The European Commission’s 2019 assessment of macroeconomic imbalances and progress on reforms

Published as part of the ECB Economic Bulletin, Issue 2/2019.

On 27 February 2019, the European Commission published its annual assessment of macroeconomic imbalances and the progress made with structural reforms based on the country-specific recommendations (CSRs) as adopted in July 2018. This assessment is a key part of the European Semester framework for coordinating economic and fiscal policies across the EU. Within this context, the macroeconomic imbalance procedure (MIP) provides a framework for assessing macroeconomic imbalances. It aims to prevent the emergence of harmful imbalances and to actively correct imbalances where they have already become excessive.[1]

Macroeconomic imbalances

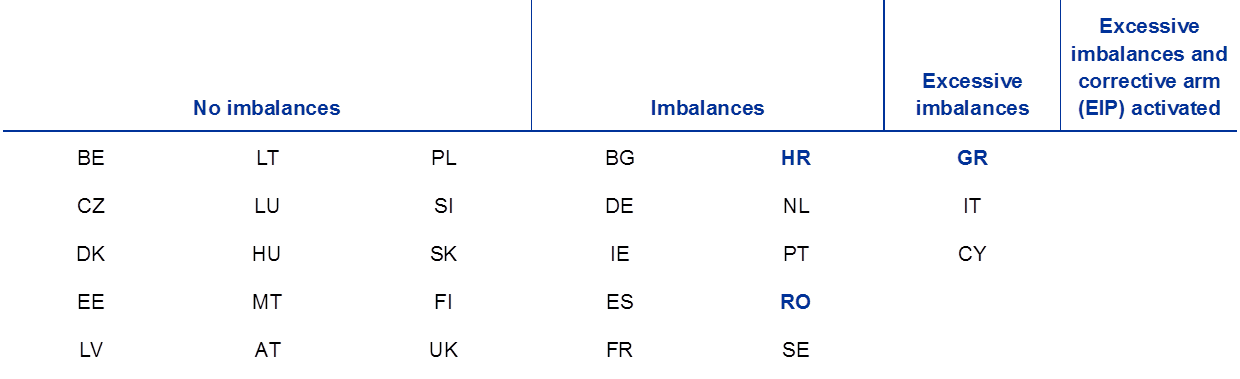

According to the Commission, the number of countries experiencing imbalances has increased to 13 overall, from 11 in 2018 (see Table A). This year, three countries have been assessed as experiencing “excessive imbalances” – Italy, Cyprus and Greece. While Italy and Cyprus were also included in this category last year, Greece has been included in this exercise for the first time this year as it exited its financial assistance programme in summer 2018. Its major challenges are high public debt, a negative net international investment position, a very high share of non-performing loans, a still-high unemployment rate and low growth potential. Cyprus is still facing challenges related to high levels of both non-performing loans and external, private and government debt. For Italy, the Commission finds that fiscal sustainability risks, as well as broadly stalling reform progress and backtracking, are now overshadowing the progress made in previous years. In addition, the Commission recategorised two countries in this year’s assessment. Croatia was recategorised from “excessive imbalances” to “imbalances”, owing to a decrease of private, public and external sector debt, among other factors. Romania was also recategorised, from “no imbalances” to “imbalances”, due to factors including reduced competitiveness and a widening of current account imbalances.

Table A

European Commission conclusions on the 2019 MIP

Source: European Commission.

Notes: The three countries in blue (Croatia, Romania and Greece) are those whose MIP classification changed in 2019. For all countries in the “no imbalances” group, the Commission had already assessed that no imbalances existed in the first stage of the procedure – the Alert Mechanism Report. Thus, no in-depth review was drafted for any of these countries.

Despite the persistence of excessive imbalances in some Member States, the excessive imbalance procedure has never been triggered since the introduction of the MIP in 2012. Under this so-called corrective arm of the MIP, the Council can require a Member State experiencing excessive imbalances to submit a corrective action plan and can eventually impose fines, if needed. The repeated non-activation of the excessive imbalance procedure risks undermining the credibility and effectiveness of the overall procedure. Chart A shows that a quarter of EU Member States have experienced excessive imbalances that persisted for multiple consecutive years. While some countries have managed to reduce the severity of the imbalances over time, the persistence of excessive imbalances over several years in some countries indicates that the correction of imbalances could be better facilitated by the MIP. Applying all available tools – including activating the corrective arm of the procedure for countries with excessive imbalances – could increase the procedure’s effectiveness and credibility. This has also been explicitly called for by the five Presidents in their 2015 report[2] and, more recently, by the European Court of Auditors[3].

Chart A

EU Member States with excessive imbalances

Source: European Commission.

Notes: The chart shows those countries assessed by the European Commission as experiencing “excessive imbalances” in the years indicated. A country subject to an economic adjustment programme enters the MIP automatically once the programme ends. In 2012 no country was assessed as having excessive imbalances.

Persistent macroeconomic imbalances – whether excessive or not – leave Member States vulnerable to adverse macroeconomic shocks and tend to increase the probability of recessions, which often carry high social and economic costs. While the EU has experienced economic growth for the past seven years, uncertainties related to geopolitical factors, the threat of protectionism and macroeconomic imbalances pose downside risks to economic activity. It is therefore important that countries undertake ambitious reform efforts to strengthen the resilience of their economies to adverse shocks.

Debt levels are still historically high in some Member States, for both government and private debt, which makes responding to a downturn or to negative shocks more difficult. Higher economic growth has helped to reduce debt-to-GDP ratios in recent years, but debt levels in several cases remain very high. Corporations have managed to reduce debt levels faster than households. At the same time, in a number of countries the high public and private indebtedness is reflected in large stocks of external debt, which highlights the need to ensure sufficient current account surpluses.

To support rebalancing and avoid new imbalances in cost competitiveness across the EU, accelerating growth in unit labour costs in some countries has to be carefully monitored. In particular, in countries with current account surpluses that the Commission finds are experiencing a lack of domestic demand and labour shortages, unit labour cost growth that is higher than the euro area average might facilitate rebalancing among euro area countries. At the same time, a relative deterioration of cost competitiveness in more vulnerable countries with relatively high unemployment should be monitored carefully so that a reversal of the positive adjustment achieved in recent years can be avoided.

Reform progress

Reforms remain crucial to address these imbalances, and progress on recommended reforms is assessed annually by the Commission. Specifically, the Commission has reviewed the implementation of the CSRs that were adopted in July 2018 by the Council. Each CSR provides a Member State with guidance in a specific policy area.

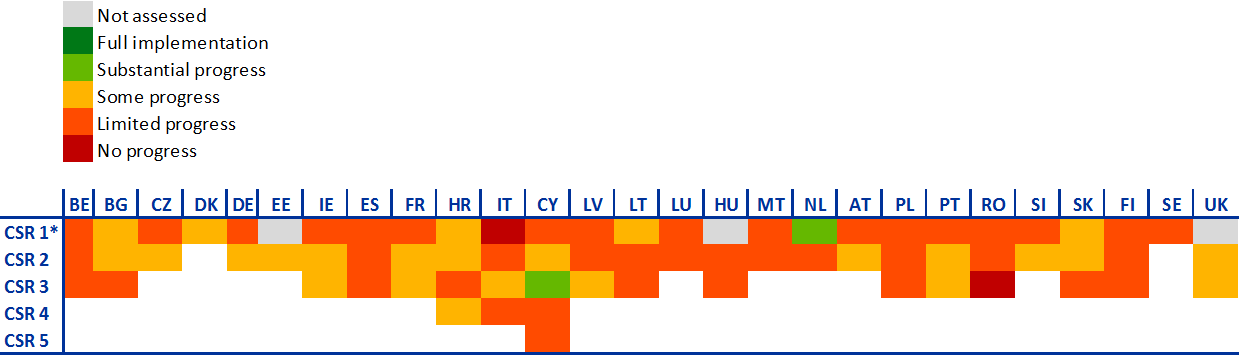

The Commission assessment again finds only limited progress on recommended reforms. The progress made is evaluated using five categories: “no progress”, “limited progress”, “some progress”, “substantial progress” and “full implementation”.[4] Table B summarises this year’s assessments. Out of 73 CSRs, none saw full implementation, and substantial progress was made in only two cases. For the overwhelming majority of CSRs (more than 90%), the Commission found that Member States made at best some or limited progress. On two CSRs, no progress was made. According to the Commission methodology, “no progress” means that the Member State concerned did not even “credibly announce” measures that would aim to address the policy recommendation. Finally, and most concerning, despite being very vulnerable, the countries experiencing excessive imbalances did not make significantly more reform progress during the last year than the EU average. The same is true for the countries experiencing imbalances. Overall, progress on reforms this year was as weak as last year.[5]

Table B

European Commission assessment of implementation of the 2018 CSRs

Source: European Commission.

Notes: CSR 1* assessment excludes compliance with the Stability and Growth Pact, which will be assessed by the European Commission later in spring 2019. “Not assessed” applies to cases in which CSR 1 pertains mostly or exclusively to the Stability and Growth Pact.

Progress with reforms has been uneven, and is particularly lacking in the areas of product markets and public finances. Somewhat more effort has been made concerning aspects of the financial sector and labour markets. At the same time, the Commission even finds cases of backtracking on reforms, for instance regarding the long-term sustainability of public finances (including pensions).

Further reforms to improve the investment environment are essential to stimulate well-targeted investment that improves productivity, potential growth and resilience. The Commission finds that the highest barriers to investment are low quality of institutions and burdensome regulations. Creating an investment-friendly environment will help strengthen investment focused on productivity and growth – essential at this point in the business cycle. In turn, investment needs to be well targeted to be most effective. While investment in education, research, development and innovation is needed in most EU countries, it is important that it flows to those sectors where it would most increase productivity growth and competitiveness. To this end, the Commission has taken the positive step of adding a new annex to the country reports. The annex identifies country-specific investment needs and bottlenecks, and also aims to better align the use of EU funds with the European Semester’s analysis.

- To identify imbalances, the Commission uses a standardised scoreboard to select countries that require an in-depth review. There are three possible outcomes from these in-depth reviews: “no imbalances”, “imbalances” or “excessive imbalances”. If the Commission identifies imbalances, the country concerned will receive policy recommendations meant to address them. When the imbalances are assessed as being so severe that they are found to be “excessive”, the Commission can take further action by recommending that the Council activates the excessive imbalance procedure (EIP).

- Juncker, J.-C. et al., Completing Europe’s Economic and Monetary Union, June 2015.

- European Court of Auditors, Audit of the Macroeconomic Imbalance Procedure (MIP), Special Report No 3, 2018.

- “Full implementation” means that the Member State has implemented all measures needed to address the CSR appropriately; “substantial progress” means that the Member State has adopted measures that go a long way in addressing the CSR, most of which have been implemented; “some progress” means that the Member State has adopted measures that partly address the CSR, and/or it has adopted measures that address the CSR but a fair amount of work is still needed to fully address it as only a few of the adopted measures have been implemented; “limited progress” means that the Member State has announced certain measures but these only address the CSR to a limited extent, and/or it has presented non-legislative acts, yet with no further follow-up in terms of implementation; and “no progress” signifies that the Member State has not credibly announced or adopted any measures to address the CSR.

- See the box entitled “The European Commission’s 2018 assessment of macroeconomic imbalances and progress on reforms”, Economic Bulletin, Issue 2, ECB, 2018.