Interconnectedness of derivatives markets and money market funds through insurance corporations and pension funds

Published as part of the Financial Stability Review, November 2020.

In the most turbulent week during the coronavirus-related market turmoil in March 2020, euro-denominated money market funds (MMFs) experienced very high outflows.[1] But which investors withdrew from these funds and why did they do so? This box suggests that the increase in variation margin (VM) on derivatives contracts held by euro area insurance corporations and pension funds (ICPFs) was one of the key drivers behind these outflows.[2]

The derivative portfolios of euro area ICPFs are heavily concentrated in interest rate and currency derivatives. At the end of March 2020, euro area ICPFs held derivatives with a notional value of almost €4.8 trillion, of which interest rate derivatives and currency derivatives represented 60% and 35% respectively. As the market value of these derivative portfolios changes, so will the variation margin, or collateral, that counterparties must post. In the case of ICPFs, the VM therefore fluctuates with moves in interest and foreign exchange (FX) rates. Long-term interest rates are particularly important, since ICPFs hold mainly long-dated interest rate swaps. These instruments help them extend the duration of their assets and thus hedge the interest rate risk arising from their typically long-dated liabilities.

Market developments drove significant fluctuations in VM during March. Towards the end of February and in early March 2020, long-term interest rates declined and the euro appreciated against the US dollar, resulting in ICPFs receiving VM (see Chart A, left panel). But when interest and FX rates reversed their trends around 12 March, ICPFs had to pay most of this VM back to their counterparties. These volumes are estimated to have reached almost €50 billion between 11 and 23 March. More than 90% of this VM was posted by Dutch ICPFs, which have portfolios of exceptionally large size and long duration. In terms of notional values, Dutch entities hold around 60% of euro area ICPF derivatives, followed by French (12%), Finnish (9%) and German (8%) entities. But the exceptionally long duration of the swaps held by Dutch ICPFs, with residual maturity of around 14 years compared with around 7 years on average for other euro area ICPFs, makes their value particularly sensitive to interest rate movements.

These VM payments were large compared with the highly liquid asset holdings of ICPFs pre-turmoil and put some ICPFs under liquidity strains.[3] Typically, VM payments must be met in cash.[4] This means that ICPFs use highly liquid (or “cash-like”) sources of liquidity such as bank deposits, MMF shares, repurchase agreements or credit lines to manage them. At the end of 2019, Dutch ICPFs held around €30 billion in currency and bank deposits and another €30 billion in MMF shares (see Chart A, right panel). The overall VM posted by Dutch ICPFs during the March market turmoil is thus estimated to have reached around 77% of these highly liquid asset holdings, although this is likely to mask some heterogeneity. While the VM payments were also sizeable compared with Finnish ICPFs’ highly liquid asset holdings, this was not the case for ICPFs in Germany and France.

Chart A

Variation margin payments of euro area ICPFs during the March market turmoil co-moved with interest and FX rates and were sizeable compared with their highly liquid asset holdings

Sources: European Market Infrastructure Regulation (EMIR) data, Bloomberg Finance L.P., ECB IC and PF statistics and authors’ calculations.

Notes: Left panel: the EUR-USD FX rate is transformed by the formula (FX rate - 1) * 1000 to fit all lines in one chart. The 30-year overnight index swap (OIS) rate and FX rate are lagged by two days since ICPFs’ variation margin is typically to be paid with a one or two-day lag with respect to the actual market movements. “Net VM received” is the difference between the EMIR variables “VM received” and “VM posted” using deduplicated data. If either “VM received” or “VM posted” is not reported by a given ICPF, the information is taken from the reporting by the other counterparty. The arrows show the increase in (net) VM received between 20 February and 11 March 2020 and subsequent (net) VM posted until 23 March 2020. Right panel: the red dots refer to the difference between the peak and trough estimates of net VM received by ICPFs in selected countries and other euro area countries between 11 and 23 March 2020. VM posted by “Other EA” ICPFs is negative (-1.5%) and not shown in the chart.

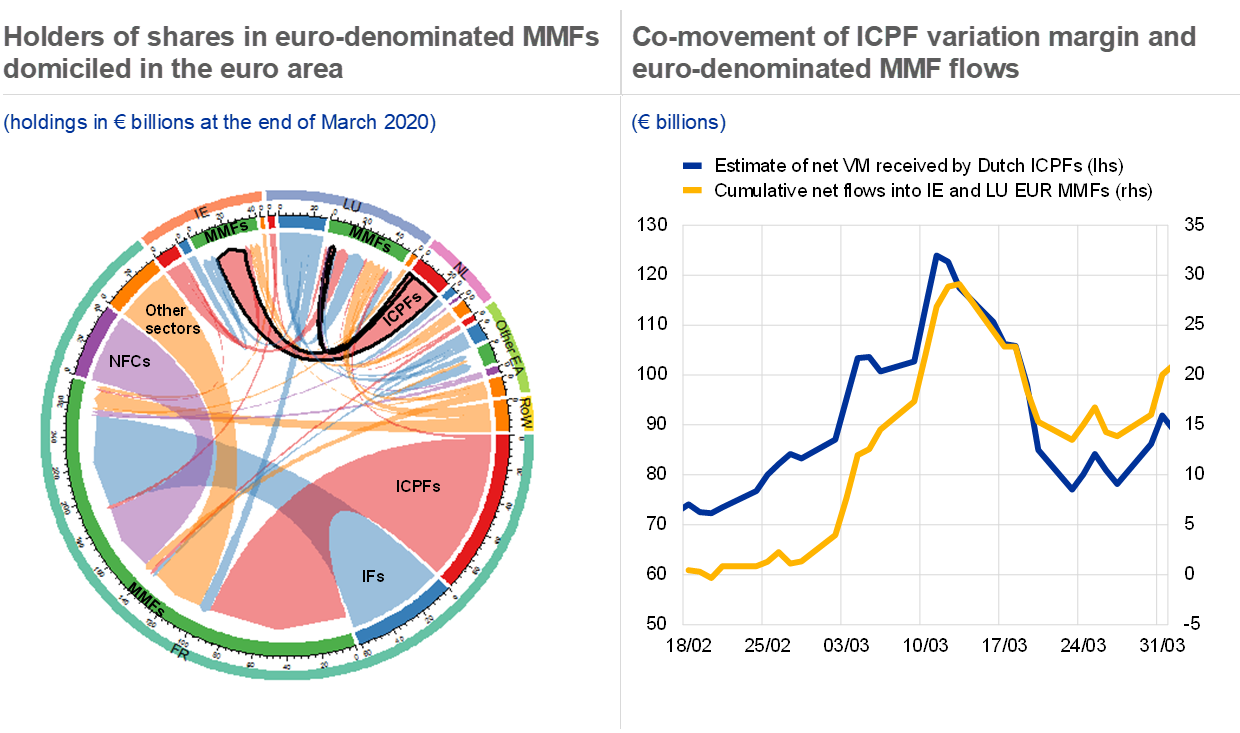

There is a strong correlation between the VM payments and the inflows to and outflows from MMFs held by the ICPFs facing these payments. Since most VM payments of ICPFs were in euro, Chart B (left panel) maps all holders of euro-denominated MMFs domiciled in the euro area. Almost all Dutch ICPF holdings of euro-denominated MMF shares are invested in either Irish or Luxembourgish MMFs and their VM payments had an 82% correlation with flows into and out of these MMFs during the market turmoil (see Chart B, right panel). The larger size of the VM payments (€47 billion) compared with MMF flows (€15 billion) suggests that ICPFs also used other sources of liquidity to manage these payments. From the perspective of Irish and Luxembourgish euro-denominated MMFs, however, the VM payments appear to be a key driver of their inflows and outflows. Given that all euro-denominated MMFs domiciled in the euro area experienced aggregate outflows of around €40 billion during the market turmoil, the Dutch ICPF VM payments could explain over one-third of these aggregate outflows, even if, in this instance, previous inflows from ICPFs into MMFs might have mitigated the overall effect to some extent.

These findings highlight the risks of reliance on the cash-like properties of MMF shares as a reliable source of liquidity under stress, including in the context of ICPFs’ liquidity management. MMFs should be made more resilient to significant outflows, and the structure of their investor base should also be taken into account (see Chapter 5). ICPFs’ liquidity management should also account for the fact that the value of MMFs can sometimes decline and they can suspend redemptions in exceptional circumstances, although no MMF had to suspend redemptions in the March market turmoil. Finally, the results underline the importance of monitoring interconnectedness across markets, including from relatively small but volatile links, and across borders.

Chart B

ICPFs hold a large amount of euro-denominated MMF shares, with Dutch ICPFs heavily invested in Irish and Luxembourgish MMFs, the flows of which are closely correlated with the VM payments of Dutch ICPFs

Sources: ECB (securities holdings statistics by sector and EMIR data), EPFR Global and authors’ calculations.

Notes: Left panel: holdings of shares of euro-denominated MMFs (domiciled in France, Ireland, Luxembourg, the Netherlands and other euro area countries) by euro area sectors and investors from the rest of the world (RoW). Only links above €1 billion are plotted. The red connections with the black borders between Dutch ICPFs and Irish/Luxembourgish MMFs indicate that Dutch ICPFs hold shares of around €19 billion and €3 billion in euro-denominated MMFs domiciled in Ireland and Luxembourg respectively. IFs: investment funds; NFCs: non-financial corporations.

- See Box 7 entitled “Recent stress in money market funds has exposed potential risks for the wider financial system”, Financial Stability Review, ECB, May 2020.

- Variation margin is collateral exchanged by two counterparties to a derivative transaction, which reflects the price movement of such a transaction or a portfolio of such transactions.

- According to the June 2020 results of the ECB’s survey on credit terms and conditions in euro-denominated securities financing and over-the-counter derivatives markets (SESFOD).

- See, for example, de Jong, A., Draghiciu, A., Fache Rousová, L., Fontana, A. and Letizia, E., “Impact of variation margining on EU insurers’ liquidity: an analysis of interest rate swaps positions”, Financial Stability Report, European Insurance and Occupational Pensions Authority, December 2019.