Liquidity usage in TARGET2

Published as part of the ECB Economic Bulletin, Issue 3/2021.

1 Introduction

Real-time gross settlement (RTGS) systems typically require large amounts of liquidity to support the settlement of payments on a gross basis.[2] At the same time, settling on a gross basis[3] benefits the payment system by reducing credit risk[4] and, more generally, systemic risk. For these reasons, TARGET2[5], the Eurosystem’s RTGS system that processes euro-denominated payments in central bank money, also settles payments on a gross basis. To enable participants to optimise the use of liquidity and reduce their liquidity needs, TARGET2 offers a number of features, called liquidity-saving mechanisms.[6] In addition, when liquidity on their accounts is not sufficient, TARGET2 participants can make use of the intraday credit line (ICL) facility, which is offered by the Eurosystem against eligible collateral and is interest free.

TARGET2 participants can also help to optimise their liquidity usage by actively managing their intraday liquidity. By coordinating their incoming and outgoing payments, TARGET2 participants can limit their liquidity needs and make more efficient use of their liquidity resources. There are three sources of liquidity that payment system participants can tap in order to fund their payments: (i) incoming payments, i.e. flows received from other participants; (ii) positive balances available on their accounts – called “central bank reserves”; and (iii) the additional liquidity that can be accessed via the ICL facility.

The use of the various liquidity sources differs across participants and can also vary depending on exogenous factors, such as monetary policy decisions. The interest rates set by the central bank can have an impact on the cost of the liquidity sources, and in particular of the central bank reserves, as holding the liquidity in the account may carry the opportunity cost of not placing it on the interbank market. At the same time, intraday credit, or any collateralisation with the Eurosystem, bears the opportunity cost of having eligible collateral encumbered for this purpose. Using incoming payments is the cheapest source of liquidity, as it carries no cost. Measures taken by the central bank that have an impact on the level of central bank reserves are also an important factor. When central bank reserves[7] increase significantly, there is a lower need for participants to synchronise their payments. This is currently the case for euro area banks due to the various monetary policy instruments deployed by the Eurosystem[8] to maintain price stability in an environment of protracted weakness in inflation.

This article examines how liquidity has been used in TARGET2 since June 2008. Liquidity usage – for the purpose of this article – is a broad term used for all aspects that could reflect the efficiency in the use of the participants’ liquidity sources. Analysing such aspects can help in understanding the implications of the high levels of central bank reserves in TARGET2 for the smooth settlement of payments and how this type of regime has changed the behaviour of banks in settling payments in TARGET2.

The remainder of the article is structured as follows. Section 2 provides some general considerations about liquidity usage over time. Section 3 focuses on the particularities of banks in managing their intraday liquidity, as well as on the impact of monetary policy decisions on intraday liquidity management. Section 4 concludes.

2 Liquidity velocity in TARGET2

A good indication of overall liquidity usage in a payment system is given by its liquidity velocity. Liquidity velocity in a payment system is the value of payments made for each unit of liquidity that is used for settling payments,[9] and it basically shows how many times one unit of liquidity, in this case one euro, changes ownership on average in a day. Liquidity used encapsulates the central bank reserves available on the TARGET2 accounts that are actively utilised to settle payments as well as the liquidity drawn from the ICL facility, i.e. overdrafts.[10] There are various components that affect liquidity velocity: (i) the liquidity-saving mechanisms available in the payment system, typically a constant factor through time; (ii) the way the payment system participants manage their liquidity to meet their payment obligations; and (iii) the amount of central bank reserves available for participants to settle payments. In practice, liquidity velocity in TARGET2 is measured as the ratio of the total value of payments settled to the liquidity used to settle them. The amount of liquidity used depends on each participant’s intraday management of liquidity, i.e. the extent to which the participant synchronises incoming with outgoing payments. However, depending on the level of central bank reserves, there is either less or more of a need for a participant to manage its liquidity in the most efficient way, i.e. to synchronise incoming with outgoing payments. Thus, liquidity used fluctuates in line with the liquidity available in the system. The liquidity available on the participants’ TARGET2 accounts is approximately equal to the overall central bank reserves available in the banking system.[11]

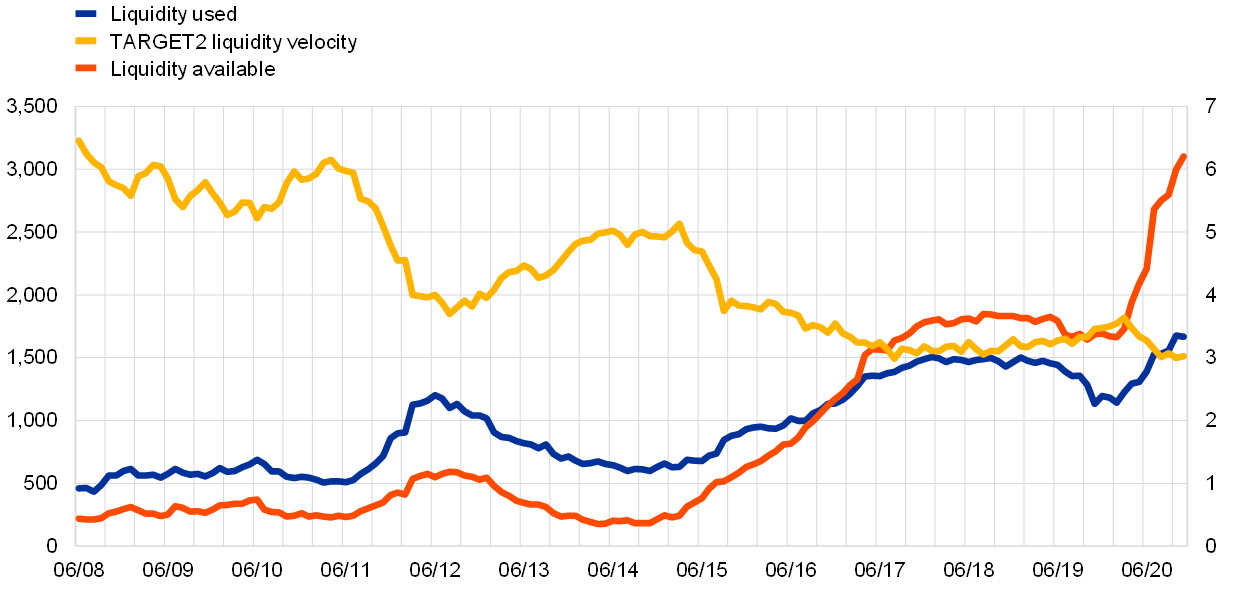

Liquidity velocity in TARGET2 fell amid the upsurge in central bank reserves resulting from the Eurosystem’s asset purchase programme (APP) and, more recently, the pandemic emergency purchase programme (PEPP), as well as the third series of targeted longer-term refinancing operations (TLTRO-III). The liquidity velocity indicator in TARGET2 decreased from 5.1 in March 2015 to 3.0 in November 2020, most of the decrease taking place between March and September 2015 (Chart 1). Similar developments took place during and following the sovereign debt crisis as well. Liquidity velocity decreased between 2011 and 2012 in the context of rising levels of central bank reserves resulting from the significant uptake in the two three-year very long-term refinancing operations (VLTROs) conducted by the Eurosystem. In early 2013, liquidity velocity started to increase again as a consequence of the early repayments of the VLTROs, which led to a decrease in central bank reserves. The visible decline between March and August 2020 was driven by the additional stimulus provided by the Eurosystem in the context of the coronavirus (COVID-19) pandemic, in particular the PEPP and TLTRO-III. Overall, there is a declining trend of liquidity velocity in TARGET2, which may have also been reinforced by the introduction of the fixed-rate full allotment approach in October 2008 to guarantee an elastic supply of liquidity. These developments show that liquidity velocity in TARGET2 correlates strongly and negatively[12] with the central bank reserves available, which in turn are positively correlated with the liquidity used.

Chart 1

Liquidity used and available versus TARGET2 liquidity velocity

(y-axis: liquidity used and liquidity available, EUR billions (left-hand scale); liquidity velocity (right-hand scale); x-axis: months)

Sources: TARGET2, ECB calculations.

Note: The chart covers the period from June 2008 to November 2020 at a monthly frequency.

Since December 2016, the liquidity used for payments in TARGET2 has stood below the liquidity available in TARGET2. The gap between the liquidity used and the liquidity available has since steadily increased, with it surging over the course of 2020 due to the additional stimulus programmes – in particular the PEPP and TLTRO-III – implemented by the Eurosystem to address the impact of the COVID-19 crisis (Chart 1). More precisely, as of November 2020, the gap stood at €1,435.2 billion. Compared with March 2015, the liquidity used in 2020 increased by 2.6 times, while the liquidity available increased by 12.8 times. Interestingly, before November 2016, the liquidity used was even higher than the central bank reserves on TARGET2 accounts on the back of the use of intraday credit. During that period, the overall size of the ICL was higher than it currently is, and overdrafts were used much more to settle payments.[13]

All of these observations indicate that, currently, TARGET2 participants would also be able to settle payments in TARGET2 with lower account balances. In fact, by comparison, in 2020 the value of payments settled was, on average,[14] only 5.4% above the value settled in 2012, while the liquidity available was 304.0% higher and the liquidity used 29.7% higher. This clearly suggests that, currently, there are more central bank reserves than that needed by banks to settle their payment obligations.[15] At the same time, liquidity velocity also stood at its lowest historical value at the end of 2020. Thus, historical evidence shows that going forward banks could settle their payments with a lower level of central bank reserves. In the following section, we explain in greater depth how banks participating in TARGET2 use the liquidity sources available to them.

3 Payment funding sources

Overview of use of funding sources

To fund their payments, TARGET2 participants can rely on three sources of funding: (i) incoming payments; (ii) the account balance, i.e. central bank reserves available on their TARGET2 account; and (iii) intraday credit.[16] Incoming payments are considered to fund outgoing payments when the latter are settled within the same minute as the reception of the incoming flows. This is a concept also known as “liquidity recycling” in the payments literature. Whenever outgoing payments are in excess of the incoming payments received within the same minute, they are considered to be funded using the account balance, provided that sufficient liquidity is available on the account. Whenever incoming payments and the account balance are not sufficient to settle the outgoing payments, the remaining outgoing payments are funded using the ICL. The ensemble of payment funding sources is also known as “payment capacity”. As discussed in the introduction, banks typically need to actively manage their liquidity sources during the day to ensure that they have sufficient capacity to settle payments and economise on liquidity costs.

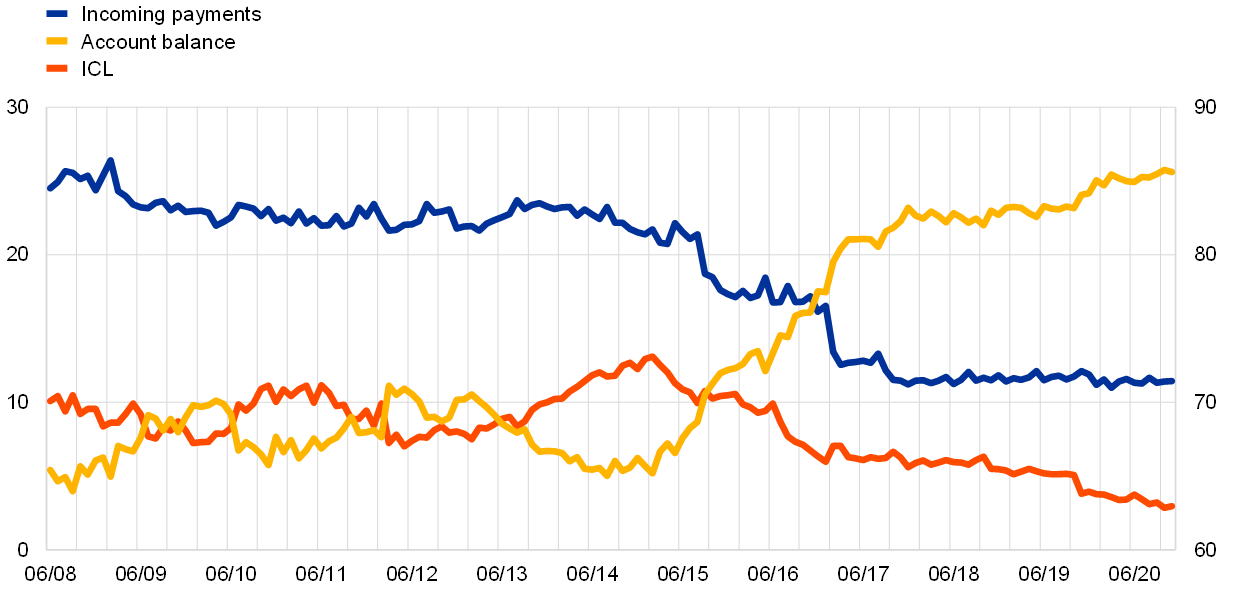

In TARGET2, the main source of funding payments is the account balance.[17] In the period under analysis, participants funded, on average, 73.0% of their payments using the liquidity available on their account balance, whereas incoming payments constituted the second source of funding, covering, on average, 18.8% of the payment outflows (Chart 2). Intraday credit was used to provide liquidity for 8.1% of outgoing transactions. The fact that TARGET2 participants rely on intraday credit only to a very limited extent indicates that the intraday liquidity risk for TARGET2 participants is low.

Chart 2

Funding sources of payments in TARGET2

(y-axis: incoming payments and ICL, percentages (left-hand scale); account balance, percentages (right-hand scale))

Sources: TARGET2, ECB calculations.

Note: The chart covers the period from June 2008 to November 2020 at monthly frequency.

The use of the account balance increased over time, whereas the use of incoming payments and intraday credit decreased. These developments coincided, in particular, with the upsurge in aggregate liquidity levels in TARGET2 resulting from the Eurosystem’s monetary policy measures. After the public sector purchase programme (PSPP) was introduced in March 2015, the usage of intraday balances grew, on average, from 67.6% to 79.4%, whereas the use of incoming payments fell, on average, from 23.0% to 13.0%. At the same time, recourse to intraday credit declined, from 9.4%, on average, in the period before the introduction of the PSPP to 6.6% in the following period, and it stood below 4.0% in the last year under review. With central bank reserves becoming abundant and lower money market activity, these developments are rather natural. First, they indicate a lesser need for TARGET2 participants to focus on intraday liquidity management practices – a behaviour that is nevertheless expected to be reversed once returning to lower levels of central bank reserves. Second, they show that there is also less of a need for banks to resort to the ICL facility, which brings about a further reduction in the intraday liquidity risk for TARGET2 participants.

Comparable developments in payment funding were also observed in other RTGS systems worldwide owing to higher levels of central bank reserves. In Fedwire, the RTGS system operated by the Federal Reserve, following the upsurge in reserves that began in 2009, the funding of payments with own account balances almost tripled, while the proportion of payments funded by overdrafts fell significantly.[18] In the Clearing House Automated Payments System (CHAPS), the RTGS system operated by the Bank of England, the use of own funds – defined as reserve balances and the ICL – to make payments only increased to a limited extent following the start of its quantitative easing programme in March 2009.[19] UK participants are reported to predominantly recycle liquidity to fund their payments. While it should be acknowledged that the methodology used for the CHAPS analysis is not the same as that of this article, these differences may also be attributable to the UK system being highly tiered[20], as well as to throughput guidelines that oblige banks to settle a part of their daily payments value within fixed time slots.

The funding behaviour of payment obligations varies considerably across different communities of TARGET2 participants. Reliance on incoming payments is high in Finland, Germany and Italy, covering roughly one-third or more of their outgoing traffic, on average. On the other hand, liquidity recycling is very low in Belgium, the Netherlands, France and Slovakia, where this source of payment funding is used for less than 3.4% of outgoing payments. Intraday credit appears to be used to a greater extent in Slovakia, which makes the highest use of the ICL with 21.5%, as well as Germany, Luxembourg and Belgium, while it is of rather limited use in Portugal and Ireland. At the same time, all countries make predominant use of the account balance, with Germany and Finland being the two countries to make more even use of the account balance and incoming payments, i.e. within an 11-percentage point difference between the two. These developments suggest that there are heterogeneous intraday liquidity management practices across national banking communities in the euro area. Such differences could be attributable to the unique structure of each country’s banking sector and the way that this is reflected in their participation in TARGET2.[21] The next part of this section provides a further analysis of the drivers behind this heterogenous use of funding sources.

Chart 3

Average usage of sources of payment funding across national banking communities

(y-axis: percentages)

Sources: TARGET2, ECB calculations.

Notes: The chart shows average daily figures over the period from June 2008 to November 2020. Only those euro area countries for which data are sufficiently representative are included in the chart.

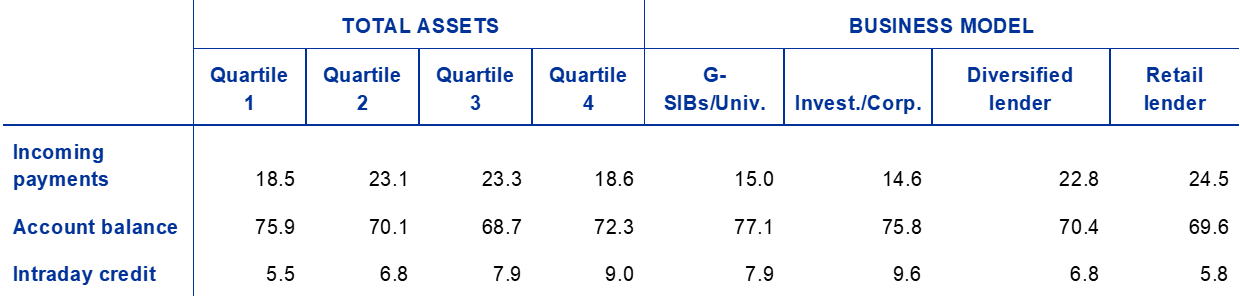

The relative usage of the sources of payment funding differs across specific bank characteristics. Smaller banks, i.e. banks in the first quartile of the sample ordered by total assets, appear, on average, to rely more on their account balances to settle outgoing payments than larger banks (Table 1). This can be explained by the fact that smaller banks typically conduct less activity in TARGET2 and therefore encounter greater difficulties in recycling liquidity. Incoming payments are mainly used as a source of funding by mid-size banks, i.e. banks in the second and third quartile by total assets, with an average of 23.2%.[22] Larger banks, i.e. banks in the fourth quartile by total assets, appear instead to rely more than the others on overdrafts, with an average of 9.1%. This finding is in line with the results by bank business model, with investment and corporate banks as well as global systemically important banks (G-SIBs) and universal banks also having wider recourse to overdrafts. Larger-size and corporate banks benefit from larger collateral pools to cover intraday liquidity needs, thus having more flexibility to use this particular payment funding source. These participants, due to the nature of their business, are also more likely to settle transactions of higher values, making it more likely for them to use the ICL to cover specific payment obligations. In addition, larger banks may offer correspondent banking services[23] which can generate payment flows that are difficult to predict. Diversified and retail lenders are able to match their incoming payments with their outgoing ones to a large extent, i.e. 22.8% and 24.5% respectively, hence reducing the opportunity cost of funding their traffic in TARGET2. These banks typically benefit from a more foreseeable payment schedule, allowing them to coordinate a higher share of transactions. Compared with other participants, they also concentrate their payments in a shorter time frame and tend to settle their payments earlier in the day.

Table 1

Average usage of payment sources by bank characteristics

(percentages)

Sources: TARGET2, Orbis, ECB, ECB calculations.

Notes: Due to data availability, the results reported are calculated based on a sub-sample reduced to approximately one-third of the TARGET2 participants included in this analysis. While the overall behaviour of the sub-sample is in line with that at system level, levels of individual indicators may be different.

Liquidity recycling is more intense at the beginning of the business day and once more before the end-of-day. In the first two hours of the business day, when activity is very high,[24] TARGET2 participants fund 19% to 26% of their payments using incoming liquidity (Chart 4). During the day, the use of incoming payments is lower, only to increase once more in the last hour of business, when mainly interbank traffic and liquidity management transactions, which can be more easily coordinated, are settled. The use of account balances perfectly mirrors the incoming payments and reaches its maximum at 17:00 CET, standing at 84.4%. The usage of intraday credit decreases steadily from 13:00 CET onwards and reaches a very low level towards the end of the business day, i.e. 1.4% between 17:00 CET and 18:00 CET. This is an important point, as it indicates a low risk of banks not being able to repay their negative positions towards the end-of-day. If banks were to be unable to repay their negative positions, they would need either to: (i) have recourse to the marginal lending facility for which an interest rate is charged – in the case of eligible counterparties for Eurosystem monetary policy operations with access to the marginal lending facility; or (ii) to incur penalty interest – in the case of TARGET2 participants who do not have access to the marginal lending facility.[25]

Chart 4

Intraday pattern of funding sources in TARGET2

(percentages)

Sources: TARGET2, ECB calculations.

Notes: The chart shows average daily figures over the period from June 2008 to November 2020.

Bank-level analysis of the factors that influence the use of the different payment funding sources

To understand what influences the heterogenous use of payment funding sources, a bank-level panel analysis using data at daily frequency was performed (Table 2). The sources of payment funding show the share of outgoing payments settled via a specific source, i.e. incoming payments, the account balance or intraday credit, and they are expressed in percentages. The panel approach allows several individual bank features to be taken into account at once, such as: (i) the value settled; (ii) the start-of-day balance; (iii) the ICL size; and (iv) the size of the bank’s network;[26] as well as other more general factors: (v) the overnight interest rate, which provides the cost of liquidity; and (vi) a dummy to control for the start of the APP,[27] which equates to a change of regime in terms of Eurosystem central bank reserve levels.

The availability of central bank reserves on the TARGET2 account weighs negatively on the use of incoming payments and intraday credit as funding sources, but positively on the use of the account balance. More precisely, an increase of €1 billion in the start-of-day balance on a TARGET2 account decreases the share of payments settled by a participant via incoming payments by approximately 0.2 percentage point (Table 2, “Start-of-day balance”, (1) and (2)) and via intraday credit by approximatively 0.6 to 0.7 percentage point (Table 2, “Start-of-day balance”, (4) to (6)). At the same time, an increase of €1 billion in the start-of-day balance increases the use of the account balance by approximately 0.7 to 0.9 percentage point (Table 2, “Start-of-day balance”, (7) to (9)). These results confirm the findings at aggregate level that were mentioned in the previous section. The start-of-day balance available on banks’ accounts has increased significantly since the introduction of the APP in 2015, and, according to the bank-level panel analysis, this has led to a decrease of 5.8 percentage points, on average, in the use of incoming payments as a source of payment funding, a decrease of 2.2 percentage points in the use of intraday credit and an increase of 8.0 percentage points in the use of the account balance (Table 2, “APP”, (3), (6) and (9)). These results are not only statistically significant, but they also demonstrate the sizeable impact of the APP on the use of different payment funding sources by TARGET2 participants.

Table 2

Factors affecting different uses of payment funding sources – bank-level panel analysis

Sources: ECB, TARGET2 and ECB calculations.

Notes: Data cover the period from June 2008 to November 2020. The overnight unsecured rate is measured as the EONIA until 1 October 2019 and the €STR from then onwards. The reported results are based on fixed-effect regressions. The numbering (1) to (9) denotes the specifications employed for each of the regressions. Each specification uses a different set of regressors which are clearly marked by the presence of a coefficient. Robust standard errors are reported in parentheses. *** p<0.01; ** p<0.05;* p<0.1.

The size of the network of a bank has a positive effect on its ability to synchronise incoming with outgoing payments. The effect is statistically significant and relatively large: extending a bank’s network by 70 counterparties – equivalent to a one standard deviation of the number of counterparties across participants averaged through time – results in an approximately 2.8 percentage point increase in the use of incoming payments as a funding source (Table 2, “Network size”, (1) and (2)). At the same time, it seems to drive downwards the use of the account balance (Table 2, “Network size”, (7) to (9)), the effect being even stronger – but of opposite sign – than that on the use of incoming payments. Having more counterparties creates more occasions for synchronising payments. Similarly, settling more payments has a positive impact on the use of incoming payments as a funding source – the larger volume of business facilitates obtaining liquidity that can be reused to fund outgoing obligations – while it has the opposite effect on the use of the account balance (Table 2 “Value settled”, (1) to (3) and (7) to (9)).

A larger ICL size is associated with lower funding of payments through the account balance and a higher use of incoming payments and intraday credit. When operating with limited liquidity on the account balance, banks can increase their payment capacity by either synchronising their outgoing payments with their incomings, or by increasing the size of their ICL. The size of the credit line, which is interest free, depends on the amount of collateral posted with the Eurosystem. Participants set the ICL at the beginning of the day and can flexibly modify it throughout the day. The size of the ICL does not necessarily indicate a need to increase the payment capacity: larger banks typically have large holdings of collateral parked in the Eurosystem collateral pool when not being used otherwise. As the ICL can fluctuate during the day, the daily ICL size available to each participant is approximated in the panel analysis by the maximum value reached over the course of the day. Since intraday modifications are not captured, it could be argued that the variable is exogenous to intraday liquidity management. The figures in Table 2 show that a larger ICL size is associated with a higher use of intraday credit and incoming payments. This indicates either that the size of the ICL is modified to increase the payment capacity or that, when available, the ICL is used more often. Also, the results confirm that when in need, participants invest more in synchronising their payments (Table 2, “ICL size”, (1) to (6)).

An increase in the overnight interest rate translates into an increase in the use of incoming payments and of intraday credit and a decrease in the use of the account balance. When the central bank absorbs reserves and their cost increases, there is traditionally an incentive for banks to lend on the money market, thereby decreasing their individual account balance holdings in favour of profitable lending opportunities. This leaves them with less central bank reserves on their TARGET2 accounts, thus making them more likely to use alternative sources to settle their outgoing payments. Likewise, in the case of borrowing banks, an increased cost of central bank reserves provides an incentive to use payment funding sources other than their account balances. The use of incoming payments as a funding source bears no cost, while for intraday credit, even though it is interest free, there is a cost associated with the fact that collateral is encumbered for this purpose. This, in turn, creates an incentive for banks to actively manage their central bank reserves. According to the bank-level panel analysis, an increase of 1 percentage point in the overnight rate is associated with an increase of 1.8 percentage points in the use of incoming payments or 1.0 percentage point in the use of the ICL (Table 2, “Overnight rate”, (2) and (5)). On the contrary, the use of central bank reserves decreases with an increase in the overnight rate, suggesting that when the cost of central bank reserves is high, banks prefer to create additional payment capacity by better synchronising their payments or using the ICL, as they are both cheaper than borrowing funds on the money market.

4 Conclusions

Liquidity usage in TARGET2 has changed considerably since 2008, primarily as a result of the level of central bank reserves available in the system. The velocity at which liquidity circulates in TARGET2 has fallen over the course of time, particularly when the level of central bank reserves increased during the sovereign debt crisis and subsequently once the APP was introduced, as well as more recently with the additional stimulus provided in the context of the COVID-19 pandemic. Clearly, liquidity velocity fluctuates with the amount of central bank reserves available in the system, because, in the presence of higher levels of central bank reserves, banks tend to use more liquidity to settle payments, albeit a similar volume of payments could be settled even if lower levels of central bank reserves were available. This could be made possible, for instance, if banks were to synchronise their incoming with outgoing payments more efficiently or were to use the intraday credit line (ICL) to a greater extent. Nonetheless, the liquidity used to make payments has increased at a slower pace than the liquidity available, resulting in a significant amount of central bank reserves on TARGET2 accounts that is currently not being actively used to settle payments.

While most payments in TARGET2 are funded using the liquidity available on the account balance, the interplay between different funding sources varies across time, countries and bank characteristics. On average, throughout the period of analysis, TARGET2 participants funded 73.0% of their payments using the liquidity available on their account balance, 18.8% using incoming payments, and 8.1% using intraday credit. With central bank reserves becoming abundant, a higher proportion of outgoing payments were settled using the account balance, which further supports the previous argumentation behind the decrease in liquidity velocity in TARGET2. The usage of liquidity differs not only with the level of central bank reserves available, but also across bank characteristics. Smaller banks have greater difficulties in coordinating incoming and outgoing payments, which can be a consequence of lower activity in TARGET2 and fewer connections. At the same time, larger-size banks, such as G-SIBs and corporate banks, make wider use of the intraday credit line, as they benefit from a larger collateral pool. Furthermore, intraday liquidity management practices differ significantly across national banking communities in the euro area.

A bank-level panel analysis provides a quantification of the impact of both monetary policy decisions and participant features on liquidity usage in TARGET2. The availability of higher levels of central bank reserves leads to a lower recycling of incoming liquidity and a higher use of the account balance. The panel analysis shows that since 2015 the recycling of incoming payments fell, on average, by 5.8 percentage points, while the use of the account balance for payment settlement increased, on average, by 8.0 percentage points. Also, the use of intraday credit decreased by 2.2 percentage points. A lower recourse to intraday credit in TARGET2 is generally seen to reduce liquidity risk for the participants and to decrease the likelihood of the marginal lending facility being used at the end-of-day, the latter implying a cost for the participants. A tightening in the monetary policy rates, on the other hand, is associated with an increased recycling of payments and reduced reliance on the account balance. More specifically, an increased cost of central bank reserves incentivises banks to manage their intraday liquidity more actively by using payment funding sources other than their account balance. At participant level, what makes a difference in the ability to synchronise payments better is the size of their network or the amount of payments that they settle – both of which providing more opportunities to recycle liquidity.

To conclude, with the increase in central bank reserves, the efficiency of liquidity usage in TARGET2 has slowed down, as banks have fewer incentives to actively manage their intraday liquidity. This is natural, as the need for banks to synchronise payments or use intraday credit has decreased in the presence of higher account balances and low opportunity costs as well as reduced opportunities of using them differently. However, historical evidence shows that, when there were lower levels of central bank reserves, participants were able to make more efficient use of their liquidity. It is therefore likely that, in the event of a reduction in central bank reserves, participants will be able to shift back towards a more active intraday liquidity management, thus contributing to the continuation of a smooth settlement of payments in TARGET2.

- The authors of this article are members of one of the user groups with access to TARGET2 data in accordance with Article 1(2) of Decision ECB/2010/9 of the European Central Bank of 29 July 2010 on access to and use of certain TARGET2 data. The ECB, the Market Infrastructure Board and the Market Infrastructure and Payments Committee have checked this article against the rules for guaranteeing the confidentiality of transaction-level data established by the Market Infrastructure Board pursuant to Article 1(4) of the above-mentioned Decision.

- An additional characteristic of RTGS systems is that payments are settled on a continuous basis, i.e. in real time. As soon as a payment is settled, it becomes final and irrevocable, hence liquidity can immediately be reused by the recipient.

- For a payment to be settled on a gross basis, i.e. one by one, sufficient liquidity needs to be on the debited account, i.e. the account of the sender of the payment.

- Credit risk is the risk that a counterparty, whether a participant or other entity, will be unable to fully meet its financial obligations when they fall due or at any time in the future.

- For more details about TARGET2, how it works and its relevance for credit institutions in the euro area, see the article entitled “Liquidity distribution and settlement in TARGET2”, Economic Bulletin, Issue 5, ECB, 2020.

- For example, a well-known liquidity-saving mechanism is the multilateral offsetting algorithm that matches and offsets payments between multiple participants, thus reducing their liquidity needs.

- In TARGET2, the central bank reserves available on the participants’ accounts in TARGET2 can be fully utilised for settling payments, i.e. there is no distinction between the use of minimum and excess reserves. Minimum reserve requirements need to be met over the maintenance period.

- For example, the asset purchase programme (APP), the three series of targeted longer-term refinancing operations (TLTROs), and more recently the launch of the pandemic emergency purchase programme (PEPP) to counter the downward impact of the pandemic on the projected path of inflation.

- In this article, we apply the methodology used by Benos, E., Garratt, R. and Zimmerman, P., “Bank behaviour and risks in CHAPS following the collapse of Lehman Brothers”, Working Paper Series, No 451, Bank of England, 2012. Other alternatives exist in the literature, in which, for instance, liquidity velocity is computed relative to the liquidity available, see also Garratt, R., Antoine, M. and McAndrews, J., “Turnover in Fedwire Funds Has Dropped Considerably since the Crisis, but it’s Okay”, Technical Report, Liberty Street Economics, Federal Reserve Bank of New York, August 2014.

- In practice, this is measured as the sum of the maximum positive net debit positions (outgoing payments minus incoming payments) on the TARGET2 accounts. In this article, we measure the net debit positions every minute. This is, nevertheless, a proxy and there are alternative ways of measuring it.

- In several publications, liquidity available also includes the ICL available to the participant. In this article, the two concepts are considered separately.

- Correlation coefficient stands at -0.82.

- See Duca-Radu, I. and Polo Friz, L., “Liquidity distribution and settlement in TARGET2”, Economic Bulletin, Issue 5, ECB, 2020.

- Note that for the sake of comparison, data available from January through to November only were taken into account, as data for December 2020 were not yet available.

- Note that central bank reserves are, on aggregate, determined by monetary policy actions and their level depends on central bank decisions.

- To quantitatively determine the size of the funding sources, we apply the methodology of McAndrews, J. and Rajan, S., “The timing and funding of Fedwire Funds transfers”, Economic Policy Review, Federal Reserve Bank of New York, July 2000. Unlike the methodology in that paper, we use time intervals of one minute to increase the precision of the calculations.

- Note that the results provided in this section and the article henceforth are based on a sub-sample of TARGET2 participants, i.e. those TARGET2 participants that are technically provided with intraday credit in TARGET2 via the ICL, as the methodology employed allows the three payment funding sources to be distinguished in this way only.

- See Garratt, R., Antoine, M. and McAndrews, J., “Turnover in Fedwire Funds Has Dropped Considerably since the Crisis, but it’s Okay”, Technical Report, Liberty Street Economics, Federal Reserve Bank of New York, August 2014.

- See Benos, E. and Harper, G., “Recycling is good for the liquidity environment: Why ending QE shouldn’t stop banks from being able to make CHAPS payments”, Bank Underground, May 2016.

- Tiered participation in a payment system is when a direct participant of that system provides services allowing other participants to access the system indirectly. The indirectly connected participants thus benefit from the clearing and settlement facility services offered through the direct participants.

- In Germany, for example, many of the small savings banks are not connected to TARGET2.

- Before the start of the PSPP in March 2015, the use of incoming payments by this group of banks was even higher, standing at 28.7%.

- A correspondent bank is a bank that provides settlement services on behalf of another bank.

- Around 20% of the total payments value in TARGET2 is settled within the first two hours of the business day.

- See Annex III, Provision of intraday credit, to Guideline ECB/2012/27 of the European Central Bank of 5 December 2012 on a Trans-European Automated Real-time Gross settlement Express Transfer system (TARGET2) (OJ, L 30, 30.1.2013, p. 1).

- The size of a bank’s network is measured as the average number of counterparties with which each bank interacts on a daily basis in TARGET2.

- The start of the APP is approximated with the start of the PSPP in March 2015, given that the PSPP had the largest impact on the levels of central bank reserves among the programmes implemented under the APP.