Published as part of the Financial Stability Review, November 2023.

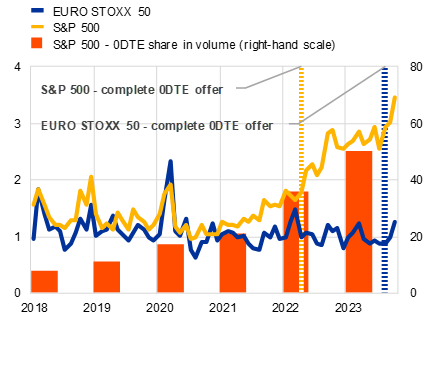

Option trading volumes in the euro area equity market could increase significantly in the coming quarters in response to the broader offer of such instruments. In the United States, there has been growing interest in trading S&P 500 options on the day of their expiry (commonly referred to as “0 days to expiry” or “0DTE”). In response, the Cboe Exchange has expanded the offer of these options by adding expiration dates to include every business day.[1] Since then, trading volumes for options on the S&P 500 have soared (Chart A, panel a). Recently they reached an all-time high, with 0DTE options accounting for more than 50% of total option volumes for this index. In anticipation of similar investor interest in trading 0DTE options in the euro area equity market, on 28 August 2023 EUREX expanded the offer of weekly options on the EURO STOXX 50 to also cover every business day.

Chart A

Trading activity and leverage in the euro area equity option market might rise after EUREX expanded the offer of options on the EURO STOXX 50 to cover every business day

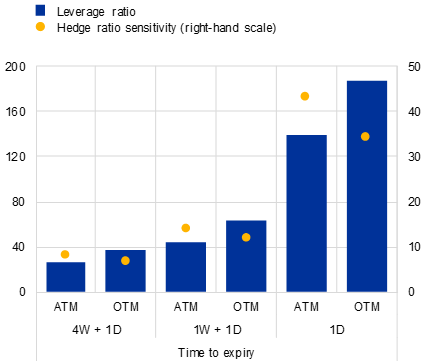

a) Average daily trading volumes for options on equity indices and 0DTE options share | b) Leverage ratios and hedge ratio sensitivities in call options on the EURO STOXX 50, by time to expiry |

|---|---|

(Jan. 2018-Oct. 2023; millions of contracts, percentages) | (26 Oct. 2023; ratio, percentage points) |

|  |

Sources: Bloomberg Finance L.P., Cboe Global Markets and ECB calculations.

Notes: Panel a: the latest observations are for 26 October 2023. “Complete 0DTE offer” marks the date from which options start to expire on each business day. Data on 0DTE share in S&P 500 option volume traded in 2023 show a year-to-date share at the end of August.* Panel b: the option leverage ratio (i.e. the option lambda parameter, or how much leverage market participants are employing while engaging in these trades) is calculated as the value of the delta-equivalent position (i.e. the effective exposure in the underlying index) over the option price. Hedge ratio sensitivity (i.e. the option gamma parameter) is calculated as the sensitivity of the option delta parameter (i.e. how much an option price changes when the underlying equity index changes) to the level of the underlying index. A higher gamma implies higher volatility in option prices. At-the-money (ATM) and out-of-the-money (OTM) options represent options closest to 50% and 25% delta respectively.

*) See “Volatility Insights: Evaluating the Market Impact of SPX 0DTE Options”, Cboe, 8 September 2023.

Trading in 0DTE options is more cost efficient for market participants. A broader range of expiries gives market participants more flexibility, for instance if they want to hedge against or speculate on the immediate market impact of a specific macroeconomic data publication or policy decision. Since the timing of such events is known in advance, investors can open their positions on the same day, paying less in premia for the relevant 0DTE options than they would otherwise have done for longer-dated contracts. This feature makes them particularly attractive during periods of heightened economic uncertainty.

Some characteristics of 0DTE options might, however, increase procyclicality in the equity market. The smaller premia paid for options with a shorter time to expiry mean the effective leverage embedded in these contracts is much higher (Chart A, panel b). This can magnify their impact on the underlying stock market because of the way exposures are managed by option sellers. Some traders only hedge their position after breaching a certain loss threshold. Others, such as market-makers (typically large banks or investment firms), tend to hedge their short positions swiftly, either by buying other options or trading the underlying securities, depending on the market situation. As the effective exposure stemming from options is sensitive to changes in the underlying index, the quantity of securities that must be bought or sold (the hedge ratio is determined by the option delta) also changes over the life of a contract. Sensitivity to changes is much higher for out-of-the-money options with a shorter time to expiry (Chart A, panel b). This means that the sellers of such 0DTE options might need to trade the underlying securities in a way which is very dynamic and in line with the short-term trend. In other words, they need to buy more and more when prices go up and sell more and more when prices go down. As a result, these transactions might fuel short-term price movements and amplify intraday volatility spirals.

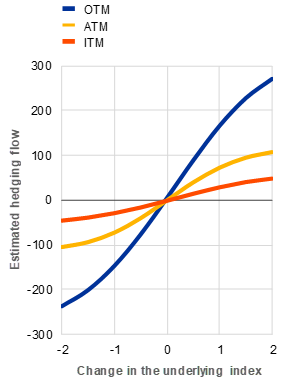

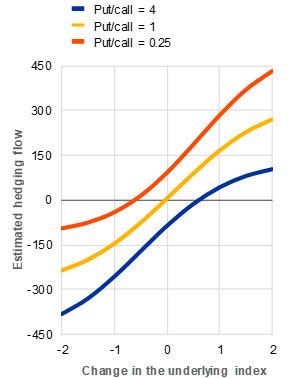

The potential for 0DTE options to affect the underlying equity market depends heavily on investors’ positioning. Option sellers hedge their positions at a portfolio level, and the hedging transactions of individual market participants might offset each other. This means that the aggregate market impact of these trades depends on the current structure of option exposures. If investors open similar positions in call and put options to a comparable degree, the initial impact on the underlying index might be negligible. Nevertheless, hedging trades might still affect short-term price developments over the life of these contracts. This effect is larger if market participants exploit higher leverage by choosing options with shorter maturities (Chart B, panel a) and out-of-the-money options (Chart B, panel b). If, on the other hand, the market positioning becomes more one-sided – meaning participants invest more in put (call) options – even the immediate market impact can become material (Chart B, panel c), and the potential for further impact in line with short-term price trends is skewed to the downside (upside).

A build-up of exposures in 0DTE options might fuel disorderly market moves. Greater sensitivity of shorter-dated options to changes in the price of the underlying index might constitute a structural vulnerability. The potential impact of 0DTE options grows with the size of exposures in these instruments relative to the size of the underlying equity market. Such an impact might remain muted until a large, abrupt swing in investor sentiment occurs, when markets typically become one-sided. Option sellers might then be forced to rapidly trade underlying securities in line with the short-term price trend. The expected deterioration in market liquidity conditions could also add to an adverse volatility spiral. In addition, some market participants – such as retail investors – might exploit this vulnerability by triggering or feeding a volatility spike through 0DTE options with the highest effective leverage.[2] Although the number of such investors in this market segment remains small, their share is growing rapidly.[3]

Chart B

The potential impact of options on the underlying equity market depends on various factors

a) Stylised simulation of hedging flows from a €1 million investment in EURO STOXX 50 options, by time to expiry | b) Stylised simulation of hedging flows from a €1 million investment in EURO STOXX 50 options with one day to expiry, by moneyness | c) Stylised simulation of hedging flows from a €1 million investment in EURO STOXX 50 options with one day to expiry, by put/call ratio |

|---|---|---|

(26 Oct. 2023; percentages, € millions) | (26 Oct. 2023; percentages, € millions) | (26 Oct. 2023; percentages, € millions) |

|  |  |

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Out-of-the-money (OTM), at-the-money (ATM) and in-the-money (ITM) options represent options closest to 75%, 50% and 25% delta respectively. “Estimated hedging flow” shows the values of the underlying securities that must be traded by option sellers to delta-hedge the option exposure. Other option parameters and characteristics (e.g. implied volatility) are assumed constant in the analysis. Panel a: investment amount assumed in the scenario is split equally between put and call ATM options. Panel b: investment amount assumed in the scenario is split equally between put and call options with one day to expiry. Panel c: investment amount assumed in the scenario is split between put and call OTM options with one day to expiry, in line with indicated put/call ratio.

Risks for the euro area from 0DTE options also stem from the high level of integration with global equity markets. Although it is yet to be seen if interest in trading EURO STOXX 50 options on the day of their expiry will grow rapidly, the euro area equity market might experience a disorderly correction if risks associated with 0DTE options were to materialise in the United States. The correlation between the two markets tends to rise during stress events, so adverse spillover effects could be expected. In addition, a rapid deterioration of market sentiment abroad might interplay with vulnerabilities in the EURO STOXX 50 option market. Further monitoring of trading patterns in 0DTE options globally is therefore warranted.

Before 2022, contracts expired on Mondays, Wednesdays and Fridays. Tuesday and Thursday expiries were added on 18 April and 11 May 2022 respectively.

For more information on the potential role of retail investors in inducing forced equity trades (e.g. short squeeze), see, for example, Anand, A. and Pathak, J., “The role of Reddit in the GameStop short squeeze”, Economics Letters, Vol. 211, February 2022, and Vasileiou, E., “Does the short squeeze lead to market abnormality and antileverage effect? Evidence from the Gamestop case”, Journal of Economic Studies, Vol. 49, No 8, October 2022.

See the box entitled “The Fast-Growing Interest in Retails’ Trading in the Zero-Day Options Market: Is It a Hidden Risk?’’, Global Financial Stability Report, International Monetary Fund, April 2023.