Euro area monthly balance of payments (July 2017)

- In July 2017 the current account of the euro area recorded a surplus of €25.1 billion.[1]

- In the financial account, combined direct and portfolio investment recorded net disposals of assets of €112 billion and net disposals of liabilities of €135 billion.

Current account

The current account of the euro area recorded a surplus of €25.1 billion in July 2017 (see Table 1). This reflected surpluses for goods (€26.4 billion), primary income (€10.9 billion) and services (€2.6 billion), which were partly offset by a deficit for secondary income (€14.8 billion).

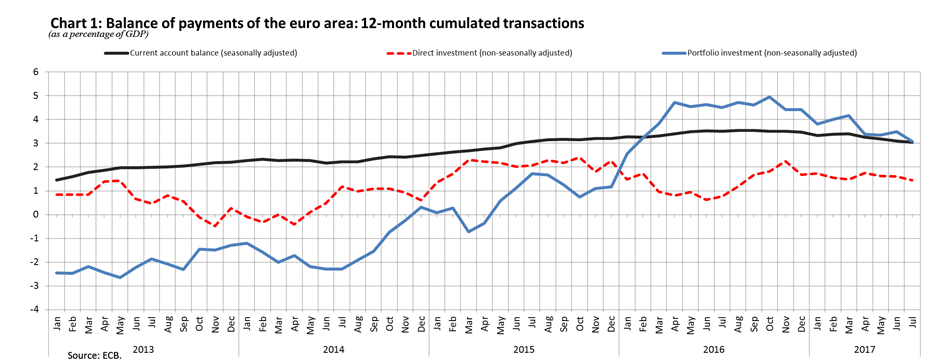

The 12-month cumulated current account for the period ending in July 2017 recorded a surplus of €333.1 billion (3.0% of euro area GDP), compared with one of €373.3 billion (3.5% of euro area GDP) for the 12 months to July 2016 (see Table 1 and Chart 1). This development was due to decreases in the surpluses for goods (from €367.2 billion to €338.6 billion) and services (from €63.4 billion to €43.3 billion), and an increase in the deficit for secondary income (from €123.2 billion to €146.5 billion). These were partly offset by an increase in the surplus for primary income (from €65.9 billion to €97.6 billion).

Financial account

In July 2017 combined direct and portfolio investment recorded net disposals of both assets (€112 billion) and liabilities (€135 billion) (see Table 2).

Euro area residents recorded net disposals of €176 billion of direct investment assets as a result of net disinvestments in equity (€183 billion), which were partly offset by net investments in debt instruments (€6 billion). Direct investment liabilities decreased by €186 billion as a result of net disinvestments in euro area equity (€188 billion) by non-euro area residents. This was also partly offset by net acquisitions of debt instruments by non-euro area residents (€2 billion).

With regard to portfolio investment assets, euro area residents made net purchases of foreign securities amounting to €64 billion. This resulted from net acquisitions of equity (€23 billion) and long-term debt securities (€59 billion), which were partly offset by net sales/amortisations of short-term debt securities (€18 billion). Portfolio investment liabilities increased by €50 billion as a result of non-euro area residents’ net acquisitions of euro area equity (€61 billion), which were partly offset by net sales/amortisations of euro area debt securities, both short-term (€4 billion) and long-term (€7 billion), by non-euro area residents.

The euro area net financial derivatives account (assets minus liabilities) recorded negative net flows of €4 billion.

Other investment recorded increases of €100 billion in assets and €72 billion in liabilities. The increase in assets was largely explained by the MFI sector (excluding the Eurosystem) (€115 billion), which was partly offset by a decrease in assets of other sectors (€14 billion). The increase in liabilities was also mainly attributable to the MFI sector (excluding the Eurosystem) (€115 billion). This was partly offset by decreases in the liabilities of the Eurosystem (€37 billion) and other sectors (€6 billion).

In the 12 months to July 2017 combined direct and portfolio investment recorded increases of €671 billion in assets and €177 billion in liabilities, compared with increases of €864 billion and €303 billion respectively in the 12 months to July 2016. This resulted primarily from a decrease in the direct investment activities of both euro area residents abroad and non-residents in the euro area, with the net acquisition of equity assets decreasing from €443 billion to €92 billion and a shift in the equity liabilities, from net investments of non-euro area residents of €290 billion to net disinvestments of €81 billion. The changes in direct investment were partly offset by the developments in portfolio investment, in particular those related to transactions in equity. On the asset side, there was a shift from net sales of foreign equity by euro area residents of €34 billion to net purchases of €137 billion. On the liabilities side, the non-euro area residents increased the net purchases of euro area equities from €145 billion to €339 billion.

According to the monetary presentation of the balance of payments, the net external assets of euro area monetary financial institutions (MFIs) decreased by €187 billion in the 12 months to July 2017, compared with a decrease of €143 billion in the 12 months to July 2016. This still reflects primarily a 12-month cumulated current account surplus (€316.3 billion), whose counterpart entries are observed in net financial transactions by non-MFIs. In particular, the cumulated transactions in direct investment shifted from a net incurrence of liabilities of €355 billion to a net reduction of €33 billion.

In July 2017 the Eurosystem’s stock of reserve assets decreased to €668.8 billion from €682.7 billion in the previous month (see Table 3). This decrease (€13.9 billion) is explained by net disposals of assets (€5.2 billion), negative exchange rate developments (€5.6 billion) and other negative price changes (€3.2 billion), particularly of monetary gold.

Data revisions

This press release incorporates revisions to the data from April to June 2017. These revisions have resulted in an increase of net portfolio investment (€17 billion) in May 2017 and in a decrease of net other investment (€48 billion) in June 2017.

Additional information

Time-series data: the ECB’s Statistical Data Warehouse (SDW)

Methodological information Monetary presentation of the balance of payments Next press releases:- quarterly balance of payments and international investment position: 4 October 2017 (reference data up to the second quarter of 2017);

- monthly balance of payments: 20 October 2017 (reference data up to August 2017).

Annexes

- Table 1: Current account of the euro area

- Table 2: Balance of payments of the euro area

- Table 3: Reserve assets of the euro area

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

[1] References to the current account are always to data that are seasonally and working day-adjusted, unless otherwise indicated, whereas references to the capital and financial accounts are to data that are neither seasonally nor working day-adjusted.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts