Analytical indicators on physical risks

Global warming increases the likelihood of extreme weather events. The resulting damage can have a significant impact on the financial system. For example, companies affected by flooding or droughts might find it difficult to service their debts. Or collateral, such as buildings or land, might suddenly lose value. This can affect the stability of our financial system.

Our physical risk indicators take into account risks stemming from climate change-induced natural hazards and consider how these risks affect firms’ ability to pay back loans and bonds and the performance of their equity. The indicators cover coastal flooding, river flooding, wildfires, landslides, subsidence, windstorms, water stress, droughts and rainfall variation.

You will find on this page:

Risk scoresPotential exposure at riskNormalised exposure at riskCollateral-adjusted exposure at riskData accessWith the latest data release, the range of hazards was extended to cover additional risks, such as droughts and rainfall. The indicators were also expanded to take into account climate scenarios, which allows benchmarking with historical data. These scenarios are based on representative concentration pathways (RCPs) – greenhouse gas concentration (not emissions) trajectories adopted by the Intergovernmental Panel on Climate Change. RCP 4.5 is considered to be a moderate mitigation scenario. It assumes that policies will be implemented to reduce greenhouse gas emissions. RCP 8.5 assumes a high-emission scenario in which no significant actions are taken to mitigate climate change. RCP 8.5 is shown in the charts below.

Compiling these indicators is subject to data-related limitations. In particular, there is a lack of suitable data to identify all relevant locations of firms’ physical assets and their vulnerability to natural hazards. Because the data are constantly being improved, we are only releasing them as analytical indicators for the time being.

In addition, the compilation framework for the indicators makes use of statistical methodologies that are usually applied to larger samples. Therefore, the framework should not be directly applied to single entities (e.g. a specific firm) or to single neighbourhoods. The developers of climate models have also cautioned against applying them at the local level, as the models are constructed with larger geographical areas in mind.

For further details on the methodology, data sources and limitations, please consult the statistical paper.

Risk scores

Risk scores sort portfolio exposures according to the location of the debtor, with locations being assigned a score from 0 (no risk) to 3 (high risk). With the latest data release, two new hazards have been included for the first time:

- the consecutive dry days (CDD) indicator, which captures drought conditions

- the standardised precipitation index (SPI), which captures excessively dry or overly wet conditions

Comparing the risk scores of different hazards is not advisable because they are based on differing methodological assumptions. But they do provide valuable insights for assessing relative risk levels across countries and climate scenarios as well as variations within a single hazard.

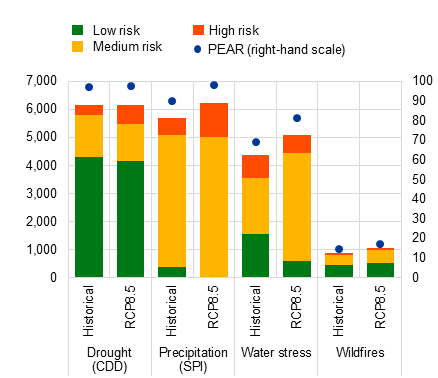

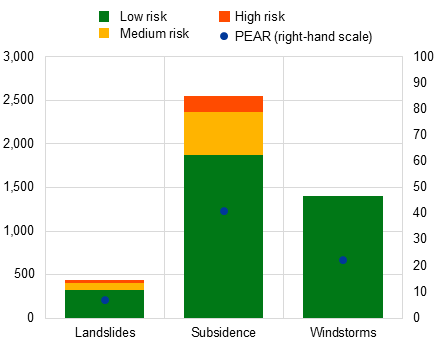

The exposure of financial institutions to the various physical risks is broadly linked to the geographic prevalence of each hazard. Projections for a high-emission climate scenario suggest that hazards related to temperature and rainfall would pose a greater risk to these institutions’ portfolios than in the current situation (Chart 1, panel a).

For three hazard types – landslides, subsidence, and windstorms – only historical data are available. Although a significant portion of portfolios are potentially exposed to these hazards, most exposures of euro area financial institutions are deemed low risk. This is particularly true for windstorms, owing to the relatively low intensity of this hazard and the quality of buildings and construction materials used in the euro area (Chart 1, panel b).

Chart 1

Portfolio exposures of euro area financial institutions to different hazards by risk score

a) Hazards with climate projections | b) Hazards with only historical data |

|---|---|

(left-hand scale: EUR billions; right-hand scale: percentage of portfolio) | (left-hand scale: EUR billions; right-hand scale: percentage of portfolio) |

|  |

Sources: European System of Central Banks (ESCB) calculations based on data from AnaCredit, Register of Institutions and Affiliates Database (RIAD), Securities Holding Statistics (SHSS), Intergovernmental Panel on Climate Change Interactive Atlas, World Resource Institute, Joint Research Centre (JRC), and Copernicus.

Notes: Portfolio exposures cover loans, debt securities and equity portfolios of euro area financial institutions vis-à-vis non-financial corporations. RCP 8.5 projections are for 2050. Historical and projection estimates are based on varying reference periods depending on the hazard considered. For more information, please refer to the statistical paper. Financial institutions include deposit-taking corporations except central banks (S122), non-money market fund investment funds (S124), insurance corporations (S128) and pension funds (S129). Risk scores are not comparable across hazard types as they rely on different methodologies and sources.

Potential exposure at risk

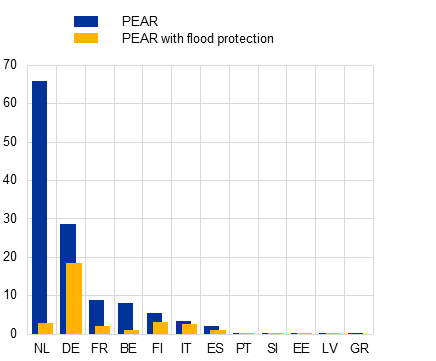

The potential exposure at risk (PEAR) indicator provides insight into the prevalence of a natural phenomenon and is compiled as a sum of risk scores (from 1 – low risk to 3 – high risk). The PEAR indicator can serve as a summary measure, enabling comparison across various dimensions of the indicators. For example, Chart 2 shows the effect of climate adaptation strategies across countries.

While adaptation strategies are crucial for measuring future resilience to hazards, information is currently only available for flood defences. Flood protection standards in coastal areas appear to be more effective than those for river flooding. Overall, adaptation measures can significantly decrease flood risk, as can be seen in Chart 2 for the Netherlands. The flood protection dataset is partially based on technical assumptions, so the data may not reflect the actual defence structures in place. This has major implications for the risk assessment.

Chart 2

Potential exposure at risk with and without flood protection

a) River flooding | b) Coastal flooding |

|---|---|

(EUR billions) | (EUR billions) |

|  |

Sources: ESCB calculations based on data from AnaCredit, RIAD, SHSS, Delft University of Technology and JRC.

Notes: Portfolio exposures cover loans, debt securities and equity portfolios of euro area financial institutions vis-à-vis non-financial corporations. RCP 8.5 projections are for 2050. Financial institutions include deposit-taking corporations except central banks (S122), non-money market fund investment funds (S124), insurance corporations (S128) and pension funds (S129). Some countries have been removed owing to confidentiality constraints.

Normalised exposure at risk

The normalised exposure at risk (NEAR) indicator measures the losses that financial institutions are expected to incur should their debtors not be able to repay their loans following a natural event that damages their physical assets.

The indicator takes into account the intensity of a hazard using damage functions. For example, for a flood that is 1 m deep, damage amounting to 25% of a company’s fixed assets is assumed, while for a flood that is over 3 m deep it is assumed that all the company’s fixed assets are destroyed. Because damage functions are not currently available for all hazards, the normalised exposure at risk indicator is only provided for river flooding, coastal flooding and windstorms. The indicator also captures the probability of a hazard occurring, so it is possible to estimate expected losses. The indicator shows losses both on an annual basis and over the remaining maturity of an instrument to highlight potential differences in the maturity structure of banks’ portfolios.

Collateral-adjusted exposure at risk

Like the normalised exposure at risk indicator, the newly available collateral-adjusted exposure at risk (CEAR) indicator provides an estimate of expected losses within a bank’s portfolio. The difference is that the new indicator also takes into account the mitigating effect of collateral pledged with a loan commitment. In terms of minimising financial losses, collateral serves as a robust mitigating factor for euro area creditors. However, it is important to note that physical collateral could be damaged following a natural disaster, and its value could fall. This is also accounted for in the calculation of the CEAR.

Chart 3 shows the expected loss indicators – NEAR and CEAR – for the loan portfolios of euro area banks. These harmonised indicators are a valuable tool for comparing the economic impact of climate change across various hazards, climate scenarios and countries. However, it should be emphasised that national practices vary considerably with regard to collateral requirements, which affects the country risk profiles.

Chart 3

Expected loss indicators: annualised normalised and collateral-adjusted exposure at risk of euro area banks’ loan portfolios

(percentage of portfolio) |

|

Sources: ESCB calculations based on AnaCredit and RIAD, Delft University of Technology and Copernicus.

Notes: RCP 8.5 projections are for 2050. For coastal floods the analysis is extended to 2100 to demonstrate the increase in risks in comparison with earlier decades; the risks for other hazards are evident sooner. For windstorms only historical data are available.

Data access

The underlying aggregated data for the analytical physical risk indicators are available as compressed csv files below.

To receive updates on methodology and data quality, subscribe to our climate data information service.

Data for the analytical physical risk indicators