The international dimension of the ECB’s asset purchase programme: an update

Speech by Benoît Cœuré, Member of the Executive Board of the ECB, at a conference on “Exiting Unconventional Monetary Policies”, organised by the Euro 50 Group, the CF40 forum and CIGI, Paris, 26 October 2018

It was more than 30 years ago, in October 1987, when the spread between the yield on ten-year US Treasuries and their German equivalents last reached current levels. Such stark divergences in monetary policy cycles are often followed by abrupt reversals in cross-border capital flows.

Purchases of US securities by private non-residents, for instance, accelerated strongly in 1988 and 1989. Much of the inflow went into US Treasuries, partly due to attractive bond yield differentials. But when returns on German Bunds caught up with those of US Treasuries in 1990, the situation was turned on its head. In less than 12 months, private non-residents went from being net buyers of US securities to net sellers.[1]

In recent years, the United States has once again become a destination for large capital inflows. Between 2014 and 2017, purchases of US securities by non-residents roughly tripled. And in the first half of this year, private foreign investors were still important net buyers of US securities.

I have provided evidence in the past that the unconventional monetary policy measures adopted by the ECB since 2014 have led to sizeable capital outflows from the euro area that have contributed to the inflows into the United States.[2] With the ECB’s net asset purchases nearing their end – the Governing Council yesterday reaffirmed its anticipation that net purchases will end after December – concerns have been voiced that cross-border capital flows may once again rise to become a source of market volatility, with uncertain effects on global asset prices.

In my remarks today I will argue that such fears are largely unfounded. I will present evidence that suggests that the stock effect of central bank asset purchase programmes, together with increased transparency around our reaction function, has helped mitigate abrupt changes in international asset allocation in recent years.

And I will argue that recent changes to our forward guidance, together with sizeable future reinvestments from maturing securities under our Asset Purchase Programme (APP), will also in the future reduce the likelihood of sudden and adverse spillover and spillback effects. This will help to maintain the financial conditions necessary for us to achieve our price stability objective.

Unconventional monetary policy and international capital flows

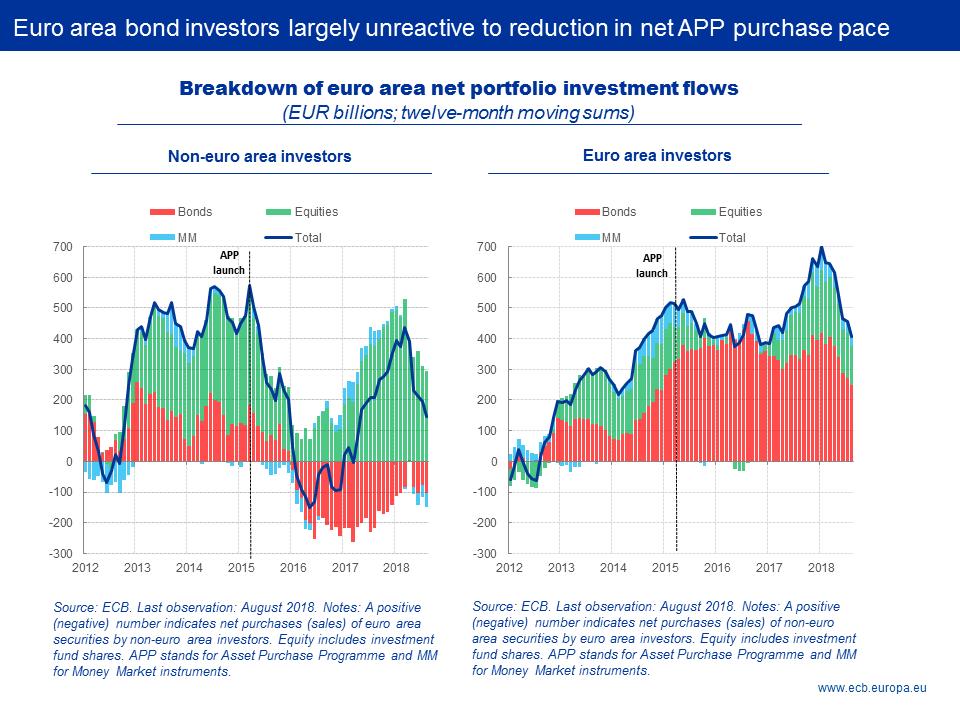

Let me start by briefly recalling the empirical evidence on the impact of the ECB’s policies on cross-border capital flows. My first slide illustrates this impact quite clearly for the euro area.

There was a striking turnaround in capital flows, from net inflows to net outflows, that started in mid-2014, just when we had announced our credit easing package and when expectations were gradually building among market participants that we would also begin purchasing government bonds.

At their peak in the spring of 2016, net capital outflows – measured here in terms of 12-month moving sums – reached nearly 5% of euro area GDP. Never before in the history of the euro area have capital flows been so high.

You can also see that virtually all net capital outflows have been concentrated in purchases of foreign long-term debt securities. That is, large-scale purchases of sovereign bonds by the ECB encouraged many investors to rebalance their portfolios towards the closest substitute – bonds issued by other sovereigns.[3]

These capital outflows are likely to have added to downward pressure on global bond yields.[4] On the right-hand side you can see that the start of the APP, and prior expectations thereof, coincided with a measurable decline not only in euro area overnight index swap term premia but also in term premia in the United States. Put simply, increased demand for foreign securities increased their prices and thereby lowered their yield.

The question, then, is whether the approaching end of net asset purchases in the euro area might see a sudden waning in the support for global bond yields, and thereby risk amplifying prevailing upward pressure on global sovereign bond yields stemming from the ongoing tightening by the US Federal Reserve.

If such adjustments were abrupt, they could risk causing broader capital reallocations, including from emerging market economies, and force a revaluation of global equity prices, with potentially adverse impacts on the financial conditions consistent with our primary mandate.

The gradual decline in net capital outflows since their peak in the spring of 2016, which you can see in the chart on the left-hand side, would, at least at face value, nurture such concerns. It suggests that there is at most a loose correlation between the actual pace of Eurosystem purchases under the APP – which has been gradually declining since April last year – and the intensity of cross-border capital flows.

The persistence of policy-induced cross-border capital flows

The chart masks important differences across investors, however. You can see this more clearly on my next slide. Up until May this year, net capital outflows in debt securities have decelerated, by and large, as a result of a reduction in the pace of net sales by non-euro area residents – as you can see in the chart on the left-hand side.[5]

In April this year, non-euro area residents became net buyers of euro area long-term debt securities – in moving annual sums – for the first time in nearly three years. As non-residents have been important counterparties to the Eurosystem in implementing the APP, the gradual slowdown in their net sales of euro area securities may not be surprising. It is likely related to the step-wise reduction in the actual pace of Eurosystem purchases.[6]

Euro area residents, by contrast, and this you can see on the right-hand side, have reduced their purchases of foreign securities to a much lesser extent. In fact, when we cut the monthly pace of our purchases from €80 billion to €60 billion in April last year, euro area residents increased their acquisition of foreign debt securities by more than 15% over the following six months.

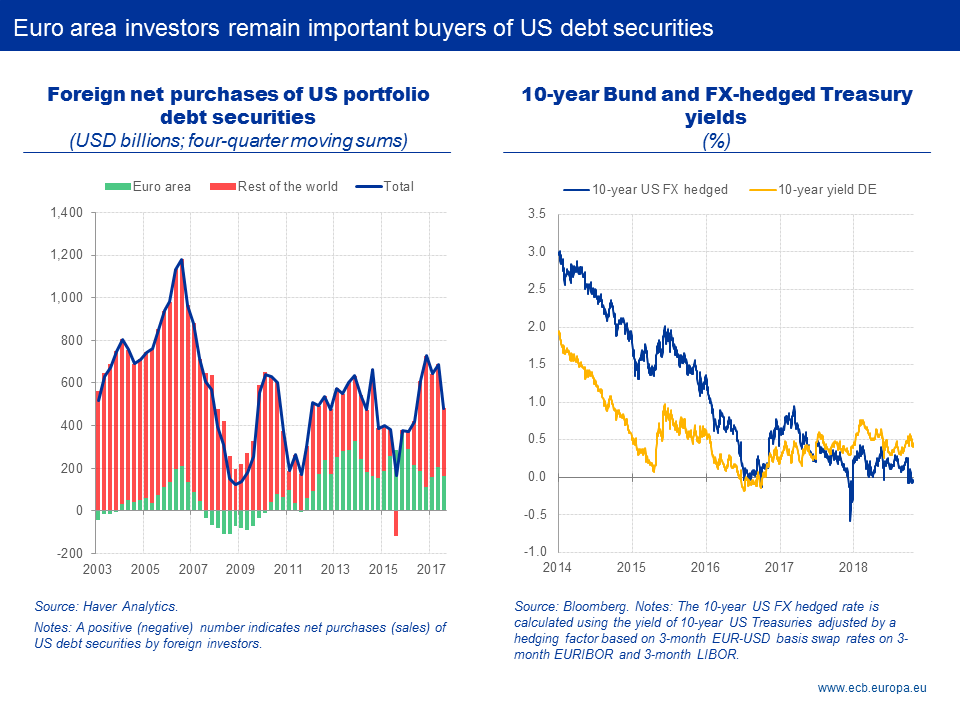

Even when we cut the monthly pace of purchases to €30 billion as of January this year, euro area residents remained important buyers of foreign securities. In the United States, and this you can see in the chart on the left-hand side of my next slide, euro area residents accounted for nearly 30% of total US Treasury purchases during the first half of 2018. In 2017, their share was 25%.

Now, there is no simple answer that could help explain the observed investment pattern. Some would argue that foreign securities – US Treasuries in particular – offer a considerable yield pick-up compared with comparable euro area securities. So it should not come as a surprise to see continued outflows from low-yielding euro area bond markets.

But not all investors are willing or able to assume large amounts of foreign exchange risk on their balance sheets, particularly when the direction of exchange rate movements might be less predictable than during the run-up to the launch of a major monetary policy measure, such as asset purchases.

Returns on US Treasuries adjusted for foreign exchange risk, however, have fallen steadily as the government bond yield curve in the United States has flattened. You can see this on the right-hand side. Since about mid-2017 the yield of a hedged ten-year US Treasury has been below that of its German equivalent.

There are two factors, in my view, that might help explain the observed persistence of capital flows.

The first has to do with the “traditional” stock effect of asset purchases.[7]

Central bank asset purchase programmes effectively constrain the supply of bonds available to private price-sensitive investors. So, the share of outstanding central government bonds held by the private sector – the so-called “free float” – has declined measurably as a result of our cumulative purchases, also when taking into account the considerable amount of buy-and-hold investors.

The implication is that some euro area fixed income securities are increasingly hard to come by, or come with a price tag unattractive for more short-term orientated investors. This may incentivise some market participants to roll over their international asset allocations instead.

The Governing Council at its meeting yesterday reaffirmed its intention to reinvest the principal payments from maturing securities purchased under the APP for an extended period of time after the end of our net asset purchases, and in any case for as long as necessary to maintain favourable liquidity conditions and an ample degree of monetary accommodation. This will reinforce the stock effect channel and, as a result, is likely to also help to mitigate abrupt changes in the direction of capital flows.

The second factor that may help explain the persistence of cross-border capital flows relates to our forward guidance.

By clearly spelling out the Governing Council’s reaction function, and the sequence by which we would adjust our various policy instruments, markets were able to better anticipate our actions based on the progress made towards a sustained adjustment in the path of inflation consistent with our inflation aim.

They understood that, even as we were gradually reducing the monthly pace of purchases in response to growing confidence in the convergence of inflation towards our aim, our key policy rates would remain at current levels “well past” the horizon of our net asset purchases.

This transparency has contributed to reducing policy-induced uncertainty on the rate outlook, thereby extending the planning horizon of investors and, ultimately, moderating volatility.

More recently, the enhancement of our forward guidance in June has provided a similar sense of the direction of the rate outlook in the euro area beyond the expected end of net asset purchases in December.

By clarifying that the Governing Council expects its key policy rates to remain at their present levels at least through the summer of 2019, we increased transparency around our near-term policy intentions, which investors could then reflect in their asset allocation strategies.[8]

It may therefore not be surprising to see capital flows by euro area residents being rather unreactive to the nearing end of the APP, thereby limiting any abrupt and adverse spillovers from policy normalisation in the euro area to global financial conditions. I would call this the “international stock effect” of our APP.

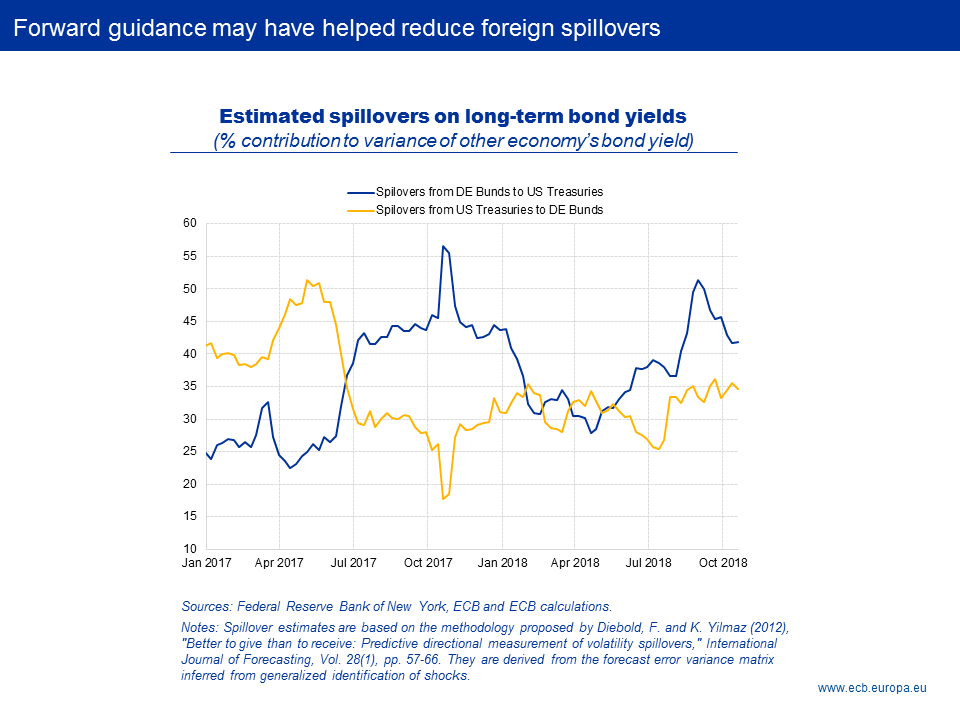

Moreover, the benefits go both ways, meaning that our forward guidance is also likely to have contributed to reduce the sensitivity of euro area rates to foreign spillovers.

On my last slide you can see that ECB researchers, using the Diebold-Yilmaz methodology, find that spillovers from US Treasury bonds to German Bunds – the yellow line – have remained remarkably stable, at low levels, over the past year or so, despite the continued upward pressure on long-term US Treasury yields.

ECB forward guidance, and clear communication more generally, may therefore have helped insulate the euro area from unwarranted foreign tightening pressures and comfort its monetary autonomy, at a time where the independence of monetary policies under floating exchange rates and freely mobile capital has been challenged by international financial integration.[9]

And if communication indeed provides an effective shield, then further changes in our forward guidance, if warranted in the future, may help us remain in control of financing conditions along the policy normalisation path.[10]

Conclusion

Overall, therefore, and with this I would like to conclude, it is fair to say that much clearer communication, not only by the ECB, but also by other major central banks, together with a commitment by central banks to handle changes to the size of their balance sheet with care, have contributed to substantially reducing sudden and sharp directions of change in cross-border capital flows. This is despite the notable divergence in the pace of policy normalisation across advanced economies. As a result, policymakers have been able to pursue their domestic objectives without sending shock waves across global financial markets.

None of this is to say that markets are immune to foreign spillovers. In an integrated global financial market, central banks need to calibrate their policies according to their domestic mandates. In the euro area, this means that significant monetary policy stimulus is still needed to support the further build-up of domestic price pressures and headline inflation developments over the medium term. This support will continue to be provided by the net asset purchases until the end of the year, by the sizeable stock of acquired assets and the associated reinvestments, and by our enhanced forward guidance on the key ECB interest rates.

Thank you.

- [1]In moving annual sums. Source: US Department of the Treasury.

- [2]See Cœuré, B. (2017), “The international dimension of the ECB’s asset purchase programme”, speech at the Foreign Exchange Contact Group meeting, 11 July.

- [3]See also Bergant, K., M. Fidora and M. Schmitz (2018), “International capital flows at the security level – evidence from the ECB’s asset purchase programme”, ECMI Working Paper No 7.

- [4]For quantitative evidence, see Cœuré, B. (2017), “Monetary policy, exchange rates and capital flows”, speech at the 18th Jacques Polak Annual Research Conference hosted by the International Monetary Fund, Washington, 3 November.

- [5]Since May, foreign investors have again become net sellers of euro area debt securities, with sales concentrated in one euro area Member State.

- [6]Incidentally, not only have we observed a decline in the absolute amount of net capital outflows by non-residents, we have also seen their relative share in Eurosystem purchases fall. This shift towards domestic investors, such as pension funds and insurance companies, with a higher reservation price as marginal seller to the Eurosystem, implies that our purchases are likely to also have become more effective over time. See Cœuré, B. (2018), “The persistence and signalling power of central bank asset purchase programmes”, speech at the 2018 US Monetary Policy Forum, New York City, 23 February.

- [7]See Cœuré, B. (2018, op. cit.).

- [8]See Cœuré, B. (2018), “Forward guidance and policy normalisation”, speech at the Deutsches Institut für Wirtschaftsforschung, 17 September.

- [9]See, for example, Rey, H. (2015), “Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence”, NBER Working Paper No 21162.

- [10]See Cœuré, B. (2018, op. cit.).

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts