- THE ECB BLOG

Cash or cashless? How people pay

6 February 2023

The ECB has asked people in the euro area how they pay and which payment methods they prefer. The ECB Blog discusses our survey findings and what they mean for the future of cash and digital means of payment.

Digitalisation has changed, and will continue to change, the way people make payments. Today’s payment options are in some ways unrecognisable from what was available a decade ago. Using a device or app, you might pay for your groceries with your watch today, and use an app tonight to share costs and settle up with your dinner date before your plates are even cleared.

But to be clear: cash remains the most frequently used means of payment. More than half of all day-to-day transactions in shops, restaurants, etc. are made using coins and banknotes. Many languages in Europe have expressions such as “cash is king” or “nur Bares ist Wahres” and our survey shows that 60% of citizens want to have the option of using cash.

Cash remains the most frequently used means of payment

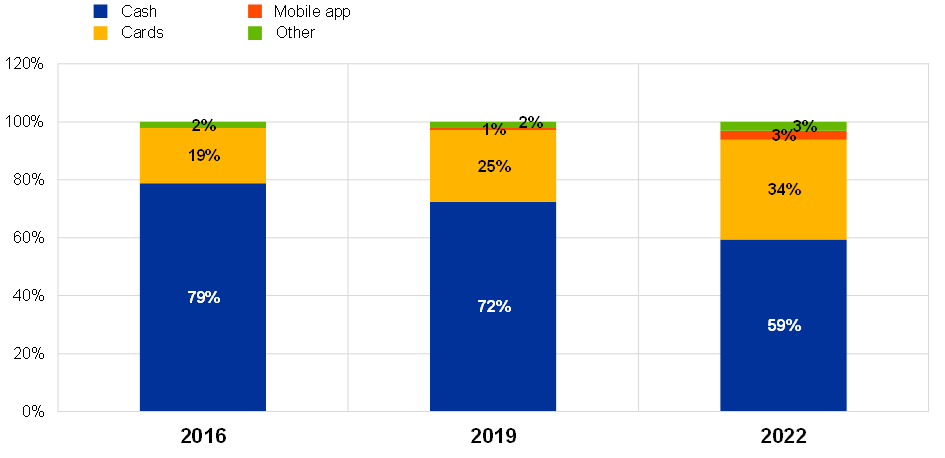

More and more people are paying online for their day-to-day purchases. But with the increase of digital payment options, how do we know that a majority of consumers still want physical cash in their pockets? Well, we ask them. The study on the payment attitudes of consumers in the euro area[1] (SPACE) is conducted on a regular basis and sheds light on payment trends. It’s an important activity given the ECB’s responsibility to issue public money and promote the smooth functioning of payment systems. The study demonstrates that cash is still the most frequently used means of payment at point of sale, although its use in the euro area has declined. In 2016 and 2019, 79% and 72% of the total number of transactions at points of sale, such as shops and restaurants, were made in cash.[2] In 2022, this figure had fallen to 59%. While the reason for this change cannot be determined unequivocally, it seems that consumption and payment behaviours learned during the pandemic outlasted the restrictions that caused them.

Chart 1

Number of payments at point of sale

Although most payments were still made in cash, 55% of euro area consumers prefer paying with card or other cashless means of payment. This is mostly due to the convenience of cashless payments: people do not need to carry hard cash. Still, cash is the preferred means of payment for 22% of those surveyed, largely because it helps to track people’s expenses and is more private.

Despite the preference for cashless payments, 60% of euro area consumers state that they value having the option to pay in cash. This shows that people appreciate having a choice when it comes to how they pay. Their decision may then depend on the particular situation or purchase.

What does all this mean for us at the European Central Bank?

A healthy payment system guarantees access to different payment options as well as the freedom to choose.

We will continue to support the availability of different payment instruments

As cash remains widely used and valued, we are committed to maintaining euro cash and will continue to make sure it is available. This means we will guarantee the supply of euro banknotes, coordinate their production, and ensure their security and resistance to counterfeiting. We are working on new themes and designs for future banknotes. The aim is to have banknotes with a look that is even more relatable to European citizens.

Moreover, we will continue to support the availability of different payment instruments. Compared to a decade or more ago, today’s payment options are far more diverse. To keep and further develop this diversity, we are working on the potential issuance of a digital euro. This will add another option for citizens to pay with central bank money, besides cash. We also continue to support point of sale and e-commerce solutions based on instant payments with a pan-European reach and European governance. Today and tomorrow, European citizens will pay with different methods but with the same stable, reliable money: the euro.

Subscribe to the ECB blogECB (2022), “Study on the payment attitudes of consumers in the euro area (SPACE) – 2022”, December.

Esselink, H., and Hernandez, L. (2017) “The use of cash by households in the euro area”, Occasional Paper Series, No 201, ECB, November.