- THE ECB BLOG

- 22 April 2020

Improving funding conditions for the real economy during the COVID-19 crisis: the ECB’s collateral easing measures

Blog post by Luis de Guindos, Vice-President of the ECB, and Isabel Schnabel, Member of the Executive Board of the ECB

In response to the coronavirus (COVID-19) pandemic, the Governing Council has adopted a broad set of policy measures to mitigate the economic impact of the crisis. The first package of collateral easing measures announced on 7 April 2020 is a core element of our monetary policy response to the pandemic, facilitating banks’ access to Eurosystem liquidity operations. As announced on 22 April 2020, this first package is supplemented by a second targeted set of measures to alleviate the effects of potential rating downgrades on collateral availability.

This blog post explains the economic rationale behind our collateral easing packages. By temporarily expanding the set of assets eligible as collateral, these measures ensure that the banking sector retains access to ample central bank liquidity at favourable terms. Importantly, this complements our liquidity-providing measures – including our targeted and non-targeted longer-term refinancing operations (TLTRO-III and LTRO) – by increasing the amount of collateral available to our counterparties. In combination with our other monetary policy instruments, the revised collateral framework thus creates a supportive environment for banks to continue lending to the real economy.

The collateral easing measures serve three primary objectives. First, by acting promptly and decisively, the Governing Council takes pre-emptive action to avoid a situation in which banks experience an acute shortage of eligible collateral. Second, by allowing for inbuilt leeway in applying the revised framework at the level of the national central banks (NCBs), our collateral easing measures add substantial flexibility from a risk management perspective. Third, and most importantly, the measures counter adverse procyclical feedback effects that could emerge due to reduced collateral availability, while containing the build-up of additional risk on our balance sheet.

The collateral easing packages are designed as temporary measures that will remain in place until September 2021. In assessing the evolving risks to the smooth transmission of our monetary policy to the real economy, the Governing Council will use the full flexibility embedded in our measures to extend or modify these decisions as necessary.

The role of collateral for the real economy

The Statute of the European System of Central Banks and the European Central Bank requires that the Eurosystem can only conduct lending operations “based on adequate collateral”.[1] Credit institutions thus have to mobilise assets to ensure repayment when accessing central bank liquidity. To fulfil their role of lending to the real economy, banks need to have sufficient amounts of eligible collateral at their disposal. The term “eligible collateral” refers to the marketable financial assets (especially bonds) and non-marketable financial assets (such as loans) that the Eurosystem accepts as collateral. Chart 1 shows that the largest part of mobilised collateral is composed of marketable assets. It also illustrates the increase in the volume of the Eurosystem’s liquidity operations, as well as in the amount of mobilised collateral, since the onset of the COVID-19 pandemic.

Collateral mobilised for Eurosystem liquidity operations.

Our set of rules for the eligibility of assets is governed by the general collateral framework. It is designed to ensure that banks from different jurisdictions and with different business models are able to access Eurosystem liquidity. In response to the extraordinarily tight funding conditions during the global financial crisis, the Eurosystem granted additional flexibility to NCBs to temporarily accept additional types of collateral under the temporary framework. Some extensions of this framework allow NCBs to take into account specific conditions in their respective countries to enlarge the pool of available collateral.

Under both frameworks, assets must fulfil minimum credit quality requirements to be eligible as collateral. Credit quality is usually ascertained in the form of a credit rating.[2] Ratings are assigned by recognised sources such as credit rating agencies. When used to secure borrowing from the Eurosystem, collateral assets are generally valued on a daily basis at market prices.[3] To provide a buffer against potential changes in the value of collateral, the Eurosystem applies a discount, known as the valuation haircut. The maximum amount of liquidity that a bank can borrow from the Eurosystem is determined by the value of its eligible collateral after adjusting for valuation haircuts.

The Eurosystem’s collateral rules thus play a vital role in ensuring credit institutions’ access to central bank liquidity. Falling asset prices during the COVID-19 crisis have already put pressure on the availability of collateral. Potential rating downgrades could increase this pressure markedly. As the value of eligible collateral falls, banks see their potential access to central bank liquidity reduced. In the absence of central bank intervention, banks would likely react by reducing their lending activity, which could eventually cause the crisis to become self-reinforcing. A central objective of our collateral easing packages is to prevent such procyclical feedback loops in order to safeguard and restore favourable lending conditions for the real economy.

Collateral easing measures in response to the COVID-19 crisis

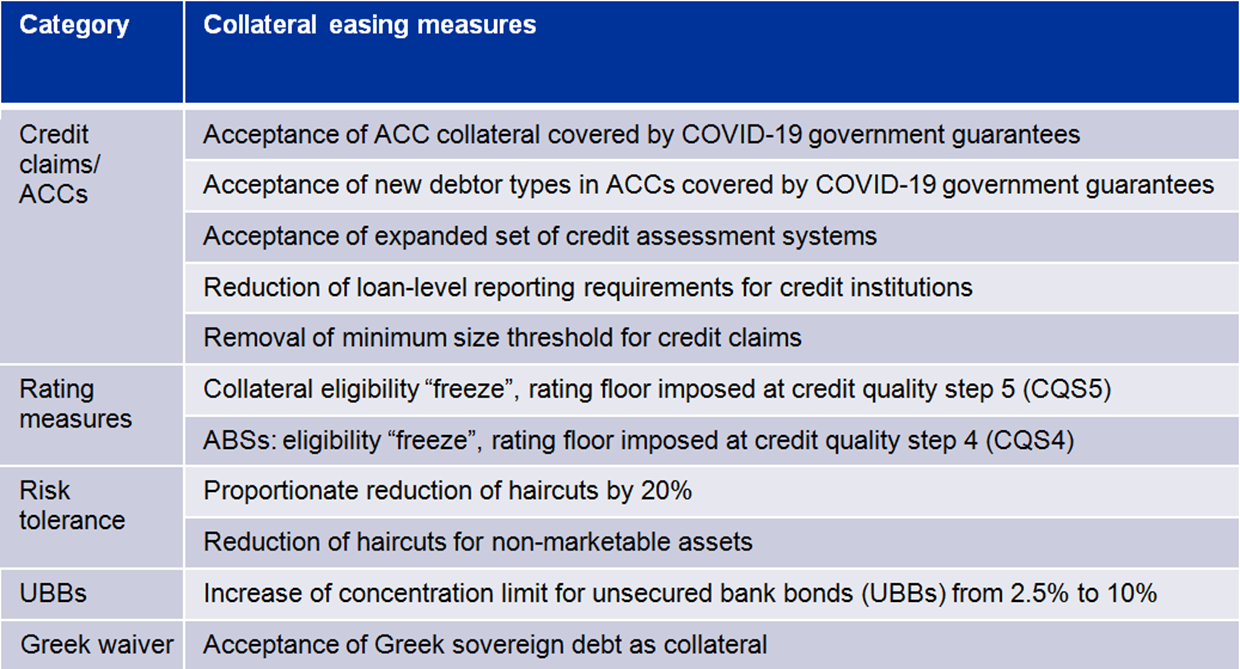

Our collateral easing measures are a targeted response to ensure that euro area credit institutions retain sufficient collateral to benefit from our liquidity operations, including the liquidity-providing operations recently announced to address the pandemic crisis. By acting forcefully and promptly before collateral shortages have materialised, the ECB is providing reassurance that banks will continue to benefit from access to ample central bank liquidity at favourable terms. The remainder of this blog summarizes the set of interrelated and mutually reinforcing measures contained in our collateral easing packages (see also Table 1).

Overview of collateral easing measures.

Source: ECB.Note: The table only lists collateral measures that were introduced as a response to the COVID-19 crisis.

1. Credit claims and additional credit claims (ACCs)

A central element of our collateral easing measures is to expand the acceptance of credit claims as collateral. Additional credit claims (ACCs) are assets that do not fulfil all eligibility criteria under the Eurosystem’s general collateral framework. For example, loans with a lower credit quality than the credit claims accepted under the general framework can be eligible as ACC collateral. While the ACC framework was already introduced on a temporary basis in 2012, it has now been amended to enable banks to mobilise more collateral.

Under the revised framework, NCBs are permitted to accept as collateral loans to small and medium-sized enterprises (SMEs) or self-employed individuals that benefit from recently announced government guarantee schemes.[4] Moreover, the approval of alternative rating systems used for assessing the credit quality of ACCs, such as banks’ internal rating-based (IRB) models, has been simplified. In addition, loan-level reporting requirements have been reduced.

The quantitative impact of this measure cannot be estimated precisely as it depends on the extent to which individual NCBs develop new or revise existing national ACC frameworks. However, assuming that government-guaranteed loans will be mobilised as collateral under the expanded ACC frameworks, the impact on collateral availability is expected to be substantial.

2. Measures to mitigate the impact of potential rating downgrades

As a second element, the ECB announced a comprehensive set of measures to mitigate the impact of potential rating downgrades on collateral availability. The economic disruptions caused by the COVID-19 pandemic could trigger a wave of credit rating downgrades in the corporate sector even though the medium-term viability of companies’ business models is not in doubt. This could lead to a sudden shortage in collateral availability, which could depress banks’ lending activity and exacerbate the crisis in a procyclical manner.

To mitigate adverse feedback effects of this nature, the Governing Council has decided to temporarily “freeze” ratings at the level that applied on 7 April 2020 – the day we announced our first collateral easing package. In particular, the Eurosystem will continue to accept as collateral marketable assets that were eligible for liquidity operations prior to the reference day – provided that the rating remains above a certain credit quality level. The Governing Council has agreed to set this threshold at credit quality step 5 (CQS5) for all marketable assets, with the exception of asset-backed securities (ABSs).[5] Assets that fall below the minimum credit quality requirements will be subject to haircuts based on their actual ratings.

Collectively, these measures will ensure that banks’ collateral availability is not jeopardised by the economic shock associated with the pandemic.

3. Increase of the Eurosystem’s risk tolerance

To complement its revised collateral rules, the Governing Council has also decided to temporarily tolerate more risk on its balance sheet by loosening its usual risk control measures. In particular, haircuts have been reduced proportionally, by 20%, for all eligible collateral assets. Unlike the revised ACC framework, this measure has an immediate impact on the entire current collateral pool.

Chart 2 summarises the average impact of this measure on haircuts across eligible asset classes. Preliminary estimates indicate that this reduction in haircuts could increase the amount of collateral that is eligible for Eurosystem liquidity operations by up to €140 billion.[6]

Average valuation haircuts applicable to eligible asset categories.

Source: ECB calculations, based on Decision (EU) 2020/506 of the European Central Bank of 7 April 2020 amending Guideline (EU) 2015/510 on the implementation of the Eurosystem monetary policy framework and Guideline (EU) 2016/65 on the valuation haircuts applied in the implementation of the Eurosystem monetary policy framework (ECB/2020/20); and Guideline (EU) 2020/515 of the European Central Bank of 7 April 2020 amending Guideline ECB/2014/31 on additional temporary measures relating to Eurosystem refinancing operations and eligibility of collateral (ECB/2020/21).Notes: The haircuts represent the unweighted average of valuation haircuts across credit quality steps and maturity brackets for assets with fixed coupon structures for each haircut category. These haircut categories reflect a combination of asset type and issuer group. The blue and yellow bars display the average haircuts in place before and after the implementation of the first collateral easing package, respectively.

4. Concentration limits for unsecured bank bonds (UBBs)

Prior to our collateral easing measures, credit institutions were restricted to holding a maximum of 2.5% of their collateral pool in the form of unsecured bank bonds (UBBs) issued by a single banking group.[7] The Governing Council has decided to increase this risk concentration limit for UBBs from 2.5% to 10%.

One motivation for this increase was to mitigate the funding stress in money market funds. The higher concentration limit incentivises banks to buy other banks’ short-term debt (including commercial paper), thereby allowing them to absorb outflows from money market funds as observed during the first weeks of the COVID-19 crisis. Tentative estimates indicate that easing the UBB concentration limits could increase collateral eligibility by up to €160 billion.

5. Waiver for Greek sovereign bonds

Prior to the adoption of our first collateral easing package, Greek government bonds were not eligible as collateral in Eurosystem liquidity operations because their credit rating did not meet the minimum requirements. As part of our policy response to the adverse economic shock exerted by the pandemic, we have decided to temporarily waive this minimum rating requirement for Greek government bonds. This measure helps shield the recent progress achieved by the Hellenic Republic and the Greek banking system from the economic fallout of the pandemic and prevents fragmentation in funding access across the euro area.

Conclusion

At a time of uncertainty and volatile financial market conditions, our comprehensive collateral easing packages pre-emptively forestall a potential lack of collateral, thus preventing liquidity strains in the euro area banking system. Importantly, our measures apply across the euro area and therefore effectively counter risks of fragmentation in funding conditions. A strong central bank response for the whole euro area banking system is essential, particularly given the heterogeneous size of the fiscal packages implemented at national level to alleviate the impact of the crisis. The ECB’s flexible and targeted policy response hence supports a sustained economic recovery following the pandemic.

The economic shock from the COVID-19 crisis is amplified through its adverse effect on the value of banks’ collateral. As asset valuations drop and ratings are downgraded across economic sectors, the resulting drop in eligible collateral may cause banks to further tighten their credit supply to the real economy. By acting swiftly, the Eurosystem can interrupt such procyclical feedback loops before they impair funding conditions. However, from a risk management perspective, this comes at the cost of additional risk on the Eurosystem’s balance sheet. By easing collateral rules in a targeted fashion, the Governing Council takes this trade-off into account.

Finally, the collateral easing measures complement other elements of our broad policy response to the crisis, most importantly our targeted and non-targeted liquidity-providing measures. If banks lack sufficient collateral, they cannot benefit from our provision of liquidity at highly favourable rates. Our set of collateral measures underscores our commitment to ensuring continued liquidity provision to banks, and thereby to the real economy in the euro area.

- [1]Article 18.1 of the Statute of the European System of Central Banks and of the European Central Bank (https://www.ecb.europa.eu/ecb/legal/pdf/c_32620121026en_protocol_4.pdf).

- [2]Under the Eurosystem credit assessment framework (ECAF), the minimum credit quality requirement for marketable assets is credit quality step 3 (CQS3), as defined in the framework’s harmonised credit quality scale. This is equivalent to a rating of BBB-. For asset-backed securities (ABSs), the Eurosystem imposes a minimum credit quality requirement of CQS2, or A-.

- [3]This rule does not apply to non-marketable assets, which are valued at their nominal amount outstanding.

- [4]To complement this measure, the minimum size threshold for loans accepted under the general collateral framework has also been removed so that NCBs can decide to accept very small loans as collateral.

- [5]Under the Eurosystem harmonised credit quality scale, CQS5 is equivalent to a rating of BB. The applicable rating floor for asset-backed securities will be set at CQS4, equivalent to a rating of BB+.

- [6]This tentative impact estimate refers to the immediate increase in the maximum amount of liquidity that banks will be able to draw after the decision by the Governing Council is implemented, assuming that banks continue to mobilise the same assets as collateral.

- [7]UBBs are general obligations not protected by a guarantor or collateralised by a lien on specific assets of the borrower in the case of bankruptcy, liquidation or failure to meet the terms for repayment.