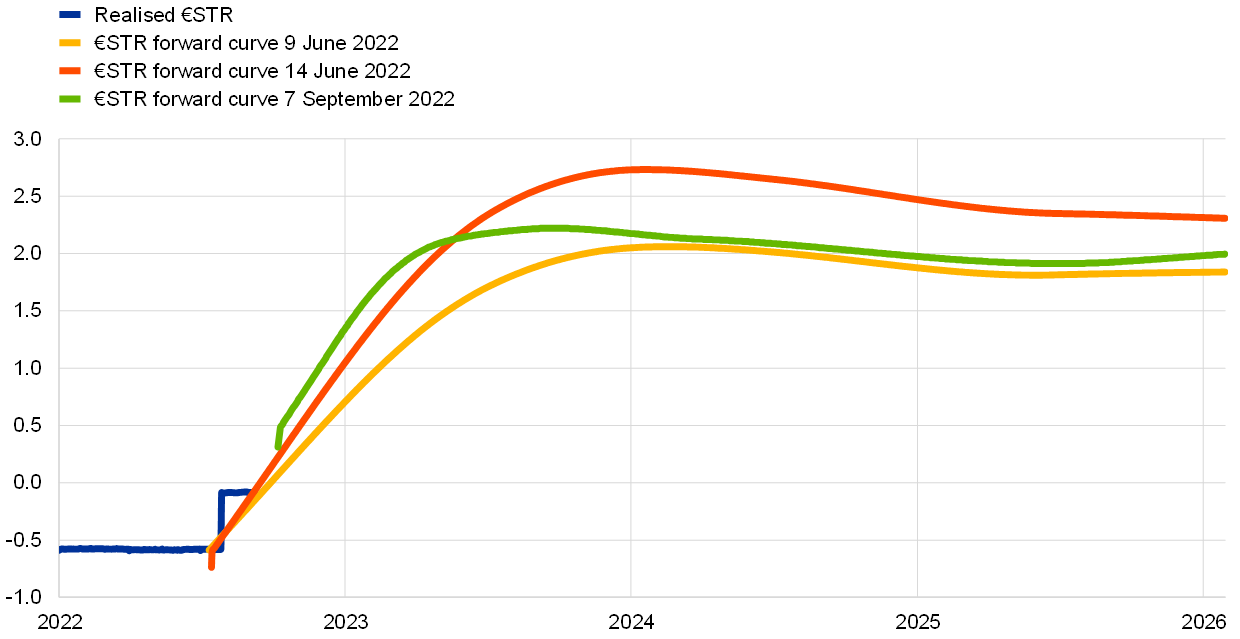

Since the June Governing Council meeting, the euro area short-term risk-free rates rose as market participants revised their expectations towards a faster and more pronounced tightening of monetary policy. Over the review period, the €STR averaged -34 basis points and excess liquidity decreased by approximately €39 billion to €4,578 billion. The overnight index swap (OIS) forward curve – based on the benchmark €STR – displayed a volatile pattern. Overall, as inflation concerns outweighed the rising risk of recession, the OIS forward curve increasingly pointed towards expectations for a faster and more pronounced tightening of the ECB’s rate policy (Chart 15). At the end of the review period, the OIS forward curve priced in cumulative hikes amounting to around 150 basis points by the end of 2022 and peaking at approximately 2.2% in late 2023.

Chart 15

€STR forward rates

(percentages per annum)

Sources: Thomson Reuters and ECB calculations.

Note: The forward curve is estimated using spot OIS (€STR) rates.

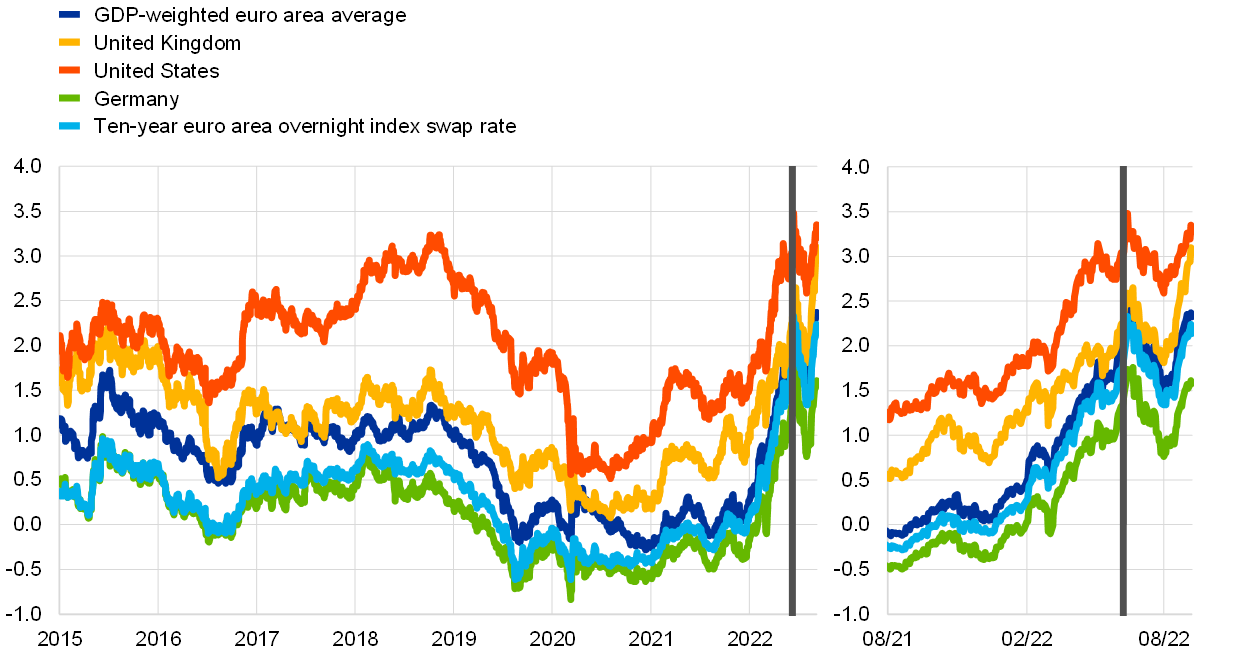

Long-term bond yields increased in response to the market reassessment of the expected future monetary policy path (Chart 16). Over the review period, global longer-term bond yields fluctuated markedly as market participants continuously reassessed expectations for central bank policy in response to any news about inflation and the growth outlook. On balance, euro area long-term bond yields rose somewhat: the euro area GDP-weighted average ten-year sovereign bond yield increased to stand at about 2.3%, 16 basis points higher than at the time of the June Governing Council meeting. Likewise, the ten-year US, UK and German sovereign bond yields rose 22, 71 and 14 basis points to about 3.3%, 3.0% and 1.6% respectively.

Chart 16

Ten-year sovereign bond yields and the ten-year OIS rate based on the €STR

(percentages per annum)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 June 2022. The latest observations are for 7 September 2022.

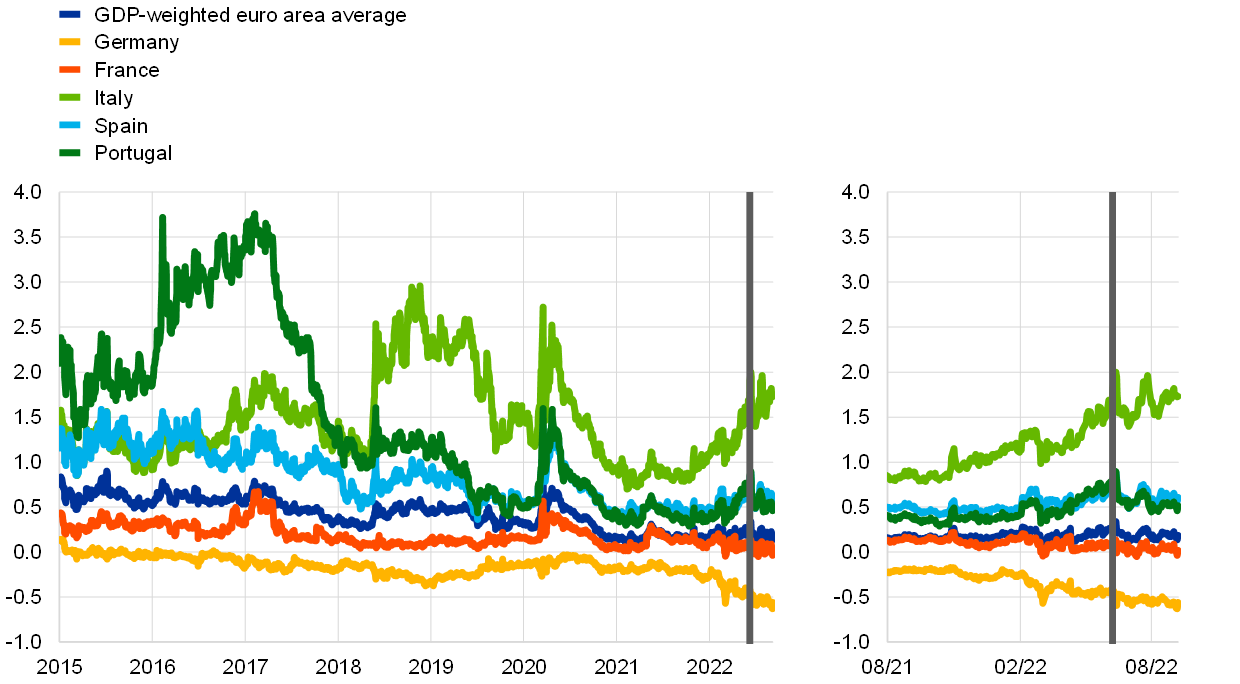

Euro area sovereign bond yields moved roughly in line with risk-free rates, and sovereign spreads remained almost unchanged (Chart 17). While risk-free rates fluctuated markedly over the review period, the ten-year GDP-weighted euro area sovereign spread over the OIS rate remained relatively stable, decreasing by 12 basis points. At the end of the review period, changes in individual sovereign spreads differed somewhat across countries. For example, the Italian and Portuguese ten-year sovereign bond spreads narrowed by 10 and 29 basis points respectively, while the German ten-year Bund spread fell by a further 14 basis points. At the same time, Italian spreads showed a volatile pattern amid the escalation of the internal political crisis, albeit entailing limited spillovers to other sovereigns.

Chart 17

Ten-year euro area sovereign bond spreads vis-à-vis the ten-year €STR OIS rate

(percentage points)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 June 2022. The latest observations are for 7 September 2022.

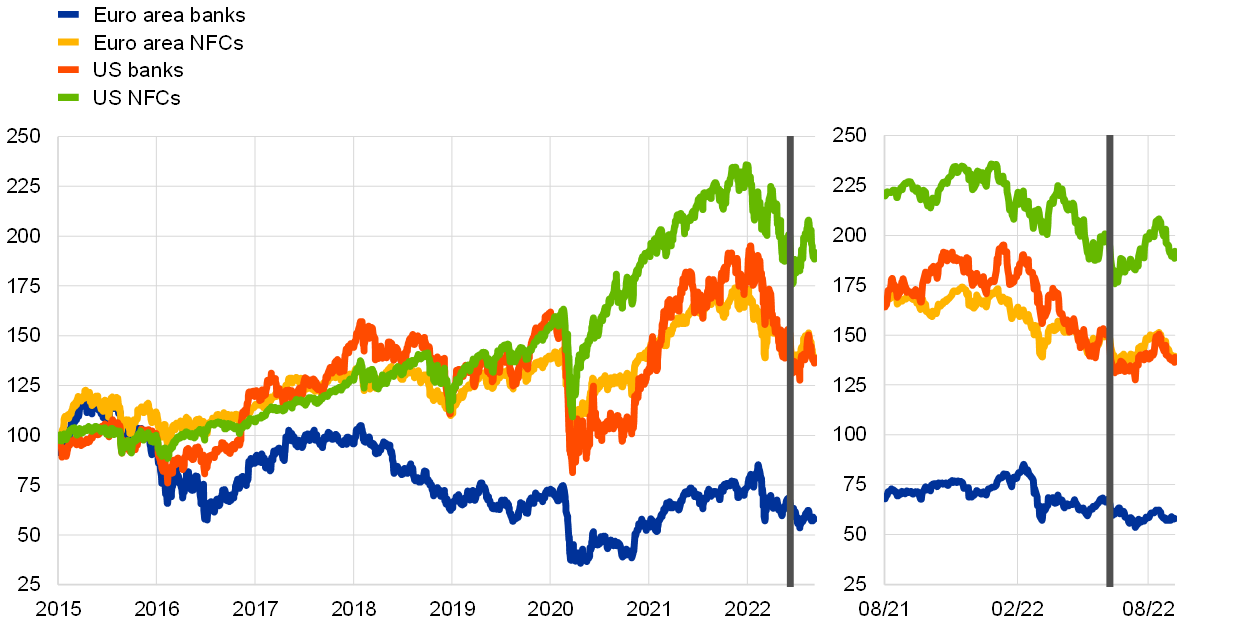

Chart 18

Euro area and US equity price indices

(index: 1 January 2015 = 100)

Sources: Refinitiv and ECB calculations.

Notes: The vertical grey line denotes the start of the review period on 9 June 2022. The latest observations are for 7 September 2022.

Growing concerns about the economic outlook and tightening monetary policy continued to weigh on euro area corporate bond spreads, which widened overall during the review period. Over the review period, concerns about a slowdown in economic growth ahead, some downgrades in earnings expectations and tighter expected monetary policy resulted in somewhat wider spreads. On balance, spreads on high-yield corporate bonds widened by 18 basis points, while spreads on investment-grade corporate bonds showed some resilience and ended the review period 2 basis points wider.

European equity markets fell over the review period, driven by similar factors to those affecting corporate bond markets (Chart 18). European equity markets fluctuated throughout the review period, as markets were sensitive to any news about the inflation and growth outlooks and their implications for global central bank rate policies. Ultimately, euro area equity markets fell overall during the review period. Specifically, equity prices of euro area non-financial corporations (NFCs) and banks decreased by 5.7% and 11.3% respectively. Stock prices were negatively affected by some downward revisions to earning expectations, by the sizeable downgrades to real euro area expected GDP growth, possibly not yet fully reflected in earnings expectations, and by the higher level of long-term interest rates. This decline in the stock prices of NFCs and banks was cushioned by the decline in the equity risk premium (see Section 5). In the United States as well, higher interest rates and fears of a recession led to a 3.1% decrease in the equity prices of banks, but only a 0.8% decrease in those of NFCs, proving the latter to be more resilient.

In foreign exchange markets, the euro continued to depreciate in trade-weighted terms (Chart 19). Overall, during the review period, the nominal effective exchange rate of the euro, as measured against the currencies of 42 of the euro area’s most important trading partners, weakened by 2.9%. The broad euro weakness was also reflected in an 8% depreciation of the euro against the US dollar, trading slightly below parity at the end of the review period, amid rising concerns about the euro area growth outlook and faster monetary policy tightening in the United States. The euro also depreciated against the Swiss franc and the Japanese yen by 7.1% and 0.5% respectively, but appreciated by 1% against the pound sterling. The euro also weakened against the currencies of most emerging market economies, including the Indian rupee (by 5.5%) and the Chinese renminbi (by 3.8%).

Chart 19

Changes in the exchange rate of the euro vis-à-vis selected currencies

(percentage changes)

Source: ECB.

Notes: EER-42 is the nominal effective exchange rate of the euro against the currencies of 42 of the euro area’s most important trading partners. A positive (negative) change corresponds to an appreciation (depreciation) of the euro. All changes have been calculated using the foreign exchange rates prevailing on 7 September 2022.

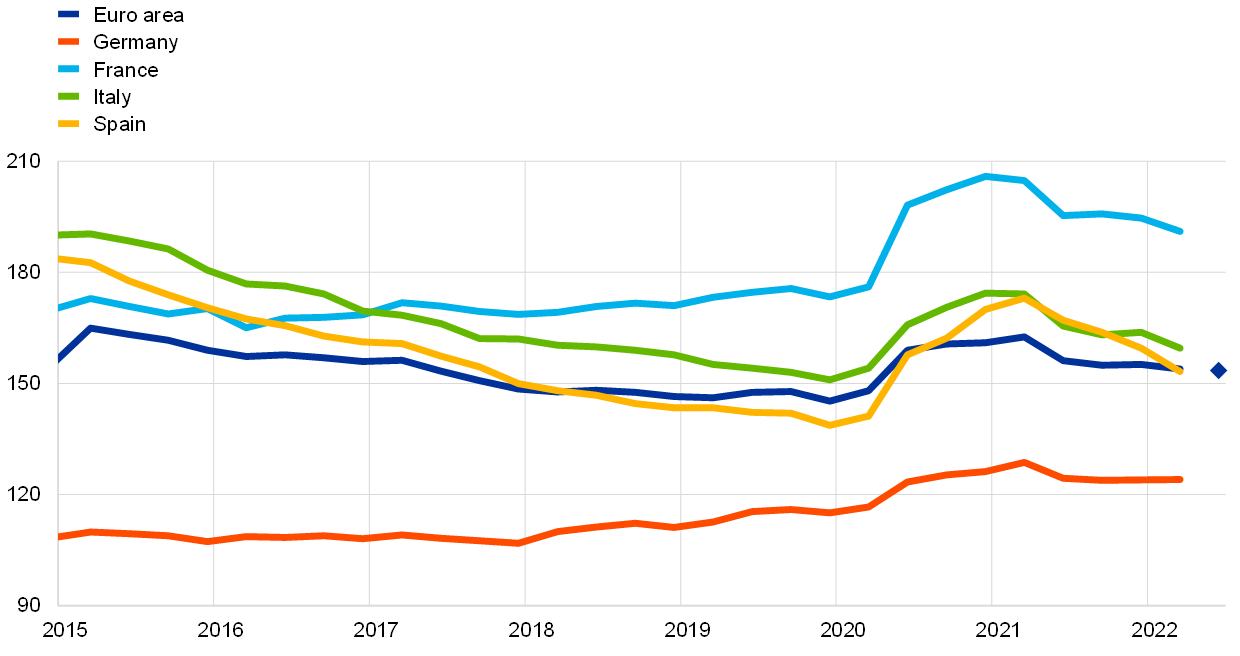

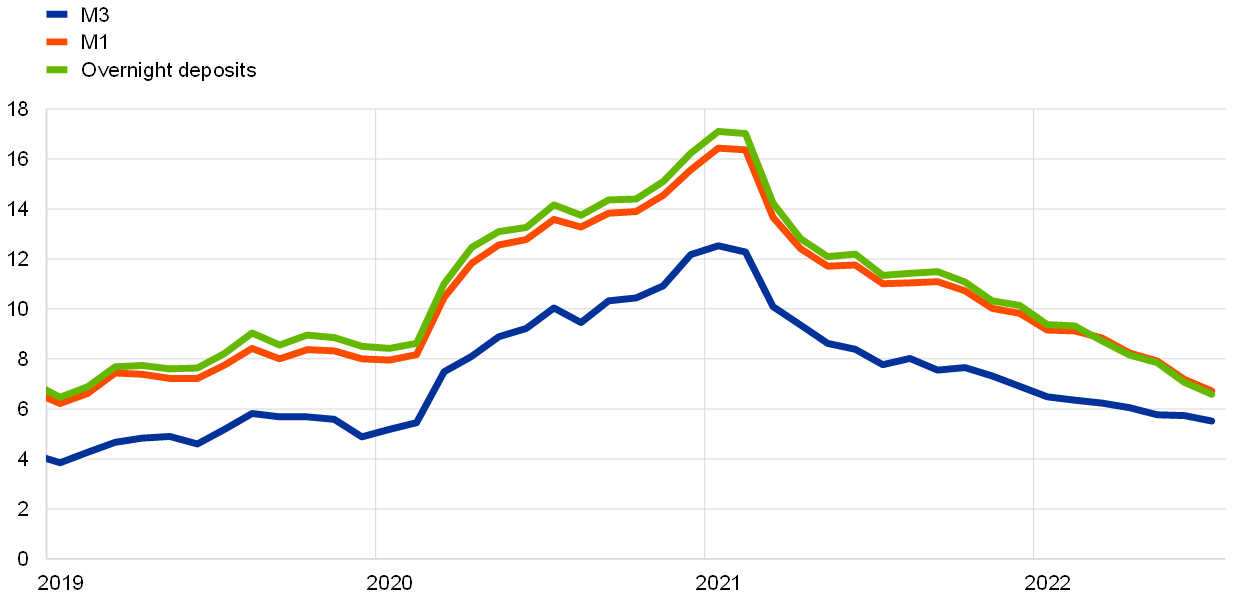

5 Financing conditions and credit developments

Bank lending rates and bank funding conditions have increased since the end of May, as policy normalisation continues. The growth rate of loans to firms was strong in nominal terms and lending to households was solid but with incipient signs of moderation. Over the period from 9 June to 7 September, the cost of equity for firms declined sizeably, while the cost of market-based debt financing increased. The total volume of external financing for firms rose, mainly reflecting increased bank borrowing. Broad money growth continued on a moderating trend, reflecting the end of the Eurosystem’s net asset purchases in July and the higher energy bill of euro area households and firms which reduces disposable income.

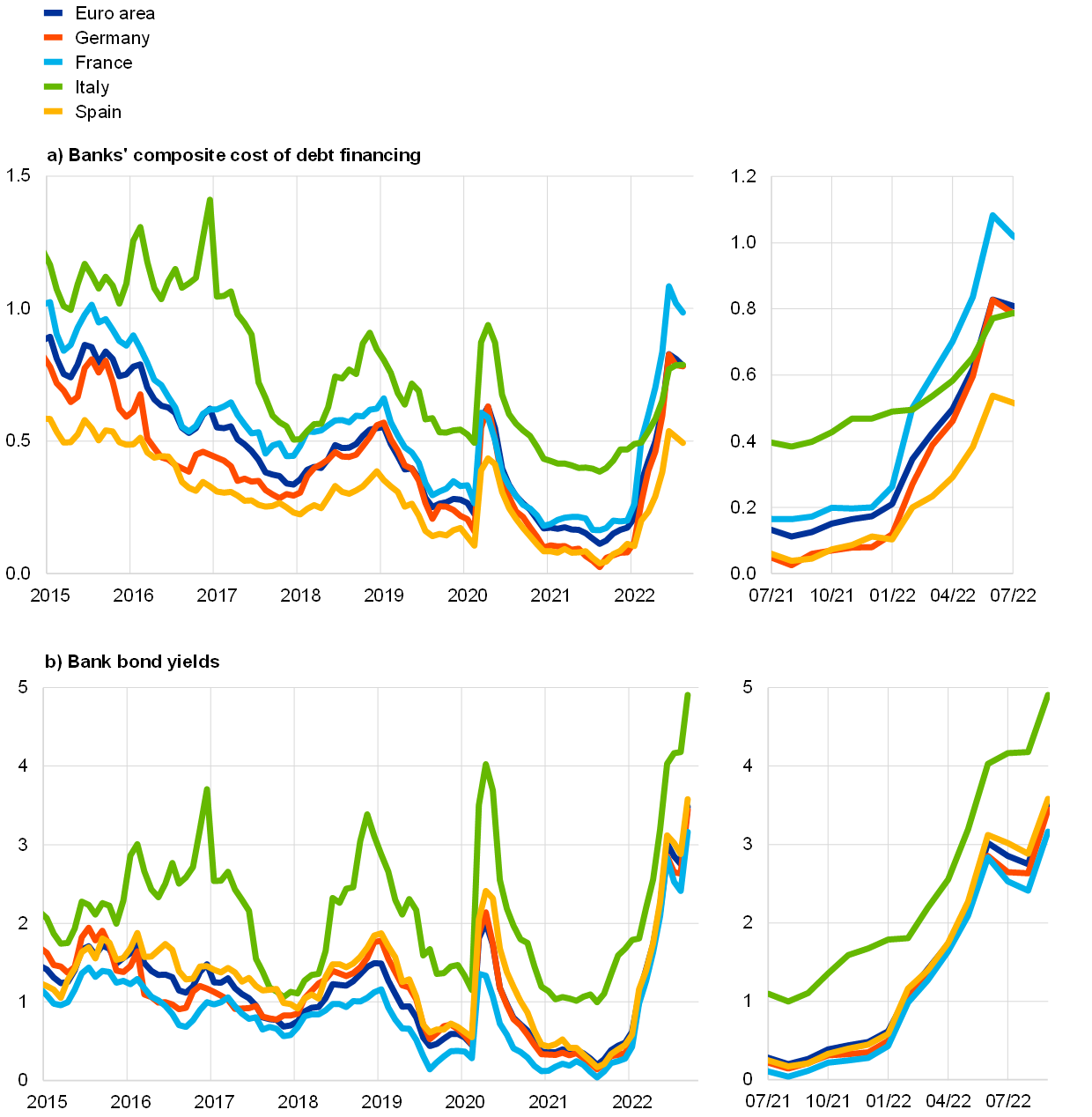

The funding costs of euro area banks were overall higher in recent months, as policy normalisation continued. The steep upward trend in the composite cost of the debt financing of euro area banks seen at the start of 2022 paused in July (Chart 20, panel a). Since the beginning of 2022, increasing risk-free rates have led to rising yields on bank bonds to levels exceeding those seen before the start of the asset purchase programme in 2015, despite some volatility since the June Governing Council meeting (Chart 20, panel b). With the recent interest rate hike in July 2022, the ECB brought an end to the negative interest rates for the first time in eight years. Most banks have begun increasing remuneration on their customer deposits, which account for a sizeable share of euro area banks’ funding.

The balance sheets of banks were overall robust but are starting to reflect the weakening economic environment. Bank capital ratios returned to their lower pre-pandemic levels. Moreover, bank profitability is supported by higher net interest income, as policy normalisation continues. While banks also made further progress in reducing their non-performing loan ratios, some measures of asset quality have deteriorated. The recent decline in bank price-to-book ratios points to some deterioration in the outlook for banks, amid the weakening economic prospects and increasing credit risk.

Chart 20

Composite bank funding rates in selected euro area countries

(annual percentages)

Sources: ECB, IHS Markit iBoxx indices and ECB calculations.

Notes: Composite bank funding rates are a weighted average of the composite cost of deposits and unsecured market-based debt financing. The composite cost of deposits is calculated as an average of new business rates on overnight deposits, deposits with an agreed maturity and deposits redeemable at notice, weighted by their respective outstanding amounts. Bank bond yields are monthly averages for senior-tranche bonds. The latest observations are for July 2022 for composite bank funding rates and 7 September 2022 for bank bond yields.

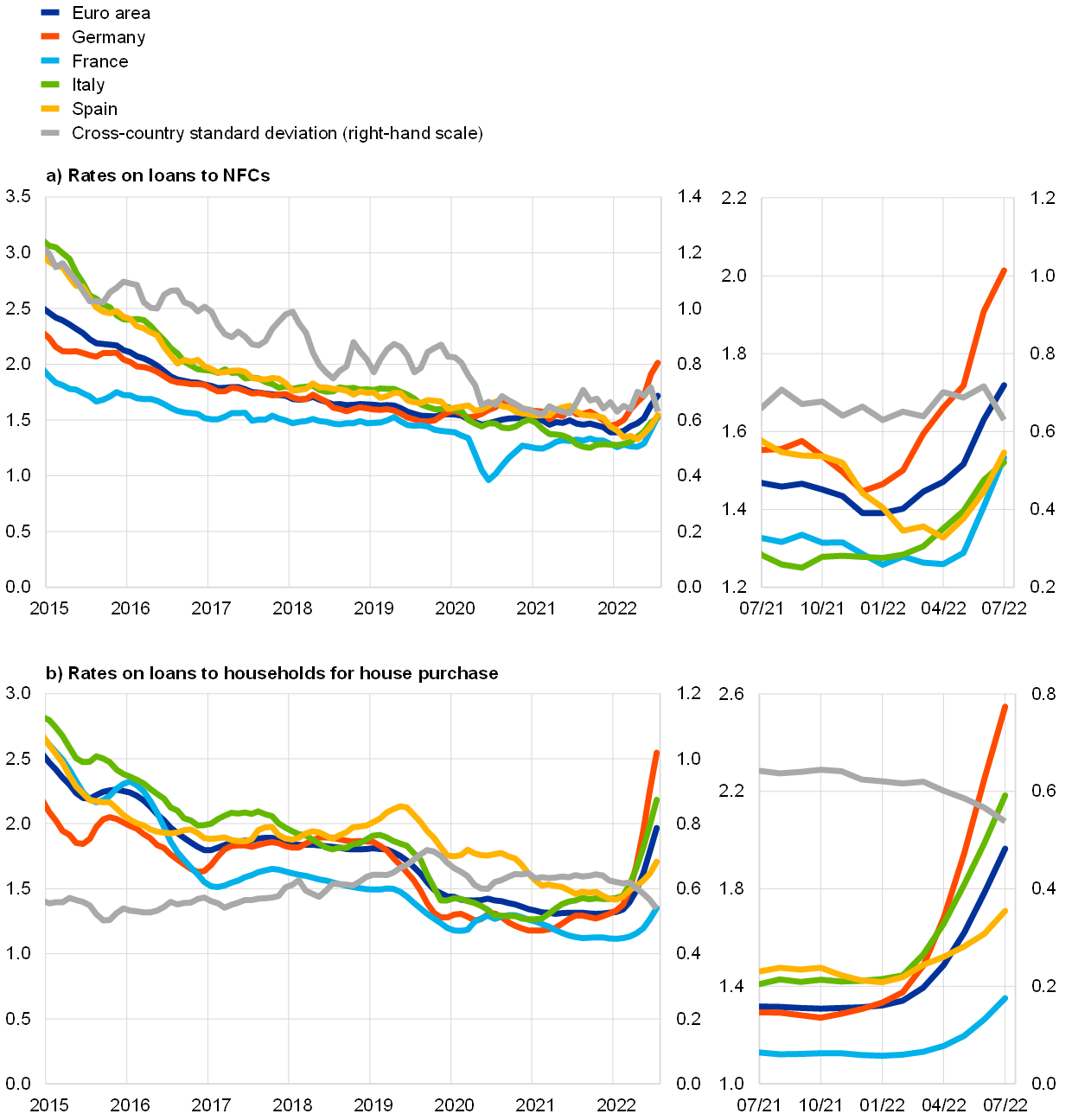

Bank lending rates for firms and households have increased further since the end of May, as banks tighten their loan supply. The sharp increase in risk-free rates and in euro area government bond yields since the beginning of 2022 has pushed up lending rates, especially those of households for house purchase (Chart 21). The composite bank lending rate for loans to households for house purchase showed another strong increase in July and stood at 2.15%. The monthly increase of 18 basis points has brought mortgage rates up by a cumulated 84 basis points since the beginning of the year. Meanwhile, bank lending rates for loans to non-financial corporations (NFCs) were more volatile and decreased slightly by 6 basis points to 1.77% in July, having increased by 41 basis points since the start of 2022. For the coming months, available evidence suggests a further increase in the lending rates for firms based on the marked increase recorded by diffusion indices.[5] On the supply side, lending rate developments reflect a tightening of credit standards on loans to firms and households, as indicated by the July euro area bank lending survey, since downside risks related to the economic outlook have increased and policy normalisation is under way. On the demand side, higher energy prices have driven firms’ financing needs up and adversely affected households’ budgets, in particular those of low-income households. Moreover, according to the Consumer Expectations Survey, consumers lowered their expectations for economic growth, and increased their expectations for becoming unemployed. The spread between bank lending rates on very small loans and on large loans was close to pre-pandemic levels, suggesting that bank-based financing conditions for small and medium-sized enterprises have remained favourable in relative terms. Moreover, the cross-country dispersion of lending rates to firms and households has remained contained (Chart 21, panels a and b).

Chart 21

Composite bank lending rates for NFCs and households in selected countries

(annual percentages, three-month moving averages; standard deviation)

Source: ECB.

Notes: Composite bank lending rates are calculated by aggregating short and long-term rates using a 24-month moving average of new business volumes. The cross-country standard deviation is calculated using a fixed sample of 12 euro area countries. The latest observations are for July 2022.

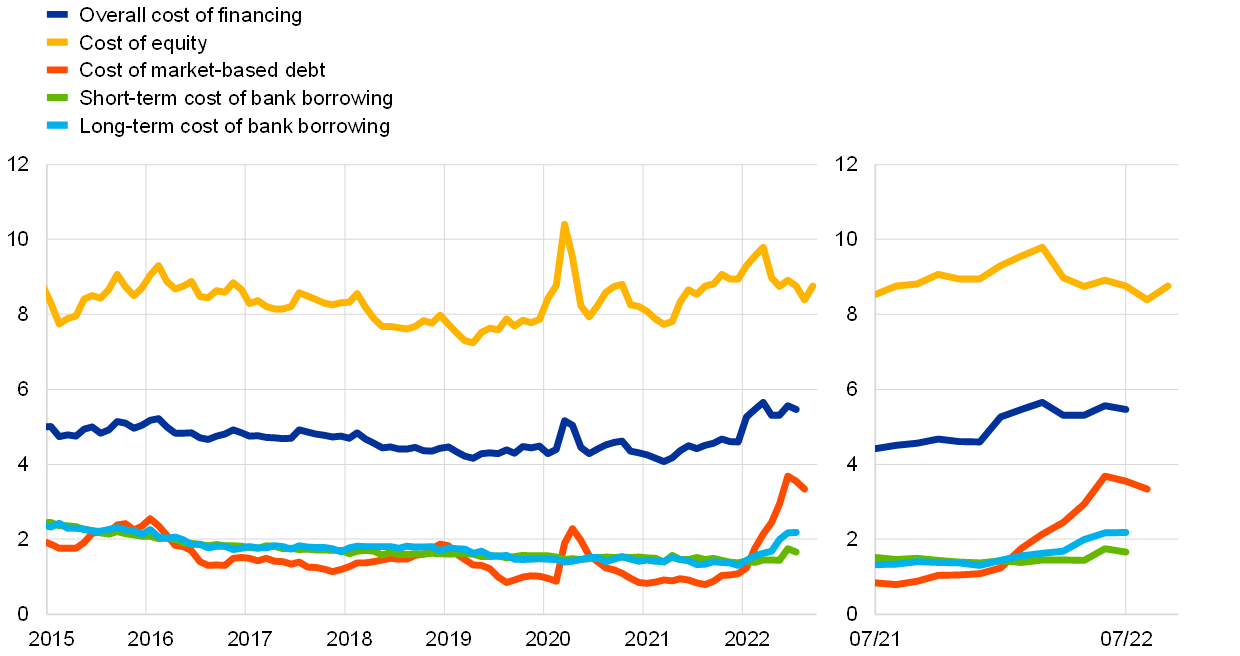

Over the period from 9 June to 7 September 2022, the cost of equity financing for NFCs declined sizeably, while the cost of market-based debt issuance increased. Due to lags in the data available for the cost of bank borrowing, the overall cost of financing for NFCs, comprising the cost of bank borrowing, the cost of market-based debt and the cost of equity, can be calculated only up to July 2022, when it increased to 5.5% from 5.3% in May. This was mainly the result of a substantial increase in the cost of market-based debt, with the cost of bank borrowing (Chart 22) also contributing to the increase in the overall cost of financing, albeit to a lesser extent. The cost of equity remained virtually unchanged until July 2022. The July 2022 data remained close to the peak recorded earlier in the year and significantly above the levels seen in the previous two years. Over the period from 9 June to 7 September, the cost of equity declined by around 15 basis points, while the cost of market-based debt increased by around the same amount. The slight decline in the cost of equity is attributable to a decline in the equity risk premium that more than compensated for the impact of a higher risk-free rate on the cost of equity. The increase in the risk-free rate also contributed to the increase in the cost of market-based debt. Spreads on bonds issued by NFCs declined marginally in the investment grade segment but widened largely in the high-yield segment.

Chart 22

Nominal cost of external financing for euro area NFCs, broken down by components

Sources: ECB and ECB estimates, Eurostat, Dealogic, Merrill Lynch, Bloomberg and Thomson Reuters.