The ECB Survey of Monetary Analysts: an introduction

Published as part of the ECB Economic Bulletin, Issue 8/2021.

1 Introduction

Understanding the expectations of households, firms and financial markets regarding monetary policy and macroeconomic developments is important for the conduct of monetary policy. Expectations regarding macroeconomic developments and monetary policy matter for the transmission of monetary policy and can be used as a yardstick to assess the credibility of monetary policy. Their development over time also helps central banks understand the effectiveness of monetary policy.

Surveys can play an important role in understanding expectations and complement expectations inferred from market pricing. While it is not possible to measure expectations of households, firms and financial markets directly, surveys provide information on the expectations of these specific groups.

The ECB Survey of Monetary Analysts (SMA) brings together information on financial sector expectations of monetary policy and macroeconomic developments in a coherently structured and regularly updated survey.[1] Integrating survey information on both macroeconomic developments and monetary policy closes a knowledge gap that is left by surveys focusing either just on expectations of economic developments alone (e.g. the ECB Survey of Professional Forecasters – SPF) or only on monetary policy (e.g. private sector surveys available from Thomson Reuters and Bloomberg). The SMA is not the first survey of this type to be conducted by a central bank as part of its market intelligence gathering (see Box 1 for a description of how the SMA adds to information obtained from other surveys for the euro area, how it compares to the Federal Reserve Bank of New York’s Survey of Primary Dealers (SPD) and how it contributes to the ECB’s market intelligence gathering).

The key objective of the SMA is to “gather regular, comprehensive, structured and systematic information on market participants’ expectations”. This information is intended to serve three purposes (see examples in Section 5): (i) assessing financial market participants’ expectations of the ECB’s monetary policy measures, including their possible impact on financial markets; (ii) examining respondents’ outlook for the economy; and (iii) understanding whether the ECB’s communication and forward guidance is well understood.

The ECB launched the SMA initially as a pilot project in April 2019, which ended in June 2021 with the publication of aggregate results. The survey runs eight times a year, ahead of the Governing Council’s monetary policy meetings. The ECB decided to end the pilot phase and publish aggregate results on its website following a staff assessment that the SMA had significantly advanced the quality and comprehensiveness of systematic market intelligence gathering.[2]

Box 1

The role of surveys in gathering market intelligence related to monetary policy expectations and the economy

This box examines the role of private sector and central bank surveys in gathering systematic market intelligence and how they contribute to the understanding of monetary policy expectations and expectations regarding the development of the economy.

Gathering market intelligence is important for central banks to be able to better understand financial market participants’ monetary policy expectations, their participation in open market operations and their overall view of market developments and market functioning. For the most part, market intelligence gathering is qualitative in nature and takes the form of direct interactions with traders and market participants, complemented by information inferred from high-frequency market data and analysts’ research reports.[3] Regular market contact group meetings are an important component of the ECB’s market intelligence gathering.[4]

Surveys undertaken by private sector companies are a valuable market intelligence source for summarising market expectations in a more systematic way than bilateral exchanges or market contact group discussions. An advantage of surveys over discussing topics of interest with market participants is that surveys can provide a more systematic view of financial market participants’ expectations by asking a broad set of respondents the same questions over a fixed time horizon. Such surveys also cover a wide range of respondent types (in a relatively stable but still changing composition). Bloomberg and Thomson Reuters run two of the most established surveys of market participants’ expectations of ECB policy with, on average, 35 and 70 respondents, respectively, per survey round in 2021. The private sector surveys do not have fixed survey periods or fixed dates for the publication of their results, but typically occur in the week prior to the Governing Council’s monetary policy meetings.[5]

Central banks also undertake their own surveys to address their specific informational needs and to better understand monetary policy expectations and the economy.[6] The key advantage of a central bank undertaking its own survey is that it can control the precise timing around monetary policy meetings, the scope and detail of the questions, the forecast horizons and the panel of respondents. Moreover, by having recurring questions and a broadly stable group of respondents, regular surveys provide comprehensive information about the evolution of expectations, while the inclusion of questions on key macroeconomic variables captures how policy expectations correlate with economic developments.

The SMA shares many similarities with the Federal Reserve Bank of New York’s Survey of Primary Dealers (SPD), which is the most established survey undertaken by a major central bank.[7] Like the SMA, the SPD is staff-led, but the SPD is conducted by the Trading Desk of the Federal Reserve Bank of New York.[8] The SPD questionnaire is distributed to the 24 primary dealers of the Federal Reserve Bank of New York and published on its website approximately two weeks ahead of each scheduled meeting of the Federal Open Market Committee (FOMC). Both the SPD and the SMA focus on expectations regarding monetary policy measures, financial conditions and the macroeconomic outlook. However, while SMA policy questions only relate to communication from the Governing Council’s monetary policy statement (formerly the introductory statement), the SPD also covers “topics that are widely discussed in the public domain”. Both questionnaires typically ask respondents to provide modal expectations, which may be supplemented by probability distribution questions. The period of time between the end of the SPD’s response period and the first day of the FOMC meeting is about one week, which is slightly shorter than the corresponding period for the SMA. Summaries of the SPD results are published about three weeks after each FOMC meeting. Since the end of the pilot phase in June 2021, the SMA results have been published in aggregate form on the Friday of the week after the Governing Council’s monetary policy meeting.

This article looks at the structure of the survey and the rationale behind it and explains what role it plays in understanding changes in market participants’ expectations of euro area monetary policy and the macroeconomy. Section 2 outlines the scope and main features of the SMA; Section 3 describes how the panel of respondents was initially selected and the survey’s likely future evolution; Section 4 examines the SMA’s governance along several dimensions; and Section 5 illustrates how the SMA’s results can be used to inform views on market expectations.

2 Scope and main features of the SMA

The objective of the SMA is to gather “regular, comprehensive, structured and systematic information on market participants’ expectations”.[9] First, the SMA provides “regular” information by collecting market participants’ expectations ahead of each Governing Council monetary policy meeting and making the results available to the Eurosystem committees, to the Governing Council and, since June 2021, also to the general public after the Governing Council meeting. For this purpose, it gathers “comprehensive” data on ECB policy expectations, such as: (i) the key ECB interest rates and other market interest rates – the euro interbank offered rate (EURIBOR) and the euro short-term rate (€STR) – over an extended horizon and in the long run, as well as expectations on interest rate forward guidance; (ii) the ECB’s asset purchase programmes and expectations on changes in forward guidance; (iii) targeted longer-term refinancing operations (TLTROs) (repayments and take-ups); and (iv) the macroeconomic outlook (baseline and risks) over an extended horizon and in the long run. In addition, the SMA provides “structured” information by ensuring that the survey covers horizons that give visibility to the main policy parameters (e.g. interest rate lift-off, end of net asset purchases and end of reinvestments) and by collecting information on how changes in the macroeconomic outlook and policy expectations jointly evolve. Finally, the SMA provides “systematic” information by asking a set of questions that are intended to remain fairly stable over time, thereby fostering respondents’ understanding of the questions and gradually building up the longitudinal dimension of the survey.

The questionnaire is structured around four sections pertaining to interest rate expectations, asset purchases, refinancing operations and the macroeconomic outlook. The questions in these sections are largely kept stable in order to facilitate comparability of replies over time. However, when new policy measures are announced by the Governing Council, these are systematically incorporated into the questionnaire. For example, in the September 2021 SMA, a dedicated section was included relating to the ECB’s new monetary policy strategy. Over time the questionnaire has been adjusted, but its structure has been maintained, ensuring that all key policy parameters are always captured.

The questionnaire collects modal and probabilistic views of respondents. While it asks for the modal view (in the form of a point estimate), in many instances it also makes use of probabilistic questions to elicit the likelihood that respondents assign to different future events. This type of question is particularly suitable where there is a bimodality of expectations. Probabilistic questions also eliminate uncertainty about whether the respondent is referring to the mean, median or mode when asked to provide a point estimate.[10]

As intended, the information gathered by the SMA can be used to undertake the following analyses:

- Assessing financial market participants’ expectations regarding monetary policy: To the extent that survey results can be understood as reflecting financial market expectations, these results can complement information in asset prices and inform analysis to extract such financial market expectations. Specifically, econometric models can be deployed that combine both surveys and prices to extract useful “underlying” or average expectations (for a more technical discussion, see Box 2). At the same time, survey data are not necessarily representative of financial market expectations: their cross-section dimension can be small (given the small size of the SMA panel), and the heterogeneity of panellists may affect aggregate results.

- Examining respondents’ outlook for the economy: The SMA provides respondents’ forecasts on key macroeconomic variables and risks that correspond to their policy expectations (see Section 5).

- Examining how the ECB’s communication and forward guidance are understood:[11] As the SMA provides joint information on expected interest rates, asset purchases and macroeconomic developments, it allows a quantitative assessment of how forward guidance translates into expectations regarding the timing and pace of interest rate changes and net asset purchases and of the duration of reinvestments under the ECB’s purchase programmes. Specifically, the SMA reveals information on respondents’ expectations regarding the timing of “shortly before” the ECB rates start increasing, while expectations regarding the ending of full reinvestments provide insight on interpretations of the “extended period of time” after which the ECB rates will start increasing. It can also be used to analyse the extent to which the ECB’s current interest rate forward guidance conditions regarding inflation are met (see Box 3).

Box 2

Inferring financial market participants’ expectations from asset prices and surveys

The SMA captures survey panellists’ expectations regarding monetary policy and macroeconomic developments. An alternative way to capture economic agents’ expectations is to look at financial asset prices, which incorporate expectations of future payoffs, which in turn link to interest rates, inflation, economic growth, corporate profits and other key variables. As asset prices are available at daily or even higher frequency, these can be used to extract financial market participants’ expectations in a timely manner. These prices can therefore complement survey information, which is available at lower frequency and only for a selection of forecast horizons.

Forward interest rates are indicators of market participants’ interest rate expectations. These rates (e.g. the one-year interest rate four years ahead) are locked in today and apply to lending or borrowing contracts that start in the future.[12] Considering the simplest form of the expectations hypothesis, forward rates can be interpreted as expected short-term rates. By this logic, the current flatness of the short end of the €STR forward curve suggests that market participants expect the €STR (and hence also the ECB’s DFR) to remain at its current level for an extended period of time. Similarly, forward rates derived from inflation-linked swaps reflect expectations regarding future inflation rates.

However, forward rates do not exclusively reflect market participants’ actual rate expectations; they also reflect a risk premium component compensating investors for the risk of rate changes or reinvestment risk.[13] This risk premium is measured by the difference between forward rates and a measure of the expected short-term interest rate at corresponding horizons. It can be positive or negative, it can change over time, and its absolute size varies with the uncertainty and risk aversion of market participants. While forward rates as such are readily available, their sub-components (rate expectations and risk premia) are not individually observable. This poses a challenge to the use of asset prices for monitoring market participants’ expectations over time.

Chart A compares the three-month EURIBOR forward rate 12 months ahead (blue line) with survey forecasts of the three-month EURIBOR rate in 12 months. Survey figures represent the average of Consensus Economics’ panellists’ expected rate (yellow dots) and the median of SMA panellists’ most likely rate (red dots). Assuming that aggregated survey responses are broadly in line with interest rate expectations embedded in three-month EURIBOR forward rates, Chart A illustrates the presence and time variation of forward risk premia measured by the difference between survey expectations and forward rates. An analysis of forward rates and Consensus Economics survey forecasts suggests that the 12 months ahead three-month EURIBOR forward risk premium has, on average, been slightly negative since 2014.[14] For the most recent period, aggregated SMA forecasts differ slightly from aggregated Consensus Economics forecasts, which might be due to panel compositional effects, different reporting periods, and discrepancies in underlying questions.

Chart A

Three-month EURIBOR rate: 12-months-ahead forward rate and survey expectations

(percentages per annum)

Sources: Consensus Economics, SMA and ECB staff calculations.

Notes: The latest survey forecasts are for September 2021. Consensus Economics reports averages across survey panellists of mean point forecasts. The SMA reports medians across survey panellists of modal point forecasts.

As survey expectations are only available at certain points in time, these may not be available when they are most useful to gauge market participants’ expectations, e.g. in times of crisis.[15] Asset prices, by contrast, are available daily, but, as argued above, their information content regarding interest rate expectations is blurred by the presence of risk premia. In order to reap the benefits of both data sources, econometric models have been developed to combine the timeliness of asset price data with the premia-free but more sporadic information from surveys. Econometric models of the term structure of interest rates, for instance, can be designed to include survey information.[16] Accounting for survey information in the estimation of term structure models helps econometricians to better estimate the degree of persistence of interest rates expectations. This could otherwise be underestimated, implying too strong a reversion of rate forecasts to their long-run model-implied mean.[17] In addition, including survey information in term structure models can also help to better pin down the long-run mean of interest rates.[18] Overall, these models provide a high-frequency measure of interest rate expectations that reflects both sources of information: asset prices (the yield curve observed every day) and surveys (rate expectations at various horizons, sampled at certain points in time).

Importantly, model-based estimates of interest rate expectations typically do not (and need not) precisely match survey-based expectations. The difference between the two partly reflects the fact that models are subject to estimation and model uncertainty, as the true “data generating process” cannot be observed. Moreover, the reported average or median expectations across survey panellists may differ from expectations of the marginal investors who determine asset prices.[19] Besides, as models typically include average or median survey expectations, they neglect the heterogeneity across survey panellists.[20] In addition, survey expectations might suffer from misunderstandings or a misrepresentation of expectations induced by wrong incentives (like a reluctance to deviate too much from the consensus view).

Chart B compares snapshots of the EONIA and €STR forward curves with model-based forecasts and survey-based expectations of the money market rates at three different points in time over the last decade. The model-based results are obtained from an econometric term structure model with a lower bound on interest rates that takes Consensus Economics forecasts and recent SMA forecasts into account.[21] The upper and middle panels of Chart B show that survey expectations and model-implied expected rate paths can be below or above the forward curve, indicating that forward term premia can be positive or negative. Moreover, the panels illustrate that model-based expectations can be displayed for an arbitrary and dense set of horizons. By contrast, surveys can only cover the horizons specified in the respective questionnaires. The lower panel of Chart B compares the €STR forward curve prevailing in August 2021 with the median of the SMA participants’ most likely path for the €STR.[22] The survey and model results suggest close to nil forward term premia up to about three years out, and negative forward term premia thereafter.

Chart B

Forward curves, model-based expectations and survey-based forecasts

(x-axis: months ahead; y-axis: percentages per annum)

Sources: Bloomberg, Consensus Economics, Refinitiv and ECB (SMA and staff calculations).

Note: Model-implied estimates follow Geiger, F. and Schupp, F., “With a little help from my friends: Survey-based derivation of euro area short rate expectations at the effective lower bound”, Discussion Paper, No 27, Deutsche Bundesbank, 2018.

The SMA can be particularly helpful for models that decompose asset prices into expectations and risk premia, owing to its unique features: first, compared to other surveys, it provides forecasts for a broader range of variables (the three key ECB policy interest rates, the €STR, the three-month EURIBOR rate and inflation); second, unlike most other surveys, SMA vintages also provide a consistent and dense grid of forecast horizons, reaching up to ten years ahead (“long term”) for some variables; third, the survey is carried out shortly before Governing Council monetary policy meetings (every six weeks on average).

Owing to the still short history of the SMA, SMA survey results need to be complemented with other survey data to inform models used to extract interest rate or inflation expectations at high frequency. As more SMA vintages become available, such models will increasingly be informed by the survey.

3 Panel selection

The press release announcing the launch of the SMA gave four criteria for the selection of respondents. The criteria are: (i) market relevance, (ii) geographical representativeness, (iii) commitment to participating regularly in the survey, and (iv) having an active involvement in the areas of activity covered by the survey.[23]

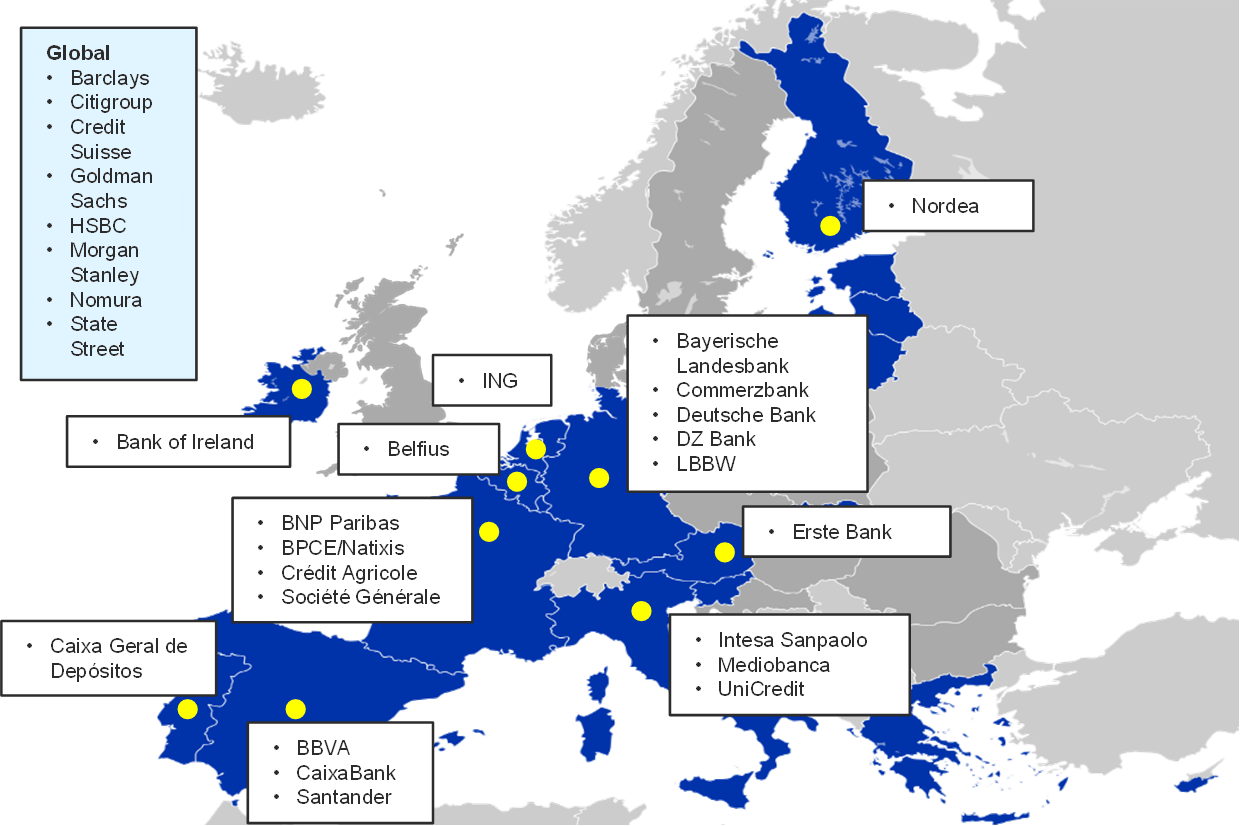

The survey respondents have been selected from among members of the ECB’s market contact groups, as these largely satisfy the four criteria.[24] The track record of the ECB’s market contact groups provides an effective way to identify potential SMA participants, as their willingness to actively engage is critically important in ensuring the quality of the survey.[25] The degree of engagement is especially relevant as the SMA sample size consists of 29 institutions, so a high response rate is required if the survey is to be indicative of the market’s view. The list of institutions is published on the ECB’s website and the participation rate has been high, including during the pilot phase.[26] The panel composition, which has remained largely unchanged since the start of the survey, is currently being reviewed. Figure 1 illustrates the geographical distribution of the current panellists.

Figure 1

Panel composition

Source: ECB.

The selection of respondents has focused on the banking community. One reason for this approach is the important role banks play in euro area monetary policy transmission, be it as counterparties to the ECB, traders in financial markets or as credit intermediators in the euro area bank-based system. In addition, banks’ economic forecasting and market research can inform the views of their clients. As such, their expectations regarding monetary policy and the economy can also be considered as being informative of investor expectations. To obtain the “house view”, SMA respondents were asked to coordinate the answers based on the views of their own economists, strategists and traders so as to ensure consistency.

The panel composition will henceforth be reviewed annually. The ECB periodically updates the panel of banks in its contact groups. Accordingly, the SMA panel composition is reviewed too, with a focus on assessing the quality of responses and the degree of engagement of respondents over the preceding 12 months. At the same time, new potential respondents may be invited to take part in the survey. Looking ahead, and in view of the increasing importance of the asset management industry in financial markets, buy-side institutions may eventually be invited to take part in the SMA too.

4 SMA governance

With the SMA being an ECB survey on monetary policy, specific safeguards are required to ensure that survey questions cannot be misinterpreted as revealing signals of future monetary policy decisions and, at the same time, to ensure that these capture decisions taken by the Governing Council in a timely and comprehensive manner. Accordingly, the SMA’s governance has been shaped along several dimensions:

Staff ownership: From the outset the SMA has been staff-led with the questionnaire disclaimer stating “This survey has been formulated by ECB staff; members of the ECB’s decision-making bodies are not involved in the formulation of the survey” and “The questions never presume or signal an intention to undertake any particular policy action in the future”.[27]

Scope of the questionnaire: The SMA questionnaire appears to be well-understood by respondents and has evolved considerably over the pilot phase to incorporate new policy measures introduced by the Governing Council through questions that are generally based on the monetary policy statement.

Formulation of the questions: Questions are formulated in a neutral manner.

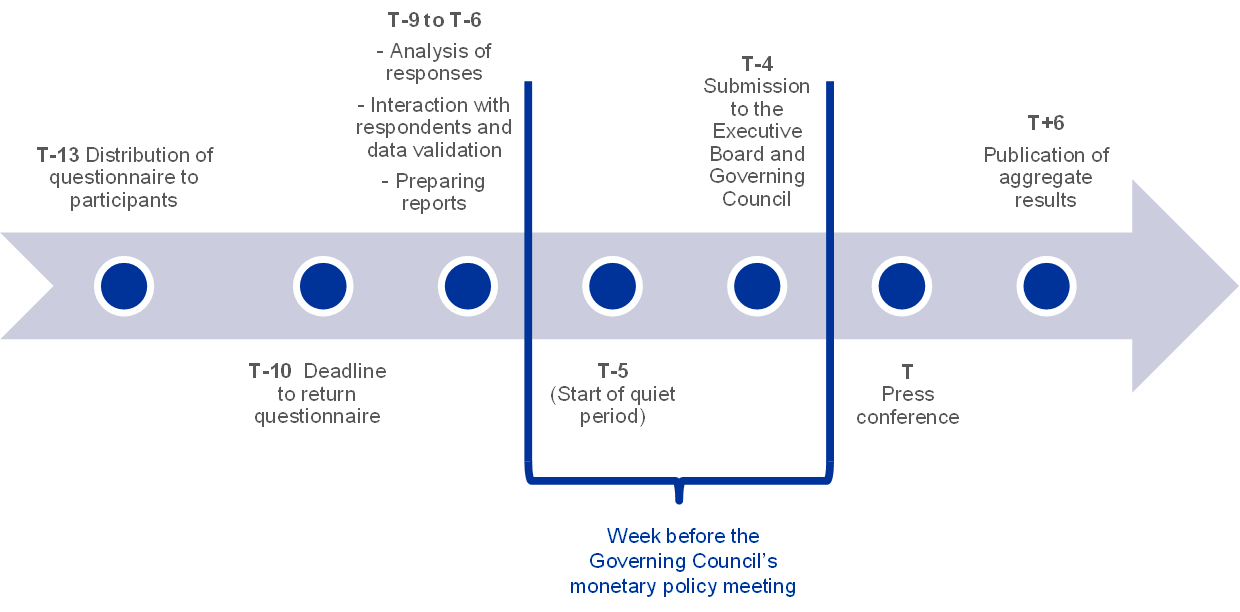

Survey frequency: Since its launch, the frequency of the SMA has been aligned with the six-weekly schedule of the Governing Council’s monetary policy meetings (see Figure 2 for a typical SMA timeline). 13 business days before the Governing Council meeting, typically on a Monday morning at 10:00 CET, the questionnaire is sent to the respondents and published simultaneously on the ECB’s website. Respondents provide their responses by Thursday evening of the same week, then the SMA team validates and analyses the questionnaires before disseminating the aggregated results to the Governing Council four business days before the Governing Council meeting. Since June 2021, the results have been published on the ECB’s website at 18:00 CET on the Friday of the week after the Governing Council meeting.

Quality control of results: Cross-checks of responses against other publicly available information and periodical statistical exercises are consistently applied.

Figure 2

SMA timeline

Source: ECB.

Note: The timeline is in business days with T referring to the date of the Governing Council’s monetary policy meeting.

5 How the SMA results can inform views on financial market expectations

One of the main purposes of the SMA is to assess respondents’ expectations regarding key interest rates, asset purchases and refinancing operations. Section 1 of the questionnaire asks respondents for their expectations regarding key ECB interest rates, market rates and market conditions. For example, the first question in the section asks respondents to indicate the probability that the next change in key ECB interest rates will be an increase or decrease, the most likely timing of the change and the expected size of the change. According to the September 2021 SMA, there was a near unanimous expectation with a median 95% probability that the next change in the DFR would be an increase (Chart 1, third column). In terms of the timing of the increase, the median expectation was that this would occur in the fourth quarter of 2024, six months later than expected in the July 2021 SMA (Chart 2). As described in Box 3, this development reflects the Governing Council’s revised interest rate forward guidance announced in July 2021. This shows that the information in the SMA captures the way changes in respondents’ expectations about the economic outlook, as covered in Section 4 of the survey, affect their policy expectations.

Chart 1

Probability attached to next change in the DFR being an increase

(left-hand scale: percentages; right-hand scale: months)

Source: ECB.

Note: Number of respondents is 21 for the September 2021 SMA, 21 for the July 2021 SMA and 22 for the June 2021 SMA.

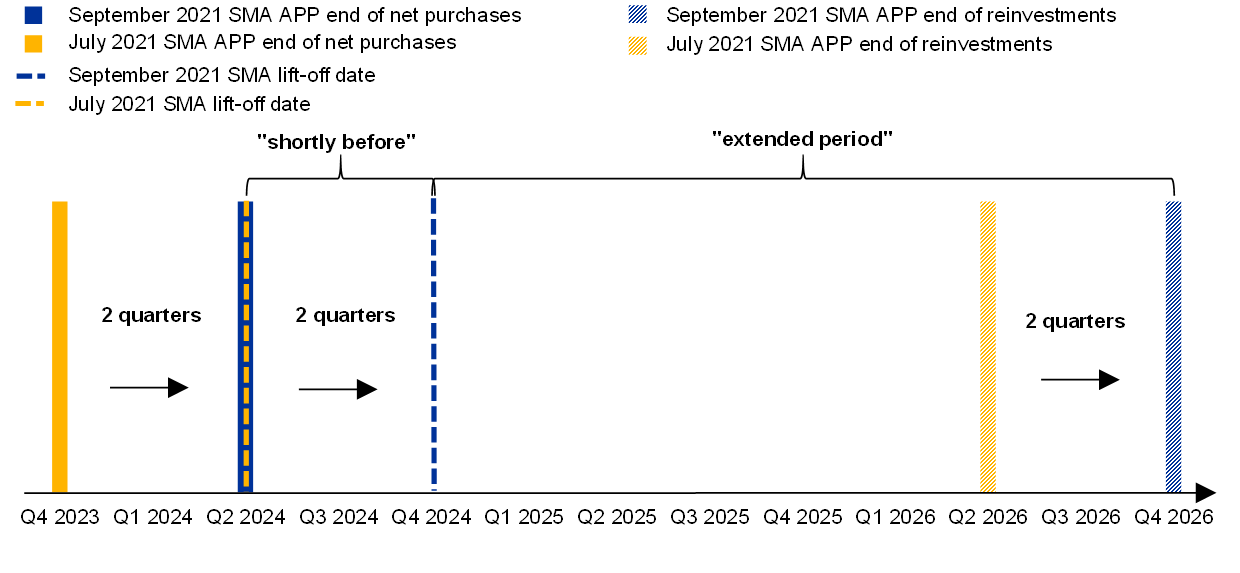

Chart 2

Expectations for policy parameters

(x-axis: date)

Source: ECB.

Note: Number of respondents is 24 for the September 2021 SMA and 24 for the July 2021 SMA.

The respondents’ expectations regarding the ECB’s asset purchase programmes – the APP and the pandemic emergency purchase programme (PEPP) – and reinvestments are covered in Section 2 of the questionnaire. The section starts with the APP and asks multipart questions pertaining to when net asset purchases will end, the length of time the reinvestment of maturing securities purchased under the APP will continue, the evolution of the stock of the APP and whether respondents expect changes to the programme. In the September 2021 round, the median expectation was that the APP would end in mid-2024 with full reinvestments continuing until the end of 2026 (Chart 2).

SMA survey results on interest rates and asset purchases can be used to understand the effectiveness of the interaction between forward guidance on interest rates and on asset purchases. Forward guidance on APP parameters are linked to forward guidance on interest rates via the conditions that are required to be met before policy interest rates start increasing (see Box 3): net purchases will be conducted until “shortly before” the date on which the Governing Council starts raising interest rates, and reinvestments will run for “an extended period of time” past that date (see Chart 2). SMA survey results indicate that respondents have revised the expected timing of the end of net purchases, the interest rate lift-off, and the end of reinvestment in a consistent manner in line with the chained forward guidance on interest rates and asset purchases: the postponement of the DFR lift-off date is associated with the prolonged horizon of APP net purchases and reinvestments, and vice versa.

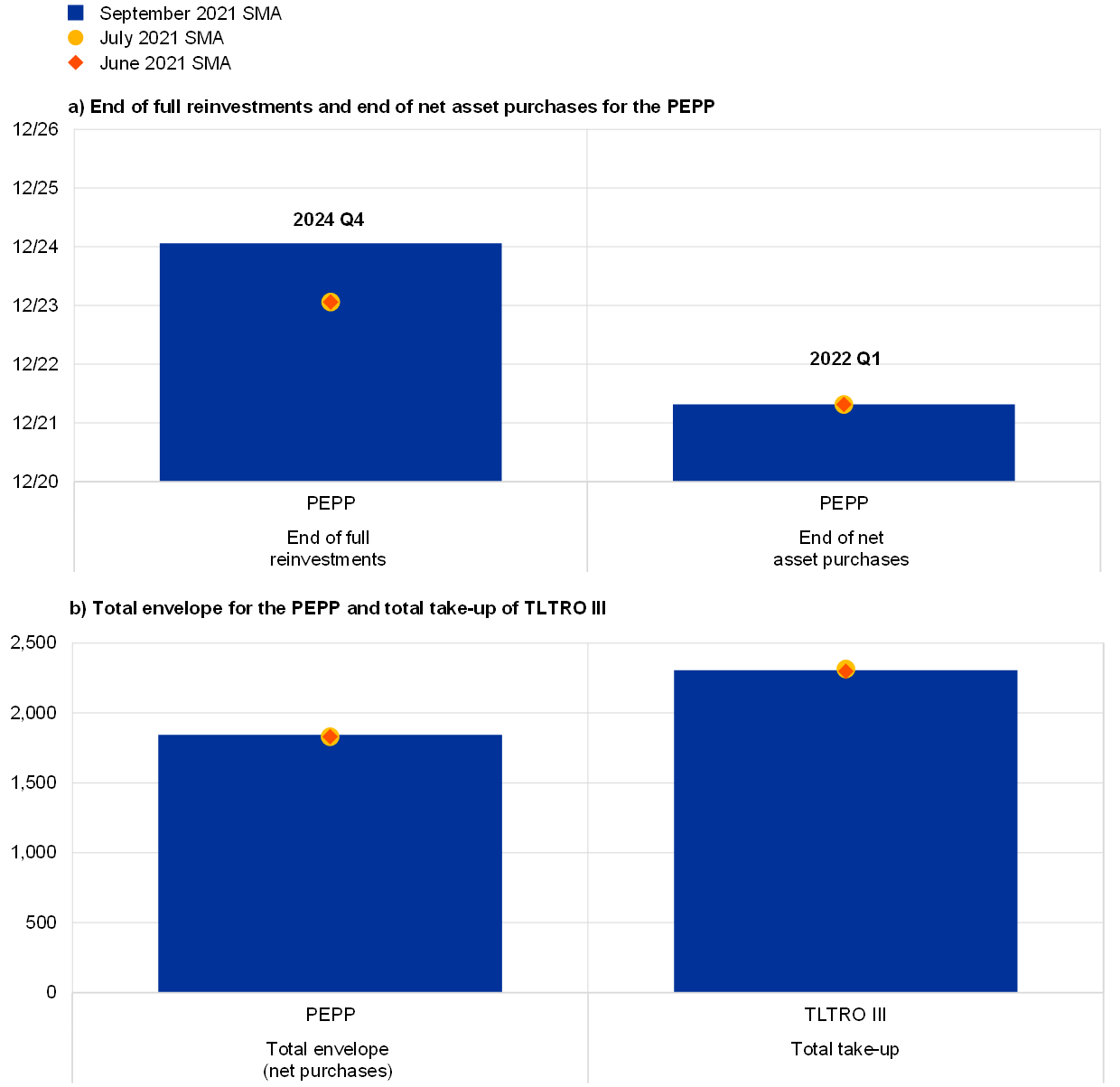

The second part of Section 2 of the questionnaire relates to respondents’ expectations regarding the PEPP, which was introduced in response to the COVID-19 pandemic. Respondents were asked multipart questions covering the amount of the PEPP envelope they expect to be used by March 2022, when they expect the programme to end and what they expect the profile of quarterly purchases to be. In the September round, the median expectation was for the programme to end in the first quarter of 2022 (Chart 3, panel a), reinvestments to continue until the end of 2024 (Chart 3, panel a) and the €1,850 billion envelope to not be fully taken up by March 2022 (Chart 3, panel b). The median expectation that the entire PEPP envelope would not be fully exhausted by the second quarter of 2022 was also corroborated by Bloomberg and Thomson Reuters surveys. The respondents’ median expectation was that the size of average monthly purchases per quarter would progressively decline over the final three quarters of the programme (Chart 4).

Chart 3

Expectations for the PEPP and TLTRO III

(panel a: date; panel b: EUR billions)

Source: ECB.

Note: Number of respondents is 24 for the September 2021 SMA, 24 for the July 2021 SMA and 24 for the June 2021 SMA.

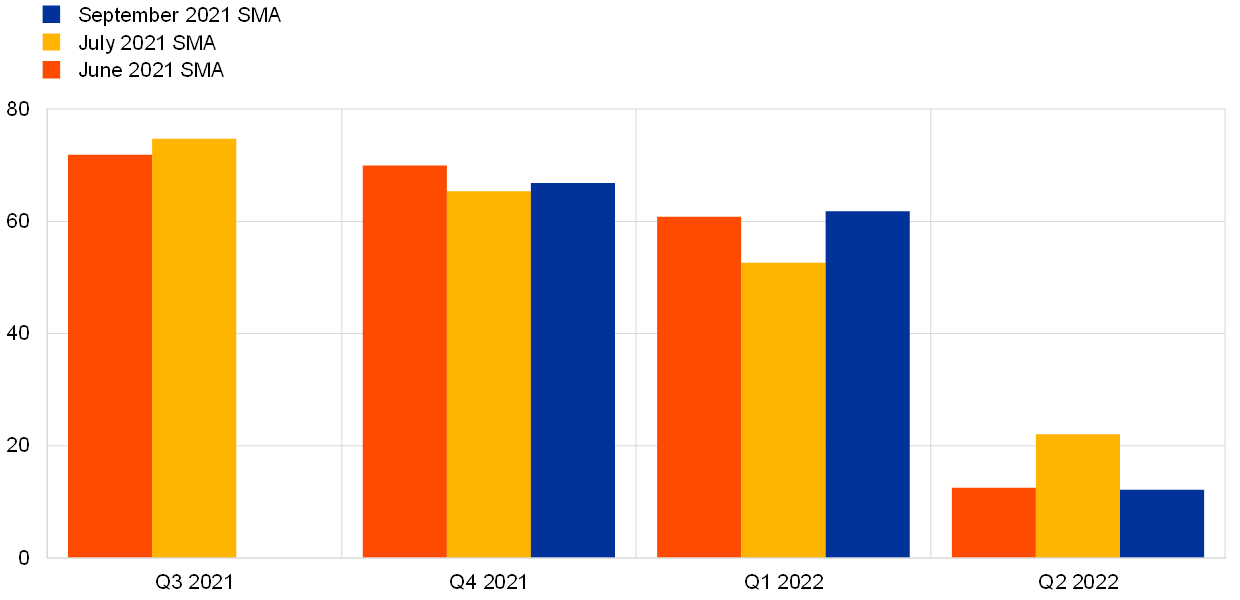

Chart 4

Expectations for average monthly PEPP purchase pace by quarter

(EUR billions per month)

Source: ECB.

Notes: Number of respondents is 22 for September SMA, 21 for July 2021 SMA and 22 for June 2021. Pace derived as first difference of the PEPP holdings for the median respondent.

Section 3 of the questionnaire garners expectations of the ECB’s refinancing operations. In the September round, the median respondent expected the total take-up of TLTRO III to be €2,304 billion (Chart 3, panel b). Together, Sections 1, 2 and 3 of the survey provide a very comprehensive assessment of financial market participants’ expectations.

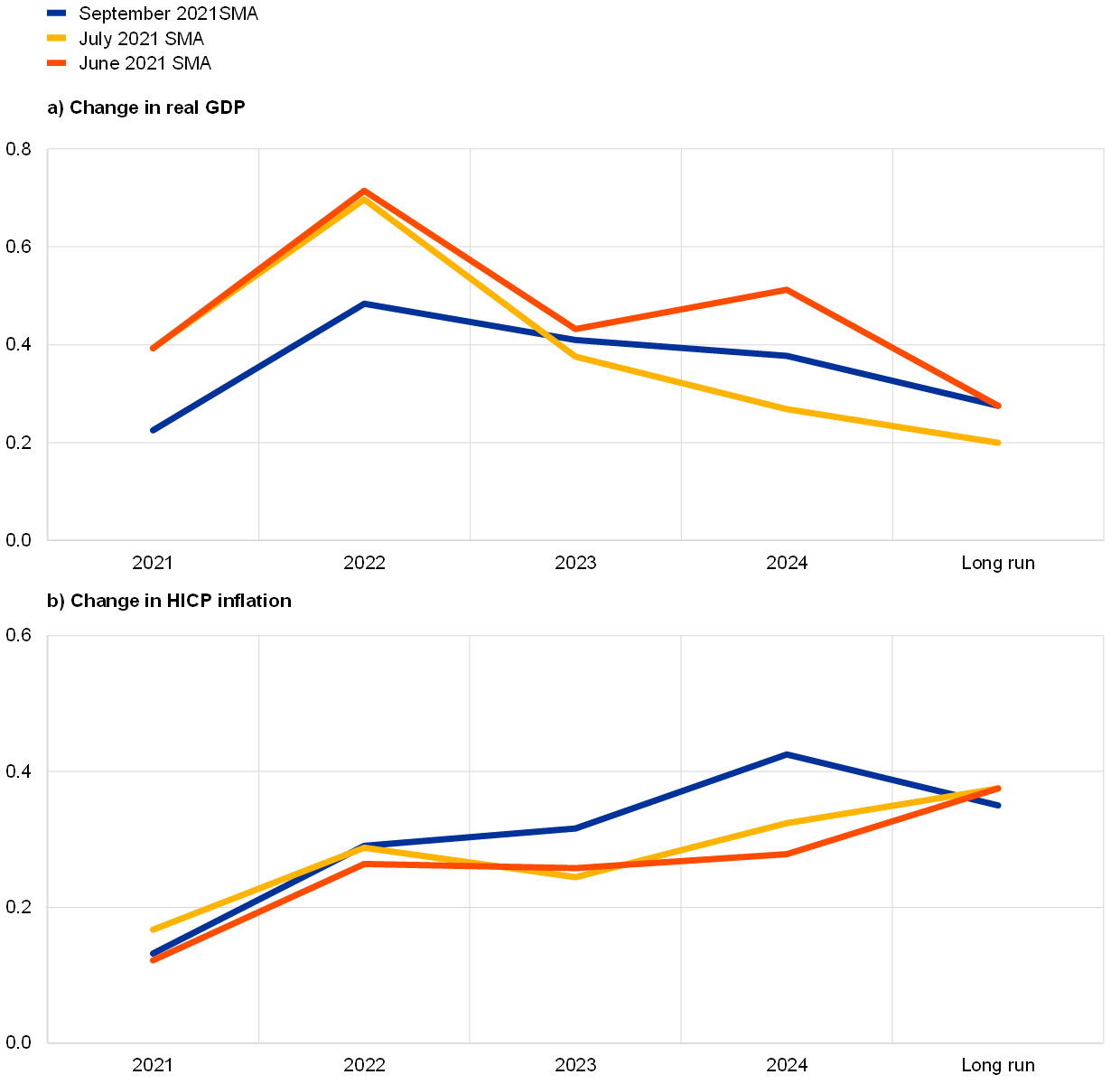

The macroeconomic outlook is captured in Section 4 of the questionnaire. Respondents are asked to provide forecasts for key macroeconomic variables over a long horizon as well as the associated risks surrounding the outlook. The survey rounds from June to September 2021 indicated upward revisions of the near-term euro area growth and inflation outlooks (Chart 5). The SMA gathers respondents’ macroeconomic forecasts, longer-term outlook and risks which are commensurate with their policy expectations. Notably, the median expectation for long-run inflation was 1.9% in September and, as outlined in Box 3, there was an increase in the number of respondents indicating long-run inflation in the 1.8% to 2% range following the ECB’s new strategy review.[28] As for risks associated with the panellists’ outlook, the majority of respondents assess the risks to growth as being balanced, with upside risks to inflation increasing over recent surveys (Chart 6).

Chart 5

Median forecasts of real GDP and HICP inflation

(year-on-year percentage changes)

Source: ECB.

Note: Number of respondents is 23 for the September 2021 SMA, 24 for the July 2021 SMA and 25 for the June 2021 SMA.

Chart 6

Balance of risks

(percentages of respondents)

Source: ECB.

Note: Number of respondents is 21 for the September 2021 SMA, 23 for the July 2021 SMA and 27 for the June 2021 SMA.

The level of disagreement between respondents was limited in relation to the growth outlook and slightly more elevated for the inflation outlook. The survey allows the heterogeneity of replies across respondents to be examined, which can be illustrated by plotting the disagreement among respondents (calculated as the difference between the 75th percentile and 25th percentile) on growth and inflation forecasts (Chart 7). There was a similar degree of disagreement among respondents regarding the growth outlook, with a growing share of respondents assessing the outlook to be balanced (Chart 6, panel a). By contrast disagreement over the inflation outlook increased in the September 2021 SMA, with a growing share of respondents perceiving upside risks to inflation (Chart 6, panel b).

Chart 7

Disagreement on real GDP and HICP inflation among SMA respondents

(interquartile ranges)

Source: ECB.

Note: Number of respondents is 23 for the September 2021 SMA, 24 for the July 2021 SMA and 25 for the June 2021 SMA.

As mentioned above, SMA survey results have been used to examine how SMA respondents interpret the ECB’s new strategy statement and revised interest rate forward guidance in order to analyse the effectiveness of ECB communication (see Box 3 for a more detailed discussion). The September 2021 SMA included a specific section dedicated to the new strategy statement with SMA respondents indicating that they now had greater clarity regarding the ECB’s price stability target following the statement. Also, respondents appeared to have taken on board the conditions that need to be met, as outlined in the revised forward guidance on interest rates, before policy interest rates can begin increasing.

Box 3

Examining the impact of the ECB’s revised strategy statement on market expectations through the lens of the SMA[29]

On 8 July 2021 the ECB communicated its new monetary policy strategy, which incorporates two key innovations: first, the redefinition of the price stability objective as a symmetric two per cent inflation target over the medium term; second, a conditional commitment to take into account the implications of the effective lower bound when conducting policy in an environment of structurally low nominal interest rates.[30]

On 22 July 2021 the Governing Council revised its interest rate forward guidance to align it with the achievement of the symmetric two per cent inflation target. The revised forward guidance stipulates three conditions that need to be met before policy interest rates start increasing: first, looking forward, inflation should be expected to reach the new two per cent target “well ahead” of the end of the projection horizon; second, this convergence should be reached “durably for the rest of the projection horizon”; third, progress in current-looking underlying inflation should be judged to be “sufficiently advanced” at the time of lift-off, so as to act as a safeguard against a premature policy tightening in the face of adverse cost-push shocks that might elevate headline inflation temporarily but fade quickly with no implication for inflation trends. Also, according to the revised forward guidance, and in line with the strategy review statement, the verification of these three conditions might imply a transitory period in which inflation is moderately above target.

The ECB’s monetary policy strategy statement

SMA respondents reported that the revised strategy statement has improved their understanding of the ECB’s communication. The September SMA round featured questions specifically tailored to gauge the effects of the ECB’s revised strategy statement on market participants’ perception of the ECB’s reaction function. Respondents overwhelmingly considered the statement to have enhanced the clarity of the ECB’s price stability definition, as well as to have clarified the ECB’s reaction function (Chart A, panel a). Respondents’ comments revealed that they welcomed the new strategy and signalled that it was broadly anticipated.[31] They also indicated that it remained to be seen how the revised strategy would translate into the practical implementation of monetary policy over time.[32]

Chart A

Strategy review announcement (list of survey respondents)

a) Improved understanding through strategy statement

(percentages of respondents)

b) Long-term inflation expectations (pooled probability distribution)

(x-axis: percentages per annum; y-axis: percentages)

Source: ECB.

Notes: Panel a depicts the share of respondents to the September 2021 SMA that answered “yes” (blue) or “no” (yellow) to Question 0.1 “Has [the ECB’s monetary policy strategy statement] enhanced the clarity of your understanding of the ECB’s price stability target?” (left column) and Question 0.2 “Has [the ECB’s monetary policy strategy statement] enhanced the clarity of the ECB’s policy reaction function” (right column). The number of respondents to each question was 24. In panel b, the grey areas highlight the medians for June (1.5% to 1.7%) and September (1.8% to 2.0%). The number of respondents was 19 for the September 2021 SMA and 20 for the June 2021 SMA.

The September 2021 SMA also indicated a noticeable upshift in respondents’ long-term inflation expectations.[33] Compared to the June round, the median long-term inflation expectation across respondents has increased, from 1.5-1.7% in June to 1.8-2.0% in September (Chart A, panel b). In addition, respondents’ expectations exhibited a slightly more symmetric distribution, as indicated by the reduced skewness compared to the June distribution. This change is also visible in the increased probability – from 30% in June to 40% in September – attached to euro area long-term inflation ranging between 1.8% and 2.3% (Chart A, panel b).

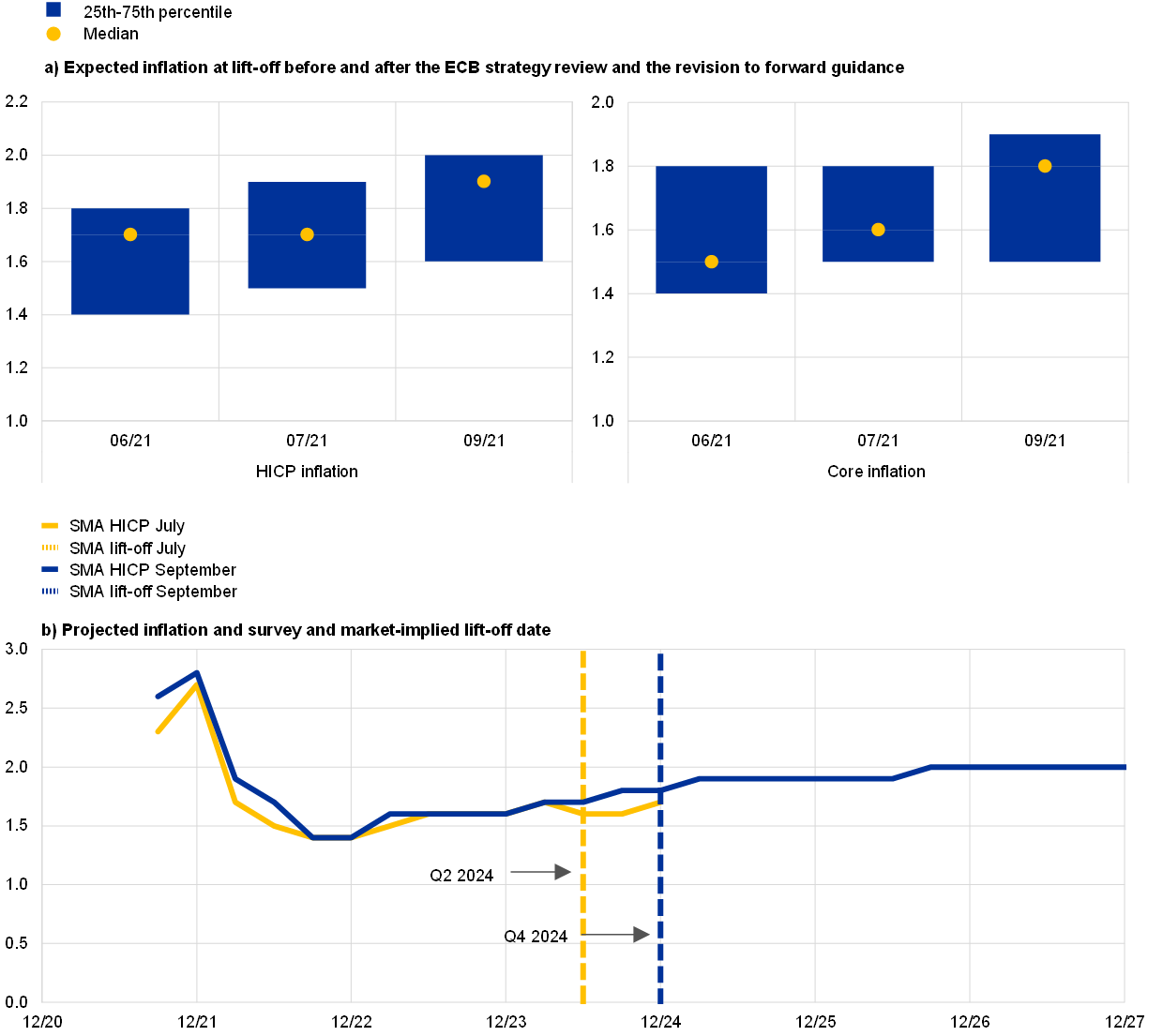

Revised interest rate forward guidance

In addition to the strategy statement, the evolution of respondents’ expectations over the reviewed period also reflected the update to the Governing Council’s interest rate forward guidance. First, in the September SMA, the median expected timing of the first increase in key interest rates was postponed by two quarters to the end of 2024, compared to mid-2024 in the July round, which was conducted before the revised forward guidance was announced. Second, respondents indicated that, at the time of lift-off, they expected the prevailing headline inflation rate to be higher, at 1.85%, compared to 1.7% in the two preceding rounds, albeit with significant dispersion across responses (Chart B, panel a). Third, responses to a direct question included in the September SMA imply the “well ahead” condition to be interpreted as around six quarters before the end of the projection horizon. Fourth, with regard to the “sufficiently advanced” progress in underlying inflation, the September SMA signalled expected HICP inflation excluding food and energy to be at 1.8% at the time of lift-off, which was an increase compared to 1.6% in July and 1.5% in June. A cross-check with a direct question on the third conditionality of rate forward guidance featured in the September SMA confirms this assessment, with respondents indicating their understanding that the “sufficiently advanced” condition would be fulfilled when euro area underlying inflation stands at 1.8%.

Chart B

Revised interest rate forward guidance

(year-on-year percentage changes)

Sources: ECB, Bloomberg, ECB calculations.

Notes: Panel a is based on Question 4.2: “Please indicate your estimate of the most likely value (i.e. the mode) for [inflation] during the quarter of the next increase in key interest rates”. Panel b depicts the median responses to Question 1.1 (expected timing of the next increase in the DFR) and Question 4.1 (expectations for HICP inflation) from the July and September 2021 SMA rounds. The forecast horizon for macroeconomic variables was until the end of 2024 in the July round and until the end of 2028 in the September round.

Market participants’ answers to additional questions in the SMA, such as respondents’ expectations for the path of key interest rates combined with their expectations for the inflation outlook (Chart B, panel b), allows the fulfilment of the new interest rate forward guidance condition to be cross-checked. In the September round, median expectations were for interest rate lift-off to occur in the fourth quarter of 2024 and HICP inflation to reach 2% in the third quarter of 2026. From the fourth quarter of 2024 – when rate lift-off is expected to take place – the typical projection horizon would extend for three years until the end of 2027. Accordingly, as inflation is expected to reach 2% around five quarters ahead of the end of the projection horizon, the interpretation of the length of the “well-ahead” period would be around five quarters, which is broadly consistent with the estimate from the above-mentioned direct question.[34]

Overall, the evolution of respondents’ answers over the June, July and September survey rounds provides valuable insights into market participants’ perception of the changes in the ECB’s reaction function following the strategy revision. Nonetheless, the understanding of the entire scope can be expected to take time and be fully internalised only over a longer horizon. Such a pattern would be consistent with the recent experience in the United States, where it took some time for the new strategy of the Federal Reserve System and the subsequent reformulation of forward guidance to be reflected in market-based inflation expectations.

6 Conclusions

Understanding the evolution of expectations of households, firms and financial markets pertaining to macroeconomic developments and monetary policy is crucial for the success of central banks in pursuing price stability. It is not possible to measure these expectations directly and in an all-encompassing, representative manner. However, surveys collecting forecasts on the expected use of monetary policy instruments and the macroeconomic outlook (alongside information contained in asset prices) can inform this understanding in important ways. The ECB’s SMA complements these sources of information. In particular, the SMA fills a knowledge gap concerning the joint evolution of both macroeconomic developments and monetary policy. It is also informative on financial market participant's understanding of the ECB’s reaction function. Specifically, the survey covers all ECB monetary policy measures and thereby provides important information to monitor the effectiveness of the ECB’s monetary policy decisions and forward guidance and the credibility of its inflation targets, as measured by long-run inflation expectations.

- For information on the SMA, see the ECB’s website.

- See the press release of 8 February 2021.

- See “Market Intelligence Gathering at Central Banks”, Markets Committee Papers, No 8, Bank for International Settlements, December 2016.

- More information on the ECB’s market contact groups is available on the ECB’s website.

- Such surveys typically ask questions concerning the path of key interest rates and other policy parameters, like the pace of asset purchases and communication aspects. Bloomberg also publishes the results of a separate monthly survey that focuses solely on the path of the deposit facility rate (DFR) and the main refinancing operations (MRO) rate.

- The Federal Reserve System also gathers market intelligence on other topics, e.g. on banks’ strategies and practices for managing reserve balances (via the Senior Financial Officer Survey).

- For more information on the SPD, see the Federal Reserve Bank of New York’s website, and for an in-depth study, see “Understanding the New York Fed’s Survey of Primary Dealers”, Current Issues in Economics and Finance, Vol. 19, No 6, Federal Reserve Bank of New York, 2013. The Federal Reserve Bank of New York also conducts the Survey of Market Participants, which covers a subset of firms associated with its advisory groups and committees.

- See, for example, “Responses to Survey of Primary Dealers”, Federal Reserve Bank of New York, July 2021. The SMA is jointly formulated by ECB staff from the Directorate General Market Operations and the Directorate General Monetary Policy.

- See press release of 30 January 2019.

- For an instructive overview of the rationale behind the Federal Reserve System’s introduction of probability distribution questions in the SPD, see Fischer, S., “Monetary Policy Expectations and Surprises”, speech at the School of International and Public Affairs, Columbia University, April 2017.

- For a description of the ECB’s revised interest rate forward guidance, see Lane, P.R., “The new monetary policy strategy: implications for rate forward guidance”, The ECB Blog, ECB, August 2021. The chained forward guidance structure of the asset purchase programme (APP) links the horizons of net asset purchases and reinvestments to the interest rate lift-off date.

- Forward rates are often reported as “implied forward rates”, i.e. they are computed from observed spot interest rates using the fact that one can replicate the pay-off stream of a forward contract by creating certain portfolios of long and short positions in bonds. The “implied forward rate” would then depend on the current yields of the bonds constituting the replicating portfolio. The one-year forward rate four years ahead, for instance, would be implied by the four-year and five-year bond yields.

- The size and sign of the forward risk premium will depend on the uncertainty about the future level of the short-term interest rate, but also on the economic environment in which those higher or lower-than-expected rate realisations are expected to happen. See, for example, Chapter 19.2 on “Yield curve and expectations hypothesis” in Cochrane, J.H., Asset pricing, Princeton University Press, 2001.

- Paying a negative risk premium might be reasonable from an investor’s perspective if an asset serves as insurance against adverse shocks – i.e. it tends to have a high pay-off in bad states of the world. For nominal risk-free assets this may, for example, be the case if investors are worried about low growth/low inflation scenarios (see Piazzesi, M. and Schneider, M., “Equilibrium Yield Curves”, NBER Macroeconomics Annual, Vol. 21, 2006; and Campbell J.Y., Sunderam, A. and Viceira, L.M., “Inflation Bets or Deflation Hedges? The Changing Risks of Nominal Bonds”, Critical Finance Review, Vol. 6, 2017, pp. 263-301).

- For instance, at the end of February and beginning of March 2020, when the financial market turmoil related to the coronavirus (COVID-19) outbreak in Europe intensified, surveys were only available on 9 March (Consensus Economics), 6 and 17 March (Bloomberg surveys on the DFR), and 1 March (SMA pilot phase), with survey results quickly becoming obsolete following their release.

- A central assumption frequently imposed on econometric term structure models is the exclusion of arbitrage opportunities across maturities. This assumption implies that it is not possible to build bond portfolios across maturities such that the investor receives positive profits with certainty in the future without investing any capital today. Technically, the no-arbitrage constraint is imposed via restrictions across model parameters. See, for example, Joslin, S., Singleton, K.J. and Zhu, H., “A New Perspective on Gaussian Dynamic Term Structure Models”, The Review of Financial Studies, Vol. 24, No 3, 2011, pp. 926-970.

- See, for example, Kim, D.H. and Orphanides, A., “Term Structure Estimation with Survey Data on Interest Rate Forecasts”, Journal of Financial and Quantitative analysis, Vol. 47, No 1, 2012, pp. 241-272; and Geiger, F. and Schupp, F., “With a little help from my friends: Survey-based derivation of euro area short rate expectations at the effective lower bound”, Discussion Paper, No 27, Deutsche Bundesbank, 2018.

- Models that use survey information to help pin down the (potentially time-varying) long-term mean of interest rates include Kozicki, S. and Tinsley, P.A., “Effective Use of Survey Information in Estimating the Evolution of Expected Inflation”, Journal of Money, Credit and Banking, Vol. 44, No 1, 2012, pp. 145-169; Del Negro M., Giannone, D., Giannoni, M.P. and Tambalotti, A., “Safety, Liquidity, and the Natural Rate of Interest”, Brookings Papers on Economic Activity, Spring, 2017, pp. 235-316; and Bauer, M.D. and Rudebusch, G.D., “Interest Rates under Falling Stars”, American Economic Review, Vol. 110, No 5, 2020, pp. 1316-1354.

- See, for example, Reis, R., “The People versus the Markets: A Parsimonious Model of Inflation Expectations”, CEPR Discussion Paper, No 15624, 2021.

- The availability of individual data across participants to measure the heterogeneity of views is an advantage of survey data. However, most econometric models deploying surveys focus on a measure of central tendency, ignoring such dispersion.

- As Consensus Economics asks survey participants for their expectations for the three-month EURIBOR rate, these forecasts are adjusted for the observed spread between the three-month EURIBOR rate and the €STR before being input into the model.

- For consistency, the model-based most likely rate path, i.e. the modal path, is shown instead of the mean path.

- See the press release of 30 January 2019.

- All respondents are given equal weight when constructing the summary statistics.

- Details on the ECB’s market contact groups are available on the ECB’s website. It should be noted that these groups contain the largest institutions, as reflected in their market relevance and analytical capacity.

- A list of SMA participants in the pilot phase can be found on the ECB’s website.

- For the full disclaimer, see, for example, “ECB Survey of Monetary Analysts (SMA), September 2021”, ECB, August 2021.

- The long run should be interpreted as the horizon over which the effects of all shocks will vanish. For the purposes of this survey and, for the sake of simplicity, this can be interpreted as around ten years.

- All aggregate results referred to in this box are available on the ECB’s website.

- For more detail, see the ECB’s monetary policy strategy statement and the accompanying overview of the ECB’s monetary policy strategy.

- The broad anticipation of the strategy review outcome implies that the comparison of the June, July and September SMA rounds may only partially capture the impact of the revised strategy on respondents’ expectations. That the outcome of the strategy review was broadly anticipated is further evidenced by the limited reaction of financial markets on the day of the announcements. Indeed, reports by market analysts published ahead of the announcements support the view that market participants were correctly anticipating important elements of the new strategy and the revised forward guidance.

- A favourable disposition towards the ECB’s new monetary policy strategy was also evident from the results of a special survey of professional forecasters on the ECB’s new monetary policy strategy.

- The assessment focuses on the September SMA, as the July round’s deadline was only one day after the strategy announcement, allowing little time for respondents to digest the announcement. In addition, the September SMA is the first round available following the revised forward guidance announcement and therefore allows for a broader assessment of the joint impact of the strategy and forward guidance revisions on respondents’ expectations. While respondents are asked to provide long-run inflation expectations referring to a horizon when the effects of all transitory disturbances have vanished, short-run inflation dynamics, which increased during the summer period, cannot be ruled out as a factor behind the increase in long-run dynamics.

- In the SMA, minor differences in the assessment of the “well ahead” condition are to be expected and may arise for various reasons, e.g. different subsets of respondents that provided answers to the direct question and to the additional questions on lift-off and macroeconomic forecasts. Moreover, the implied “well ahead” conditionality derived from the macroeconomic forecasts is based on respondents’ own expectations of inflation developments, whereas the duration enquired about in the direct question is more likely to relate to the respondents’ interpretation of the Governing Council’s projections, in line with the revised forward guidance.