- THE ECB BLOG

Climate scenarios: procrastination comes at high cost

4 December 2023

This post is the third in our series accompanying COP28.

Policy makers around the world need to move faster to reach net zero emissions by 2050. Latest scenarios are alarming as the foreseeable impact of climate change is worse than previously projected. This ECB Blog post discusses the risks of further delaying the green transition.

Current global climate policies are not bold enough to reach carbon neutrality by 2050. This is one of the findings of the latest scenario update by the Network for Greening the Financial System (NGFS).[1] [2] This network of central bankers and banking supervisors, together with leading academic climate institutions, has developed an analytical toolkit to assess what our economies might look like on different climate policy paths. These are called “climate scenarios”. The latest results are alarming, pointing to an economic impact from climate change worse than what it was previously projected.

Same goal, less time

This is rather negative news for those hoping to speed up on the road to Paris. In 2015, global leaders meeting in Paris decided to limit global warming to 1.5°C above pre-industrial levels by the end of this century.[3] Achieving this objective requires the world to reach net zero emissions by 2050.[4] Every day of procrastination leads to a need for even more stringent policies, faster technological advancements, and more profound behavioural changes. The narrowing time frame, in turn, increases transition risks for economies worldwide and is thereby also relevant for central banks.

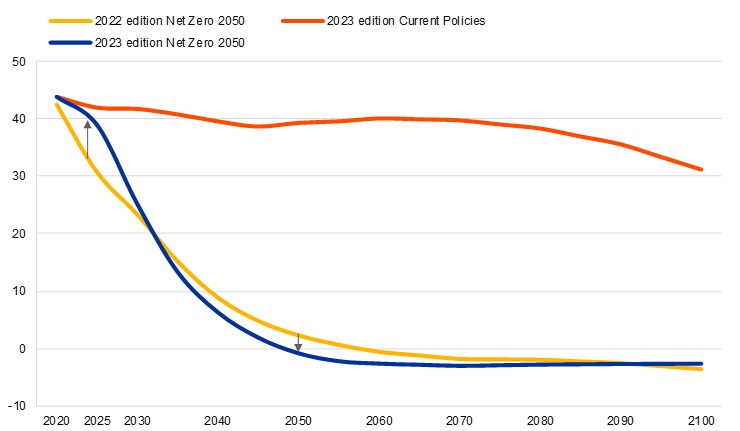

Chart 1 shows how in the “Net Zero 2050” scenario – one of the seven NGFS scenarios – global carbon emissions are higher before 2030 compared to last year’s scenario development exercise.[5] In the 2022 calculations, emissions were projected to decrease gradually throughout the 21st century. In the latest 2023 calculations, emissions stay at elevated levels longer, due to the recent macro developments and further delays in the implementation of climate policies, requiring a steeper reduction after 2025. For reference, the emission projection according to the NGFS “Current Policies” scenario has been added as well. It shows global annual emissions if only currently implemented policies remain in place.

Chart 1

Carbon emission pathways are steepening in the NGFS Net Zero 2050 and Current Policies scenario

Annual global CO2 emissions: 2022 versus 2023 edition of the NGFS Net Zero 2050 scenario and 2023 edition of Current Policies scenario

Gt CO2

Source: IIASA NGFS Climate Scenarios Database, REMIND model (Phase III & Phase IV publications)

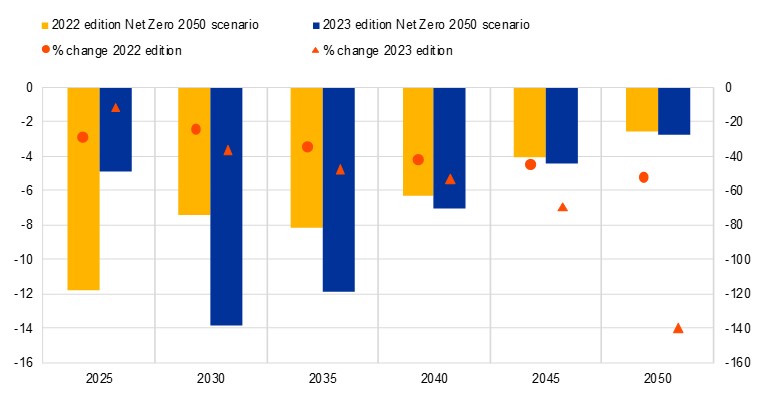

Chart 2 shows the required emission reductions in five-year time steps. Prior editions of the NGFS scenarios envisaged noticeably larger emission reductions in the years until 2025, stipulating that global annual CO2 emissions should be approximately 12Gt lower in 2025 compared to 2020. But according to the latest edition, this assessment is too optimistic, limiting the reduction to only 5Gt by 2025.[6] As a result, the 2023 scenario shows that global emissions would need to be cut much more drastically between 2025 and 2050 to still reach the net zero target.

Chart 2

The bulk of carbon emission reductions in the NGFS Net Zero 2050 scenario shifts 5-10 years forward

Change in annual CO2 emissions compared to 5 years prior: 2022 versus 2023 edition of the NGFS Net Zero 2050climate scenario

Left-hand scale: Gt CO2; right-hand scale: percentage

Source: IIASA NGFS Climate Scenarios Database, REMIND model (Phase III & Phase IV publications)

Scenario criticisms and improvements

The scenarios are certainly a useful tool for analysing climate risks to the economy and financial system. Nevertheless, they are subject to some limitations and criticisms; some are rooted in a misunderstanding of the NGFS scenarios, others are pointing at limitations which the NGFS acknowledges and is seeking to gradually address to the extent possible.

First, it is important to be aware that the NGFS scenarios are not forecasts. Instead, they explore a range of plausible futures (neither the most probable nor the most desirable), without making predictions about the probability of occurrence of any of the scenarios. For instance, while the 2023 edition of the NGFS scenarios highlights the increasing transition risks of the Net Zero 2050 scenario compared to the 2022 edition of the calculation, it does not make any statements about (changes in) the likelihood of this scenario materialising.

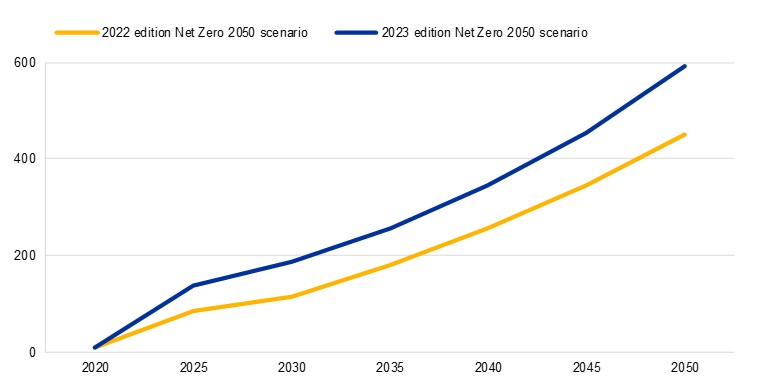

Second, the main policy lever to drive the transition in the models is a “shadow” carbon price. This carbon price serves as a proxy for overall climate policy ambition and effectiveness. It is not the same as a carbon tax. Instead, a higher carbon price reflects a more stringent overall climate policy, regardless of the policy instrument used. This can include carbon taxes, but also other instruments such as green subsidies, energy efficiency requirements and fossil fuel bans. Comparing the 2023 edition with the 2022 edition of the Net Zero 2050 scenario, higher “shadow” carbon prices reflect the need for more stringent climate policies going forward (see chart 3). This, again, demonstrates how the net zero target becomes increasingly difficult to attain by 2050.

Chart 3

“Shadow” carbon prices now rise higher, reflecting need for more stringent climate policies due to delays

Global “shadow” carbon price: 2022 versus 2023 edition of the NGFS Net Zero 2050 climate scenario

US$2010 / t CO2

Source: IIASA NGFS Climate Scenarios Database, REMIND model (Phase III & Phase IV publications)

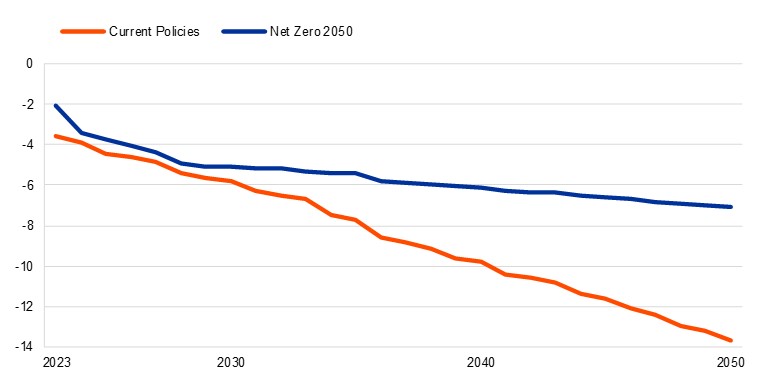

Chart 4 displays global GDP losses from climate change for the Current Policies scenario, which foresees that only currently implemented climate policies stay in place (red line). Under this troublesome scenario, the annual GDP losses would amount to 14 percent in 2050. Under the more enviable Net Zero 2050 scenario (blue line), the losses are still substantial with up to 7 percent but much smaller compared to the Current Policies scenario. These losses, as featured in the NGFS scenarios, have often been deemed too reassuring in terms of economic impact.[7] In the latest release this has been partly dealt with by reducing the (projected) availability of Carbon Capture and Storage technologies, and by extending the modelling of acute physical risk to other types that were previously not included (heatwaves and droughts).[8]

Chart 4

Global GDP losses due to climate change are much less severe in the Net Zero 2050 scenario. The losses are calculated relative to a hypothetic scenario without any climate change at all.

Global GDP losses due to climate change: Current Policies and Net Zero 2050 scenario (2023 edition)

% of annual global GDP

Source: IIASA NGFS Climate Scenarios Database, NiGEM model with REMIND inputs (Phase IV publication)

Furthermore, in the latest edition of the NGFS scenarios, Net Zero 2050 and Below 2°C scenarios reflect higher transition risk due to protracted inadequate climate action. If insufficient climate action continues to be the norm, transition risk in the Net Zero 2050 scenario will further increase in future versions of the scenarios.

On a final note, we need to be aware that models used to produce climate scenarios, despite their importance, have certain limitations. It remains very difficult to include non-linear elements, like climate tipping points, in the models. This will be a priority of further work for the NGFS in the years ahead. In the meanwhile, the NGFS is also working on short term scenarios that focus on potentially severe near-term climate related risks and can be used for climate stress tests and similar exercises.[9]

Conclusion

COP28 takes place at a pivotal moment. The NGFS scenarios, despite their limitations, show that it is becoming increasingly challenging to reach net zero by 2050. Insufficient climate action in recent years make even bigger emissions reductions necessary to reach climate goals. Timely and globally coordinated climate action has become a prerequisite for sustainable growth. The further delay of a green transition will cause substantial economic loss and financial stability risks down the road.

The views expressed in each blog entry are those of the author(s) and do not necessarily represent the views of the European Central Bank and the Eurosystem.

The Network for Greening the Financial System (NGFS) is a group of, by now, 127 central banks and supervisors (and 20 observers) from across five continents committed to sharing best practices, contributing to the development of climate- and environment-related risk management in the financial sector and mobilising mainstream finance to support the transition toward a sustainable economy.

NGFS scenarios are aligned with projections from the IPCC, who concluded in their 2023 AR6 Synthesis Report that emissions implied by current policies and pledges make warming levels exceeding 1.5°C likely during the 21st century.

The Paris Agreement is a legally binding international treaty on climate change. It was adopted by 196 Parties at the UN Climate Change Conference (COP21) in Paris, France, on 12 December 2015.

Emissions refer to greenhouse gas emissions, which contribute to global warming and climate change. This includes carbon dioxide (CO2), methane (CH4) and several other greenhouse gases. For calculation and comparison purposes, these gases are often represented by their ‘carbon dioxide equivalent’.

Each NGFS scenario has its own pre-defined temperature warming limit, after which plausible emission pathways are defined by Integrated Assessment Models to stay below this limit (while also accounting for other - scenario-specific - assumptions). From the 2022 to the 2023, temperature warming limits have not changed for the Net Zero 2050 scenario. However, there are multiple possible emission pathways towards this warming limit, one more disorderly than the other, e.g., gradual decrease in emissions over time or very sudden large emission reductions at one point in time.

This is mainly due to delays in climate action, but also due to a decrease in the predicted availability of Carbon Dioxide Removal (CDR) technologies, and due to recent adverse macroeconomic developments which add additional uncertainty to (energy) markets.

See, for example, the ‘Finance in Hot House World’ report by Finance Watch.

Four perils are considered as acute physical risk in the NGFS scenarios: droughts, heatwaves, tropical cyclones, and riverine floods.

Short-term scenarios aim to help central banks and supervisors to better understand the near-term macro-financial impact of transitioning to a net zero economy, including the consequences of severe natural disasters.