Introduction

This report presents the main results of the 25th round of the Survey on the Access to Finance of Enterprises (SAFE) in the euro area, which was conducted between 6 September and 15 October 2021. The survey covered the period from April to September 2021. The sample comprised 10,493 enterprises in the euro area, of which 9,554 (91%) had fewer than 250 employees.[1]

The report provides evidence on changes in the financial situation of enterprises and documents trends in the need for and availability of external financing. It examines developments both at the euro area level and in individual countries and includes results for micro, small and medium-sized enterprises (SMEs), and large firms.

1 Overview of the results

In this survey round, enterprises of all sizes, in particular large firms, reported the lack of skilled labour to be the dominant concern for their business activity, while access to finance was among the least reported obstacles. The lack of skilled labour was considered the main concern for euro area SMEs (28%), followed by the difficulty in finding customers (18%). Concerns about access to finance declined in the euro area as a whole (7%). Concerns about production costs (13%), competition (9%) and regulatory burden (11%) were also relatively low for enterprises in the euro area as a whole.

Reflecting the rebound in economic activity, SMEs signalled an increase in turnover (15% in net terms,[2] compared with -29% in the previous survey round). At the same time, SMEs continued to signal declining profits in most countries and sectors, although there was a significant improvement on the previous survey round (-6%, compared with -35%).

The decline in profits among SMEs reflected increases in labour costs and, in particular, rises in other costs (materials and energy). In net terms, 43% of SMEs indicated an increase in labour costs (up from 17%), while 71% of SMEs (up from 36%) reported higher costs for material and energy on account of the resurgence in commodity prices during the reporting period.

The economic recovery is widespread across all firm sizes, although it seems to have taken place at a faster pace for larger companies. Compared with the previous survey round, a higher net percentage of large firms reported a rise in both turnover (41%) and profits (20%).

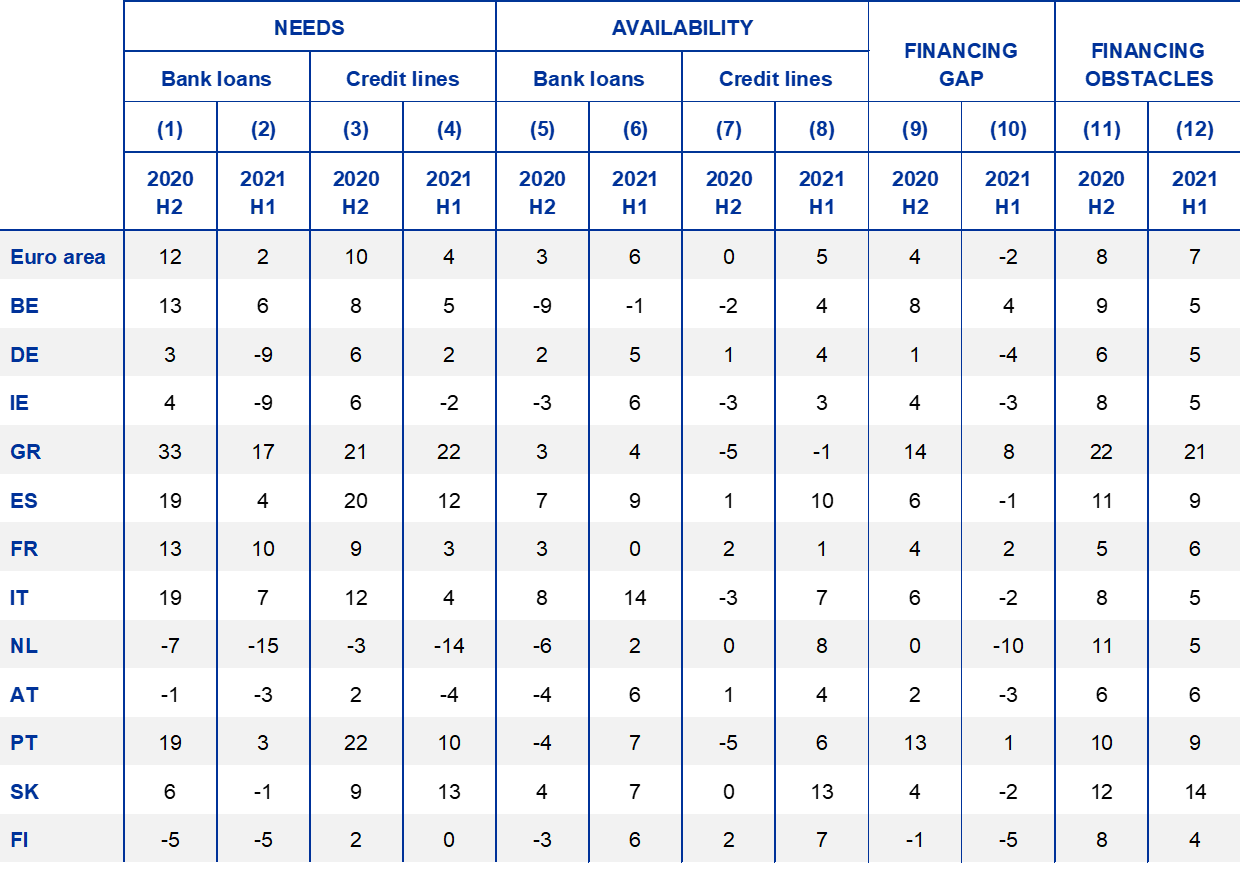

In net terms, euro area enterprises reported very moderate increases in the demand for both bank loans and credit lines, which were lower than in the previous round. A net 2% of SMEs reported higher demand for bank loans (down from 12%) and 4% increased demand for credit lines (down from 10%) (see Table 1, columns 2 and 4). External and internal financing continued to be used primarily for fixed investment, inventories and working capital, but around 20% of SMEs also used it to hire and train new employees, and to develop and launch new products. Large enterprises’ demand for bank loans was driven more by the need for fixed investment.

Overall, the availability of bank loans continued to rise slightly across all classes of firm size and countries. The net percentage of SMEs reporting an improvement in the availability of bank loans increased from 3% to 6% (see Table 1, column 6). Firms across all size groups, with the exception of medium-sized firms, pointed to a return to pre-COVID 19 levels of bank loan availability. The increase was broad-based across countries, although SMEs in Belgium reported reductions in the availability of bank loans. SMEs also indicated, on balance, an increase in the supply of credit lines to 5% (up from 0%) and a rise in trade credit to 7% (up from 0%).

The external financing gap for SMEs – i.e. the difference between the change in demand for and the change in availability of external financing – returned to negative territory, both at the euro area level (-2%, down from 4%) and across almost all euro area countries (see Table 1, column 10), while large companies continued to report a negative external financing gap (-7%, up from -2%).

Table 1

Latest developments in SAFE country results for SMEs

(net percentages of respondents)

Notes: For “needs”, see Chart 13; for “availability”, see Chart 18; and for the “financing gap”, see the notes to Chart 19. For “financing obstacles”, see the notes to Chart 24. “H2 2020” refers to round 24 (October 2020-March 2021) and “H1 2021” refers to round 25 (April 2021-September 2021).

In this survey round, euro area SMEs no longer regarded the macroeconomic environment as having adversely affected the availability of external financing (0% on net, compared with -29% in the previous round) (Chart 20). Similarly, fewer SMEs reported improvements in their firm-specific outlook (14%) and capital position (14%). At the same time, a larger net percentage of SMEs signalled an improvement in the willingness of banks to provide credit (11%). Large companies felt that the business environment had had an even stronger positive impact on their access to external finance (22%).

SMEs continued to see public financial support as a factor moderately contributing to their access to finance, with increasing percentages among micro and small firms.

The overall indicator[3] of obstacles preventing SMEs from accessing bank loans declined to 7% (see Table 1, column 12). 22% of SMEs applied for a loan (down from 27%). The percentage of fully successful loan applications reached 72%, while the rejection rate rose slightly to stand at 6%. The percentage of SMEs that were discouraged from applying for bank loans declined marginally to stand at 4% (down from 5%).

When asked about price terms and conditions for bank financing, on balance, few SMEs reported that bank interest rates had increased (from 2% to 4%). At the same time, a net 33% of SMEs (up from 28%) signalled increases in other financing costs, such as charges, fees and commissions. As for non-price terms and conditions, compared with the previous survey round fewer SMEs signalled increases in collateral requirements (13%) and in other requirements such as covenants (17%). In general, SMEs reported improvements in the size and maturity of loans (9% and 8% respectively). Likewise, few large firms reported increases in bank interest rates (6%, down from 12%), while they reported some improvements in other price and non-price terms and conditions.

Looking ahead, SMEs expect to see an improvement in their access to external financing, with percentages similar to those in 2019. In particular, a small percentage of SMEs anticipated better access to bank loans (1%, up from -9%) for the period October 2021-March 2022. Expectations were similar for the availability of most other external funding instruments, including credit lines (2%, up from -10%) and trade credit (4%, up from -6%).

Large companies reported easier access to finance than SMEs. Around 42% of large firms applied for a bank loan, with a higher success rate than SMEs (85%) and a lower rejection rate (2%). According to the survey results, the average interest rate charged to large enterprises on credit lines was around 129 basis points lower than that paid by SMEs, with the spread widening slightly compared with the previous round.

Overall, the survey results signal that the rebound in economic activity was also favourable for euro area SMEs, as reflected by the widespread increases in turnover. Conditions for access to finance improved, and the availability of external finance was considered higher than the demand for it. In coming months SMEs expect to see an improvement in the availability of most external financing sources to levels similar to those prevailing before the coronavirus (COVID-19) pandemic.

2 The financial situation of SMEs in the euro area

2.1 The financial situation of SMEs continues to improve

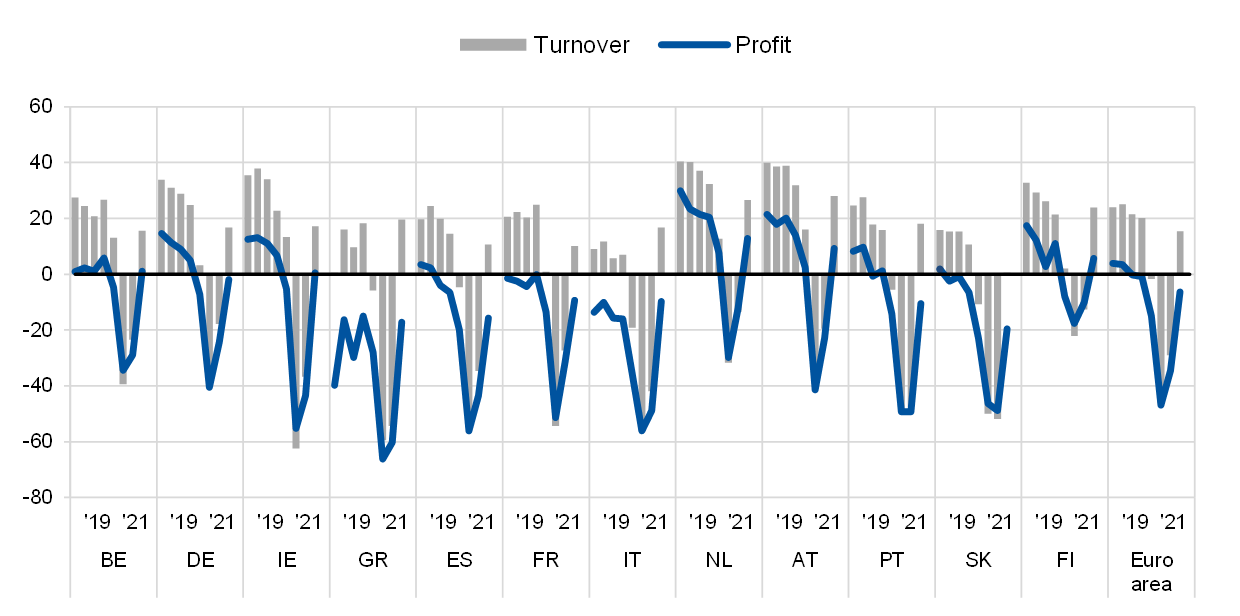

Reflecting the ongoing economic recovery from the pandemic, euro area SMEs reported an increase in turnover after three consecutive survey rounds of declines (see Chart 1). In the period from April to September 2021, a net percentage[4] of euro area SMEs reported increasing turnover (15%, following -29%, -46% and -2% in the three previous survey rounds respectively). While that net percentage remains below the pre-pandemic level, it suggests a significant rebound in the business activity of SMEs from the levels recorded in 2020, which were the lowest since the inception of the survey.

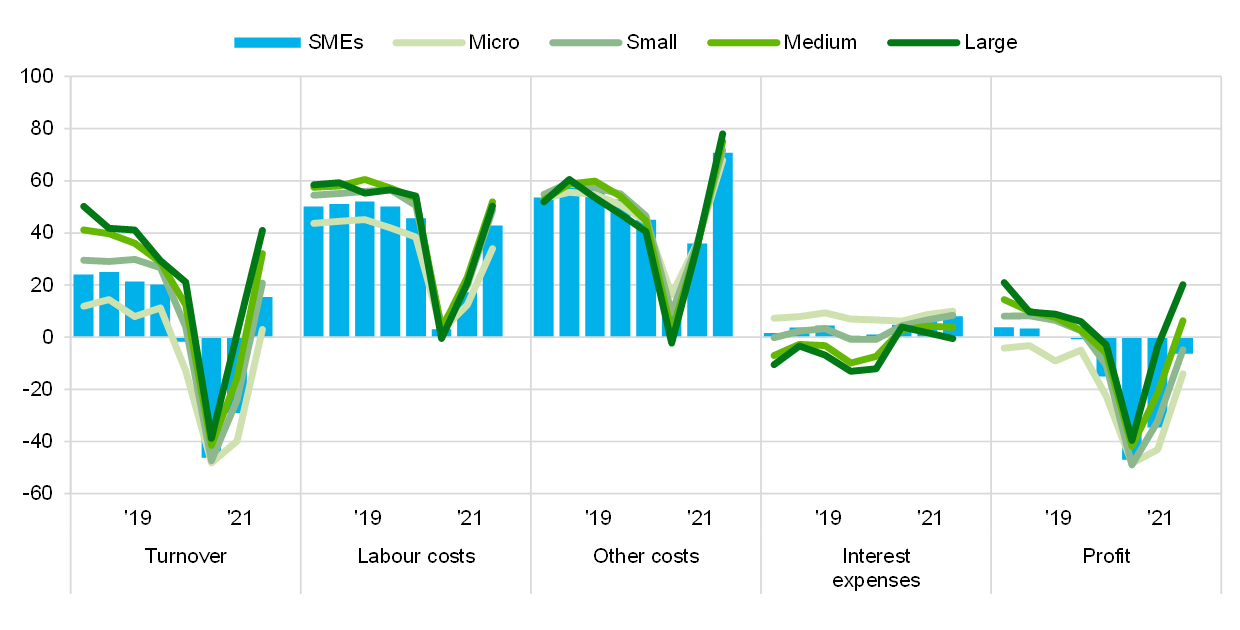

Chart 1

Changes in the income situation of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease. Since round 11 (April 2014-September 2014), “net interest expenses (what you pay in interest for your debt minus what you receive in interest for your assets)” has been replaced with “interest expenses (what your company pays in interest for its debt)”. The data included in the chart refer to Question 2 of the survey.

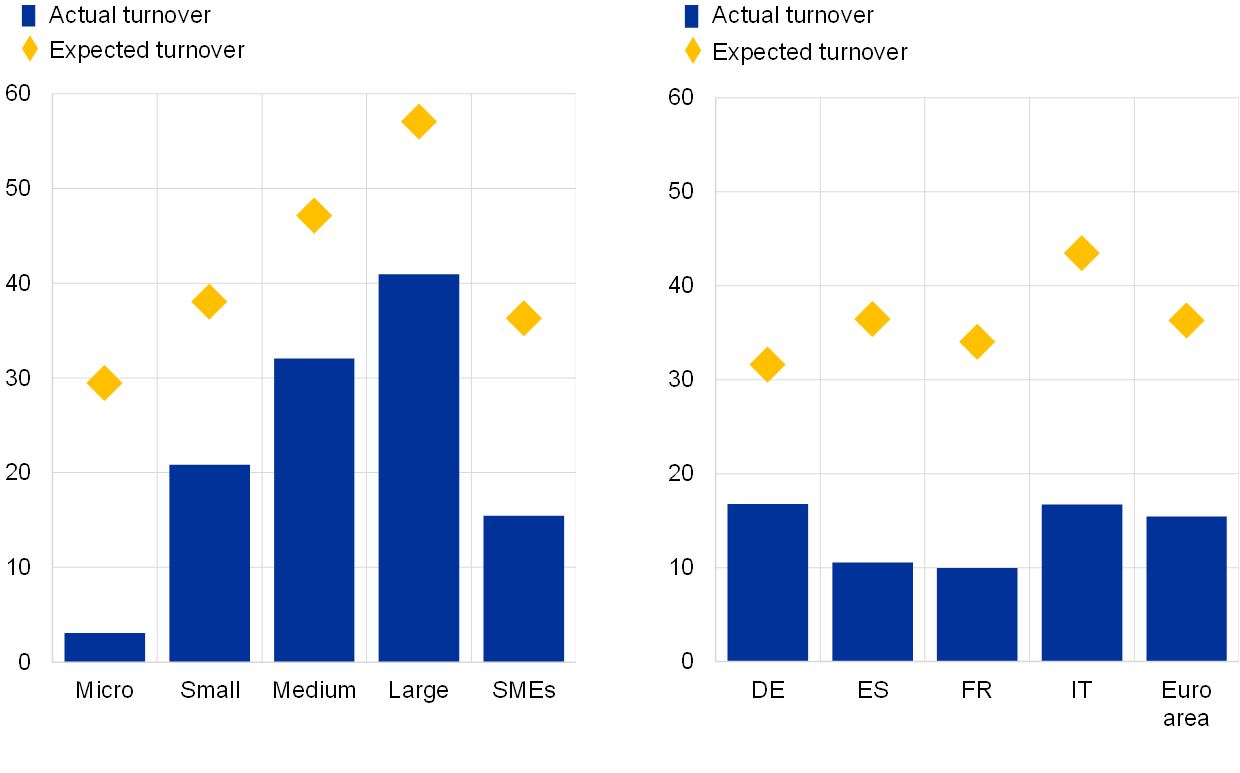

The recovery in turnover is widespread across firm sizes, although it seems to have taken place at a faster pace for larger companies. The net percentage of large firms reporting turnover growth rose to 41% in this round (up from 2%), while among SMEs that number was 32% (up from -15%) for medium-sized companies; 21% (up from -24%) for small firms; and just 3% (although up from -40%) for micro firms.

At the same time, euro area enterprises also reported significant increases in labour and other costs (i.e. for materials and energy). A larger net proportion of euro area SMEs reported increases in labour costs (43%, up from 17%) and other costs (71%, up from 36%), with increases being reported for all firm sizes. In contrast, larger firms did not report, in net terms, increases in interest rate expenses, while the percentage of SMEs reporting them rose marginally.

Consequently, a significant proportion of euro area SMEs continued to report a deterioration in profits, albeit less so than in the previous round (-6%, up from -35%). However, there were important differences in profits across firm sizes, with a positive net percentage of large companies and medium-sized SMEs reporting an increase in profits (20% and 6% respectively), while small and micro SMEs continued, in net terms, to show decreases in profits (-5% and -14% respectively).

Chart 2

Changes in the income situation of euro area SMEs

(net percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 2 of the survey.

Across countries, developments in SMEs’ activity have followed very similar patterns over the past six months (see Chart 2 and Chart 33 in Annex 1). SMEs in the largest euro area countries showed a very similar recovery in turnover. However, for the euro area aggregate, the widespread increases in labour and other costs led to a net percentage of companies continuing to report a decline in profits, with Spanish SMEs being particularly affected (-16% compared with -6% for the euro area as a whole).

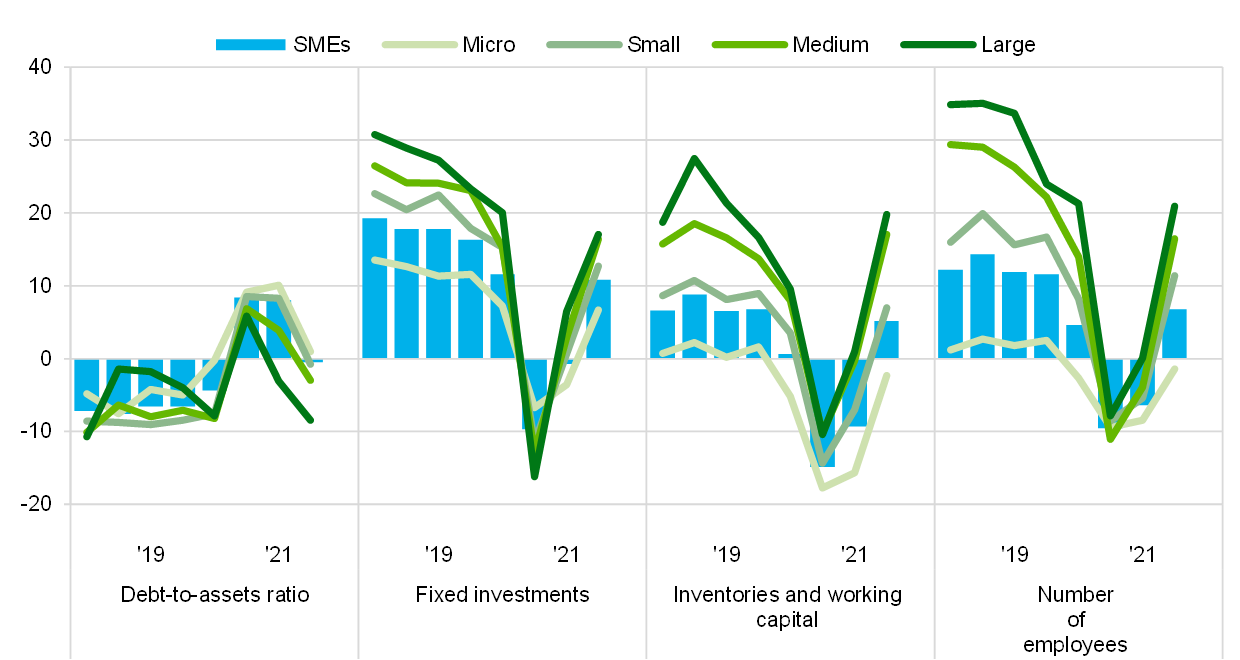

Chart 3

Changes in the debt situation and real decisions of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 2 of the survey.

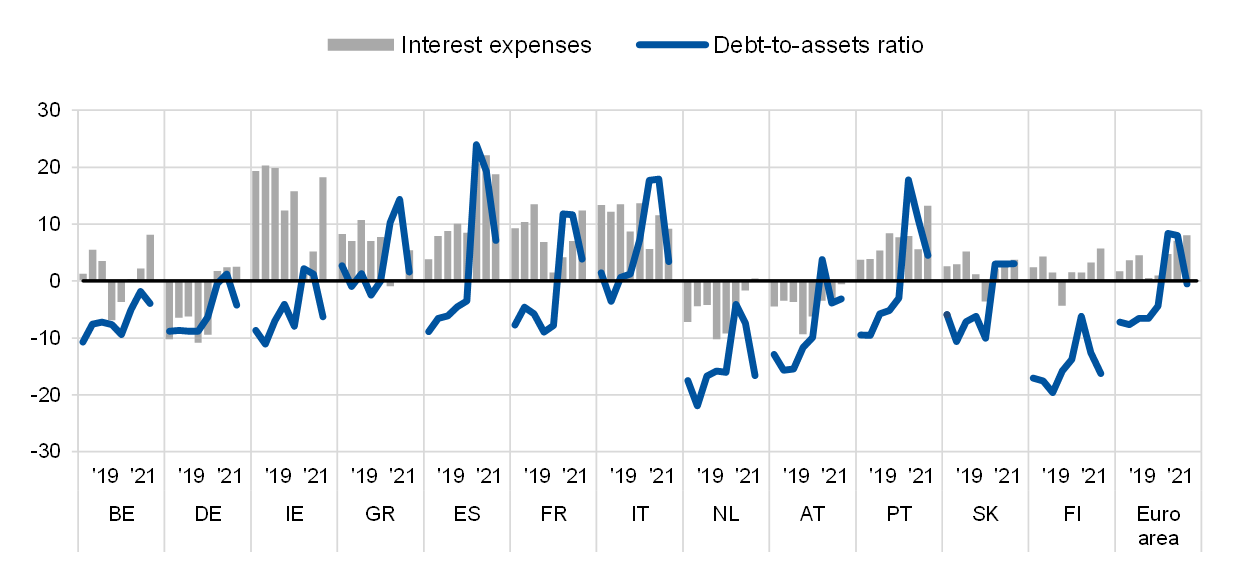

The balance sheets of euro area SMEs improved over the past six months. A net percentage of SMEs indicated a decline in their debt-to-assets ratios, reflecting a more benign economic environment (-1% compared with the two previous rounds in which a net 8% of euro area SMEs reported increases). Furthermore, in this survey round, the continued weakening in firms’ financial positions only affected micro SMEs in net terms. Large firms as well as small and medium SMEs reported, on balance, declines in their debt-to-asset ratios.

Firms’ investment and hiring decisions have also benefited from the recovery in economic activity. A net percentage of SMEs reported increases in fixed investment (11%, up from -1%), inventories and working capital (5%, up from -9%) and the number of employees (7%, up from -6%), with similar dynamics seen for firms of all sizes, although large firms seemed to experience a faster recovery and micro SMEs a much slower one.

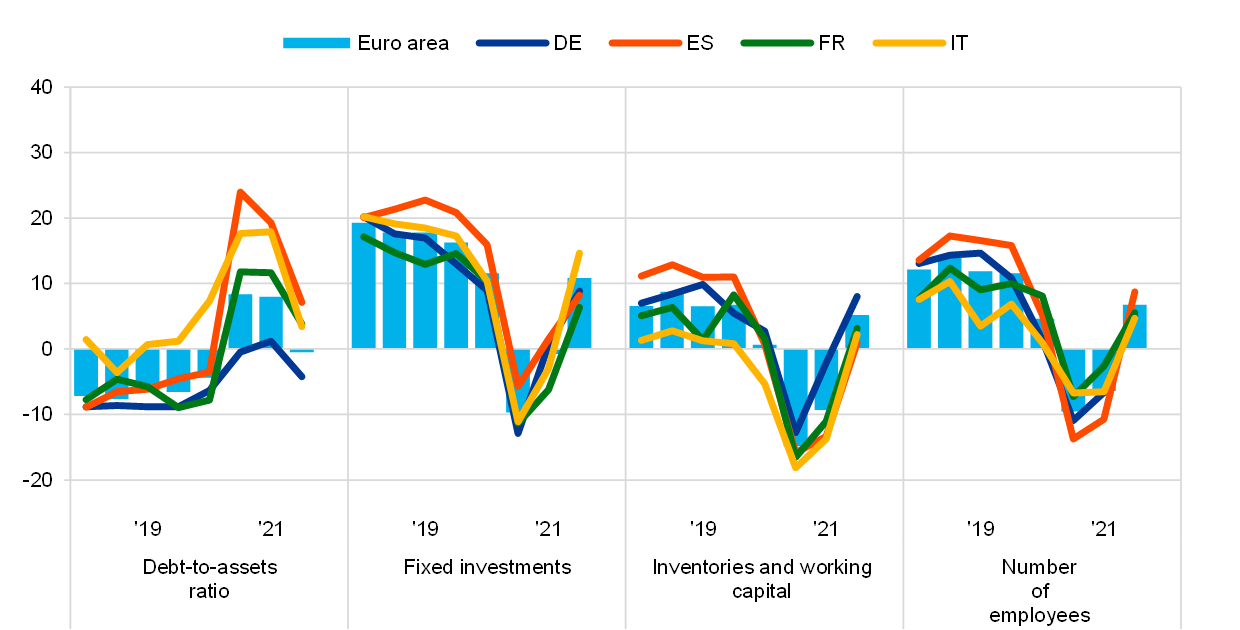

Chart 4

Changes in the debt situation and real decisions of euro area SMEs

(net percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 2 of the survey.

While SMEs’ balance sheets show positive dynamics across the euro area countries, the reported debt-to-assets ratios continue to reflect the different intensity of the effect of the COVID-19 pandemic across countries. While German SMEs report lower debt-to-assets ratios in net terms, SMEs in the other large countries continue to report increases, albeit significantly smaller ones than in previous survey round (7%, down from 19% in Spain, 3% down from 18% in Italy, and 4% down from 12% in France) (see Chart 34 in Annex 1 for other countries).

Moreover, SMEs in all large countries reported, in net terms, a rise in inventories and working capital expenses, as well as in employment and fixed investment. In net terms, 5% of euro area SMEs reported an increase in inventories and working capital expenses (with net percentages ranging from 1% to 8% across the four largest countries), 7% reported a rise in employment (with net percentages ranging from 5% to 9%), and 11% reported increases in fixed investment (ranging between 6% and 15% in the four largest euro area economies).

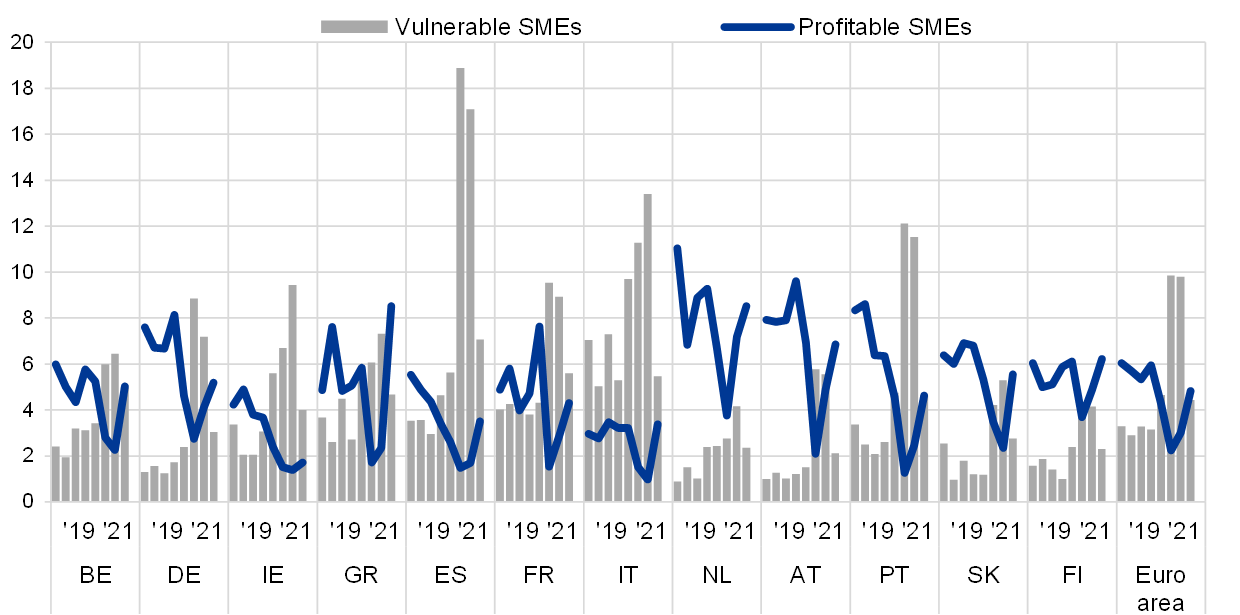

The financial vulnerability of euro area SMEs decreased with the ongoing economic recovery. A comprehensive indicator of firms’ financial situation[5] (the “financial vulnerability indicator”) suggests that 4.4% of euro area SMEs (less than half of the 9.8% and 9.9% seen in the previous two rounds) encountered major difficulties in running their businesses and servicing their debts. As such, they could, therefore, face more difficulties than other firms in accessing finance in the future. Nevertheless, the financial vulnerability indicator still remains somewhat above its average levels prior to the outbreak of COVID-19. At the other end of the spectrum, the percentage of profitable firms (i.e. those that are more likely to be resilient to financial shocks) rose to 4.8% (up from 3%) (see Chart 5; Chart 35 in Annex 1 shows the results at country level).

Chart 5

Vulnerable and profitable enterprises in the euro area

(percentages of respondents)

Base: All enterprises. The figures refer to rounds 3-25 of the survey (March 2010-September 2010 to April 2021-September 2021).

Notes: For definitions, see footnote 5. The data included in the chart refer to Question 2 of the survey.

Looking at firm size, smaller firms continue to be more vulnerable than larger companies. In this survey round, the percentage of vulnerable enterprises fell to 3.9% for large firms (down from 6.4%). Although there were improvements among SMEs of all sizes (i.e. only 3.4% of medium-sized SMEs, down from 8.5%) and small firms (3.9%, down from 9.7%), the percentage of vulnerable firms among micro firms still remains the highest at 5.3% (although down from 10.5%). Similarly, the percentage of firms that can be characterised as “profitable”,[6] also rose in this survey round, with profitability returning to pre-COVID-19 levels for most size categories.

The profitability and vulnerability indicators for SMEs showed improvements across all the largest euro area economies (see Chart 6 for the euro area and the four largest countries). Nevertheless, the percentage of vulnerable companies remains somewhat higher in Spain (7.1%, but down from 17.1%), Italy (5.5%, down from 13.4%) and France (5.6%, down from 8.9%), compared with Germany (3%, down from 7.2%) and the euro area as whole (4.4%, down from 9.8%). Profitability also improved, ranging between 3.4% and 5.2% of firms across the four largest economies in this survey round. For details of trends in other euro area countries, see Chart 35 in Annex 1.

Chart 6

Vulnerable and profitable SMEs

(percentages of respondents)

Base: All SMEs. The figures refer to rounds 3-25 of the survey (March 2010-September 2010 to April 2021-September 2021).

Note: The data included in the chart refer to Question 2 of the survey.

For the third year in a row, the questionnaire included two additional questions for euro area enterprises: (1) on their main export markets and (2) on the impact of late payments on their business plans. Box 1 summarises the main results.

Box 1

Special questions – SMEs’ export markets and the impact of late payments

Main features of euro area SME exports in 2021

The survey collected some information on the exporting activities of euro area enterprises for the third time. The overall picture of euro area SME exports arising from this survey round reaffirms the crucial role of non-domestic sales for euro area companies. Of the SMEs that participated in the survey, 42% reported that they had exported some goods or services, with the percentage of exporting enterprises increasing with size and reaching 67% among large companies.

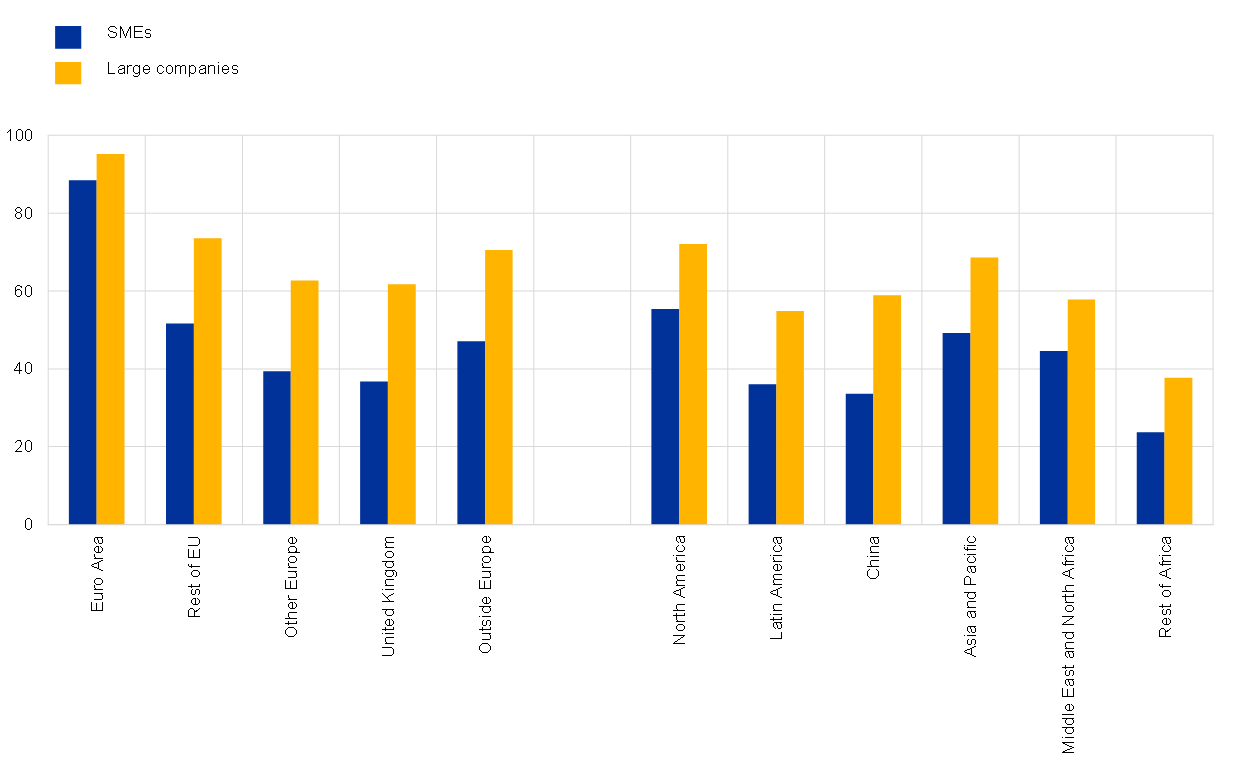

Overall, survey results suggest that the reported percentages of European companies exporting across markets has remained very resilient during the pandemic, with marginal declines in most markets. However, China is an important exception in terms of SMEs, since around 34% of exporting firms reported exports to that country (down from 42% last year), in stark contrast to the 4 percentage points rise seen for large companies to 59%. With regard to the composition of these exports, while SMEs and large companies continued to export predominantly within the euro area (88% and 95% respectively), a significant percentage of companies also exported outside the euro area: 52% of SMEs exported to non-euro area EU countries, 39% to other European countries (with the United Kingdom at 37% in line with the rest of non-EU countries) and 47% to countries outside Europe (see Chart A). Among SMEs exporting outside Europe, North America continues to be the most common market destination (for 55% of SMEs), followed by Asia and the Pacific (around 49%, excluding China) and the Middle East and North Africa (45%).

Chart A

Export markets of euro area enterprises

(percentages of: (i) all exporting SMEs and large companies, left-hand panel; and (ii) SMEs and large companies exporting outside Europe, right-hand panel)

Base: Left-hand panel – all enterprises that exported; right-hand panel – all enterprises that exported outside Europe. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question A1A, Question A1B and Question A1C of the survey.

Larger companies continue to assign a greater degree of importance to exports to non-domestic markets. However, in terms of export country destinations, they show similar patterns of diversification as those of SMEs. Almost 74% of them sell their goods and services to other EU countries, and 71% sell outside Europe, particularly to North America (72%) and to Asia and the Pacific (69%, excluding China), and to China (59%). These continued to be the biggest markets for large euro area firms exporting outside Europe (see Chart A, right-hand panel).

The frequency and impact of late payments to euro area SMEs

In the survey, euro area enterprises were also asked about the extent to which they perceived late payments[7] as a problem, and what impact these had had on their business activity. In this survey round, 10% of SMEs signalled that in the last six months they had experienced problems on a regular basis, and 28% that they had experienced problems occasionally as a result of late payments from private and/or public entities. These numbers imply just a marginal decrease compared with the responses given in the survey conducted in 2020 (down from 12% and 31% respectively), a pattern that was also reported by large companies (a decrease to 11% and 31% respectively), which suggests that payments to companies have also recovered from the adverse effects of the COVID-19 pandemic.

Chart B

Frequency of late payments among euro area enterprises between 2020 and 2021

(percentages of respondents)

Base: All enterprises. The figures refer to round 23 (April 2020-September 2020) and round 25 (April 2021-September 2021) of the survey.

Note: The data included in the chart refer to Question A2 of the survey.

A crucial reason for monitoring late payments is their potential impact SMEs’ business decisions, such as hiring and investing. In addition, late payments may exacerbate the liquidity needs of SMEs. Compared with the replies in the 2020 survey, a lower percentage of SMEs reported that their regular operations had been impacted by late payments (see Chart C). Among those operations, payments to other suppliers were the most frequently affected (as reported by 31% of SMEs, down from 35%), but other business operations were also affected for a smaller percentage of SMEs this year, namely investment or recruitment (22%, down from 27%), repayments of loans or use of additional financing (18%, down from 25%) and production or operations (20%, from 25%). Together with the decline in the incidence of late payments, the survey results point to a normalisation of conditions following the pandemic. A similar picture emerges for large companies, although investment decisions and production plans appear to show more resilience to late payments (for example only around 6% of these companies reported that business operations had been affected).

Chart C

Impact of late payments on euro area SMEs between 2020 and 2021

(percentages of respondents)

Base: All enterprises that experienced regular or occasional problems due to late payments. The figures refer to round 23 (April 2020-September 2020) and round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question A3 of the survey.

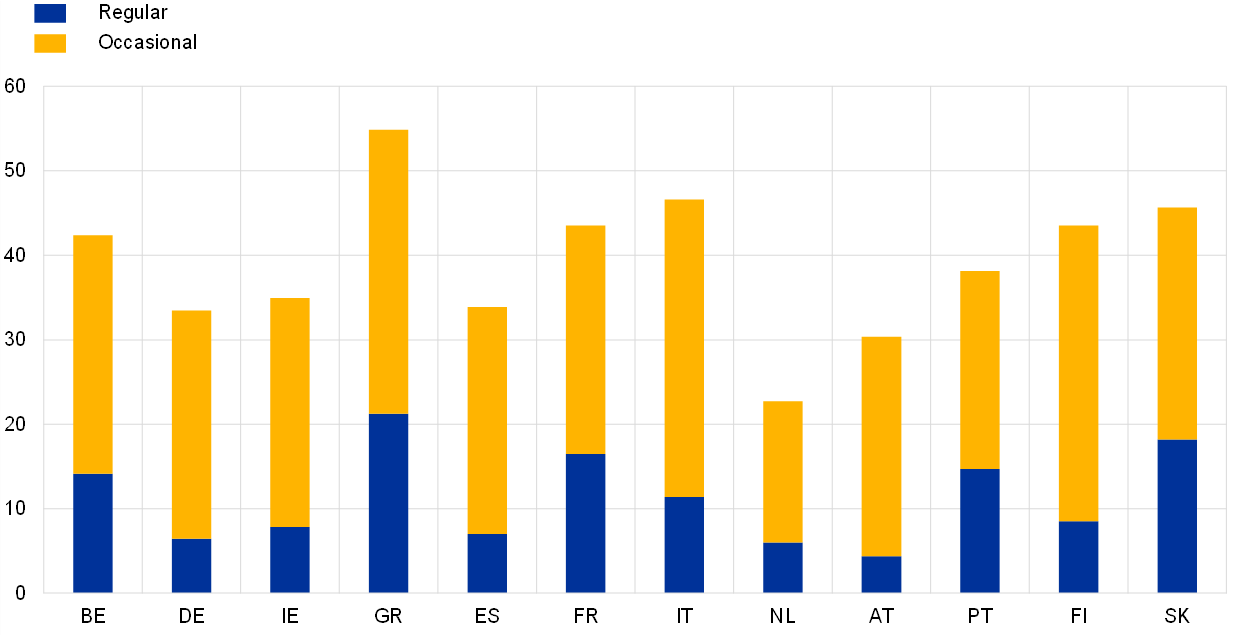

Turning to the situation across euro area countries, late payments are a regular problem for a relatively large proportion of firms in Greece and Slovakia (21% and 18% respectively), but also in France (17%) and Italy (11%) among the four largest countries (see Chart D). Occasional late payments have been more frequent in Italy, Finland and Greece. In contrast, SMEs in the Netherlands have been the least affected by late payments over the past six months.

Chart D

Frequency of late payments among euro area SMEs in euro area countries in 2021

(percentages of respondents)

Base: All enterprises that experienced regular or occasional problems due to late payments. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question A3 of the survey.

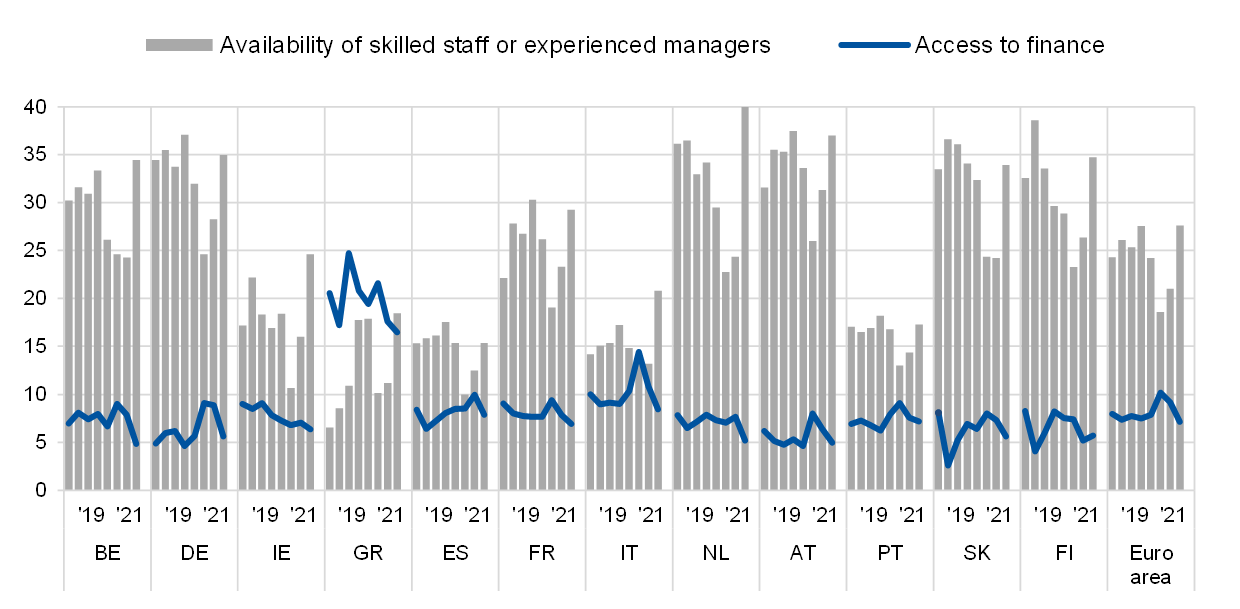

2.2 SMEs are more concerned about the availability of skilled staff and less concerned about access to finance

The availability of skilled labour and the difficulty of finding customers continue to be the main concerns for euro area SMEs (see Chart 7). Over the past six months, concerns about the availability of skilled labour have risen again (signalled by a net 28% of SMEs, up from 21%). The difficulty of finding customers remains the second most important concern among SMEs, but declined slightly to 18% (down from 20%). Concerns regarding production costs (13%, up from 12%), regulation (11%, down from 12%) and competition (9%, down from 10%) are mentioned by fewer firms. Finally, SMEs reported marginally fewer concerns regarding access to finance (7%, down from 9%), broadly in line with pre-pandemic percentages.

Chart 7

The most important problems faced by euro area enterprises

(percentages of respondents)

Base: All enterprises. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: The formulation of the question has changed over the survey rounds. Initially, respondents were asked to select one of the categories as the most pressing problem. From round 8, all respondents were asked to indicate how pressing a specific problem was on a scale of 1 (not pressing) to 10 (extremely pressing). In round 7, the question used the initial phrasing for one half of the sample and the new phrasing for the other half. In addition, if two or more items had the highest score in Question 0B on how pressing the problems were, a follow-up question (Question 0C) was asked in order to resolve this, i.e. to determine which of the problems was more pressing, even if only by a small margin. This follow-up question was removed from the questionnaire in round 11. The past results from round 7 onwards were also recalculated, disregarding the replies to Question 0C. In round 12, the word “pressing” was replaced by the word “important”. The data included in the chart refer to Question 0b of the survey.

Overall, concerns are broadly similar across euro area enterprises, regardless of their size. Larger firms tended to report somewhat stronger concerns about shortages of skilled staff than smaller companies, possibly on account of their more advanced recovery from the trough in economic activity (as discussed above). The concerns reported regarding production costs, regulation and competition showed broadly similar patterns across firm sizes.

The main concerns among SMEs followed broadly similar patterns across euro area countries, although some cross-country heterogeneity remained (see Chart 8 and Chart 36 in Annex 1). Looking at the largest euro area countries, the lack of skilled staff was the biggest concern for German SMEs (35%), but less of a problem for Spanish and Italian SMEs (15% and 21% respectively). At the same time, Spanish and German SMEs reported more difficulty finding customers (22% and 21% respectively, above the euro area average of 18%), but this was significantly less of a concern for French and Italian SMEs (15% and 16% respectively).

Concerns among SMEs about access to finance have eased in the majority of countries (being seen as the least pressing problem in most countries) and are far below their historical peaks. Greek SMEs continued to be disproportionately affected by a lack of access to finance in this survey round, with 16% of firms still citing it as their most important problem (down from 18%). This was well above the levels seen in other euro area countries, where net percentages were in single digits.

Chart 8

The most important problems faced by euro area SMEs

(percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 7. The data included in the chart refer to Question 0b of the survey.

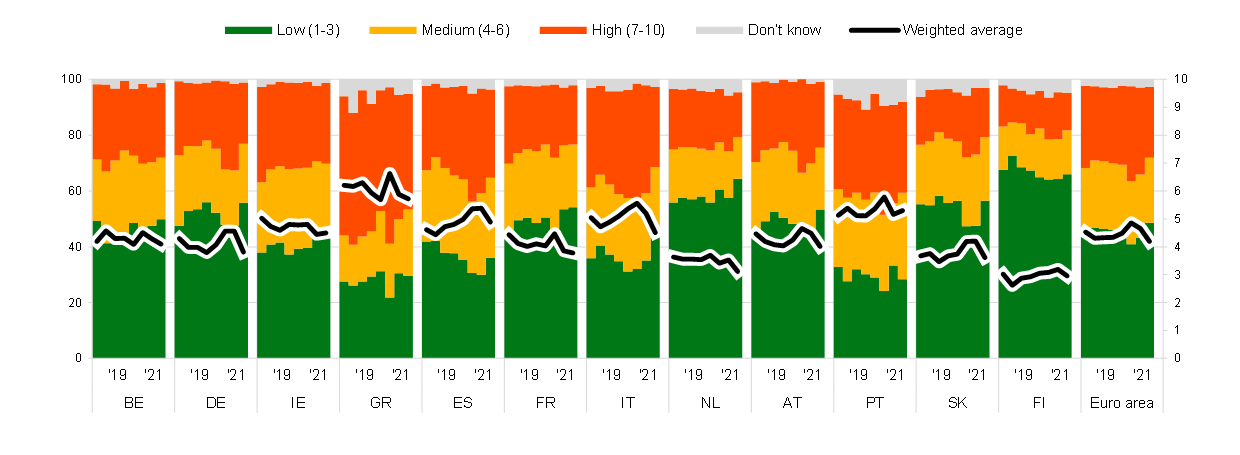

The responses by SMEs regarding the importance of access to finance as a problem on a scale of 1 to 10 (see Chart 9) confirm the overall picture of moderating concern in most countries. Scores declined in all countries except Ireland and Portugal, as well as in the euro area as a whole. In terms of magnitude, concerns among SMEs regarding access to finance have declined to levels observed before the pandemic in most countries. In Greece, however, it is still regarded as a very important issue (with a rating of 5.7 on average). The only other country with scores in excess of 5 was Portugal (5.3).

Chart 9

Importance of access to finance as perceived by SMEs across euro area countries

(left-hand scale: percentages; right-hand scale: weighted averages)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: Enterprises were asked to indicate how important a specific problem was on a scale of 1 (not at all important) to 10 (extremely important). On the chart, the scale has been divided into three categories: low (1-3), medium (4-6) and high importance (7-10). The weighted average score is an average of the responses using the weighted number of respondents. The data included in the chart refer to Question 0b of the survey.

3 SME financing needs and sources

3.1 SMEs rely on bank financing

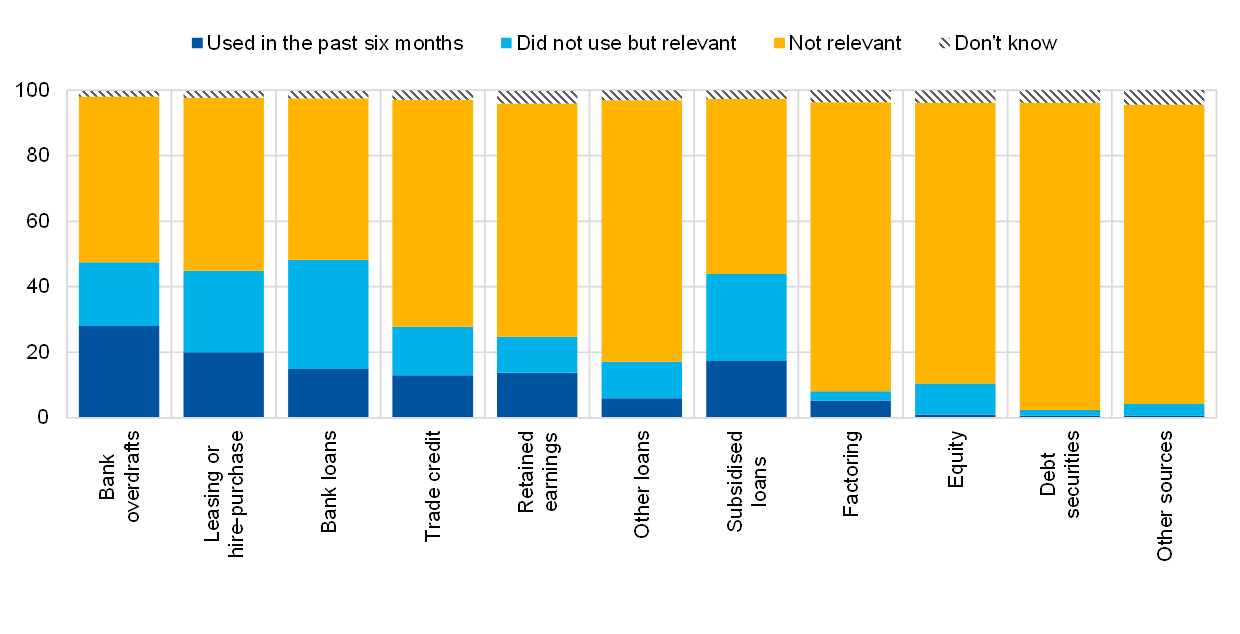

Bank-related products and subsidised loans remained the most important financing source for SMEs (see Chart 10). Almost half of the euro area SMEs (48%) reported that bank loans had been an important source of financing over the past six months. Bank overdrafts, leasing or hire-purchase, and subsidised loans had been almost equally relevant in the past six months (47%, 45% and 44% respectively).[8]

The use of subsidised loans increased during the pandemic and has remained high in the past six months, with 44% of SMEs reporting that such loans had been important (compared with 33% just prior to the pandemic). Since the onset of the pandemic, increased use of subsidised loans has been accompanied by a slight decrease in the three main sources of financing, namely banks loans, bank overdrafts, and leasing or hire-purchase. Other instruments mentioned by SMEs as an important source of finance were trade credit (28%) and internal funds (25%). Use of other loans (for example, loans from family, friends or related companies), and market-based instruments (such as equity, debt securities and factoring) was relatively low in the past six months (respectively only 17%, 10%, 2% and 8% of SMEs pointed to those instruments as a relevant source of finance).

Chart 10

Relevance of financing sources for euro area SMEs

(percentages of respondents)

Base: All SMEs. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question 4 of the survey.

The use of almost all financing instruments increased with firm size (see Chart 11). Short-term bank finance (credit lines/bank overdrafts/credit cards) remained the most popular source of finance for firms of all sizes, with the exception of large companies, which reported only slightly higher use of leasing or hire-purchase. The likelihood of usage of leasing or hire-purchase was proportional to firm size. For example, 42% of large firms favoured leasing or hire-purchase, compared with only 20% of SMEs. The use of subsidised loans was broadly similar for small, medium and large firms (19%, 22% and 17% respectively), and only somewhat smaller for micro firms (14%). Bank loans were used more by large and medium-sized firms (31% and 23% respectively), and somewhat less by small and micro firms (16% and 10% respectively), while equity and debt securities remained among the least frequently used sources of finance across all firm sizes.

Chart 11

Use of internal and external funds by euro area enterprises by firm size

(percentages of respondents)

Base: All enterprises. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question 2 and Question 4 of the survey.

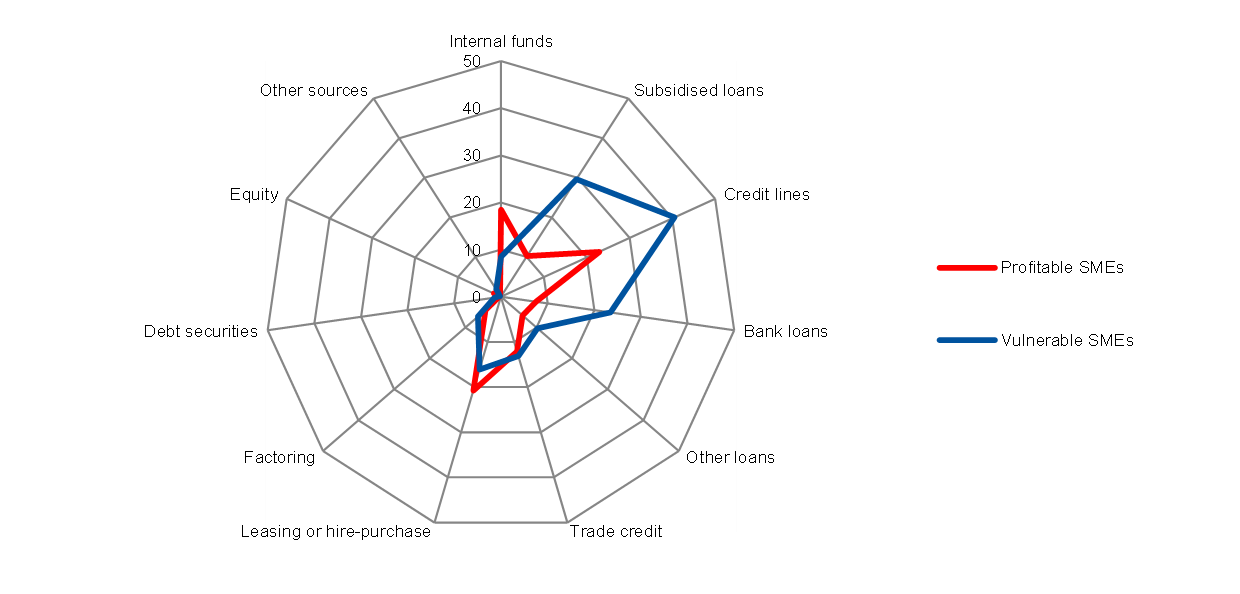

Vulnerable firms were much more likely to resort to credit lines (41%), subsidised loans (30%) and banks loans (23%) as their main source of external financing than profitable firms (23%, 10% and 8% respectively) (see Chart 12). In turn, profitable firms were more likely to opt for leasing or hire-purchase (21%) or internal funds (18%), compared with vulnerable firms (16% and 8% respectively), while the degree of reliance on trade credit was similar.

Chart 12

Use of internal and external funds by profitable and vulnerable SMEs in the euro area

(percentages of respondents)

Base: All SMEs. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question 2 and Question 4 of the survey.

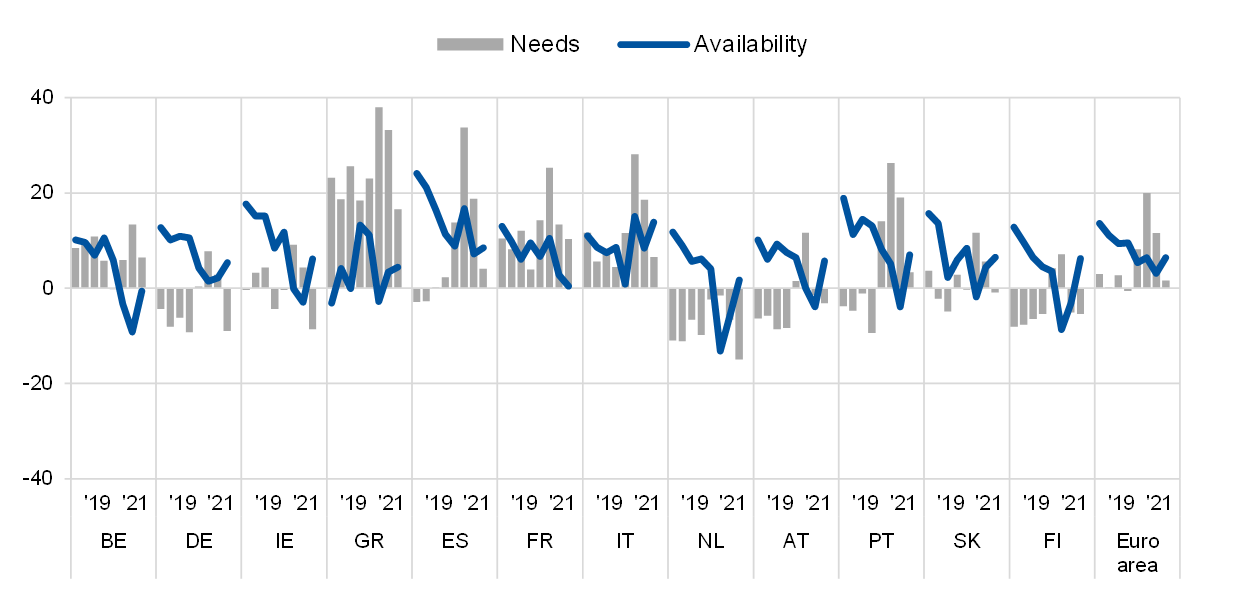

3.2 Demand for external financing moderated

In net terms, SMEs reported very moderate increases in the demand for bank loans and credit lines (see Chart 13). SMEs reported a considerable moderation in net demand for bank loans[9] (2%, down from 12%) and credit lines (4%, down from 10%). Net demand for trade credit and leasing or hire-purchase were almost the same as in the previous round (7% and 9% respectively). Demand for other loans moderated from 14% in the previous round to 1% in this round.

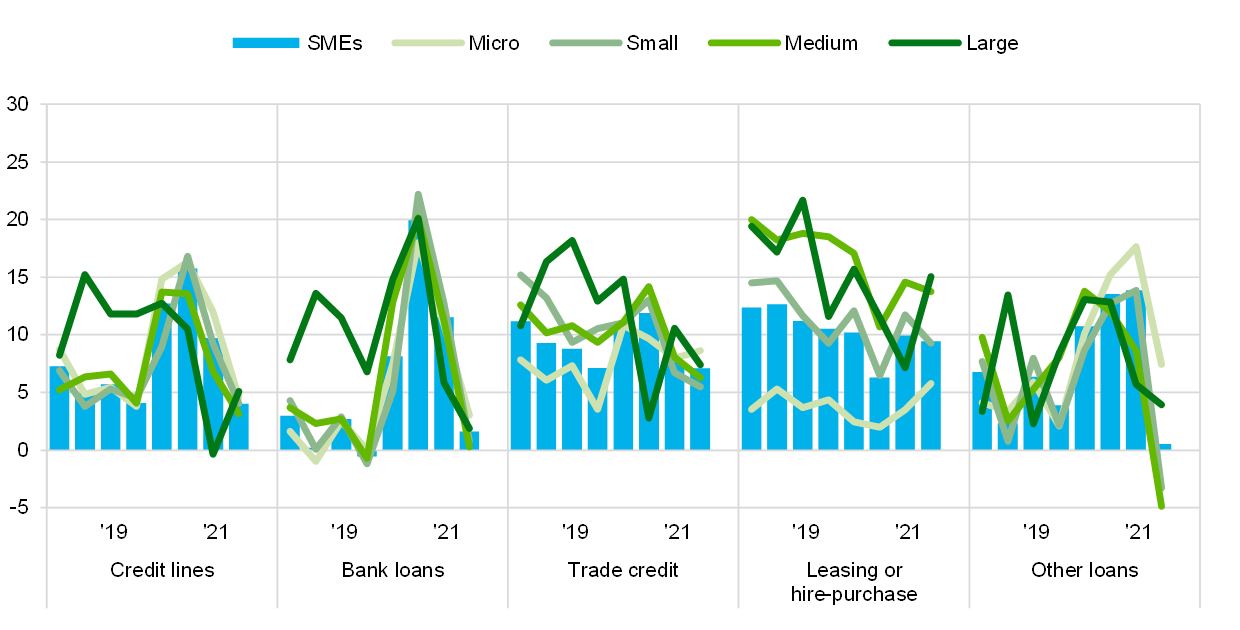

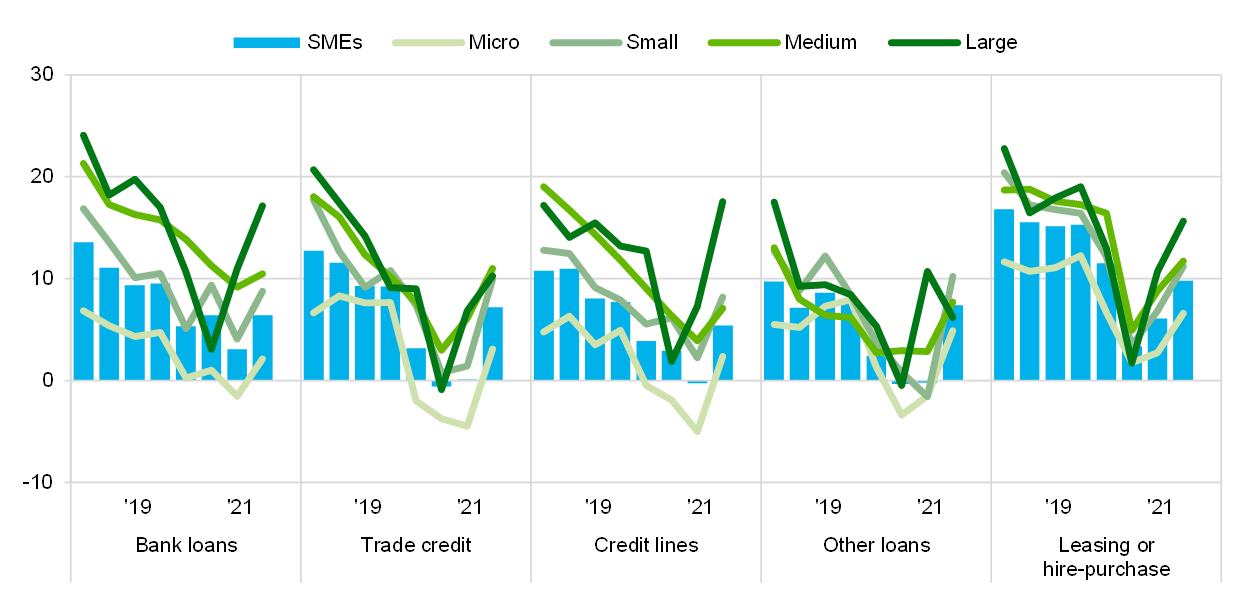

Chart 13

Changes in external financing needs of euro area enterprises

(net percentages of respondents)

Base: Enterprises for which the instrument in question is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The categories “other loans” and “leasing or hire-purchase” were introduced in round 12 (October 2014-March 2015). In rounds 1-10, a financing instrument was “relevant” if the enterprise had used the instrument in the past six months or had not used it, but had experience of it. Since round 11, respondents have been asked whether an instrument is relevant, i.e. whether the enterprise has used it in the past or considered using it in the future. Given that the current definition of a “relevant” financing instrument differs from the one used in the past, this might have an impact on comparability over time. Caution should therefore be exercised when comparing recent results with those of previous rounds. The data included in the chart refer to Question 5 of the survey.

Large firms reported a slowdown in demand for bank loans and trade credit. Large firms reported a moderation in the demand for bank loans (2%, down from 6%) and trade credit (7%, from 11%) and an increase in net demand for credit lines (5%, up from 0%) and leasing (15%, up from 7%). Demand for other loans moderated very slightly to 4% (down from 6%).

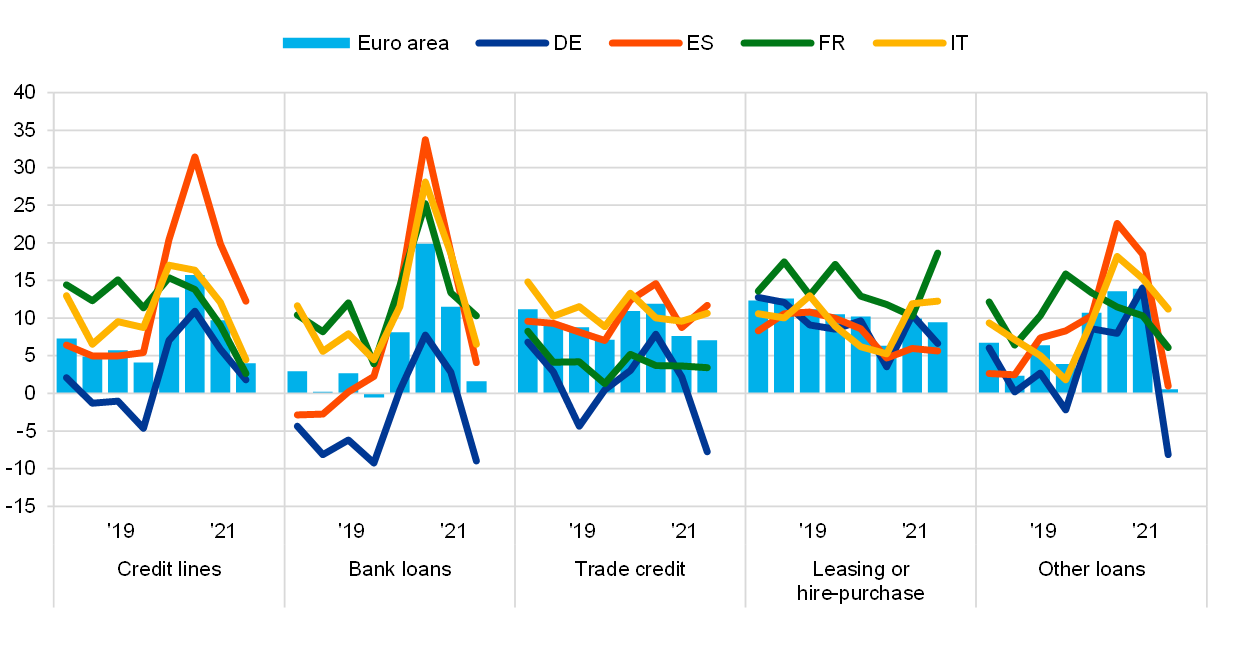

After reaching a peak during the pandemic, SMEs demand for bank loans and credit lines moderated in most countries. Looking at the four largest economies, net demand for bank loans moderated in Spain (4%, down from 19%), Italy (7%, down from 19%), France (10%, down from 13%), and even decreased in Germany (-9%, from 3%). The same pattern across countries was observed for trade credit and other types of loan (from family, friends and related enterprises or shareholders) (see Chart 14). Net demand for credit lines was also weaker in the previous round, but remained positive in those four countries, while use of leasing or hire-purchase changed little compared to the previous round. In the other euro area countries, the strongest demand for external financing continued to be seen in Greece (see Chart 37 in Annex 1).

Chart 14

Changes in external financing needs of euro area SMEs

(net percentages of respondents)

Base: SMEs for which the instrument in question is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 5 of the survey.

3.3 SMEs used financing primarily for fixed investment and inventories and working capital

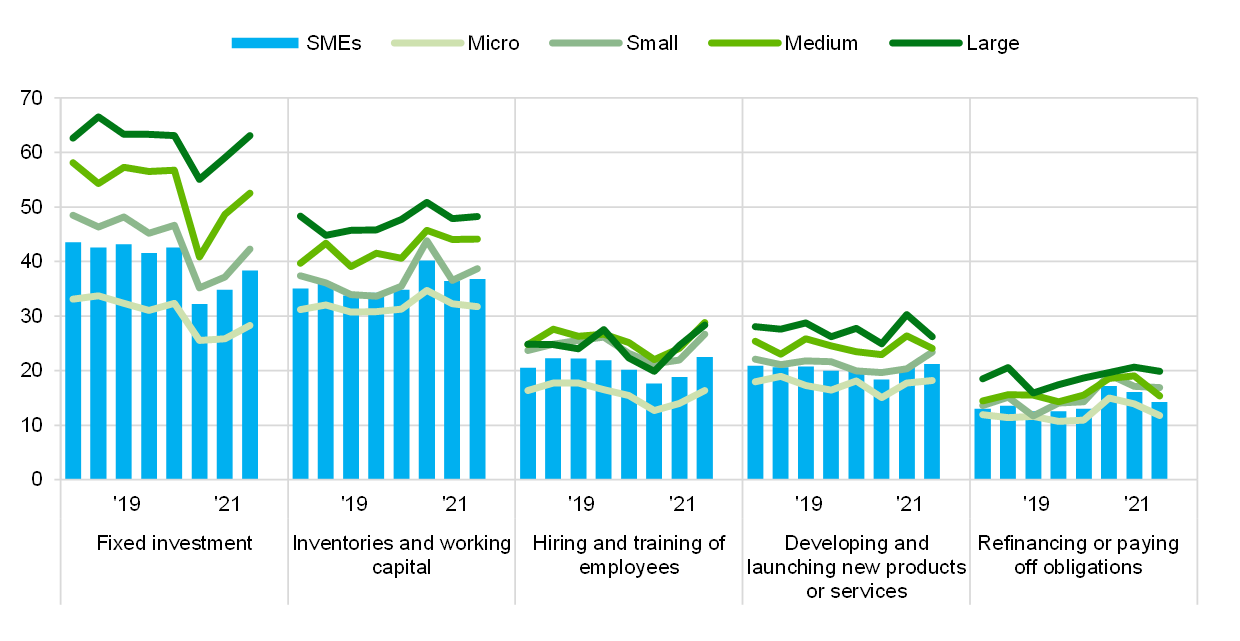

Financing from external and internal sources continued to be used mainly for fixed investment and for inventories and working capital (see Chart 15). Around 38% of SMEs (up from 35%) mentioned using financing for fixed investment, while 37% (up from 36%) reported using it for inventories and working capital. Fixed investment and hiring and training of employees, which had declined during the pandemic, rebounded in the last two survey rounds to reach levels close to those prevailing before the pandemic.

Chart 15

Purpose of financing as reported by euro area enterprises

(percentages of respondents)

Base: All enterprises. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Note: The data included in the chart refer to Question 6A, which was a new question introduced in round 11 of the survey (April 2014-September 2014).

Use of funds for fixed investment continued to be correlated with company size. While 63% of large firms reported using funds for fixed investment, this applied to only 28% of micro firms. Firms’ use of financing for investment in working capital and inventories also differed according to their size (48% for large firms, but only 32% for micro firms). SMEs were less likely to use financing to hire and train employees (23%, up from 19%), develop new products (unchanged at 21%) or refinance obligations (14%, down from 16%) than large firms. Looking at the largest euro area countries, German SMEs continued to stand out in terms of their use of funds for fixed investment (47% compared with just 38% in Italy and 34% in France). Spanish SMEs, in contrast, continued to use financing mainly for inventories and working capital (47%) instead of fixed investment (see Chart 16).

Chart 16

Purpose of financing as reported by SMEs across euro area countries

(percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the note to Chart 15. The data included in the chart refer to Question 6A of the survey.

4 Availability of external financing for SMEs in the euro area

4.1 Availability of external financing increased as the readiness of banks to provide credit improved

Increases in the availability of bank loans across firm size and countries

In the latest survey round, SMEs reported improvements in the availability of most external financing sources relevant for their business (see Chart 17).[10] For bank loans and credit lines, the net percentage of respondents indicating an improvement in availability increased to 6% and 5% (up from 3% and 0% respectively). Furthermore, SMEs signalled increases in the availability of trade credit (7%) and equity (6%).

Chart 17

Changes in the availability of external financing for euro area enterprises

(net percentages of respondents)

Base: Enterprises for which the instrument in question is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 9 of the survey.

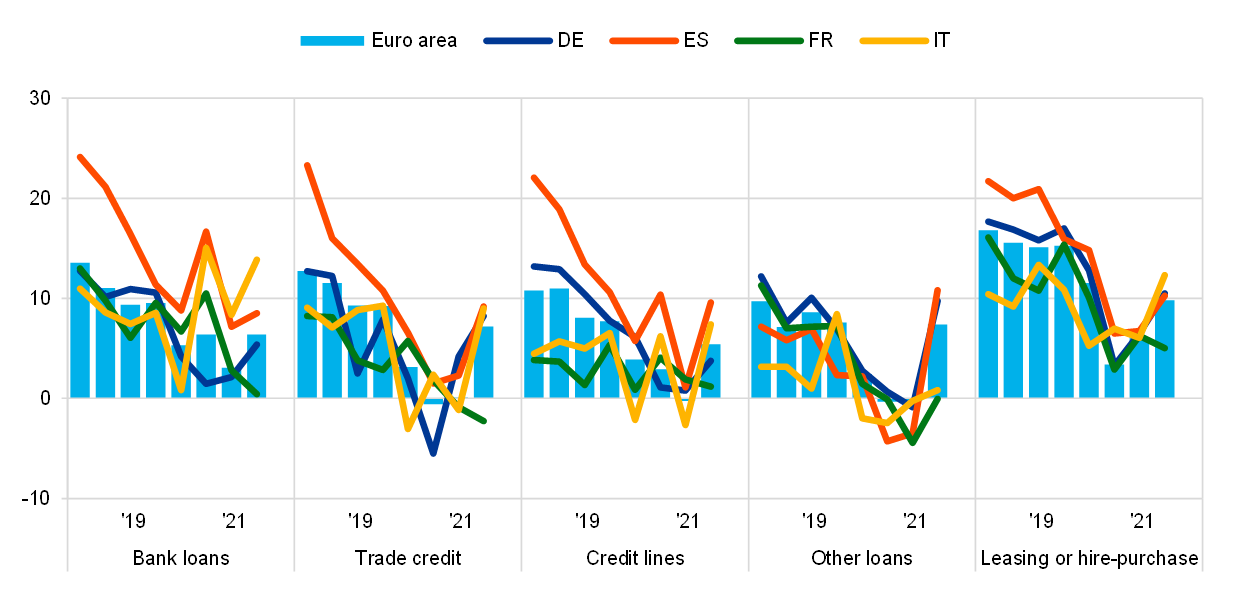

Looking at firms of different sizes, firms across size classes pointed to a return to pre-COVID 19 loan supply. Indeed, in this survey round, micro firms reported an improvement in the availability of bank loans (2%) and credit lines (2%), and trade credit (3%). Meanwhile, the net percentage of large companies reporting improvements in availability increased even further, intensifying the disparities in access to external financing across firm sizes.

The improved availability of bank loans was broad-based across countries (see Chart 18 and Chart 37 in Annex 1). The net percentage of respondents indicating improvements in the availability of bank loans increased in the largest euro area countries, except in France, where SMEs reported no changes with respect to the previous survey round.

Chart 18

Changes in the availability of external financing for euro area SMEs

(net percentages of respondents)

Base: SMEs for which the instrument in question is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 9 of the survey.

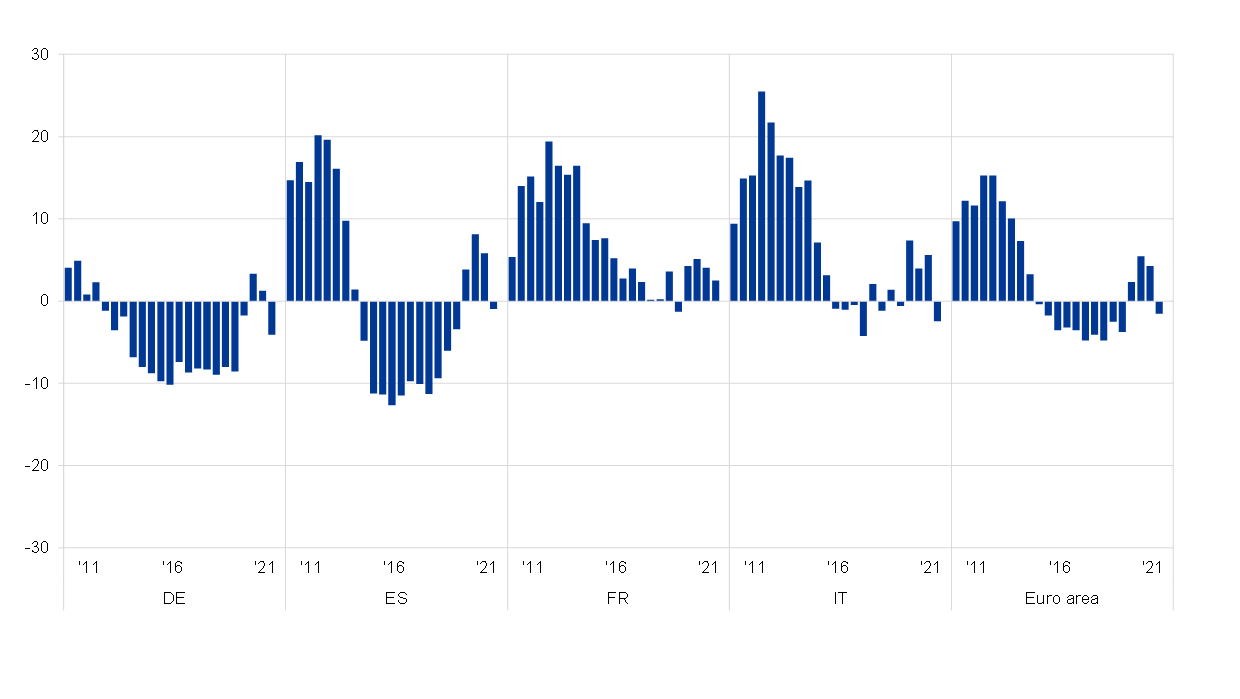

Availability of external funds rose somewhat faster than demand

The external financing gap for euro area SMEs returned to negative territory, as it was before the beginning of the pandemic. At the level of the euro area as a whole, SMEs felt that the improvements in their access to external funds outweighed the corresponding increases in their financing needs, resulting in a negative external financing gap of -2% (down from 4%) (see Chart 19). At the level of individual euro area countries, the financing gaps remained positive in France (2%), Greece (8%), Belgium (4%) and Portugal (1%) (see also Chart 38 in Annex 1).

Chart 19

Changes in the external financing gaps reported by SMEs across euro area countries

(weighted net balances)

Base: SMEs for which the instrument in question is relevant. Respondents replying with “not applicable” or “don’t know” are excluded. The figures refer to rounds 3-25 of the survey (March 2010-September 2010 to April 2021-September 2021).

Notes: See the notes to Chart 13. The financing gap indicator combines both financing needs and the availability of bank loans, credit lines, trade credit, and equity and debt securities issuance at firm level. For each of the five financing instruments, the indicator of the perceived change in the financing gap takes a value of 1 (-1) if the need increases (decreases) and availability decreases (increases). If enterprises perceive only a one-sided increase (decrease) in the financing gap, the variable is assigned a value of 0.5 (-0.5). The composite indicator is a weighted average of the financing gaps for the five instruments. A positive value for the indicator points to an increase in the financing gap. Values are multiplied by 100 to obtain weighted net balances in percentages. The data included in the chart refer to Question 5 and Question 9.

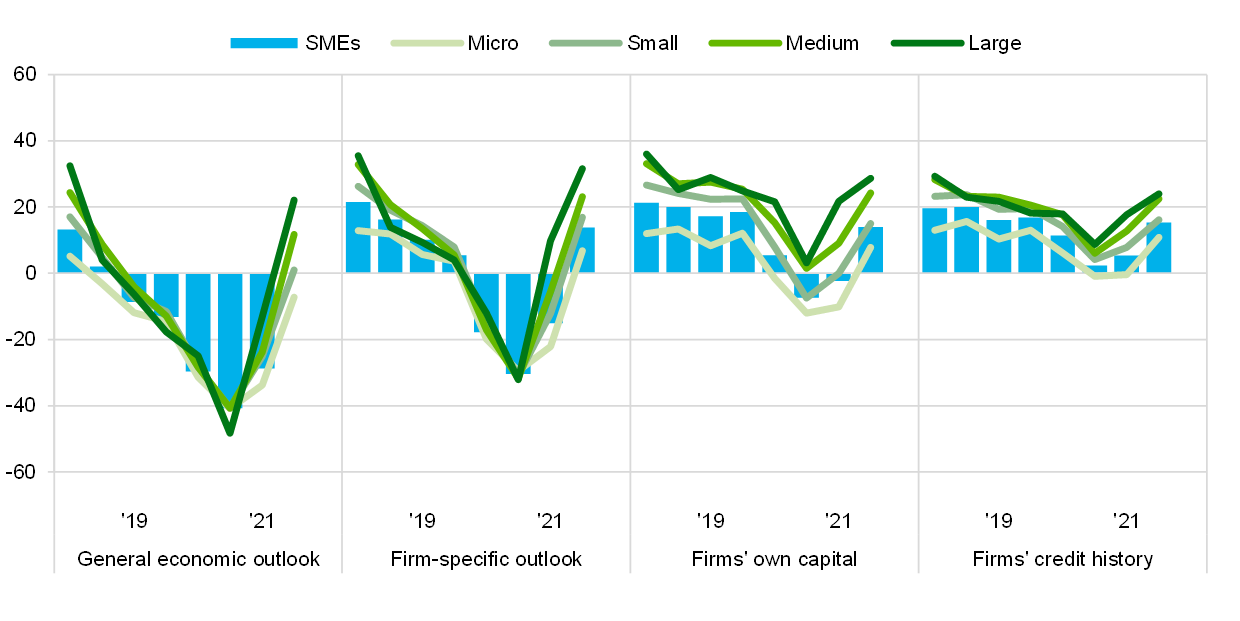

SMEs perceived that financial conditions were positively affecting their ability to obtain external finance

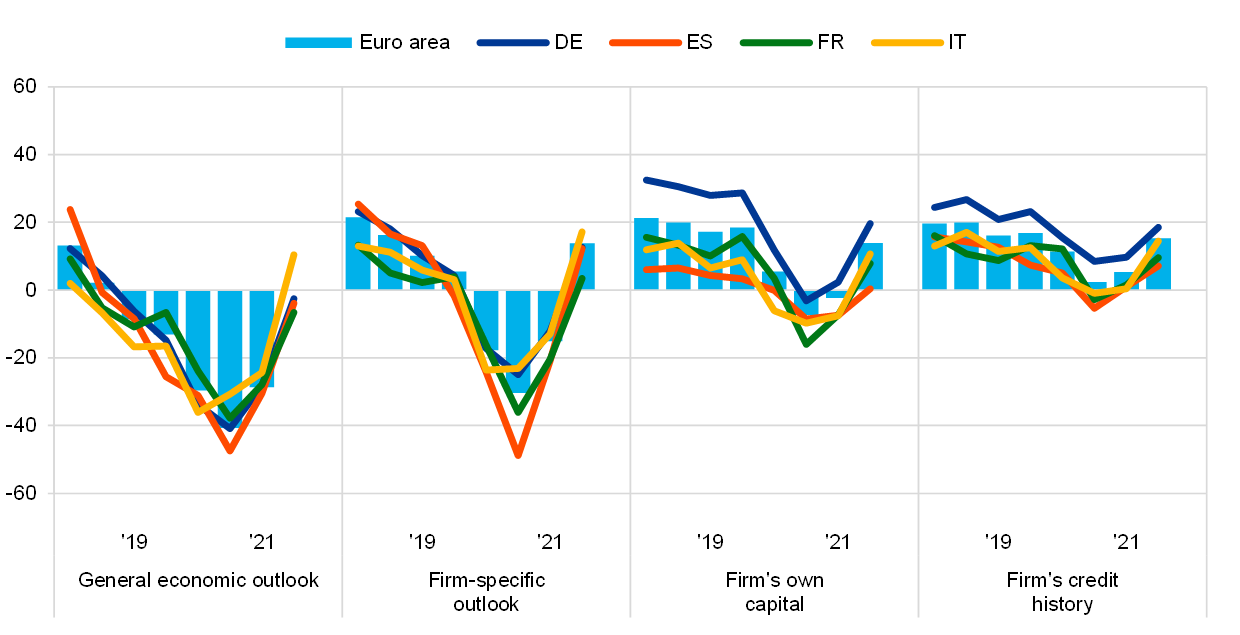

SMEs no longer perceived macroeconomic factors as an impediment to accessing external finance (see Chart 20). In this survey round, SMEs felt that changes in the general economic outlook had had no impact on their access to finance (0%, up from -29%). At the same time, SMEs reported strong improvements in their firm-specific outlook (14%, up from -15%) and capital position (14%, up from -2%). Furthermore, SMEs’ creditworthiness seemed to have also improved, as, in net terms, 15% of SMEs signalled improvements, up from 5% in the previous survey round.

Chart 20

Changes in factors that have an impact on the availability of external financing to euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Note: The data included in the chart refer to Question 11 of the survey.

Chart 21

Changes in factors that have an impact on the availability of external financing to euro area SMEs

(net percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: In round 11 (April 2014-September 2014), the category “willingness of banks to provide a loan” was changed slightly to “willingness of banks to provide credit to your enterprise”. The data included in the chart refer to Question 11 of the survey.

However, micro firms felt that the business environment was still having a negative impact on their access to external finance. A net 7% of micro firms reported that the general economic outlook might have impeded their access to external finance (down from 34% in the previous survey), despite reporting strong improvements in their firm-specific outlooks and capital positions in net terms.

Among the largest euro area countries, the improved perceptions on the business environment was mainly related to Italian SMEs. In particular, 10% of Italian SMEs reported a net positive impact of the general economic outlook (from -24%), while in the other countries, the net percentages were still on the negative side. (see Chart 21). Fewer SMEs in Germany (-3%, from -28%), Spain (-4%, from -30%), France (-7%, from -28%) felt that the general economic outlook had negatively affected the availability of external financing also in this survey round.

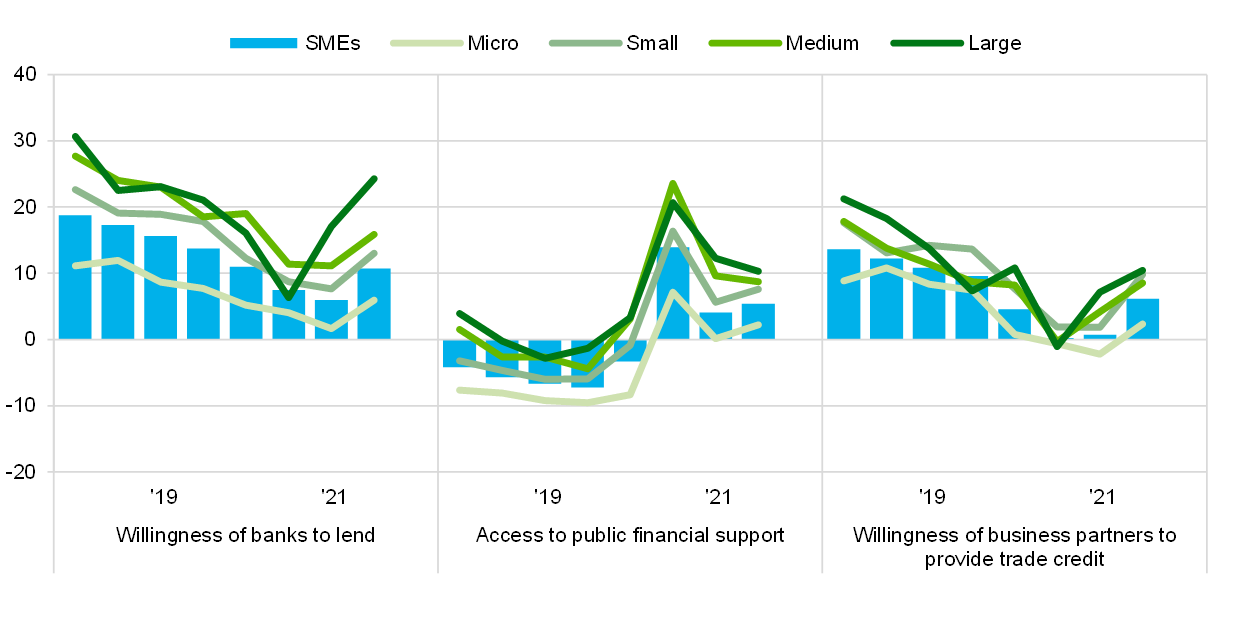

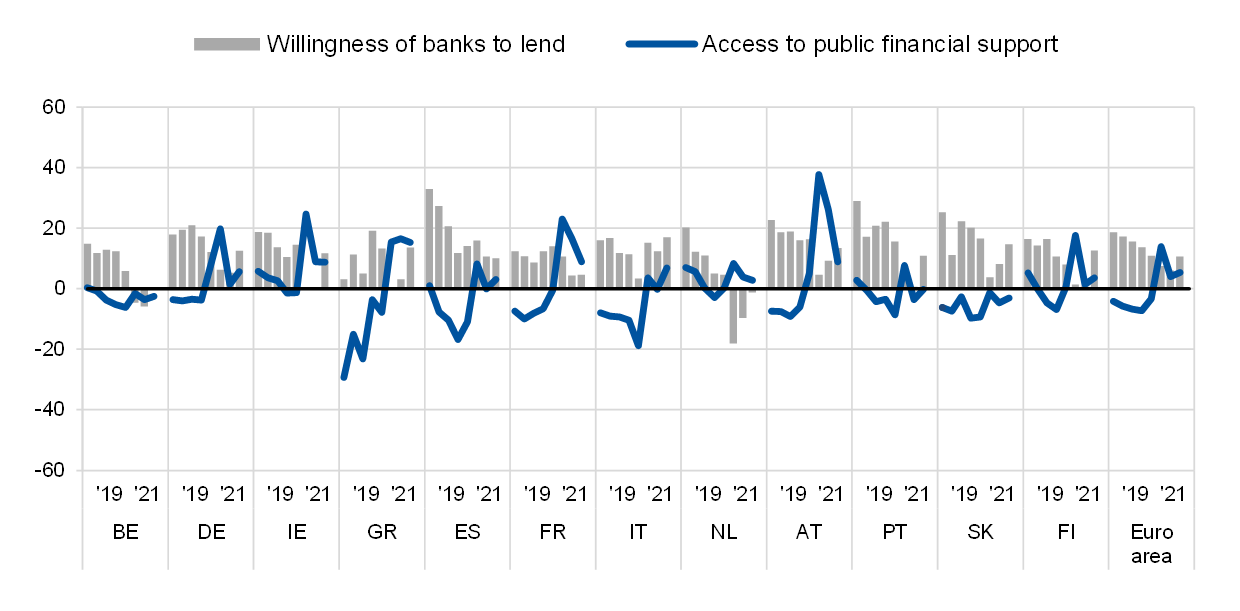

Chart 22

Changes in factors with an impact on the availability of external financing to euro area enterprises

(net percentages of respondents)

Base: All enterprises; for the category “willingness of banks to lend”, enterprises for which at least one bank financing instrument (credit line, bank overdraft, credit card overdraft, bank loan or subsidised bank loan) is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: In round 11 (April 2014-September 2014), the category “willingness of banks to provide a loan” was changed slightly to “willingness of banks to provide credit to your enterprise”. The data included in the chart refer to Question 11.

Chart 23

Changes in factors that have an impact on the availability of external financing to euro area SMEs

(net percentages of respondents)

Base: All SMEs; for the category “willingness of banks to lend”, SMEs for which at least one bank financing instrument (credit line, bank overdraft, credit card overdraft, bank loan or subsidised bank loan) is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 and April 2021-September 2021).

Notes: In round 11 (April 2014-September 2014), the category “willingness of banks to provide a loan” was changed slightly to “willingness of banks to provide credit to your enterprise”. The data included in the chart refer to Question 11.

SMEs perceived that banks’ willingness to provide credit had continued to improve across firm size classes and countries (see Chart 22). In net terms, 11% of SMEs reported an increase in banks’ willingness to lend (up from 6%), ranging from 6% of micro firms (up from 2%) to 24% of large enterprises (up from 17%).

At country level, the highest net percentages were seen in Italy (17%, up from 12%) and Slovakia (15%, up from 8%). By contrast, a small net percentage of SMEs in the Netherlands continued to report a decreased willingness of banks to provide credit (-1%, following -10% in the previous survey round). (see Chart 23 and Chart 39 in Annex 1).

Euro area SMEs continued to report improvements in access to public financial support, almost unchanged from the previous round (5%, up from 4%) (see Chart 22). Looking at firm size, micro and small firms reported that their access to public support had increased slightly (2% and 8%, up from 0% and 6% respectively), whereas larger firms were more moderate in signalling improvements in access. At country level, the highest net percentages of SMEs reporting improvements in access were seen in Greece (15%) and in France and Austria (both 9%) (see Chart 23 and Chart 39 in Annex 1).

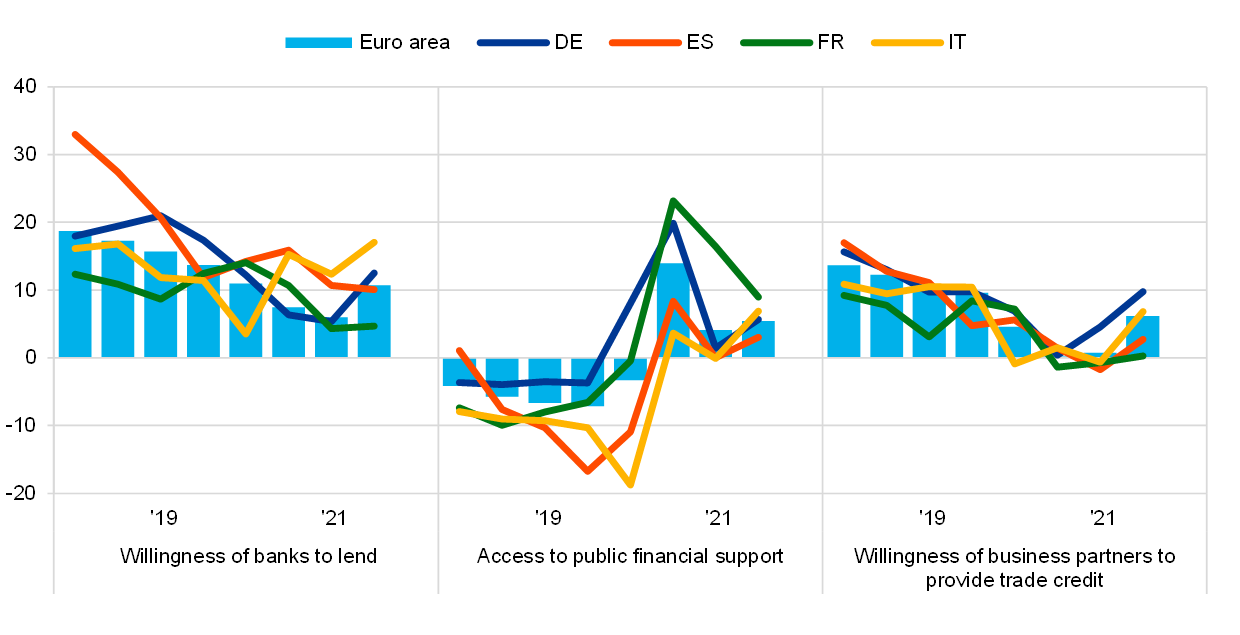

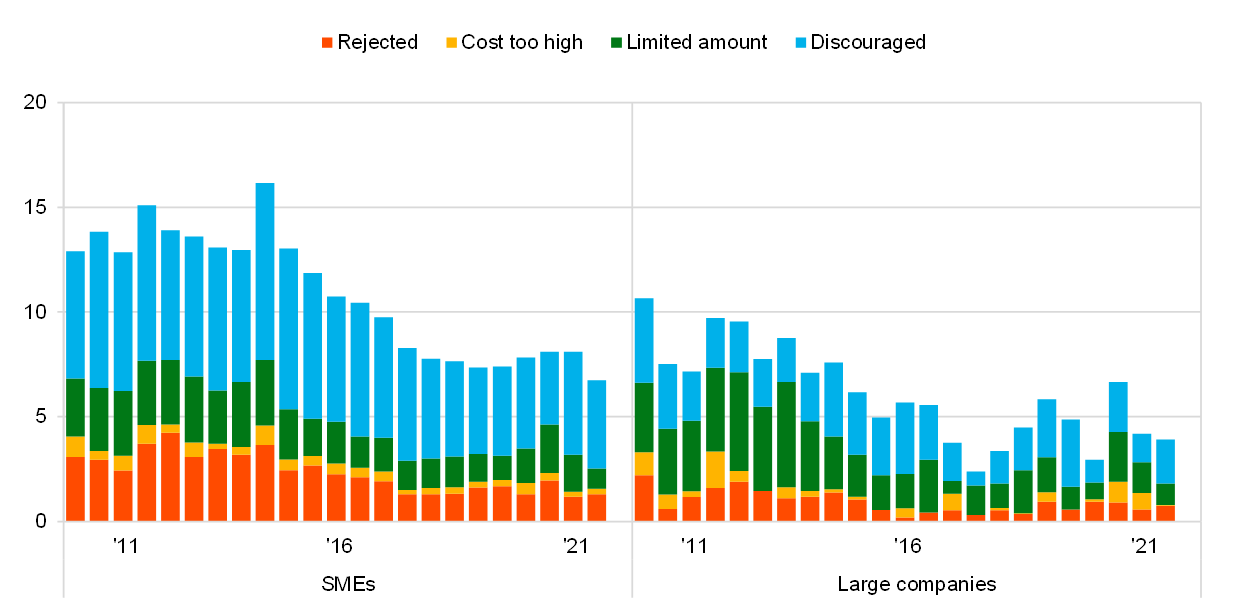

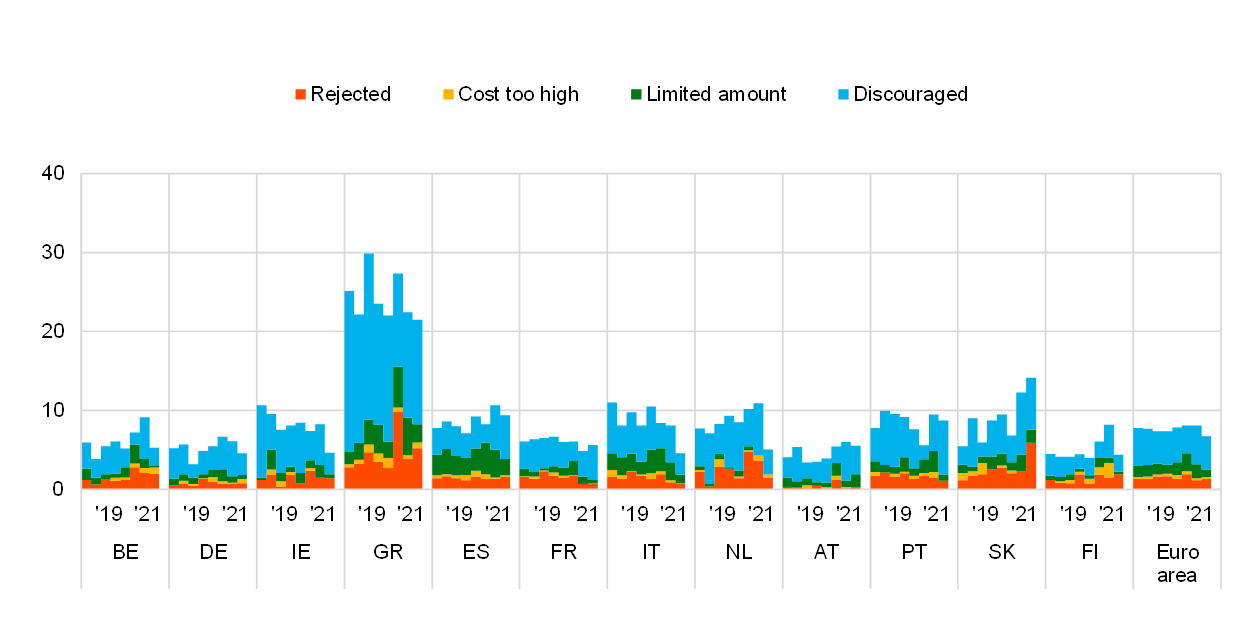

4.2 Small reductions in financing obstacles for SMEs

The percentage of SMEs reporting obstacles to obtaining a bank loan declined marginally (see Chart 24, panel a). Among enterprises that judged bank loans to be relevant for their funding, 7% of SMEs faced obstacles when obtaining a loan (down from 8% in the previous survey round), compared with 4% for large enterprises (unchanged). Looking at the different components of the indicator for financing obstacles, the percentage of SMEs that were discouraged from applying for a loan declined to 4% (down from 5%), while for large enterprises it increased to 2% (up from 1%).

Chart 24

Obstacles to obtaining a bank loan

(percentages of respondents)

Panel a: Euro area SMEs and large companies

Panel b: SMEs in large euro area countries

Base: Enterprises for which bank loans (including subsidised bank loans) are relevant for rounds 3-25 of the survey (March 2010-September 2010 to April 2021-September 2021).

Notes: Financing obstacles are defined here as the total of the percentages of enterprises reporting (i) loan applications that were rejected, (ii) loan applications for which only a limited amount was granted, (iii) loan applications that resulted in an offer that was declined by the enterprise because the borrowing costs were too high, and (iv) a decision not to apply for a loan for fear of rejection (discouraged borrowers). The calculation of the indicator starts in 2010, when the question on applications for credit lines was first included in the questionnaire. The components of the financing obstacles indicator were affected by the amendments to the questionnaire in round 11 (filtering based on the relevance of the financing instrument and addition of the new category “my application is still pending”), and past data have been revised accordingly. These figures include the categories “my application is still pending” and “don’t know”.

France was the only country among the four largest euro area countries to see an increase in the percentage of SMEs reporting perceived obstacles to financing (see Chart 24, panel b). Increases in the percentage of SMEs facing financing constraints were reported in France (6%, up from 5%), with a few more SMEs signalling that they had not applied for fear of rejection. In this survey round, the highest percentages of SMEs reporting difficulties in accessing bank loans were seen in Slovakia (14%, up from 12%) and Greece (21%, down from 22%) (see Chart 40 in Annex 1).

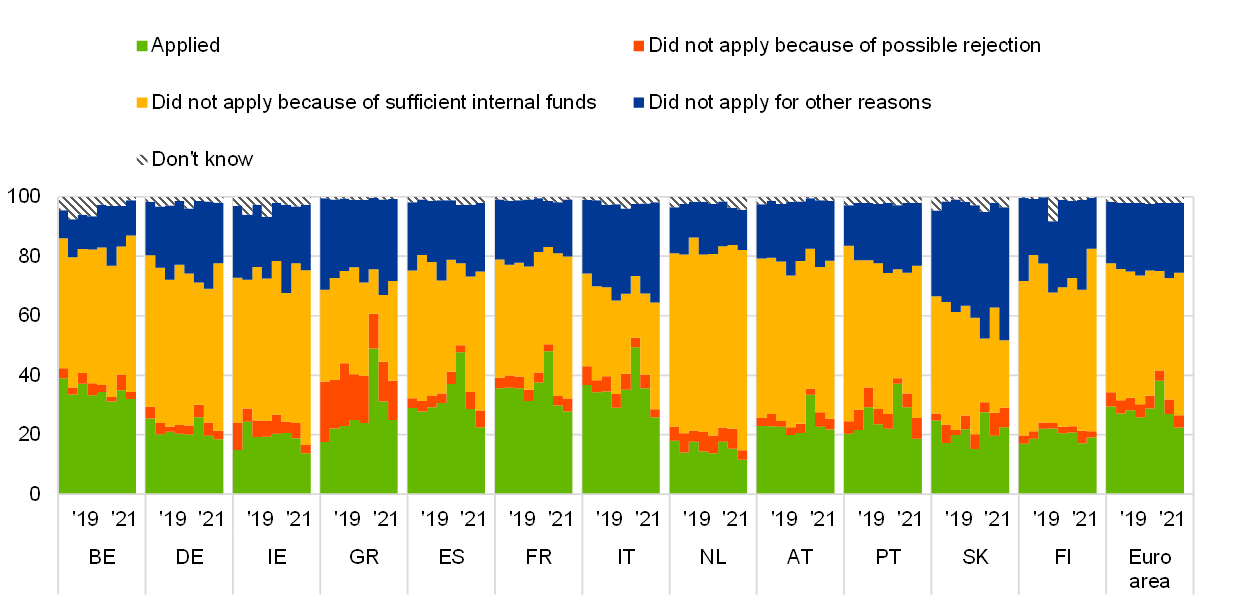

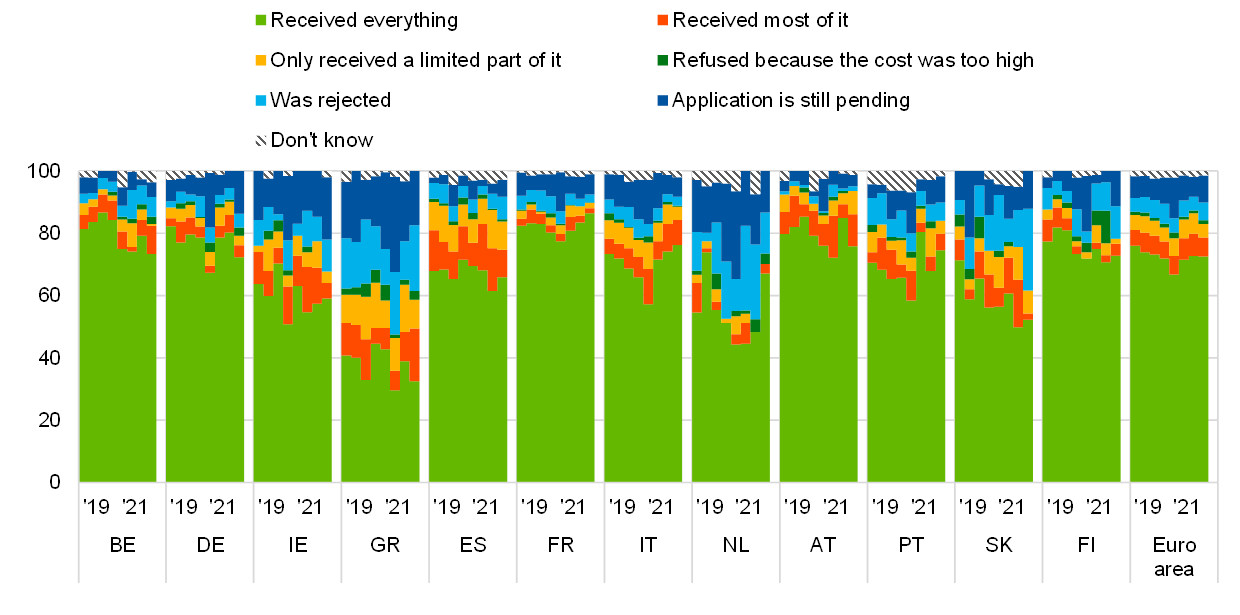

The percentage of SMEs applying for bank loans declined, according to figures based only on firms that deemed such financing to be relevant for their business (see Chart 41 in Annex 1). At the level of the euro area as a whole, 22% of SMEs reported having applied for a loan (down from 27%), while 48% of SMEs did not apply because they had sufficient internal funds available (up from 41%). Among firms that submitted a loan application, 72% reported that they were successful in obtaining the full amount requested (down from 73%) (see Chart 42 in Annex 1). Meanwhile, 42% of large enterprises reported having applied for a bank loan (unchanged) and, of these, 85% received the full amount requested (up from 83%).

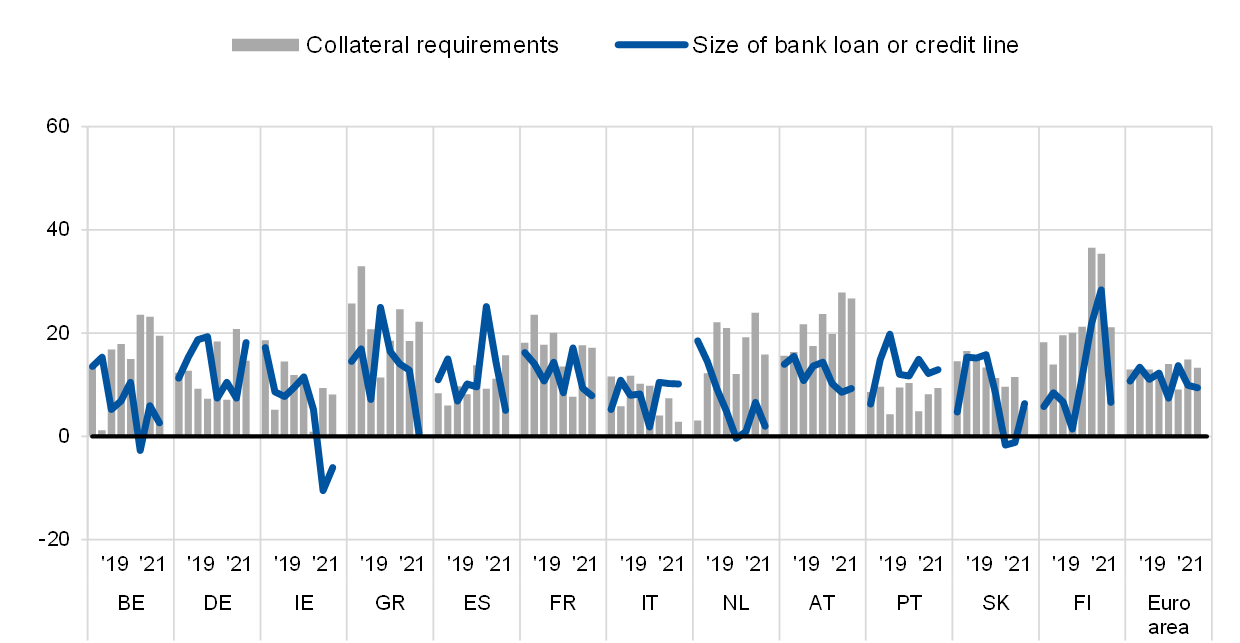

4.3 Other bank financing costs still more likely to rise than interest rates

In this survey round, few SMEs reported increases in interest rates on bank loans, with the net percentage reporting such increases standing at 4% (up from 2% in the previous round) (see Chart 25). At the same time, a net 33% of SMEs (up from 28%) signalled increases in other costs of financing, such as charges, fees and commissions. Turning to non-price terms and conditions, fewer SMEs signalled increases in collateral requirements (13%, down from 15%) and other requirements such as covenants (17%, down from 19%). On the other hand, SMEs also reported further improvements in the size and maturity of loans (9% and 8% respectively), albeit less so than in the previous survey round.

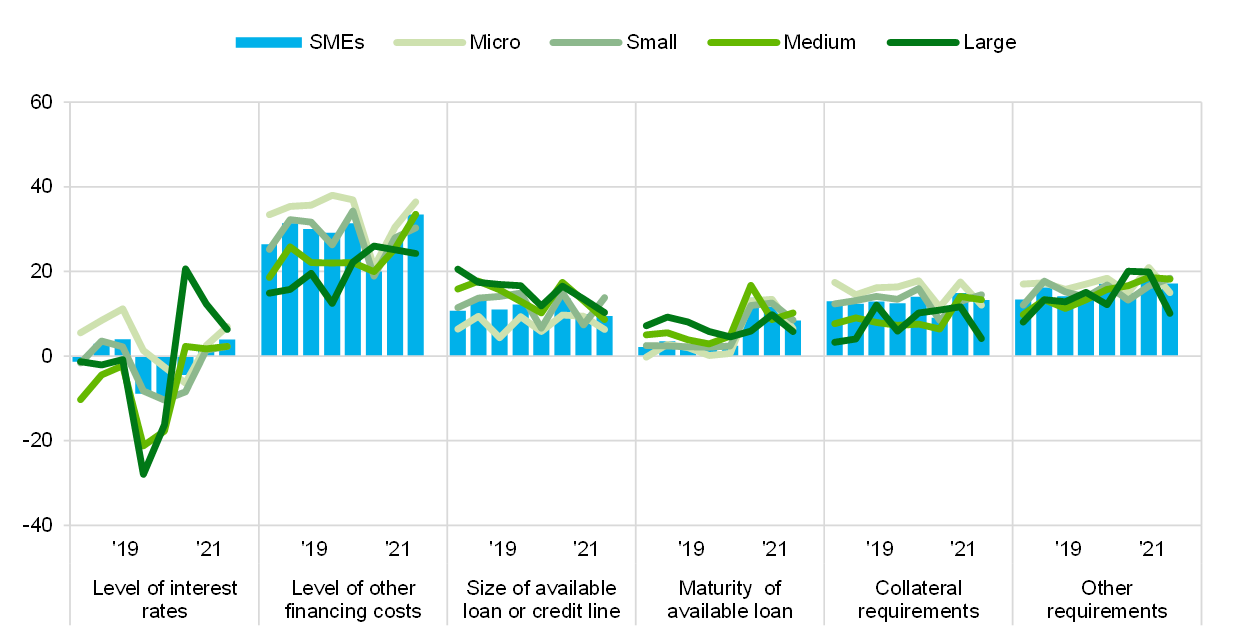

Chart 25

Changes in the terms and conditions of bank financing for euro area enterprises

(net percentages of respondents)

Base: Enterprises that had applied for bank loans (including subsidised bank loans), credit lines, or bank or credit card overdrafts. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 10.

Fewer large enterprises reported increases in interest rates and other costs of financing. A net 6% of large enterprises reported increases in interest rates on loans granted to them (down from 12%), while net percentages remained more stable relative to the previous survey round for other costs of financing (24%). A smaller net percentage of large firms reported an increase in collateral requirements (4%), and in other requirements (10%). Likewise, fewer large firms reported, on balance, an increase in the maturity of loans (6%, down from 10%) and in the size of available loans or credit lines (10%, down from 13%).

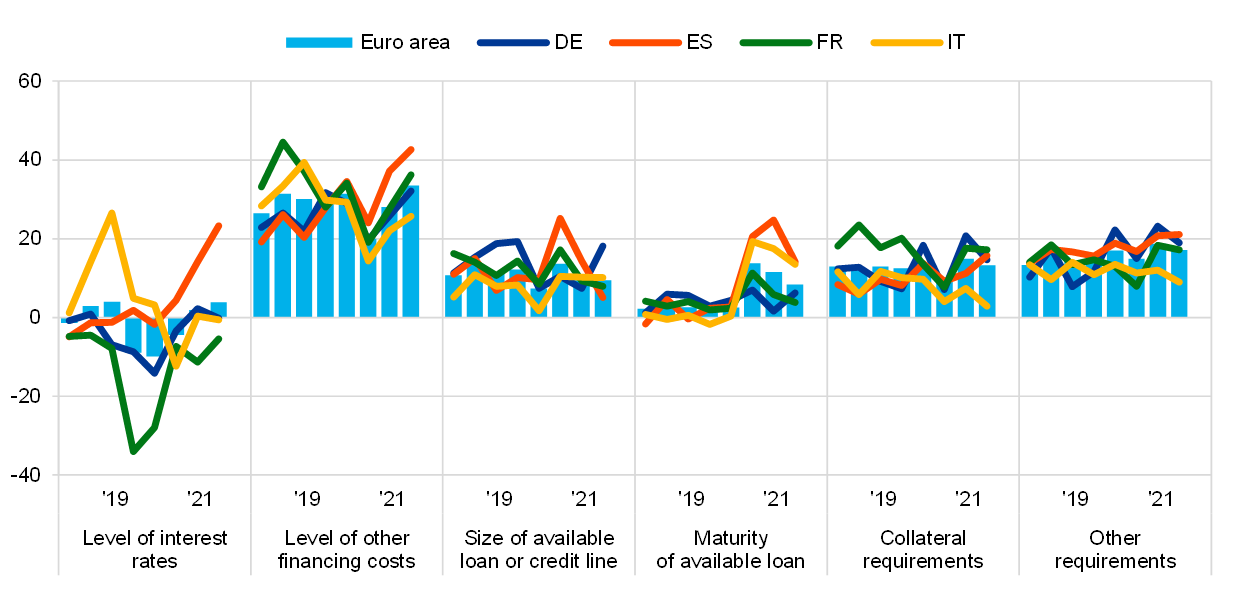

Developments in interest rates were mixed within the largest euro area economies (see Chart 26). The net percentage of SMEs reporting increases in interest rates rose to 23% in Spain (up from 14%), while French and Italian SMEs reported declines (-5% and -1%, down from -11% and 0% respectively). No changes were reported by German SMEs (0%, down from 2%). In contrast, the net percentage of SMEs reporting increases in other costs of financing continued to rise in all four countries, reaching 32% in Germany, 43% in Spain, 36% in France and 26% in Italy. Similar patterns can be observed for other euro area countries (see Chart 43 and Chart 44 in Annex 1).

Chart 26

Changes in the terms and conditions of bank financing for euro area SMEs

(net percentages of respondents)

Base: SMEs that had applied for bank loans (including subsidised bank loans), credit lines, or bank or credit card overdrafts. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 10 of the survey.

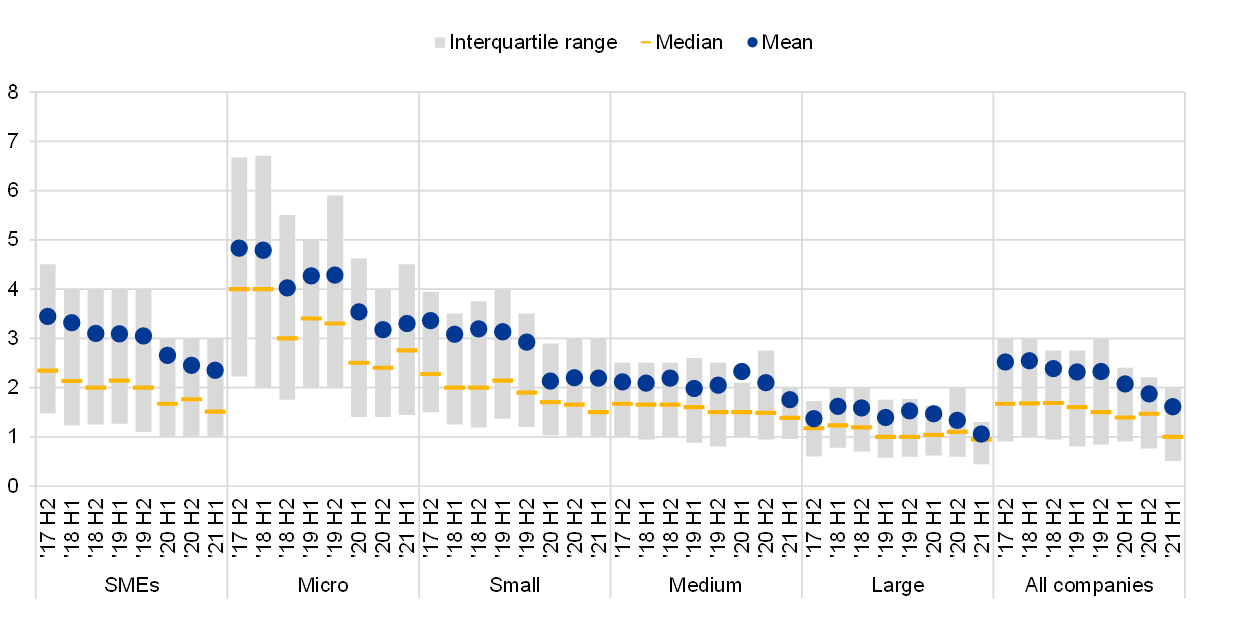

When asked about the interest rates charged by banks on credit lines and overdrafts, SMEs tended, on average, to signal declines in the period from March 2021 to September 2021 (see Chart 27).[11] The average interest rate paid by SMEs decreased by 10 basis points to 2.4%. However, the average interest rate applied by banks to micro firms rose to 3.3% (up from 3.2%). Large firms continued to pay lower interest rates on credit lines and overdrafts than other firms (on average 1.1%, 28 basis points lower than in the previous survey round). As a result, the discrepancy between the borrowing costs of micro and large firms increased somewhat to 2.2 percentage points (up from 1.8 percentage points in the previous survey).

Chart 27

Interest rates charged on credit lines or bank overdrafts for euro area enterprises

(percentages)

Base: Enterprises that successfully applied for a credit line or bank overdraft or applied but didn’t accept the terms that were offered to them (for example, because the rate was too high). The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: The interquartile range is defined as the difference between the 75th percentile and the 25th percentile. The data included in the chart refer to Question 8B of the survey, which was introduced in round 11 (April 2014-September 2014).

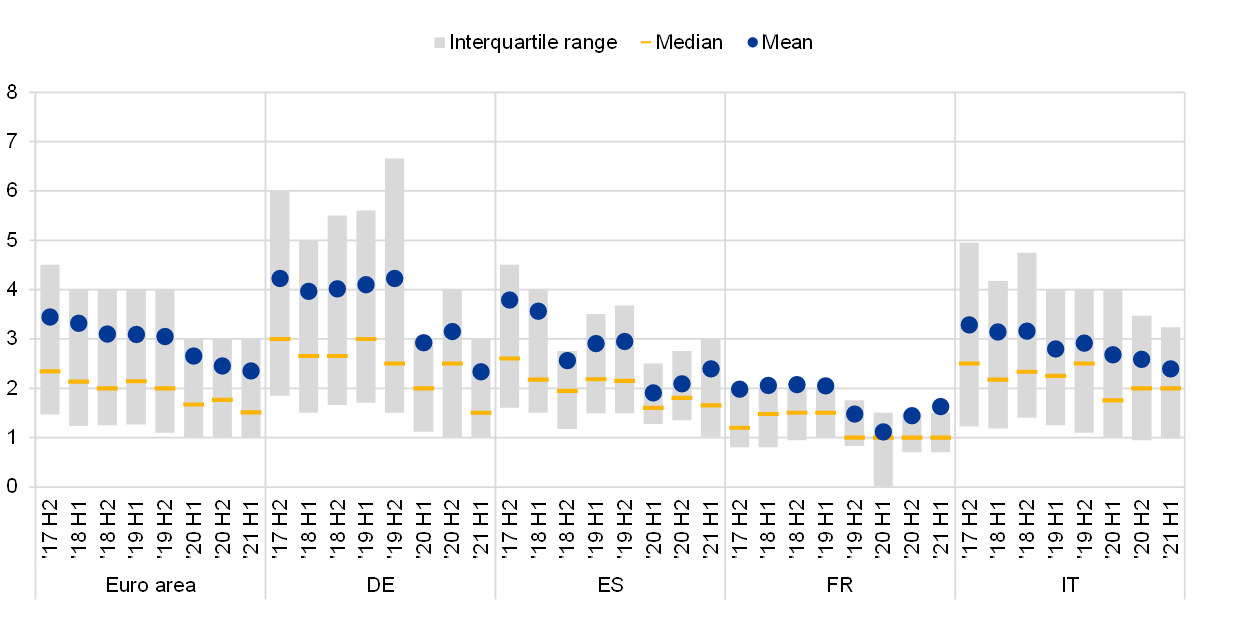

SMEs reported different developments across the largest euro area countries. Rises in the interest rates charged for bank overdrafts and credit lines were signalled in Spain, where the mean reported interest rate increased by 31 basis points to 2.4%, and in France, where SMEs reported mean interest rates of 1.6% (18 basis points higher than in the previous survey round). In Italy, average interest rates declined to 2.4% (20 basis points lower than in the last survey round), while the average rate in Germany fell by 81 basis points to stand at 2.3% (see Chart 28).

Chart 28

Interest rates charged for credit lines or bank overdrafts for euro area SMEs

(percentages)

Base: Enterprises that successfully applied for a credit line or bank overdraft or applied but didn’t accept the terms that were offered to them (for example, because the rate was too high). The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 27. The data included in the chart refer to Question 8B of the survey.

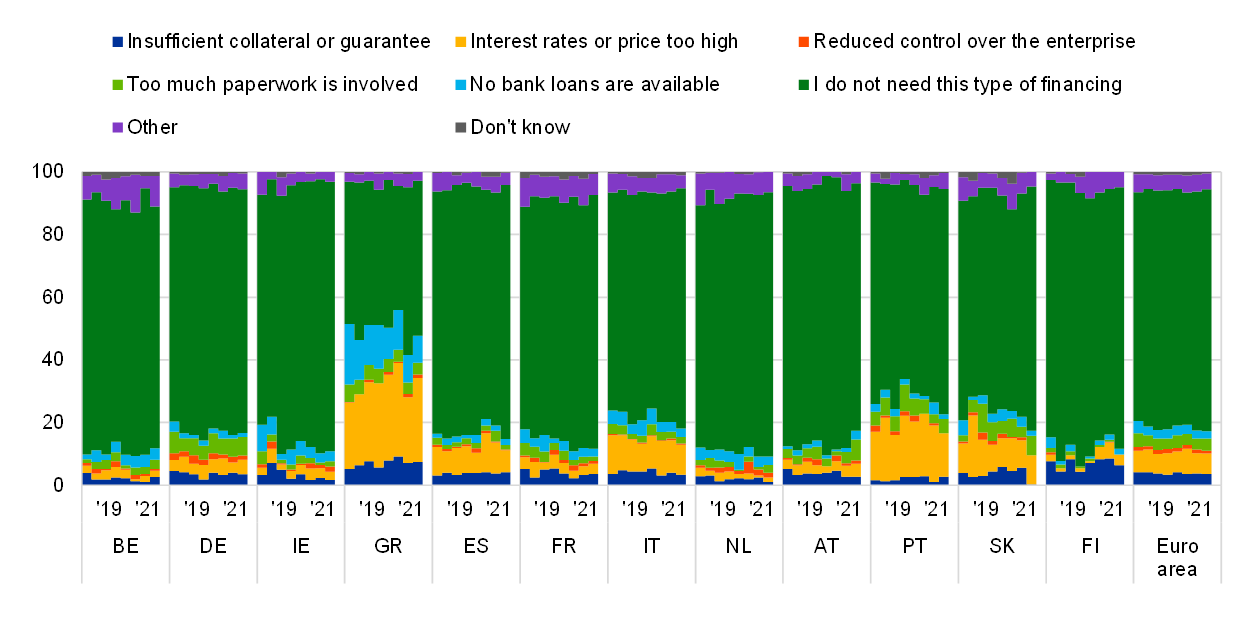

In this survey round, around 49% of the SMEs surveyed indicated that bank loans were not a relevant source of financing for them. In the vast majority (77%) of cases, SMEs had no need for financing via bank loans (see Chart 29). A small percentage of SMEs pointed to high interest rates or prices as the primary reason for not using bank loans (7%, up from 6%), with the highest percentages seen in Portugal (14%, down from 18%) and Greece (27%, up from 21%).

Chart 29

Reasons why bank loans are not a relevant source of financing for euro area SMEs

(percentages of respondents)

Base: SMEs for which bank loans are not a relevant source of financing. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Note: The data included in the chart refer to Question 32 of the survey.

5 Expectations regarding access to finance

5.1 SMEs expect improvements in their access to external financing in the near future

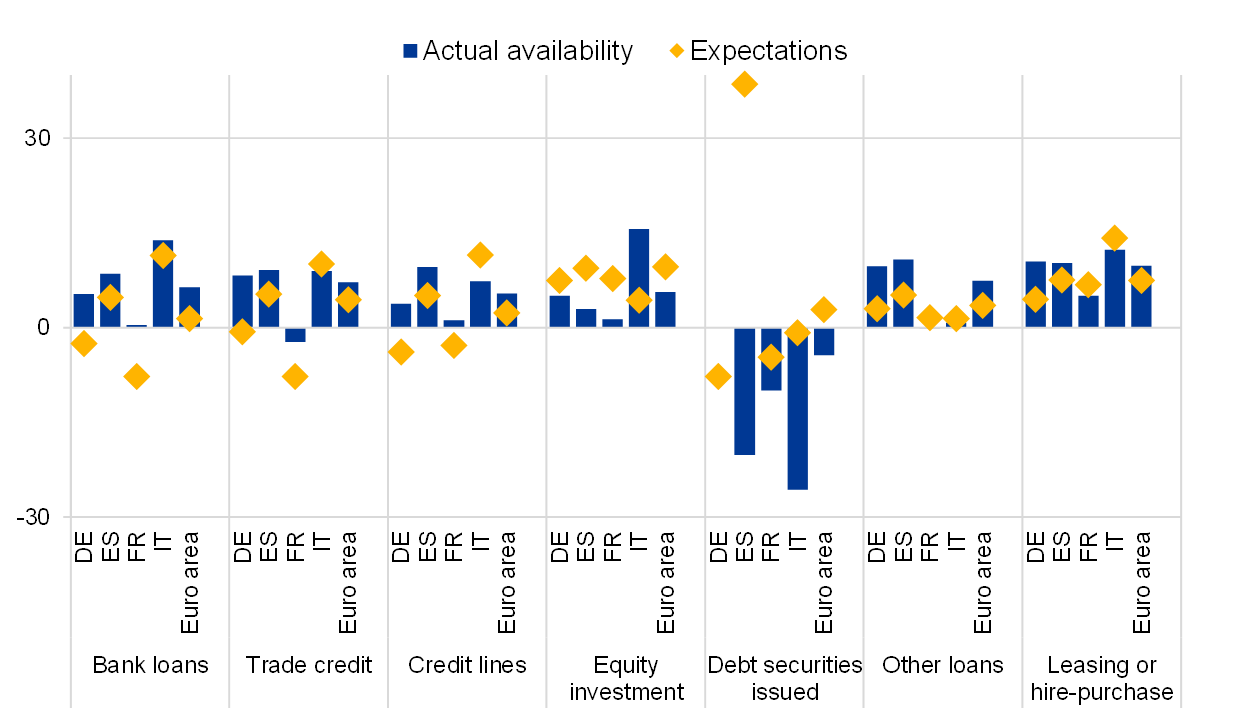

SMEs were more optimistic about the availability of most sources of external financing (see Chart 30). In particular, SMEs now expect their access to bank loans to improve over the next six months (1% in net terms, up from a deterioration of -9% in the previous survey round). Similar improvements were expressed as regards access to credit lines (2%, up from -10%), trade credit (4%, up from -6%) and other loans (4%, up from -3%). At the same time, the improvement already expected in the last survey round for leasing and hire-purchase consolidated further (8%, up from 1%). Moreover, SMEs also had positive expectations for debt securities issuance (3%, up from -4%), while equity issuance was expected to continue to improve (10%, up from 2%).[12]

Chart 30

Changes in euro area enterprises’ expectations regarding the availability of financing

(past six-month period and next six-month period; net percentages of respondents)

Base: Enterprises for which the instrument in question is relevant. The figures refer to round 25 of the survey (April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 9 and Question 23 of the survey.

Larger enterprises tended to be more optimistic in their expectations for most sources of external financing. For example, large firms expected, in net terms, to see an improvement in their access to most sources of external financing in the months ahead, whereas expectations for improvements appeared to be more limited among SMEs.

Conditions for SMEs’ access to external financing seems to be expected to improve across euro area countries, but some differences remain (see Chart 31). For example, among the four largest countries, although SMEs expected to see a deterioration in the last survey round, access to bank loans was expected to improve in Spain (5% in net terms) and particularly in Italy (11%). However, in Germany and France, SMEs continued to expect a deterioration (-3% and -8% respectively), albeit to a lesser extent than in the previous survey round. Similar differences in expectations across countries were reported for trade credit and credit lines, while SMEs in the four countries had positive expectations for other loans and for leasing and hire-purchase. When it comes to the issuance of equity, positive improvements are expected in all countries, while for debt securities, Spanish SMEs expect to see a substantial improvement, in stark contrast to firms in other countries, where a deterioration continues to be expected.

Chart 31

Changes in euro area SMEs’ expectations regarding the availability of financing

(past six-month period and next six-month period; net percentages of respondents)

Base: SMEs for which the instrument in question is relevant. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 9 and Question 23.

Expectations regarding turnover suggest that firms expect the economic recovery to continue in the coming months. On balance, 36% (up from 19%) of euro area enterprises foresee an increase in turnover over the next six months, thereby consolidating the recovery in turnover that occurred as the pandemic situation improved (see Chart 32). Moreover, higher turnover expectations were reported in the four largest euro area countries, with that optimism ranging from 43% in net terms among Italian SMEs to 32% among German ones. Firms of all sizes expected, in net terms, to see advances in turnover over the next six months, suggesting a broad-based recovery in business activity. Company size is, however, a fundamental factor in such expectations: larger companies reported the highest expectations (57% in net terms), whereas a lower but still a considerable net percentage of micro SMEs reported positive turnover expectations (29%).

Chart 32

Actual and expected turnover among euro area enterprises

(past six-month period and next six-month period; net percentages of respondents)

Base: All enterprises. The figures refer to round 25 of the survey (April 2021-September 2021).

Note: The data included in the chart refer to Question 2 and Question 26 of the survey.

Annexes

Annex 1

Overview of survey replies – selected charts

Chart 33

Changes in turnover and profits of SMEs across euro area countries

(net percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 2 of the survey.

Chart 34

Changes in debt-to-assets ratios and interest expenses of SMEs across euro area countries

(net percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 and April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 2 of the survey.

Chart 35

Vulnerable and profitable SMEs across euro area countries

(percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: For definitions, see footnote 5 of the report. In Slovakia, the survey was initially conducted every two years (first half of 2009, 2011 and 2013). Since 2014 Slovakia has been included in the sample in each survey round. The data included in the chart refer to Question 2 of the survey.

Chart 36

The most important problems faced by SMEs across euro area countries

(percentages of respondents)

Base: All SMEs. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 7. The data included in the chart refer to Question 0 of the survey.

Chart 37

Changes in the availability of and need for bank loans for SMEs across euro area countries

(net percentages of respondents)

Base: SMEs for which bank loans are a relevant source of financing. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 13. The data included in the chart refer to Question 5 and Question 9 of the survey.

Chart 38

Changes in the external financing gap perceived by SMEs across euro area countries

(weighted net balances)

Base: SMEs for which the instrument in question is relevant. Respondents replying with “not applicable” or “don’t know” are excluded. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 19. The financing gap indicator combines both financing needs and the availability of bank loans, credit lines, trade credit, and equity and debt securities issuance at firm level. For each of the five financing instruments, the indicator of the perceived change in the financing gap takes a value of 1 (-1) if the need increases (decreases) and availability decreases (increases). If enterprises perceive only a one-sided increase (decrease) in the financing gap, the variable is assigned a value of 0.5 (-0.5). The composite indicator is a weighted average of the financing gaps for the five instruments. A positive value for the indicator points to an increase in the financing gap. Values are multiplied by 100 to obtain weighted net balances in percentages. The data included in the chart refer to Question 5 and Question 9 of the survey.

Chart 39

Changes in factors with an impact on the availability of external financing for SMEs across euro area countries

(net percentages of respondents)

Base: All SMEs; for the category “willingness of banks to lend”, SMEs for which at least one bank financing instrument (credit line, bank overdraft, credit card overdraft, bank loan or subsidised bank loan) is relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1 and Chart 22. In round 11 (April 2014-September 2014), the category “willingness of banks to provide a loan” was changed slightly to “willingness of banks to provide credit to your enterprise”. The data included in the chart refer to Question 11 of the survey.

Chart 40

Obstacles to obtaining a bank loan for SMEs across euro area countries

(percentages of respondents)

Base: Enterprises for which bank loans (including subsidised bank loans) are relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: Financing obstacles are defined here as the total of the percentages of enterprises reporting (i) loan applications that were rejected, (ii) loan applications for which only a limited amount was granted, (iii) loan applications that resulted in an offer that was declined by the enterprise because the borrowing costs were too high, and (iv) a decision not to apply for a loan for fear of rejection (discouraged borrowers). The calculation of the indicator starts in 2010, when the question on applications for credit lines was first included in the questionnaire. The components of the financing obstacles indicator were affected by the amendments to the questionnaire in round 11 (filtering based on the relevance of the financing instrument and addition of the new category “my application is still pending”), and past data have been revised accordingly. These figures include the categories “my application is still pending” and “don’t know”.

Chart 41

Applications for bank loans by SMEs across euro area countries

(percentages of respondents)

Base: SMEs for which bank loans (including subsidised bank loans) are relevant. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 13. The data included in the chart refer to Question 7A of the survey.

Chart 42

Outcome of applications for bank loans by SMEs across euro area countries

(percentages of respondents)

Base: SMEs that had applied for bank loans (including subsidised bank loans). The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Note: See the notes to Chart 13. The data included in the chart refer to Question 7B of the survey.

Chart 43

Changes in the cost of bank financing for SMEs across euro area countries

(net percentages of respondents)

Base: SMEs that had applied for bank loans (including subsidised bank loans), credit lines, or bank or credit card overdrafts. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question10 of the survey.

Chart 44

Changes in non-price terms and conditions of bank financing for SMEs across euro area countries

(net percentages of respondents)

Base: SMEs that had applied for bank loans (including subsidised bank loans), credit lines, or bank or credit card overdrafts. The figures refer to rounds 18-25 of the survey (October 2017-March 2018 to April 2021-September 2021).

Notes: See the notes to Chart 1. The data included in the chart refer to Question 10 of the survey.

Annex 2

Descriptive statistics for the sample of enterprises

Chart 45

Breakdown of enterprises by economic activity

(unweighted percentages)

Base: The figures refer to round 25 of the survey (April 2021-September 2021).

Chart 46

Breakdown of enterprises by age

(unweighted percentages)

Base: The figures refer to round 25 of the survey (April 2021-September 2021).

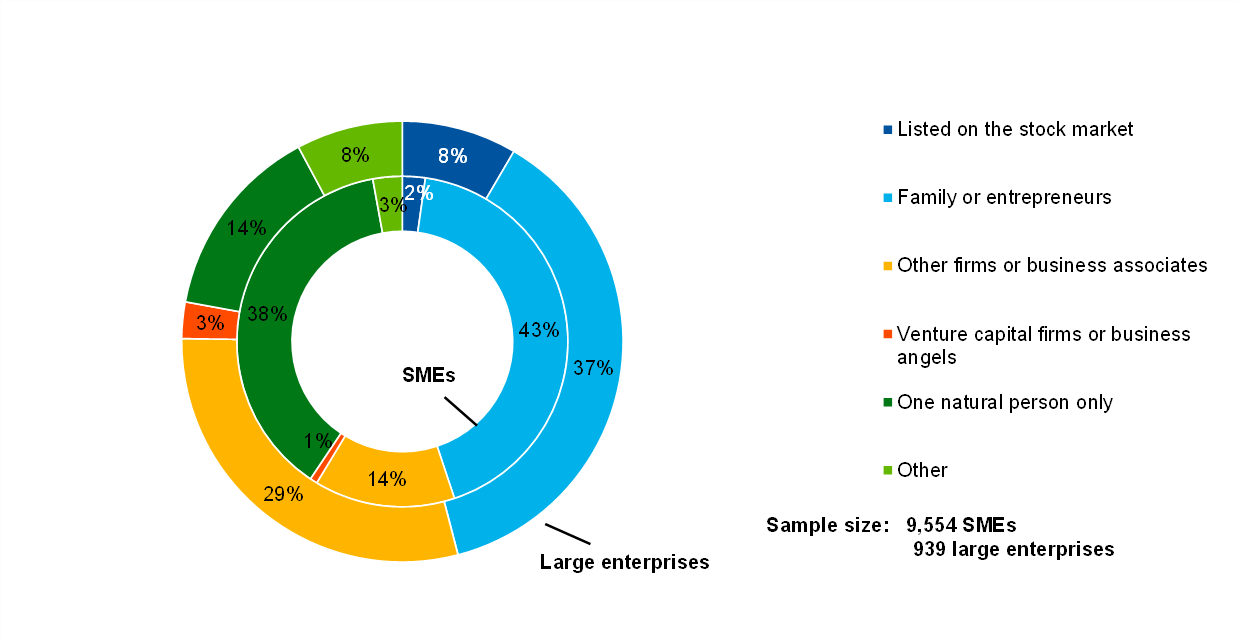

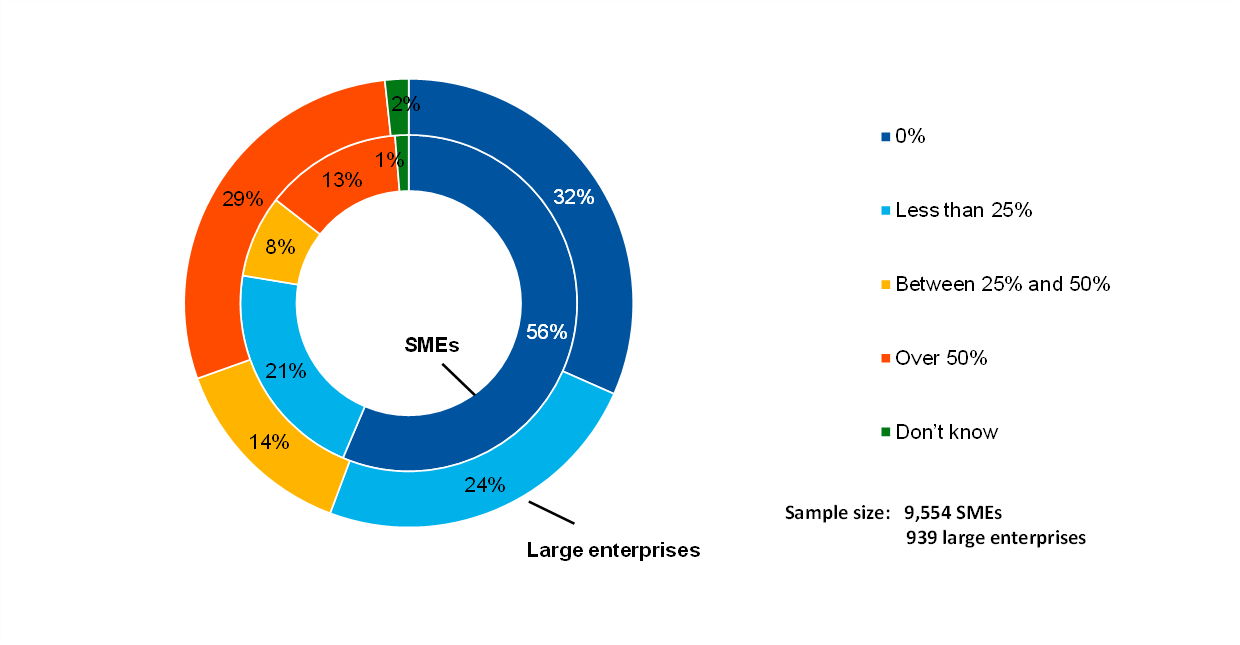

Chart 47

Breakdown of enterprises by ownership

(unweighted percentages)

Base: The figures refer to round 25 of the survey (April 2021-September 2021).

Chart 48

Breakdown of enterprises by exports

(unweighted percentages)

Base: The figures refer to round 25 of the survey (April 2021-September 2021).

Annex 3

Methodological information on the survey

This annex presents the main changes introduced in the latest round of the Survey on the Access to Finance of Enterprises (SAFE). For an overview of how the survey was set up, the general characteristics of the euro area enterprises that participate in the survey and the changes introduced to the methodology and the questionnaire over time, see the “Methodological information on the survey and user guide for the anonymised micro dataset”, which is available on the ECB’s website.[13]

Since September 2014 the survey has been carried out by Panteia b.v., in cooperation with the fieldwork provider GDCC. To the best of our knowledge, no breaks in the series are attributable to any change of provider over the life cycle of the survey.

However, some changes in the questionnaire may have caused a break between the round covering the second half of 2013 and that covering the first half of 2014. This stems from the review of various components of the survey after ten survey rounds, covering the questionnaire, sample allocation, the survey mode and the weighting scheme (see Annex 4 to the corresponding report on the ECB’s website for details).[14]

With regard to the weighting scheme, up to the survey round covering the first half of 2015, the calibration targets were updated with each survey round on the basis of the latest available figures from Eurostat’s structural business statistics. Since then, with all the euro area countries participating in the survey, the weighting scheme has been updated once a year.[15]

In this survey round, no major changes were made to the existing questions in the questionnaire.[16]

© European Central Bank, 2021

Postal address 60640 Frankfurt am Main, Germany

Telephone +49 69 1344 0

Website www.ecb.europa.eu

All rights reserved. Reproduction for educational and non-commercial purposes is permitted provided that the source is acknowledged.

The cut-off date for data included in this report was 23 November 2021.

For specific terminology please refer to the ECB glossary (available in English only).

PDF ISSN 1831-9998, QB-AP-20-002-EN-N

HTML ISSN 1831-9998, QB-AP-20-002-EN-Q

- See Annex 3 for details of methodological issues relating to the survey.

- The net percentages indicated in this report are defined as the difference between the percentage of enterprises reporting that something has increased and the percentage reporting that it has declined.

- The financing obstacles indicator is the sum of the percentages of SMEs reporting the rejection of loan applications, loan applications for which only a limited amount was granted, and loan applications which resulted in an offer that was declined by the SME because the borrowing costs were too high, as well as the percentage of SMEs that did not apply for a loan for fear of rejection.

- Net percentages (or net terms) are defined as the difference between the percentage of enterprises reporting that something has increased and the percentage reporting that it has declined.

- Vulnerable firms are defined as firms that simultaneously report lower turnover, decreasing profits, higher interest expenses and a higher or unchanged debt-to-assets ratio, while profitable firms are those that simultaneously report higher turnover and profits, lower or no interest expenses and a lower or no debt-to-assets ratio. The third (and typically largest) group consists of firms that satisfy some, but not all, conditions of the vulnerable and profitable categories. See the box entitled “Distressed and profitable firms: two new indicators on the financial position of enterprises”, Survey on the Access to Finance of Enterprises in the euro area, October 2017 to March 2018, ECB.

- See footnote 5 for details.

- A late payment is defined as a payment not made within the contractual or statutory period of payment, unless the debtor is not responsible for the delay, and when the creditor has fulfilled all its legal and contractual obligations.

- The formulation of this question allows the relevance of a specific financial instrument to be disentangled from its usage. See the SAFE questionnaire.

- See the note to Chart 13. Only survey respondents who report that a particular financing instrument is relevant for their enterprise are asked about their need for that source of financing.

- See the notes to Chart 13. Only those survey respondents which report that a particular financing instrument (i.e. bank loans, credit lines, trade credit, leasing or hire-purchase, or other loans) is relevant for their enterprise are asked about the availability of that source of financing.

- The weighted mean and median values reported by euro area enterprises (1.6% and 1% respectively) is 17 and 78 basis points lower than the official MFI interest rate statistics on bank overdrafts (the average for the period from April to September 2021). Two caveats apply when comparing the figures quoted in this report with official bank interest rate statistics: (i) the bank statistics are weighted by loan volumes, whereas the survey responses are weighted by the number of employees; and (ii) the bank statistics refer to all financing granted in the review period, whereas the survey responses only include enterprises that successfully applied for a credit line or bank overdraft or applied, but didn’t accept the terms that were offered to them (for example, because the rate was too high).

- As usual, the figures relating to market-based financing need to be treated with some caution, as the percentage of firms answering this survey question remains extremely low (with only 14% of all SMEs regarding market-based financing as potentially relevant).

- Survey on the access to finance of enterprises – Methodological information on the survey and user guide for the anonymised micro dataset.

- Survey on the Access to Finance of Enterprises in the euro area – April 2014 to September 2014.

- For more details, see the section on weighting in Survey on the access to finance of enterprises – Methodological information on the survey and user guide for the anonymised micro dataset.

- The questionnaire is available on the ECB’s website. It has been translated into various languages for the purposes of the survey.

-

24 November 2021