Published as part of the ECB Economic Bulletin, Issue 8/2024.

While uncertainty plays a prominent role in many economic decisions, it is not directly measurable, making its precise impact difficult to gauge. In times of high uncertainty, households and firms may delay or cancel spending and investment plans, which in turn dampens economic activity.[1] Given that uncertainty is not directly observable, this box assesses recent signals from different proxies, categorising them as those that are directly associated with the short-term economic situation and those that reflect longer-term policy issues. We also examine the implications of these measures for key macroeconomic variables.

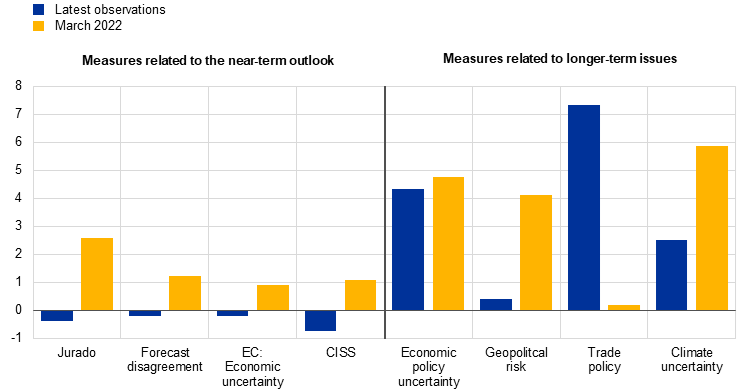

Uncertainty about the short-term economic situation is usually tracked using a mix of statistical, survey-based and financial indicators. One key measure for the euro area is the macroeconomic uncertainty index developed by Jurado et al., which defines uncertainty as the volatility of the forecast errors three months ahead for a wide range of economic indicators.[2] Another proxy is the forecast disagreement from Consensus Economics, which captures the dispersion in predictions one year ahead for real GDP, industrial production, private consumption and private investment growth, as well as HICP inflation and long-term interest rates. Additionally, the survey-based economic uncertainty measure of the European Commission reflects the difficulty of business managers and consumers to make predictions about their business situation and household finances. Finally, the Composite Indicator of Systemic Stress (CISS) is a financial stress indicator developed by the ECB, constructed using a variety of market-based financial variables from multiple segments of the financial system.

There are also uncertainty measures related to longer-term policy issues. One such measure is the news-based Economic Policy Uncertainty index for the euro area, which tracks the frequency with which specific words related to economic policy uncertainty are mentioned in newspaper articles. Three other text-based indicators show uncertainty surrounding geopolitics, trade and climate policy.[3]

Measures that capture concerns about the short-term economic situation currently display relatively low levels of uncertainty, while those related to longer-term policies are showing higher levels (Chart A). While all these indicators peaked during the Russian invasion of Ukraine, measures related to the near-term outlook have since returned to their historical averages.[4] By contrast, most policy-related measures of uncertainty are still significantly above their historical means, reflecting ongoing political polarisation, prospective regulation and the global energy transition.[5]

Chart A

Uncertainty measures

(standardised, percentage point changes)

Sources: Jurado et al.,1) Consensus Economics, European Commission, Baker et al.,2) Caldara et al.,3) Caldara et al.,4) Gavriilidis,5) and ECB staff calculations.

Notes: Series are standardised over the 1999-2019 sample with the exception of the European Commission economic uncertainty series which is standardised over the period from April 2019 to September 2024, given the limited sample availability. Economic policy uncertainty is the weighted average of standardised country-specific measures for Germany, France, Italy and Spain. The latest observations are for September 2024 for Jurado and climate uncertainty, October 2024 for forecast disagreement, and November 2024 for European Commission (EC) economic uncertainty, CISS, economic policy uncertainty, geopolitical risk and trade policy.

1) Jurado, K., Ludvigson, S.C. and Ng, S., “Measuring Uncertainty”, American Economic Review, Vol. 105, No 3, March 2015.

2) Baker, S.R., Bloom, N. and Davis, S.J., “Measuring Economic Policy Uncertainty”, Working Papers, No 21633, National Bureau of Economic Research, October 2015.

3) Caldara, D. and Iacoviello, M., “Measuring Geopolitical Risk”, American Economic Review, Vol. 112, No 4, 2021, pp. 1194-1225.

4) Caldara, D., Iacoviello, M., Molligo, P., Prestipino, A. and Raffo, A., “The Economic Effects of Trade Policy Uncertainty”, International Finance Discussion Papers, No 1256, September 2019.

5) Gavriilidis, K., “Measuring Climate Policy Uncertainty”, University of Stirling, May 2021.

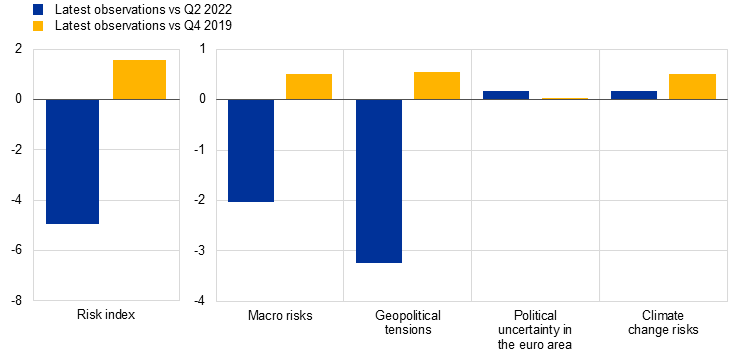

Moreover, a risk index derived from earnings calls suggests that risk perceptions for many of the uncertainties mentioned above have declined from the peaks reached in the spring of 2022 but remain above pre-pandemic levels (Chart B).[6] The index measures the percentage of a number of specific risks as a share of all risks mentioned in earnings calls among listed euro area firms.[7] While the risks cannot be exactly mapped to the categories of uncertainty shown above, this risk index corroborates the finding that risk perceptions for several perceived uncertainties have fallen back substantially from the peaks seen in the spring of 2022. Meanwhile, concerns about geopolitical tensions and the climate remain elevated.

Chart B

Risk index derived from earnings calls

(percentage of all risk mentions, changes in percentage points)

Sources: NL Analytics and ECB calculations.

Notes: “Macro risks” refer to mentions related to supply chain risks and financing conditions; “Geopolitical tensions” refer to geopolitical tensions in Ukraine and the Middle East; “Political uncertainty in the euro area” refers to political risks in the euro area as a whole or in euro area countries; and “Climate change risks” refer to mentions of words such as “carbon”, “climate” and “policy”. The latest observations are for the third quarter of 2024.

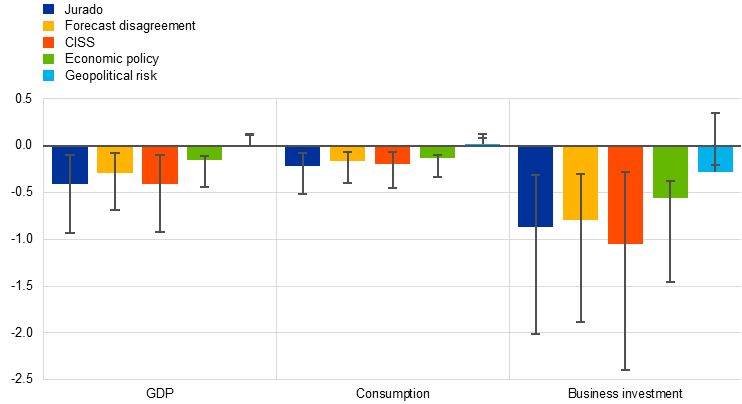

Increases in uncertainty are typically associated with lower real GDP and with a stronger adverse impact on business investment than on consumption (Chart C). To investigate the implications of rising uncertainty, Bayesian vector autoregression (BVAR) models are estimated over the period from the first quarter of 1999 to the second quarter of 2024.[8] The models incorporate real GDP, private consumption and business investment, the GDP deflator and one uncertainty (risk) measure at a time.[9] The results suggest that for all measures – with the exception of geopolitical risk – rises in uncertainty are associated with a decline in real GDP, private consumption and business investment, with business investment declining significantly more than consumption.[10]

Chart C

Impact of rises in uncertainty measures

(percentage deviation from the trend)

Source: ECB staff calculations.

Notes: The BVAR models include GDP, consumption, business investment, the GDP deflator and one of the uncertainty (risk) measures at a time. The models are estimated over a quarterly period, from the first quarter of 1999 to the second quarter of 2024, and identification is based on a “Cholesky decomposition” approach with the uncertainty measure ordered first. Nevertheless, the results are also robust in terms of their adverse implications for economic activity when the uncertainty measure is ordered last. The rise in uncertainty reflects an increase of one standard deviation in the uncertainty measure. The results reported in the chart refer to the effects after four quarters. The whiskers refer to 68% credible intervals.

Uncertainty about the short-term economic situation does not appear to have greatly affected ongoing economic activity so far; however, that surrounding longer-term policy issues is likely to remain relevant. While uncertainty derived from short-term economic indicators has been contained recently, compared with previous peak periods, economic policy uncertainty is likely to remain elevated, reflecting the persistent, evolving nature of domestic policy issues. Accordingly, uncertainty surrounding policy issues is expected to continue to weigh on economic activity, particularly on business investment, in the coming quarters.

Certain types of uncertainty, such as that related to the recent surge in Artificial Intelligence investment, can also increase investment and economic activity (see Ludvigson, S.C., Ma, S. and Ng, S., “Uncertainty and Business Cycles: Exogenous Impulse or Endogenous Response?”, American Economic Journal: Macroeconomics, Vol. 13, No 4, 2021, pp. 369-410.

Jurado, K., Ludvigson, S.C. and Ng, S., “Measuring uncertainty”, American Economic Review, Vol. 105, No 3, 2015, pp. 1177-1216 and Scotti, C., “Surprise and uncertainty indexes: Real-time aggregation of real-activity macro-surprises”, Journal of Monetary Economics, Vol. 82, 2016, pp. 1-19.

For more information on the methodology used see Baker, S.R., Bloom, N. and Davis, S.J., “Measuring Economic Policy Uncertainty”, The Quarterly Journal of Economics, Vol. 131, No 4, 2016, pp. 1593-1636 and Gavriilidis, K., “Measuring Climate Policy Uncertainty”, University of Stirling, May 2021.

See the box entitled “The impact of the Russian invasion of Ukraine on euro area activity via the uncertainty channel”, Economic Bulletin, Issue 4, ECB, 2022.

Economic policy uncertainty has been particularly elevated in Germany and France.

While comoving, “uncertainty” measures differ from “risk” measures in the sense that uncertainty occurs when the information for forecasting developments is insufficient or unavailable, while risk is associated with the probability of a specific economic event.

For more details on the methodology, see the box entitled “Insights from earnings calls – what can we learn from corporate risk perceptions and sentiment?”, Economic Bulletin, Issue 4, ECB, 2024.

The estimation is corrected in line with Lenza and Primiceri (2022) to account for the unique economic disruptions caused by the COVID-19 pandemic (see Lenza, M. and Primiceri, G.E., “How to estimate a vector autoregression after March 2020”, Journal of Applied Econometrics, Vol. 37, No 4, 2022, pp. 688-699.

Given that trade and climate uncertainty measures relate to specific areas that are directly exposed to trade fluctuations and environmental policy, this box does not investigate their broader implications for economic activity. At the same time, the risk index is not included in the empirical exercise given its short time sample.

See also De Santis, R.A. and Van der Veken, W., “Deflationary financial shocks and inflationary uncertainty shocks: an SVAR Investigation”, Working Paper, No 2727, ECB, 2022 and Bobasu, A., Quaglietti, L. and Ricci, M., “Tracking Global Economic Uncertainty: Implications for the Euro Area”, IMF Economic Review, International Monetary Fund, Vol. 72, No 2, 2024, pp. 820-857.