The US and UK labour markets in the post-pandemic recovery

Published as part of the ECB Economic Bulletin, Issue 8/2021.

During the post-pandemic recovery, the US and UK labour markets show many similarities, albeit with different implications for wages. This box reviews post-pandemic labour market developments in the United States and United Kingdom. It shows that, in both countries, imbalances between labour demand and labour supply are causing a high and unusual tightness for such an early stage in a recovery. This could translate into broad-based wage pressures, in turn posing a risk to inflation. Such pressures are becoming increasingly visible in the United States, but are less marked in the United Kingdom.

In the United States, labour demand outstrips supply. According to the latest available data, in October 2021 the labour force participation rate still stood significantly below its pre-crisis level (1.7 percentage points below the level prevailing in February 2020). Such a level is commonly observed at an early stage of a recovery in the labour market cycle. The maximum employment objective for the Federal Reserve System, of which the participation rate is one element, appears to be far from being reached (Chart A). At the same time, firms are opening positions at a fast pace in response to the rapid recovery of the US economy. This has brought vacancies to very high, even unprecedented, levels, which are usually associated with a late stage in the labour market cycle. As a result, labour market tightness has already jumped above pre-crisis levels, instead of making a slow recovery, as was the case after the global financial crisis (Chart A).[1] The lack of response on the part of labour supply (low participation) to rising labour demand (high level of vacancies) is indicative of a decline in matching efficiency in the current recovery. This appears to be the case especially for businesses with frequent customer contact, such as bars and restaurants, which have encountered difficulties in attracting workers. Moreover, a temporary increase in unemployment benefits (particularly significant for low-paid workers), early retirement, and an increased need to care for children and other family members during the pandemic, particularly for women, has also reduced the labour supply.[2] This partly accounts for what has been called the “Great Resignation”, as support programmes have allowed people more freedom to leave their jobs or to be more selective when looking for new ones.

Chart A

US employment rate, participation rate and labour market tightness

(percentages of civilian population; ratio of vacancies to unemployment; monthly)

Sources: BLS and author’s calculations.

Notes: Labour market tightness is measured by the ratio of vacancies to unemployment. Shaded areas indicate recessions. The latest observations are for September 2021 for tightness and October 2021 for employment and participation rates.

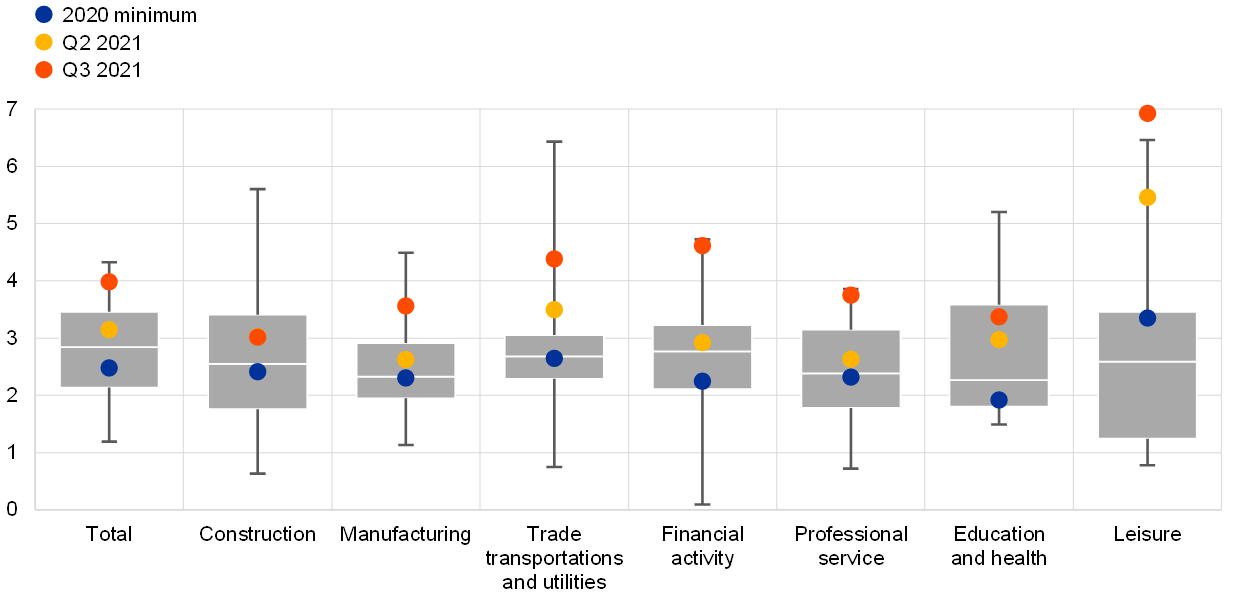

The increase in labour market tightness has translated into broadening wage pressures. While the high level of vacancies has been broad-based across industries, up to the second quarter of this year wage growth – as measured by the employment cost index – was limited to leisure and hospitality, as firms tried to make these contact-intensive and mostly low-paid jobs more attractive (Chart B). In the third quarter of this year, however, an acceleration in wages also became visible in most other industries, such as trade and, to a lesser extent, manufacturing, financial activities and professional services, although for the latter three industries still remaining within ranges observed in the past. This development has sparked a debate about the risk of a further broadening of wage pressures, and if it could ultimately lead to a wage-price spiral. Whether these risks materialise depends on various factors. First, most of the factors which have held back labour supply in the United States are expected to be temporary and to revert in the coming months, therefore reducing the level of tightness. The temporary increase in unemployment benefits has already expired. Second, new coronavirus (COVID-19) infections have been falling since summer, which should attenuate fears about returning to work in high-contact industries, and the reopening of schools should favour a return to work by parents. At the same time, above average productivity growth has kept unit labour costs, a measure that is more relevant for firms in setting prices than nominal wages, close to long-term averages. Third, the recent increase in inflation has to a large extent been driven by goods and services, for which wage growth has remained subdued (for example car manufacturing), or is related to other factors (such as rents, which are linked to housing market developments). On the other hand, although indexation clauses are not a common practice in the United States, the high inflation environment (highest headline inflation rate recorded since 1990), coupled with labour market tightness could translate into a heightened risk of higher wage demands proliferating going forward.

Chart B

US employment cost index by industry

(year-on-year growth rates)

Sources: BLS and author’s calculations.

Notes: The box plots represent the minimum, the first quartile, the median, the third quartile and the maximum from the first quarter of 1997 to the fourth quarter of 2019. The latest observations are for the third quarter of 2021.

The UK labour market is also showing signs of increased tightness, coupled with a slow recovery in employment and labour market participation. As in the United States, both the employment rate and the labour force participation rate have only slowly been approaching their pre-crisis levels. The respective gaps of 1.2 percentage points and 0.9 percentage points compared with February 2020 levels remain considerable and indicate an early cycle stage of the labour market recovery (Chart C). In contrast, vacancies have been increasing rather sharply, as UK firms have faced both an increased demand for goods and services (driven by the re-opening of the economy) and a decreased supply of low-skilled EU workers (owing to Brexit). As a result, labour market tightness has already surpassed pre-crisis levels, pointing towards a late stage in the cycle, as opposed to the slower recovery experienced in the aftermath of the global financial crisis (Chart C). Similar to the United States, the sluggish response of UK labour supply relative to strong labour demand suggests lower matching efficiency. This is for similar reasons, but also because of lower participation by many younger people who have chosen to stay in education. The furlough scheme may be another explanation for the tightness in the labour market, as employees on furlough had less incentive to join the pool of available workers and apply for new jobs. However, the scheme ended in September, meaning that labour market tightness might already be lower than the official data show.

Chart C

UK employment rate, participation rate and labour market tightness

(percentages of working age population and ratio of vacancies to unemployment, 3-month moving average)

Sources: ONS and authors’ calculations.

Notes: Labour market tightness is measured by the ratio of vacancies to unemployment. Shaded areas indicate recessions. The latest observations are for September 2021.

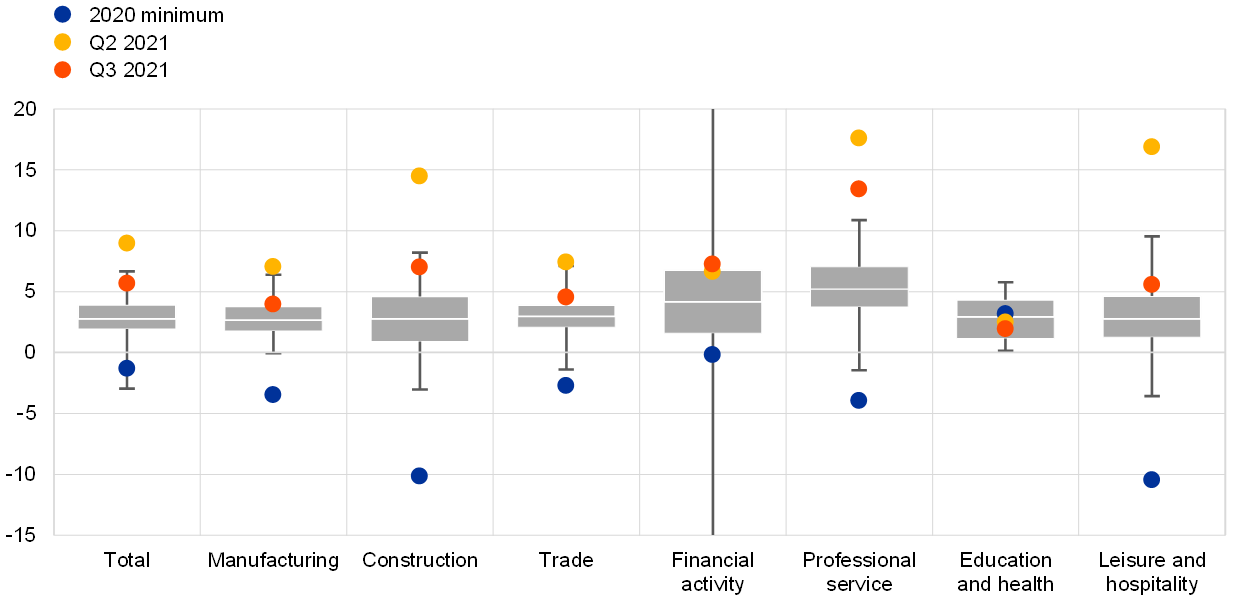

Reflecting the diverse developments in vacancies, wage pressures have so far remained limited to specific sectors. While economy-wide growth in average weekly earnings remains high (at 5.8% in September), most of the increase comes from negative base effects reflecting the introduction of the furlough scheme last year.[3] This can also be observed on a sectoral level, as base effects drove wages in the second quarter of this year to historically high rates across most industries. The latest data for the third quarter indicate that wage growth has not increased further and, in most cases, has even decelerated (Chart D).[4] Wage increases were most pronounced in professional and business services and in sectors previously relying on low-skilled migrant labour (construction, and leisure and hospitality). It is worth noting that even though specific professions (such as lorry drivers) experienced a substantial increase in earnings, this increase did not extend to the industry as a whole (trade, transportation and utilities). Therefore, the risk of broad-based wage pressures and a wage-price spiral appears less likely at this stage of the recovery, considering that the underlying wage growth remains much more contained.

Chart D

Average weekly earnings by industry in the United Kingdom

(year-on-year growth rates, 3-month moving average)

Sources: ONS and authors’ calculations.

Notes: The box plots represent the minimum, the first quartile, the median, the third quartile and the maximum from the first quarter of 2002 to the fourth quarter of 2019. The latest observations are for the third quarter of 2021.

Overall, while both the United States and United Kingdom are experiencing labour shortages, developments on the wage front differ to some extent. Factors constraining labour supply are expected to fade somewhat in both countries. In the United Kingdom, this is likely to reduce labour market tightness and to dampen what have been – up until now – very localised wage pressures. In the United States, expectations of further strong economic growth in the short term could prolong labour market tightness, in turn leading to broader-based wage increases.

- The Empire State Manufacturing Survey confirms that firms are struggling to expand the workforce.

- The slow recovery of older groups’ participation in the United States could be partly due to fears related to the pandemic. For a detailed analysis at the euro area level, see the box entitled “Labour supply developments in the euro area during the COVID-19 pandemic”, Economic Bulletin, Issue 7, ECB, 2021.

- The government-run furlough scheme in the United Kingdom provided staff on furlough with 80% of their usual salary, up to a maximum of £2,500 per month. This resulted in a considerable decrease in average weekly earnings.

- When annualised growth rates are compared over two years, the influence of base effects disappears, and the second and third quarters show only moderate wage pressures.