- Press release

Euro area monthly balance of payments: August 2021

20 October 2021

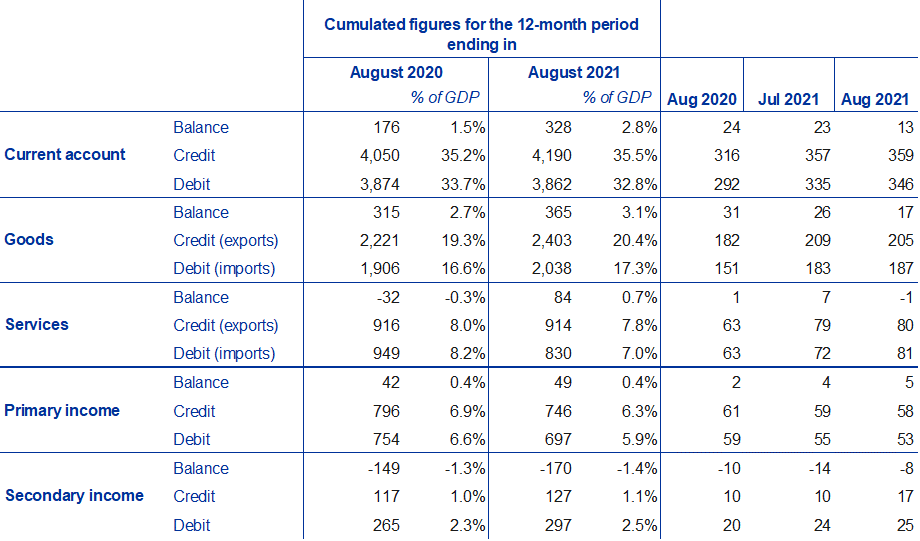

- Current account recorded €13 billion surplus in August 2021, down from €23 billion in previous month

- Current account surplus amounted to €328 billion (2.8% of euro area GDP) in 12 months to August 2021, up from €176 billion (1.5%) one year earlier

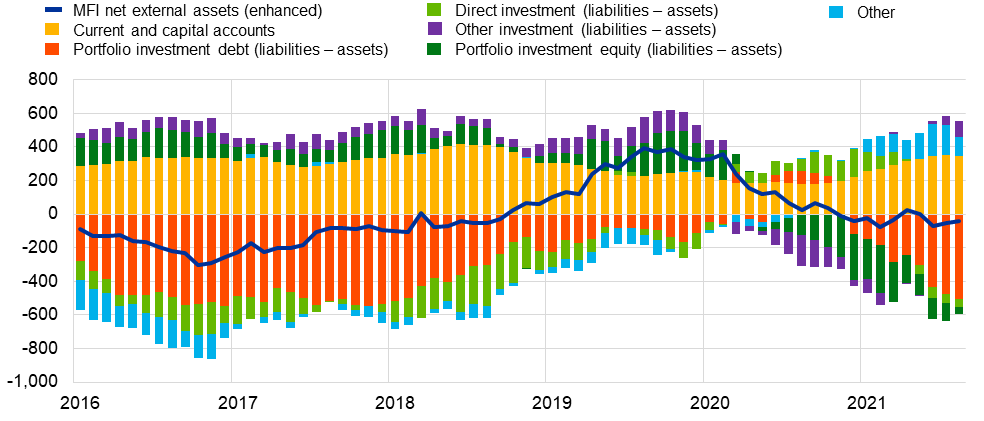

- In financial account, euro area residents’ net acquisitions of non-euro area portfolio investment securities totalled €942 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €129 billion in 12 months to August 2021

Chart 1

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

The current account of the euro area recorded a surplus of €13 billion in August 2021, a decrease of €10 billion from the previous month (see Chart 1 and Table 1). Surpluses were recorded for goods (€17 billion) and primary income (€5 billion). These were partly offset by deficits for secondary income (€8 billion) and services (€1 billion).

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB.

Note: Discrepancies between totals and their components may be due to rounding.

In the 12 months to August 2021, the current account recorded a surplus of €328 billion (2.8% of euro area GDP), compared with a surplus of €176 billion (1.5% of euro area GDP) in the 12 months to August 2020. This increase was mainly driven by a switch in the services balance from a deficit of €32 billion to a surplus of €84 billion and also by larger surpluses for goods (up from €315 billion to €365 billion) and primary income (up from €42 billion to €49 billion). These developments were partly offset by a larger deficit for secondary income (up from €149 billion to €170 billion).

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

In direct investment, euro area residents made net disinvestments of €9 billion in non-euro area assets in the 12-month period to August 2021, following net investments of €21 billion in the 12 months to August 2020 (see Chart 2 and Table 2). Non-residents disinvested €37 billion from euro area assets in the 12-month period to August 2021, following net investments of €91 billion in the 12 months to August 2020.

In portfolio investment, euro area residents’ net purchases of non-euro area equity increased to €535 billion in the 12-month period to August 2021, up from €162 billion in the 12 months to August 2020. Over the same period, net purchases of non-euro area debt securities by euro area residents increased to €406 billion in the 12-month period to August 2021, up from €358 billion in the 12 months to August 2020. Non-residents made net sales of euro area debt securities amounting to €227 billion in the 12 months to August 2021, following net purchases of €260 billion in the 12 months to August 2020. Over the same period, non-residents’ net purchases of euro area equity increased to €356 billion, up from €202 billion in the 12 months to August 2020.

Table 2

Financial account of the euro area

(EUR billions unless otherwise indicated; transactions; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

In other investment, euro area residents recorded net acquisitions of non-euro area assets amounting to €48 billion in the 12 months to August 2021 (following net acquisitions of €99 billion in the 12 months to August 2020), while their net incurrence of liabilities was €593 billion (following net disposals of €55 billion in the 12 months to August 2020). This latter development partly reflects the “2021 General Allocation of Special Drawing Rights (SDRs)” as explained below.

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs decreased by €44 billion in the 12-month period to August 2021. This decrease was mainly driven by euro area non-MFIs’ net outflows in portfolio investment debt and, to a lesser extent, in portfolio investment equity and direct investment. These developments were partially offset by the current and capital accounts surplus and by euro area non-MFIs’ net inflows in other investment and other flows.

In August 2021 the Eurosystem’s stock of reserve assets increased to €1,009.4 billion, up from €888.5 billion in the previous month (Table 3). This increase was mainly driven by net acquisitions of assets (€122.1 billion) and, to a lesser extent, by positive exchange rate changes (€0.6 billion) which were partly offset by negative changes in the price of gold (€1.6 billion). The large net acquisitions of assets reflect the “2021 General Allocation of SDRs” on the 23 August 2021 of €122.1 billion to the euro area members of the International Monetary Fund (IMF), representing about 22% of the total 2021 allocation.[1]

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB.

Note: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims.

Data revisions

This press release incorporates revisions to the data for July 2021, which mainly affect other investment.

Next releases:

- monthly balance of payments: 19 November 2021 (reference data up to the September 2021)

- quarterly balance of payments and international investment position: 11 January 2022 (reference data up to the third quarter of 2021)[2]

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- Current account data are always seasonally and working day-adjusted, unless otherwise indicated, whereas capital and financial account data are neither seasonally nor working day-adjusted.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

- For further details please visit the IMF webpage: https://www.imf.org/en/Topics/special-drawing-right/2021-SDR-Allocation.

- On 29 October 2021 there will be a release of the quarterly balance of payments and international investment position data (second release of reference data up to the second quarter of 2021) with revisions for periods since at least the first quarter of 2013. It will not include a press or statistical release and is aimed at ensuring consistency between the balance of payments/international investment position and the euro area sector accounts.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts