- THE ECB BLOG

A problem shared is a problem halved – the benefits of private and public risk sharing

29 March 2023

What is the best way to absorb economic shocks? Some approaches favour private risk sharing, others, public risk sharing. In this ECB Blog post we argue that a combination of both offers the best protection for European citizens against poor economic performance.

Europe is coping with two unprecedented economic shocks, caused by the global pandemic and the war in Ukraine. Even though these shocks have hit every Member State, their effects on income, employment and other economic variables have varied widely across the euro area. This poses a major challenge for the ECB’s single monetary policy and makes risk sharing a necessary tool to increase resilience and preserve convergence within the Economic and Monetary Union (EMU).

The focus of this blog post is on the optimal interaction between private and public risk sharing. The economic debate has thus far been focused on “either public or private risk sharing”.[1] Private risk sharing mainly refers to the provision of risk sharing via the banking sector and capital markets, amongst others. Public risk sharing instead generally refers to the provision of risk sharing via common fiscal tools, potentially also via public goods provided at the European level.[2] We contend that there are good arguments and evidence that the two – public and private - should complement each other, especially in times of crisis.[3]

Risk sharing matters as shocks are not symmetric

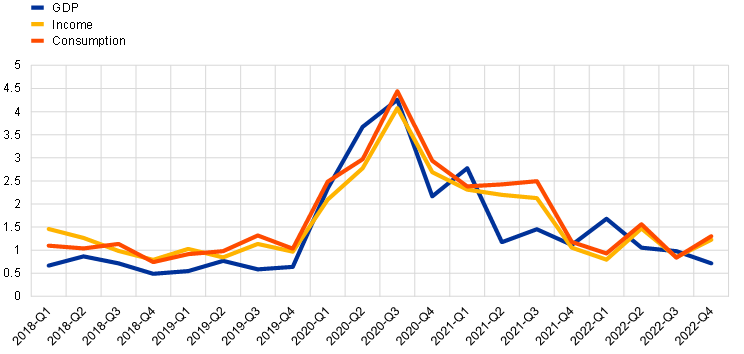

Common, external shocks like the coronavirus (COVID-19) pandemic result in asymmetric impacts across Member States due to these states’ different economic, financial and institutional structures.[4] European countries have also been affected differently by shocks caused by the war in Ukraine. The implementation of sanctions imposed on Russia and different dependencies on various energy sources[5] matter for their exposure to the shock, leading to asymmetric impacts across Member States (Figure 1). The close resemblance between the variation in Gross Domestic Product (GDP), income and consumption dispersion suggests limited (or a lack of) risk-sharing.

Chart 1

Dispersion of annual growth rates of real GDP, real gross disposable income and consumption across euro-area countries

Source: Updated from Giovannini, Ioannou, Stracca (2022).

The asymmetries resulting from these shocks pose a dilemma. Should public resources at the European level be used to deal with them, or should that be left to market mechanisms? Should public or private risk sharing be promoted, or both, and to what degree, to provide for consumption smoothing and reduce economic divergence between member states following each shock?

The euro area has lower risk sharing on average than – to compare it with another similarly sized continental monetary union – the United States (Figure 2).[6] We observed a rise in risk sharing within the euro area in the period immediately following the global financial crisis. This highlights the role of euro area financial assistance instruments in shock absorption, also considering that risk sharing deteriorated after 2015.[7]

Chart 2

Risk sharing in the euro area (left) and the United States (right), 2000-18

Source: Giovannini, Ioannou, Stracca (2022).

Notes: We have inverted the scale to show risk sharing rising on the y-axis: perfect risk sharing is thus indicated here by 1 and no risk sharing by 0 on a 0 to 1 scale; or, the higher the degree of correlation between residuals, the lower the risk sharing on the y-axis. The yellow horizontal lines show the simple average over the period 2000-18. Data for the 19 euro area countries and the 50 states of the USA, Washington D.C. and Puerto Rico.

Private and public risk sharing: friends or foes?

In theory, public and private risk sharing can act as substitutes or complements. More concretely, the development of private risk sharing through a deeper financial market integration (including through the banking union and capital markets union in the euro area) can either complement or substitute for a central fiscal capacity acting as a backstop.[8] One theoretical view is that, in the presence of efficient markets, private risk sharing acts as the main shock absorber in the economy, with little or no role for public risk sharing. This view calls for only the establishment of a deeper financial market union.

An alternative view is that public risk sharing is an essential element in the shock-absorbing defences of an economy, both on its own or as a complement to the role of private risk sharing. In this view, a central fiscal capacity is an essential building block complementing the financial markets union.

Our main finding is that, especially in times of extraordinarily deep economic shocks or crises, private risk sharing cannot do without adequate public risk sharing. In other words, the two forms of risk sharing are (highly) complementary in times of crisis.

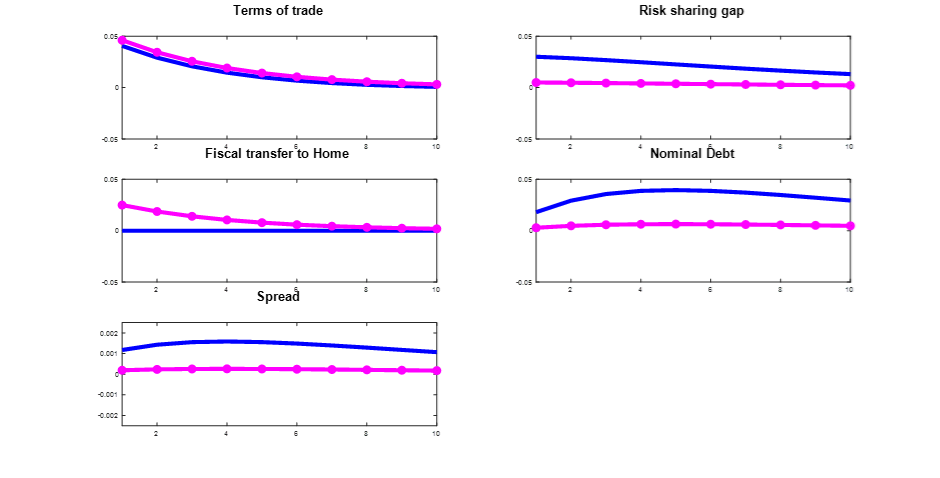

To look at how the two channels of risk sharing could interact we developed a model of a monetary union comprising two countries, and we looked at the effect of having a central fiscal capacity able to provide shock-dependent transfers to individual countries. The effect of the central fiscal capacity just discussed is also illustrated in Figure 3, which shows the effect of a negative shock to income in the Home country. The magenta lines show what happens if a central fiscal capacity is present, the blue lines if it is not.

First, note that after a country-specific negative shock to income the country’s terms of trade improves, i.e. the country can purchase more imports for each unit of its exports than before. That happens regardless of the presence of the central fiscal capacity and compensates part of the effect of the shock by already providing significant risk sharing.

The central fiscal capacity, instead, makes the difference by reducing the need for agents of one country to borrow private funds from the other country when faced with a negative shock (see difference between magenta and blue lines for nominal debt in Figure 3). In other words, a central capacity leads to less private debt accumulation, thereby leading to a better risk-sharing outcome. Public risk sharing thus acts as a substitute for private risk sharing.

The central fiscal capacity also makes the difference by reducing the financial frictions associated with foreign private debt. When the debt is higher, the borrowing country tends to pay a higher interest rate (spread) on the money borrowed. The reduction in debt accumulation through the presence of the central fiscal capacity decreases the cost of private indebtedness (see difference between magenta and blue lines in for spread in Figure 3). This, in turn, leads to better risk-sharing outcomes. Hence, public risk sharing enhances the efficacy of private risk sharing by diminishing the impact of financial frictions, thereby serving as a complementary role.

In our simulation, public risk sharing acts mainly as a substitute for private risk sharing, but it also plays a complementary role. Complementarity rises when we simulate a scenario where a large shock causes a significant increase in government bond spreads similar to the “sudden stop” scenario during the euro area sovereign debt crisis. This shows that having public risk sharing in place can make private risk sharing work better and be more effective.

Chart 3

Effect of a negative shock to income in the Home country with no central fiscal capacity (blue lines) and with central fiscal capacity (magenta lines with circles)

Source: Giovannini, Ioannou, Stracca (2022).

Notes: Impulse responses to a 10% reduction in Home output. The blue solid lines refer to the calibration with a debt elastic interest rate and the magenta dotted lines to a calibration with public risk sharing from a central fiscal capacity. The risk-sharing gap is the difference between the ratio of Home and Foreign marginal utility of consumption and the real exchange rate; a positive value indicates that Home consumption is inefficiently low compared with Foreign consumption.

Policy implications

In the past, proposals to enhance the ability of EMU member states to deal with adverse shocks mainly depicted private risk-sharing channels as an alternative to public ones. Our results clearly show the potential for the two risk-sharing approaches to complement each other. Further research could help to identify the most efficient form for a fiscal capacity to take, as it would need to be commensurate to the external shocks currently affecting all the countries of the euro area.

The EU response to the COVID-19 crisis – drawing on the lessons from the global financial crisis and the sovereign debt crisis – has demonstrated that increasing public risk sharing at the European level is both possible and desirable.[9] The establishment of innovative and appropriate fiscal tools at the European level – like the Next Generation EU or the Support to mitigate Unemployment Risks in an Emergency (SURE) initiatives – present valuable case studies to assess in detail the interaction between public and private risk sharing and help EU authorities to better design risk-sharing frameworks.

Subscribe to the ECB blogBénassy-Quéré, A, M Brunnermeier, H Enderlein, E Farhi, M Fratzscher, C Fuest, P-O Gourinchas, P Martin, J Pisani-Ferry, H Rey, I Schnabel, N Véron, B Weder di Mauro, and J Zettelmeyer (2018), “Reconciling risk sharing with market discipline: A constructive approach to euro area reform”, CEPR Policy Insight No. 91.

Buti, M and G Papaconstantinou (2022), “European public goods: How we can supply more”, VoxEU.org, 31 January.

Giovannini, A, D Ioannou, and L Stracca (2022), “Public and private risk sharing - friends or foes?”, ECB Occasional Paper No. 295.

ECB (2022), “ECB report on Financial Integration and Structure in the euro area”, April 2022 and Milesi Ferretti, G.-M. (2021), “The travel shock”, Hutchins Center Working Paper #74.

McWilliams, B, G Sgaravatti, S Tagliapietra, and G Zachmann (2022), “Preparing for the first winter without Russian gas”, Bruegel Blog, 28 February. See also: Palacio A, S Merler, F Nicoli, S Tagliapietra (2022), ‘How Europe Can Sustain Russia Sanctions’, Project Syndicate, 28 February.

Giovannini, A, D Ioannou, and L Stracca (2022), “Public and private risk sharing - friends or foes?”, ECB Occasional Paper No. 295. There, we conduct a simple empirical test to compare risk sharing in the euro area and in the United States. We look at residual analysis for the period 2000-18 by plotting the (cross-sectional) correlation of the residuals from regressing consumption in the 19 euro area (EA) countries and the United States (all 50 states as well as Washington D.C. and Puerto Rico).

See also ECB (2018), “Risk sharing in the euro area”, Economic Bulletin, Issue 3 / 2018 and Milano, V and P Reichlin (2017), “Risk sharing across the US and Eurozone: The role of public institutions”, VoxEU.org, 23 January.

See also Beetsma, R, J Cimadomo and J van Spronsen (2021), “One Scheme Fits All: a Central Fiscal Capacity for the EMU Targeting Eurozone, National and Regional Shocks”, CEPR Discussion Paper 16829.

Giovannini, A, C Horn, and F Mongelli (2021), “An early view on euro area risk-sharing during the COVID-19 crisis”, VoxEU.org,10 Jan.