Macroprudential policy should remain focused on maintaining capital buffers in the absence of widespread materialisation of financial stability risks. At the same time, the financial cycle is continuing to turn, making it more likely that financial stability risks will materialise. It is therefore worth discussing in general the factors that could inform potential buffer releases in the future and, in particular, examining the indicators and conditions under which buffer releases might be considered.

Conceptually, key factors that can guide potential decisions to release buffers relate to expectations of credit supply tightening due to capital constraints, as well as expectations of widespread bank losses. A buffer release can effectively mitigate the procyclicality of binding capital requirements by reducing the pressure for banks to adjust when capital ratios decline (for example due to losses) and thus avoiding excessive deleveraging and further amplification of adverse shocks. The most important considerations informing a potential decision to release buffers are the likelihood and extent of a significant tightening of credit supply due to bank capital constraints and, respectively, widespread bank losses, as also noted in discussions with national authorities.[1]

Going beyond these conceptual considerations, determining the appropriate timing and size of a release is an important but challenging task. On the one hand, if too much capital is released too early, there is a risk that the capital corresponding to the buffer requirement might be paid out. This would deprive the banking system of the capital needed when risks eventually materialise. In addition, such a release might have to be followed by a costlier rebuilding of capital buffers at a later stage (for example due to lower profitability). On the other hand, releasing buffers too late, when banks are already capital-constrained as a result of loss materialisation, could result in credit supply constraints. This could aggravate the downturn and lead to higher bank losses overall.

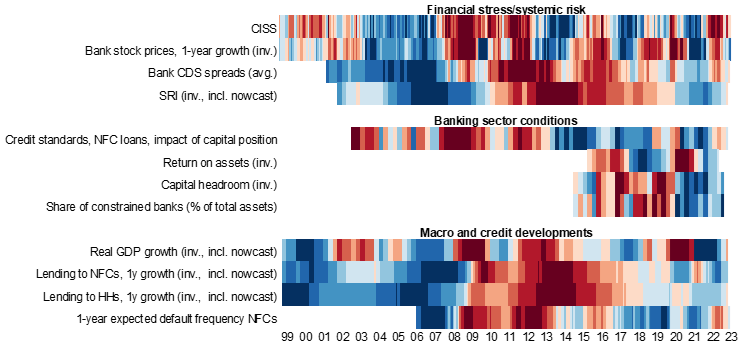

Based on the factors discussed above, various indicators can be used to inform the decision on whether to release capital buffers – and on aggregate, they do not currently signal the need for a release. The indicators proposed in the literature[2] can be grouped into three categories. The first of these covers market-based variables measuring general systemic stress (such as the Composite Indicator of Systemic Stress (CISS), the Country-Level Index of Financial Stress (CLIFS) or the Libor-OIS spread) or bank funding stress (bank credit default swap (CDS) prices, stock prices) which inform expectations about future losses and are the best coincident or near-crisis indicators. However, these measures are unavailable for many banks and therefore often not representative (for example in countries where financial markets are less developed). In addition, they can give the signal for a release too early and too often. The second category covers indicators of banking sector health and credit supply constraints (for example existing capital headroom, forward-looking balance sheet indicators of future losses such as provision staging, and survey indicators of credit standards), which directly identify expected losses or the extent of potential credit supply constraints but often have considerable publication lags. The third category covers indicators reflecting the macroeconomic environment and outlook (GDP growth, unemployment rate, credit growth, etc., including forecasts) which capture the overall stress in the economy but are also often delayed. These indicators are less suited for identifying turning points between risk build-up and risk materialisation in real time. Given the pros and cons of different measures, only a comprehensive evaluation across categories can help to assess (i) the systemic nature of a shock and (ii) its size, persistence, pass-through speed and impact on the banking system and broader economy. A heatmap covering all three categories does not currently signal the need to release buffers at euro area aggregate level (Chart A).

Chart A

Current signals from the heatmap do not indicate risk materialisation in the euro area as a whole

Evolution of tentative indicators in the euro area

Sources: ECB and ECB calculations.

Notes: HH = household; inv. = inversed variables (lower values denote higher risk); NFC = non-financial corporation. SRI = systemic risk indicator. Colours based on the deciles of historical distribution computed using euro area aggregate indicators (1st decile = darkest blue colour, 10th decile = darkest red colour). Share of constrained banks = share of banks with distance to MDA < 1 percentage point of total assets. Impact of capital position on credit standards for housing loans has only been available since the second quarter of 2022 and is excluded from the heatmap. The latest observation for nowcasts is for the first quarter of 2023. Expected defaults are based on Moody’s KMV data.

Ultimately, additional information and expert judgement are needed alongside quantitative signals to inform the decision on whether to release capital buffers. On the quantitative side, the choice of a particular transformation of selected indicators is important, given the trade-off between timeliness and signal-to-noise ratio (for example, short-term transformations can be much timelier but might also contain more noise). The global financial crisis experience also suggests that some of the indicators (such as non-performing loans and lending growth) tend to issue late signals. Therefore, nowcasted, projected or surveyed indicators of losses, provisioning and capital constraints, where available, can be more informative. In addition, qualitative information is crucial in the event of a rapid change in loss expectations or in the assessment of credit supply constraints, for example due to unexpected trigger events. Overall, market intelligence, supervisory assessments, stress tests and, ultimately, expert judgement (especially if signals diverge across indicators or in periods of increased uncertainty) have an essential role to play alongside an indicator-based approach.

Other factors that could be relevant include a tightening of bank credit supply regardless of bank capital constraints or signs that the financial cycle has entered a downturn phase.

See, for example, Detken, C., Weeken, O., Alessi, L., Jahn, N. and others. (2014) “Operationalising the countercyclical capital buffer: indicator selection, threshold identification and calibration options”. ESRB Occasional Paper, No 5., Drehmann, M., Borio, C., Gambacorta, L., Jimenez, G. and Trucharte, C. (2010). “Countercyclical capital buffers: exploring options”. BIS Working Papers No 317. Bank for International Settlements, Drehmann, M., Borio, C. and Tsatsaronis, K. (2011). “Anchoring countercyclical capital buffers: the role of credit aggregates”. International Journal of Central Banking, 7(4): 189-240, and the ESRB Recommendation on guidance for setting countercyclical buffer rates (ESRB/2014/1).