Published as part of the ECB Economic Bulletin, Issue 6/2022.

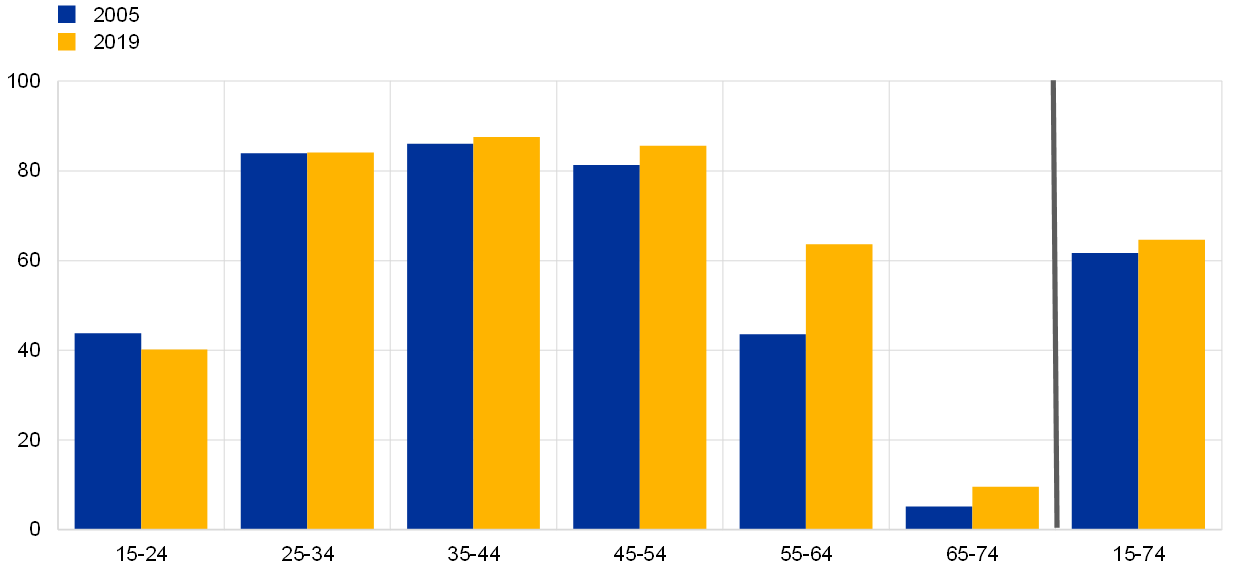

The increased activity of older workers has been a feature of the rise in the euro area labour force participation rate over the past 15 years. The euro area labour force participation rate increased from 61.7% in 2005 to 64.6% in 2019 (Chart A), driven primarily by the greater labour market activity of older workers. The participation rate for people aged between 55 and 64 increased by more than 21 percentage points over this period and by more than 4 percentage points for workers aged between 65 and 74. These developments are particularly important in the context of an ageing society, with the euro area labour force becoming older over time.[1] Workers aged 55 or older accounted for more than 20% of the labour force in 2021, up from 12% in 2005.

Chart A

Labour force participation rates in the euro area by age group

(percentages, age groups)

Sources: Eurostat, European Union Labour Force Survey (EU-LFS) and ECB staff calculations.

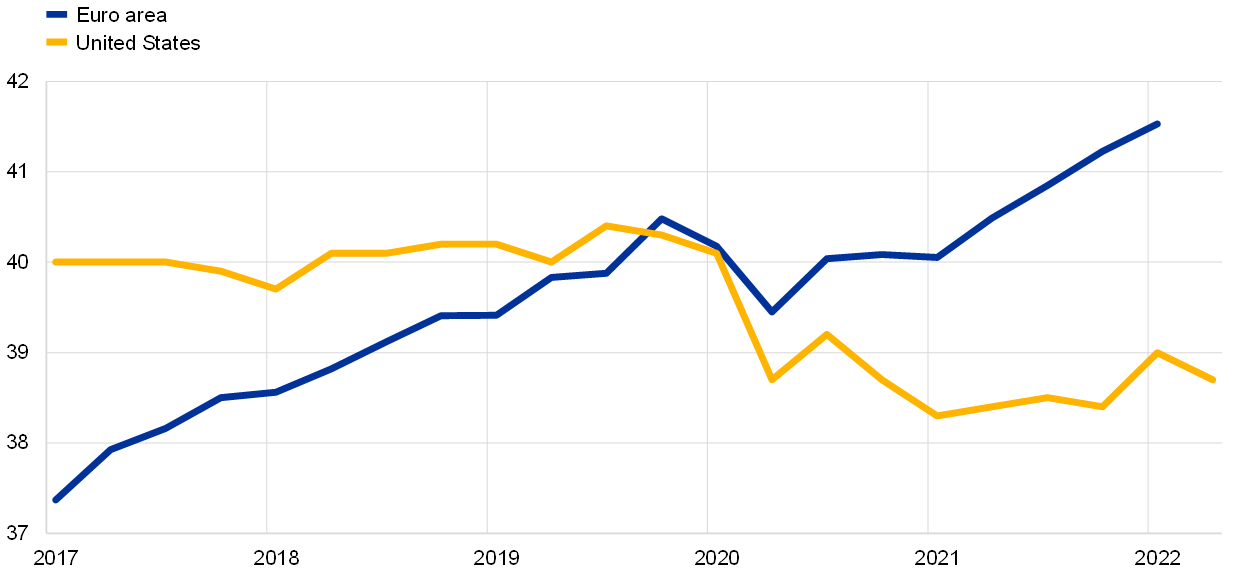

At least at first, the coronavirus (COVID-19) pandemic triggered a decrease in the labour market activity of older workers in the euro area (Chart B). The euro area labour market has recovered a long way since the trough reached during the pandemic, with some indicators even exceeding their pre-COVID-19 levels. While participation rates of older workers have exceeded pre-pandemic levels, they still fall short of what would be expected given the increasing activity of older workers observed in previous years.[2] Looking forward, the European Commission’s 2021 Ageing Report projects that the participation rate of older workers will keep increasing until 2040, before slowly stabilising thereafter at over 72% for workers aged 55-64 and around 20% for workers aged 65-74.[3] The recent developments in the euro area are in stark contrast with one frequently discussed observation for the United States. There, the labour force participation of older workers has not yet recovered to pre-pandemic levels. This is despite the US participation rate for older workers being broadly stable before the pandemic, while the rate in the euro area had steadily increased to match US levels by the end of 2019 and surpass them from 2020 onwards. Hence, while some people argue that the United States saw an excessive rate of early retirement and hence a permanently reduced participation rate during the pandemic, this effect is not directly observable in the euro area.[4]

Chart B

Labour force participation rates of older workers in the United States and the euro area

(percentages)

Sources: Eurostat, EU-LFS, U.S. Bureau of Labor Statistics Current Population Survey and ECB staff calculations.

Notes: Older workers are people aged 55-74 for the euro area and 55 and over for the United States.

The latest observations are for the first quarter of 2022 for the euro area and the second quarter of 2022 for the United States.

On aggregate, yearly transitions of older workers into retirement rose only marginally in 2020 following the outbreak of COVID-19. The number of retirees is rising in the euro area, albeit at a slow pace. The increase is largely in line with demographic trends such as the ageing of the population, with yearly rates of transition into retirement remaining broadly unchanged in 2020 compared with pre-pandemic levels (Chart C). There was only a limited number of excess retirees in the first year of the pandemic – irrespective of how much they were at risk of being infected at their workplace. In addition, there remains the possibility that some of those excess retirees might later re-join the labour market. In the United States, the share of retirees returning to the labour market has been moving back towards pre-crisis levels.[5] This suggests that some older workers will gradually return to the labour market as the economy recovers, assuming that the health risks remain mitigated.

Chart C

Yearly transitions into retirement by occupation categories

(percentages)

Source: Eurostat, EU-LFS, O*NET and ECB staff calculations.

Notes: A worker transitioning into retirement is no longer active, has left their job over the last year and is considered to have left the job for (early) retirement. Under all definitions, workers are aged between 55 and 74, and retirement transitions are calculated as a share of the active population of people aged 55-74 in the previous year in all euro area countries. Occupation categories follow Basso, G., Boeri, T., Caiumi, A. and Paccagnella, M., “Unsafe jobs, labour market risk and social protection”, Economic Policy, Vol. 37, Issue 110, 2022, pp. 229-267. This classification of occupations reflects the extent to which workers are at risk of being infected by airborne viruses.

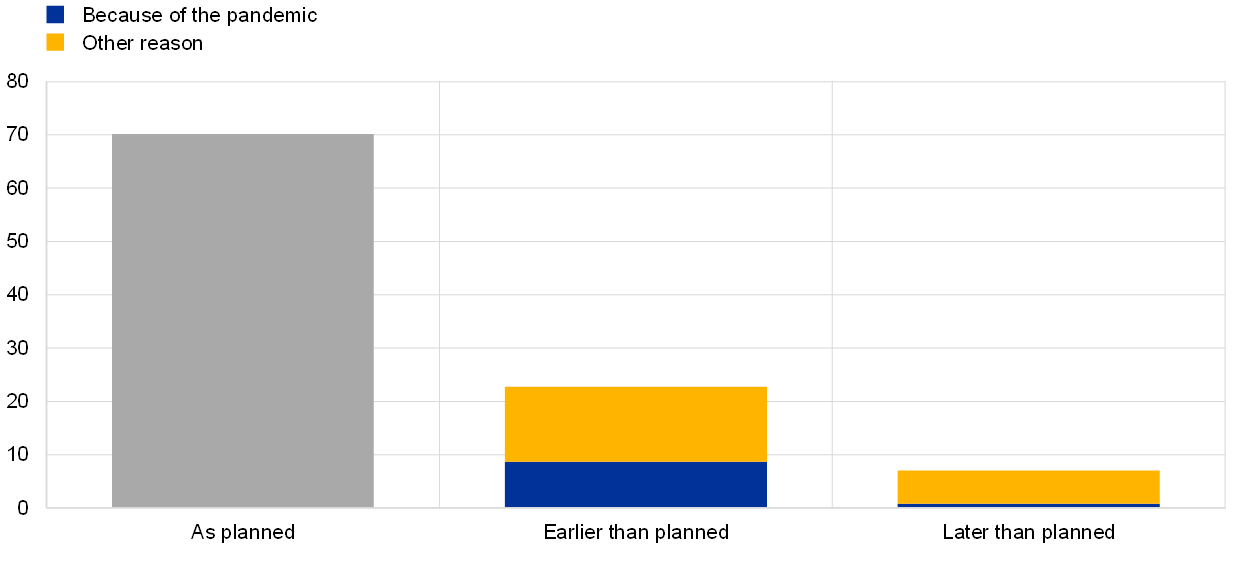

More granular data show that the marginal increase in retirements affected around 175,000 workers, driven mostly by a shift in the timing of retirement decisions. Any potential impact of the pandemic on the retirement transitions of older workers in the euro area is likely driven by various factors, such as lockdowns and associated containment measures, an increase in economic and health uncertainty, and the strong fiscal support and labour market policy actions involving the widespread use of job retention schemes. Using data from the Survey of Health, Ageing and Retirement in Europe (SHARE) for people aged 55-74 from March-April 2020 and June 2021, it is possible to quantify how the pandemic shaped the retirement decisions of some older workers.[6] During this period, 70% of retirees reported retiring as initially planned, 23% earlier than planned and 7% later than planned (Chart D). These figures imply that most retiring workers were broadly unaffected by the pandemic. By contrast, 38% of those who retired earlier than planned report doing so because of the pandemic. Hence, of the 5.5% of all active workers who retired after the outbreak of the pandemic, 8.7% retired early directly because of the pandemic. This is equivalent to only around 0.5% of the labour force aged 55-74, or some 175,000 people, which is in line with the only marginal increase in retirement seen in the aggregate data. At the same time, only a very small share of older workers retired later than planned as a consequence of the pandemic, suggesting that most older workers did not smoothen the effects from the heightened economic uncertainty by postponing their retirement.[7]

Chart D

COVID-19 and the timing of retirement decisions by older workers

(percentages)

Source: Survey of Health, Ageing and Retirement in Europe (SHARE) Wave 9.

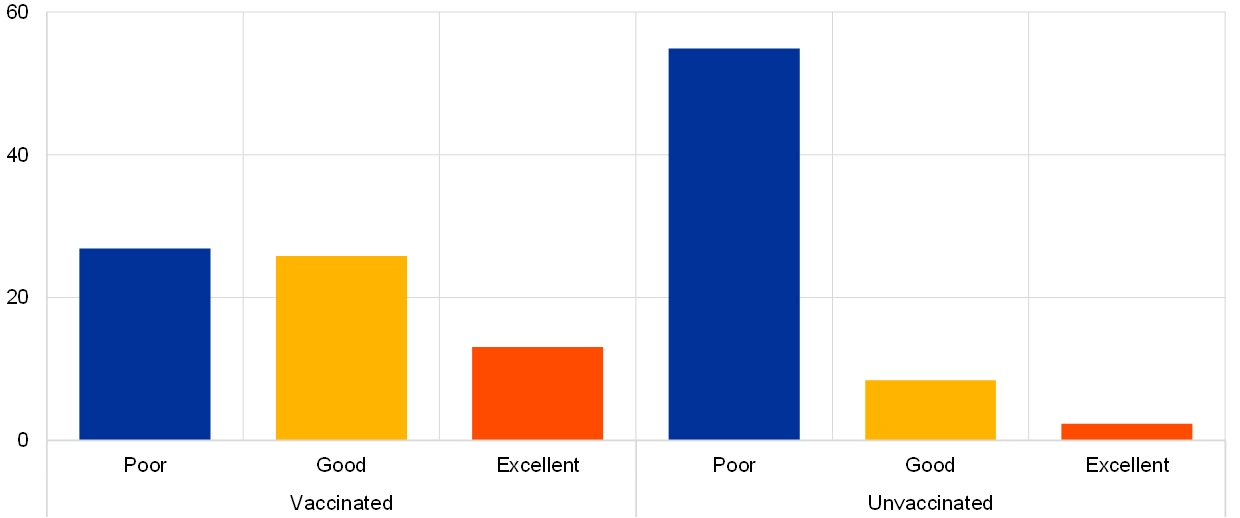

Early retirement was most pronounced for workers in relatively poorer health, reflecting perceptions of heightened health risks stemming from the pandemic. Factors such as socio-demographic or health characteristics are important when assessing the retirement decisions of older workers.[8] A prominent factor associated with early retirements is the individual’s assessment of their own personal state of health (Chart E). Following the outbreak of the pandemic, around 30% of the older workers that assessed their health to be relatively poor retired earlier than initially planned. Conversely, only 12% of those that stated being in excellent health retired early. These patterns are far more pronounced for workers who have not been vaccinated against COVID-19. Among the unvaccinated older workers, more than half of those with poor health retired earlier than planned, while less than 10% of those with good health and less than 5% of those with excellent health ended up retiring early. These findings highlight an important link between the state of health of workers and their retirement decisions.

Chart E

Share of retirees who retired earlier than planned after the outbreak of the pandemic, by state of health and vaccination status

(percentages)

Source: Survey of Health, Ageing and Retirement in Europe (SHARE) Wave 9.

Notes: The weighted SHARE data are representative of the population aged 50 and over. Health is defined as excellent if respondents report having very good or excellent health (26.2% of the older population), good when they report having good health (43.9%) and poor when they report having fair or poor health (29.9%). Among older workers with poor health, 86.3% reported being vaccinated, with the vaccination rate standing at 87% for older respondents with good health and 84.7% for older respondents with excellent health.

Overall, our analysis finds that the development of the labour market activity of older workers was driven to some extent by a pandemic-induced shift in retirement decisions. The pandemic caused the labour market activity of older workers in the euro area to decrease temporarily and shifted the timing of retirement decisions for around 175,000 workers forward. This relatively low number suggests that in contrast with developments observed in the United States, the pandemic did not have a very strong impact on the retirement decisions of older workers in the euro area. However, health concerns seemed to play a role in the timing of retirement for older workers. These findings are important for analysing the euro area labour market by demonstrating the transmission of large, exogenous health shocks into economic activity. This highlights the potential role of structural policies in improving the resilience of the euro area labour force by improving workers’ health or by facilitating a health-oriented working environment.

See also the article entitled “Drivers of rising labour force participation – the role of pension reforms”, Economic Bulletin, Issue 5, ECB, 2020, and Bodnár, K. and Nerlich, C., “The macroeconomic and fiscal impact of population ageing”, Occasional Paper Series, No 296, ECB, June 2022.

See the box entitled “Labour supply developments in the euro area during the COVID-19 pandemic”, Economic Bulletin, Issue 7, ECB, 2021.

See “The 2021 Ageing Report”, Institutional Paper, No 148, European Commission, 2021. According to the report, this is mostly driven by a further catch-up in labour force participation of women and various potential pension reforms increasing the actual retirement age.

See Faria-e-Castro, M., “The COVID Retirement Boom”, Economic Synopses, No 25, Federal Reserve Bank of St. Louis, 2021, and Domash, A. and Summers, L.H., “How tight are U.S. labor markets?”, NBER Working Paper Series, No 29739, National Bureau of Economic Research, 2022.

See, for example, Bunker, N., “‘Unretirements’ Continue to Rise as More Workers Return to Work”, Indeed Hiring Lab, April 2022.

This paper uses data from SHARE Wave 9 (10.6103/SHARE.w9ca800); for details of the SHARE methodology, see Börsch-Supan, A. et al., “Data Resource Profile: The Survey of Health, Ageing and Retirement in Europe (SHARE)”, International Journal of Epidemiology, Vol. 42, Issue 4, August 2013, pp. 992-1001.

The SHARE data collection has been funded by the European Commission, DG RTD through FP5 (QLK6-CT-2001-00360), FP6 (SHARE-I3: RII-CT-2006-062193, COMPARE: CIT5-CT-2005-028857, SHARELIFE: CIT4-CT-2006-028812), FP7 (SHARE-PREP: GA N°211909, SHARE-LEAP: GA N°227822, SHARE M4: GA N°261982, DASISH: GA N°283646) and Horizon 2020 (SHARE-DEV3: GA N°676536, SHARE-COHESION: GA N°870628, SERISS: GA N°654221, SSHOC: GA N°823782, SHARE-COVID19: GA N°101015924) and by DG Employment, Social Affairs & Inclusion through VS 2015/0195, VS 2016/0135, VS 2018/0285, VS 2019/0332 and VS 2020/0313. Additional funding from the German Ministry of Education and Research, the Max Planck Society for the Advancement of Science, the U.S. National Institute on Aging (U01_AG09740-13S2, P01_AG005842, P01_AG08291, P30_AG12815, R21_AG025169, Y1-AG-4553-01, IAG_BSR06-11, OGHA_04-064, HHSN271201300071C, RAG052527A) and from various national funding sources is gratefully acknowledged (see www.share-project.org).See the box entitled “COVID-19 and the increase in household savings: precautionary or forced?”, Economic Bulletin, Issue 6, ECB, 2020, and the box entitled “COVID-19 and the increase in household savings: an update”, Economic Bulletin, Issue 5, ECB, 2021, both noting that COVID-19 has led to a surge in household savings. This can be a major factor mitigating any fear of future income risks, which is an important driver of the timing of retirement decisions.

See, for example, Beydoun, H., Beydoun, M., Weiss, J., Gautam, R., Hossain, S., Alemu, B. and Zonderman, A., “Predictors of Covid-19 level of concern among older adults from the health and retirement study”, Scientific Reports 12, article number 4396, 2022.