Liquidity transformation by investment funds: structural fault line or desirable financial transformation? A systemic perspective

During the market turmoil of March 2020, many money market funds (MMFs) and other investment funds which were exposed to liquidity risk through a liquidity mismatch between their assets and liabilities experienced significant outflows. Those funds reacted in a procyclical manner by either selling assets in already stressed markets or curtailing investors’ access. That behaviour resulted in knock-on effects on other sectors of the economy and amplified the stress within the financial system. This overview article discusses financial stability risks arising from liquidity transformation by MMFs and other investment funds, a subject which is then explored in greater depth in the three other articles in this issue of the Macroprudential Bulletin. While the liquidity transformation carried out by investment funds serves an important economic function, by intermediating savings and real economy financing, it can also generate risks to financial stability. With this in mind, this article argues for a macroprudential approach to the regulation of investment funds to enhance their resilience and facilitate a stable provision of funding to the wider economy in both normal market conditions and periods of market stress.

1 Introduction

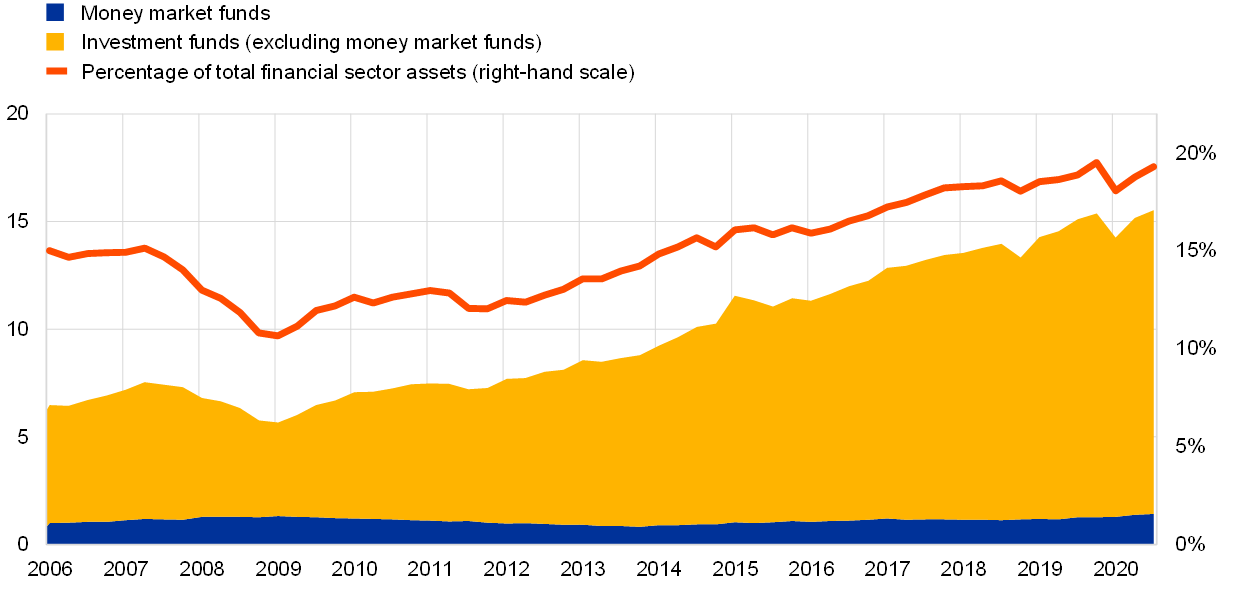

MMFs and other investment funds have gained in prominence in recent years, providing a range of services to the financial system and the wider economy. The euro area’s investment fund sector has grown significantly over the last decade, with the total value of its assets more than doubling – rising from €7.4 trillion in 2010 to €15.5 trillion in 2020. Indeed, that sector now accounts for about 20% of the total assets of the financial sector (Chart 1). Investment funds provide a range of services to the financial system and the wider economy, such as diversified portfolio investment, cash management and funding. Market-based credit now accounts for around 20% of total external credit to non-financial corporations (NFCs), having roughly doubled over the last decade.[1] The capital markets union will further support the development of this sector and strengthen the cross-border dimension of investment, with benefits in terms of both greater financial integration and risk sharing within the European Union.[2]

Chart 1

Strong growth by euro area investment funds since the global financial crisis

(total assets in EUR billions; percentages)

Sources: Euro area accounts, balance sheet items and ECB calculations.

The growth of the investment fund sector has increased its potential to amplify market stress, as demonstrated during the coronavirus (COVID‑19) market turmoil of early 2020, which highlighted the systemic importance of the sector. MMFs and other investment funds also contributed to financial stress in previous crisis episodes such as the global financial crisis. However, the growing role of the investment fund sector has led to stronger interlinkages with the rest of the financial system and the real economy. When funds experienced substantial investor redemptions in March 2020, the stress which was seen on account of the liquidity mismatch that is inherent in the transformation process was transmitted to other economic sectors via those interlinkages.

This issue of the Macroprudential Bulletin aims to contribute to the policy debate regarding vulnerabilities in the investment fund sector. More specifically, the articles in this issue provide support for a macroprudential approach to the regulation of investment funds, since liquidity mismatches constitute an important vulnerability for the sector, amplifying market-wide shocks and resulting in greater procyclicality. A macroprudential approach would take account of both the collective actions of the sector and its interconnectedness with the rest of the financial system and the real economy.[3] In particular, the articles in this issue highlight the need for public authorities to be able to implement pre-emptive policies to mitigate the build-up of risk in the financial system.

In this issue we differentiate between MMFs and investment funds due to the differing role they play within the financial system. MMFs are an important provider of credit to the system but also provide an important cash like asset for investors. These dual functions result in a natural trade-off for policy makers when assessing how to improve the resilience of these funds. While MMFs are an important provider of liquidity, particularly to short-term markets, other investment funds arguably play a greater role in the provision of credit to the real economy through their holding of longer-term debt securities. For this reason, a holistic approach to the development of a macroprudential policy would be crucial.

2 Structural fault lines in investment funds as a result of liquidity mismatches

MMFs and other open-ended investment funds are vulnerable to liquidity stress because of the mismatch between the daily liquidity that they offer on the liability side and their investment in less liquid assets. The events of March 2020 highlighted that issue, with investors withdrawing money on a large scale to raise cash.[4] Faced with withdrawals, open-ended funds funds behaved in a procyclical manner by selling assets, thereby increasing pressure on market liquidity and asset valuations.[5] The funds’ procyclical behaviour added to the decline in market liquidity and tightening of funding conditions. This tightening was only alleviated following extraordinary central bank intervention by the ECB and other authorities globally. As such, it is evident that structural vulnerabilities resulting from liquidity mismatches may compromise funds’ ability to absorb shocks and prompt them to engage in procyclical behaviour.

Larger liquidity mismatches may increase negative externalities for investors, resulting in greater procyclicality and a risk of investor runs. Article 3 of this issue argues that the variable net asset value (NAV) offered by investment funds reduces both the degree of liquidity transformation and the risk of investor runs relative to what might be the case for banks without deposit insurance. However, it also shows that such runs can still occur if a fund invests in relatively illiquid assets and offers short-term redemptions. Because investor withdrawals are costly for the future value of the fund, they impose a negative externality on investors remaining in the fund. The expectation that some investors will withdraw their money can lead remaining investors to follow suit, resulting in first-mover advantages which can lead to investor runs.

Liquidity risk is particularly pronounced during periods of crisis, as the collective behaviour of funds and their investors can amplify market-wide shocks. MMFs are often used as a cash management vehicle and are therefore collectively exposed to redemption pressures in any market-wide shock. Similarities in fund structures and portfolio holdings mean that difficulties in individual funds can quickly spread to other funds and, from there, to the underlying markets. Article 3 looks at how individual investment funds sought to protect their investors in March 2020 by deploying exceptional liquidity management tools, such as suspending redemptions. The recourse to such tools – which remained the exception – was unable to prevent liquidity risk from increasing at system level. At the same time, collective use of such suspensions could even have amplified liquidity stress through broader confidence effects. Such interdependencies, combined with the limited nature of the intervention measures available to authorities, make it even more important to tackle the vulnerabilities associated with investment funds’ liquidity transformation.

3 Contribution to the ongoing policy debate

Policymakers have repeatedly highlighted the need to address structural vulnerabilities in the investment fund sector. The growing relevance of that sector and the absence of policies that could limit the build-up of structural vulnerabilities have repeatedly triggered calls from financial regulators and central bank representatives for enhancements to the regulatory framework (Constâncio, 2017). The Financial Stability Board has issued recommendations aimed at addressing structural vulnerabilities in the sector (FSB, 2017), and the ECB has highlighted the need to incorporate additional ex ante requirements in the regulatory framework (de Guindos, 2019).

This policy debate has gained further momentum following the events in the investment fund sector in March 2020. The ECB has highlighted that parts of the non-bank financial sector (including MMFs and other investment funds investing in relatively illiquid assets) experienced significant stress during the market turmoil of March 2020 (ECB, 2020b). Existing (ex post) crisis management tools such as suspensions were not able to adequately mitigate that stress, and liquidity strains only started to ease after extraordinary monetary policy action had been taken in the euro area and other parts of the world (Lagarde, 2020). At a global level, the FSB has stressed the need to strengthen the resilience of the investment fund sector in light of the events of March 2020 (FSB, 2020). During 2021, the FSB will conduct an assessment of policies aimed at tackling systemic risks in non-bank financial institutions.[6]

The other three articles in this issue provide evidence to support the introduction of additional ex ante policy measures, with a view to enhancing the regulatory framework governing the investment fund sector. By analysing the sector, this issue of the Macroprudential Bulletin also contributes to the ongoing debate regarding the implications of the March 2020 turmoil for the regulatory framework. Together, the three articles argue in favour of additional pre-emptive policies to strengthen the resilience of the investment fund sector, presenting both theoretical insights and empirical evidence.

Article 2, which examines MMFs, highlights several areas where the EU’s current regulatory framework could be improved to make the MMF sector more resilient to future shocks. Based on its analysis of the stress seen in MMFs during the COVID-related market turmoil of March 2020, that article highlights several remaining fragilities in the regulatory framework. First, investment in non-public debt instruments exposes MMFs to liquidity risk, which calls for a review of existing limits on such investment. Second, the recently introduced low-volatility net asset value (LVNAV) structure showed significant vulnerabilities during the recent turmoil. In particular, the article shows that the risk of breaching regulatory NAV limits amplified outflows for some LVNAV investors, suggesting a need to review that structure. And third, MMFs seem reluctant to draw down on their liquidity buffers during periods of stress, suggesting a need to make buffers more usable.

Article 3 analyses the drivers of the suspensions seen in the investment fund sector in March 2020 and provides evidence of their adverse effects. It finds that, on average, funds which were forced to suspend redemptions invested more in illiquid assets (thereby worsening their liquidity mismatch), made greater use of leverage and had lower cash holdings than funds that did not implement suspensions. The analysis also suggests that suspensions have spill over effects on other funds and sectors, highlighting the hazards of relying on ex post crisis management tools. Against that background, the article argues in favour of introducing additional pre-emptive regulatory measures for investment funds to enhance their resilience and reduce the likelihood of needing to use ex post tools.

Finally, Article 4 presents theoretical evidence on the usefulness of ex ante liquidity requirements for investment funds, complementing empirical evidence. By modelling the liquidity management of an open-ended fund, the article assesses the efficacy of liquidity management policies and provides a theoretical justification for pre-emptive measures aimed at increasing the resilience of the investment fund sector. A cost-benefit analysis shows that well-designed ex ante liquidity requirements, such as restrictions on funds’ liquidity profiles, or swing pricing can improve outcomes relative to a scenario without such regulation.

4 Conclusion

This issue of the Macroprudential Bulletin highlights the need for pre-emptive measures in the investment fund sector aimed at better aligning the liquidity of portfolio assets with redemption terms. While investment funds vary widely in nature and economic function, many share similar vulnerabilities when it comes to the mismatch between the liquidity of assets and redemption terms. Without appropriate pre-emptive policy measures, those vulnerabilities can give rise to procyclical investor flows, inefficient runs and asset fire sales, which may threaten financial stability and real economy financing more broadly.

The events of March 2020 also highlighted the importance of understanding the wider ecosystem of non-bank financial intermediation when considering regulatory reforms. The materialisation of liquidity risk across markets and non-bank financial intermediaries showed that many different sectors can be affected at the same time, reinforcing and amplifying the stress in individual parts of the system. With that in mind, a whole suite of measures will be needed to increase the resilience of the wider non-bank financial sector and provide a first line of defence against such shocks in the future.

References

Cominetta, M., Lambert, C., Levels, A., Rydén, A. and Weistroffer, C. (2018), “Macroprudential liquidity tools for investment funds – A preliminary discussion”, Macroprudential Bulletin, Issue 6, ECB, October.

Constâncio, V. (2017), “Macroprudential stress-tests and tools for the non-bank sector”, speech at the ESRB Annual Conference, 22 September.

de Guindos (2019), “Global financial regulation: where next? Pending tasks for regulators and macroprudential policy makers”, speech in the context of London City Week, 21 May.

ECB (2020a), “Non-bank financial sector”, Chapter 4, Financial Stability Review, November.

ECB (2020b), “Non-bank financial sector”, Chapter 4, Financial Stability Review, May.

ESRB (2016), “Macroprudential policy beyond banking: an ESRB strategy paper”, July.

FSB (2017), “Policy Recommendations to Address Structural Vulnerabilities from Asset Management Activities”, January.

FSB (2020), “Holistic Review of the March Market Turmoil”, November.

FSB (2021), “FSB Work Programme for 2021”, January.

Lagarde, C. (2020), “Our response to the coronavirus emergency”, The ECB Blog, 19 March.

Pires, F. (2019), “Non-banks in the EU: Ensuring a smooth transition to a Capital Markets Union”, SUERF Policy Notes, No 103.

- ECB (2020a).

- Pires (2019).

- See ESRB (2016) and Cominetta et al. (2018) for a discussion regarding sources of systemic risk and macroprudential policies.

- For a review of the March 2020 market turmoil from a global perspective and an overview of related literature, see FSB (2020).

- See also ECB (2020b).

- FSB (2021).