Published as part of the ECB Economic Bulletin, Issue 4/2022.

1 Introduction

The euro short-term rate (€STR), which has been published by the ECB since October 2019, is the overnight interest rate benchmark for the euro. The €STR shows the average rate at which banks borrow overnight (one-day) deposits from other financial institutions, including non-banks, on an unsecured basis, i.e. without having to provide collateral. The €STR is published on each TARGET2 business day on the basis of transactions conducted and settled on the previous TARGET2 business day.[1]

Benchmark rates like the €STR are a useful reference for many financial contracts, as they are publicly accessible, published by an independent institution on a regular basis and follow a transparent methodology that reflects market developments fairly and objectively. Benchmarks are used to determine the interest due on loans, deposits and other debt, as well as to determine payments on more complex products such as options, forward contracts and swaps. They are also key for the valuation of financial assets. Reliable benchmark rates contribute to legal certainty in financial contracts and reduce the risk that a party might seek to influence an agreed rate in its favour. For that reason, benchmarks are widely used by organisations and individuals throughout the economic system.[2]

Given their role in financial markets, benchmark rates are an important component in the initial stages of monetary policy transmission. An accurate reflection of how bank funding conditions are affected by changes in the monetary policy stance is critical for monitoring the transmission of monetary policy impulses. Reliable benchmarks are also necessary for the smooth functioning of money markets, and therefore for financial stability.

The launch of the €STR was part of a global reform of benchmarks. The reform was initiated to address the vulnerability of some benchmarks to possible manipulation when volumes declined in the markets they were supposed to represent (Box 1). The replacement of the euro overnight rate, EONIA, took place against this background. [3]

Following a carefully planned transition, the €STR successfully replaced EONIA as the benchmark overnight rate for the euro. EONIA was discontinued on 3 January 2022. The transition took place over several years, guided by a private sector working group on euro risk-free rates (WG RFR).[4]

Users of EONIA managed to successfully switch to the new benchmark within the required deadlines.[5]

2 The €STR as the new euro benchmark

In 2017, in response to uncertainties over the viability of EONIA and the possible impact of its discontinuation, the ECB decided to start working on its own benchmark interest rate: the €STR. EONIA was an overnight transaction-based lending rate, but did not comply with the new standards set out in the EU Benchmarks Regulation,[6] not least due to the lack of underpinning transactions and the high concentration of contributions. The absence of alternatives to EONIA could have led to major market disruptions, as trillions of euro of notional amounts in OISs were linked to it. The benchmark was also used as a discount rate in the valuation of derivatives and other assets, as a floating rate in some short-term debt and floating-rate repos, and as a remuneration rate in a number of deposits and secured transactions. The original aim of the ECB with the €STR was to provide a backstop should EONIA be discontinued.

In the aftermath of the LIBOR manipulation scandals, a coordinated global response guided the efforts to reform reference rates (Box 1).[7] Clear guidance was issued by public authorities to reduce reliance on IBOR-type rates, i.e. unsecured interbank benchmarks based on panel bank contributions. Instead, public authorities have promoted the use of near risk-free rates, i.e. overnight benchmarks based on market transactions. These rates benefit from higher market liquidity, are anchored in actual transactions and therefore do not incorporate expert judgement, which was required for many IBORs. For this reason, it was important to ensure that the euro area has a robust and reliable near risk-free rate.

When designing the €STR, the ECB had to address several important issues to develop a credible reference rate representative of the cost of liquidity, while avoiding the weaknesses of EONIA. In particular, it was important to consider: (i) the information used for the daily rate calculation, specifically avoiding the pitfalls of contributions from a panel of some 20 voluntary contributing banks; (ii) the declining activity in the unsecured interbank market,[8] which suggested looking for broader coverage to anchor the rate in a sufficiently liquid market; (iii) how to engage the public in the design of the rate to make it reliable and understandable, enhancing acceptance among future users.

The ECB was already collecting granular, timely, daily statistical data on the money market activities of selected euro area banks across four market segments: unsecured money market, secured money market, foreign exchange swap market and OIS market. The data were readily available to the ECB. They were not collected for the sole purpose of calculating a benchmark but because they were necessary for the European System of Central Banks (ESCB) to fulfil its tasks, in particular implementing monetary policy. They were considered of sufficient quality and timeliness to serve the daily production of a reference rate. Reporting was supported by a legal obligation on the sample banks to provide data to the ECB under the Money Market Statistical Regulation (MMSR),[9] hence obviating the need to rely on voluntary contributions.

The ECB initially considered both the unsecured and secured segments in order to identify sufficient market activity to underpin the €STR and resolve the lack of sufficient representative underlying data that led to EONIA’s demise. The secured segment is by far the most liquid market, as repo instruments have gained significantly in importance since the financial crisis at the expense of the unsecured money market. Moreover, the secured market has provided the basis for calculating risk-free rates in other jurisdictions, such as SOFR in the United States.[10] In the euro area, however, several important features meant that a benchmark reflecting the secured market would not always provide a clear indication of the cost of liquidity. These included: (i) the variety of government bonds used as collateral in repo transactions; (ii) the fact that these bonds often trade at different yields and have varying liquidity conditions; and (iii) the significant impact that balance sheet reporting dates (e.g. quarter-ends) have on repo rates. As a result, repo rates are driven by collateral costs as much as liquidity costs. This would have made such a benchmark particularly difficult to interpret in the euro area. Moreover, since the €STR was meant to replace EONIA, which was an unsecured benchmark, it was considered more logical from the user perspective to switch to a benchmark that reflected solely the cost of liquidity and did not include collateral costs. For these reasons, the ECB finally opted for the unsecured market.

The ECB published the benchmark methodology after two public consultations and before the launch of the €STR in October 2019. It solicited feedback on the main design parameters to ensure alignment with the prospective user base. The first consultation focused on broader considerations such as scope, with the second dedicated to more detailed methodological elements. In the run-up to the official start of the benchmark the ECB also published pre-€STR time series to allow market participants and prospective users to become familiar with the rate ahead of its launch. Market participants strongly backed the proposals put forward for consultation. With overwhelming support for a new overnight rate administered by the ECB, publication of the €STR started in October 2019.

3 The €STR determination process

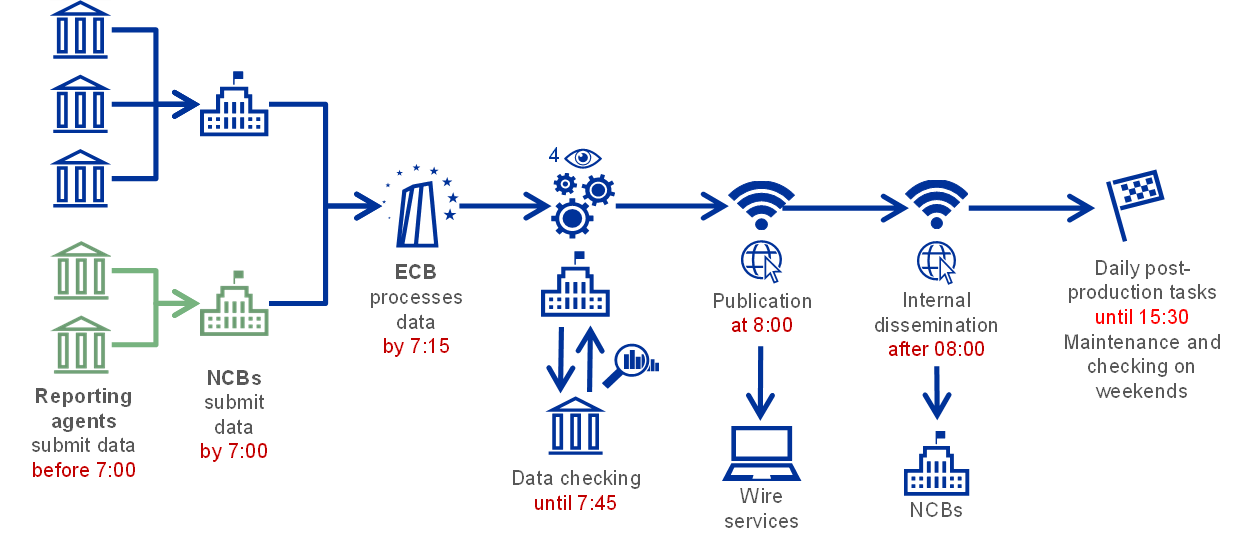

The daily €STR determination runs every TARGET2 business day to publish the rate and accompanying information at 08:00 CET. The process starts at the reporting agents, i.e. the 47 banks that currently constitute the MMSR reference population. These report data on money market transactions each day in a standardised format, as required by the MMSR Regulation.[11] The reporting banks compile transaction-by-transaction data and send them to the national central bank (NCB), where the latter manages a local collection platform, or to a centralised ECB collection platform.[12] The collection platforms receive the data and automatically perform initial checks on their format and content. The NCBs and ECB interact with reporting agents on any technical issues that could affect receipt of complete data on time. The data are then submitted to the ECB, where they are processed and the economic sector classification of the counterparties added, and ineligible transactions filtered out according to the €STR methodology. Plausibility checks are then performed by the ECB on this subset of the data and transactions identified as atypical are double-checked with the reporting agents by the Eurosystem. The €STR and accompanying information are then automatically calculated and published, after a final check, at 08:00. If errors with an impact larger than two basis points are detected following publication, the ECB will revise and re-publish the €STR at 09:00, although such an event has never occurred at the time of writing. No changes are made to the €STR after that time. At 09:15, the compounded €STR (C-€STR) average rates and index are published.[13] Finally, the ECB performs a series of post-production activities to prepare for the following publication day and review data quality. Together with NCBs, the ECB liaises with reporting agents where necessary to verify the correctness of reported data and address any quality issues to prevent any effects on future calculations.

Figure 1

Graphical representation of the €STR determination process

The robustness of the €STR determination process is underpinned by the use of MMSR data and largely automated procedures, thus avoiding any expert judgement and submissions as defined in the IOSCO principles for financial benchmarks.[14] The €STR is automatically calculated using pre-existing statistical data related to actual transactions conducted by the MMSR reporting agents in financial markets. No extrapolations or adjustments are made to values. The supporting data are sourced in reliance on the ECB’s powers to collect statistical data, which guarantees continuity – in collection and in the rate itself.[15] This also avoids the use of data submitted solely for the purpose of compiling a benchmark, a practice that can create additional vulnerabilities such as conflicts of interest and incentives for manipulation, as indicated in the IOSCO principles. The MMSR Regulation establishes minimum standards for transmission, accuracy, conceptual compliance and revisions, as well as minimum standards for data integrity. Compliance is regularly monitored by the Eurosystem. In cases of repeated non-compliance or serious misconduct an infringement procedure must be launched, and sanctions may be imposed under the ECB’s legal framework for failure to comply with statistical reporting requirements.

The IT systems set up by the Eurosystem to receive and process the data and calculate the €STR are designed and implemented to meet high standards of criticality in terms of the availability, integrity and confidentiality of the receipt, processing and storage functions. Manual actions are rule-based and not subject to any discretion, being limited to interactions with reporting agents for quality checks and contingency measures in the event of any automatic steps failing. Finally, transparency is ensured through the quarterly publication of errors higher than 0.1 basis point.

Box 1

The end of LIBOR: an overview of benchmark reforms in major currencies

Ten years of reflection to reform the IBORs and progressively phase out LIBOR

In 2012 the vulnerabilities of the IBORs (interbank offered rates, which are unsecured interbank rates for longer tenors) became apparent, with declining liquidity in the interbank markets underpinning these rates and cases of attempted manipulation. It became clear that the overreliance of global financial markets on these rates posed clear risks to financial stability. The Financial Stability Board (FSB)[16] endorsed the Principles for Financial Benchmarks developed by the International Organization of Securities Commissions (IOSCO), covering standards on governance, integrity, methodology, quality and accountability. The FSB also established a subgroup, the Official Sector Steering Group (OSSG), to coordinate the efforts of public institutions, including central banks, to reform benchmarks. Over time, the OSSG agreed on the following recommendations:[17] i) that existing IBORs be strengthened, in particular by anchoring their methodologies in real transactions, as opposed to expert judgement; ii) that overreliance on IBORs be reduced, notably by promoting wider use of risk-free rates as alternative benchmarks; and iii) that contractual robustness be fostered, notably by encouraging implementation of robust fallback rates, i.e. rates available should an IBOR materially change or cease to be provided, in existing and new contracts referencing it. To guide market participants in these efforts, financial industry working groups were set up in the major currency areas with the support of public authorities to catalyse reform efforts. In addition, the International Swaps and Derivatives Association (ISDA) was mandated by the OSSG to develop fallback protocols for contracts referencing IBORs for derivative products.

The fate of LIBOR was progressively sealed.[18] As a first step, the new administrator, ICE Benchmark Administration (IBA), reformed its contribution-based methodology to anchor it in real transactions as far as possible. This was complemented by observed values in neighbouring market segments and by models (the “waterfall approach”). In 2017, however, LIBOR’s supervisory authorities (the UK Financial Conduct Authority (FCA) and the Bank of England), acknowledged that the rate remained fragile owing to the lack of transactions in the interbank unsecured market and the vulnerability of its panel, which was based on voluntary contributors. The panel agreed to continue contributing until the end of 2021 to allow a transition to alternative benchmarks. In March 2021 the FCA and IBA confirmed that GBP, EUR, CHF and JPY LIBOR rates would be discontinued at the end of 2021, along with a few of the USD settings; the five main tenors of USD LIBOR would cease at the end of June 2023. To allow an orderly wind-down, the main tenors of GBP and JPY LIBOR are also being published for an additional year using a synthetic methodology (i.e. based on compounded risk-free rates and a credit spread, instead of panel contributions). These synthetic rates cannot be used in new contracts and are aimed solely at easing the transition of legacy contracts that are particularly difficult to amend.

The picture for the euro is somewhat different, as EURIBOR is being maintained for the foreseeable future. Reform efforts here have mostly focused on the methodology, which was amended by its administrator, the European Money Markets Institute (EMMI), to better base contributions on real market transactions. The WG RFR also recommended fallback language based on the €STR (i.e. rates, trigger events and templates) for EURIBOR contracts. These recommendations complement those from the ISDA on fallback protocols for EURIBOR derivatives. Current work by the WG RFR includes fostering the use of the €STR in a diverse range of financial products.[19]

4 Stages in the transition from EONIA to the €STR

The transition from EONIA to the €STR occurred in three stages. During the first of these, starting in September 2017, the €STR was developed and implemented. In the second stage, after the launch of the €STR in October 2019, the two rates co-existed side by side, with EONIA based on a new calculation method, i.e. it became fully dependent on the €STR plus a fixed spread. The official cessation of EONIA on 3 January 2022 marked the final stage of the transition.

The development and implementation of the €STR

The first step in the development of the €STR was to define the methodology for two main building blocks: (i) the underlying interest of the benchmark, i.e. the economic reality it seeks to measure and (ii) how the benchmark should be calculated so as to measure this accurately.[20] The underlying interest of the €STR was defined as the wholesale euro unsecured overnight borrowing costs of euro area banks. EONIA focused exclusively on interbank lending, whereas the €STR reflects much broader activity by including short-term borrowing from a wider set of counterparties.[21] Taking borrowing activity beyond the interbank segment into account made it possible to overcome the limitations of an illiquid interbank lending market. The rate produced is based on a structurally stable activity for banks (accepting overnight funds from other entities) and reduces the influence of the credit element. The next step was to determine how to best measure the underlying interest, i.e. which transactions would be eligible for inclusion when computing the €STR and which calculation technique to apply. Analysis suggested narrowing down the eligible transactions to those executed by MMSR reporting banks as fixed rate overnight deposits placed by financial institutions. The specific instruments (deposits) and counterparties (financials) selected provide a sufficiently homogeneous set of eligible transactions and ensure they are executed on market terms. Transactions with large non-financial corporates were excluded, as their pricing often reflects the quality of the customer relationship. Similarly, other types of instrument such as call accounts were kept out of the scope, as their pricing tends to be less reactive to day-to-day market movements. Finally, the decision was taken to calculate the €STR as a volume-weighted trimmed mean of the eligible transactions. Trimming is used to safeguard the rate from idiosyncratic volatility caused by transactions priced off the market, or from errors in the underlying statistical data. A contingency formula for calculating the €STR is activated when there is insufficient underlying data, owing to either market events or technical errors. A calculation with sufficient underlying data is defined as one based on reporting by at least 20 banks, where the largest five of these do not represent more than 75% of the volume. If these requirements are not met, the contingency calculation method is applied instead. This applies a weighted average of the previous day’s €STR and the rate resulting from using the data for the current day.

The regular methodology reviews that have been conducted confirm that the €STR remains a fair reflection of market movements, that it is backed by sufficient underlying data and that the scope and calculation method selected are therefore adequate. These methodology reviews are conducted annually, and the resulting reports published on the ECB website.[22]

The €STR governance has been set out in a dedicated ECB Guideline, while the pre-existing MMSR data collection continues to be founded in an ECB Regulation.[23] The Guideline establishes the ECB’s responsibility for administering the €STR and the tasks and responsibilities of the ECB and Eurosystem national central banks which contribute to the determination process and related procedures. It also sets up a control framework to protect the integrity and independence of the determination process and deal with any existing or potential conflicts of interest identified. In addition, the Guideline lays down the legal basis for establishing the €STR Oversight Committee, which reviews, challenges and reports on all aspects of the €STR methodology and determination process.[24]

Operational implementation of the €STR required a dedicated IT system with high criticality standards to be set up and Eurosystem-internal operational procedures established. These were both tested during a shadow production period of nine months before launch.[25]

A pre-€STR time series was published after each reserve maintenance period from mid-2018 onwards to allow the public to familiarise itself with the forthcoming rate and to test internal operational procedures.

Internal audits were conducted on both the design and implementation of the €STR.[26]

The transition from EONIA to the €STR

The transition from EONIA to the €STR was designed by the WG RFR in line with the guidance of the FSB.[27] The working group first focused on the replacement for EONIA and recommended the €STR as the main risk-free rate in euro,[28] following the wider market’s preference for an unsecured overnight borrowing rate based on ECB statistical data. The working group also made recommendations[29] to ensure a smooth transition until EONIA was discontinued in 2022. For a two-year period, EONIA was recalibrated to be equal to the €STR plus a fixed spread that matched the difference observed between the underlying interests of the two benchmarks. The working group also issued a legal action plan[30] to discourage use of EONIA in new contracts and support implementation of €STR-based fallback language in legacy contracts, and issued recommendations to the industry in technical areas such as valuations and accounting.[31] These took into account market feedback gathered through public consultations and a number of outreach events hosted by both public and private sector institutions. The working group was also supported by the strong involvement of the EONIA administrator (EMMI) and the active steps taken by market infrastructure bodies.

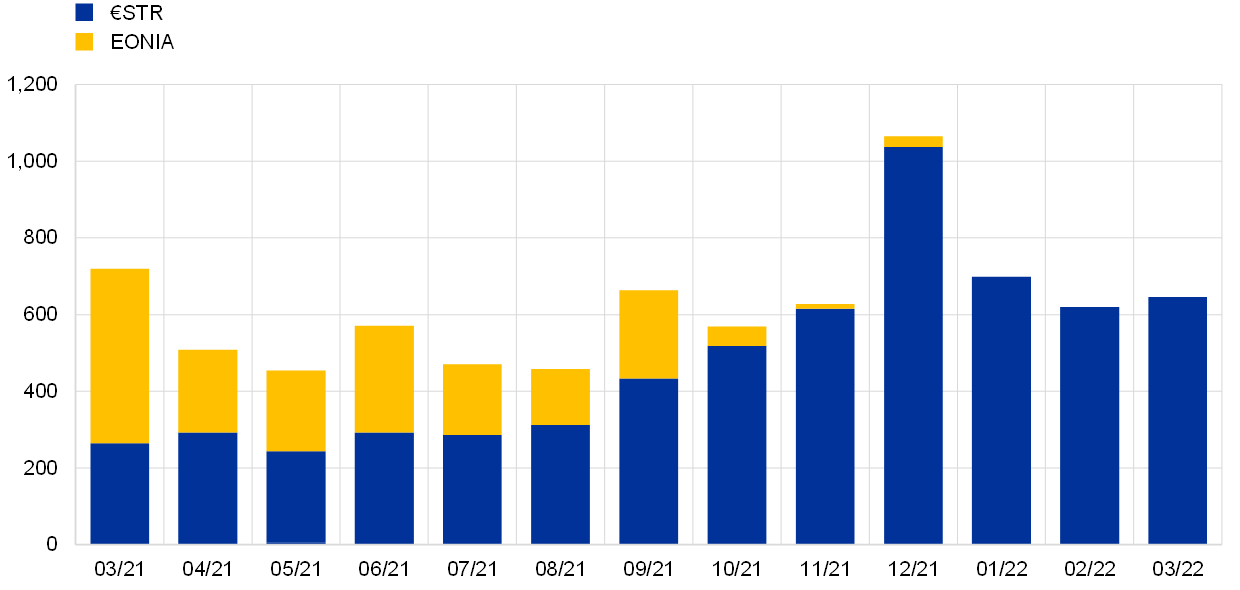

The €STR started to be used as a reference in financial contracts immediately after its inception in 2019 and the switch from EONIA to the €STR was smooth. The main market to transition was the overnight index swap market, where €STR swaps slowly started being traded in October 2019, supported by clearing infrastructure. Many market participants, however, continued to reference EONIA, because the two indices were economically equivalent. The transition only accelerated once the main central counterparties converted the remaining contracts cleared from EONIA to the €STR and stopped clearing EONIA swaps in October 2021,[32] as shown below in Chart 1. The switch was also supported by a European Commission implementing regulation adopted in October 2021, which designated the €STR as replacing remaining references to EONIA in contracts and financial instruments with no, or no suitable, fallback provisions as of the date of its discontinuation.[33] Chart 2 shows the transition from EONIA to the €STR in the unsecured and secured segments of the euro money market.

Chart 1

Shares of the €STR and EONIA OIS in MMSR transactions

(EUR billions)

Source: ECB

Chart 2

Relative use of EONIA and the €STR as benchmarks in the euro variable-rate unsecured and secured money market segments

(percentages of total variable-rate business volume, monthly aggregates)

Source: ECB

The €STR after the transition

Following the discontinuation of EONIA on 3 January 2022, the €STR became the only overnight benchmark rate for the euro, with the working group on euro risk-free rates investigating ways to promote its wider use in the market. The €STR, much like EONIA, is now mainly used in derivatives such as OIS contracts. In response to the recommendations of the FSB, the WG RFR is considering other uses, including in cash market and cross-currency products.

The €STR is also the fallback in EURIBOR contracts should that rate cease to exist in future. The ISDA has already introduced €STR-based fallback provisions in its standard documentation to cater for discontinuation of EUR LIBOR and EURIBOR. The WG RFR has issued recommendations for €STR-based fallback rates in cash market products linked to EURIBOR. Depending on the asset class, the recommendations suggest using either forward-looking €STR rates (subject to their future availability), or a compounded €STR rate in all other cases.

In response to market feedback, the ECB publishes compounded €STR average rates and a compounded index based on the €STR. The rates are backward-looking compounded averages of the €STR calculated over standardised tenors of one week, one month, three months, six months and twelve months. The compounded €STR index makes it possible to calculate a compounded €STR average rate over any other tenor of choice. The ECB started publishing compounded average rates and a compounded index based on the €STR on 15 April 2021. Publication takes place each TARGET2 business day at 09:15. The rules for the calculation and publication of the compounded €STR average rates and index are published on the ECB website[34] and their design took account of a public consultation.

Box 2

Stylised statistical facts about the overnight index swap market

The €STR, as previously EONIA, is of importance for all euro-denominated derivative markets for the valuation of positions. In the case of overnight index swap (OIS), the €STR is in addition the actual underlying against which participants seek to hedge interest risk or take exposure to future rate changes. In this sense, the OIS market can be seen as the derivative market most directly connected to the new overnight benchmark.

Two large groups of transactions in the OIS market can be distinguished: the spot transactions and the forward transactions. Trades with a start date within three business days from the trade date are classified as spot, with those with a later start date classified as forward. According to MMSR data for the first quarter of 2022, most trading volume takes place in the forward market (56%) while the spot market is significantly smaller (32%). The remaining activity (12%) relates to novations, which usually occur when a transaction is cleared with a central counterparty between the two original transactors.

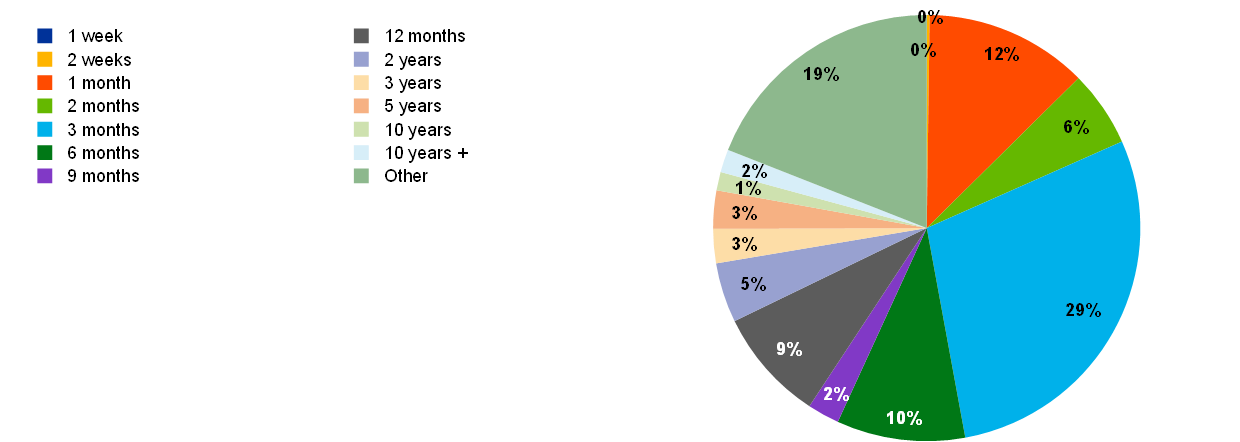

The data reveal that the OIS spot market is characterised by a strong dispersion in contract length (Chart A). The spot transactions can be classified by maturity buckets that define the most standard contract lengths according to the difference between contract start and maturity dates. In the first quarter of 2022, 68% of the activity in spot trading was concentrated in the intermediate maturities represented by the one-month bucket and its multiples up to and including the 12-month bucket; 13% of the volume was split among longer maturities (i.e. two years and above). Maturities under one month were traded much less (close to 0%). The remaining 19% of activity corresponds to less standardised transactions that cannot be classified in any standard maturity bucket and are labelled “other”. These have non-standard contract lengths (e.g. four months) and have either short maturities of up to five months or very long maturities of three to ten years.

Chart A

Total notional amounts broken down by maturity bucket for the first quarter of 2022

Source: ECB.

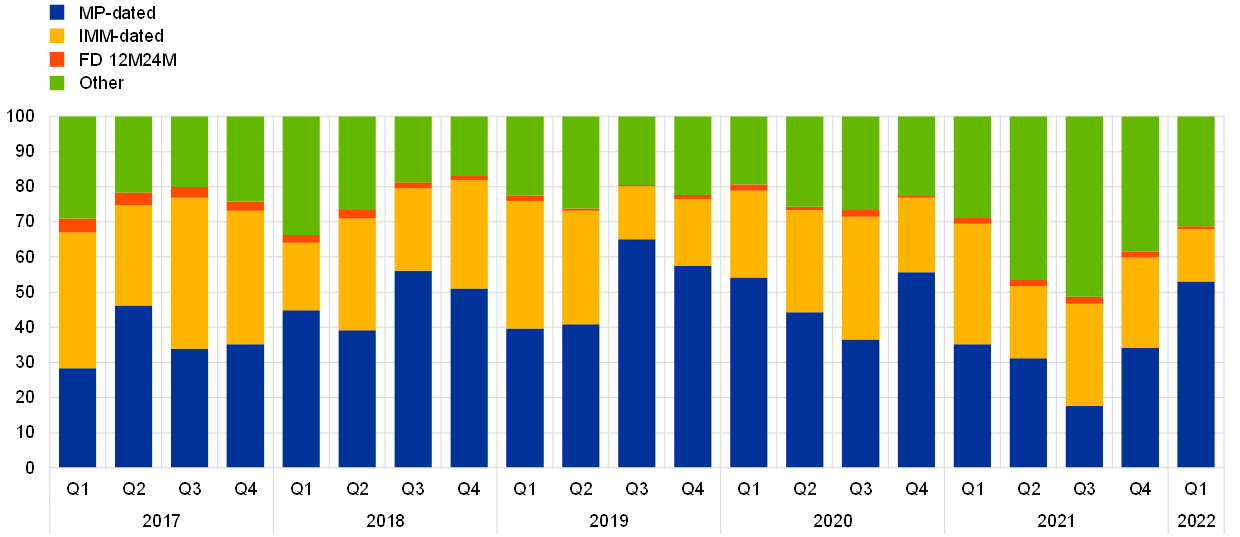

The OIS forward market is dominated by three different classes of contract, which jointly represented on average about 69% of the activity in this segment in the first quarter of 2022 (Chart B). Most of the volume is concentrated in transactions that have both their start and end dates tied to the Eurosystem’s reserve maintenance periods (labelled “MP-dated trades” in Chart B). These made up about 53% of the activity in the period. The second most traded type of OIS forwards have start and end dates matching International Monetary Market futures dates (IMM-dated trades),[35] with 15% of the market in the first quarter of 2022. A relatively small percentage of around 1% of the forward market corresponds to another standard contract, labelled “FD 12M24M”, which starts 12 months after the trade date and matures 12 months thereafter. The remaining 31% of volume in forward swaps relates to swaps not falling into any of the previous categories.

Chart B

Forward notional amounts broken down by forward classification

Source: ECB.

5 Conclusion

The transition from EONIA to the €STR was successfully completed according to schedule. The smooth switch between the two benchmarks avoided risks to financial stability and monetary policy. Once private sector efforts to maintain the historical overnight rate EONIA met unsurmountable challenges, the ECB initiated work on its own benchmark rate based on existing statistical data. The €STR, initially conceived as a back-up, has become the main euro unsecured overnight rate. The financial industry has showed a clear preference for an unsecured rate produced by the central bank. Since its launch in 2019, the €STR has proved to be a reliable and robust reference rate, available to the entire market and accurately reflecting money market trends in the euro area.

As the main euro overnight risk-free rate, the €STR not only replaces EONIA but also serves as a basis for recommended fallback rates for the eventuality of EURIBOR being discontinued. The ECB supports this by publishing compounded €STR rates, which can be used as a EURIBOR fallback. Use of the €STR may develop in future as an alternative to EURIBOR in other market segments, too. This would be in line with international moves towards risk-free rates and consistent with the guidance from the FSB. Any concrete steps in this direction, however, need to be taken by the financial industry in Europe.

TARGET2 is the real-time gross settlement system owned and operated by the Eurosystem. TARGET2 settles payments related to the Eurosystem’s monetary policy operations, as well as bank-to-bank and commercial transactions, see What is TARGET2? on the ECB’s website. A TARGET2 business day means in this context a day on which TARGET2 operates.

See “What are benchmark rates, why are they important and why are they being reformed?”, ECB, Frankfurt, July 2019.

The Euro Overnight Index Average (EONIA) was a transaction-based lending rate based on a panel of voluntary contributors and administered by a private benchmark provider, the European Money Markets Institute (EMMI).

See the website of the European Securities and Markets Authority (ESMA) for more information on the WG RFR, an industry group created to identify and recommend risk-free rates that could serve as alternatives to EONIA and fallbacks for EURIBOR benchmarks.

See “Goodbye EONIA, Welcome €STR!”, Economic Bulletin, Issue 7, ECB, November 2019.

Regulation (EU) 2016/1011 of the European Parliament and of the Council of 8 June 2016 on indices used as benchmarks in financial instruments and financial contracts or to measure the performance of investment funds and amending Directives 2008/48/EC and 2014/17/EU and Regulation (EU) No 596/2014 (OJ L 171, 29.6.2016, p. 1).

LIBOR (London Interbank Offered Rate) was designed to produce an average rate representative of the rates at which large, leading, internationally active banks with access to the wholesale unsecured funding market could fund themselves in that market in particular currencies for certain tenors. It is currently in the process of being wound down.

The interbank market refers to transactions taking place between banks; the unsecured market refers to transactions such as deposits, call accounts and fixed-rate or variable-rate short-term debt securities issued with a maturity of up to and including one year.

Regulation (EU) No 1333/2014 of the European Central Bank of 26 November 2014 concerning statistics on the money markets (ECB/2014/48) (OJ L 359, 16.12.2014. p. 97).

SOFR (the Secured Overnight Financing Rate) is a broad measure of the cost of borrowing cash overnight against Treasury securities, published daily by the Federal Reserve Bank of New York.

Regulation ECB/2014/48, the MMSR reporting instructions and other methodological and operational guidance are available on the ECB’s website.

Currently, reporting banks in Germany, Spain, France and Italy submit the data to the local collection platform operated by their NCB, while those in Belgium, Ireland, Greece, the Netherlands, Austria and Finland submit data to the centralised ECB collection platform. The NCBs participate in the data checks that form part of the daily determination process.

See Section 3.

The IOSCO principles define expert judgement as “the exercise of discretion by an administrator or submitter with respect to the use of data in determining a benchmark”, such as “extrapolating values from prior or related transactions, adjusting values for factors that might influence the quality of data such as market events or impairment of a buyer or seller’s credit quality, or weighting firm bids or offers greater than a particular concluded transaction”. They define submissions as “prices, estimates, values, rates or other information that is provided by a Submitter to an Administrator for the purposes of determining a Benchmark”. See “Principles for Financial Benchmarks – Final Report”, The Board of the International Organization of Securities Commissions (IOSCO), July 2013.

Article 5.1 of the Statute of the European System of Central Banks and the European Central Bank states that “In order to undertake the tasks of the ESCB, the ECB, assisted by the NCBs, shall collect the necessary statistical information either from the competent national authorities or directly from economic agents.”

The FSB coordinates national financial authorities and international standard-setting bodies in regulatory, supervisory and other financial sector issues.

See “Reforming Major Interest Rate Benchmarks”, FSB, July 2014.

See the FCA’s website for more information on the transition away from LIBOR.

See the working group’s Work Programme for 2022/23, on the ESMA website.

See “First ECB public consultation on developing a euro unsecured overnight interest rate”, ECB, Frankfurt, November 2017.

Interbank lending at the time had become very illiquid, making EONIA vulnerable in view of its very low volumes.

For the latest report see “€STR Annual Methodology Review”, ECB, Frankfurt, January 2022.

Guideline (EU) 2019/1265 of the European Central Bank of 10 July 2019 on the euro short-term rate (€STR) (ECB/2019/19), (OJ L 199, 26.7.2019, p. 8), and Regulation (EU) 1333/2014 of the European Central Bank of 26 November 2014 concerning statistics on the money markets (ECB/2014/48), (OJ L 359, 16.12.2014, p. 97). The Regulation establishes the reporting obligations, timeliness, frequency and quality requirements of the MMSR data collected and used to calculate the €STR.

The Oversight Committee is chaired by the Vice-President of the ECB. It comprises five members, of whom three, including the Chair, are selected on the basis of nomination by the ECB and two on the basis of nomination by the NCBs operating a local collection platform, in each case upon a proposal from the ECB’s Executive Board approved by a decision of the Governing Council.

Shadow production of the €STR from January to September 2019 encompassed live testing of both the Eurosystem IT system and the operational procedures, and also involved reporting agents.

The audits covered the methodology, governance, determination process and IT. All audit recommendations were implemented before launch. The requirement for internal and external audits was also included in the €STR Guideline as part of governance; audits continued to take place after the launch of the €STR, see the ECB’s Statement of compliance with the IOSCO principles for financial benchmarks, published in 2020.

See footnote 4.

See press release, ECB, Frankfurt, 13 September 2018.

See Working group on euro risk-free rates, “Recommendations of the working group on euro risk-free rates on the transition path from EONIA to the €STR and on a €STR-based forward-looking term structure methodology”, Frankfurt am Main, March 2019.

See Working group on euro risk-free rates, “Recommendations of the working group on euro risk-free rates on the EONIA to €STR legal action plan”, Frankfurt am Main, July 2019.

See Working group on euro risk-free rates, “Report by the working group on euro risk-free rates on the impact of the transition from EONIA to the €STR on cash and derivatives products”, Frankfurt am Main, August 2019 and “Report by the working group on euro risk-free rates on the risk management implications of the transition from EONIA to the €STR and the introduction of €STR-based fallbacks for EURIBOR”, Frankfurt am Main, October 2019.

Most EONIA swap transactions were cleared, i.e. settled, through a third party called a central clearing counterparty, which acts as an intermediary between the two counterparties and takes over the credit risk, the matching of transactions and the settlement process.

Commission Implementing Regulation (EU) 2021/1848 of 21 October 2021 on the designation of a replacement for the benchmark Euro overnight index average (OJ L 374, 22.10.2021, p. 6).

See “Compounded €STR average rates and index: Calculation and publication rules”, ECB, Frankfurt, October 2020.

The IMM (International Monetary Market) dates are the third Wednesday of March, June, September and December.