- 19 February 2019

- PRESS RELEASE

Euro money market statistics: eighth maintenance period 2018

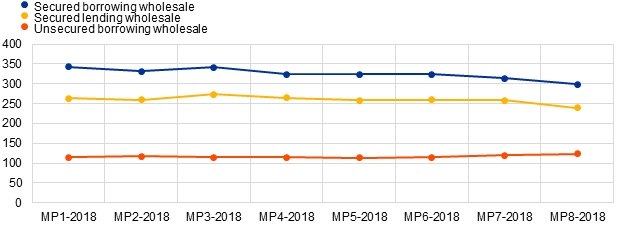

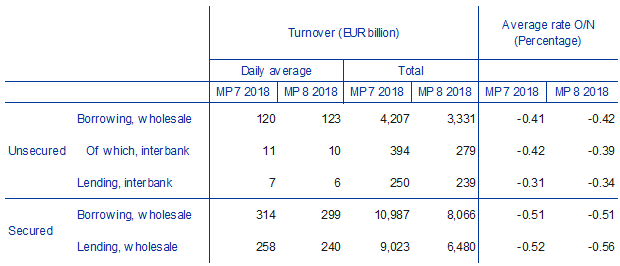

- Daily average borrowing turnover in the unsecured segment increased from €120 billion in the seventh maintenance period of 2018 to €123 billion in the eighth

- Weighted average overnight rate on borrowing transactions in the unsecured segment decreased from -0.41% to -0.42% for the wholesale sector and increased from -0.42% to -0.39% for the interbank sector

- Daily average borrowing turnover in the secured segment decreased from €314 to €299 billion, with a weighted average overnight rate of -0.51%

Chart 1

Daily average nominal borrowing and lending turnover in the secured and unsecured markets by maintenance period (MP)

(EUR billion)

Unsecured market

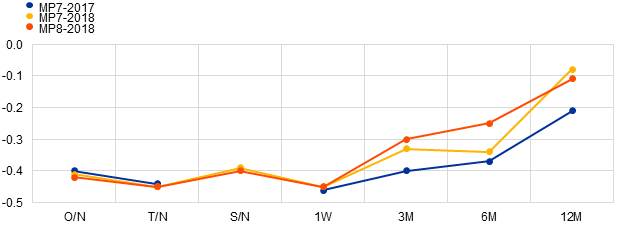

Chart 2

Weighted average rate for wholesale sector borrowing in the unsecured segment by tenor and maintenance period

(Percentage)

In the latest maintenance period, which started on 19 December 2018 and ended on 29 January 2019, the borrowing turnover in the unsecured segment averaged €123 billion per day. The total borrowing turnover for the period as a whole was €3,331 billion. Borrowing from credit institutions, i.e. on the interbank market, represented a turnover of €279 billion, i.e. 8% of the total borrowing turnover, and lending to other credit institutions amounted to €239 billion. Overnight borrowing transactions represented 49% of the total borrowing nominal amount. The weighted average overnight rate for borrowing transactions was -0.39% for the interbank sector and -0.42% for the wholesale sector, compared with -0.42% and -0.41% respectively in the previous maintenance period.

Secured market

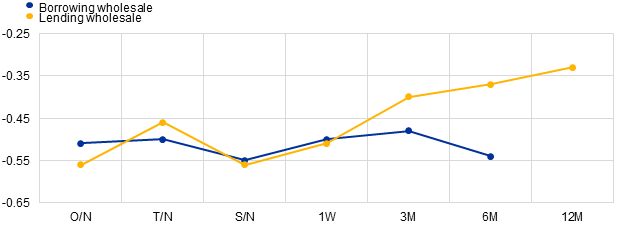

Chart 3

Weighted average rate for wholesale sector borrowing and lending in the secured segment by tenor

(Percentage)

In the latest maintenance period, the borrowing turnover in the secured segment averaged €299 billion per day, while the total borrowing turnover for the period as a whole was €8,066 billion. Cash lending represented a turnover of €6,480 billion and the daily average amounted to €240 billion. Most of the turnover was concentrated in tenors ranging from overnight to up to one week, with overnight transactions representing around 21% and 25% of the total nominal amount on the borrowing and lending side respectively. The weighted average overnight rate for borrowing and lending transactions was, respectively, -0.51% and -0.56% for the wholesale sector, compared with -0.51% and -0.52% respectively in the previous maintenance period.

For media queries, please contact Stefan Ruhkamp, tel.: +49 69 1344 5057.

Notes

- The money market statistics are available in the ECB’s Statistical Data Warehouse.

- The Eurosystem collects transaction-by-transaction information from the 50 largest euro area banks in terms of banks’ total main balance sheet assets, broken down by their borrowing from and lending to other counterparties. Unsecured transactions include all trades concluded via deposits, call accounts or short-term securities with financial counterparties including banks, the government sector and non-financial corporations. Secured transactions cover all fixed-term and open-basis repurchase agreements and transactions entered into under those agreements, including tri-party repo transactions, denominated in euro with a maturity of up to one year, between the reporting agent and other monetary financial institutions (MFIs), other financial intermediaries (OFIs), insurance corporations, pension funds, general governments or central banks as well as non-financial corporations classified as wholesale under the Basel III liquidity coverage ratio framework. More information on the methodology applied, including the list of reporting agents, is available in the statistics section of the ECB’s website.

- The weighted average rate is calculated as the arithmetic mean of the rates weighted by the respective nominal amount over the maintenance period on all days on which TARGET2, the Trans-European Automated Real-time Gross settlement Express Transfer system, is open.

- Borrowing refers to transactions in which the reporting bank receives euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- Lending refers to transactions in which the reporting bank provides euro-denominated funds, irrespective of whether the transaction was initiated by the reporting bank or its counterpart.

- The tenors O/N, T/N, S/N, 1W, 3M, 6M and 12M refer to, respectively, overnight, tomorrow/next, spot/next, one week, three months, six months and twelve months.

- The missing values for tenors in some of the reserve maintenance periods may be due to confidentiality requirements.

- In addition to the developments in the latest maintenance period, this press release incorporates minor revisions to the data for previous periods.

- Data are published 15 working days after the end of each maintenance period. The release calendar and the indicative calendars for the Eurosystem’s reserve maintenance periods are available on the ECB’s website.

- The next press release on euro money market statistics will be published on 2 April 2019.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts