The new TARGET instant payment settlement (TIPS) service

June 2017

The Eurosystem has decided to develop a new service for the settlement of instant payments. The TARGET instant payment settlement (TIPS) service will enable payment service providers to offer fund transfers in real time and around the clock, 365 days a year. This article provides some background information on the emergence of instant payments and their challenges in Europe and describes the main features of TIPS.

The emergence of instant payments and their challenges

Digitalisation has resulted in greater “speed” in all areas of life. Consumers access music, news and traffic updates in real time. Not surprisingly, there is also a growing expectation to be able to make payments instantly. In response, innovative retail payment services are increasingly focused on providing faster and more convenient payments to consumers and businesses, while safeguarding security.

Instant payments will increase the speed of euro payments in the European Union. Today it takes up to one business day for a payment in euro to reach the beneficiary. With instant payments, the funds will be available immediately for use by the recipient, 24/7/365.

From an end-user perspective, the benefit of instant payments is the ability to make time-sensitive payments immediately, wherever and whenever necessary. The implementation of instant payments may also provide the basis for service enhancements and value-added services, e.g. person-to-person mobile payments.

Instant payment solutions have been implemented, or are in the process of being developed, in many countries across the world. Some are central bank-driven (e.g. Mexico), some are industry-driven (e.g. United Kingdom, Denmark, Sweden, Poland) and some are the result of a joint approach (e.g. Australia, where the central bank subscribed as a participant in the development of the New Payments Platform). In the euro area, the first countries to launch instant payment initiatives were Italy, Spain and the Netherlands.

For the Eurosystem, as a catalyst for European financial market integration, a major challenge is ensuring that the introduction of instant payment services – and more generally innovative retail payment solutions – does not (re)introduce fragmentation into the European retail payments market. There is a risk of new fragmentation in the euro area arising from the development of national, proprietary or closed-loop solutions which are not interoperable. To counter this risk, the Euro Retail Payments Board (ERPB), which includes high-level representatives of the demand and the supply side of the retail payments market and chaired by the ECB, mandated the European Payments Council (EPC) to develop the SEPA Instant Credit Transfer (SCTinst), a scheme for pan-European instant payments. The rulebook for this scheme was delivered in November 2016.

Payment service providers are encouraged to make instant payment solutions in euro available at a pan-European level as of November 2017. Although it is not mandatory for payment service providers to offer SCTinst, it is expected that a large number of them will do so.

The roll-out of instant payments depends not only on the payment service providers, but also on the availability of a safe and efficient underlying market infrastructure that can process instant payments across Europe. By providing TIPS, the Eurosystem will make sure that the demand for instant payments is met at European level and will further facilitate integration in the euro area.

What services and benefits will TIPS offer?

TIPS will offer final and irrevocable settlement for instant payments in central bank money on a 24/7/365 basis. It will allow participating banks to set aside part of their liquidity on a dedicated account opened with their central bank, from which instant payments could be settled around the clock. The balance on these accounts will count towards their required minimum reserve. Instant settlement will eliminate credit risk for all involved participants. The broad participation criteria for TIPS will ensure a high level of reachability.

The primary objective of TIPS is to provide efficient settlement services in euro. However, the service will be technically capable of settling other currencies, too.

The flexible structure of TIPS will allow market actors to play three types of roles in TIPS:

- Participants: Any payment service provider that is eligible to open a payment account in TARGET2 can become a participant in TIPS. TIPS participants can have one or more accounts in TIPS to send and receive instant payments.

- Reachable parties: A payment service provider that cannot (because it is not eligible to open a payment account in TARGET2) or does not want to open an account in TIPS can become a reachable party by establishing contractual arrangements with a participant in TIPS to settle instant payments on that participant’s account in TIPS.

- Instructing parties: Any entity (e.g. payment service provider or automated clearing house) that has contractual agreements with one or more participants or reachable parties in TIPS could issue instructions in TIPS on behalf of the participant or reachable party. Participants and reachable parties can also act as instructing parties.

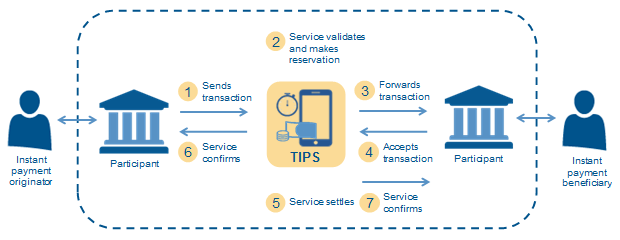

Transaction and information flow in TIPS

- A participant sends an SCTinst payment transaction message to TIPS. (The participant may also be an instructing party acting on behalf of the participant, or a reachable party.)

- TIPS validates and reserves the amount to be transferred (conditional settlement).

- TIPS forwards the payment transaction for acceptance to a receiving participant.

- The receiving participant sends a positive reply message to TIPS.

- TIPS settles the payment.

- TIPS confirms the settlement to the sending participant.

- TIPS confirms the settlement to the receiving participant.

The market consultation on user requirements for the TIPS service ran from 9 January 2017 to 24 February 2017. The input received showed that there is significant interest in the instant payments topic in general and the potential service offering of TIPS in particular. Overall, the feedback on the proposed services was very positive. Points that required further clarification concerned the broader framework of how TIPS would fit into the future European market infrastructure landscape, e.g. on interoperability, reachability, the role of automated clearing houses and liquidity management. For a dedicated discussion of these points, please refer to the note “Co-existence of TIPS with other instant payment services”.

The TIPS pricing policy will favour reachability. The entry and maintenance fees for an account in TIPS will be set at zero. The charges to be paid per transaction will be proportional to the volume of instant payments processed via TIPS in order to comply with our full cost recovery principle. In this context, the feedback on expected volumes in the market consultation was very encouraging. It exceeded the volumes initially estimated by the Eurosystem both as regards total market volumes and the volumes that market participants would expect to process in TIPS. The Eurosystem will offer the service to banks at the price of a maximum of 0.20 eurocent (€0.0020) per payment for at least the first two years of operation.

The TIPS accounts can be funded/defunded during TARGET2 operating hours. There will be no opportunity cost attached to “overfunding” TIPS accounts during the night, weekends or holidays because holdings on TIPS accounts will count towards the minimum reserve requirements in the same way as those on TARGET2 RTGS accounts.

What next?

Following the June 2017 decision by the Governing Council of the ECB to develop the TIPS service, the project has now entered the development phase. TIPS is scheduled to commence operations in November 2018. The Eurosystem will continue to work closely with market participants to ensure a smooth and timely launch of TIPS.