Digitalisation and its impact on the economy: insights from a survey of large companies

Published as part of the ECB Economic Bulletin, Issue 7/2018.

This box summarises the findings of an ad hoc ECB survey of leading euro area companies looking at the impact that digitalisation has on the economy.[1] Digitalisation may be viewed as a technology/supply shock which affects the main economic aggregates, notably via competition, productivity and employment effects, as well as through its interaction with institutions and governance. Digital technologies are also changing the ways in which firms do business and interact with their customers and suppliers. Understanding digital transformation and the channels through which it influences the economy is therefore increasingly relevant for the conduct of monetary policy.

The main aim of the survey was to look at how digital transformation is affecting macroeconomic aggregates, as perceived by firms. The questionnaire asked companies about their take-up of digital technologies and the main obstacles to the adoption of such technologies. It then asked about the various channels through which they saw digital transformation affecting their sales, prices, productivity and employment, as well as the expected overall direction and magnitude of the impact over the next three years. Responses were received from 74 leading non-financial companies, split equally between producers of goods and providers of services. Those companies were generally very large, accounting for a combined total of around 3.7% of output and 1.7% of employment in the euro area.

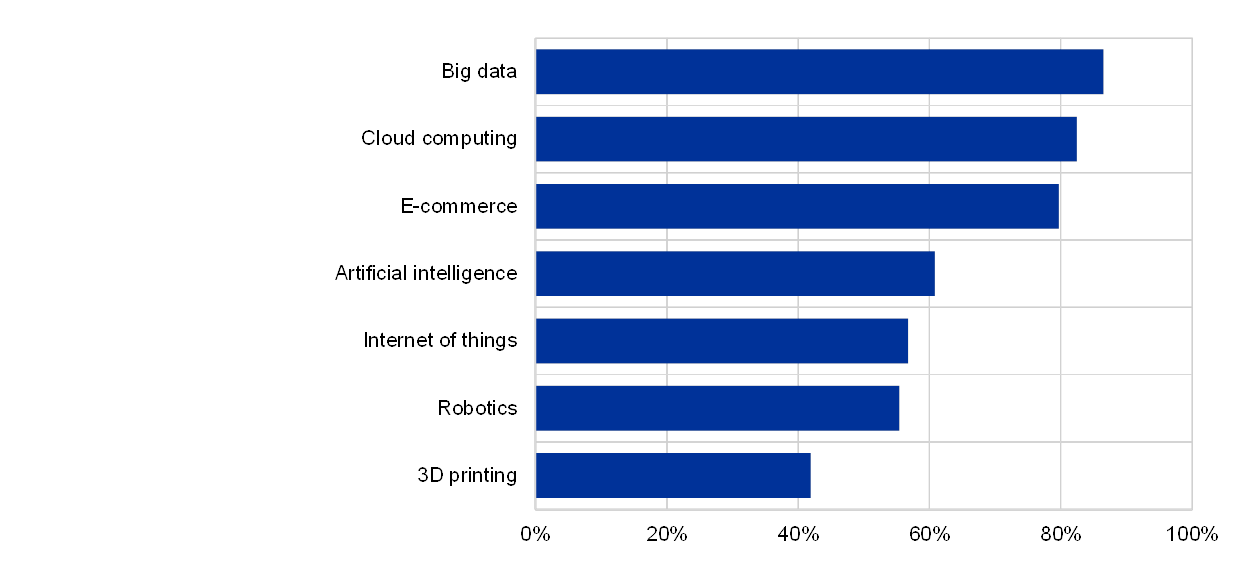

The take-up of digital technologies at those companies is very high, with big data and cloud computing being the most widely adopted (see Chart A). The take-up of big data and cloud computing is pervasive across all sectors, as is the use of e-commerce, which is crucial in business-to-consumer segments. In the manufacturing and energy sectors, artificial intelligence, the “internet of things”, robotics and 3D printing are almost equally widespread, with respondents tending to report that the real impact comes when these technologies are combined. The main obstacles to the adoption of digital technologies are the difficulty of adjusting the organisation of the company and the need to recruit and retain highly skilled ICT staff. Regulation and legislation were not typically seen as a major obstacle, although some firms noted that, while not a hindrance, regulatory frameworks did need to evolve.

Chart A

Take-up of digital technologies and obstacles to their adoption

Take-up of digital technologies

(percentages of respondents; responses ranked by overall rating)

Sources: ECB Digitalisation Survey and ECB calculations.

Note: Based on responses to the following two questions: “Which digital technologies has your company adopted, including those you are in the process of adopting?” and “What are the main obstacles your company faced in relation to the adoption of digital technologies?”

Obstacles to the adoption of digital technologies

(percentages of respondents; responses ranked by overall rating)

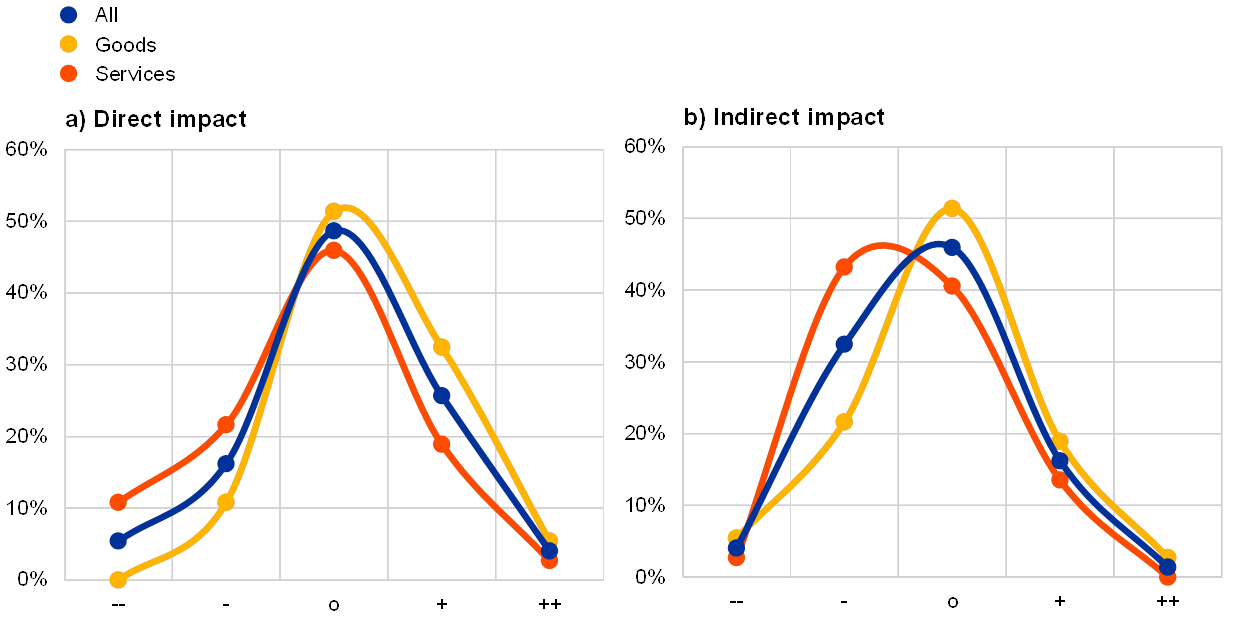

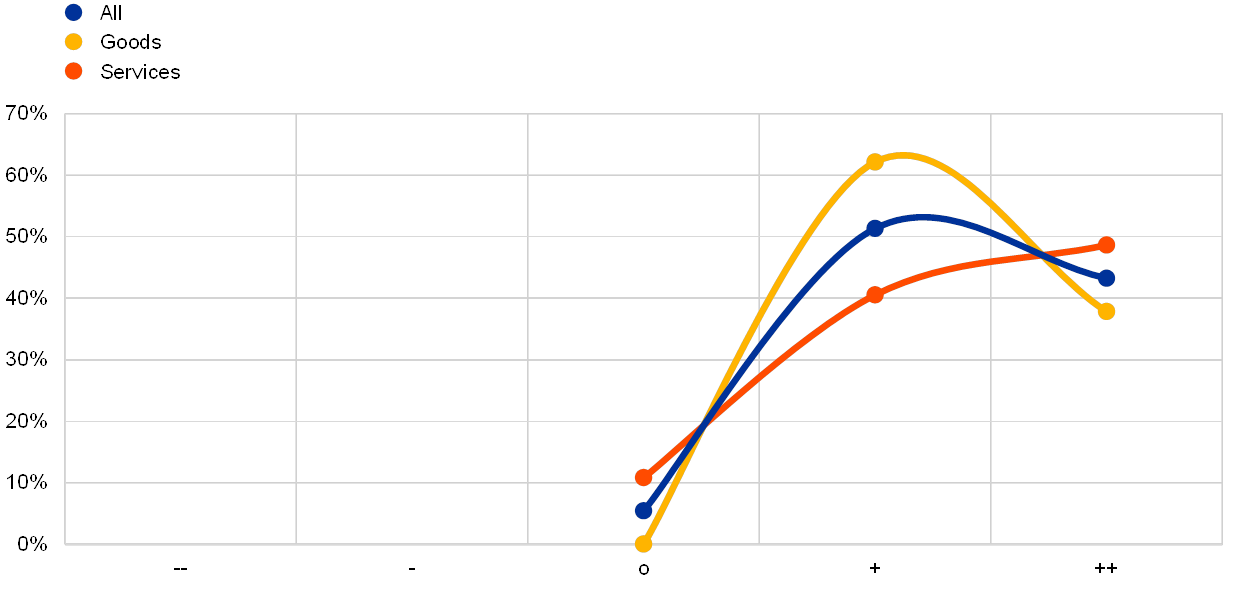

Overall, the vast majority of respondents see digitalisation as having a positive impact on their company’s sales (see Chart B). More than half expect the adoption of digital technologies to give rise to a “slight increase” in sales over the next three years, while around one-third expect a “significant increase”. To some extent, this positive view may reflect the relative size and strength of the companies surveyed, as their high take-up rate for digital technologies was in some cases seen as enabling them to gain market share.

Chart B

Impact of digitalisation on sales

Channels through which digitalisation affects sales

(average scores across all replies: 0 = not important; 1 = important; 2 = very important)

Sources: ECB Digitalisation Survey and ECB calculations.

Note: Based on responses to questions about (i) how digital technologies have affected the respondent company’s sales and (ii) the overall impact that the adoption of digital technologies is expected to have on sales over the next three years, with answers ranging from “significant decrease” (--) to “significant increase” (++).

Overall impact on sales

(percentages of respondents)

Better access to customers is the main channel through which digitalisation supports sales growth. In particular, respondents stressed the role that digital technologies play in providing access to customer data, which helps firms to understand their customers’ needs (termed “customer intimacy”) and offer new or improved services and tailored solutions with higher levels of quality. This, in turn, supports improvements in the quality of existing products (in addition to purely technology-driven improvements). Easier access to markets is also widely viewed as important.

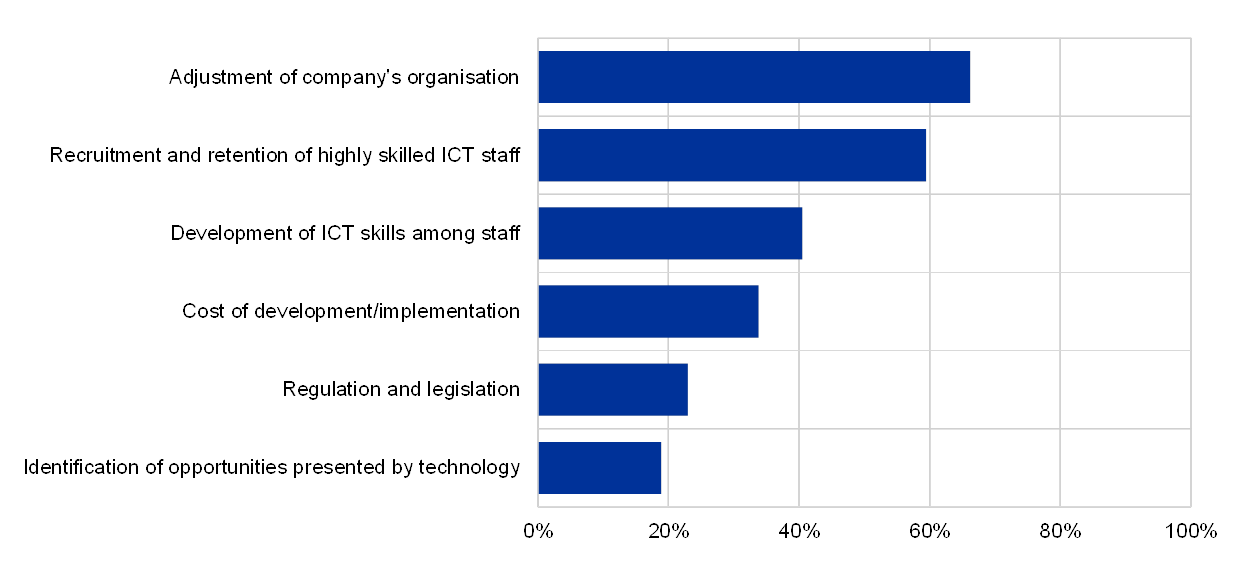

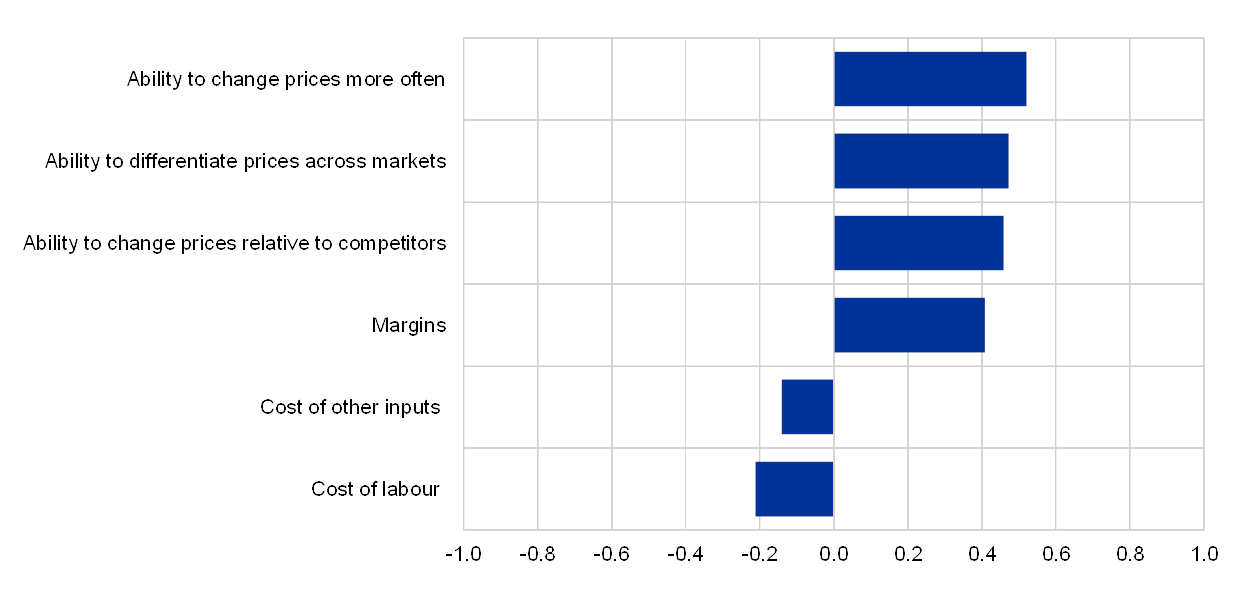

Respondents also see digitalisation increasing their flexibility when it comes to price setting (see Chart C). Around half of the respondents said that the adoption of digital technologies had increased their company’s ability to adjust prices in relation to those of their competitors, over time and/or across markets. In particular, respondents stressed the ability to “leverage more accurately peaks in demand” and thereby “capture the value” of the goods and services provided to customers. At the same time, digitalisation also makes it possible to “manage and optimise sourcing much better” and “get rid of waste and friction across the value chain”. While most companies, particularly manufacturers, tended to see digitalisation reducing costs and increasing margins, retailers were more likely to see input costs increasing and margins being squeezed.

Chart C

Impact of digitalisation on prices

Channels through which digitalisation affects prices

(average scores across all replies: -1 = decrease; 1 = increase; 0 = no change)

Sources: ECB Digitalisation Survey and ECB calculations.Note: Based on responses to questions about (i) how the adoption of digital technologies affects the respondent company’s prices and costs, and (ii) the overall impact that the adoption of digital technologies by (a) the respondent company and (b) other parties (i.e. suppliers, customers and competitors) is expected to have on sales prices over the next three years, with answers ranging from “significant decrease” (--) to “significant increase” (++).

Overall impact on prices

(percentages of respondents)

The impact that digitalisation is having on prices is unclear, with downward pressure being observed mainly in the consumer services segment. Respondents were asked about the impact that the adoption of digital technologies by (i) their own company (“direct impact”) and (ii) other parties, i.e. suppliers, competitors and customers (“indirect impact”), was expected to have on prices. In both cases, the number of respondents who expected little or no impact, or were unsure, was relatively high (around 50%). On balance, producers of goods tended to see their own adoption of digital technologies as enabling them to increase prices.[2] In contrast, service providers (especially retailers) were more inclined to see the adoption of digital technologies by others as putting downward pressure on their sales prices.

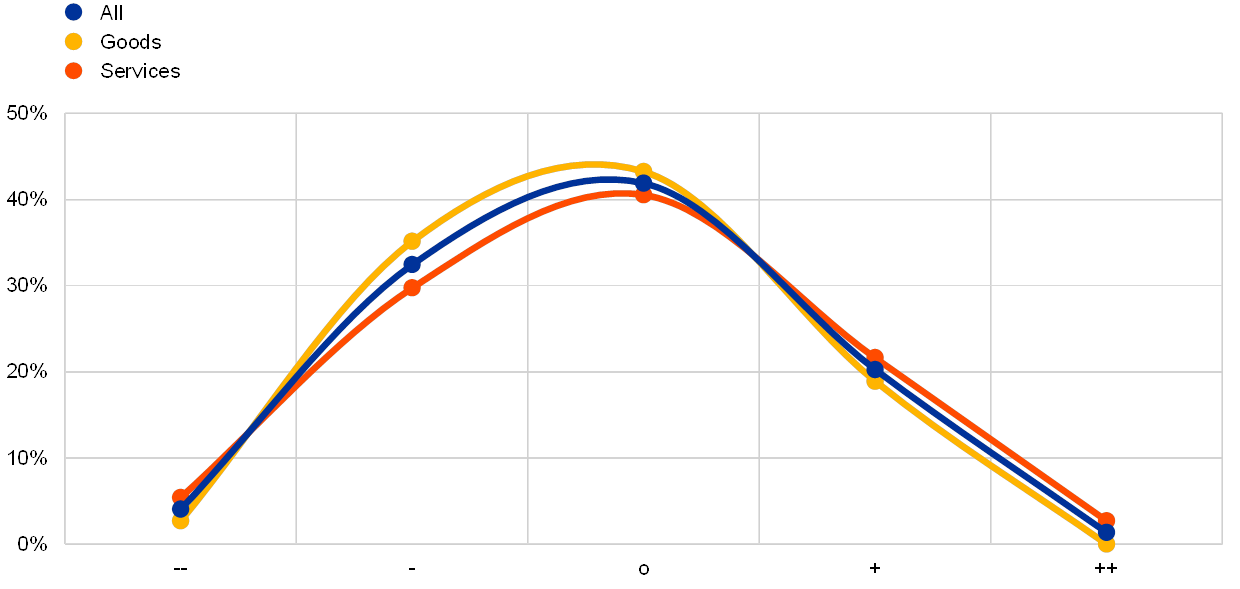

Respondents see digitalisation increasing productivity, driven by the ease of sharing knowledge and more efficient production processes (see Chart D). Virtually all respondents regarded the easier sharing of knowledge (especially within the company) as being an important channel through which digitalisation raises productivity, with around half considering that aspect to be very important. The role that digitalisation plays in making the production process more efficient via automation is almost equally as important. Many respondents emphasised that the increase in the amount of data and information that they collected, both inside and outside of the organisation, was helping them to satisfy their customers’ needs. The overall effect on productivity was perceived to be overwhelmingly positive, with a stronger effect typically being reported in service sectors, particularly in business-to-business segments.

Chart D

Impact of digitalisation on productivity

Channels through which digitalisation affects productivity

(average scores across all replies: 0 = not important; 1 = important; 2 = very important)

Sources: ECB Digitalisation Survey and ECB calculations.

Note: Based on responses to questions about (i) how digital technologies affect the respondent company’s productivity and (ii) the overall impact that the adoption of digital technologies is expected to have on productivity over the next three years, with answers ranging from “significant decrease” (--) to “significant increase” (++).

Overall impact on productivity

(percentages of respondents)

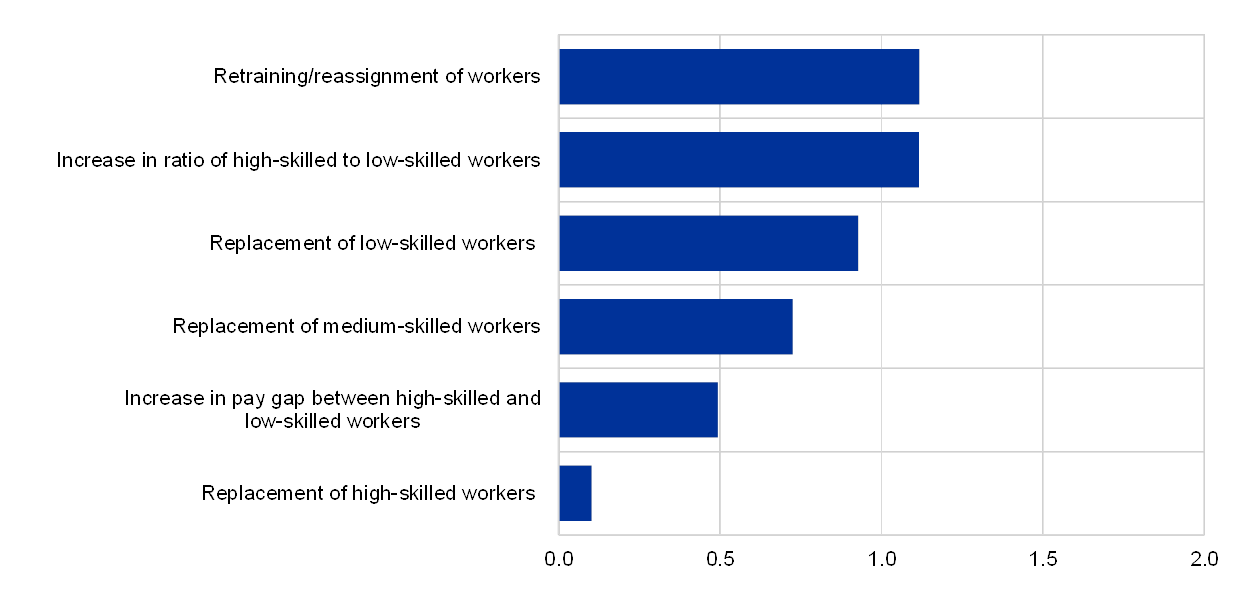

On balance, respondents see digitalisation having a small negative impact on employment, while emphasising the importance of retraining and upskilling (see Chart E). Around one-third of respondents expected digitalisation to reduce employment in their company over the next three years, while around one-fifth foresaw increases in employment. Digitalisation was seen as replacing low and medium-skilled jobs, but not high-skilled jobs. Above all, digitalisation was regarded as increasing the ratio of high-skilled to low-skilled workers, with emphasis on retraining and the reassignment of workers to new tasks supported by digital technologies.

Chart E

Impact of digitalisation on employment

Channels through which digitalisation affects employment

(average scores across all replies: 0 = not important; 1 = important; 2 = very important)

Sources: ECB Digitalisation Survey and ECB calculations.

Note: Based on responses to questions about (i) how digital technologies affect the respondent company’s employment and (ii) the overall impact that the adoption of digital technologies is expected to have on employment over the next three years, with answers ranging from “significant decrease” (--) to “significant increase” (++).

Overall impact on employment

(percentages of respondents)

- This survey – the ECB Digitalisation Survey – was conducted in spring 2018.

- However, to the extent that higher sales prices reflect greater added value, this could still be consistent with digitalisation putting downward pressure on producer prices for goods and services on a “like-for-like” basis.