Foreword

Households and firms across the euro area are already feeling the effects of higher inflation and weaker economic activity, amid the ongoing energy crisis prompted by the war in Ukraine.

The November 2022 Financial Stability Review (FSR) sets out how the deterioration in economic and financial conditions has increased the risks to euro area financial stability. This year has seen notable declines in financial asset prices across many regions and asset classes, an increase in market volatility and, at times, strained market liquidity. Sharp asset price movements have also triggered unexpectedly large margin calls for some market participants, notably non-financial corporations and non-bank financial institutions, testing their liquidity preparedness. These asset price shifts have reflected increasing uncertainty about what will be required of monetary policy to moderate inflation in advanced economies. Not for the first time, we have been reminded that, when positions are leveraged or when exposures are created through derivatives, the impacts of market shocks are often felt well beyond those investors that are directly affected.

As financial conditions tighten, the vulnerabilities of more-indebted sovereigns, households and corporates are at greater risk of coming to the fore. Despite the pandemic-induced disruption of economic activity, corporate defaults and unemployment have, thanks to a variety of policy support measures, remained low. Banks have thus been shielded from loan losses. While they are now benefiting from near-term gains derived from higher interest rates and margins, deteriorating growth prospects point to rising risks in the medium term. With the present macroeconomic environment, where monetary policy is focused on lowering inflation, it is crucial for governments to be targeted in the support they provide to vulnerable sectors, while avoiding policies that could interfere with the monetary policy normalisation process.

This issue of the FSR also includes three special features on topics that are becoming more prominent for our risk assessment. The first examines the impact of the energy crisis on energy-related financial derivatives markets, which are used by energy producers across the euro area to hedge their positions and intermediated by the banking system and clearing houses. The second special feature explores how increasing energy and other prices, together with rising interest rates, are affecting euro area households at different income levels, and the challenges posed for less well-off households in particular. The third special feature looks at how threats to financial stability from cyberattacks are evolving, how their costs are rising, and how this can be mitigated.

This issue of the FSR has been prepared with the involvement of the ESCB Financial Stability Committee, which assists the decision-making bodies of the ECB in the fulfilment of their tasks. The FSR promotes awareness of systemic risks among policymakers, the financial industry and the public at large, with the ultimate goal of promoting financial stability.

Luis de Guindos

Vice-President of the European Central Bank

Overview

Financial stability risks increase as macro-financial conditions continue to weaken

Euro area financial stability conditions have deteriorated further, reflecting rising inflation, higher interest rates, weaker growth prospects and financial market repricing. Inflationary pressures have risen both globally and in the euro area since the publication of the previous FSR (Chart 1, panel a), driven by elevated food and energy prices and their pass-through to other prices. This has prompted an adjustment of monetary policy stances by major central banks, contributing to tighter global financial conditions and increased financial market volatility. The mix of high inflation outturns and rising interest rates has continued to weigh on economic growth in many advanced economies. Against this background, one-year ahead recession probabilities have increased markedly, in both the euro area and other major advanced economies (Chart 1, panel b).

Chart 1

Ongoing inflationary pressures and tighter financial conditions fuel recession risks

Sources: Bloomberg Finance L.P., Eurostat, U.S. Bureau of Labor Statistics, Haver Analytics and ECB calculations.

Notes: Panel a: Bloomberg’s financial conditions indices measure stress in money, bond and equity markets relative to the period before the global financial crisis. Positive values indicate accommodative financing conditions, while negative values indicate tighter financing conditions. EA stands for euro area; HICP stands for Harmonised Index of Consumer Prices; CPI stands for consumer price index. Panel b: recession probabilities are displayed as the Bloomberg Recession Probability Forecast Index. Recession probabilities for emerging market economies are the median Bloomberg Recession Probability Forecast Index for a set of countries defined as emerging market economies in alignment with the IMF, excluding Ukraine and Russia.

Pre-existing vulnerabilities could be exposed by euro area economic developments, monetary and fiscal policy challenges and geopolitical tensions. The ongoing war in Ukraine still poses a significant risk to inflation and growth, especially if it leads to euro area households and firms facing rationed energy supplies. Other risks to inflation, growth and global financial conditions could also be triggered by a faster than expected rise in interest rates, fiscal policy missteps, a broader resurgence of the pandemic, and emerging market stress, including the possibility of a sharper economic slowdown or real estate correction in China. Should any of these risks materialise, they could trigger or amplify the unravelling of financial stability vulnerabilities identified in previous issues of the FSR, possibly simultaneously, including pockets of debt sustainability concerns for corporates, households and sovereigns, or abrupt adjustments in both financial and tangible asset valuations.

Risk of disorderly market adjustments rises amid higher volatility and potential for further asset repricing

Despite large corrections in 2022, risky-asset valuations remain sensitive to the uncertain path of inflation, monetary policy normalisation and economic activity. After a brief summer rally, global bond and equity markets resumed their simultaneous decline that has been under way since the start of 2022 (Chart 2, panel a). While recent corrections have generally been orderly, there has been unusually strong price co-movement across a wide range of asset classes – a development that complicates diversification strategies and could amplify losses (Box 2). Activity in primary markets – including initial public offerings of equity and issuance of high-yield corporate bonds – has also fallen significantly year on year.

Some risky-asset prices, such as US equities, still appear stretched given fundamentals. So far, asset prices declines have mainly reflected the direct impact of higher interest rates, and, therefore, prices may not yet fully reflect the more negative outlook. Further corrections in market valuations could be triggered if the outlook for growth, inflation and financial conditions deteriorates further. In particular, more persistent inflation might require further monetary policy responses by major central banks than currently expected by market participants.

The risk of disorderly adjustments has risen with increased market volatility, knock-on effects for margin demands and lower liquidity in some market segments. Significant financial market repricing has translated into higher market volatility, in particular – but not exclusively – in bond markets (Chart 2, panel b). In addition, some signs of lower market liquidity have emerged in euro area corporate bond markets, especially for high-yield bonds (Chart 2, panel c). This could make it harder for participants to adjust portfolios, reprice assets or raise financing in periods of stress. Furthermore, the cash and collateral stress that can arise from large price moves and volatility that trigger unexpectedly large margin calls poses a risk for some derivatives market participants, as recently seen in euro area commodity derivatives markets (Special Feature A) and UK sovereign debt markets. This combination of developments makes markets more vulnerable to disorderly adjustments.

Chart 2

Markets remain vulnerable to disorderly adjustments amid high volatility and signs of lower market liquidity in some market segments

Sources: Bloomberg Finance L.P., S&P Dow Jones Indices LLC and/or its affiliates, and ECB calculations.

Notes: Panel a: global equity markets are reflected by the MSCI All Country World Index and global bond markets by the Bloomberg Barclays Multiverse Index. Panel b: volatilities indicated are the VIX Index for equities, the MOVE Index for bonds, the 30-day volatility of the Bloomberg Commodities Index for commodities and the J.P. Morgan Global FX Volatility Index for foreign exchange rates. Original data were transformed into z-scores by subtracting their average and dividing by their standard deviation. Panel c: bid-ask spreads are weighted by market value for euro-denominated bonds included in the iBoxx investment-grade, high-yield and sovereign bond indices with original maturity of one year.

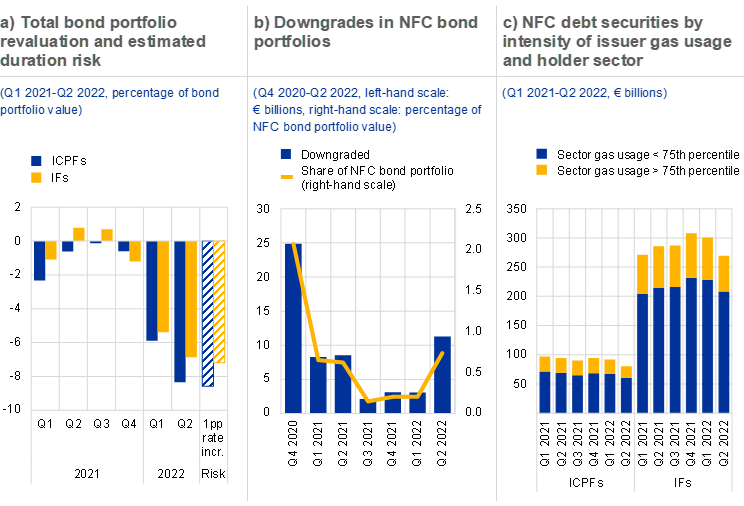

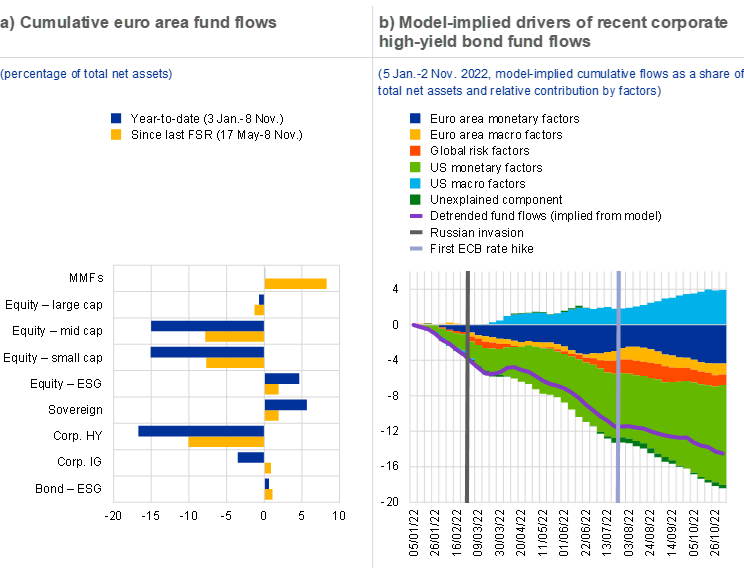

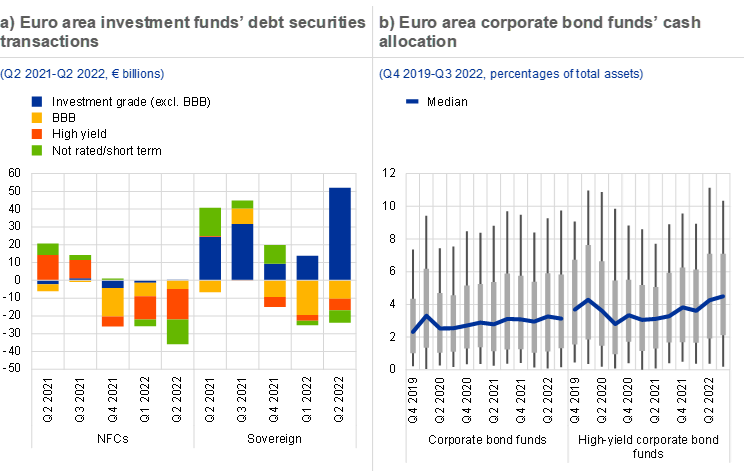

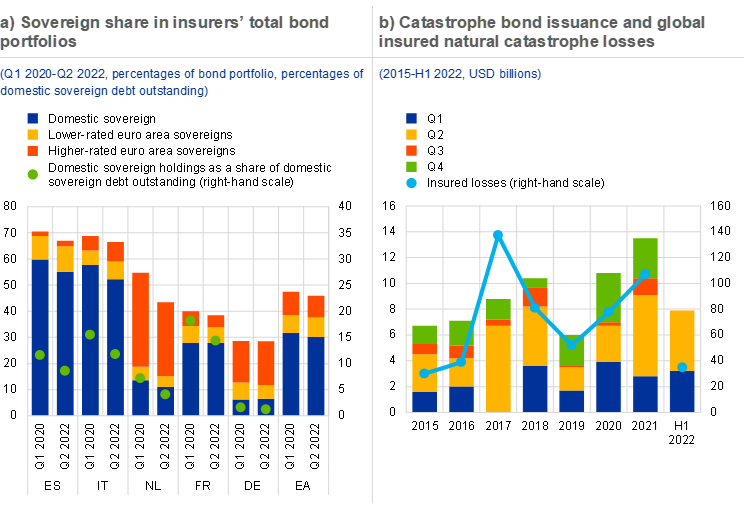

Despite some active portfolio de-risking, the credit risk exposure of the non-bank financial intermediary sector remains high. Non-bank financial institutions (NBFIs) have responded to rising yields and a worsening macroeconomic outlook by starting to offload their holdings of lower-rated corporate and sovereign bonds (Chart 3, panel a). This points to a reversal of the search for yield observed in the prolonged low interest rate environment (Section 4.1). That said, overall exposures to credit risk remain high, exposing NBFIs to the risk of substantial credit losses should corporate sector fundamentals deteriorate. In this regard, the credit risk outlook remains particularly uncertain for energy-sensitive industries. While aggregate exposures to these sectors are not large, concentrated exposures may increase risks, especially for leveraged and liquidity-constrained NBFIs. In addition to liquidity needs from investor redemptions, insurance policy lapses and margin calls, the broad-based correction of financial asset prices has been the main driver of a significant decline in the total value of assets in the non-bank financial sector.

NBFIs are exposed to a further rise in bond yields and possible forced asset sales amid low liquid asset holdings. In a context of rising bond yields, NBFIs’ duration risk remains elevated, exposing the sector to further bond portfolio revaluation losses. That said, in the medium term, the transition to a higher interest rate environment could, in addition to reducing the incentives for NBFIs to search for yield, benefit the life insurance and pension fund sector because of their structural negative duration gaps (with the duration of liabilities typically exceeding that of their assets) (Section 4.3 and Box 4). While the cash holdings of investment funds have risen since early 2022 (Chart 3, panel b), their holdings of liquid assets remain relatively low amid rising volatility and the lack of a sufficiently developed macroprudential approach for addressing liquidity mismatches in open-ended funds. As such, the risk remains high that investment funds could, in an adverse scenario, amplify a market correction via procyclical selling behaviour. In addition, NBFIs which use interest rate derivatives, including insurance companies and pension funds (Section 4.1 and Box 3), are exposed to funding liquidity risk from unexpectedly large margin calls. Subsequent forced asset sales could worsen a market sell-off and increase wider risks to financial stability.

Chart 3

Non-bank financial institutions in the euro area have been de-risking, but credit, liquidity and duration risks continue to linger amid rising rates and weaker growth

Sources: CSDB, Bloomberg Finance L.P., Refinitiv, ECB (Securities Holdings Statistics, Balance Sheet Items, Investment Funds Balance Sheet Statistics) and ECB calculations.

Notes: Panel a: non-banks include investment funds, insurance corporations and pension funds. Unrated holdings are excluded. NFC stands for non-financial corporations. Panel b: the latest data point is an estimate assuming total assets remained constant from August 2022. Cash holdings are defined as deposits vis-à-vis euro area investment funds other than money market funds reported by monetary financial institutions excluding the ESCB in the euro area divided by total assets of euro area investment funds.

Higher funding costs and less fiscal space for sovereigns

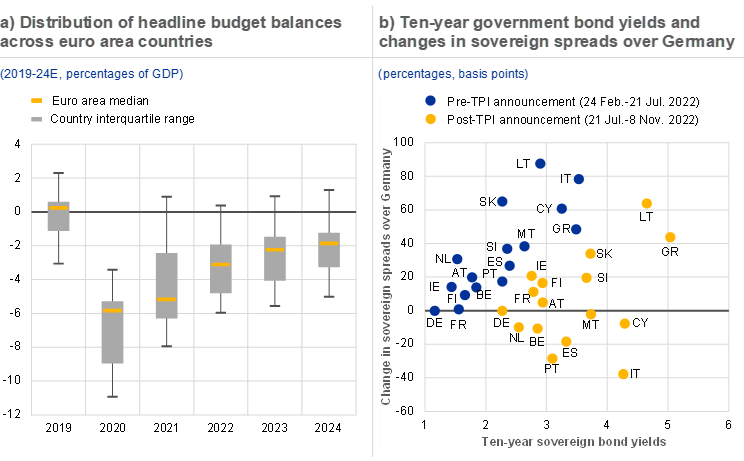

Sovereign vulnerabilities have increased amid ongoing fiscal support to cushion the impact of higher energy prices and a weaker economic outlook. Euro area governments have spent around 1.4% of GDP on discretionary measures since the invasion of Ukraine (Section 1.2). Most of this reflects support to cushion the rise in energy prices and inflation, and several governments have announced extensions to energy support into 2023. This sizeable stimulus comes at a time when governments had only just ended pandemic-related support measures and when the normalisation of the monetary policy stance has started. Prolonged high deficits in a number of countries (Chart 4, panel a), coupled with rising funding costs, may not only limit the fiscal space available to shelter the economy from future shocks, but may also put debt dynamics on a less favourable trajectory, especially in countries with higher levels of debt. To preserve debt sustainability and limit the risk of fuelling inflationary pressures, support measures should be temporary and targeted towards the most vulnerable households and firms.

Chart 4

Downside risks to public finances have risen further as fragmentation concerns resurface amid energy price support and a slowing economy

Sources: IMF (Fiscal Monitor), Refinitiv and ECB calculations.

Notes: Panel a: figures for 2022-24 are projections. Panel b: ten-year sovereign bond yields are shown as at the last day in the reference period.

Resurgent concerns that some countries could face excessive increases in sovereign financing costs have been partly mitigated by policy action. On the funding side, government bond yields have increased sharply across the euro area over the past six months. In recent years, though, many sovereigns have locked in a greater fraction of their financing at low interest rates and longer maturities, reducing their vulnerability to abrupt shifts in market sentiment. However, higher funding costs may still represent a greater near-term risk for those countries with high short-term debt servicing needs. Short-term market pressures increased in a number of countries in early summer, as tighter financing conditions spurred fragmentation concerns in euro area sovereign debt markets (Box 1). Since then, the widening of sovereign yield spreads has stabilised (Chart 4, panel b), as reinvestment flexibility under the ECB’s pandemic emergency purchase programme was exploited and the Transmission Protection Instrument (TPI) was approved by the ECB’s Governing Council on 21 July 2022. This new tool is designed to counter any unwarranted and disorderly market dynamics that pose a serious threat to the transmission of monetary policy across the euro area.

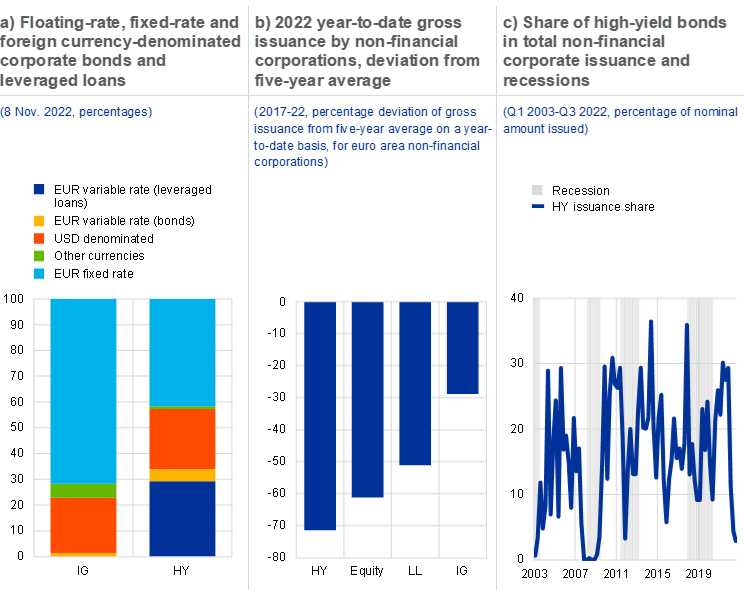

Low growth, high inflation and rising rates are exposing corporate and household vulnerabilities

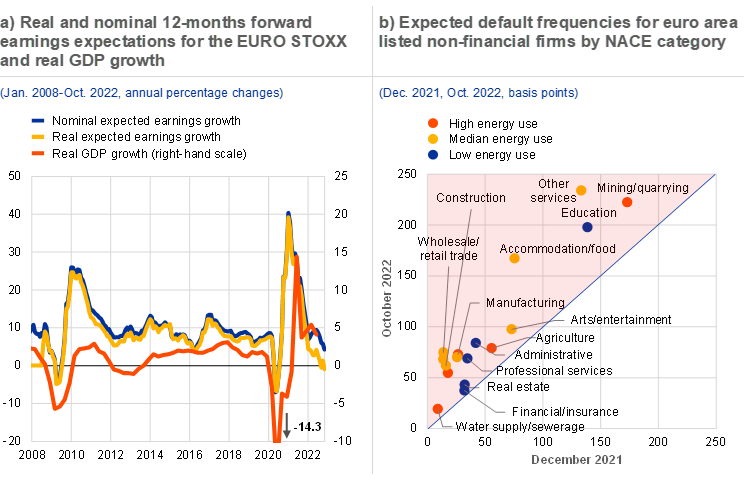

Euro area firms are challenged by high inflation and energy prices, recession risks and tighter financial conditions. On aggregate, in the first half of 2022 euro area corporates saw profitability return above pre-pandemic levels (Chapter 1.3), as firms were still able to pass on higher input prices to customers. However, a weaker economic outlook and, for some firms, growing margin pressures have seen corporate earnings growth expectations turn negative in real terms recently – a development previously observed during the global financial crisis and the pandemic (Chart 5, panel a). At the same time, euro area firms face challenges from higher market-based and bank funding costs. There are also signs of corporates switching from bonds to bank loans, given a faster pass-through of policy rate increases to bond yields. That said, the ongoing tightening of credit supply, coupled with the deterioration of economic prospects, indicates that bank lending volumes may soon moderate too.

Chart 5

Euro area corporates face growing headwinds from declining earnings, weaker growth expectations and rising default risks

Sources: Bloomberg Finance L.P., Haver Analytics, Refinitiv, Moody’s Analytics, Eurostat, OECD (Trade in Value Added (TiVA) database (2018)) and ECB calculations.

Notes: Panel b: expected default frequencies shown are monthly averages of sectoral medians for publicly listed firms in euro area countries. Direct and indirect energy use is measured by the share of input from mining and quarrying, energy-producing products, coke and refined petroleum products and the electricity, gas, steam and air-conditioning industries for each sector, classified according to the United Nations International Standard Industrial Classification for All Economic Activities (ISIC), Rev. 4. “High energy use” refers to the sectors with energy use in the 75th percentile, “Low energy use” refers to The energy use for the sector mining/quarrying is measured as the energy use in mining and quarrying, non-energy producing products and mining support service activities.the sectors with energy use in the 25th percentile and “Median energy use” refers to the sectors with energy use in between the 25th and 75th percentile.

Corporate vulnerabilities are greater for energy-intensive firms which may face growing debt servicing problems. A sharper economic slowdown, together with a further tightening of financing conditions, may in particular challenge those firms that exited the pandemic with higher debt levels, more subdued earnings and lower liquidity buffers – many of which also have lower credit ratings. At the same time, higher energy and commodity prices could hurt activity in those energy-intensive sectors that are less able to pass on higher costs to customers, such as some utility and construction firms. Small and medium-sized enterprises benefited less from the post-pandemic rebound in economic activity and may be particularly vulnerable to a slowdown in economic activity and higher borrowing costs. While corporate insolvencies have remained well below their pre-pandemic levels, some sectors have already seen an increase in expected default rates (Chart 5, panel b) and might be at greater risk of insolvencies in the event of adverse economic surprises or of a further tightening of financial conditions, or both.

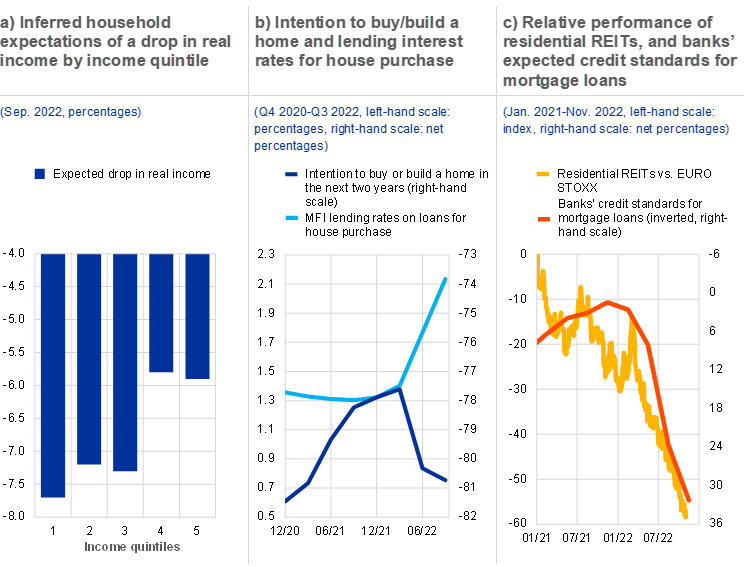

Chart 6

Deteriorating financial position of euro area households may be made worse by a turn of the real estate cycle

Sources: Bloomberg Finance L.P., European Commission, ECB (Consumer Expectations Survey, Bank Lending Survey) and ECB calculations.

Notes: Panel a: data cover surveys from Belgium, Germany, Spain, France, Italy and the Netherlands. The expected drop in real income is calculated as the mean of households’ income expectations 12 months ahead (percentage change) minus mean inflation expectations over the next 12 months (percentage change). Income quintiles are computed at survey wave-country level. Panel c: REIT stands for real estate investment trusts. The FTSE EPRA Nareit Eurozone Residential Index is used here to calculate the relative performance against the EURO STOXX 50 index.

High inflation is weighing on the disposable income and debt servicing capacity of lower-income euro area households in particular. Against the backdrop of higher inflation and energy prices, the outlook for euro area households has become gloomier, as reflected by a plunge in consumer confidence and expectations regarding their financial situation (Section 1.4). The squeeze on real incomes is expected to affect lower-income households disproportionately (Chart 6, panel a), as they often spend a larger proportion of their incomes on food and energy. Erosion of real disposable income and savings, together with higher interest rates, weakens households’ debt servicing capacity, particularly in countries where household debt levels are more elevated. Simulations of the impact of consumer price rises and interest rate changes on the near-term financial health of households reveal a more pronounced risk of default in lower income quintiles (Special Feature B), particularly for consumer credit. That said, there are a number of mitigants, including the small share of these households in overall household sector (especially mortgage) debt. Moreover, despite a weaker growth outlook, resilient labour markets have so far supported incomes, and the shift towards more fixed-rate mortgage lending in recent years shields many households from the immediate impact of higher interest rates. The use of macroprudential policies, notably borrower-based measures, in most euro area countries in recent years has also helped to limit excessive household borrowing.

Signs of a turn in the real estate cycle may compound the vulnerabilities of euro area household incomes and balance sheets. While moderating somewhat, euro area property markets still saw almost double-digit nominal price increases and sustained strong lending growth in the second quarter of 2022 (Section 1.5). However, households’ reported intentions to buy or build a home point to a turn in the real estate cycle, mirroring the sharp increase in interest rates on new mortgage loans since the start of 2022 (Chart 6, panel b). Also, providers of finance have become more cautious, as residential real estate investment trusts (REITs) have significantly underperformed the broader stock market and euro area banks have tightened their credit standards for mortgage loans (Chart 6, panel c). Overall, there are signs that the real estate expansion of recent years could come to an end, with overvaluation estimates and mortgage rates now standing at their highest levels in more than five years. Similarly, financing conditions in commercial real estate (CRE) markets have tightened, potentially reversing the post-pandemic recovery. According to survey data, a growing share of investors now see the market in the downturn phase of the cycle. A more pronounced correction in CRE markets could prompt investor losses, higher credit risk for lenders and a decline in collateral values.

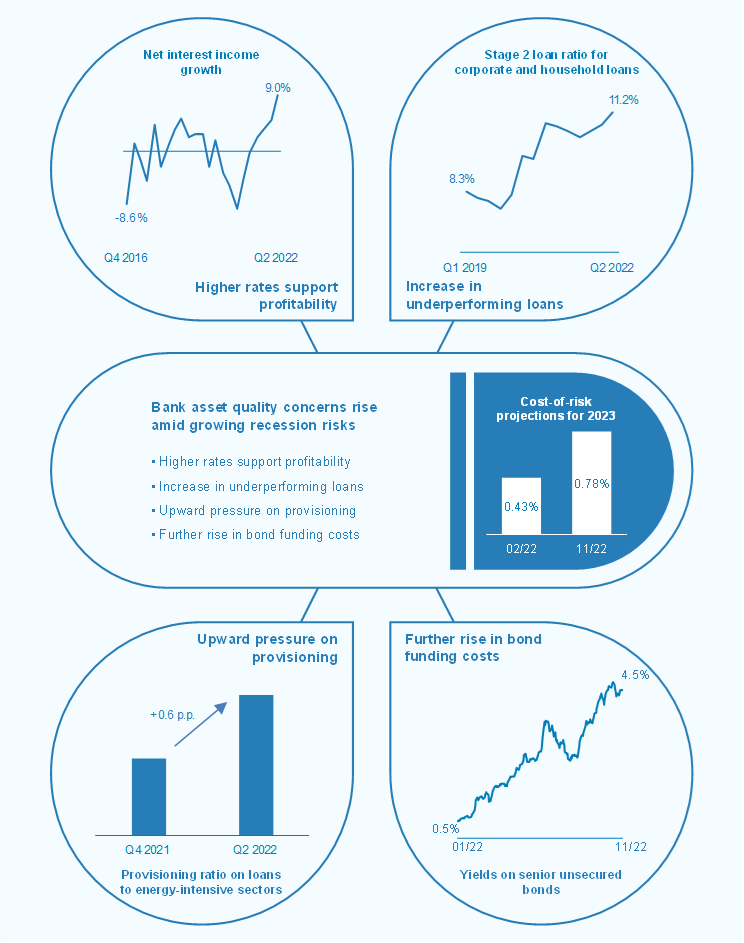

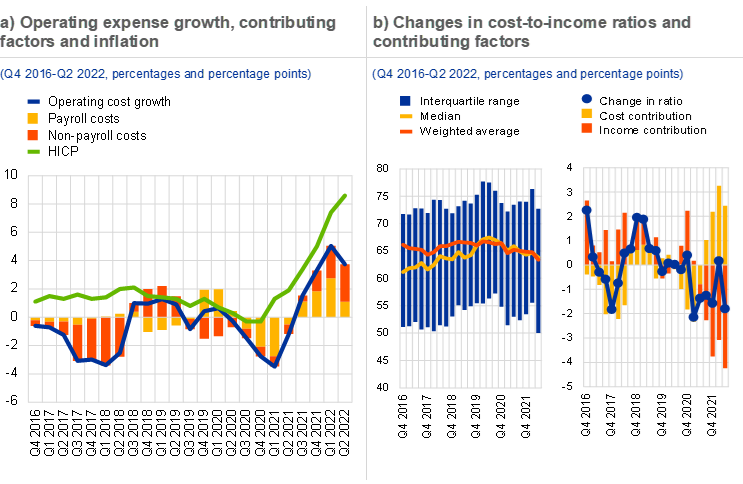

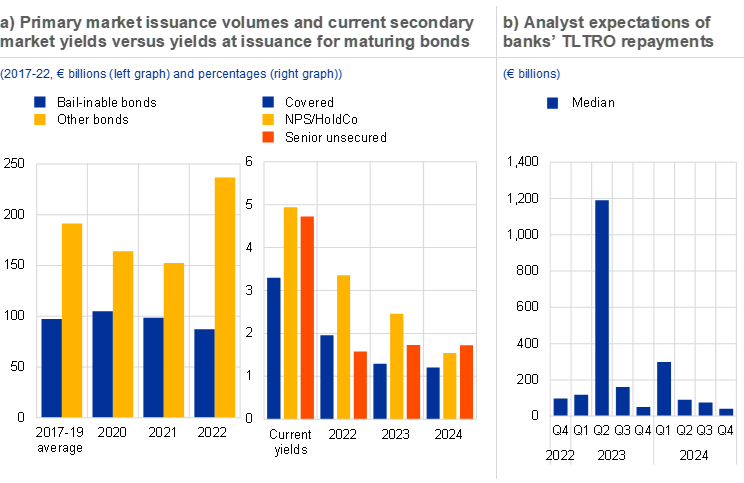

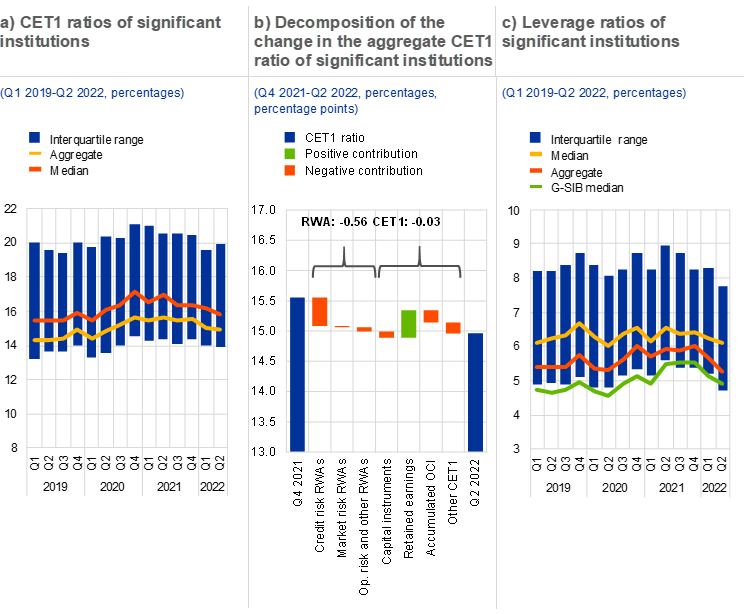

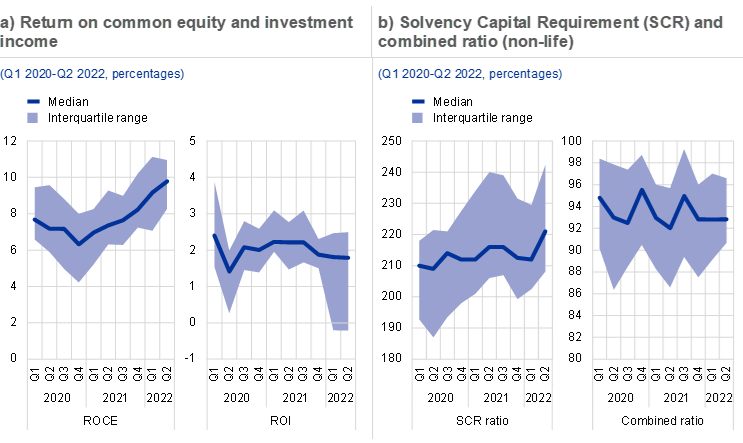

Higher interest rates support bank profits, but worsening asset quality and higher funding costs pose headwinds

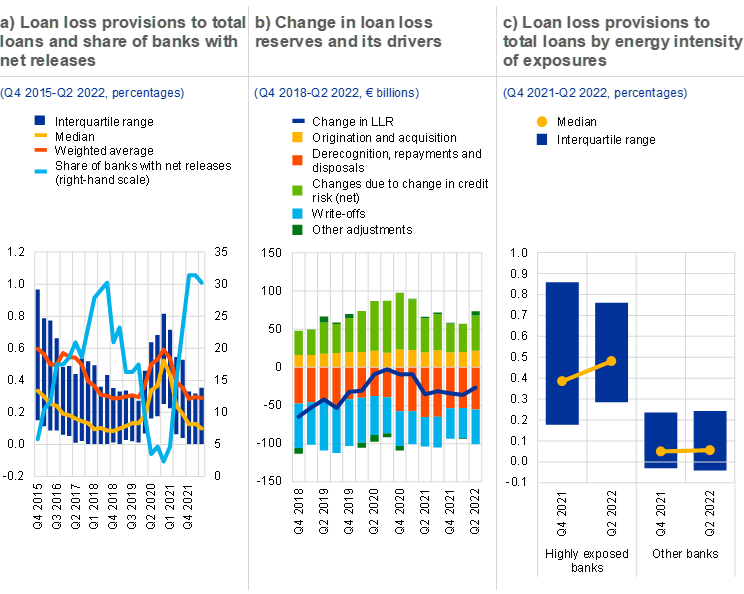

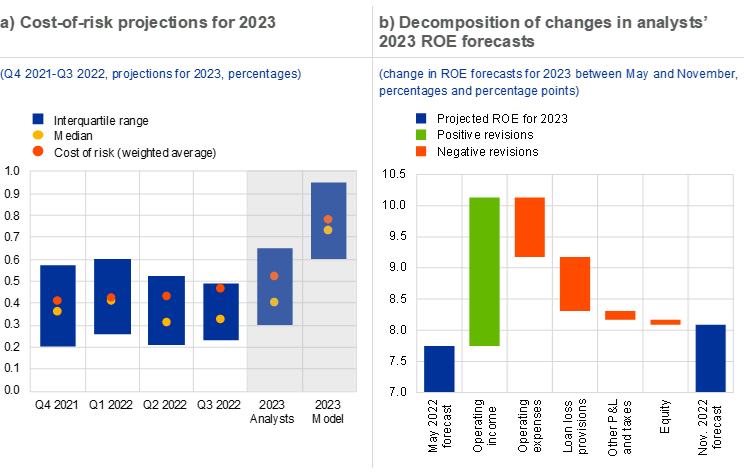

Rising interest rates have bolstered the short-term profitability outlook of euro area banks, which are becoming more active in hedging interest rate risk. Euro area bank profitability improved slightly in the first half of 2022, underpinned by lower operating expenses, still low loan loss provisions and higher operating income thanks to wider margins and stronger lending volumes (Chapter 3.2). Accordingly, bank analysts have also revised up their 2023 return on equity (ROE) forecasts for listed euro area banks to around 8%, as a higher interest rate environment bolsters their net interest income and, in turn, bank profitability (Chart 7, panel a). However, these expectations assume that future credit losses remain limited and are subject to downside risks. In terms of managing interest rate risk, euro area banks have become more active in the interest rate swaps market since early 2021. In particular, they have generally been net buyers of floating rate payments, hedging the risk from fixed-rate euro-denominated assets (Box 3).

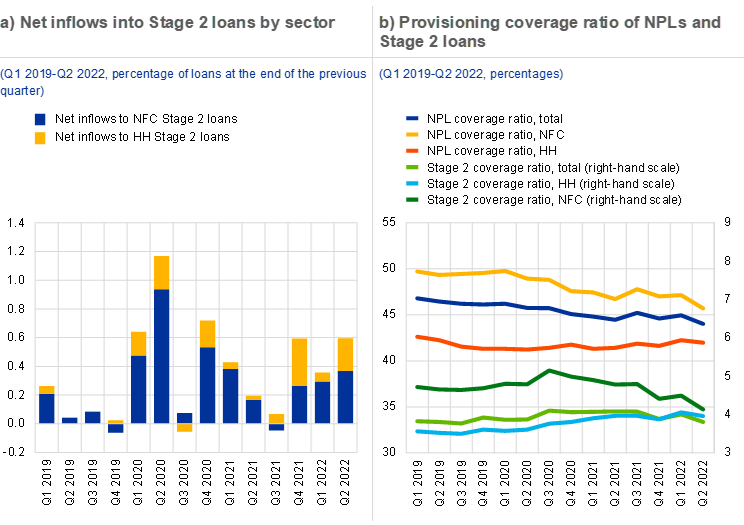

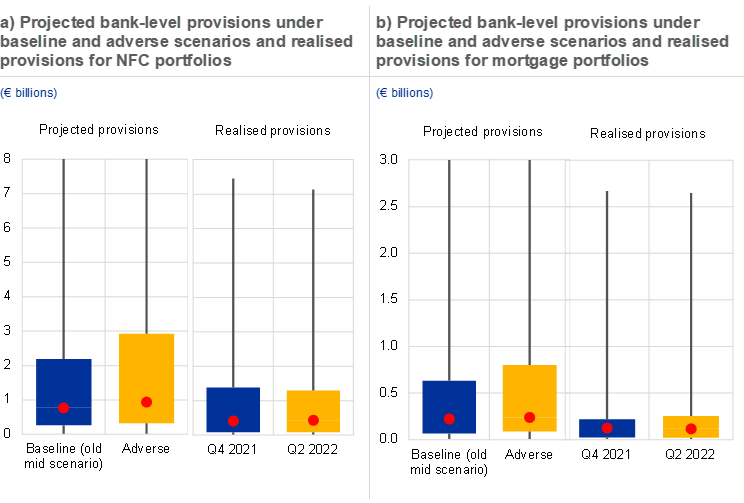

A weaker economy and increased credit risk may weigh on bank profitability prospects in the medium term. Despite a significant worsening of the economic outlook, the asset quality of euro area banks showed no signs of broad-based deterioration in the first half of 2022, although recent trends in “underperforming” Stage 2 loans suggest some increase in credit risk. Since Russia’s invasion of Ukraine, loans to energy-intensive firms have seen higher probabilities of default compared with less energy-intensive firms (Chapter 3.1). As interest rates rise, banks could also face higher credit risks stemming from their exposures to vulnerable sectors which have grown in recent years, notably including residential real estate markets. Banks’ cost of risk, defined as the ratio of loan impairments to loans, has fallen to pre-pandemic lows (Chart 7, panel b), but could rise going forward driven by both the need for higher loan loss provisions and the adverse denominator effect from likely lower loan volume growth as macroeconomic prospects deteriorate (Chapter 3.2).

Chart 7

Benefiting from higher rates, banks’ profitability outlook has remained favourable, but prospects of worsening asset quality and higher funding costs create headwinds

Sources: Bloomberg Finance L.P., Refinitiv, S&P Global Market Intelligence, ECB and ECB calculations.

Notes: Panel b: cost-of-risk data are available until Q2 2022 only. Cost of risk is defined as impairments on loans divided by loans. PMI stands for Purchasing Managers’ Index.

Higher market funding costs for banks make it more challenging to fund low-yielding assets. Bond funding costs have risen markedly for banks during 2022 – even surpassing pandemic highs across most instruments – driven by expectations of monetary policy normalisation, growing recession fears and deepening geopolitical tensions (Chart 7, panel c). While bank debt markets have remained open with no signs of fragmentation across euro area countries, banks with lower ratings and/or MREL shortfalls may need to issue new debt at much higher funding costs amid limited investor appetite. In addition, rising rates on new deposits, in particular in countries with a higher incidence of negative deposit rates, and maturing TLTRO III funds have started to translate into higher average funding costs for banks. Given the large shift over the last decade from floating to fixed-rate lending, higher funding costs may dampen some of the benefits for banks from higher interest rates.

Pre-existing structural weaknesses, together with a greater need to manage cyber risk, remain a challenge for banks looking ahead. Growing cyclical headwinds are compounded by longer-term challenges associated with low cost-efficiency, limited revenue diversification and remaining overcapacity in parts of the euro area banking sector. Accelerated digitalisation would help remedy some of these long-standing issues, although it comes at a cost of greater exposure to the threat of cyber risks (Special Feature C). However, heightened macro-financial uncertainty may delay the digital transformation plans of euro area banks, dampening their sustainable long-term profitability. In addition, euro area banks also need to manage the implications of the transition to a greener economy, including underlying concentration risks associated with climate-related exposures (Box 5).

Macroprudential policy enhances banks’ resilience, but the policy framework for non-banks must be strengthened

Prudential regulation and policy since the global financial crisis have helped put euro area banks in a good position to withstand the unfolding economic challenges. Despite several mitigating factors, accumulated macro-financial vulnerabilities have been compounded by the war in Ukraine, and the deteriorating economic outlook, inflationary pressures and tighter financing conditions are weighing on the debt servicing capacity of households and firms alike. At the same time, risks are more likely to materialise, given the possibility of further geopolitical and economic shocks. In this challenging environment, the substantial strengthening of bank balance sheets and capital positions over recent years has ensured that the sector is well-prepared to adapt to the potential materialisation of risks.

While considering headwinds to economic growth, macroprudential policy action can still help preserve and strengthen resilience across the financial system. Macroprudential policies, and in particular capital buffers consistent with the prevailing level of risk, help to ensure banks’ resilience and their ability to support the economy when systemic risk materialises. While activating buffers at an early stage has important benefits, increasing buffer rates can still be beneficial at the current, late stage of the financial cycle, provided that procyclical effects are avoided. Some countries with macro-financial imbalances may still increase macroprudential buffers, also considering that the existing capital headroom and remaining ability of many banks in the euro area to generate profits mitigate the risk of procyclical consequences (i.e. tighter lending conditions). Nevertheless, possible macroprudential policy responses need to take account of the highly volatile and uncertain course of the energy crisis in Europe and should be properly tailored to the specific conditions in each country. Irrespective of any macroprudential measures, banks themselves should ensure that their provisioning practices and capital planning properly account for the deteriorating risk environment and are aligned with supervisory expectations. Moreover, to enhance resilience over the medium term, the focus should remain on improving the effectiveness of the macroprudential toolkit and faithfully implementing Basel III.

Persistent vulnerabilities in the non-bank financial sector and recurring liquidity challenges make it important to expedite the policy response. While the Financial Stability Board (FSB) is currently assessing the effectiveness of its 2017 recommendations on liquidity mismatch in open-ended investment funds,[1] concrete policy proposals have already been developed for reforming money market funds (MMFs) globally.[2] In the light of the vulnerabilities that surfaced in March 2020 and the latent risk of renewed stress in the MMF sector, it is important that legislative reforms for MMFs be implemented in the EU without delay. The policy response on open-ended funds should aim to significantly reduce vulnerabilities arising from liquidity mismatch by better aligning redemption terms with asset liquidity (Chapter 5 and Box 6). Enhancing the availability and use of anti-dilution liquidity management tools should be part of the policy response, but this should not be seen as a substitute for more structural measures, such as minimum notice periods or requirements targeting asset liquidity. Another key priority for the international work should be to develop a globally consistent approach for addressing risk from leverage – including synthetic leverage – in the non-bank financial sector. In addition, recent volatility in financial markets and associated liquidity challenges have again emphasised the need to improve margining practices and NBFI preparedness to meet margin calls in derivatives transactions. Since agreeing and implementing such regulatory reforms internationally will take some time, NBFI supervisors should pay particularly close attention at this time to credit risk, liquidity risk and leverage in NBFIs, and take an active role in strengthening resilience within their mandate and existing regulatory frameworks.

Overall, financial stability conditions have deteriorated further in the euro area since the May 2022 FSR. Upside risks to inflation, especially from energy prices, and downside risks to growth have increased and are coupled with uncertainty around the precise path for monetary policy normalisation, less fiscal space, more volatile financial markets and multiple geopolitical risks. Together, these developments amplify the risk of disorderly adjustments in financial markets and pressures in NBFIs, as well as increasing debt sustainability concerns for more-indebted households, firms and governments. These vulnerabilities could materialise simultaneously and possibly reinforce each other, increasing the risks to euro area financial stability. In this challenging environment, targeted macroprudential policy can still support banks’ resilience, while risks in the non-bank financial sector should also be addressed from a systemic perspective.

1 Macro-financial and credit environment

1.1 Recession risks rise on energy prices and tighter financial conditions

Recession risks for the euro area have increased as energy prices have soared. Mounting pressure from gas supply disruptions, supply chain disruptions, elevated energy prices and weaker global trade are weighing heavily on economic activity. Private sector forecasters have downgraded their growth expectations for 2023 (-0.1% vs 2% in May 2022) while inflation expectations have increased further (5.8% vs 2.4% in May 2022, Chart 1.1, panel a). Moreover, inflation outturns have continued to overshoot consensus expectations, resulting in a global tightening of financial conditions (Overview). There are pronounced downside risks to central growth expectations, as reflected in an elevated probability of recession for all major western economies in the year ahead. Moreover, the pandemic continues to be a source of uncertainty, as the winter season might be accompanied by new containment measures. As a result, euro area economic growth-at-risk estimates for the year ahead are at highly elevated levels (-2.5%, Chart 1.1, panel b).

Chart 1.1

Forecasters increase inflation projections and pair back growth prospects as recession looms

Sources: Consensus Economics Inc., Bloomberg Finance L.P., Eurostat and ECB calculations.

Notes: Panel b: growth-at-risk is the 5th percentile prediction of a quantile regression model estimated on a panel of euro area countries*. Explanatory variables include current GDP growth and indicators of cyclical systemic risk, financial stress (Country-Level Index of Financial Stress), the debt service ratio and economic sentiment.

*) See Lang, J.H., Rusnák, M. and Greiwe, M., “Medium-term growth-at-risk in the euro area”, Working Paper Series, ECB, 2022, mimeo.

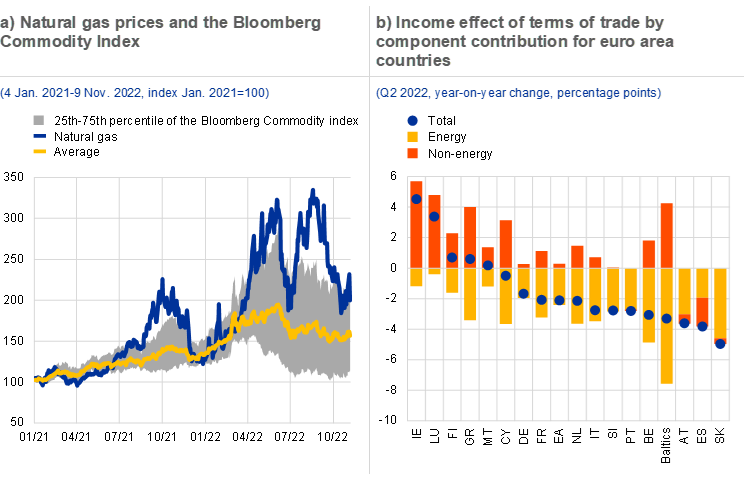

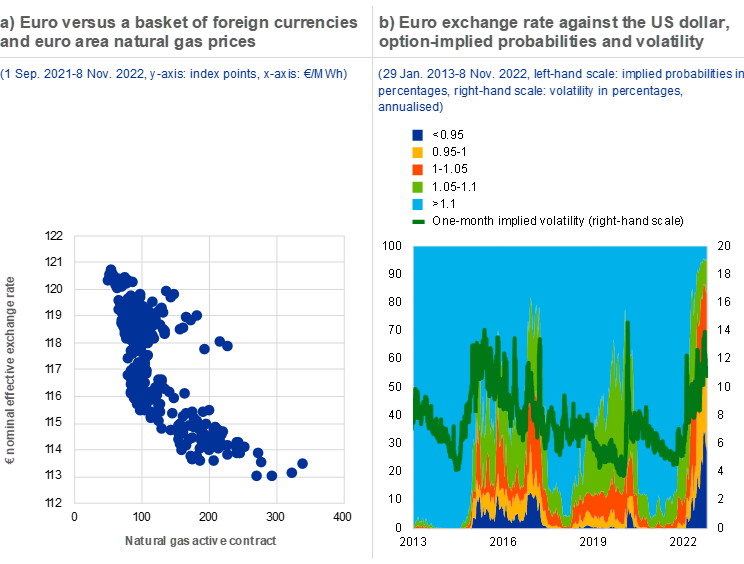

The severity of the energy crisis in the euro area has impacted the area’s terms of trade, weakening economic growth prospects. Although commodity prices have come down from their recent peaks, they remain elevated, particularly for natural gas and other energy commodities (Chart 1.2, panel a). As the euro area economy is a large net importer of energy, the euro area’s terms of trade have worsened in 2022. Maintaining import volumes at higher prices results in a transfer of purchasing power from the euro area to the rest of the world. This transfer has been more pronounced for euro area countries with more negative energy trade balances, because the composition of their exports does not allow such countries to benefit from positive terms of trade effects by exporting specific services, for instance (Chart 1.2, panel b). The negative income effect seems significantly larger in the euro area than in the United States and the United Kingdom, as these economies are less dependent on (net) energy imports.[3] This weaker trade position has also contributed to the sizeable depreciation of the euro’s exchange rate against its major global peers.

Chart 1.2

As a large net energy importer, the euro area economy faces deteriorating terms of trade, weighing further on growth prospects

Sources: Bloomberg Finance L.P., Eurostat and ECB calculation.

Notes: Panel a: the 25th-75th percentile range is calculated based on the Bloomberg commodity subindices. Panel b: the income effect of terms of trade is calculated by weighing export and import price changes by their respective previous-year values and considered as a percentage share of GDP.

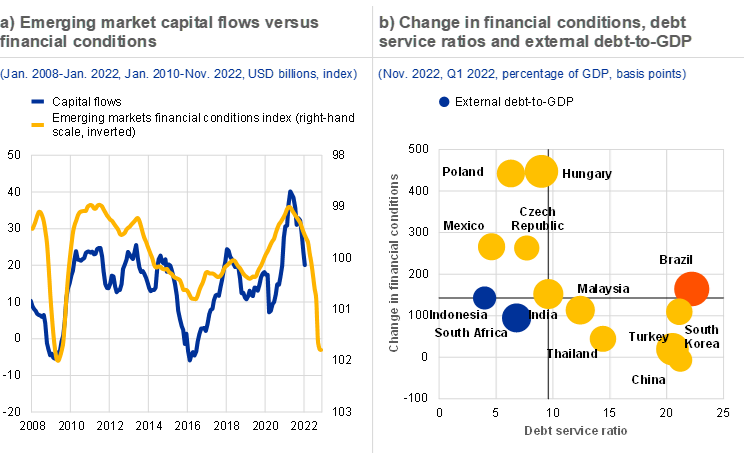

Globally, the fallout from the energy shock and the accompanying monetary policy normalisation has tightened financial conditions and increased risks for emerging market economies. The ongoing normalisation of accommodative domestic monetary policies amid a common inflation shock has led to a tightening of financial conditions and capital outflows for many emerging market economies (Chart 1.3, panel a). Sovereign spreads in emerging market economies have risen sharply, leaving the countries with a large share of foreign-owned or foreign currency-denominated debt vulnerable to a further tightening of financial conditions (Chart 1.3, panel b). Moreover, commodity-importing countries are under particular pressure from sustained high food and energy prices. As such, tail risks could materialise if there is a further deterioration in financial conditions or a prolonged period of high commodity prices.

Chart 1.3

Emerging market economies look increasingly vulnerable as global financial conditions tighten

Sources: IMF, Goldman Sachs, Bloomberg Finance L.P., Bank for International Settlements and ECB calculations.

Notes: Panel a: capital flows show the sum of equity and debt capital to Turkey, South Africa, Brazil, Chile, Mexico, Lebanon, Sri Lanka, India, Malaysia, Pakistan, the Philippines, Thailand, Bulgaria, China, Ukraine, Czech Republic, Slovakia, Estonia, Latvia, Hungary, Lithuania, Mongolia, Slovenia, North Macedonia, Poland and Romania*. The financial conditions index is shown as the six-month moving average. Panel b: debt service ratio as a percentage of GDP for the private non-financial sector, see the Bank for International Settlements database for the debt service ratios of the private non-financial sector. Orange bubbles reflect changes in financial conditions or debt service ratio above the median, red bubbles reflect both changes in financial conditions and debt service ratio above the median. Change in financial conditions reflect yearly change.

*) see Koepke, R. and Paetzold, S., “Capital Flow Data – A Guide for Empirical Analysis and Real-time Tracking”, IMF, 2020.

Stress in the Chinese residential real estate sector has risen in recent months, increasing the downside risks to the global economy. This is reflected in a continued contraction in residential real estate sales. In addition, strict pandemic containment policies continue to depress economic activity, which is forecast to grow at around 4% per annum in the period 2022-23, significantly below the long-term average of 8%. Although the government’s interventions have largely contained the fallout from the real estate sector so far, the combination of strict zero-COVID policies and limited fiscal space could undermine its ability to manage future shocks. All in all, these developments add further downside risks to global economic prospects, with potentially significant spillovers to the euro area.[4]

In sum, both the global and the euro area economy are facing a turbulent period, with risk stemming from tighter financial conditions, high indebtedness and soaring prices. Global economies are facing a historic inflation shock, while growth prospects have materially weakened and there are further pronounced downside risks to growth. High energy prices and tighter financial conditions are translating increasingly into financial market volatility, a weakening outlook for corporate earnings and a deteriorating fiscal outlook (Sections 1.2 and 1.3). Against this background, the risks stemming from exposing vulnerabilities to financial stability have increased since the previous issue of this review.

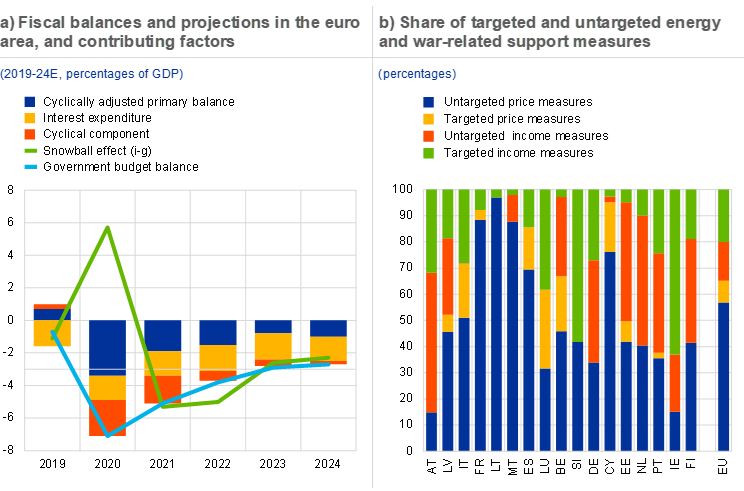

1.2 More constrained fiscal space available to cushion the economy

Fiscal positions have been weakened by the economic outlook, the impact of the war in Ukraine and a further tightening of financial conditions. The euro area budget balance is expected to improve steadily in the period to 2024, but by less than foreseen in May (Chart 1.4, panel a). The budget balance for this year is expected to be -3.8% of GDP (versus -3.1% forecast in May) and by 2024 is expected to be -2.7% of GDP (versus -2.3% forecast in May). Fiscal assumptions and projections are currently surrounded by a high degree of uncertainty, given the elevated macroeconomic risks and the wider fallout from the Russian invasion of Ukraine. Moreover, it is estimated that the total fiscal stimulus related to reducing the impact of the war and the energy crisis on households and corporations will increase to at least 1.4% of GDP in 2022.[5] This sizeable stimulus follows pandemic-related support measures which were only just being wound up. Most of these measures are untargeted (Chart 1.4, panel b). Ideally, support measures should become more targeted and should aim to cushion the parts of the economy most affected by the current energy crisis.

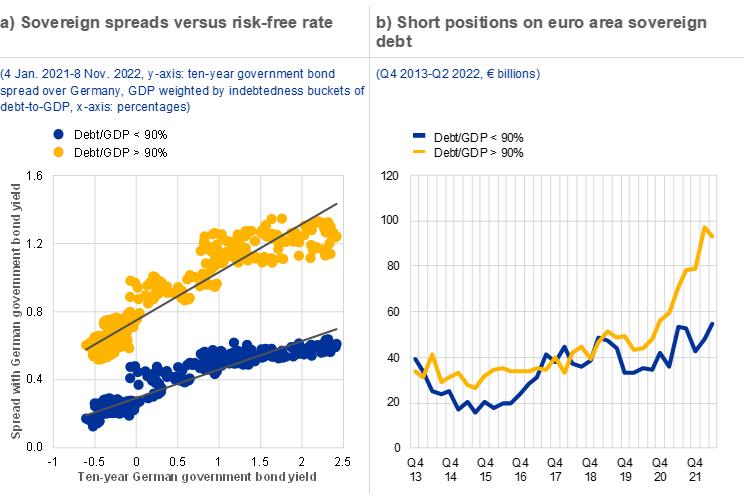

Sovereign financing conditions have tightened significantly as credit risk premia have increased. Government bond yields have increased sharply since the previous issue of the Financial Stability Review, but so far government bond spreads have moved steadily in line with risk-free rates. Moreover, measures of sovereign stress – such as the ECB Sovereign Systemic Stress Composite Indicator – have shown a significant increase, but higher-debt countries have not been any more affected than other euro area countries. At the same time, debt servicing needs remain elevated, with some euro area countries facing refinancing and interest expenditure of around 40% of GDP over the next two years (Chapter 2).[6] Moreover, the increase in interest rates is weighing more heavily on fiscal positions than previously anticipated. As such, a further deterioration in financial conditions could change market sentiment towards some of the more vulnerable euro area sovereign issuers (Box 1).

Rollover risks are elevated but are currently being kept in check by several other structural factors. Although rollover risks have increased, sovereigns might be more resilient to deteriorating financial conditions than they were during the previous hiking cycle for a number of reasons. First, the lengthening of the maturity of the outstanding debt stock means that principal repayment needs are about 15% lower than they would have been for running the same amount of debt against the maturity profile in 2010.[7] Second, although yields have been increasing, the average interest paid on outstanding government debt for most euro area sovereigns is still hovering around record lows (1.6% in September 2022). Finally, the Transmission Protection Instrument partly reduces the risk of there being an unwarranted increase in risk premia.

Chart 1.4

Public finances are challenged by a slowing economy, tighter financial conditions and the need for additional support measures

Sources: September 2022 ECB staff macroeconomic projections and European Commission.

Notes: Panel a: the grey line depicts the 3% of GDP budget deficit threshold set in the Maastricht Treaty. The data refer to the aggregate general government sector of euro area countries. The fiscal stance is adjusted for the impact of Next Generation EU grants on the revenue side. The cyclical component refers to the impact of the economic cycle as well as that of temporary measures implemented by governments and includes one-off revenues and one-off capital transfers. For the snowball effect, i-g stands for interest rate-growth differential. Panel b: figures represent the shares of different types of measures in 2022 as at 31 October 2022, “price measures” are those that have a direct impact on the marginal cost of energy consumption, “income measures” are those providing temporary income support to households or (non-price) compensations to firms, “targeted” refers to measures specific to vulnerable households or firms.*

*) See Bethuyne, G., Balcerowicz, W. and Erdei. M., “Budgetary policy measures to mitigate the impact of high energy prices on households and firms: methodology and budgetary impact”, European Commission, November 2022.

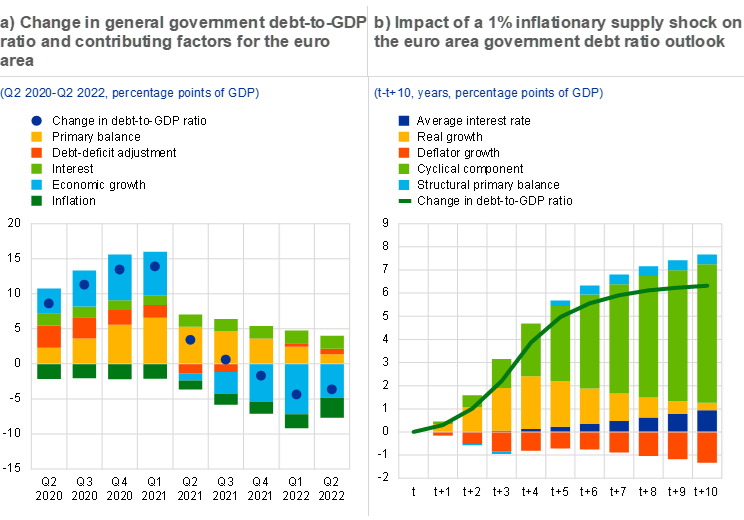

Despite the sizeable deficits, higher nominal GDP and a favourable snowball effect have helped to place government debt-to-GDP ratios on a declining trajectory. Euro area debt-to-GDP is projected to decline from 95.6% of GDP in 2021 to 89.9% in 2024, thereby remaining significantly above pre-pandemic levels (84%). The expected decline is driven mainly by expectations of a favourable interest rate-growth differential because of high nominal GDP growth, which should more than offset the persisting, albeit decreasing, primary deficits. Moreover, sovereign debt ratios have benefited from a declining real debt burden owing to first round effects (a favourable denominator effect, Chart 1.5, panel a)[8]. However, higher than expected inflation could contribute to deteriorating debt servicing capacity, even as inflation may reduce the real value of outstanding debt.[9] As such, risks to sovereign indebtedness are to the upside as a stagnating economy and higher-than-anticipated deficits might turn debt dynamics less favourable.

Chart 1.5

Inflation is currently reducing debt ratios, but could prove more detrimental to debt dynamics in the medium term if driven by an external supply shock

Sources: ECB and ECB calculations.

Notes: Panel a: the debt-deficit adjustment captures the effects of the accumulation or sale of financial assets*. Inflation reflects the difference between real and nominal GDP, i.e. the GDP deflator. Panel b: the shock is calibrated to lead, in the absence of any monetary policy reaction, to a 1 percentage point increase in HICP inflation over three years. It is designed as a series of unexpected cost-push shocks originating in the rest of the world on their export of goods. This shock is analysed using the Euro Area and Global Economy (EAGLE) model, a multi-country dynamic stochastic general equilibrium model calibrated for the euro area’s four biggest countries, the rest of the euro area and the rest of the world. To limit the substitutability between goods imported from the rest of the world and euro area tradable goods, the elasticity has been lowered to take into account the high dependency of euro area countries on commodities imports. This calibrated parameter in EAGLE was lowered from 1.5 to 0.9 to reflect this dependency of euro area economies on some commodities imports.

*) Kezbere, L. and Maurer, H., “Deficit-debt adjustment (DDA) analysis: an analytical tool to assess the consistency of government finance statistics”, Statistics Paper Series, No 29, ECB, November 2018.

In a downside scenario, an inflationary supply shock originating from outside the euro area could prove particularly detrimental for public debt developments. An external supply shock could prove to be particularly unfavourable for public finances in the medium term. Simulations considering a stylised 1% inflationary supply shock show that the negative impact on economic activity might outweigh the positive impact of higher inflation on debt ratios (Chart 1.5, panel b). Despite the positive impact of inflation (indicated by a debt-reducing contribution of deflator growth), the decline in real growth, higher interest payments and a deteriorating cyclical budgetary component would contribute to a debt-to-GDP level that would be almost six percentage points higher over a ten-year horizon compared with the benchmark scenario. Although the currently observed shock is much more complex and involves additional demand components, its strong supply component may slow and, in some countries, even reverse the decline in sovereign debt ratios anticipated by the current benchmark scenario.

The fiscal space available to cushion the economy from an economic downturn is becoming more limited. Looking ahead, fiscal policy will be affected by both exposure to the war and the slowdown in economic activity. Moreover, a further inflationary shock driven by factors outside the euro area economy might be particularly bad for sovereign indebtedness, causing sovereigns to have less resilience to increasing debt service costs. For these reasons, the fiscal space available to cushion the economy from an economic downturn is becoming more constrained. Moreover, although the current support measures have helped to prevent tail risks from materialising during the COVID-19 pandemic, they would ideally be replaced by more targeted measures supporting those firms and households most impacted by the energy crisis. All in all, these adverse developments could trigger a reassessment of sovereign risk by market participants and reignite pressures on more vulnerable sovereigns (Box 1).

Box 1

Euro area spread divergence, risk premia and financial stability[10]

When financial fragmentation becomes a self-reinforcing dynamic, it can present a risk to financial stability.[12] As long as market functioning is orderly, credit spreads reflect macroeconomic fundamentals and risks. However, history has shown that spread-widening dynamics can become self-reinforcing. In the euro area, such adverse market dynamics have often been termed “fragmentation”. This is often associated with impaired market liquidity conditions, ultimately resulting in impaired market functioning. In such conditions spread differences may start to diverge from fundamentals. However, differences in spreads alone do not necessarily point to fragmentation (Figure A).

More1.3 Corporate resilience tested by energy price and borrowing costs

Following the sharp recovery and high profits seen over the past year, euro area corporates now face stagnating activity and tightening financial conditions. Backward-looking measures of aggregate corporate vulnerabilities have remained below their long-run average, with surprisingly strong gross profits (8% above pre-pandemic levels in the second quarter of 2022). Additionally, public support measures implemented by governments have helped to mitigate the adverse effects of the COVID-19 pandemic. Moreover, despite the overall tightening of financial conditions, lower indebtedness and a high interest coverage ratio are keeping corporate vulnerabilities below their long-term average (Chart 1.6, panel a). However, corporates are facing new challenges and corporate vulnerabilities are expected to increase above their long-run average over the coming quarters because of a worsening interest coverage ratio, higher financing costs, fading activity and higher leverage. Moreover, small and medium-sized firms (SMEs) have benefited less from the rebound in economic activity, as survey indicators suggest that their profitability is still lagging that of large corporations (Chart 1.6, panel b). These firms might be at a higher risk of insolvency if economic activity surprises to the downside and financial conditions tighten further.

Chart 1.6

Corporate vulnerabilities are expected to increase, especially for SMEs

Sources: Eurostat, Quarterly Sector Accounts, the ECB’s survey on the access to finance of enterprises (SAFE), H1 2022.

Notes: Panel a: positive values indicate higher vulnerability while negative values indicate lower vulnerability* Panel b: the chart refers to rounds 3-26 of the SAFE survey (from March 2016-September 2016 to October 2021-March 2022). Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease. The data included in the chart refer to Question 2 of the survey.

*) For the construction of the index in more detail, see the box entitled “Assessing corporate vulnerabilities in the euro area”, Financial Stability Review, ECB, November 2020.

The sharp increase in energy prices may challenge certain business models and may negatively impact the competitiveness of euro area firms. Business confidence has started to decline in those sectors that are most energy intensive (Chart 1.7, panel a). At the same time, the ECB’s bank lending survey and hard data on bank loans show that loan demand has increased strongly for short maturities, reflecting the increased need for firms to cover higher production costs (Chart 1.7, panel b).[13] This is also reflected by the larger increase in leverage for sectors with a high exposure to commodities (Chart 1.7, panel c). Going forward, it might become difficult to sustain high output prices as economic activity stagnates while supply pressures remain. Moreover, as the euro area is a large net importer of energy, the current energy price shock – and in particular higher gas prices in the euro area – is negatively impacting the competitiveness of euro area firms. Producers therefore might have less pricing power than their international competitors to pass on higher costs and input prices to end users (Section 1.1). This has put some corporates in a vulnerable position, particularly those with elevated debt service needs, high energy use and fixed contractual obligations.

Chart 1.7

Business prospects look bleaker for sectors with high energy intensity as corporates take on more debt to cover the cost of doing business

Sources: European Commission, OECD (Trade in Value Added database (2018)), Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: direct and indirect energy use is measured by the share of input from mining and quarrying, energy-producing products, coke and refined petroleum products and the electricity, gas, steam and air-conditioning industries for each sector, classified according to the United Nations International Standard Industrial Classification for All Economic Activities, Rev. 4. Panel b: “actual” values are changes that have occurred while “expected” values are changes that are expected by banks. Net percentages for the questions on demand for loans are defined as the difference between the sum of the percentages of banks that responded “increased considerably” and “increased somewhat” and the sum of the percentages of banks that responded “decreased considerably” and “decreased somewhat”. Panel c: commodity exposure is calculated as the market beta of the sector EURO STOXX subindex of the Bloomberg Commodity Index over the period Jan. 2015-Sep. 2022.

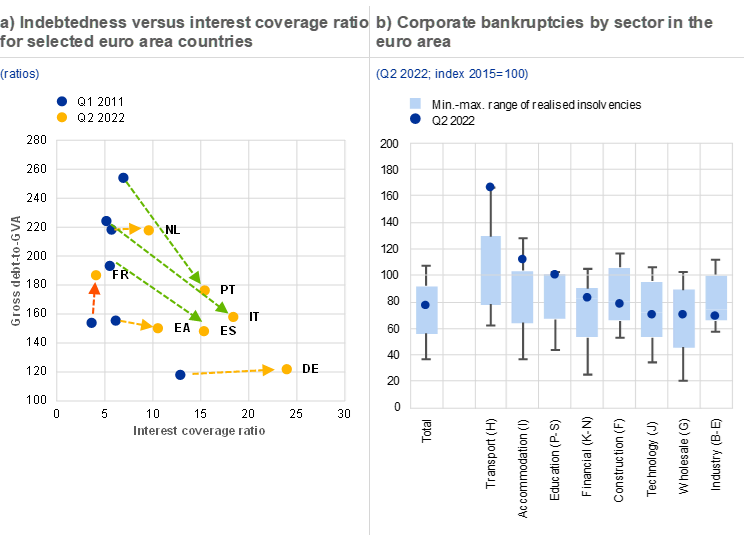

Tighter financing conditions have impacted firms’ debt servicing costs and might increase credit risk for more vulnerable firms. Corporate financing conditions have deteriorated as monetary policy has normalised and both markets and banks have reassessed the risks surrounding corporate activity (Chapter 2). Moreover, the shift from bank loans towards market-based funding seen since the financial crisis is currently helping to ensure that tightening financing conditions are having a more direct impact on corporate debt service ratios than was the case a decade ago.[14] As a result, the cost of debt has increased sharply in recent months.[15] Banks are also anticipating a further net tightening of credit standards in the future, reflecting the uncertain economic outlook (Chapter 3). This may be particularly concerning for the cohort of firms that exited the pandemic with higher debt levels, subdued earnings and lower liquidity buffers. At the same time, corporate balance sheets in most euro area countries are currently healthier than they were during previous rate hiking cycles. Gross debt and interest coverage ratios have improved, in particular for countries which started with higher debt levels in the non-financial corporate sector (Chart 1.8, panel a). Non-financial corporate debt levels declined to 150% of gross value added (GVA) in the second quarter of 2022 but remain above the 148% of GVA recorded before the pandemic.

Chart 1.8

High interest coverage ratios and lower debt levels give corporates some resilience as insolvencies remain low

Sources: ECB, Eurostat and ECB calculations.

Notes: Panel a: consolidated gross debt is defined as the sum of total loans granted to non-financial corporations net of intra-sectoral lending, debt securities issued and pension liabilities. The interest coverage ratio is defined as the ratio of gross operating surplus to gross interest payments before the calculation of financial intermediation services indirectly measured (FISIM). Panel b: minimum-maximum range calculated over the period Q1 2015-Q2 2022.

Insolvencies have remained well below their pre-pandemic levels, although they have increased in some economic sectors. Insolvencies remained below their long-term average in the second quarter of 2022 (Chart 1.8, panel b). At the same time, insolvencies in those sectors most heavily impacted by the pandemic remain above their long-run average. Moreover, forward-looking measures for insolvencies signal elevated insolvency risk for those sectors impacted by the current energy crisis, such as transport and industry. As such, insolvencies could rise in those sectors most affected by the current energy crisis and have not yet fully recovered from the impact of the pandemic.

All in all, corporate vulnerabilities have increased given that financial conditions are tightening, the cost of doing business remains high and economic activity is stagnating. Structural factors might mean the average corporate is in better health than it was during previous hiking cycles, providing corporates with some resilience to weather the current tightening of financial conditions. However, the uneven impact along the cross-section of firms during both the pandemic and the current energy crisis might imply that an economic recession could have more severe consequences for financial stability than this aggregate picture suggests. As such, defaults could increase going forward, with potential knock-on effects on bank balance sheets and household employment prospects.

1.4 Household vulnerabilities, previously contained, are rising

High inflation and fears of recession are clouding euro area households’ economic outlook. As households are increasingly worried about their future amid rising living costs and concerns over an economic downturn, consumer confidence and households’ expectations of their future financial situation have reached new historical lows (Chart 1.9, panel a). While buoyant labour markets, with a historically low unemployment rate of 6.6% in September 2022, have so far supported household incomes, inflation is continuing to squeeze their real disposable incomes. Higher spending on non-durables such as food and gas have shaped the rebound in consumer expenditures, but this mostly reflects higher prices (Chart 1.9, panel b). As the high savings rate seen during the pandemic normalises, households’ ability to cushion further price increases is gradually decreasing. Due to downturns in financial markets, households’ net worth has started to decline, standing at 750% of disposable income in the second quarter of 2022, down over 25 percentage points in the first half of the year.

Chart 1.9

Consumer sentiment is falling further amid continued high inflation, despite labour market strength supporting households

Sources: European Commission, Eurostat, ECB and ECB calculations.

Notes: Panel a: the latest data for the unemployment rate refer to September 2022.

Household borrowing has remained robust, although there are increasing signs it has reached a turning point. Household indebtedness has remained broadly stable, decreasing slightly to just under 97% of disposable income in the second quarter of 2022, although the figures vary greatly across countries. So far, credit provision to households has held up. Growth in lending for house purchase as well as consumption has remained stable in recent months, with September showing growth of 5.1% and 3.7% respectively, but the upward trend appears to have come to a halt (Chart 1.10, panel a). However, with interest rates on household credit having increased sharply in the wake of monetary policy normalisation and banks reporting a tightening of credit standards as well as a reduction in loan demand from households, a further moderation of lending volumes is likely.

Chart 1.10

Households’ indebtedness remains stable while interest rates have increased sharply

Sources: ECB (MFI Interest Rate Statistics, MFI Balance Sheet Items), Eurostat (Quarterly Sector Accounts) and ECB calculations.

Notes: Panel a: the latest data for the gross debt-to-income ratio refer to the second quarter of 2022. Panel b shows the share of new credit flows with initial interest rate fixation for more than five years of new lending to households for house purchase, consumption and other purposes, including renegotiations. The cost of borrowing is the average of interest rates on new lending to households for house purchase, consumption and other purposes, weighted by new lending volumes.

As interest rates rise, some households’ debt servicing capacity may suffer. In the low interest rate environment of the last decade, the share of new loans with interest rate fixation periods of more than five years has increased steadily in many countries, reaching almost 70% across the euro area in the first half of 2022. This has shielded many households from having their existing debt repriced at higher interest rates in the short term. However, following the sharp increase in interest rates the share of new loans with longer interest rate fixation periods has started to decline in a number of countries (Chart 1.10, panel b). Households may therefore become more exposed to interest rate risks in the medium term. As a further tightening of credit standards is expected, a cohort of households at the lower end of the income distribution – who may have high individual indebtedness, but overall account for a low share of aggregate debt – and a cohort of those that used low interest rates to exhaust their borrowing capacity may be at risk of falling into distress (Special Feature B).

Overall, vulnerabilities among households have increased further, although there are some resilience factors. While excess savings have been re-absorbed by inflation and net wealth has started to decline, the aggregate household balance sheet remains resilient and households are benefiting from the current strength of labour markets. At the same time, rising inflation is weighing on households’ real incomes and consumption, which could slow the economy’s growth path. Some households may have to limit consumption or become dependent on government support. Such vulnerabilities could worsen should labour market conditions deteriorate. The immediate effect of the rapid increase in interest rates on households’ debt servicing capacity is being mitigated by the longer interest rate fixation periods which have benefited many households in recent years. In the medium term, vulnerabilities could be exposed and debt servicing capacity could deteriorate, especially in countries where residential properties are overvalued, debt levels are elevated and household debt is prevalently at variable interest rates.

1.5 Vulnerable real estate markets may be at a turning point

Euro area residential real estate (RRE) markets have shown strong price and lending growth, but forward-looking indicators suggest a slowdown. Nominal house prices grew 9.3% at the euro area aggregate level in the second quarter of 2022 – a slightly lower rate than in the previous quarter (Chart 1.11, panel a). This strong growth led to increasingly stretched valuations in some euro area countries as house price dynamics exceeded the fundamentals. The stock of housing loans has continued to show stable growth, but the record steep increase in borrowing costs since the beginning of 2022 and the expected further tightening of financial conditions are likely to reduce demand for new loans going forward (Chart 1.11, panel b). Euro area households have also declared they are less likely to buy or build a home whilst a lower share of construction companies expect construction prices to increase and the residential construction PMI reflects a weakening of activity in this sector. As demand slows, the construction sector could come under pressure, potentially resulting in rising defaults and declining investment. Monthly data indicate that in some national RRE markets prices have been falling month-on-month since late summer.

Chart 1.11

RRE prices and lending have continued to show strong growth but forward-looking indicators point to a moderation in RRE prices

Sources: ECB, European Commission, S&P Global Market Intelligence and ECB calculations.

Notes: Panel a: the latest observation for RRE price growth is for the second quarter of 2022. Panel b: expected credit standards and demand refer to loans for house purchase. Intention to buy a house and construction companies’ price expectations are shown in standard deviations from long-term averages. Residential construction PMI is shown in standard deviations from 50, the level which demarcates expansionary (above 50) and contractionary (below 50) territory.

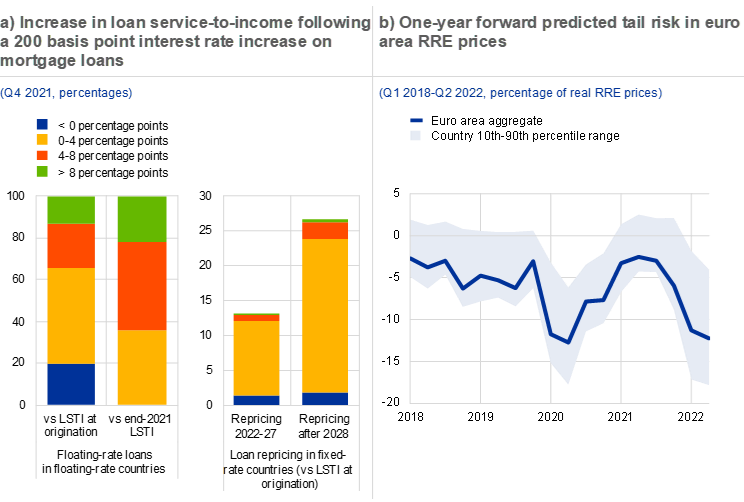

Higher interest rates will increase households’ debt servicing costs, with the speed of impact differing according to mortgage type. Between the beginning of the year and September 2022, interest rates on mortgage loans increased by over 110 basis points at the euro area level. Simulations using loan-level data from securitised mortgage loans from the end of 2021 show that an increase in interest rates of 200 basis points would lead to an increase in the loan servicing-to-income ratio of below eight percentage points for most loans (Chart 1.12, panel a). For floating-rate loans there would be a near-term increase in debt service burdens from recent very low levels. However, many households have benefited from falling debt service in recent years, when interest rates were decreasing. For fixed-rate loans the impact of higher interest rates would be seen mainly after 2027, as interest rate fixation periods would shield the existing debt of many households from higher interest rates for several more years.

The downside risks to euro area RRE prices have increased. Short-term downside risks to RRE prices have increased significantly, as reflected in the pronounced fall in RRE prices-at-risk in the first two quarters of 2022 (Chart 1.12, panel b). This potential decline in RRE prices in an adverse scenario is heterogenous across the euro area, with countries where valuations are more stretched generally facing a higher risk of a severe correction in RRE prices.[16] Such a pronounced downturn remains a tail risk as households have generally benefited from favourable labour market conditions and borrower-based macroprudential policy measures and the increasing share of fixed-rate mortgages has increased the resilience of borrowers in many countries in recent years.

Chart 1.12

The steep increase in borrowing costs might challenge some households’ debt servicing capacity while downside risks to RRE prices have increased significantly

Sources: ECB, European DataWarehouse GmbH and ECB calculations.

Notes: Panel a: loans originated in the period 2012-20. The shock to interest rates is calculated over December 2021 levels. Based on data available for Belgium, Germany, Ireland, Spain, France, Italy, the Netherlands and Portugal. The chart uses information on securitised mortgage loans alone (potentially resulting in selection bias) and may therefore not be an accurate reflection of national mortgage markets. Belgium, Germany, France and the Netherlands are classified as fixed-rate countries while Ireland, Spain, Italy and Portugal are classified as variable-rate countries. The total is weighted by GDP. Further details on the methodology underlying this analysis can be found in the article entitled “Gauging the sensitivity of loan-service-to-income (LSTI) ratios to increases in interest rates”, Macroprudential Bulletin, Issue 19, ECB, October 2022. LSTI stands for loan service-to-income. Panel b shows the results from an RRE price-at-risk model based on a panel quantile regression on a sample of 19 euro area countries. The chart shows the 5th percentile of the predicted RRE price growth for the euro area aggregate and the 10th-90th percentile range of this estimate across individual euro area countries. Further details on the methodology can be found in the article entitled “The analytical toolkit for the assessment of residential real estate vulnerabilities”, Macroprudential Bulletin, Issue 19, ECB, October 2022.

Following some stabilisation from late 2021 to early 2022, forward-looking indicators are also pointing to a deterioration in commercial real estate (CRE) markets. While price index dynamics for the second quarter of 2022 remain broadly stable, there has been a sharp rise in both the share of investors who view the market as being in the downturn stage of the cycle and the share of investors who view CRE assets as overvalued. In addition, the vast majority of euro area CRE investors are now reporting a deterioration in financing conditions (Chart 1.13, panel a). This has coincided with a sharp rise in interest rates on new loans to non-financial corporations (Section 1.3) and a deterioration in financing conditions for real estate firms in both bond and equity markets. Survey data have also reported a sharp drop in investor demand across all CRE sectors. Market intelligence attributes this to the wait-and-see approach adopted by investors facing uncertainty on the future path of financing conditions, inflation and the macro-financial environment (Chart 1.13, panel b).

Chart 1.13

Forward-looking indicators also point to the possibility of another deterioration in CRE market conditions

Sources: RICS and ECB calculations.

After a long period of rapid expansion, euro area real estate markets may have reached a turning point. Rising interest rates and forward-looking indicators are generally pointing to a moderation in RRE markets, but short-term downside risks have also increased, especially in those countries where debt levels are elevated and properties might be overvalued. CRE markets face similar headwinds, suggesting that the divergence between the two markets seen since the start of the coronavirus (COVID-19) pandemic may be coming to an end. A pronounced correction in CRE markets could have an adverse effect on the wider financial system and the real economy. This is because financial institutions may suffer from direct losses, increased credit risk and declines in collateral values, which could limit their ability to provide financing to non-financial corporations and which may be exacerbated through negative feedback loops.

2 Financial markets

2.1 Markets are fragile amid heightened macroeconomic uncertainty

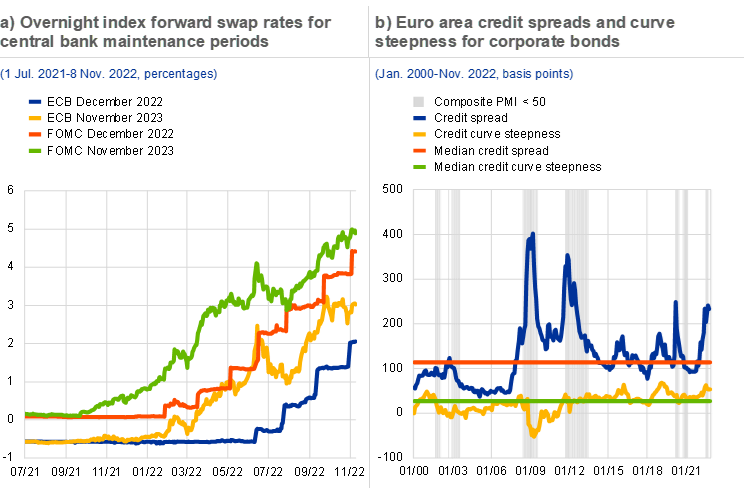

The risk of financial market conditions turning disorderly has increased, against a backdrop of elevated inflation, growing recession fears and tighter global financial conditions. While inflationary pressures have risen, the growth outlook has weakened (Chapter 1). Markets for interest rates have shown elevated volatility, as market participants are continually adjusting their expectations with regard to the path of monetary policy.[17] Central bank communications and key economic and inflation data releases have, at times, been followed by relatively large adverse price moves across asset classes.[18] Expectations with regard to the path of policy rates, as seen through the lens of markets, have adjusted towards more frontloaded rate hikes in 2022 but fewer additional hikes in 2023 (Chart 2.1, panel a). Such central bank tightening while growth is slowing – in contrast to the monetary policy easing seen during previous episodes of weak growth – may add to downside pressures on risky-asset valuations. Also, while recent corrections in asset prices have been orderly, there is now an elevated risk of market dynamics turning disorderly.

Chart 2.1

Central banks react to inflation despite signs of looming recession risk

Sources: Bloomberg Finance L.P., Refinitiv, S&P Global Market Intelligence and ECB calculations.

Notes: Panel a: FOMC stands for Federal Open Market Committee. Panel b: credit spreads are based on the index-level option-adjusted spreads for ICE Bank of America indices for investment-grade euro-denominated corporate bonds. Credit curve steepness is computed as the spread-difference between the index covering the longer five-to-seven-year maturities and the index covering the shorter one-to-three-year maturities.

Market developments also reflect heightened recession fears, although there is still much uncertainty. The US Treasury yield curve shows a relatively strong inversion while the German government bond yield curve has flattened considerably: for the United States, inversion is frequently considered to indicate a higher risk of recession.[19],[20] The euro area may be especially vulnerable to recession risk due to its energy import dependence (see below and Chapter 1).[21] Euro area corporate bond spreads have become more elevated (Chart 2.1, panel b). At the same time, corporate bond credit curves remain upward sloping. During economic downturns, credit curves have, historically, tended to invert or flatten considerably.

The recent corrections in risky-asset valuations may have largely been driven by interest rates increases, and asset prices might still be stretched given the current outlook. Asset pricing theory implies that an asset’s fair value reflects the present discounted value of its expected future cash flows. When risk-free rates and risk premia increase, the present value of future cash flows falls. Risk premia tend to increase when risk-free rates increase, further eroding the value of risky assets (Chart 2.4, panel a).[22] Euro area equity prices declined as rates increased (Chart 2.2, panel a) and further (unexpected) rate increases could trigger additional corrections in risky-asset valuations. Given the importance of risk-free rates for the valuation of most assets, asset prices have also shown relatively strong co-movements across different asset classes. This stronger co-movement complicates hedging strategies and could lead to larger than expected and more frequent losses (Box 2).

Volatility in interest rate markets has been high, after both realised and expected inflation rates exceeded central bank targets. Risk-free rates depend strongly on the expected path of central bank policy rates. In a context of inflation running substantially above central bank targets, market participants have become more sensitive to news that could affect the policy rate path and realised interest rate volatility has increased markedly (Chart 2.2, panel b). More broadly, the combination of high government debt levels and elevated fiscal pressures (Chapter 1) and a less accommodative monetary policy stance puts further stress on interest rate markets. Rapid changes in interest rates can cause strains in markets and challenge financial institutions through, for example, margin calls on interest rate derivatives. An example of such strains is given by the recent turmoil in the UK’s sovereign bond market, which erupted in September after a new budget was proposed. Non-bank financial institutions, notably pension funds, came under liquidity pressures from margin calls on interest rate derivatives and leveraged positions on government bonds. This also underpins the importance of liquidity preparedness for non-bank financial institutions, especially when leverage is used (Chapter 4 and Chapter 5).

Chart 2.2

Risky-asset valuations fell as rates increased and interest rate volatility increased markedly as inflation exceeded central bank targets

Sources: Bloomberg Finance L.P. and ECB calculations.

Notes: Panel a: equity index performance is based on the EURO STOXX index price change relative to 1 January 2022. The real risk-free rate is the difference between the ten-year German government bond yield and the ten-year German government bond inflation breakeven rate. Data points between 24 February and 1 April 2022 are marked in yellow to indicate the market reaction to the invasion of Ukraine. On 4 April 2022 the VSTOXX fell below 30 points for five consecutive days for the first time since the start of the invasion, indicating a (partial) recovery of risk sentiment. During the preceding period, markets could be characterised by “risk-off” sentiment, whereby equities temporarily underperform and rates outperform. Such a period thus results in a temporary deviation in the scatter plot in the bottom-left direction, during which the relationship between rates and equity prices is positive. Panel b: OIS stands for overnight index swap.

Market liquidity in bond markets has been relatively poor recently, increasing the likelihood of disorderly market dynamics taking hold. Market liquidity affects the ease with which market participants can buy or sell assets without making large price concessions. Elevated bid-ask spreads suggest that euro area bond markets have become more illiquid (Chart 2.3, panel a). US Treasury markets are also showing signs of increased frictions (Chart 2.3, panel b). Market liquidity can deteriorate quickly in times of stress, amplifying the risk of fire sale dynamics taking hold (Chapter 4).

In summary, while recent market corrections have been relatively orderly, market dynamics may turn disorderly in the event of further adverse shocks. In the context of increased recession risk, tightening financial conditions, high volatility and signs of lower liquidity in rates and credit markets, further adverse shocks are more likely to trigger a disorderly correction in risky-asset valuations. Adverse shocks may also be more likely owing to high levels of economic and macro-financial uncertainty. Triggers could emanate from the continued stresses in the Chinese economy, emerging market vulnerabilities and geopolitical developments.[23]

Chart 2.3

Market liquidity deteriorated in US Treasury and euro area bond markets

Sources: S&P Global, Refinitiv and ECB calculations.

Notes: Panel b: the spline spread deviation is the average distance in basis points of individual bonds’ yield deviations from a smooth yield curve fit – a spline fit. In an efficient and liquid market, larger deviations from such a smooth curve would likely disappear through arbitrage. A failure-to-receive can occur in the post-trade process if the seller of a security does not manage to deliver that security to the buyer. The failure-to-receive metric covering the number of settlement failures for US Treasury primary dealers is not technically a liquidity metric, but instead indicates market frictions in a broader sense.

2.2 Debt issued by more-indebted sovereigns and firms poses vulnerabilities