A theoretical model analysing investment funds’ liquidity management and policy measures

Large differences between the liquidity of investment funds’ assets and liabilities (i.e. liquidity mismatches) can create vulnerabilities in the financial system and expose funds to a risk of large outflows and sudden drops in market liquidity. From a macroprudential perspective, the current regulatory framework may not sufficiently address the risks stemming from liquidity mismatches in investment funds. By modelling the liquidity management of an open-ended fund, this article provides theoretical justification for pre-emptive policy measures such as cash buffers that enhance financial stability by helping to increase the resilience of investment funds.

1 Introduction

To assess the benefits and costs of policies aimed at addressing liquidity risks in investment funds, this article models a stylised open-ended mutual fund. In the model, structural vulnerabilities arise from the mismatch between investment in illiquid assets and the possibility of investors redeeming at short notice. We assume that the asset manager manages liquidity risk in the best interests of the fund’s investors but does not take full account of the possibility of panic runs and the system-wide impact that resulting asset sales can have. Such liquidity risk arises when the asset manager is not able to fulfil redemption requests without selling assets at a discounted price. In periods of low market liquidity, asset sales reduce market prices, affecting the net asset value (NAV) that is repaid to investors. Such costs, associated with meeting redemptions, also erode the future fund’s portfolio value and generate run incentives – and that, in turn, can trigger runs, which are detrimental to investors.

We find that pre-emptive liquidity management tools (such as a cash buffer) can reduce both run risks and costly sales of illiquid assets. Holding a higher percentage of liquid assets (in the case of our model, cash) that can be used to meet redemptions helps to align the liquidity of assets with redemption policies and limits the probability of forced asset sales in response to outflows. This mitigates the risk of panic runs, especially in periods of low market liquidity. The socially optimal cash buffer turns out to be larger than the one that the asset manager would naturally choose. Our model also shows that price-based measures such as swing pricing can help fund managers to reduce the volatility of fund flows and cut the risk of a run, as well as showing that swing pricing is more efficient than relying solely on the suspension of redemptions.

Our results support the view that the existing regulatory framework does not adequately address the liquidity risks in investment funds from a systemic perspective. While investment funds hold cash and liquid instruments in order to manage their liquidity needs in normal and fairly stressed market conditions, they do not necessarily take into account the impact of their actions on systemic risk. Nor do they face any concrete requirements aimed at mitigating liquidity risk and possible runs in a systemic event. Policymakers have frequently called for the regulatory framework to be enhanced to tackle such risks.[1] Those calls have gained further support in the aftermath of the market turmoil seen in March 2020, when investment funds faced large-scale redemptions, amplifying liquidity stress in financial markets.[2]

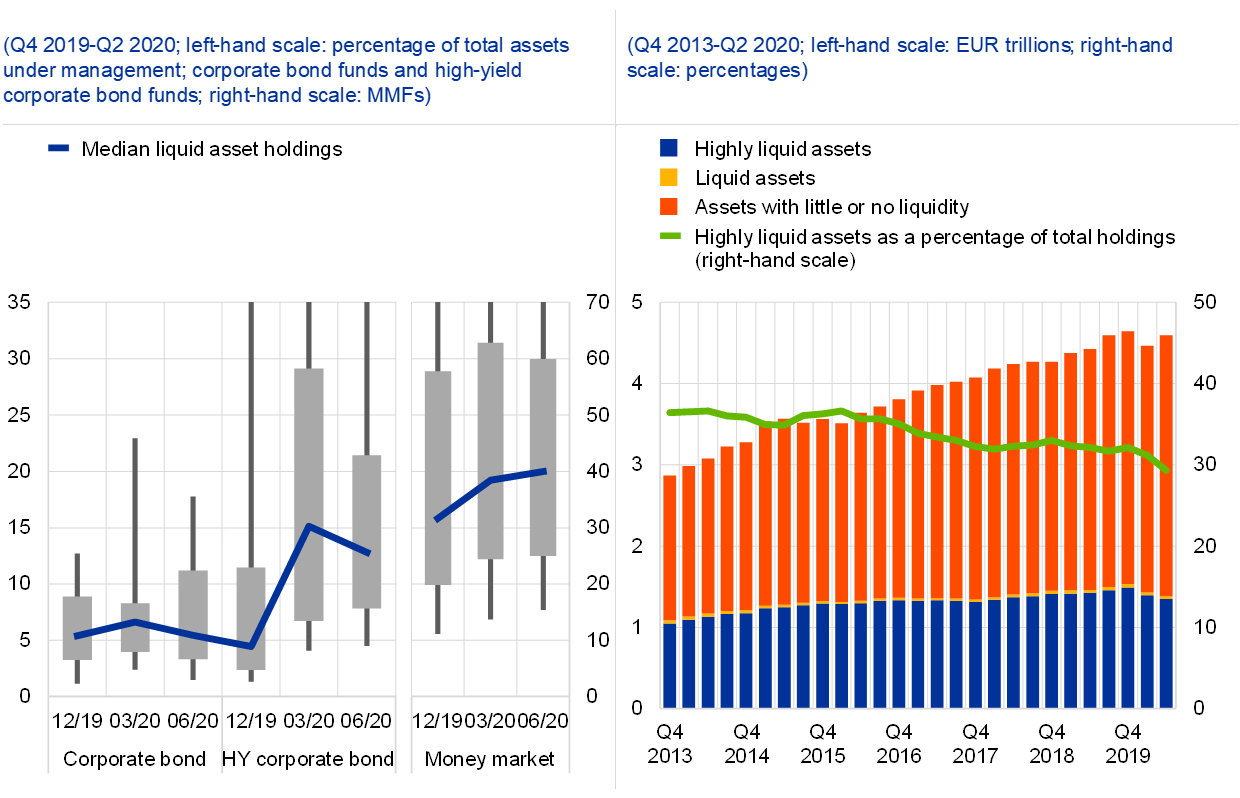

Our model shows that investment funds can have incentives to operate with a higher level of liquidity mismatch than might be desirable from a macroprudential perspective. In a low interest rate environment, funds try to boost their performance by altering their liquidity risk profile, as Chart 1 shows.[3] As a result, liquidity mismatches tend to increase over the cycle. Since fund managers lack incentives to fully internalise the system-wide effects of their behaviour,[4] this can lead to a level of liquidity mismatch which is higher than might be desirable from a macroprudential perspective.

Chart 1

Liquidity mismatches in euro area investment funds

Sources: EPFR Global, Refinitiv Lipper, ECB securities holdings statistics and ECB calculations.

Notes: The left-hand panel shows the distribution of the ratio of liquid assets to total assets for different types of fund. The boxes correspond to the interquartile range, and the whiskers indicate the 10th and 90th percentiles. “Liquid assets” comprise cash and HQLA (high-quality liquid asset) bonds. Data relate to euro area-domiciled bond funds and MMFs only. On the right-hand panel: “highly liquid assets” are level 1 assets; “liquid assets” are level 2A and 2B assets; and “assets with little or no liquidity” are non-HQLA assets.

Excessive liquidity mismatches need to be addressed, as they increase the risk of large outflows and procyclical asset sales in crisis periods, which could amplify systemic risks.[5] Asset managers may not be sufficiently prepared for a reduction in market liquidity and a simultaneous increase in redemption requests. Consequently, large redemptions may prompt asset managers to sell illiquid assets in order to raise cash. Sales of illiquid securities may drain liquidity from capital markets and affect market prices, especially at times of relatively low market liquidity. This may, in turn, spill over to other funds and other financial institutions that are holding the same assets, and also have potential implications for the financing costs of the wider economy. [6]

2 Modelling a fund’s liquidity management

This section introduces a stylised theoretical model of an open-ended mutual fund, which is then used to investigate the costs and benefits of different liquidity management measures. In the model, the asset manager can invest in both cash and an illiquid asset, and investors are allowed to redeem their fund shares in every period. This gives rise to a liquidity mismatch between the fund’s assets and liabilities, which can result in panic runs. Liquidity risk arises when the asset manager is not able to fulfil redemption requests without selling illiquid assets at a discounted price. While the asset manager manages liquidity risk in the best interests of investors, there is no internalisation of the possibility of runs or their systemic implications. In our view, the fund in our model is representative of the industry, which does not fully internalise the possibility of a wider investor run and does not, therefore, take ex ante steps to address the risks associated with such investor behaviour.[7] Thus, our model features channels relevant for evaluating the impact of potential policy measures which may be difficult to capture using empirical analysis.

2.1 Construction of the model: main intuition and timeline

Our model predicts that panic runs will occur even if the fund offers a flexible NAV. Fund shares can be redeemed at very short notice, but the flexible NAV mitigates run incentives. However, in times of low market liquidity, a panic run can still arise if the fund manager depletes cash holdings first in response to outflows.[8] At the same time, cash holdings reduce the liquidation costs that lower investors’ payouts, as well as limiting liquidity transformation, thereby reducing run incentives.[9]

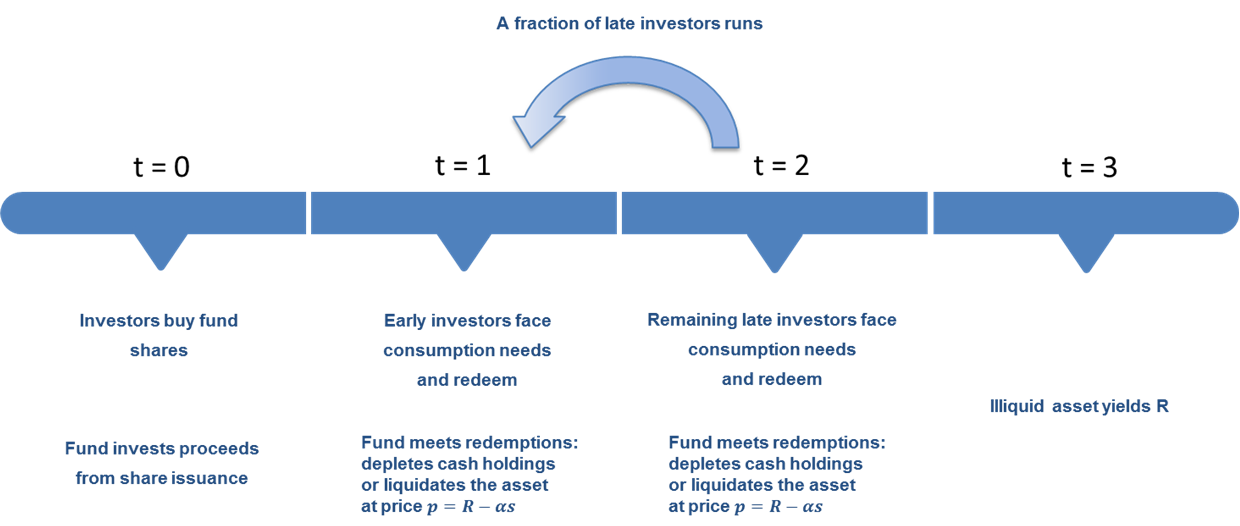

Our investment fund model is an extension of the bank run model in Diamond and Dybvig (1983).[10] Investors can face early or late liquidity needs, but they all value the stable consumption path (i.e. consumption smoothing) that is provided by the open-ended mutual fund. Early investors face liquidity needs at t=1 and must redeem at that point, while late investors face liquidity needs at t=2. In the initial stage (t=0), the asset manager issues fund shares and invests part of the capital in an illiquid asset with a certain payoff of R>1 at the last stage of the model (t=3). The rest is held in cash to fulfil future redemptions; cash is a storage technology and can be transferred across periods without cost. Selling the illiquid asset before its maturity is costly, as sales have a negative impact on prices.[11] Figure 1 below shows the timeline for our model.

Figure 1

Timeline

Source: ECB.

Note: p denotes the market price, which is a linear function of asset sales (s).

The asset manager faces redemptions on two interim dates before the illiquid asset matures. In each period, the asset manager pays a flexible end-of-day NAV to redeeming investors, which reflects current trading costs. In order to fulfil investors’ redemptions, the asset manager can choose between depleting cash holdings or liquidating the illiquid asset. The asset manager can also hoard cash and de-risk the portfolio (i.e. sales can exceed redemptions in a given period). We assume that the asset manager cannot borrow or issue debt and cannot take short positions in the illiquid asset.

2.2 Investment and liquidity management by the asset manager

We assume that the asset manager maximises investors’ utility. The asset manager seeks to maximise the returns of both early and late redeemers and knows the percentage of investors that will need to redeem early.[12] In our model, the asset manager can maximise the return of investors by minimising total losses stemming from asset sales.

The asset manager also behaves prudently by internalising the impact of their own sales on asset prices, which is beneficial to investors. At the initial date, the asset manager chooses optimal initial cash holdings and interim asset liquidation. The manager has incentives to balance cash holdings over time in order to fulfil redemptions and minimise sale costs. In particular, the asset manager chooses to hold more cash initially if liquidation costs are expected to be higher. In normal periods, when early redemptions are relatively low, the overall cost of fulfilling redemptions is divided equally among investors.

At the same time, the asset manager does not internalise all costs arising from investor behaviour. While the asset manager knows the percentage of early investors, she does not anticipate the possibility that late investors might redeem early as well (a run on the fund)[13] so does not fully internalise the costs arising from such behaviour. This gives rise to inefficiency and highlights an area where regulation could potentially improve on market outcomes.

2.3 Investor runs and related inefficiencies

Unlike deposits, the value of the fund’s shares varies over time, in line with the value of the underlying portfolio, reducing the amount of liquidity transformation and bank-like run risk. In Diamond and Dybvig (1983), the fact that bank deposits have a stable value gives rise to first-mover advantages and multiple equilibria. When there is a run, the bank’s assets are completely depleted and the bank becomes insolvent. Like bank deposits, fund shares are redeemable at very short notice, but the cost of liquidating assets is reflected in the NAV. This can mitigate run incentives, preventing the complete liquidation of the fund’s assets. However, even partial runs can be highly costly.

A first-mover advantage can still arise in our model if the fund manager depletes cash holdings first in response to outflows. The fund makes prudent use of cash holdings to actively manage liquidity risk and reduce the impact that sales have on asset prices. However, in periods of low market liquidity, when the impact of such sales is relatively high, run incentives can still arise. The market price affects the NAV that is repaid to investors, but in periods of low market liquidity the associated cost of fulfilling early redemptions erodes the value of the fund’s portfolio, also reducing future NAVs. Investors have a first-mover advantage, which leads to a run of late investors if they expect others to do the same and the fund has sufficient cash to fulfil early redemptions. If the underlying asset was perfectly liquid, the cost of asset sales would be zero, there would be no incentive to run, and the fund would not hold any cash.

Excessive early redemptions eventually result in costly asset sales, which lower the NAV and mitigate initial run incentives. If the fund uses cash holdings to fulfil redemptions, the NAV does not change and incentives to run increase as long as the number of running investors goes up. If, however, the fund runs out of cash, costly forced sales reduce the NAV that is available to running investors, thereby reducing incentives to run. [14] The left-hand panel of Figure 2 depicts how late investors’ run incentives change.

Thus, cash holdings play an ambiguous role in our model, providing incentives to run but limiting liquidity transformation in the first instance. While the availability of cash to repay redeeming investors may have the effect of increasing incentives to run, cash holdings limit liquidity mismatches and the scope for forced sales at interim dates. Ultimately, the asset manager’s decisions regarding cash holdings will weigh the costs arising from expected asset sales against the opportunity costs arising from cash holdings. In particular, the asset manager will choose to hold more cash initially if liquidation costs are expected to be higher. Depleting cash holdings first is an optimal way to fulfil redemptions which minimises total losses from asset sales. The socially optimal level of cash holdings may differ from the level chosen by the asset manager if the costs arising from runs are not fully internalised.

In our model, the asset manager does not anticipate the possibility that late investors might run on the fund, which leads to inefficiencies that regulatory intervention may be able to address. In normal times, when early redemptions are relatively low, the overall cost of fulfilling redemptions (including the opportunity cost of cash holdings) is optimally low and distributed equally among investors. However, when a panic run occurs, the cost of fulfilling redemptions increases owing to the cost of forced sales, which is both costly and collectively inefficient. Moreover, the distribution of costs among investors is distorted. Initial cash holdings are only used to fulfil early redemptions, but the costs of those initial cash holdings are also incurred by remaining investors.

3 A cost-benefit analysis of liquidity management tools

This section assesses the costs and benefits of pre-emptive liquidity management measures (such as required levels of cash holdings and swing pricing). In our model, social benefits arise from a reduction in the probability of runs, which are costly. We can calculate the probability of a run occurring using the global-game methodology.[15] To this end, we introduce a small amount of uncertainty affecting the asset price at the second interim date, which allows us to calculate the likelihood of runs under different scenario. Introducing different regulatory measures, we then calculate expected welfare over all realizations of economic fundamentals and capturing both the costs and the benefits arising from such measures.

Required levels of cash holdings or limits on illiquid assets reduce a fund’s returns, but also reduce costs related to runs. In our two-asset model, ex ante restrictions on a fund’s liquidity profile are equivalent to imposing a mandatory cash buffer that can be used to fulfil excessive redemptions. Larger initial cash holdings mean lower returns for the fund, but reduce liquidity mismatches, liquidity transformation and forced sales (thereby reducing sale costs), which can mitigate the risk of runs. In particular, when early redemptions are relatively low, a mandatory cash buffer which is larger than the one that the asset manager would naturally choose will transfer the liquidation costs associated with late redemptions to early redeemers, which reduces run incentives.[16] As Figure 2 shows, introducing a mandatory cash buffer reduces the range of scenarios in which certain investors have incentives to run, thereby reducing the likelihood of a run occurring. In the right-hand panel of Figure 2, the no-run equilibrium is further from the range of scenarios that feature runs, so in a sense the system is better insured against tail risks.

Figure 2

The effect that introducing a mandatory cash buffer has on run incentives

Source: ECB.

Notes: The left-hand panel shows the range of outcomes in which late investors have incentives to run (i.e. redeem earlier than expected) in the absence of a mandatory cash buffer. This range shrinks when such a buffer is introduced (see right-hand panel). The yellow dot indicates the percentage of early-redeeming investors at the point where the fund runs out of cash, after which the incentives to run start to decline on account of higher sales costs. The blue dot indicates the equilibrium point where only the expected early redeemers withdraw their money. The red dot indicates the partial panic run equilibrium point, at which remaining investors’ gains from running relative to waiting are zero.

The socially optimal cash buffer is larger than the one that would naturally be chosen by the asset manager, but still does not fully eliminate the possibility of runs. Our model shows that the socially optimal level for a mandatory cash buffer is higher than would naturally be chosen by the asset manager, as the decline in the probability and cost of forced sales outweighs the increased opportunity cost of holding cash. At the same time, however, it is not optimal to impose a mandatory cash buffer that eliminates any possibility of a run. Such a large buffer would entail high opportunity costs on account of forgone returns, outweighing the benefits of eliminating runs.

In our model, swing pricing helps to ensure that liquidation costs are distributed equally among investors, thereby reducing run incentives. Swing pricing is the second policy measure that we consider in our model. It enables managers to adjust the fund’s NAV in order to pass on the cost of redemptions to those investors that are buying and selling their shares. We find that full swing pricing (i.e. the application of a sufficiently high swing factor in the event of a redemption request) can eliminate any possibility of a panic run in our stylised setup,[17] whereas partial swing pricing (which is applied only when outflows reach a given threshold) can mitigate the run incentives of remaining investors. In both cases, a socially optimal swing factor is positive, as it decreases the probability of a run and costs of forced sales.

Swing pricing and higher levels of cash holdings both reduce the cost of forced sales, but they have different consequences for investors. Swing pricing involves the redistribution of returns from early redeemers to remaining investors, whereas a larger cash buffer reduces returns, which affects both early redeemers and remaining investors. Moreover, swing pricing reduces the severity of a panic run, while a mandatory cash buffer has a negligible impact on the size of a such a run. On the other hand, cash buffers provide more efficient protection against fundamental runs where following a sufficiently negative asset price realisation late shareholders have incentives to run irrespective of decisions of other late shareholders. Whether introducing swing pricing or a cash buffer is superior depends on the exact specification of our model and on the specific scenario. Overall, the different channels through which the two measures improve outcomes suggest that they could complement each other well in practice. Cash buffers would primarily aim at building resilience ex-ante whereas swing pricing would aim to fully remove first mover advantage following a shock. More generally, the relative benefits of swing pricing and cash buffers in practice will also depend on features outside the scope of the model, such as endogenous increases in systemic risk due to excessive risk-taking of asset managers, for which cash buffers are likely to be the more useful policy mitigant.

We find that well-designed pre-emptive tools are more efficient than ex post suspensions of redemptions. In our model, the socially optimal swing factor increases with the riskiness of the asset. However, it never results in the suspension of redemptions (i.e. it is never at a level that would be equivalent to suspending redemptions). In other words, the application of swing pricing is superior to a scenario in which the suspension of redemptions is the only liquidity management tool available. However, suspension of redemptions is currently the only liquidity instrument available to authorities in Europe to minimise outflows from funds.[18] During the market turmoil of March 2020, the potential use of suspensions was debated extensively, as that measure prevents investors from accessing their fund holdings to obtain liquidity at the very point when they need it the most. Our analysis supports the view that pre-emptive regulatory measures are preferable to ex post crisis management tools.

4 Conclusion and policy implications

This article provides theoretical support for the introduction of additional ex ante regulatory requirements to address liquidity risks in investment funds. The model we propose captures key aspects of funds’ liquidity management. Our model allows us to shed light on important channels for the transmission of liquidity risk in investment funds and evaluate the impact that ex ante policy measures have on run risk and forced asset sales. Overall, our analysis supports the introduction of ex ante regulatory requirements in order to reduce the risks that stem from the mismatch between the liquidity of assets and funds’ redemption policies.

Our cost-benefit analysis of policy tools suggests that well-designed ex ante liquidity requirements are superior to both ex post tools and a complete absence of requirements. In our model, the asset manager does not anticipate the possibility that late investors could run and does not fully internalise the costs arising from significant redemptions. In that context, swing pricing and stricter ex ante requirements governing the liquidity profile of the fund’s assets are both found to add value for shareholders, despite having a negative impact on the fund’s returns.

Our analysis complements existing empirical evidence on the value of using ex ante regulatory requirements to mitigate first-mover advantages and limit systemic risk arising from funds’ asset sales in times of stress. This article provides further evidence in support of using ex ante regulatory measures to enhance the resilience of the investment fund sector. It complements the empirical analysis that is presented in Article 3 of this issue of the Macroprudential Bulletin, as well as recent work on the lessons that have been learnt from the turmoil of March 2020 (FSB, 2020). Furthermore, it also provides support for the view that structural vulnerabilities in the investment fund sector should be addressed by establishing a comprehensive macroprudential framework.

References

Carbone, S. and Giuzio, M. (2021), “Excessive risk taking of investment funds in the low interest rate environment”, mimeo.

Carney, M. (2019a), “Pull, Push, Pipes: Sustainable Capital Flows for a New World Order”, speech in Tokyo, 6 June.

Carney, M. (2019b), “Après Benoît le déluge?”, speech in Frankfurt am Main, 17 December.

Chen, Q., Goldstein, I. and Jiang, W. (2010), “Payoff complementarities and financial fragility: Evidence from mutual fund outflows”, Journal of Financial Economics, Vol. 97(2), pp. 239‑262.

Chernenko, S. and Sunderam, A. (2016), “Liquidity transformation in asset management: Evidence from the cash holdings of mutual funds”, NBER Working Papers, No 22391.

Chernenko, S. and Sunderam, A. (2020), “Do fire sales create externalities?”, Journal of Financial Economics, Vol. 135(3), pp. 602‑628.

Cifuentes, R., Ferrucci, G. and Shin, H. (2005), “Liquidity risk and contagion”, Journal of European Economic Association, Vol. 3, pp. 556‑566.

Cominetta, M., Lambert, C., Levels, A., Rydén, A. and Weistroffer, C. (2018), “Macroprudential liquidity tools for investment funds – A preliminary discussion”, Macroprudential Bulletin, Issue 6, ECB, October.

de Guindos, L. (2018), “Coming to the forefront: the rising role of the investment fund sector for financial stability in the euro area”, speech in Frankfurt am Main, 12 November.

Diamond, D.W. and Dybvig, P.H. (1983), “Bank runs, deposit insurance, and liquidity”, Journal of Political Economy, Vol. 91(3), pp. 401‑419.

ECB (2019), Financial Stability Review, November.

ECB (2020), Financial Stability Review, November.

Feroli, M., Kashyap, A.K., Schoenholtz, K.L. and Shin, H.S. (2014), “Market Tantrums and Monetary Policy”, Chicago Booth Research Papers, No 14‑09.

FrickeFricke, C. and , D. (2021), “Vulnerable asset management? The case of mutual funds”, Journal of Financial Stability, Vol. 52.

FSB (2020), “Holistic Review of the March Market Turmoil”, November.

Giuzio, M., Lenoci, F. and Weistroffer, C. (2019), “Portfolio rebalancing by euro area investment funds following outflows”, Financial Stability Review, ECB, November.

Goldstein, I., Jiang, H. and Ng, D. (2017), “Investor flows and fragility in corporate bond funds”, Journal of Financial Economics, Vol. 126(3), pp. 592‑613.

Goldstein, I. and Pauzner, A. (2005), “Demand-deposit contracts and the probability of bank runs”, The Journal of Finance, Vol. 60(3), pp. 1293‑1327.

Greenwood, R., Landier, A. and Thesmar, D. (2015), “Vulnerable banks”, Journal of Financial Economics, Vol. 115, pp. 471‑485.

Lewrick, U. and Schanz, J. (2017a), “Is the price right? Swing pricing and investor redemptions”, BIS Working Papers, No 664.

Lewrick, U. and Schanz, J. (2017b), “Liquidity risk in markets with trading frictions: What can swing pricing achieve?”, BIS Working Papers, No 663.

Morris, S., Shim, I. and Shin, H.S. (2017), “Redemption risk and cash hoarding by asset managers”, Journal of Monetary Economics, Vol. 89, pp. 71‑87.

Wagner, W. (2011), “Systemic liquidation risk and the diversity-diversification trade-off”, Journal of Finance, Vol. 66, pp. 1141‑1175.

Wang, J. (2015), “Asset Managers and Financial Instability: Evidence of Run Behavior and Run Incentives in Corporate Bond Funds”, M‑RCBG Associate Working Papers, No 46.

Zeng, Y. (2017), “A Dynamic Theory of Mutual Fund Runs and Liquidity Management”, Working Paper Series, No 42, ESRB.

- See, for example, de Guindos (2018). Similarly, Mark Carney, during his time as Governor of the Bank of England, repeatedly warned about mismatches between the redemption terms and liquidity profiles of some funds’ assets and the implications for systemic risk – see, for example, Carney (2019a, 2019b). For an overview of structural vulnerabilities relating to liquidity mismatches in money market funds (MMFs) and other investment funds, see also Article 1 of this issue of the Macroeconomic Bulletin.

- FSB (2020) provides an assessment of the March 2020 turmoil and highlights the need to strengthen the resilience of non-bank financial intermediation (including the investment fund sector). Follow-up work by the FSB will include an assessment of policies aimed at addressing systemic risks in this area.

- ECB (2019) and Carbone and Giuzio (2021).

- See Chernenko and Sunderam (2020), who find evidence of that lack of internalisation, as well as evidence of meaningful fire sale externalities in the equity mutual fund industry.

- Giuzio et al. (2019).

- See Cifuentes et al. (2005), Wagner (2011), Greenwood et al. (2015), Cont and Schaanning (2017), ECB (2020), Fricke and Fricke (2021) for the importance of overlapping portfolios and asset liquidations as a source of systemic risk.

- Our model does not simulate the additional frictions that are caused by funds competing to attract investors, which could, in turn, lead to increased risk-taking and a further build-up of systemic risk in the sector. Instead, the focus of our analysis is on interaction between investors that leads to runs and is not fully internalised by the fund manager. Introducing interaction between multiple funds could be a promising avenue for future research and could further strengthen our results.

- Various empirical studies have pointed to the existence of run incentives for investors in open-ended funds where liquidity mismatches are large or levels of market liquidity are low (Chen et al., 2010; Goldstein et al., 2017; Feroli et al., 2014). In particular, Chen et al. (2010) provides evidence that investors can have incentives similar to those of depositors in a bank run.

- Empirical studies have shown that funds’ cash holdings are not generally sufficient to fulfil redemptions (Wang, 2015; Chernenko and Sunderam, 2016) and that asset managers fail to anticipate redemptions well in advance (Morris et al., 2017). We contribute to that literature by assessing the role that pre‑emptive policy measures play in reducing run risks and sales of illiquid assets.

- Like us, Zeng (2017) and Lewrick and Schanz (2017b) also build on Diamond and Dybvig (1983) in order to model fund runs. In particular, Zeng (2017) considers a repeated version of Diamond and Dybvig’s (1983) model in order to capture the dynamic interdependence of shareholder runs and funds’ liquidity management in a crisis management scenario.

- We assume that the asset manager faces downward-sloping demand curves for the illiquid asset within each trading day and internalises the impact on prices. We assume that the impact which sales have on prices is linear: .

- In our model, individual liquidity shocks are not publicly observable, but we assume that the law of large numbers holds and that the percentage of early investors is public information.

- Morris et al. (2017) finds only weak evidence that fund managers are able to anticipate the amount of redemptions well in advance.

- If the fund has sufficient cash to fulfil redemptions by running investors, there is strategic complementarity, since the utility that is gained from running increases when more investors decide to run. However, when forced sales start to increase, investors’ decision-making exhibits strategic substitutability, since the utility that is gained from running decreases when more investors decide to run.

- In line with Goldstein and Pauzner (2005), we uniquely determine investors’ redemption decisions on the basis of their individual beliefs about the fundamental value of the asset R.

- A mandatory cash buffer helps the NAV to be more forward-looking, as it incorporates the cost of fulfilling future redemptions in today’s NAV.

- Lewrick and Schanz (2017b) also find that swing pricing can completely eliminate the risk of panic runs on funds.

- See Cominetta et al. (2018) (especially Table 1 thereof), which shows that suspending redemptions halts runs, but also sends negative signals to investors and markets, with potential implications for the fund’s reputation and investors’ confidence in the fund sector. Moreover, fear of redemptions being suspended can actually increase investors’ incentives to redeem.