ECB publishes consolidated banking data for 2011

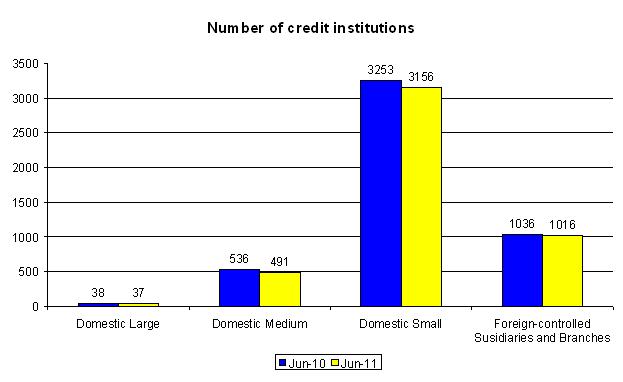

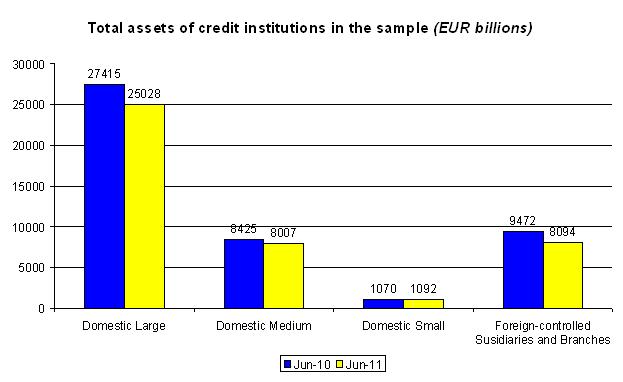

Today the European Central Bank (ECB) is publishing the June-2011 Consolidated Banking Data (CBD), a data set that provides various statistics about the EU banking system on consolidated basis. It includes statistics on both individual EU Member States and the EU as a whole. It refers to 4,700 credit institutions and 434 banking groups and covers data for 1,016 foreign-controlled branches and subsidiaries operating in the EU. In particular, the data set includes profitability and efficiency indicators, balance sheet indicators relating to banks’ funding sources, non-performing loans developments as well as solvency ratios.

The CBD data are separately reported for three sizes of domestic banking groups (small, medium-sized and large banks). In addition, information is provided on foreign-controlled institutions active in EU countries. CBD series are available on a cross-border and cross-sector basis, where “cross-border” refers to branches and subsidiaries located outside the domestic market and “cross-sector” includes branches and subsidiaries of banks that can be classified as other financial institutions. Insurance companies are not included in the consolidation.

The Consolidated Banking Data are published by the ECB on a semi-annual basis. Until 2010 the data were reported and analysed in the report on EU banking sector stability prepared by the Banking Supervision Committee of the European System of Central Banks. This report was discontinued following the creation of the European System of Financial Supervisors at the beginning of this year. However, the CBD are published in the ECB Statistical Data Warehouse. The data and more information about the methodology behind the data compilation are available on the ECB’s website:

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts