- PRESS RELEASE

Survey on the Access to Finance of Enterprises: tighter financing conditions and an expected deterioration in the economic environment

6 December 2022

- Euro area firms saw continued improvement in business activity, but rising costs of materials, energy and labour weighed on their profitability. Turnover is still expected to increase over the next six months, but by less than had been expected in the previous survey round.

- Lack of skilled labour and higher input costs were reported as the main concerns for firms of all sizes.

- The financing gap widened, especially for large firms, as financing needs increased while the availability of external funds declined slightly. A rise in price terms and conditions of bank loans was reported by the highest number of firms since the survey started in 2009.

- Despite tighter financing conditions, firms were not particularly concerned about their access to finance and reported no changes in banks’ willingness to lend. However, they expect the availability of external financing to deteriorate and anticipate that their internal funds will not be sufficient to meet their future financing needs.

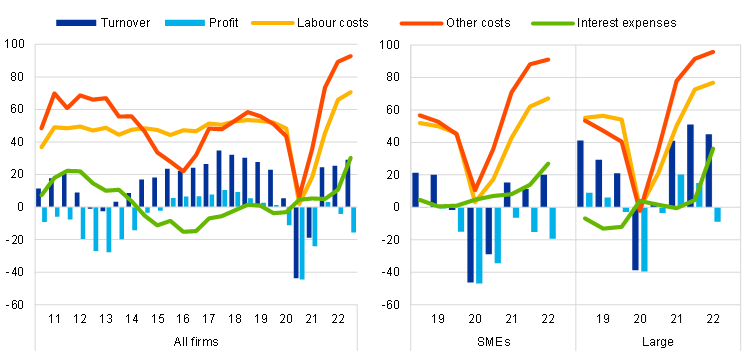

In the latest round of the biannual Survey on the Access to Finance of Enterprises (SAFE) in the euro area, covering the period from April to September 2022, firms reported that business activity continued to improve, with increases in turnover reported more frequently among large enterprises than among small and medium-sized enterprises (SMEs) (Chart 1). However, production costs surged and the net percentage[1] of firms reporting an increase in the cost of raw materials and energy reached 93%, while an increase in labour costs was reported by a net 71% of firms. Both of these figures stand at new historical peaks – for the second survey round in a row. Owing to the rise in costs, profitability weakened, with both SMEs (net -19%) and large firms (-9%) reporting a decline in profits.

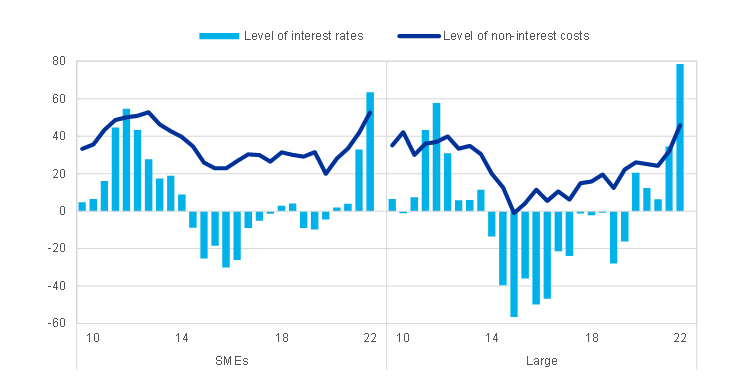

In this survey round, euro area firms signalled an increased need for financing across instruments, while indicating that their availability decreased. This resulted in a net 9% of firms reporting a widening of the financing gap. In terms of size classes, a wider financing gap was reported more often by larger companies (11%) than by SMEs (7%) (Chart 2). In addition, euro area firms reported a tightening of financing conditions, with a net 71% citing higher bank interest rates (up from 34% in the previous round) and a net 49% indicating a deterioration in other terms and conditions (i.e. charges, fees and commissions) (Chart 3). Comparable levels have not been observed in the SAFE since 2011. These developments are consistent with the euro area Bank Lending Survey for the second and third quarters of 2022, which indicate a tightening of collateral requirements and other terms and conditions, as well as a widening of margins applied to bank loans. Although firms in the SAFE indicated a substantial tightening of financing conditions, they reported no changes in banks’ willingness to provide credit. The net percentage of firms reporting obstacles to obtaining a bank loan remained broadly unchanged at 7%. Euro area firms expect a further deterioration in the availability of external financing in the coming six months, as well as a reduced capacity to meet their financing needs with internal funds.

This report published today presents the main results of the 27th round of the SAFE in the euro area, which was conducted between 7 September and 14 October 2022 and covers the period from April to September 2022. The sample comprised 10,984 firms, of which 10,006 (91.1%) are SMEs (i.e. firms with fewer than 250 employees).

For media queries, please contact Silvia Margiocco, tel.: +49 69 1344 6619.

Notes

- The report on this SAFE survey round, together with the questionnaire and methodological information, is available on the ECB’s website.

- Detailed data series for the individual euro area countries and aggregate euro area results are available from the ECB’s Statistical Data Warehouse.

Chart 1

Changes in the income situation of euro area enterprises

(net percentages of respondents)

Base: All enterprises. The figures refer to rounds 3-27 of the survey (March 2010-September 2010 to April 2022-September 2022) for all firms and to rounds 20-27 (October 2018-March 2019 to April 2022-September 2022) for SMEs and large firms.

Note: Net percentages are the difference between the percentage of enterprises reporting an increase for a given factor and the percentage reporting a decrease.

Chart 2

Changes in the external financing gaps reported by euro area enterprises

(weighted net balances)

Base: Enterprises for which the instrument in question is relevant (i.e. they have used it or considered using it). Respondents replying with “not applicable” or “don’t know” are excluded. The figures refer to rounds 3-27 of the survey (March 2010-September 2010 to April 2022-September 2022).

Notes: The financing gap indicator combines both financing needs and the availability of bank loans, credit lines, trade credit, and equity and debt securities issuance at firm level. For each of the five financing instruments, the indicator of the perceived change in the financing gap takes a value of 1 (-1) if the need increases (decreases) and availability decreases (increases). If enterprises perceive only a one-sided increase (decrease) in the financing gap, the variable is assigned a value of 0.5 (-0.5). The composite indicator is a weighted average of the financing gaps for the five instruments. A positive value for the indicator points to an increase in the financing gap. Values are multiplied by 100 to obtain weighted net balances in percentages.

Chart 3

Change in the cost of bank loans granted to euro area enterprises

(net percentages of respondents)

Base: Enterprises that had applied for bank loans (including subsidised bank loans), credit lines or credit card overdrafts. The figures refer to survey rounds 1 (January-June 2009) to 27 (April-September 2022).

Note: “Non-interest costs” comprise charges, fees and commissions.

Net percentages are defined as the difference between the percentage of enterprises reporting an increase and the percentage reporting a decrease.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts