The euro area current account after the pandemic and energy shock

Published as part of the ECB Economic Bulletin, Issue 6/2023.

1 Introduction

In 2022 the euro area current account balance recorded a deficit of 0.8% of euro area GDP compared with a surplus of 2.8% in 2021 – a deterioration of 3.6 percentage points.[1] This constituted the biggest annual change in the euro area current account balance on record as the terms-of-trade shock from rising energy prices following Russia’s invasion of Ukraine triggered a substantial worsening of the euro area trade balance.[2] Since the introduction of the euro in 1999, the euro area current account balance has been through several distinct phases. After being in deficit in the early 2000s, it maintained a roughly balanced position until the global financial crisis, when it sharply deteriorated to reach a historically high deficit of close to 2% of GDP in 2008. Following a period of consolidation, the euro area current account balance then recorded sustained surpluses between 2013 and 2019, before exhibiting some pandemic-induced volatility already in 2020 and 2021.[3]

Changes in the current account balance capture information that can have implications for the conduct of monetary policy. For instance, a decline in the current account balance due to a surge in import prices and a deterioration in the terms of trade, as in the recent energy crisis, will on the one hand increase inflationary pressures through a change in relative prices. On the other hand, it will also depress domestic demand via the accompanying decline in real income, which over time will lead to a correction of the current account balance and mitigate the inflationary pressures. This has important implications for the required degree and duration of monetary tightening in response to a terms-of-trade shock.

This article provides an in-depth analysis of the factors driving the sharp reversal in the euro area current account balance in 2022 by considering developments in the various current account components and discussing the prospects for the recovery of the current account balance based on its medium-term determinants.

2 The euro area current account after the pandemic and energy shock

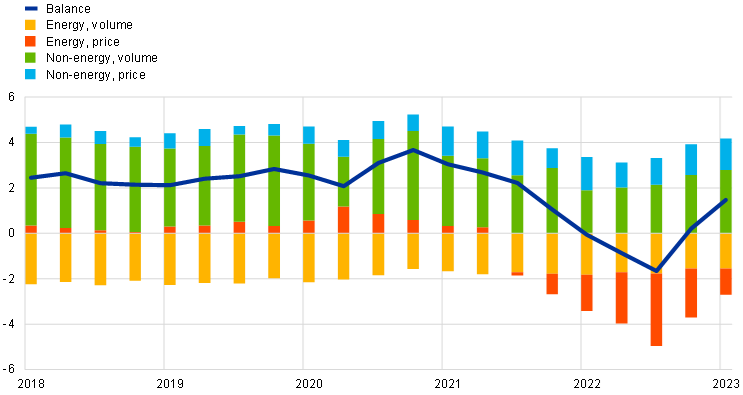

After having been in surplus since 2012, the euro area current account balance fell sharply into deficit in 2022. The deficit amounted to 0.8% of euro area GDP in 2022, a fall of 3.6 percentage points compared with a surplus of 2.8% in 2021. This was the largest annual shift in the euro area current account balance on record (Chart 1).

Chart 1

Euro area current account balance

(left: annual flows; right: quarterly flows, as a percentage of GDP)

Source: ECB.

The deterioration in the current account balance was largely driven by goods trade. The goods trade balance switched from a surplus of 2.2% of GDP in 2021 to a deficit of 0.6% in 2022. At the same time, the surplus in the primary income balance declined from 1.1% to 0.2% of GDP. These developments were slightly offset by an increase in the surplus on trade in services from 0.8% to 0.9% of GDP, while the deficit on secondary income remained unchanged at 1.3% of GDP.

The shift in the goods trade balance from a surplus to a deficit largely reflected a temporary increase in the price of net energy imports. The energy goods trade deficit amounted to 4.0% of GDP in 2022, more than double its level of 1.9% in the previous year. A decomposition of exports and imports by product group into price and volume effects shows that this increase was in turn driven by higher energy prices (Box 1). These prices had already started to rise towards the end of 2021 and accelerated sharply following Russia’s invasion of Ukraine in February 2022. The volume of imports showed smaller movements, as energy imports increased marginally until mid-2022, reflecting efforts to increase gas storage levels ahead of the winter. However, energy imports started to decline as of the autumn of 2022, on the back of energy conservation measures and favourable weather conditions. As energy prices receded in early 2023 the goods trade balance recovered and even returned to surplus in quarterly terms, also reflecting a recovery in non-energy goods net export volumes (Chart 2).

Chart 2

Euro area goods trade balance

(quarterly, as a percentage of GDP)

Source: ECB staff calculations.

Notes: The latest observations are for the first quarter of 2023. Decomposition of the goods trade balance in the balance of payments (BoP) is performed using the methods described in Box 1 of this article. The BoP breakdown by product category is derived from International Trade in Goods Statistics. Energy includes trade under Standard International Trade Classification, Revision 3. Decomposition into price and volume components is performed by multiplying values by trade-weighted sums of individual quantity indices within respective product categories and subtracting them from the nominal trade values.

The balance of trade in non-energy goods also declined for most of 2022. The decline in the surplus in non-energy goods in the first half of 2022 reflected anaemic growth in non-energy export volumes, which fell short of the increase in the volume of non-energy goods imports. The latter grew robustly, despite the depreciation of the euro and moderate domestic demand, on account of a strong rise in imports of manufactured goods with a high energy content as euro area domestic production became less competitive given the asymmetric energy price shock.[4]

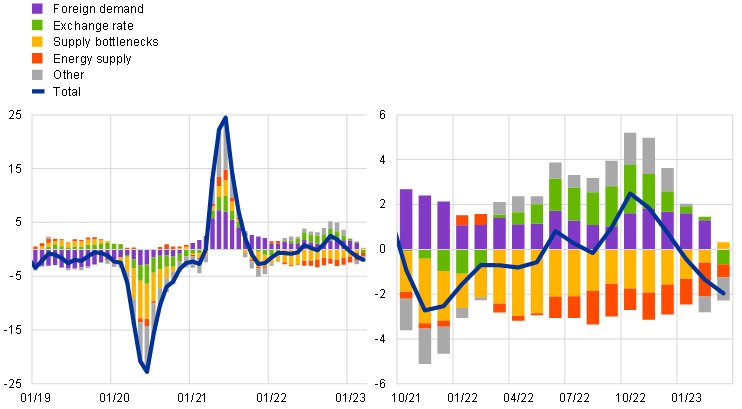

Supply bottlenecks, including energy supply shocks, continued to hold back euro area goods export growth in 2022. The response to the coronavirus (COVID-19) pandemic included lockdowns that restricted supply, which together with fiscal transfers created buoyant demand for goods. These supply bottlenecks were amplified following Russia’s invasion of Ukraine at the end of February 2022 and only began to ease from August of 2022. Chart 3 displays a historical decomposition obtained from a structural vector autoregression model. The results suggest that supply bottlenecks dampened euro area goods export growth through 2022. Indeed, the negative drag of supply chain disruptions was still present in the early months of 2023 before the easing of supply bottlenecks eventually provided a boost to export growth in March of this year.[5] The energy supply shock initially played a minor role in euro area export performance but gained importance following Russia’s invasion of Ukraine. These factors were partly offset by the depreciation in the nominal effective exchange rate of the euro last year, which increased price competitiveness during 2022.

Chart 3

Historical decomposition of goods export volumes

(three-month moving year-on-year percentage change, percentage point contributions)

Source: ECB.

Notes: The chart shows deviations from steady state based on a structural vector autoregression model for data from January 2003 to March 2023. Sign restrictions on impact: (1) foreign demand, (2) bottlenecks, (3) energy supply, and (4) nominal-effective exchange rate shocks: euro area synthetic energy price index 3:(+); euro area energy intensive to non-energy intensive industrial production 2:(+), 3:(-); world imports 1:(+), 2:(-), 3:(-); euro area harmonised index of consumer prices 1:(+), 2:(+), 3:(+), 4:(-); supply chain pressure 1:(+), 2:(+); euro area exports 1:(+), 2:(-), 3:(-), 4:(-); nominal effective exchange rate 1:(+), 4:(+).

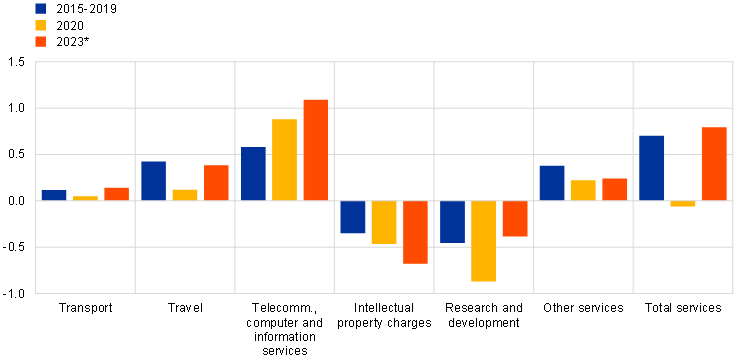

The surplus in the services balance provided a buffer to the euro area current account balance during the energy shock. Compared to before the pandemic, the main change was a larger surplus for information and telecommunication technology services which increased from 0.6% to 1.1% of euro area GDP in the latest four-quarter period (Chart 4), due to higher exports amid dynamic growth of this industry. The euro area surpluses in travel and transport services recovered to values close to their pre-pandemic levels, following the slump observed at the height of the pandemic in 2020 due to travel restrictions and the collapse in shipments of goods. In recent years sizeable deficits have been incurred on charges for the use of intellectual property, which have increased to 0.7% of GDP in the four most recent quarters. Sizeable deficits have also been incurred on research and development services, which exhibited pronounced volatility in euro area imports in recent years, linked to tax planning by large multinational enterprises (MNEs).[6]

Chart 4

Developments in the euro area services trade balance by main type of service

(percentage of GDP)

Sources: ECB and Eurostat.

Notes: “Other services” comprises the services trade categories not shown elsewhere in the chart. Average for the period 2015-2019 shown.

* 2023 refers to the period between the second quarter of 2022 and the first quarter of 2023.

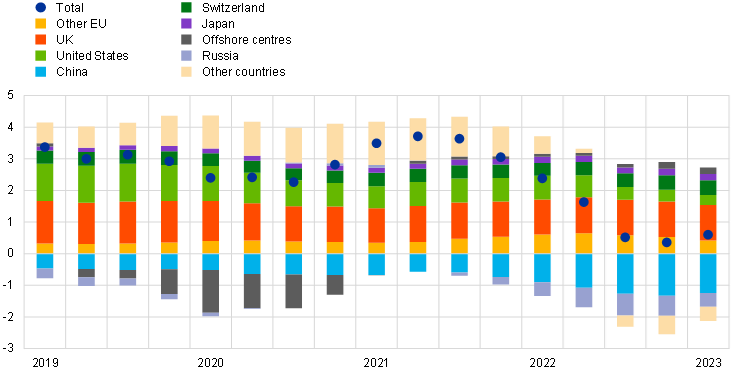

In 2022 the euro area trade balance worsened particularly vis-à-vis China, Russia and the United States. The largest bilateral deficits were recorded with China, because of strong increases in goods imports, Russia, on account of imported energy products and plummeting exports after the onset of the war and the imposition of export sanctions, and a residual group of other countries including OPEC countries and Norway, due to imports of energy products (Chart 5). The trade deficit with Russia and China subsequently decreased slightly in the beginning of 2023, in line with an overall decline in energy prices and diversification of energy suppliers, as well as the lifting of COVID-19 restrictions in China. The decline in the trade surplus with the United States in 2022 was partly driven by the volatile development of services transactions related to the operations of large MNEs, as the euro area has since 2019 tripled its bilateral deficit in payments for the use of intellectual property and other business services.[7] Additionally, euro area imports of goods from the United States increased substantially in the course of 2022, in line with increased demand for US liquified natural gas.[8] The largest bilateral trade surpluses in 2022 were recorded with the United Kingdom, Switzerland and other EU countries.

Chart 5

Euro area trade balance by trading partners

(four-quarter cumulated flows as a percentage of euro area GDP)

Sources: ECB and Eurostat.

Notes: “Other EU” comprises the non-euro area EU Member States and those EU institutions and bodies that are considered for statistical purposes as being outside the euro area, such as the European Commission and the European Investment Bank. “Offshore centres” comprises countries or jurisdictions outside the EU that provide financial services to non-residents on a scale that is disproportionate to the size of their domestic economy, including for example Hong Kong SAR and the Cayman Islands. “Other countries” includes all countries and country groups not shown in the chart, as well as unallocated transactions.

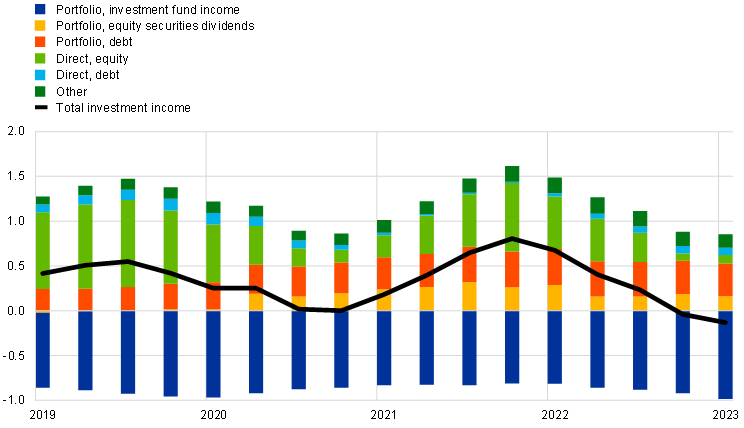

The primary income surplus deteriorated in 2022 due to lower net investment income, mainly because of a strong decline in the surplus on foreign direct investment (FDI), equity income and an increase in the deficit on investment fund share income.[9] In the course of 2022, the investment income balance switched to a small deficit (Chart 6) as the net income surplus on foreign direct investment (FDI) equity decreased substantially in 2022, reflecting mostly the strong volatility of income flows within the main euro area FDI hubs (Ireland, Luxembourg and the Netherlands). At the same time, euro area investment funds, domiciled predominantly in Ireland and Luxembourg, recorded higher income flows to their foreign investors in 2022. The global rise in interest rates observed since 2022 had a significant positive impact on portfolio debt income and other investment income paid to non-residents and received from abroad, while the net positive contribution of these items to the euro area investment income balance remained fairly stable.

Chart 6

Developments in the euro area investment income balance by main type of income

(four-quarter cumulated flows as a percentage of GDP)

Sources: ECB and Eurostat.

Note: “Other” includes income on reserve assets and other investment income.

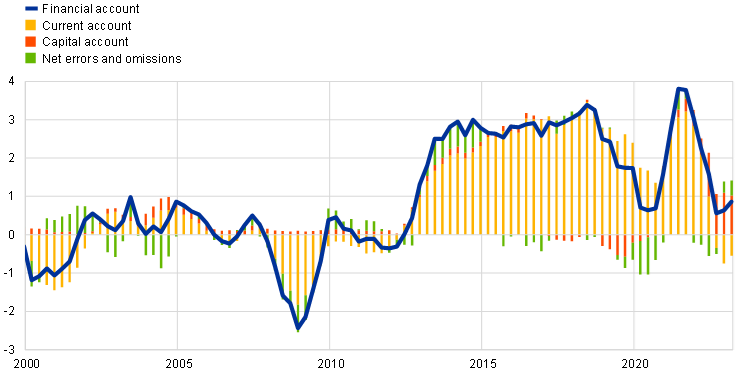

Despite the current account deficit, the euro area remained a net lender in 2022 as the capital account recorded an exceptionally large surplus. Among the major components of the balance of payments identity, the euro area current and financial account balances have moved very much in tandem over the past two decades (Chart 7), while the capital account balance and net errors and omissions recorded small values.[10] However, the close link between the current and financial accounts ended in the course of 2022, with the financial account continuing to record positive, albeit declining net financial outflows (0.9% of GDP in the four most recent quarters).[11] This was due to a historically large capital account surplus (1.0% of GDP) mainly with the United States and United Kingdom, mostly on account of sales of marketing assets (such as brand names and logos).[12] These, in turn, reflected relocations of intangible assets within MNEs from euro area subsidiaries to non-euro area entities. Such large corporate restructuring operations are usually non-recurrent so their impact on euro area net lending should be transitory.

Chart 7

Euro area balance of payments identity

(percentage of GDP)

Sources: ECB and Eurostat.

Note: Data shown as four-quarter moving sums up to the first quarter of 2023.

Taken together, the deterioration in the current account balance was mostly driven by a decline in the goods trade balance on the back of sharp increases in energy import prices. Receding energy import prices contributed to a recovery of the euro area current account to 0.9% of euro area GDP in the first quarter of 2023. However, the extent of the recovery in the euro area current account over the medium term is less clear as it hinges on the degree of persistence of the increase in energy prices and how the sequence of shocks over recent years has affected the medium-term drivers of the current account. These drivers of the current account and its medium-term prospects are discussed in the following section.

Box 1

Introducing product group breakdowns and price-quantity decompositions for goods trade in the euro area balance of payments

Recent commodity price surges and supply chain bottlenecks highlight the importance of a granular analysis of euro area goods trade that is consistent with the overall balance of payments. This box introduces two experimental breakdowns to facilitate such analysis, namely in terms of the type of goods and the contributions of prices and volumes to trade flows.

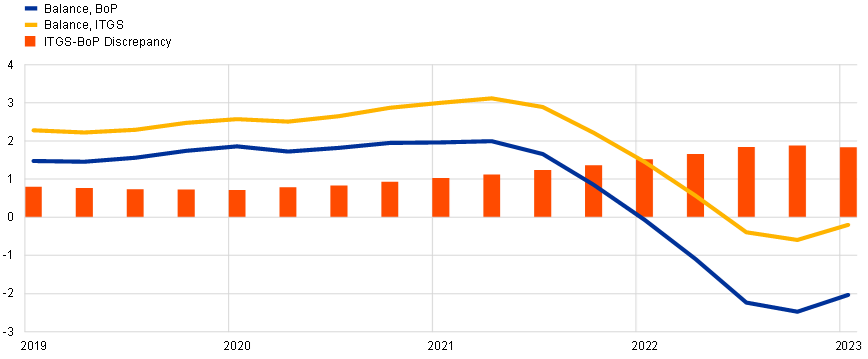

While a detailed breakdown in terms of types of goods is not available from euro area balance of payments (BoP) data, it can be estimated by using granular data from international trade in goods statistics (ITGS).[13] However, there are important conceptual differences between BoP and ITGS data, which have resulted in growing discrepancies for the euro area in recent years (Chart A, panel a).[14] Among the various possible approaches to decompose BoP goods exports and imports by product type, a simple proportional method, based on applying the trade structure observed in ITGS data to aggregate BoP figures, is most advantageous, also due to its computational simplicity.[15] Following this approach, BoP goods trade is broken down into five major product categories based on the Standard International Trade Classification (SITC): food, energy, chemicals, machinery and other goods.[16] The breakdown reveals that the deterioration in the trade balance since early 2021 was driven by an increasing deficit in energy products and a decreasing surplus in machinery (Chart A, panel b).

As regards the price-quantity decompositions, in the balance of payments, goods trade is measured in values without separate consideration of developments in quantities and prices, overlooking the potential for additional analytical insights. Although ITGS provide data with price-quantity breakdowns, these are based on highly aggregated deflators, which reduces both the precision and flexibility of the estimation. An experimental, more refined, bottom-up alternative for obtaining contributions of prices and volumes, offers greater analytical flexibility and ensures the additivity of the components. The calculations are based on the most granular trade in goods data available, specifically the 8-digit codes of the Combined Nomenclature (CN) classification.[17] For each product i in product group j in quarter t, quantity indices are calculated as a ratio of the physical volume of trade in a given quarter relative to the respective average quarterly volume in 2013-2015, . Aggregate quantity indices for product categories are obtained as a sum of quarterly single-good indices weighted by nominal trade structure in 2013-2015, i.e., . Finally, the obtained aggregate quantity index is multiplied by the average BoP value in the base period, , and the price component is calculated as a difference between the value and volume series, i.e. Overall, this method offers a transparent way to examine price and volume contributions at any required level of aggregation, as demonstrated by Chart 2 of the main text.

Chart A

Goods trade balance in the balance of payments: discrepancy with international trade in goods statistics and contributions of product categories

a) Discrepancy in BoP and ITGS goods trade balance

(percentage of GDP)

b) Goods trade balance and contributions of product categories

(percentage of GDP)

Sources: Eurostat, ECB balance of payments and ECB staff calculations.

Notes: Observations are moving sums of seasonally unadjusted data over four quarters, expressed as a percentage of euro area GDP in a respective period.

The latest observations are for the first quarter of 2023.

3 Drivers of the current account and its medium-term prospects

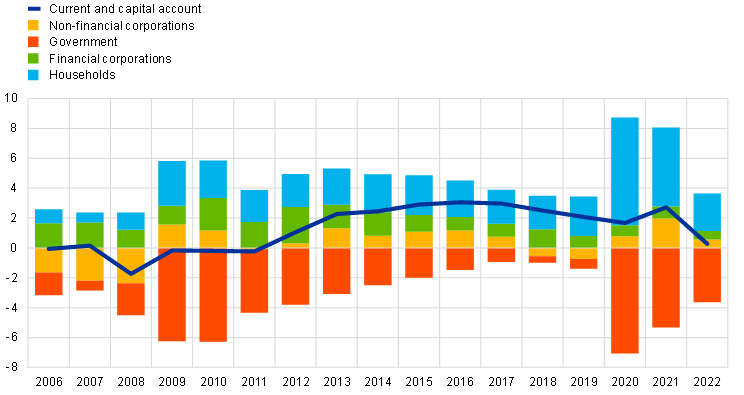

The evolution of the current account balance over the past three years reflected large swings in net lending of households, non-financial corporations and the government.[18] Following the outbreak of the coronavirus (COVID-19) pandemic, household net savings saw an unprecedented rise due to lockdown measures, which restricted consumption opportunities, and precautionary savings as well as government support, which protected household incomes.[19] At the same time, non-financial corporations turned from being net borrowers into net lenders, as firms received government support, cut costs, postponed new investments and hoarded cash for precautionary purposes.[20] However, this increase in private sector net savings was more than offset by an equally unprecedented fiscal expansion which led to a decrease in overall net lending, reflected by a lower current account surplus in 2020. As public sector net borrowing declined faster than private sector net lending in 2021, the current account balance increased again to close to historical highs. Escalating price pressures aggravated by the energy shock following Russia’s invasion of Ukraine, however, decreased the flow of private sector net savings to such an extent that euro area net lending reached its lowest level in over a decade in 2022.[21]

Chart 8

Euro area sectoral net lending/borrowing and the current and capital account

(percentage of GDP, percentage point contributions)

Source: ECB.

Substantial parts of the swings in the current account balance during 2022 were driven by cyclical factors, particularly the large swings in energy prices. A decomposition of the current account balance into its cyclical and fundamental components based on a standard current account benchmark model shows that about a third of the deterioration in the euro area current account during 2022 can be attributed to factors that are typically regarded as cyclical, including the deviation of energy prices from their medium-run trend (Box 2). As energy prices indeed receded from their record levels, the current account balance turned from a deficit of -0.8% to a surplus of 0.9% of euro area GDP in the first quarter of 2023. As a result, the current account balance now stands close to its model-based current account benchmark which is an estimate of the level of the current account balance that would be consistent with fundamentals over the medium-term (Chart 9).

Chart 9

Current account balance, cyclically-adjusted current account balance and current account benchmark

(percentage of euro area GDP)

Sources: ECB.

Note: For more details see Box 2 of this article.

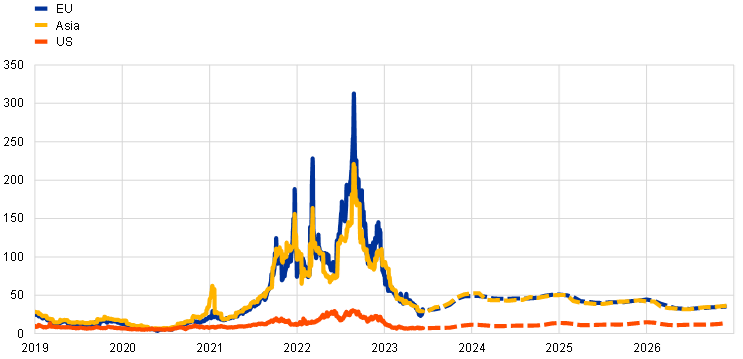

Looking ahead, the evolution of the current account will crucially depend on the extent to which the increase in energy prices will persist over the medium-term. Energy prices receded from their record levels but remain elevated compared to pre-2021 levels, particularly for gas. The price gap for gas, particularly vis-à-vis the United States, can be expected to remain elevated over the medium term given the role of the United States as a supplier of natural gas and the fact that pipeline gas from Russia had to be replaced by more costly liquified natural gas (see Chart 10). All else equal, this would imply a structurally lower euro area current account balance than before the energy shock. Lower energy import volumes, for example due to savings on the back of higher energy efficiency or substitution with domestic sources, could however mitigate the negative effect on the current account.

Chart 10

Gas prices

(EUR/MWh)

Source: Bloomberg.

Notes: EU refers to Dutch TTF, Asia refers to Nymex JMK and United States refers to Henry Hub. Solid lines refer to daily one-month ahead futures prices, dashed lines refer to monthly forward prices as of July 2023.

A worsening growth outlook relative to the rest of the world would support the euro area current account balance. To the extent that energy prices are to remain higher in the future, a worsening outlook for growth relative to the rest of the world and the associated permanent loss in income should be reflected in lower levels of consumption and investment, which would dampen the negative impact of the energy price shock on the current account balance in the medium run.

The pandemic and Russia’s invasion of Ukraine also affected euro area demographics. In particular, the influx of refugees had a positive net impact on the demographic outlook for the euro area.[22] Rapidly ageing economies like the euro area tend to register a more positive current account balance while the opposite holds for countries with faster population growth and a high old-age dependency ratio due to dissaving. According to Eurostat’s latest demographic projections, the old-age dependency ratio is expected to slightly improve compared to the 2019 projections in the coming decades.[23] That being said, the euro area’s population is still projected to continue ageing and to shrink significantly over the coming generations, also relative to the rest of the world. Hence, demographic factors are likely to continue to support the euro area current account balance in the medium term.

The expected fiscal consolidation in the euro area over the coming years is a further factor that should support the current account surplus. According to the latest ECB staff projections government balances in the euro area are expected to improve. The structural government deficit is projected to decline from 3.2% of GDP in 2022 to 2.5% of GDP by 2025, which is faster than in the rest of the world and should thus support the euro area current account balance.[24]

At the same time, public and private expenditure for greening the economy, ensuring energy security and adapting to geopolitical uncertainty could weigh on the current account. Greening the economy will require substantial investment. For example, to achieve the goals of the European Green Deal, the European Commission has pledged to mobilise at least €1 trillion in sustainable public and private investments over this decade.[25] At the same time, increased geopolitical uncertainty is not only likely to be met with higher defence spending but also likely to lead to geo-economic fragmentation.[26] To the extent that geo-economic fragmentation will trigger a reconfiguration of global supply chains away from the most price-competitive producers, this can be expected to increase the cost of imported intermediate goods. This, in turn, would weigh on euro area export competitiveness lowering the current account balance given its upstream position in global supply chains and relatively strong reliance on intermediate goods imports.

Box 2

A medium-term current account benchmark for the euro area

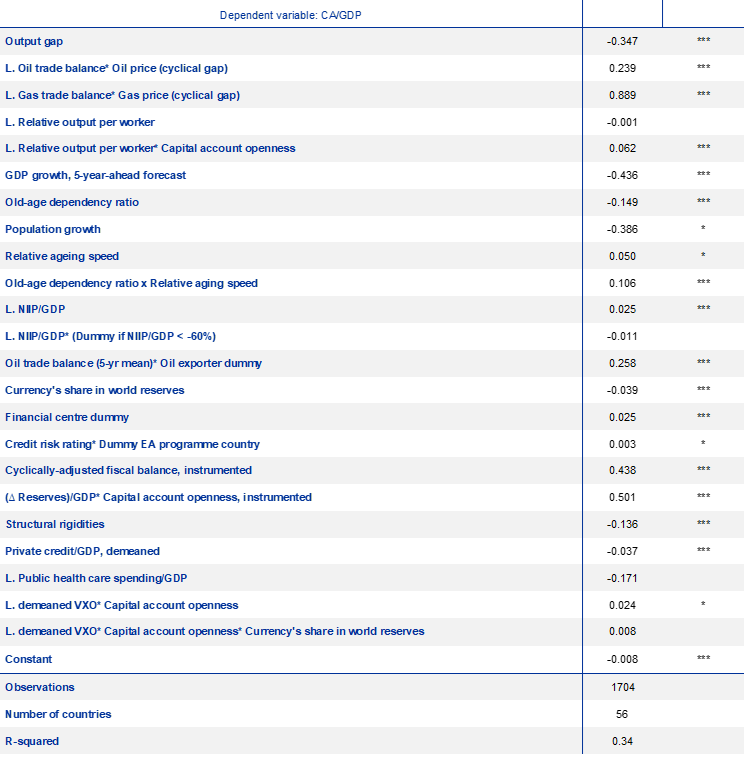

This box discusses the current account benchmark model used in the analysis of medium-term drivers of the current account. The model used in the analysis closely follows Zorell (2017) and is set up in the spirit of the IMF External Balance Assessment (EBA) model.[27] It provides a medium-term benchmark for the current account balance that is consistent with economic fundamentals and desired policies.

The current account benchmark model relates the current account balance to several macroeconomic determinants documented in the literature. These determinants are selected based on their conceptual underpinning and on whether the estimated coefficients are consistent with the theoretical priors, statistically significant and robustly associated with the current account balance. Specifically, the model relates the current account balance, expressed as a percentage of GDP, to a broad set of determinants, including cyclical variables (such as the output gap and energy price fluctuations), fundamental variables (such as demographics and future expected income growth), and policy variables (such as the structural fiscal balance). The model takes the following form, where CA corresponds to the current account balance, while Y represents cyclical variables, F exogenous fundamental variables and P the set of policy variables. Most variables are expressed relative to the rest of the world since the current account is the result of developments relative to trade partners:

The model is estimated on a panel of 56 countries over the period 1985-2022 at annual frequency. Table A provides the regression results.

Both cyclically adjusted current account balances and current account benchmarks can be derived from this framework. The cyclically adjusted current account balance corresponds to the actual current account balance, cleaned from the effects of the business cycle. It is derived by subtracting the contribution of cyclical factors from the actual current account balance:

The cyclical factors included in the model are the output gap (relative to the rest of the world) as well as the past oil and gas import balances, both interacted with a measure of the cyclical component of their respective prices. For instance, a negative domestic output gap decreases the demand for imports. However, if the rest of the world also reports a negative output gap, demand for exports will decline in parallel. Hence, the total effect of the business cycle on the current account balance is given by the contribution of the output gap relative to the rest of the world. The estimated current account benchmark, in turn, represents the cyclically adjusted current account balance that would be justified by fundamentals and desired policies:

where P* stands for the level of desired policies. As policy variables the model considers, (i) the cyclically-adjusted fiscal balance (whereby the desired level is chosen to correspond to the medium-term objective under the preventive arm of the EU’s stability and growth pact), (ii) capital controls (whereby the desired level is chosen to represent full freedom of capital flows), (iii) a measure of structural rigidities (whereby the desired level is chosen to correspond to the level observed by the best-performing countries), and (iv) public social spending (whereby the desired level is chosen to correspond to the average level of countries with comparable per-capita income and age structure. The level derived under these assumptions represents the medium-term current account benchmark, as implied by the model.

Table A

Coefficients of the current account benchmark model

Source: ECB staff estimates.

Notes: (*) significant at 10%, (**) significant at 5%, (***) significant at the 1% level based on heteroscedasticity-corrected z-values.

Most variables are constructed relative to the rest of the world. “L” is the first lag. Estimated using the Prais-Winsten methodology.

4 Conclusions

The sharp deterioration in the current account balance in 2022 is expected to be largely temporary. Falling energy prices have led to an improvement in the euro area terms of trade in early 2023, with modest further gains expected in the medium term. Together with the expected fiscal consolidation, this is likely to contribute to an increase in the euro area current account, which according to the latest Eurosystem staff projections is expected to rebound to 1.1% of euro area GDP in 2023 and improve slightly further to 1.4% and 1.6% of GDP in 2024 and 2025 respectively.[28]

Nonetheless, the euro area current account is likely to stay below pre-pandemic levels. Energy prices are likely to remain elevated over the medium term until the green transition is complete. At the same time, considerable public and private expenditure for greening the economy, ensuring safe energy supplies and dealing with geopolitical uncertainty should weigh on euro area net lending and prevent the current account balance from returning to the historical highs of around 3% of GDP observed prior to the pandemic.

The fact that the sharp decline in the euro area current account was mainly related to a deterioration in the energy terms of trade has implications for monetary policy. A deterioration in the terms of trade also affects inflation dynamics through a decline in real incomes. The large – and to some degree likely persistent – terms of trade deterioration, implies a decline in wealth via the reduced present value of future real incomes, with knock-on effects for asset pricing and consumption behaviour. The energy-related terms of trade developments sharply differentiate the euro area from the United States, since the latter is broadly balanced in its energy trade due to its large-scale domestic production of energy.[29] Therefore, despite the recent improvements in euro area terms of trade and the current account, the energy deficit is likely to remain a medium-term drag on euro area real incomes with implications for domestic demand and hence for euro area inflation.

The evolution of the euro area current account balance is closely linked to economic developments abroad. It measures transactions between euro area residents and non-euro area residents. It consists of the balance of trade in goods and services, net income from abroad recorded as primary income (such as interest and dividends) and net transfers recorded as secondary income (such as remittances and transfers related to the EU budget).

The terms of trade measures export prices relative to import prices.

See “Developments in the euro area current account during the pandemic”, Economic Bulletin, Issue 4, ECB, 2021.

See the box entitled “How have higher energy prices affected industrial production and imports?”, Economic Bulletin, Issue 1, ECB, 2023.

The supply bottlenecks implied that euro area exporters could not fully meet foreign demand which provided positive impetus to euro area export growth on average in 2022 which however faded in the most recent months.

For additional information on the impact of multinationals’ operations on the euro area’s external accounts see the article entitled “Multinational enterprises, financial centres and their implications for external imbalances: a euro area perspective”, Economic Bulletin, Issue 2, ECB, 2020; and Lane, P.R., “Maximising the user value of statistics: lessons from globalisation and the pandemic”, speech at the European Statistical Forum (virtual), 26 April 2021; and the box entitled, “Intangible assets of multinational enterprises in Ireland and their impact on euro area GDP”, Economic Bulletin, Issue 3, ECB, 2023.

The substantial increase in payments to the United States that is related to charges for the use of intellectual property rights and other business services in the past two years is reflected in a corresponding decrease of such imports from offshore centres, to where most of these payments from the euro area were directed in 2019-2020. This points to recent restructuring operations by large MNEs including the relocation to the United States of intellectual property assets, previously held in subsidiaries in offshore centres. From the euro area perspective, these transactions mostly involve Ireland and the Netherlands, due to their role as hubs for large MNEs in the euro area.

For additional information on the EU natural gas market see the box entitled “Global risks to the EU natural gas market”, Economic Bulletin, Issue 1, ECB, 2023.

Investment income reflects the receipts and payments generated by an economy’s external assets and liabilities (such as dividends and interest) and can be further decomposed into functional categories of the balance of payments (foreign direct investment, portfolio investment, other investment and reserve assets). Primary income, in addition to investment income, also includes compensation of employees and other primary income (mainly taxes and subsidies) which traditionally contribute positively to the euro area primary income balance.

According to the BoP. identity, it holds that CA + KA + EO = FA where CA stands for the current account balance, KA for the capital account balance, EO for net errors and omissions (capturing any statistical discrepancy), and FA for the financial account balance. The financial account balance is defined in terms of net financial outflows, i.e. the net purchases of foreign assets by domestic residents minus the net incurrence of liabilities by domestic residents with foreign residents.

For additional information on the evolution of euro area external financial flows in 2022 see the box entitled “The great retrenchment in euro area external financial flows in 2022 – insights from more granular balance of payments statistics”, Economic Bulletin, Issue 4, ECB, 2023.

The capital account mainly includes transfers of capital and transactions in non-produced non-financial assets, such as marketing assets.

International trade in goods statistics (ITGS) published by Eurostat measure the value and quantity of goods traded among the EU Member States and with non-EU countries.

Discrepancies between the two datasets generally exist due to conceptual differences; in particular BoP statistics – and also national accounts data – are based on the concept of change in economic ownership, while ITGS record all goods crossing a country’s border. Moreover, ITGS imports data require adjustments from a “cost, insurance and freight” (CIF) basis to a “free on board” (FOB) basis. In particular, the increase in transportation costs in recent years has led to an increased discrepancy between ITGS and BoP data.

In practice the ratio between aggregate ITGS and BoP figures is computed for each period. Moreover, it is assumed that there is no heterogeneity in this ratio among the various product categories. Using the aggregate ratio one obtains the BoP value for each product category.

The following product categories are defined: (i) Food: SITC groups 0 (Food and live animals) and 1 (Beverages and tobacco); (ii) Energy: SITC group 3 (Energy); (iii) Chemicals: SITC group 5 (Chemicals); (iv) Machinery: SITC groups 6 (Manufactured goods), 7 (Machinery and transport equipment) and 8 (Miscellaneous manufactured); (v) Other: SITC groups 2 (Crude materials), 4 (Animal/vegetable oil/fat/wax) and 9 (Other).

The method makes the following assumptions: (i) only products traded in every month between 2013 and 2022 are included, (ii) physical quantity is measured in kilograms, (iii) growth rates are trimmed at 1000%.

The decomposition of net lending/borrowing reflects domestic sectoral balances taken from the non-financial sectoral accounts dataset, while the current and capital accounts data show net lending/borrowing to/from the rest of the world as reported in BoP data. The two indicators of net lending/borrowing are conceptually equivalent, while minor discrepancies between the two data sources may exist for periods before 2013.

See the box entitled “Household saving during the COVID-19 pandemic and implications for the recovery of consumption”, Economic Bulletin, Issue 5, ECB, 2022.

See the box entitled “Non-financial corporate health during the pandemic”, Economic Bulletin, Issue 6, ECB, 2021.

The terms of trade shock caused by the energy crisis depressed real household incomes and lowered real consumption and investment. Yet this decline in real consumption and investment levels did not translate into higher net lending as the resultant increase in price levels led to an increase in expenditure and thus triggered a reduction in net lending.

The euro area labour force increased between 0.3% and 0.5% due to the influx of Ukrainian refugees in 2022 and the impact could further increase as the war continues, according to Botelho, V. and Hägele, H.,“Integrating Ukrainian refugees into the euro area labour market”, The ECB Blog, 1 March 2023.

Relative to the 2019 projections, the old-age dependency ratio is projected to improve by 0.6 percentage points by 2025 and 1.4 percentage points (to 51%) by 2050. See the box entitled “EUROPOP2023 demographic trends and their euro area economic implications”, ECB Economic Bulletin, Issue 3, ECB, 2023.

An increase in government expenditure in the domestic economy, all else equal, increases domestic demand and thus leads to a lower current account balance. If, however, government expenditure abroad increases as well, all else equal, foreign demand rises, leading to a higher current account balance.

See European Commission, “Communication on the Sustainable Europe Investment Plan, 2020”.

Many countries face structurally higher defence expenditures in view of the war in Ukraine and their NATO commitments to close the funding gap to the NATO target of 2% of GDP from 1.3% of GDP in 2021.

See Zorell, N., “Large net foreign liabilities of euro area countries”, Occasional Paper Series, No 198, ECB, October 2017 and Allen C. et al., “2022 Update of the External Balance Assessment Methodology”, IMF Working Paper, Issue 47, International Monetary Fund, 2023.

See ECB staff macroeconomic projections for the euro area, September 2023.

See Lane, P.R., “Inflation Diagnostics”, The ECB Blog, 25 November 2022.