- RESEARCH BULLETIN NO. 89

- 24 November 2021

Bank leverage constraints and bond market illiquidity during the COVID-19 crisis

The outbreak of the coronavirus (COVID-19) pandemic led to heightened uncertainty and a “dash-for-cash” in March 2020. Investors moved out of risky assets and into safe assets. The mutual fund sector in particular was hit by unprecedented investor redemptions and faced fire sale pressure as a result. Typically, banks that engage in securities trading – dealer banks – absorb such bond sales, supporting market liquidity, but regulation may limit their ability to do so by requiring them to maintain a certain leverage ratio. In recent research, we analyse the role of bank leverage constraints as an amplifier of bond market illiquidity during the March 2020 crisis. Our analysis links mutual funds bond holdings to dealer banks and their leverage constraints. We document that mutual funds that were holding more bonds exposed to dealer bank constraints in their portfolio faced bigger selling pressure in March 2020. We provide supplementary evidence that bank leverage constraints affect bond liquidity, using the introduction of leverage ratio regulation in the euro area.

Introduction: causes of market stress in March 2020

When the coronavirus (COVID-19) crisis hit in March 2020, bond markets faced a large sell-off. The sell-off was partially driven by mutual funds that suffered investor redemptions (see e.g. Falato, Goldstein and Hortaçsu (2021) and Breckenfelder, Grimm and Hoerova (2021)).

To satisfy redemptions, mutual funds had to sell some of their assets, mostly bonds. Typically, dealer banks absorb such pressure from fire sales, but this did not seem to happen in March 2020, leading to stress in even the most liquid markets such as the US Treasury market.

Market stress in March 2020 has been linked to a variety of factors. One such factor is that of dealer bank balance sheet constraints due to leverage ratio regulation (see e.g. Duffie (2020) and He, Nagel and Song (2020)). Leverage ratio regulation requires banks to hold capital against all on- and off- balance sheet exposures, regardless of their risk. This regulation may lead dealer banks to reduce balance sheet space available for market-making owing to low margins. Less market-making by banks can manifest itself in market illiquidity, particularly during stress episodes (Bao, O’Hara and Zhou (2018) and Dick-Nielsen and Rossi (2019)).

The importance of the leverage ratio as a contributing factor to the market stress was underscored by the US Federal Reserve’s move to temporarily change its supplementary leverage ratio rule on 1 April 2020 to “ease strains in the Treasury market resulting from the coronavirus and increase banking organizations’ ability to provide credit to households and businesses”.[2]

In Breckenfelder and Ivashina (2021), we provide an empirical perspective to answer the following question: did bank leverage constraints amplify bond market illiquidity during the March 2020 crisis?

Did bank leverage constraints amplify bond market illiquidity in March 2020?

The large outflows from mutual funds (“runs”) in March 2020 provide a key economic setting to study the role of dealer banks’ balance sheet constraints in propagating financial fragility by amplifying the run dynamics and sell-offs. The specific mechanism at play for mutual funds was articulated by Goldstein, Jiang and Ng (2017), and more recently by Ma, Xiao and Zeng (2020). The basic idea is that runs on some classes of assets expose mutual funds holding such assets to significant fund outflows. To satisfy outflows, funds are forced to sell off assets.

Identifying links between bonds and dealer banks

To document the above dynamics, our analysis links mutual funds and their bond holdings to dealer banks and their leverage constraints. We link individual bonds to dealer banks by exploiting two economic mechanisms. The first is related to the fact that the bulk of a country’s bonds are likely to be transacted by that country’s domestic dealer banks. The second stems from the fact that if Bank A was the underwriter of the Firm B bond issue, it is very likely that Bank A is also the key dealer for these bonds long after the initial placement. This allows us to introduce quasi-exogeneity in assignment of dealers to individual bonds and test whether dealers’ constraints matter for individual bonds and, ultimately, for mutual fund portfolios.

Measuring balance sheet constraints

We measure bank balance sheet constraints by looking at the dealer bank’s distance to the regulatory leverage constraint. Our analysis exploits cross-sectional differences in fund exposure to dealers’ balance sheet constraints and traces its impact on fund flows and sell-off pressures.

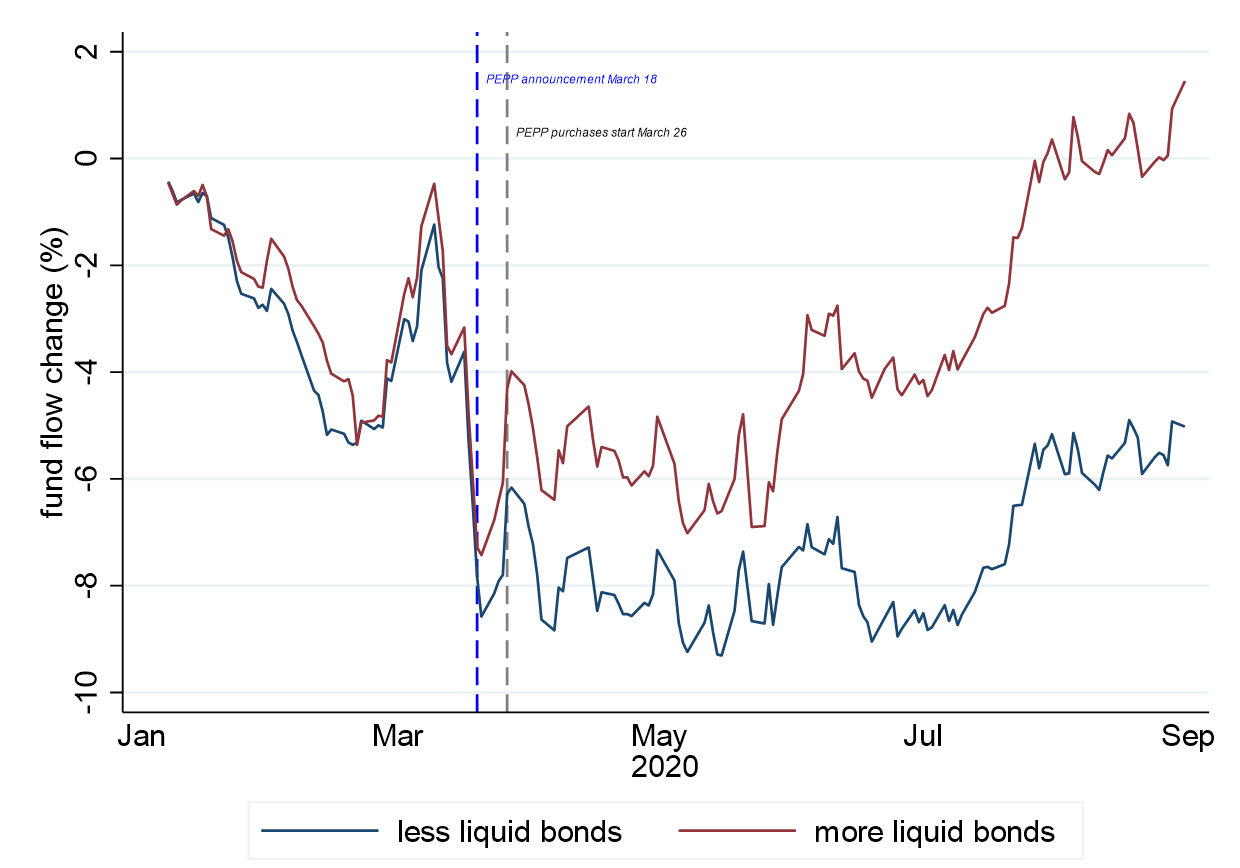

For fund flows, we document that funds more exposed to bank balance sheet constraints suffered higher outflows compared with less exposed funds (Figure 1). Leading up to March 2020, all funds closely tracked each other in terms of fund flows (and performance, not shown in Chart 1), but the COVID-19 shock resulted in decoupling, with more exposed funds emerging as particularly affected.

Chart 1

Changes in corporate bond fund flows

Note: This chart shows the evolution of corporate bond mutual funds flows before and after the COVID-19 shock. The novel result is the difference in fund value and outflows depending on funds’ holdings of bonds exposed to illiquidity through dealers’ balance sheets. The blue line depicts average flows of corporate bond mutual funds that are relatively more exposed to “illiquid” bonds and the red line gives average flows of mutual funds that are relatively less exposed to “illiquid” bonds. Daily flows are calculated as where is total net assets of fund i at day t and is the fund’s daily return. The vertical dashed lines depict the announcement and beginning of the ECB’s pandemic emergency purchase programme (PEPP).

For sell-off pressures, our hypothesis is that – conditional on their pre-crisis cash positions – mutual funds that were relatively more exposed to dealer banks with more severe balance sheet constraints faced higher sell-off pressures in their liquid bonds.

Our results confirm that investment into liquid bonds drops by 1.27 percentage points for funds relatively more exposed to dealers with lower market-making capacity. Specifically, the average fund holding of liquid bonds for these funds is 22.97%. This implies that liquid bond holdings decline by 5.5% (=100*1.27/22.97) more for funds with exposure to bank balance sheet constraints.

How does the leverage ratio affect bond market liquidity?

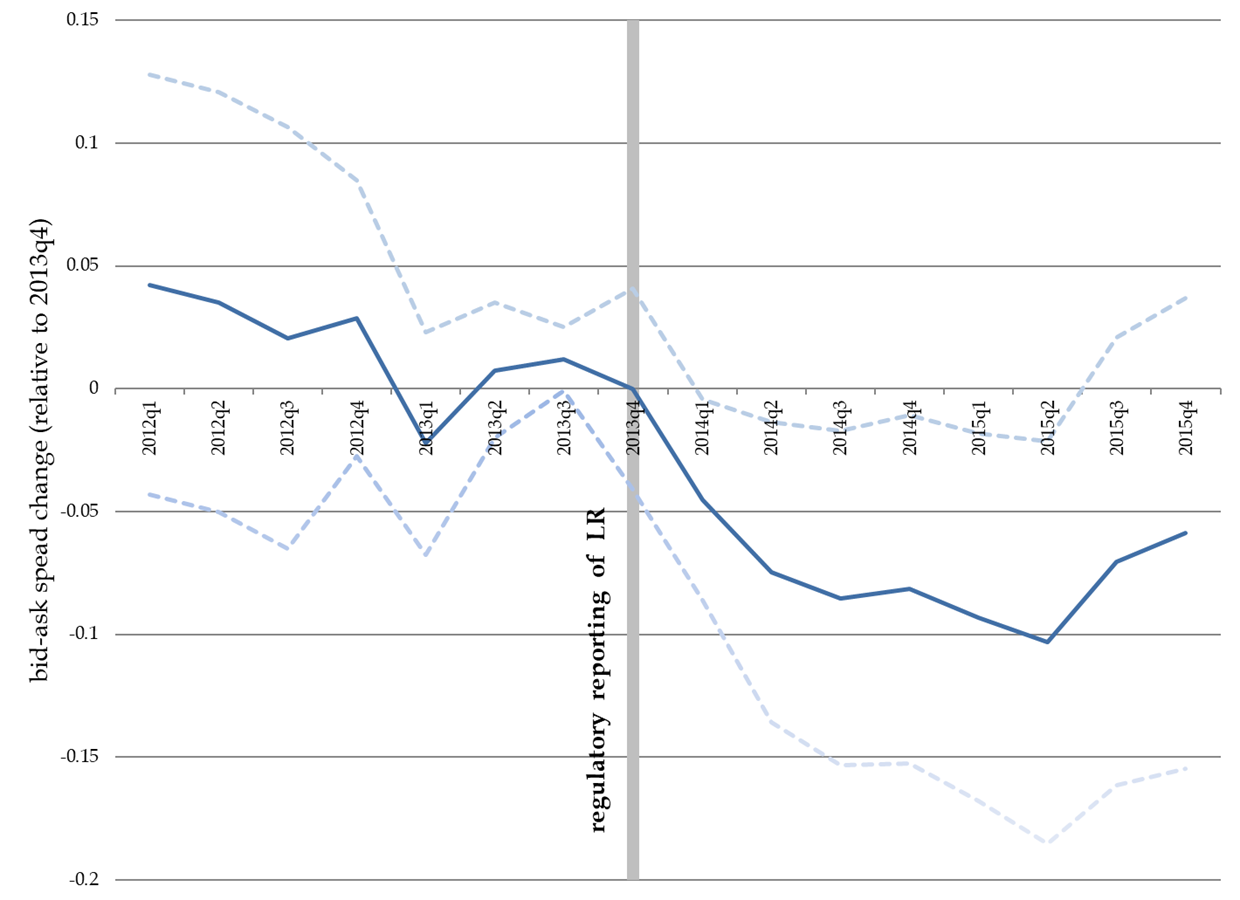

We provide supplementary evidence that dealer banks’ regulatory constraints affect bond liquidity, using the same matching between bonds and dealers based on (i) home bias and (ii) past bond underwriting relationships. For this analysis, we focus on the period around 31 December 2013. As of this date, the leverage ratio became effectively binding for euro area banks for the first time, in view of the 2014 Comprehensive Assessment exercise[3]. We compare the shift in liquidity for the same bond two years before and two years after the leverage ratio first had to be reported to bank supervisors.

Higher bid-ask spreads for banks closer to regulatory requirement

Using the home bias matching, we find that for countries where dealer banks are one percentage point closer to the regulatory requirement (about one standard deviation), the bid-ask spread is 8 basis points higher (about 25% of the median bid-ask spread in our sample). This result is robust to several ways of identifying a dealer bank in the data, and to constructing bank balance sheet constraints at the bond level.

We also show that the effect comes through the domestic dealer banks, but not through other domestic banks. We control for a range of contemporaneous macro variables including a bond’s domestic country GDP growth, domestic equity market and domestic banking sector growth, domestic volatility index and sovereign spreads. This helps us to make sure that bond liquidity and the banks’ constraints are not trivially correlated in the country-level analysis.

Using the past underwriter relationships, we find that if a bond dealer with existing underwriting ties is one percentage point closer to the regulatory requirement, the bid-ask spreads of the bond increase by 4 basis points (about 6.8% of the mean).

Chart 2

Impact of the leverage ratio on bond market liquidity

Note: The chart shows the main regression result of the impact of leverage ratio regulation on corporate bond market liquidity. The graph gives the point estimates for quarterly distances around the first time banks calculated and reported their leverage ratio to their supervisor. The regression specification is as follows: , where i is bond and t is days. The is bid-ask spreads; the is the dealers’ constraints in the issuer’s domestic country measured as distances to their required leverage ratios as of the end of 2013. The regression also includes firm fixed effects and country- and security-specific time-varying controls. The y-axis gives the spread change relative to the period prior to the event depending on the distance to the regulatory leverage constraint. The solid line depicts the point estimates and the dashed lines the corresponding 95% confidence band. Standard errors are clustered at bond level.

Conclusions

Mutual fund runs in the United States and Europe in 2020 put unprecedented pressure on the bond market and culminated in sweeping policy interventions designed to stabilise the markets on both sides of the Atlantic. We started off by asking to what extent bank balance sheet constraints due to the leverage ratio had added to the mutual fund instability and sell-off pressures. We show that, during the 2020 run episode, mutual funds with larger exposures to bank balance sheet constraints faced bigger redemptions and pressure to sell off liquid bonds.

While leverage ratio regulation introduced in the aftermath of the global financial crisis aimed to make banks more resilient, our analysis highlights that it can have side effects for market functioning, particularly in times of stress. To alleviate such side effects, both the Federal Reserve and the Eurosystem moved to temporarily change their respective leverage ratio rules in 2020. This episode suggests that the optimal leverage ratio is procyclical.

References

Bao, J., M. O’Hara and X. Zhou (2018), “The Volcker rule and market-making in times of stress”, Journal of Financial Economics, No 130 (1), 95-113.

Breckenfelder, J. and V. Ivashina (2021), “Bank Balance Sheet Constraints and Bond Liquidity”, Working Paper Series, No 2021/2589, ECB.

Breckenfelder, J., N. Grimm and M. Hoerova (2021), “Do non-banks need access to the lender of last resort? Evidence from mutual fund runs”, SSRN working paper.

Dick-Nielsen, J. and Rossi, M. (2019), “The cost of immediacy for corporate bonds”, Review of Financial Studies, No 32(1), 1-41.

Duffie, D. (2020), “Still the world’s safe haven? Redesigning the U.S. Treasury market after the COVID-19 crisis”, Hutchins Center Working Paper No 62, Brookings Institution.

Falato, A., I. Goldstein and A. Hortaçsu (2021), “Financial fragility in the COVID-19 crisis”, Journal of Monetary Economics, Vol. 123, pages 35-52.

Goldstein, I., H. Jiang, and D. T. Ng (2017), “Investor flows and fragility in corporate bond funds”, Journal of Financial Economics, 126 (3), 592-613.

He, Z., S. Nagel and Z. Song (2020), “Treasury inconvenience yields during the COVID-19 crisis”, Journal of Financial Economics, forthcoming.

Ma, Y., K. Xiao and Y. Zeng (2021), “Mutual fund liquidity transformation and reverse flight to liquidity”, Review of Financial Studies, forthcoming.

- The article was written by Johannes Breckenfelder (Senior Economist, Directorate General Research, European Central Bank) and Victoria Ivashina (Lovett-Learned Chaired Professor of Finance and Head of the Finance Unit at Harvard Business School). The authors gratefully acknowledge the comments of Alexander Popov and Louise Sagar. The views expressed here are those of the authors and do not necessarily represent the views of the European Central Bank or the Eurosystem.

- The Federal Reserve press release from 1 April 2020 can be found here:.

- The Comprehensive Assessment was the first standardised euro area-wide assessment of the health of bank balance sheets.