Consumption patterns and inflation measurement issues during the COVID-19 pandemic

Published as part of the ECB Economic Bulletin, Issue 7/2020.

The coronavirus (COVID-19) pandemic has generated challenges in measuring consumer price inflation as a result of changes in consumption patterns and limitations in price collection. The pandemic has generated two main challenges when measuring consumer price inflation. First, the pandemic triggered unusually large changes in household spending patterns which are not reflected in aggregated consumer price indices.[1] Second, price collection was affected by the lockdown, and the missing observations therefore needed to be imputed.[2] This box discusses the gap between the Harmonised Index of Consumer Prices (HICP) and the development of prices for the goods and services actually purchased by final consumers. The box also discusses how imputation has affected published HICP statistics.[3]

The HICP is compiled using consumption weights that are kept constant within a given calendar year. When constructing the HICP, the price changes of individual items are weighted using household consumption shares that are fixed for the calendar year. This reflects the intended purpose of the HICP of estimating pure price changes without accounting for shifts in household consumption patterns. The HICP weights are primarily based on past years’ national accounts data, which are adapted in an effort to be representative of the previous year’s consumption shares.[4] This means, for example, that the 2020 HICP weights mainly reflect 2018 household consumption. While keeping the weights constant within a calendar year does not generate measurement issues in normal times, the nature of the pandemic shock has triggered large consumption shifts over a short period of time.

There is a growing body of literature documenting large pandemic-induced changes in household consumption and discussing their implications for inflation. Using high-frequency data, several studies have identified large changes in spending across product categories.[5] These time-varying expenditure shares[6] have been used to quantify the difference between published consumer price indices and the inflation rate of the items actually purchased by consumers.[7] Following this approach, two statistical agencies have published experimental price indices with monthly time-varying weights showing how the pandemic has affected consumer spending and that a gap has opened up between CPI-type inflation figures and the inflation rate of the items actually purchased by final consumers.[8]

Using publicly available data, we have estimated a monthly-reweighted consumer price index for the euro area. Several steps are needed to construct a monthly-reweighted consumer price index. First, nominal monthly turnover data for the retail trade and for other services (e.g. transport services) are matched to the corresponding HICP categories.[9] While retail trade turnover data primarily reflect transactions driven by household purchases, turnover of other services includes business-to-business transactions which need to be stripped out. Second, taking the latest HICP weights as a base, the evolution of the spending categories is estimated using the corresponding nominal turnover growth rates.[10] Third, relative weights are used to construct the monthly-reweighted consumer price index.[11] By design, our index captures part of the changes in consumption during the pandemic and therefore comes closer to the rate of change in the prices of items actually purchased by consumers during this period.

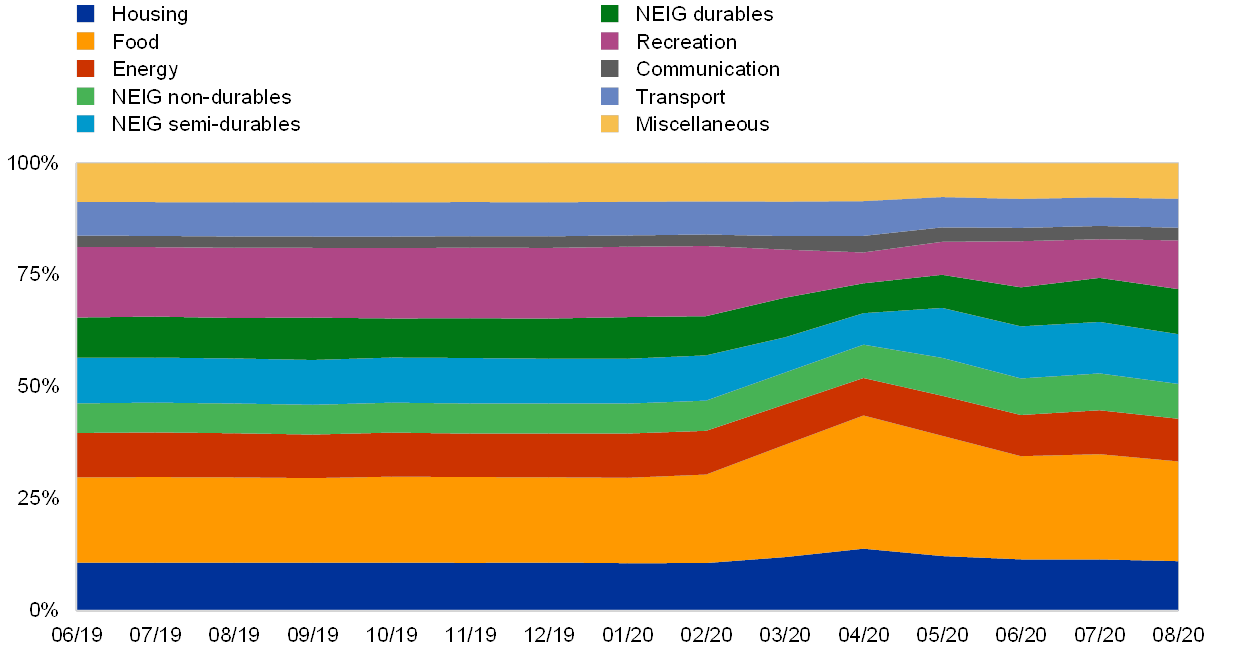

Chart A

Shares in household consumption by category

(percentages)

Source: Authors’ calculations based on Eurostat data.

Notes: The chart shows the evolution of estimated relative spending. Spending patterns are calculated using the latest HICP weights as a starting point and applying growth rates based on turnover data for the retail trade and for other services. “NEIG” stands for “non-energy industrial goods”. “Food” refers to food items and does not include eating out.

The available data suggest that household consumption patterns have changed significantly during the pandemic. Relative consumption patterns were stable until the beginning of the pandemic (see Chart A), but the pandemic and the lockdown measures led to a large increase in the weight of some categories (such as food items and communication services) and a reduction in other categories (such as recreation and energy goods). Most of the pandemic-induced shifts have been temporary, such as for semi-durable goods, which includes a diverse set of items such as clothing, books and small utensils. However, shares of spending on food items and recreation services show persistent deviations from pre-pandemic trends, as some of the restrictions remain in place. As Chart A reports relative weights, some categories show an increase in March/April because the nominal spending in that category contracted less than overall consumption. Table A shows our estimates of the development of nominal household spending across categories.[12]

Table A

Estimated nominal household spending

(index: February 2020 = 100)

Source: Authors’ calculations based on Eurostat data.

Notes: The table shows estimated absolute household consumption levels (nominal spending). Spending patterns are calculated using the latest HICP weights as a starting point and applying growth rates based on turnover data for the retail trade and for other services. Nominal spending levels are normalised to 100 in February 2020.

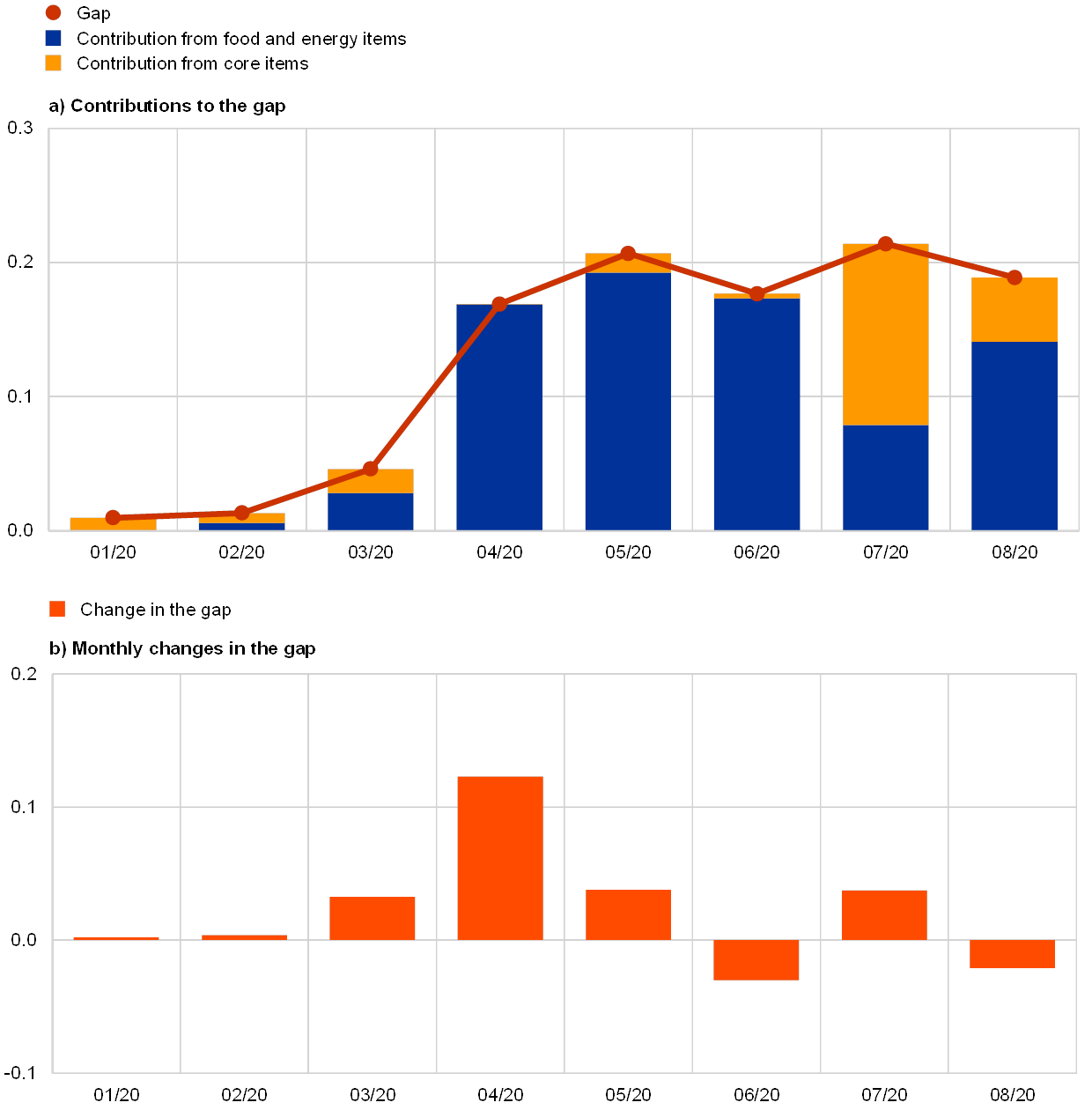

Since the beginning of the pandemic, inflation as measured by our experimental index has been running higher than HICP inflation, and the difference has remained broadly stable in recent months. Chart B shows the gap between the annual rates of change (year-on-year) of the experimental index and the HICP (the orange line in panel a). This gap started to open up in March (as shown by the orange bars in panel b) and increased to about 0.2 percentage points in April.[13] Since then, it has remained roughly constant.[14] Intuitively, this reflects consumers switching from lower-than-average inflation categories (such as fuel for transport, covered by “Energy”) to higher-than-average inflation categories (such as food items). Chart B also shows the contributions from food and energy items (the blue bars in panel a) and core items (the yellow bars in panel a). Until June, the difference between the experimental index and the HICP was driven mainly by food and energy items, while the remaining items contributed to more than half of the gap in July.

Chart B

Difference between changes in a monthly-reweighted index and the HICP

(percentage points, year-on-year changes)

Source: Authors’ calculations based on Eurostat data.

Notes: The orange line in panel a shows the difference between year-on-year HICP inflation and the year-on-year change in our alternative index. The bars in panel a show the contributions of food and energy items (blue bars) and core inflation items (yellow bars). The orange bars in panel b show the monthly change in the gap (i.e. the monthly change in the orange line in panel a).

The lockdown period also caused issues for HICP price collection. As a result, the share of imputed prices changed from month to month.[15] Price collection in “bricks-and-mortar” stores stopped where outlets were closed. In addition, sampling in supermarkets and drugstores was largely discontinued in order to protect price collectors.[16] Imputation was required in areas where the collection of actual prices was substantially reduced. Chart C shows the evolution of price imputation in HICP categories from March to August. While March was largely unaffected, in April more than 30% of the HICP was not sampled and had to be imputed.[17] This share of imputation declined to about 1% in July and remained at that level in August. Recreation was the category most affected by imputations, owing to the non-availability of package holidays and the cancellation of concerts and other events.

Chart C

Price imputation by HICP category (March to August 2020)

(percentages)

Source: Authors’ calculations based on Eurostat data.

Notes: The chart shows the share of prices in each HICP (COICOP 2-level) category as a percentage of the total HICP, divided into prices that were mainly collected (blue bars) and prices that were mainly imputed (yellow bars). Prices that were “mainly imputed” represent elementary aggregates of the respective category which were flagged with “U” by the national statistical offices in the respective month, meaning that more than 50% of the prices of the elementary aggregate were imputed.

The change in price collection method does not necessarily imply that the resulting price index is unreliable. For example, when food prices collected at traditional markets were replaced by food prices from supermarket scanner data, actual consumer behaviour was reflected quite closely. This was also the case when web-scraped prices for clothing and footwear replaced prices normally collected in bricks-and-mortar stores.[18] For package holidays, airfares and many personal services (e.g. hairdressers and dentists), however, price changes had to be imputed since no actual purchases of such products were possible. In accordance with conventions agreed upon by EU statistical offices, price developments were imputed by reference to other consumer price indices, e.g. from the same product category or the all-items HICP. In some cases, prices or price changes from pre-crisis periods were used as estimates.[19]

While the pandemic-induced measurement challenges for the HICP have fallen significantly over recent months, they will most likely continue in 2021 and, to some extent, in 2022, at least with respect to expenditure weights. This box presented the estimated impact of measurement challenges triggered by the pandemic on consumer price inflation. The impact was mainly driven by the rapidly changing consumption patterns and price collection difficulties brought on by the lockdown measures. Measurement issues had an impact on published statistics in the first few months of the pandemic, but they have significantly decreased in recent months. Going forward, should the pandemic continue, some measurement challenges will remain in 2021. This will also be the case in 2022, when 2020 consumption data are expected to be used to construct HICP weights.

- Consumer price indices (CPIs) use a fixed basket approach. This means that they keep expenditure weights constant between the base period and the reference period, assuming that relative consumption shares do not change. Therefore they do not capture changes in consumption patterns.

- For a detailed discussion on this point, see the box entitled “Inflation measurement in times of economic distress”, Economic Bulletin, Issue 3, ECB, 2020.

- Aspects related to social, health and environmental phenomena can have an impact on household utility related to consumption. Specific theoretical inflation measurement concepts try to account for some of these factors. However, there is no such quality adjustment in the HICP for a possible fall in the utility of certain services owing to infection risks and social distancing requirements such as those currently being experienced by consumers. An assessment of this issue is outside the scope of this box, which focuses on changing consumption patterns.

- The derivation of the weights is laid down in Commission Implementing Regulation (EU) 2020/1148 of 31 July 2020 laying down the methodological and technical specifications in accordance with Regulation (EU) 2016/792 of the European Parliament and of the Council as regards harmonised indices of consumer prices and the house price index (OJ L 252, 4.8.2020, p. 12).

- Consumption of food items has increased and remains relatively high because households are spending more time at home (effectively switching away from food served in bars, restaurants and cafés). See the box entitled “Recent developments in euro area food prices”, Economic Bulletin, Issue 5, ECB, 2020. Contributions to this literature include, for the United States, Cavallo, A., “Inflation with Covid Consumption Baskets”, NBER Working Paper, No 27352, 2020; Dunn, A.C, Hood, K.K. and Driessen, A., “Measuring the Effects of the COVID-19 Pandemic on Consumer Spending Using Card Transaction Data”, BEA Working Paper Series, No WP2020-5, US Bureau of Economic Analysis, April 2020; for the United Kingdom, Surico, P., Känzig, D. and Hacioglu, S., “Consumption in the time of Covid-19: Evidence from UK transaction data”, CEPR Discussion Papers, No 14733, May 2020; and, for Spain, Carvalho, V.M. et al., “Tracking the COVID-19 Crisis with High-Resolution Transaction Data”, CEPR Discussion Papers, No 14642, 2020.

- These weights are approximations and do not necessarily match the accuracy of the weights derived from national accounts.

- See, for the United Kingdom, Jaravel, X. and O’Connell, M., “Inflation Spike and Falling Product Variety During the Great Lockdown”, CEPR Discussion Papers, No 14880, June 2020; and, for Canada, Huynh, K., Lao, H., Sabourin, P. and Welte, A., “What do high-frequency expenditure network data reveal about spending and inflation during COVID‑19?”, Staff Analytical Note, No 2020-20 (English), Bank of Canada, September 2020.

- See “How to compute a Consumer Price Index in the context of the Covid-19 crisis?”, INSEE, April 2020; and “Re-weighted consumer prices basket – adjusting for consumption changes during lockdown: July 2020”, Office for National Statistics, August 2020.

- See “Classification of Individual Consumption According to Purpose (COICOP) 2018”, Statistical Papers, Series M, No 99, United Nations Statistics Division.

- The latest HICP weights reflect expenditure shares calculated using mainly 2018 data.

- The index calculation in this box is experimental. Data used for estimating monthly expenditure weights are compiled according to concepts and classifications that differ from the definition of consumption underlying the HICP. The match to HICP categories is therefore imperfect, particularly where monthly turnover data are used, as these data also include transactions between firms. The sources used to estimate monthly weights are less reliable than official HICP expenditure sources. Our (unchained) index assumes the same scope and coverage as the HICP. This implies that the items included in our index are the same as those in the HICP. It also implies that the monthly price changes of the individual items are the same as those of the HICP. In other words, the main difference between our index and the HICP is that we allow the spending weights to change from one month to the next, while the HICP keeps them constant. For the formula, we have employed a Fisher index.

- Our estimate of the contraction in overall spending is in line with published Eurostat statistics for private final consumption.

- Our results are in line with evidence from similar studies outside the euro area.

- Because our analysis is at COICOP-2 level, the gap between our index and HICP inflation reflects only the upper level of changes in consumption patterns during lockdown (in particular, the gap reflects switching between food and energy items and core items at COICOP-2 level). The gap between our index and the HICP has remained fairly constant in recent months because the change in weights has resulted in a lasting shift in the level of the series.

- See “Information on imputations made related to Covid-19”, available on Eurostat’s website. In general, imputation is required for items temporarily “missing” and for seasonal products when they are out of season and cannot be sampled.

- Eurostat and the national statistical offices of EU Member States decided not to cut out those product indices for which sampled prices were not available. The main reasons for keeping the coverage of the HICP basket complete, even though actual transactions were very limited in several of its product categories, are related to, but not limited to, legal obligations, established uses (for example, in contracts), user needs, and the continuation of HICP compilation according to its statistical concept (laid down in EU regulations).

- This refers to 30% of the overall index (in terms of weights), and not 30% of prices of the (un-weighted) items.

- Internet price collection is in the form of web-scraping samples of offer prices. These prices might not necessarily reflect actual purchases.

- See “Guidance on the compilation of the HICP in the context of the COVID-19 crisis”, methodological note, Eurostat, April 2020.