ECB communication with the wider public

Published as part of the ECB Economic Bulletin, Issue 8/2021.

1 Introduction

Central banks across the world have stepped up their efforts to communicate more effectively and reach wider audiences. With the rise of central bank independence in recent decades, central banks have become more transparent and are working harder to make themselves understood.[1] Furthermore, the wider set of tools that central banks have used and additional tasks entrusted to them since the global financial crisis have called for better explanations of what central banks do and why. Central banks have also made communication a core part of their monetary policy toolkit with the introduction of forward guidance. While central banks used to primarily address their communication to expert audiences, such as financial market participants, recently they have been making more of an effort to reach out to the non-expert wider public.

Central bank communication is important for the effectiveness of monetary policy because it can influence the expectations of market participants, firms, and consumers. For central banks to influence inflation expectations effectively, the wider public – defined here as the general, non-expert public and representative professional bodies such as employers’ groups, trade unions, political groups, etc. – needs to be aware of central banks’ messages and understand them. At the same time, attracting people’s attention and reducing the complexity of central bank communication in an effective manner is challenging.

With the recent evolution in central banking, the ECB has revisited its communication practices. To account for significant shifts in the communication landscape and the clear demand from the wider public to make ECB communication more accessible, the ECB decided – as a result of its recent strategy review – to modernise its monetary policy communication and make “listening” a regular feature of its communication.[2]

This article examines the ECB’s communication with the wider public. It starts from the premise that communication is a process that involves a “sending end” – the central bank – and a “receiving end”, i.e. different audiences, ranging from experts to the wider public. For communication to work effectively, both ends, as well as the link between the two, need to be well understood. By shedding light on this process, this article builds upon the analysis conducted as part of the ECB’s strategy review, notably by the Work stream on monetary policy communications.[3] It also provides a first assessment of efforts to modernise ECB communication following the strategy review’s conclusion.

2 The “receiving end” of central bank communication

The ECB faces various challenges in its efforts to “get through” to the wider public. First, as a supranational central bank, the ECB finds itself in a challenging position in that it speaks to diverse audiences across 19 Member States. Financial literacy levels, inflation expectations and trust in the ECB vary across and within euro area countries. ECB communication needs to take this plurality into account. Second, the ECB – like other central banks – has to overcome the challenge of people’s inattention to its messages.[4] The complexity of central bank communication and low levels of financial literacy, among other factors, can make it too “costly” for people to pay attention to what central banks say.[5] Another challenge is that trust in the ECB, which declined significantly during the global financial crisis, is only slowly recovering to previous levels. Analysing the determinants of public trust in the ECB can help us understand if and how the ECB can build trust.

One central bank, many diverse audiences

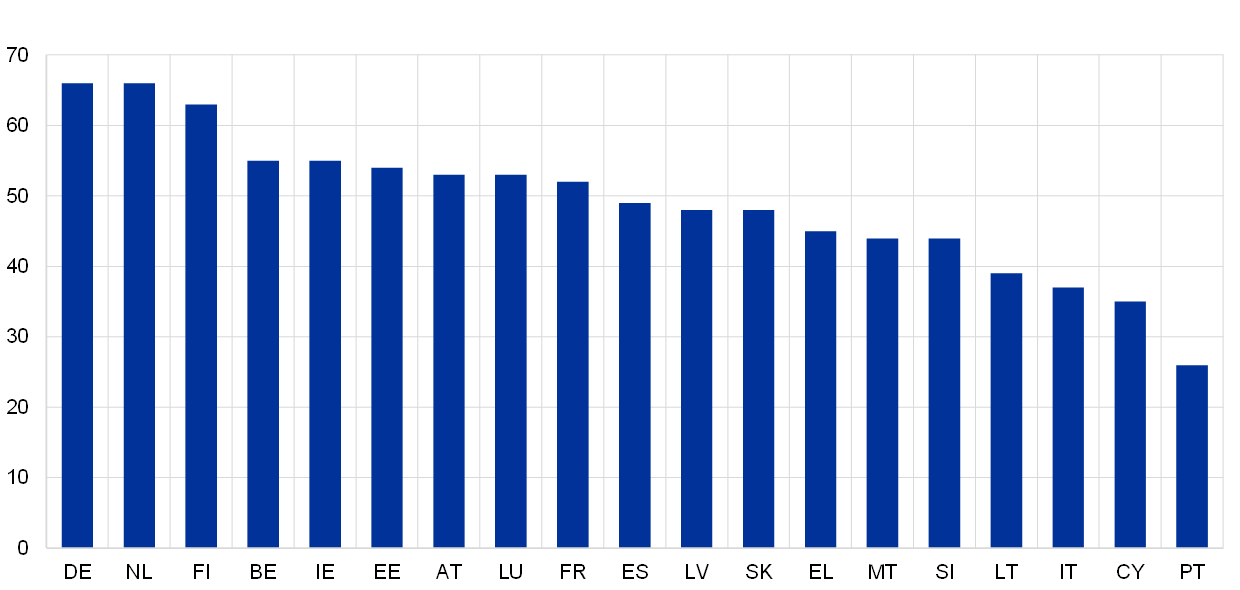

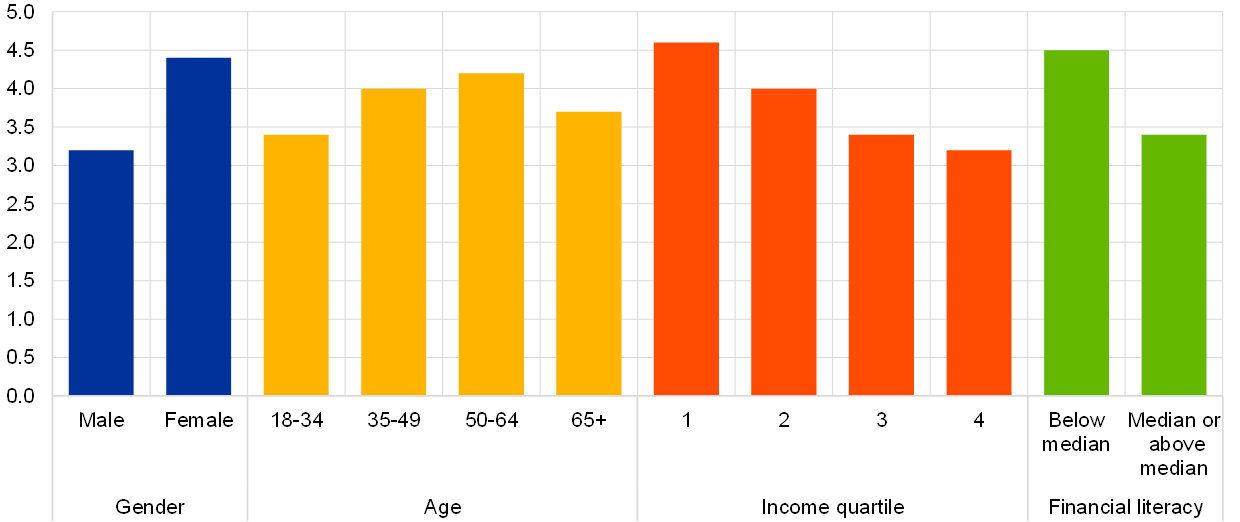

When reaching out to the wider public, the ECB needs to consider the diversity of those who are at the receiving end of central bank communication. Compared with other major central banks, the ECB stands out in terms of the linguistic diversity of its audience. It communicates in 24 languages to an audience made up of 340 million citizens, spread across 19 Member States. Besides language diversity, ECB communication also needs to account for different financial literacy levels across countries (Chart 1)[6] and the heterogeneity of inflation expectations among the wider public (Chart 2). Results from the ECB Consumer Expectations Survey (CES) indicate that inflation expectations are higher for female consumers than male consumers, increase with age and decrease with a high level of financial literacy and income.[7]

Chart 1

Financial literacy of the general public by euro area Member State

(percentage share of respondents)

Source: Klapper, L. and Lusardi, A. (2020).

Notes: Share of respondents who answered at least three out of the five questions on financial literacy correctly in the S&P Global FinLit Survey. Questions concerned risk diversification, inflation, numeracy, and compound interest. The authors derived the data from a set of five questions from the Gallup World Poll survey. More than 150,000 nationally representative and randomly selected adults (age 15+) in more than 140 countries were interviewed during 2014. The surveys were conducted face-to-face in most emerging countries and by phone in high-income countries.

Chart 2

Consumer expectations for inflation across demographic groups

Expected inflation rates over next 12 months in selected euro area Member States

(percentages)

Source: ECB Consumer Expectations Survey

Notes: Averages using weighted data. Latest observation December 2020. Pooled data across waves. The CES collects information on perceptions and expectations of households in the euro area, as well as on their economic and financial behaviour. The survey is conducted online each month. Survey participants were located in six euro area countries: Germany, France, Italy, Spain, the Netherlands and Belgium. The sample size – during the pilot phase – targeted 10,000 respondents.

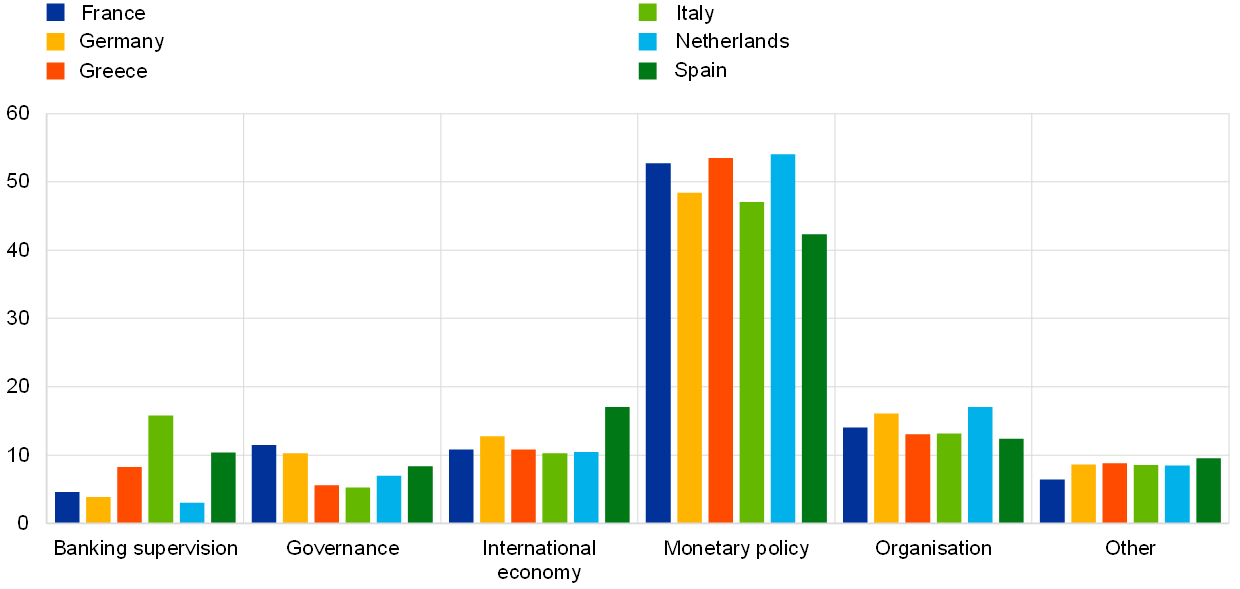

The wider public’s interest in ECB-related themes also varies widely, though its main interest lies in monetary policy. Taking media coverage as a proxy for public preferences and interests,[8] Chart 3 shows commonalities across countries, but also indicates important differences across the euro area.[9] ECB-related coverage focuses mostly on monetary policy, but there are significant cross-country differences, depending on the topic. For example, in Italy and Spain, interest in banking supervision topics is much higher than in countries such as Germany or the Netherlands, while discussion about the ECB’s mandate and accountability – under the category Governance – is more common in Germany and France than in the other countries in the sample.

Chart 3

Media attention to ECB-related topics in selected euro area Member States

(percentage share of ECB-related coverage in each country)

Source: ECB data.

Notes: The sample includes ECB-related articles featured in the main media outlets of the selected countries for the period January 2019 to September 2021. The classification was performed manually by an external provider. The category “Governance” mostly captures media coverage of the ECB’s mandate and accountability, while the category “Organisation” includes coverage of the governing bodies of the ECB and staffing issues.

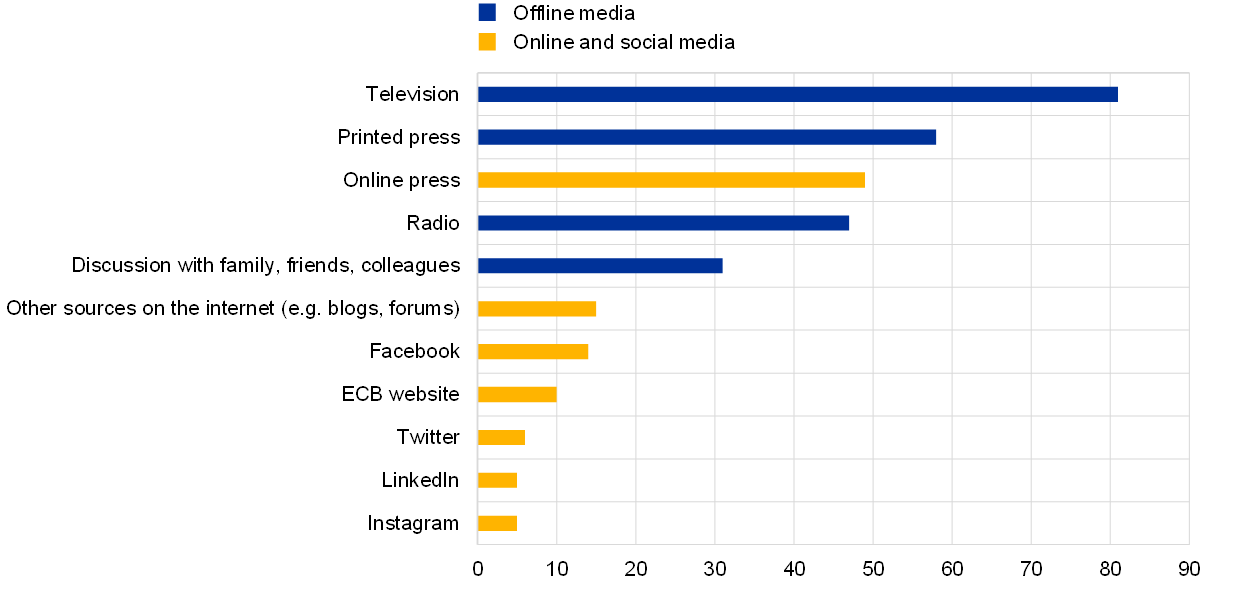

There are also significant variations in the relative importance of the channels through which the public receives news about the ECB. Data from the Knowledge & Attitudes (K&A) survey[10] from May 2021 show that television (81%) is the most popular source of information about the ECB (Chart 4).[11] Printed press is the second most popular source, followed by online press, radio and information received through people’s social circles. Relatively few people receive their news about the ECB on social media. The most popular of the social media channels is Facebook (14%), followed by Twitter and LinkedIn. At the same time, these figures mask country-level differences, which are shown in Chart 5.

Chart 4

Sources of information about the ECB in the euro area

(percentage share of respondents)

Source: ECB K&A Survey May 2021.

Notes: Respondents were asked the following question: “Where have you heard of the ECB?”. Respondents were able to pick more than one answer.

Chart 5

Sources of information about the ECB in selected euro area Member States

(percentage share of respondents)

Source: ECB K&A Survey May 2021.

Notes: Respondents were asked the following question: “Where have you heard of the ECB?”. The chart shows the share of respondents who selected a given source at the national level for selected countries. Respondents were able to pick more than one answer.

Against this background, efforts to tailor communication to specific needs, interests, local debates and media consumption habits can help the ECB get its messages through to different audiences more effectively. For example, the results of the analyses highlight that the ECB needs to take different inflation expectations and financial literacy levels into account when designing its communication. At the same time, the nature of central bank communication calls for consistent messaging.[12]

Mind the gap: awareness, interest and knowledge

Communication should be designed around solid evidence about how people view the ECB. Are they aware of the ECB? Do people know about the ECB’s tasks and objectives? Do they care? Are they interested in learning more about the ECB?

Data reveal a gap between euro area citizens’ awareness of the ECB on the one hand, and their interest in and knowledge of the ECB on the other. As Chart 6 shows, while awareness is high, interest and knowledge are relatively low. According to May 2021 K&A data, 87% of respondents have heard of the ECB. However, the majority of citizens (55%) are not interested in the ECB and its policies, with 27% of people not interested at all. Only 11% of respondents say they are very interested. Similarly, respondents’ self-assessment of their knowledge about the ECB’s tasks and objectives is low: on a scale of 1-10, respondents on average rate their own knowledge at 4.1. Only 3% rate their knowledge as very good (9-10), while 31% say it is very bad (1-2).

Chart 6

Awareness of, interest in, and knowledge about the ECB

(percentage share of respondents)

Source: ECB K&A Survey May 2021.

Notes: Respondents were asked the following questions: “Have you heard of the European Central Bank?” (Possible answers: Yes, No, Don’t know), “How interested are you in information about the European Central Bank and its policies?” (Possible answers: Very interested; Fairly interested; Not very interested; Not interested at all; Don’t know) and “On a scale from 1 to 10, where 1 means that you know nothing at all and 10 means that you know a great deal, how would you assess your knowledge of the policies of the European Central Bank?” (Possible answers include Don’t know). For the awareness question, the chart displays the share of “Yes” responses. For the interest question, the chart displays the share of “Very interested” and “Fairly interested” responses. For the self-assessed knowledge question, the chart displays the share of responses in the range 6-10.

Confusion about the ECB’s tasks seems to be widespread. K&A data indicate that when respondents pick from a list of possible tasks and objectives of the ECB, they often select topics that are beyond the ECB’s mandate (Chart 7). While 64% state that the ECB should “keep inflation at bay”, 66% also believe it is the ECB’s task to “stabilise the foreign exchange rate”, while 39% indicate that the ECB’s job is to “finance governments”.

Chart 7

Perceived tasks and objectives of the ECB

(percentage share of respondents)

Source: K&A Survey May 2021.

Notes: Respondents were asked the following question: “To your knowledge, which of the following are tasks or objectives of the ECB?”

These data underscore the need for the ECB to close the gap between high levels of awareness and lower levels of interest and knowledge. As research shows, possible ways to overcome inattention are to make ECB communication not just simpler but also more engaging.[13] Central bank communication that is both understandable and effective in generating interest and increases knowledge among the wider public matters when it comes to accountability and trust.[14]

Proximity to the different audiences across the euro area is instrumental in adapting communication to local audiences and making it more effective. In this context, national central banks play a key role in connecting and engaging with diverse national audiences across the euro area and in helping to explain ECB decisions and the rationale behind them. They can reach out to people in their local language, and might have an informational advantage when it comes to the topics that resonate with citizens in the different countries and the channels they can best use to keep citizens informed. Effective and successful communication with the wider public is therefore something the entire Eurosystem must work together to achieve.

Public trust in the ECB

Public trust in the ECB is an essential prerequisite for it to deliver on its mandate of maintaining price stability. Various studies have analysed how trust in central banks can influence the formation of people’s inflation expectations.[15] While greater trust in the ECB can anchor better public inflation expectations around the central bank’s target,[16] low levels of trust in the ECB may play a part in leading inflation expectations away from the central bank’s defined price stability target, which could undermine the ECB’s ability to deliver on its mandate.[17] Trust in an institution like the ECB has many different facets and determinants, and the processes for building trust are multi-dimensional. Some of those aspects can be influenced by the ECB itself, while others lie beyond its reach.

What determines trust

A first and decisive factor that determines trust in the ECB – and one that is at least partially under the central bank’s own control – relates to people’s perception of its performance and of its leading personnel. Recent K&A data show that the association between specific perceptions of the ECB and trust in it is strong (see Chart 8). Two relevant dimensions of trust in the ECB emerge.[18] One dimension relates to the ECB’s competence – is the ECB able to successfully deliver on its mandate, and is it credible? – which is most tightly linked to trust.[19] There is, however, also an ethical dimension: does the ECB care about its citizens and does it act responsibly?

Chart 8

Strength of association between trust in the ECB and perceptions of the institution

(standardised beta coefficients)

Source: Angino and Secola (2019).

Notes: The chart displays the perception variables most strongly associated with trust in the ECB in an ordinary least square regression estimation that controls for individual characteristics such as socio-demographics, factual and self-assessed knowledge about the ECB, and country and time fixed effects. ECB K&A data were used. Perception variables are binary variables derived from two question batteries: “Please tell me for each of the following adjectives if it corresponds very well, fairly well, fairly badly or very badly to the idea you might have of the ECB” and “I am going to read you a list of statements. Please tell me if you totally agree, tend to agree, tend to disagree or totally disagree with each of them”. Estimated effects marked by *** are statistically significant at the 0.01% significance level, those marked with ** at the 1%. Robust standard errors clustered at the country level are used.

To foster trust, the ECB not only needs to be successful in its policy performance, but also needs to show how its measures ultimately serve the people of Europe. Success at delivering price stability is an essential component of building trust among the wider public. However, by narrowly focusing on its policy performance in its communications, the ECB may miss out on important aspects of how people perceive it. Framing communication also in terms of how responsible ECB policy actually benefits people’s welfare – in other words, how it makes a positive contribution to people’s individual lives – can capture these additional dimensions and foster greater trust.

Beyond that, trust in the ECB is also determined – possibly more decisively, even – by a wide range of economic and non-economic factors. There are various studies linking trust in public institutions to economic conditions. With respect to the ECB, research shows that the public often holds the ECB responsible for macroeconomic conditions such as unemployment and stagnation, or crisis management on the part of EU institutions.[20] Besides the relevance of the perceived state of the economy, trust in the ECB depends on citizens’ satisfaction with the performance of the EU as a whole, which again differs across countries.[21] In that sense, these factors are at best indirectly related to the ECB and its performance, if not entirely exogenous.

Among non-economic determinants of trust, there is evidence that cultural and sociological factors also matter. Chart 9 shows the link between cultural traits, measured by social trust – that is, generally speaking, “faith in people”[22] – at the regional level in the euro area, and trust in the ECB. Individuals living in regions with lower levels of social trust systematically exhibit less trust in the ECB, and the underlying analysis supports a causal interpretation.[23] Clearly, these cultural and sociological factors are slow-moving components, and the scope for the ECB to influence them is limited.[24]

Chart 9

The relationship between trust in the ECB and social trust

(x-axis: regional share of respondents stating that other people can generally be trusted; y-axis: regional share of respondents stating that they trust the ECB)

Source: Angino et al. (2021).

Note: The chart displays the share of European Social Survey (ESS) respondents who state that most people can be trusted and the share of K&A respondents who state they trust the ECB. To measure social trust, data from the ESS between 2002 and 2016 are used. To measure trust in the ECB, data from the K&A survey collected in the 19 euro area countries in 2016, 2017 and 2018 are used.

Ways of building trust

Given the importance of trust for central banks, it is essential to have a deeper understanding of how public trust can be built and sustained. In this context, important societal shifts with respect to how trust is generated and lost are of great relevance for the ECB.[25] However, there is ample literature that confirms that by communicating in an accessible manner[26] and by engaging with citizens[27], central banks can build knowledge, increase understanding and ultimately affect people’s trust in them. Two key mechanisms can be distinguished: “reflective trust”, which builds on greater understanding as a stepping stone towards increased trust; and “instinctive trust”, which builds more on emotion and personal experience and generates trust in the institution even in the absence of a clear understanding of its role or policy.[28]

A survey experiment conducted with K&A survey data highlights differences between reflective and instinctive trust levels in the ECB. In the survey experiment (Chart 10), respondents were randomly asked to answer the question “Do you tend to trust or tend not to trust the ECB?” either at the beginning of the questionnaire, in the middle of it, or at the end. The randomisation made it possible to check whether deeper consideration of the ECB – that is, “reflective trust” – promotes more or less trust in the institution compared with an on-the-spot judgement – “instinctive trust”.

For the ECB it is important not to rely on instinctive trust alone but also strengthen reflective trust levels. The survey experiment shows that instinctive trust is fragile, especially for certain socio-demographic groups. When respondents had the opportunity to reflect about the ECB, the level of trust decreased for some of them. Mainly women then tend to trust the ECB less, in particular those who claim to know little about the institution. These findings suggest that for trust levels to remain steady even in times of crisis, the ECB should try and increase reflective trust levels. One way to do that could be to help improve people’s factual and self-assessed knowledge of the ECB’s tasks and objectives.

Chart 10

Evolution of net trust in the ECB by gender and education level

(percentage share of respondents)

Source: Angino and Secola (2021).

Notes: The survey experiment makes use of two consecutive waves of the ECB K&A survey. In the survey experiment, respondents were randomly asked to answer the question “Do you tend to trust or tend not to trust the ECB?” either at the beginning of the questionnaire, in the middle of it, or at the end. Net trust is calculated as the share of respondents answering “Tend to trust” divided by the sum of respondents answering either “Tend to trust” or “Tend not to trust” (i.e. “Don’t know” answers are excluded). Levels of trust at the beginning of the questionnaire are what we refer to as “instinctive trust”. Levels of trust in the middle and at the end of the questionnaire are what we refer to as “reflective trust”.

3 Analysing the “sending end” of central bank communication

Evolution of ECB communication

For central banks, communication via press conferences, speeches and interviews is a well-established means of reaching expert audiences as well as the interested, highly-educated public. As communication gains importance for central bank policy and its effectiveness, recourse to this type of communication has grown considerably. For example, Chart 11 shows the increase in the number interviews given by ECB Executive Board members over time. The increase mainly reflects the efforts made by the central bank to explain its increasingly complex policies during times of crisis and to reduce uncertainty. During the pandemic, media interviews given to both financial and general-interest media provided a suitable platform for sharing the ECB’s messages.

Chart 11

Volume of ECB interviews over time

(number of interviews)

Source: ECB website.

Notes: Number of interviews by ECB Executive Board members published on the ECB’s website. Three-year moving average is superimposed. No interviews dating before 2005 are published on the ECB’s website.

Quantity alone, however, is no guarantee of more media coverage and, by extension, a greater chance of “getting through” to the wider public. To increase its voice in traditional media and social media, the ECB needs to focus on communicating simpler messages.[29] While stepping up communication, especially in times of crisis, is relevant in terms of ensuring accountability and legitimacy, the clarity of the central bank’s messages matters for its reach. Chart 12 shows that clear communication in ECB speeches is a significant and robust predictor of media engagement. This also holds true for ECB communication on Twitter and via its press conferences.[30]

Chart 12

Clarity of ECB speeches and media engagement

(x-axis: Flesh-Kincaid Grade Level of ECB speeches; y-axis: number of ECB-related articles on the day of the speech and the day after)

Source: Ferrara and Angino (2021).

Notes: Data refer to the period from 1999-2019. Clarity of communication (x-axis) is measured using the Flesh-Kincaid Grade Level, which indicates how many years of formal training are required to understand the text based on the length of its sentences and words. Media engagement (y-axis) is measured by the number of articles about the ECB, retrieved from the digital archive of Dow Jones Factiva. Predictions are based on a regression that controls, inter alia, for the topic distribution of the speech, whether the ECB President is speaking, whether the speaker belongs to the Executive Board or the Supervisory Board, and time fixed effects.

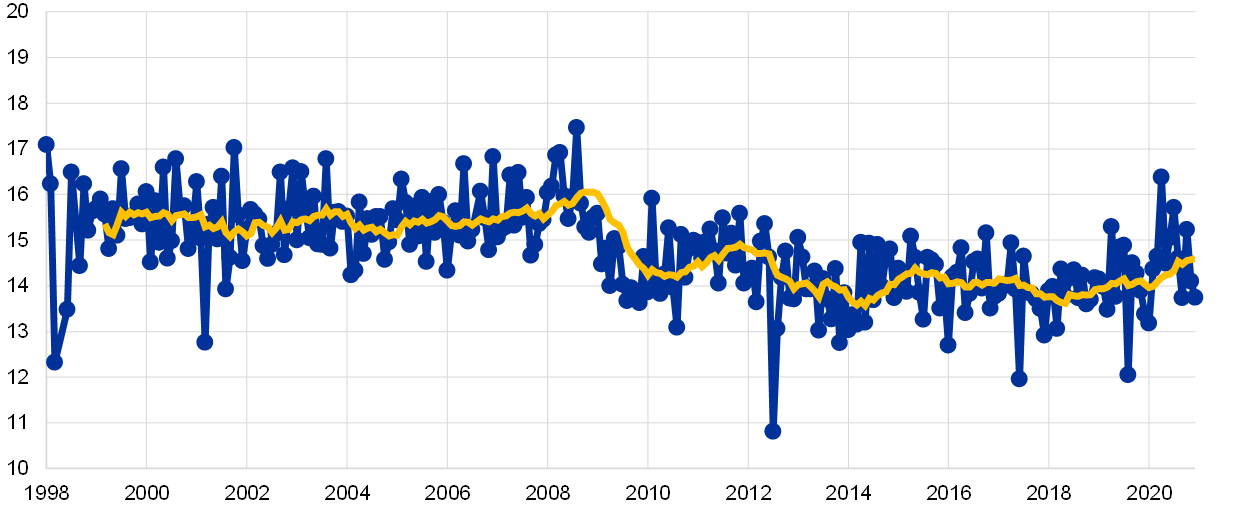

While the readability of ECB speeches has improved over time, the challenge of conveying messages in a simple, but not simplistic, way remains difficult, especially in times of crisis. Chart 13 shows that the readability of ECB speeches has generally improved since the launch of the euro, especially in the aftermath of the global financial crisis. At the same time, the pandemic and the policy response to it has led to more complex and complicated packages of measures, which is also reflected in the complexity of speeches, as is shown by the uptick in the readability score over the year 2020. The challenge for the future will be to return to the pre-pandemic downward trend when it comes to the complexity of communication activities.

Chart 13

Readability of ECB speeches over time

Monthly average of Flesch-Kincaid Grade Level from June 1998-December 2020

(Flesch-Kincaid Grade Level)

Source: ECB data, staff calculations.

Notes: The difficulty of the language employed is measured using the Flesch-Kincaid Grade Level score, which indicates how many years of formal training are required to understand the text, based on the length of its sentences and words. A 12-month moving average was superimposed.

The ECB has adapted its communication strategy to “new” communication platforms and technologies. Citizens, especially younger people, increasingly consume news on online platforms.[31] As a consequence, the ECB has expanded its activities on social media platforms. The ECB is now present on Twitter, LinkedIn, Instagram and YouTube with a combined followership of over a million.[32] While this number can still be considered modest given the size of the ECB’s audience, the ECB’s social media channels have already proved to be important platforms for reaching the wider public, as outlined in Box 1 below.

Box 1

ECB-related discussions on social media – an analysis of Twitter traffic

The ECB’s policies are actively discussed on social media. The ECB itself is an active player, posting material on its social media channels, but ECB-related social media posts originate from many different sources, with experts and non-experts both contributing. An analysis of Twitter traffic that comments on the ECB and its policies can help shed light on who is contributing to these discussions and how they respond to the ECB’s communication. This box provides such an analysis, based on a dataset of tweets that mention the ECB and the Twitter accounts from which they were posted. The dataset is studied in Ehrmann and Wabitsch (2021) and contains tweets written in English and in German.[33]

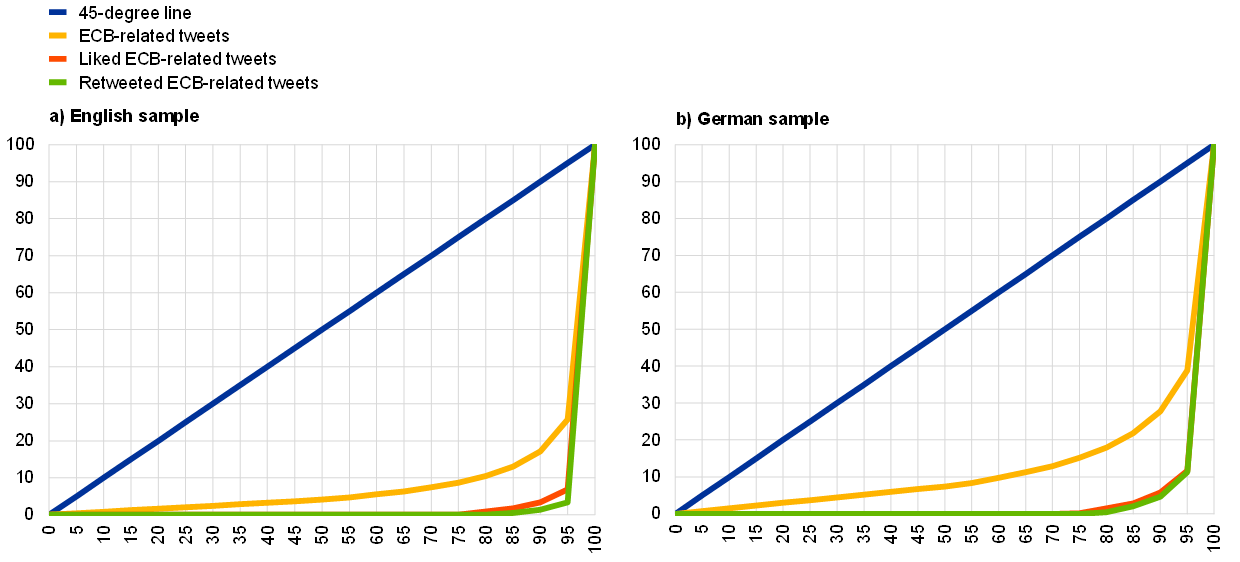

A small number of Twitter accounts generates most of the ECB-related traffic, and an even smaller number constitutes the most influential opinion-makers. This can be seen in Chart A. The yellow line plots how the contribution to ECB-related Twitter traffic is distributed across the various Twitter accounts. The chart, which shows what is known as a Lorenz curve, reveals that most of the Twitter traffic stems from relatively few accounts. For instance, the top 5% of accounts generate 74% of tweets in English and 61% of tweets in German. This is far from a situation where each account contributes in equal proportion, a hypothetical case that is represented by the blue line in the chart. What is more, the top 5% Twitter accounts are responsible for 93% of tweets in English that get “liked” and for 97% of tweets that get retweeted. For tweets in German the top 5% Twitter accounts are responsible for 89% of retweeted tweets and likes.

Chart A

Distribution of tweets across Twitter accounts

(x-axis: cumulative share of accounts; y-axis: cumulative share of tweets)

Source: Ehrmann and Wabitsch (2021).

Notes: The chart shows the Lorenz curve of ECB-related Twitter activity in English and German, respectively. The 45-degree line (in blue) represents a hypothetical case where each account contributes to the Twitter traffic in equal proportion. The yellow line shows the distribution of tweets about the ECB, the red line the distribution of tweets about the ECB that got “liked” by other Twitter accounts, and the green line the distribution of tweets about the ECB that got retweeted by other users. Based on data covering the years 2012-2018.

A more granular picture can be obtained by splitting the contributions into those stemming from experts in monetary policy matters and those written by non-experts. Differentiating these two groups is possible with a few assumptions: experts issue tweets regularly on the days of the ECB press conference, whereas non-experts do so more occasionally and post tweets about various topics, leading to a low ECB-centricity in their overall tweets.

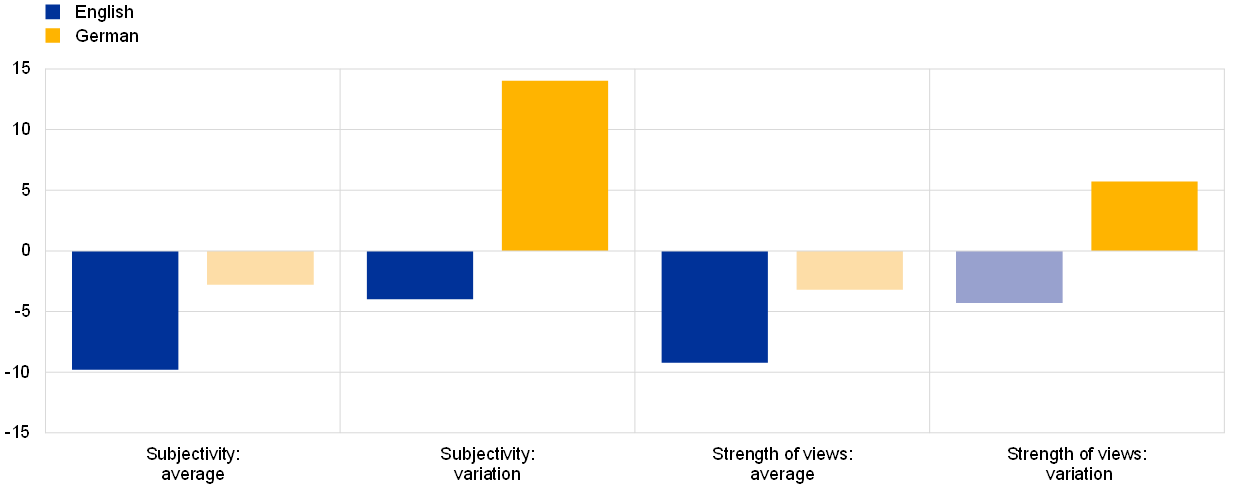

Chart B shows how ECB-related tweets differ across expert and non-expert groups. It shows that, on average, tweets by non-experts are more subjective and express stronger views. This difference is relatively small for tweets in English, but more pronounced for those in German. The chart also plots the standard deviation of the average sentiment expressed by each Twitter account, i.e. it measures how different the sentiment is across Twitter accounts in each group. The differences between experts and non-experts are notable. Tweets issued by experts are much more aligned in terms of their subjectivity and the strength of views expressed than tweets by non-experts. This shows that tweets by non-experts reflect a much larger spectrum of views.

Chart B

Sentiment expressed in ECB-related tweets

(index ranging from 0-100)

Source: Ehrmann and Wabitsch (2021).

Notes: The chart shows summary statistics for tweets issued by experts and by non-experts, in English and German respectively. Subjectivity and strength of views are measured based on a dictionary approach, and are restricted to lie between 0 and 100. The English lexicon is based on Princeton University’s WordNet, the German lexicon on the German equivalent GermaNet. Being based on two different dictionaries, sentiment in English and German tweets is not directly comparable. Words that indicate subjectivity are, for instance, “terrible” or “actual”, which yield subjectivity values of 100 and 0, respectively. Indicators for the strength of views are, for instance, “awful”, “marvellous” or “consistent”, which yield values of 100, 100 and 0, respectively. For both sentiment measures, the chart plots i) the average across all ECB-related tweets and ii) the standard deviation of the account-specific average sentiment measure as a measure of variation. Based on data covering the years 2012-2018.

How does sentiment respond to the ECB’s communication? Chart C provides some estimates for the case of the ECB’s press conference, around which Twitter traffic is elevated for several days, before and after the event. As Chart C shows, the reaction of non-experts’ tweets in English and in German is quite different. Tweets in English become considerably more factual, and the views more moderate. In addition, there is less dispersion in subjectivity. This pattern suggests that tweets in English mainly relay information about the press conference. In contrast, tweets in German do not become significantly more factual, nor more moderate. At the same time, the increase in the variation of subjectivity and in the variation of the strength of views reveals that the views expressed become substantially more heterogeneous across Twitter accounts. Tweets in German around the time of the ECB press conference, therefore, seem to reflect a more controversial discussion among Twitter users.

Chart C

Change in sentiment in non-experts’ tweets around the ECB press conference

(response coefficients)

Source: Ehrmann and Wabitsch (2021).

Notes: The chart shows the responsiveness of the sentiment expressed in non-experts’ tweets in English and German, respectively, to the ECB’s press conference. Response coefficients that are statistically significant at least at the 10% level are plotted in dark shaded colours. Based on data covering the years 2012-2018.

Even though the reception of the ECB’s press conference by non-experts is different in the two languages, there is one common pattern that is important: Twitter traffic by non-experts intensifies around the time of the ECB’s press conference, which suggests that the ECB’s communication gets noticed and is discussed by non-experts. This implies that the first necessary step on the way to successful communication, namely that the sender manages to reach the intended recipient, is being taken.

Modernising ECB communication

Big economic, societal, and technological changes that are shaping a radically altered communications landscape are inevitably driving a further evolution in ECB communication. These trends include a loss of trust in expert authority[34], a 24-hour news cycle and greater controversy around and politicisation of central bank actions.[35] Moreover, as outlined in Chapter 2, more concerted engagement efforts are necessary to build knowledge and ultimately trust. To that end, the ECB’s Governing Council decided, in the context of its recent strategy review, to adapt the substance, style and operational model of its monetary policy communication.

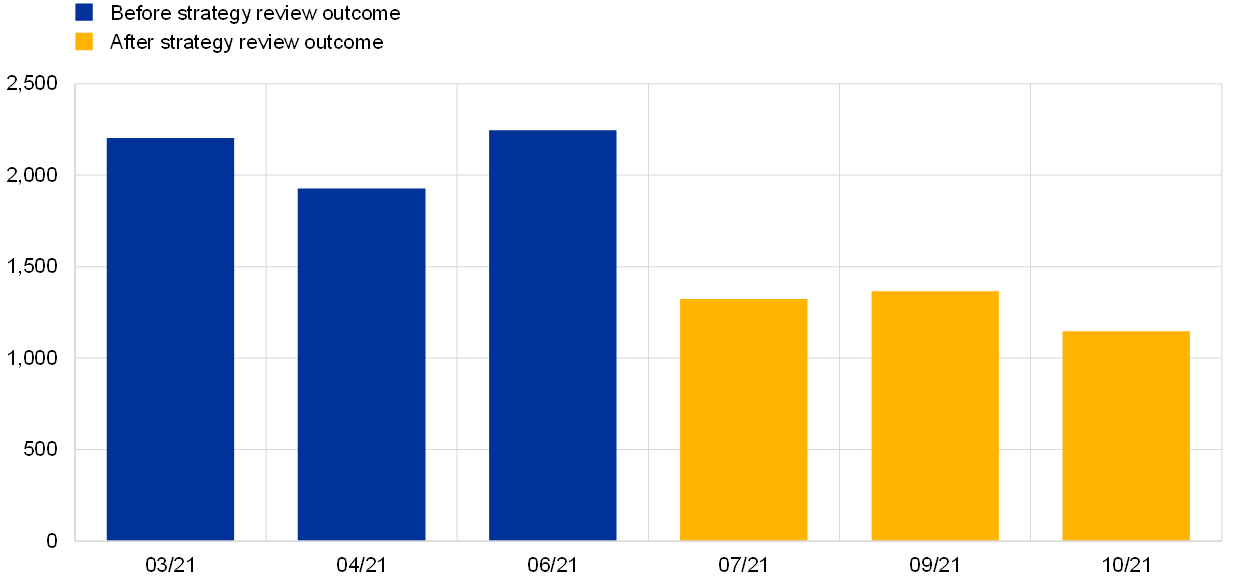

The Governing Council has made its monetary policy communication more accessible by replacing its “introductory statement” with the new “monetary policy statement”, which is more streamlined and has a stronger narrative. Chart 14 shows how the length and complexity of monetary policy statements issued before the strategy review had concluded compare with those issued after the strategy review outcome measures had been implemented. Chart 15 shows the length and complexity of monetary policy communication over time, indicating that recent monetary policy statements are more accessible than previous ones.[36]

Chart 14

The ECB monetary policy statement: before and after

a) Word count

(number of words)

b) Language complexity

(Flesch-Kincaid Grade Level)

Source: ECB data.

Notes: The chart displays the length and the complexity of the last three monetary policy statements (until June 2021 “introductory statement”) before the announcement of the outcome of the ECB strategy review (8 July 2021) and the first three following it. The difficulty of the language employed is measured using the Flesch-Kincaid Grade Level score, which indicates how many years of formal training are required to understand the text, based on the length of its sentences and words.

Chart 15

Complexity of ECB monetary policy statements

Source: Updated data (October 2021) from analysis in Coenen et al. (2017).

Notes: The figure depicts the length and the complexity of the ECB’s monetary policy statements (until June 2021 “introductory statement”). The length is measured by the number of words (indicated by circle size). The difficulty of the language employed is measured using the Flesch-Kincaid Grade Level score, which indicates how many years of formal training are required to understand the text, based on the length of its sentences and words.

In addition, the Governing Council decided to complement its monetary policy communication with “layered” communication, which relays the same core information in a more accessible and visual way. Research indicates that accessible, visualised and relatable monetary policy communication improves public comprehension and also trust.[37] Applying these findings to the ECB’s monetary policy communication, a new visual monetary policy statement was added to explain the ECB’s latest decision in a more attractive and simpler format, and in all 24 official EU languages. Using storytelling techniques, relatable visuals and language, the visual monetary policy statement aims to make the ECB’s policy decisions more accessible to non-expert audiences across the entire euro area. [38]

As a result of the strategy review the Governing Council also decided to make outreach events a structural feature of its interaction with the wider public.[39] These outreach events build upon the positive experiences of the Eurosystem’s “listening” events, involving academics, civil society organisations and the wider public, which took place during the strategy review. Via the “ECB Listens Portal” alone, the ECB received about 4,000 responses.[40] The views, suggestions and concerns received during these events formed a key input into the Governing Council’s decision to modernise the ECB’s monetary policy communication.

4 Conclusion

Central bank communication with expert audiences and the wider public plays an important role in influencing expectations and sustaining trust, thereby making monetary policy more effective and helping to ensure the legitimacy of independent monetary institutions. To ensure the effectiveness of the ECB’s monetary policy, clear and consistent communication targeted at expert audiences will remain essential. At the same time, greater efforts to “get through” to the wider public will help increase the impact of the ECB’s monetary policy communication.

This article has examined the receiving and sending ends of the ECB’s communication with the wider public, and the elements that facilitate communication between those two ends. The analysis highlighted the sheer diversity of the ECB’s audience and made the case that ECB communication needs to be adjusted accordingly. Research suggests that more accessible, relatable and visual communication can increase the impact of the central bank’s messages.

The strategy review’s outcome has led to the introduction of more understandable, relatable and visual monetary policy communication. This article has shown that the readability of the ECB’s new “monetary policy statement” is noticeably better than the “introductory statement” that preceded it. In turn, the visual monetary policy statement introduces a layer of more accessible communication that allows the ECB to better reach the wider public.

- See Dincer, N. and Eichengreen, B., “Central Bank Transparency and Independence: Updates and New Measures”, International Journal of Central Banking, Vol 10, No 1, 2014; Crowe, M. and Meade, E. E., “Central Bank Independence and Transparency: Evolution and Effectiveness”, IMF Working Paper, 2008.

- Data gathered from the “ECB Listens Portal” show that respondents find that the ECB uses too much economic jargon and that its communication is not accessible enough. Respondents called for clearer and more direct and modern communication from the ECB.

- See Assenmacher, K., Holton, S., Glöckler, G., Trautmann, P., Ioannou. D., Mee, S. et al., “Clear, consistent and engaging: ECB monetary policy in a changing world”, Occasional Paper Series, No 274, ECB, Frankfurt am Main, September 2021.

- See Coibion, O., Gorodnichenko, Y., Knotek II, E. S. and Schoenle, R., “Average Inflation Targeting and Household Expectations”, Federal Reserve Bank of Cleveland Working Paper, No 20-26, 2020.

- See, for instance, Sims, C. A., “Rational inattention and monetary economics”, Handbook of monetary economics, 2010, pp. 155-181; Binder, C., “Fed speak on main street: Central bank communication and household expectations”, Journal of Macroeconomics, Vol 52, 2017, pp. 238-251.

- See Klapper, L. and Lusardi, A., “Financial literacy and financial resilience: Evidence from around the world”, Financial Management, Vol 49, No 3, 2020, pp. 589-614.

- See Baumann, U., Darracq Paries, M., Westermann, T., Riggi, M. et al., “Inflation expectations and their role in forecasting”, Occasional Paper Series, No 264, ECB, Frankfurt am Main, September 2021.

- See Soroka, S. N., Stecula, D. and Wlezien, C., “It’s (Change in) the (Future) Economy, Stupid: Economic Indicators, the Media and Public Opinion”, American Journal of Political Science, Vol 59, No 2, 2015, pp. 457-474.

- While Chart 3 focuses on a selection of Member States, the underlying analysis covers all 19 Member States.

- The ECB Knowledge and Attitudes (K&A) survey is an annual, cross-sectional survey conducted among the general public in the 19 euro area Member States. The May 2021 edition was carried out between 5 and 19 May 2021 with a sample of 15,500 respondents (approximately 1,000 in each Member State, except for Cyprus, Estonia, Latvia, Lithuania, Luxembourg, Malta and Slovenia, where the sample size was around 500). Unlike the European Commission’s Eurobarometer, which elicits opinions about a variety of themes, the K&A survey focuses exclusively on knowledge and perception of the ECB.

- Television is the most popular source of information in all Member States, with the sole exception of Luxembourg, where the printed press was selected by a higher share of respondents.

- See also Coibion, O., Gorodnichenko, Y., Kumar, S. and Pedemonte, M., “Inflation expectations as a policy tool?”, Journal of International Economics, Vol 124, 2020.

- See Brouwer, N. and de Haan, J., “Central bank communication with the general public: effective or not?”, SUERF Policy Brief, March 2021.

- See Haldane, A., Macaulay, A. and McMahon, M., “The 3 E’s of central bank communication with the public”, Bank of England Staff Working Paper, No 847, 2020.

- See, among others, Easaw, J., Golinelli, R. and Malgarini, M., “What determines households inflation expectations? Theory and evidence from a household survey”, European Economic Review, Vol 61, 2013, pp. 1-13; Mellina, S. and Schmidt, T., “The role of central bank knowledge and trust for the public's inflation expectations”, Deutsche Bundesbank Discussion Paper, 2018.

- See Christelis, D., Georgarakos, D., Jappelli, T. and Van Roij, M., “Trust in the Central Bank and Inflation Expectations”, International Journal of Central Banking, Vol 16, No 6, December 2020.

- See Ehrmann, M., Soudan, M. and Stracca, L., “Explaining European Union citizens’ trust in the European Central Bank in normal and crisis times”, The Scandinavian Journal of Economics, Vol 115, No 3, 2013, pp. 781-807.

- See Murtin, F., et al., “Trust and its determinants: Evidence from the Trustlab experiment”, OECD Statistics Working Paper, 2018.

- See Angino, S. and Secola, S., “Pillars of Trust: What determines trust in the ECB?”, mimeo, 2019.

- See Roth, F. and Jonung, L., “Public support for the euro and trust in the ECB. The Economics of Monetary Unions: Past Experiences and the Eurozone”, VoxEU, December 2019.

- See Bergbauer, S., Hernborg, N., Jamet, J. F. and Persson, E., “The reputation of the euro and the European Central Bank: interlinked or disconnected?”, Journal of European Public Policy, Vol 27, No 8, January 2020, pp. 1178-1194. The authors measure performance evaluations of the EU on the basis of survey respondents’ assessment of whether things “are going in the right direction in the EU” as well as their evaluations of the EU’s crisis performance.

- The following survey item from the European Social Survey (ESS) was used: “Generally speaking, would you say that most people can be trusted, or that you can’t be too careful in dealing with people?”. Respondents are provided with a scale from 0 to 10; See also Pew Research Center, “Americans and Social Trust: Who, Where and Why”, Report, 22 February 2017.

- See Angino, S., Ferrara, F. and Secola, S., “The cultural origins of institutional trust: the case of the ECB”, European Union Politics, 2021.

- The same applies to socio-demographic factors such as gender, age and education; see Bergbauer, S., Hernborg, N., Jamet, J-F., Persson, E. and Schölermann, H., “Citizens’ attitudes towards the ECB, the euro and Economic and Monetary Union”, Economic Bulletin, Issue 4, ECB, Frankfurt am Main, 2020.

- See Haldane, A.,”A Little More Conversation. A Little Less Action”, Speech, Macroeconomics and Monetary Policy Conference, Federal Reserve Bank of San Francisco, March 2017, and Botsman, R., “Who can you trust? How Technology brought us together and why it could drive us apart”, Penguin, 2017.

- See Bholat, D., Broughton, N., Ter Meer, J. and Walczak, E., “Enhancing central bank communications using simple and relatable information”, Journal of Monetary Economics, 2019, pp. 1-15.

- See Haldane, A., Macaulay, A. and McMahon, M., “The 3 E’s of central bank communication with the public”, Bank of England Staff Working Paper, 2020.

- See Angino, S. and Secola, S., “Instinctive trust versus reflective trust in the

European Central Bank”, mimeo, 2021. - It is important not to see online and offline media as mutually exclusive. ECB communication via TV or the printed press can spark debates on social media.

- See Ferrara, F. and Angino, S., “Does Clarity Make Central Banks More Engaging? Lessons from ECB Communications”, European Journal of Political Economy, 2021.

- See Newman, N., Fletcher, R., Schulz, A., Andi, S. and Nielsen, R. K., “Reuters Institute Digital News Report”, 2020.

- This figure does not refer to unique followers across social media platforms. In other words, one person might follow the ECB on multiple social media channels.

- See Ehrmann, M. and Wabitsch, A., “Central bank communication with non-experts: a road to nowhere?”, Working Paper Series, No 2594, ECB, October 2021.

- See Jacobs, R., “The downfall (and possible salvation) of expertise”, Chicago Booth Review, November 2020.

- See Moschella, M., Pinto, L. and Martocchia Diodati, N., “Let's speak more? How the ECB responds to public contestation”, Journal of European Public Policy, Vol 27, No 3, 2020, pp. 400-418.

- See Coenen, G., Ehrmann, M., Gaballo, G., Hoffmann, P., Nakov, A., Nardelli, S., Persson, E. and Strasser, G., “Communication of monetary policy in unconventional times”, Working Paper Series, No 2080, ECB, Frankfurt am Main, June 2017.

- Bholat, D., Broughton, N., Ter Meer, J. and Walczak, E., “Enhancing central bank communications using simple and relatable information”, Journal of Monetary Economics, 2019, pp. 1-15.

- See, for example, the visual monetary policy statement of the ECB’s latest decisions, ECB, September 2021.

- See “An overview of the ECB’s Monetary Policy Strategy”, ECB, 8 July 2021.

- See the ECB Listens Portal.