Euro area balance of payments (monthly developments in April 2005)

In April 2005 the seasonally adjusted current account of the euro area recorded a deficit of EUR 0.8 billion, resulting from deficits in income and current transfers, which were partly counterbalanced by surpluses in goods and services. In the financial account, combined direct and portfolio investment recorded net outflows that predominantly reflected an increase in euro area companies’ outstanding loans to their foreign affiliates as well as net sales of euro area portfolio equities by non-residents.

Current account

The seasonally adjusted current account of the euro area showed a deficit of EUR 0.8 billion in April 2005 (corresponding to a EUR 11.6 billion deficit in non-seasonally adjusted terms). This reflected deficits in income (EUR 3.9 billion) and current transfers (EUR 2.9 billion) that were only partly offset by surpluses in goods (EUR 5.0 billion) and services (EUR 1.0 billion).

Compared with the revised data for March 2005, the seasonally adjusted current account balance decreased by EUR 3.5 billion, predominantly as a result of a fall in the goods surplus (by EUR 4.2 billion), but also owing to a fall in the services surplus (by EUR 0.6 billion) and to a rise in the income deficit (by EUR 0.6 billion). This was partly counterbalanced by a decrease in the current transfers deficit (by EUR 1.8 billion).

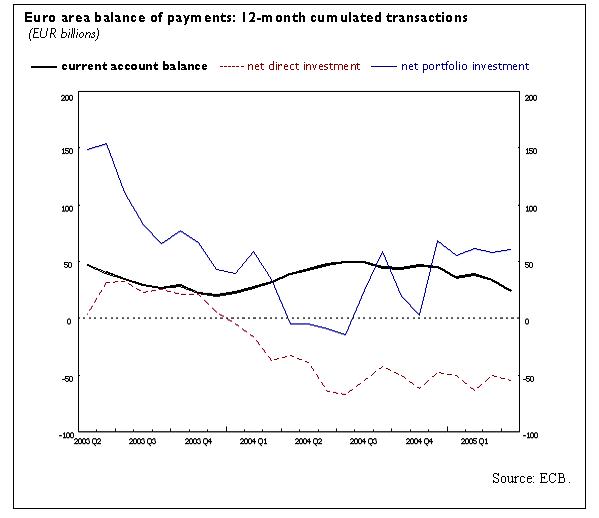

The 12-month cumulated surplus of the euro area current account amounted to EUR 26.2 billion up to April 2005, i.e. around 0.3 % of GDP, compared with EUR 39.3 billion a year earlier (see chart). This reduction mainly resulted from a decline in the surplus in goods (by EUR 33.7 billion) which was partly compensated by a falling deficit in income (by EUR 14.2 billion) and, to a lesser extent, by a rising surplus in services.

Financial account

In the financial account, combined direct and portfolio investment recorded net outflows of EUR 9.1 billion in April 2005, reflecting net outflows in both direct and portfolio investment.

The developments in direct investment were accounted for by net outflows in other capital (mostly inter-company loans) amounting to EUR 15.8 billion. In particular, euro area companies increased outstanding loans to their foreign affiliates (by EUR 14.2 billion). These net outflows were partly offset by foreign corporations’ investment in the euro area in the form of equity capital and reinvested earnings (EUR 7.5 billion) and some disinvestment of this type by euro area corporations outside the euro area.

The developments in portfolio investment resulted from net outflows in equity securities (EUR 30.5 billion), which were mostly due to net sales of euro area equity securities by non-residents (EUR 38.9 billion). Net inflows in debt instruments amounted to EUR 27.7 billion, mainly as a result of net purchases of euro area bonds and notes by non-residents (EUR 58.0 billion).

Other investment recorded net outflows of EUR 1.3 billion, mainly as a result of net outflows registered by the general government and monetary financial institutions (MFIs) excluding the Eurosystem.

Reserve assets increased by EUR 0.8 billion (excluding valuation effects). The stock of the Eurosystem’s reserve assets stood at EUR 288.9 billion at the end of April 2005.

In the 12-month period up to April 2005, combined direct and portfolio investment recorded cumulated net inflows of EUR 6.0 billion, compared with net outflows of EUR 37.8 billion a year earlier. This resulted from a switch from net outflows (EUR 5.1 billion) to net inflows (EUR 60.5 billion) in portfolio investment, which was due to a combination of lower net purchases of foreign securities by euro area residents and higher net purchases of euro area securities by non-residents. Over this period, net outflows in direct investment increased (by EUR 21.8 billion), stemming from a decrease in equity investment in the euro area by foreign companies.

Data revisions

In addition to the monthly balance of payments data for April 2005, this press release incorporates revisions to the data for March 2005. The revisions had only a minor impact on the net figures.

Additional information on the euro area balance of payments A complete set of updated euro area balance of payments is available on the ECB’s website in the “Statistics” section under the heading “Data services”/“Latest monetary, financial markets and balance of payments statistics”. The results up to April 2005 will also be published in the July 2005 issue of the ECB’s Monthly Bulletin. A detailed methodological note is available on the ECB’s website. The next press release on the euro area monthly balance of payments will be published on 21 July 2005.

Annexes

Table 1: Euro area current account – seasonally adjusted data.

Table 2: Monthly balance of payments of the euro area – non-seasonally adjusted data.

Eiropas Centrālā banka

Komunikācijas ģenerāldirektorāts

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Pārpublicējot obligāta avota norāde.

Kontaktinformācija plašsaziņas līdzekļu pārstāvjiem