An assessment of draft budgetary plans for 2019

Published as part of the ECB Economic Bulletin, Issue 8/2018.

On 21 November 2018 the European Commission released its opinions on the draft budgetary plans (DBPs) of euro area governments for 2019, together with an analysis of the budgetary situation in the euro area as a whole. Each opinion includes an assessment of the compliance of the relevant plan with the Stability and Growth Pact (SGP). This exercise is important as it assesses whether countries have incorporated into their plans the country-specific recommendations for fiscal policies that were addressed to them under the 2018 European Semester, as adopted by the Economic and Financial Affairs Council on 13 July 2018.[1] These recommendations propose, among other things, that countries with high ratios of government debt to GDP aim for a sufficiently fast reduction in indebtedness. This would raise their resilience in a future economic downturn.[2]

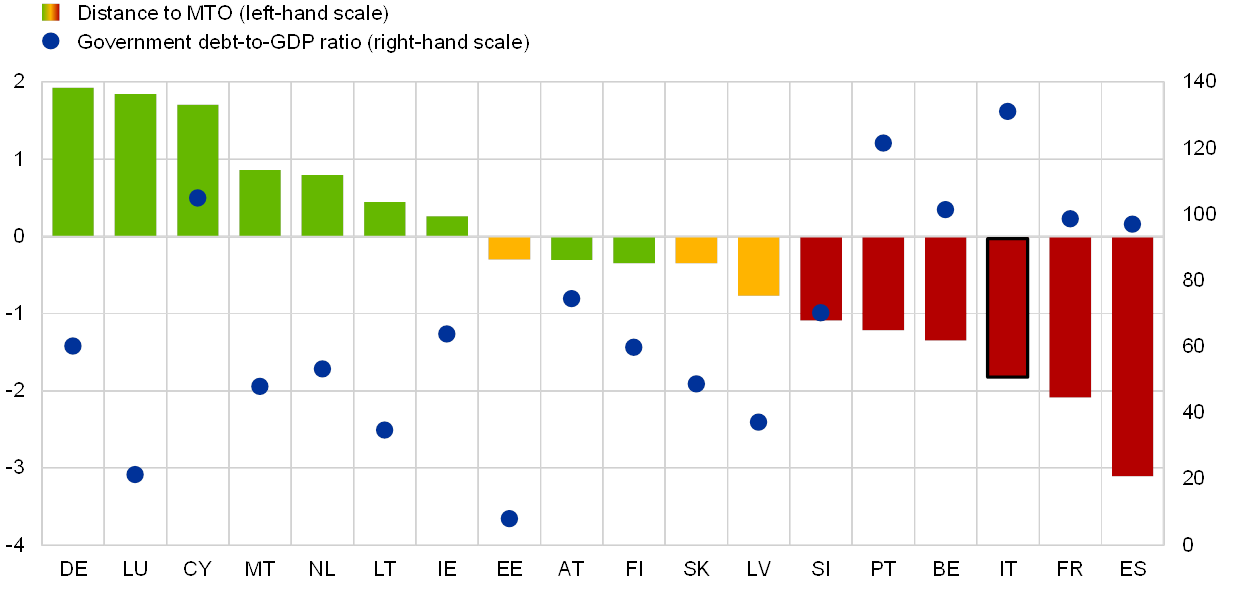

The Commission opinions point to very heterogeneous fiscal developments across the euro area countries. On the one hand, based on its 2018 autumn economic forecast, the Commission considers ten of the draft budgetary plans – an unprecedented number – as compliant with the SGP. [3] This refers to the plans of Germany, Ireland, Greece, Cyprus, Lithuania, Luxembourg, Malta, the Netherlands, Austria and Finland (all under the SGP’s preventive arm; see Chart A). These countries are projected to record sound fiscal positions in 2019 as captured by their medium-term budgetary objectives (MTOs).[4] The Commission also considers that the draft budgetary plans of a further three countries are “broadly compliant” with the SGP.[5] This refers to the plans of Estonia, Latvia and Slovakia. On the other hand, the draft budgetary plans of those countries farthest from sound fiscal positions pose the largest risks of non-compliance with the SGP. According to the Commission’s economic forecast, these countries’ structural efforts are projected to fall significantly short of their SGP commitments (see Chart B). This holds, notably, for most of the countries that are projected to record high government debt ratios of above 90% of GDP in 2019 (see Chart A).[6] Specifically, the draft budgetary plans of five countries are considered to pose a “risk of non-compliance with the SGP”.[7] This refers to the plan of Spain, which is currently under the SGP’s corrective arm – with an excessive deficit procedure (EDP) correction deadline in 2018 – and, under its preventive arm, the plans of Belgium, France, Portugal and Slovenia. The latter submitted its plan on a no-policy-change basis, because of its government having been newly elected. The Eurogroup invites the countries concerned “to consider in a timely manner the necessary additional measures to address the risks identified by the Commission and to ensure that their 2019 budget will be compliant with SGP provisions.”

In the case of Italy, the European Commission issued for the first time an opinion establishing the particularly serious non-compliance of a budgetary plan with SGP requirements.[8] Where a risk of particularly serious non-compliance with the provisions of the SGP is identified – that is, where a plan envisages structural efforts that fall clearly short of requirements – the Commission can ask the relevant member country to provide an updated budgetary plan. Such a request was issued to Italy on 23 October. The revised budgetary plan submitted by the Italian authorities on 13 November kept deficit targets unchanged, leading the Commission to confirm its assessment of particularly serious non-compliance on 21 November. At the same time, Italy's fiscal plans for 2019 were assessed by the Commission as a material change in the relevant factors as analysed by the Commission in the report under Article 126(3) of the Treaty on the Functioning of the European Union (TFEU), which was published in May 2018. As a result, on 21 November the Commission also issued a new report under Article 126(3) of the TFEU, based on data reported for 2017. In that report, the Commission came to the conclusion that the debt criterion should be considered as not complied with, paving the way for opening a debt-based EDP for Italy. The Eurogroup, in its statement of 3 December, supported the Commission’s assessment and recommended that Italy take the necessary measures to comply with the SGP. On 19 December the Commission sent a letter to the Italian authorities taking note of the fiscal measures set out by the government in a letter of 18 December and indicated that if these were adopted by the Italian Parliament before the end of the year, “this would allow the European Commission not to recommend the opening of an Excessive Deficit Procedure at this stage.”[9]

The continued failure to build fiscal buffers in countries with high government debt is a matter of concern because it raises the risk of these countries being forced to tighten fiscal policies in a future downturn. One of the major lessons from the last crisis is that sound fiscal positions provide countries with the fiscal space they may need to counter unforeseen shocks. Given the lack of follow-up to its recommendation of last year, the Eurogroup therefore “reiterates that a slow pace of debt reduction from high levels in a number of Member States remains a matter for concern and should be decisively addressed.” It also stressed that the “current economic conditions call for the urgent need to rebuild fiscal buffers, notably in Member States that have not reached their Medium-Term Budgetary Objectives.”

Chart A

Government debt and differences between structural balances and MTOs in 2018

(percentage of GDP)

Sources: European Commission 2018 autumn economic forecast, ECB calculations.

Notes: The chart depicts the deviation of countries’ structural balances in 2018 from their MTOs. Green (orange) bars relate to countries whose draft budgetary plan for 2019 is considered by the European Commission to be (broadly) compliant with the SGP. Red bars relate to countries whose draft budgetary plan for 2019 is considered by the European Commission to be at risk of non-compliance with the SGP. The black-framed red bar in the case of Italy reflects the opinion of the Commission that the draft budgetary plan poses a particularly serious risk of non-compliance with the SGP. Greece is not included in this chart as it currently does not have an MTO. Its DBP for 2019 was considered by the Commission as being compliant with the SGP.

The reasons why some countries do not make sufficient progress towards sound fiscal positions need to be addressed. First, under the SGP’s corrective arm, this requires a review of the “nominal strategies”. Under such strategies, countries subject to an EDP fall short of their structural effort requirements while complying with their nominal headline deficit targets. Consequently, many countries exited their EDP after the crisis with still large structural deficits that make them vulnerable in a downturn. Second, under the SGP’s preventive arm, the application of flexibility needs to be addressed.[10] According to the common position on flexibility, which was endorsed by the ECOFIN Council in early 2016, budgetary adjustment requirements over the economic cycle can be modulated according to a matrix that specifies that larger (smaller) fiscal efforts are required for Member States in economic good (bad) times and/or with high (low) levels of government debt. It also allows reduced structural efforts in exchange for additional structural reforms and investment. Both a special report by the European Court of Auditors (ECA) in 2018 on the preventive arm of the SGP as well as the 2018 Annual Report of the European Fiscal Board (EFB) stress that due to the cumulative effects of different forms of flexibility it is not ensured that Member States, especially high-debt ones, converge toward their MTOs within a reasonable time frame. This can put them in a precarious position when the next recession comes.

Chart B

Recommended and projected structural balance adjustments for 2019 – DBPs at risk of non-compliance with the SGP and particularly serious risks of non-compliance

(percentage of GDP) Sources: European Commission 2018 autumn economic forecast and country-specific recommendations for fiscal policies as adopted by the Economic and Financial Affairs Council on 13 July 2018.

Going forward, a fully functioning EU fiscal framework is essential for a further deepening of Economic and Monetary Union. The upcoming review of the regulations in the “six pack” and the “two pack”, which were implemented to strengthen the rules in 2011 and 2013, respectively, is an opportunity to identify and remedy shortcomings in the current set of rules.

- See the country-specific recommendations for fiscal policies under the 2018 European Semester for more information. For more background and further detail, see the box entitled “Country-specific recommendations for fiscal policies under the 2018 European Semester”, Economic Bulletin, Issue 4, ECB, June 2018.

- The review of draft budgetary plans included Greece, which participated in this exercise for the first time after having exited its financial adjustment programme in August.

- This is four more than the number of countries whose plans were found to be fully compliant last year.

- Greece does not have an MTO yet, but its surplus is assessed by the Commission as exceeding a new target that is to be established. According to the Commission’s Vade Mecum on the Stability and Growth Pact, countries with a structural balance within the 0.25% of GDP margin of tolerance of the MTO are considered as having achieved their MTO.

- For countries subject to the SGP’s preventive arm, draft budgetary plans are “broadly compliant” if, according to the Commission’s forecast, the plan may result in some deviation from the MTO or the adjustment path towards it, but the shortfall relative to the requirement would not represent a significant deviation from it. Deviations from the fiscal targets under the preventive arm are classified as “significant” if they exceed 0.5% of GDP in one year or 0.25% of GDP on average in two consecutive years.

- Except for Slovenia, these countries are not expected to reduce their government debt towards the reference value of 60% of GDP, in line with the SGP’s debt rule, in 2019.

- For countries subject to the SGP’s preventive arm, the Commission assesses a draft budgetary plan as being “at risk of non-compliance with the SGP” if it forecasts a significant deviation from the MTO or the required adjustment path towards the MTO in 2019 and/or non-compliance with the debt reduction benchmark, where that benchmark is applicable.

- This includes cases in which the improvement in the structural balance towards the country-specific MTO is forecast to fall significantly short of requirements, i.e. by more than 0.5 percentage point of GDP. This is the threshold for the significant deviation procedure under the SGP’s preventive arm.

- For details see the Commission press release.

- In May 2018 the Commission published its review of the flexibility under the SGP that had been introduced in 2015. The analysis – which focuses on the design rather than implementation of rules – suggests that the modulation of fiscal effort according to the “matrix of requirements” does not reduce the standard pace of the necessary fiscal adjustment and therefore supports the achievement of a sound budgetary position over the medium term, thus not weakening debt reduction. However, it also indicates that the actual fiscal effort of Member States has fallen short of the required effort.