Main findings from the ECB’s recent contacts with non-financial companies

Published as part of the ECB Economic Bulletin, Issue 1/2022.

This box summarises the results of contacts between ECB staff and representatives of 74 leading non-financial companies operating in the euro area. The exchanges mainly took place between 10 and 19 January 2022.[1]

Contacts reported strong or growing demand across most sectors, but many said that supply constraints continued to limit their ability to meet that demand. In this respect, little had changed in recent months. Manufacturers continued to describe healthy order books and long delivery times, but shortages of inputs made it difficult to meet orders. The acute shortage of semiconductors faced by the automotive industry (following the spread of the Delta variant of the coronavirus (COVID-19) through Asia during the summer) had eased somewhat in the fourth quarter of 2021. However, the industry-wide shortage of chips and related electronic components persisted. Furthermore, the sporadic shortages of other inputs caused by the congestion at container shipping ports and a lack of road haulage and warehousing capacity, which affected much of industry, had also not eased in recent months. The supply of manufactured goods thus struggled to keep pace with final consumer demand. Inventories of inputs and finished goods were consequently low, while stocks of semi-finished goods (and goods in transit) tended to be high. Contacts in the construction and real estate sector also reported strong demand, especially in the booming residential segment. Despite the spread of the Omicron variant since November, contacts in the services sector presented a relatively upbeat assessment of business conditions. In the case of travel and tourism, despite some interruption, the underlying trend was still one of recovering demand, aided inter alia by the reopening of travel to the United States in November. Retailers meanwhile observed that low footfall in shops was offset by a high ratio of sales to customers and by the continued strong growth of online activity. Contacts from a range of other services sectors also reported growing activity, which was particularly strong in digital-related sectors (IT, consulting) and employment services.

Looking ahead, most contacts remained optimistic about the outlook for activity in 2022. The spread of the Omicron variant would cause activity to moderate in the coming weeks, but the effect was expected to be relatively short-lived. Thereafter, strong order books would sustain activity in the manufacturing sector for several months, while the loosening of COVID-19 containment measures ‒ once the latest wave of the pandemic passed ‒ would give renewed impetus to the recovery of contact-dependent services. In this regard, contacts in the travel industry anticipated a relatively normal summer in 2022. The main risk to this benign outlook was the effect of higher and/or more persistent inflation (especially energy bills) eroding households’ real disposable income and therefore dampening final consumer demand. The recent spread of the Omicron variant also pushed back expectations of when the ongoing supply chain disruptions would ease, which for most contacts was expected to be at least six months or even a year.

Contacts continued to report tighter labour market conditions. There was both strong demand for labour and some lack of supply, although the situation varied significantly across companies, sectors and geographical areas. While the pandemic played a role (obliging or encouraging people to move to jobs in other industries, to adjust their work-life balance or to return home in the case of migrant workers), there were also longer-standing shortages in some sectors and for certain profiles. The acceleration of the process of digitalisation and decarbonisation created widespread demand for specific skills, which education systems were so far not providing in sufficient quantity. Meanwhile, contacts indicated that people were becoming more reluctant to take up jobs that they considered unattractive (e.g. involving shift work, working outside or regular travel away from home). Almost all contacts observed an above-normal rate of attrition, possibly caused in part by the move to online recruiting (which speeded up the recruitment process) and the prevalence of home-working, which removed or reduced geographical constraints for some high-skilled positions.

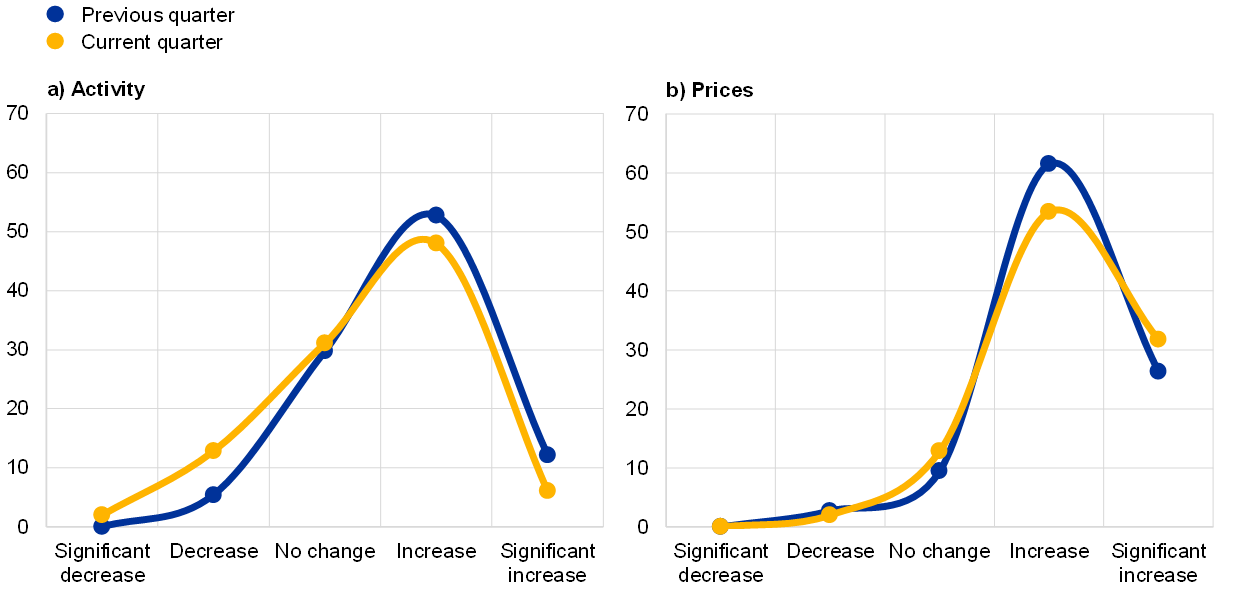

Chart A

Summary of views on developments in and the outlook for activity and prices

(percentage of respondents)

Source: ECB.

Notes: The scores for the previous quarter reflect the ECB staff assessment of what contacts said about developments in activity (sales, production and orders) and prices in the fourth quarter of 2021. The scores for the current quarter reflect the assessment of what contacts said about the outlook for activity and prices in the first quarter of 2022.

Most contacts reported increasing prices and a more dynamic pricing environment, especially in the industrial sector. Most contacts in the manufacturing and construction sectors said that selling prices had risen in the last quarter of 2021, in some cases significantly, and would do so again in the first quarter of 2022. The effect of the surge in the prices of many raw materials and of logistics costs in 2021 was still feeding through the value chain, and the demand environment for passing these costs through to prices remained very favourable in most sectors. Energy prices had risen significantly in late 2021, which for many firms would now also push costs and prices up further in 2022. Many contacts said that prices were being adjusted more frequently than in the past to avoid margins being squeezed and that prices would continue rising through much of 2022. Prices in many parts of the services sector were also rising and this applied not only to business-oriented sectors, such as transport and consulting, but also to some consumer-oriented services, such as telecoms. Contacts in or close to the retail sector continued to cite strong competition and the growth of online sales as limiting somewhat the pass-through of rising costs to final consumer prices, even if selling prices were expected to increase further in the coming months.

Most contacts expected wage growth to pick up somewhat this year. This reflected an element of catch-up following (near) wage freezes in many companies in 2020 or 2021 in response to the pandemic, the tight labour market conditions in some areas and the increase in the cost of living, especially owing to energy prices that were very visible in household bills. With regard to the latter, some contacts stressed the importance of wage agreements taking into account expected average inflation over time rather than monthly peaks driven by volatile energy prices. Typically, contacts said they expected average wage increases to move from around 2% in the recent past to 3% or possibly more this year. Significantly higher rates of wage inflation were described or anticipated in relation to those jobs for which it was a challenge to recruit and retain staff, for example in the fields of construction and road haulage and for IT experts and software engineers.

- For further information on the nature and purpose of these contacts, see the article entitled “The ECB’s dialogue with non-financial companies”, Economic Bulletin, Issue 1, ECB, 2021.