Firm productivity dynamism in the euro area

Published as part of the ECB Economic Bulletin, Issue 1/2022.

This box discusses how movements of firms along the productivity distribution over time affect aggregate productivity growth.[1] The analysis is based on firm-level data for six euro area countries; the data have been treated to represent the set of non-financial corporations with employees. Firms move along the productivity distribution in accordance with their capacity to react to shocks and to structural factors that incentivise innovative investment. This applies both to low-productivity firms that are striving to survive in the market and high-productivity firms that are facing the risk of falling behind the times. Firm productivity is very dynamic across all countries, sectors and years: Chart A shows that firms fighting for survival at the bottom of the distribution (at the 5th percentile) were, on average, able to increase their productivity ranking by 30 percentiles over a 12-year period. At the same time, firms initially at the top of the distribution (at the 90th percentile) saw their productivity ranking decrease by 20 percentiles. This is significant as changes in firm productivity account, on average, for more than 60% of annual aggregate productivity growth.[2]

Chart A

Average change in firms’ productivity ranking between 2006 and 2018

(x-axis: productivity ranking of a firm in 2006, in percentiles; y-axis: percentile change in the productivity ranking of a firm between 2006 and 2018)

Sources: Bureau van Dijk Orbis, the Bank for the Accounts of Companies Harmonized (BACH) database and ECB staff calculations.

Notes: Average change in incumbents’ productivity ranking over a 12-year period, conditional on the firm’s initial productivity ranking in 2006. Unweighted average across countries and sectors. The productivity ranking is constructed for each sector, country and year.

Firm productivity is particularly dynamic among young firms. The mean annual productivity growth of firms that have been active for fewer than six years is 8%, compared with 2.5% for firms that have been active for more than 20 years (Chart B, panel a, yellow bar). The contribution of young firms to aggregate productivity growth is the result of selection and learning, as firms learn to adapt and implement new ideas while re-optimising their business models and processes. At the same time, the average productivity developments of young surviving firms are driven by a few young “superstar” firms, which are defined as the top 10% of firms in terms of productivity growth among all firms that have been active for fewer than six years.[3] While the median young firm (in terms of productivity growth) experiences annual average productivity increases of around 4% (Chart B, panel a, orange bar) over its first six years of activity, young superstar firms increase their productivity by around 100% per year, on average (Chart B, panel a, blue bar).[4]

Young superstar firms stand out from the rest in several ways. These firms invest more, on average, than their young competitors, particularly in intangible assets, while using fewer and more specialised workers (Chart B, panel b). They also pay higher wages and benefit from higher labour productivity. This, in turn, could reflect either these firms’ higher investment in human capital or a more capital-intensive production process hinging on a strong complementary relationship between labour and capital.[5]

Chart B

Firm productivity dynamism by firm age and characteristics of young firms

a) Annual labour productivity growth of surviving firms by age group in each sector

(percentages)

b) Average characteristics of young superstar firms and other young firms after controlling for country, sector and year

(left-hand scale: ratio; right-hand scale: number of employees, intangible intensity in EUR thousands, labour productivity in EUR ten-thousands)

Sources: Bureau van Dijk Orbis, the Bank for the Accounts of Companies Harmonized (BACH) database and ECB staff calculations.

Notes: A young firm is defined as a firm that has been operating for up to six years. Young superstar firms are those in the top 10th percentile of the labour productivity growth distribution for each country, sector and year, and for at least two consecutive years. Panel a uses a weighted average across sectors, countries and years. In panel b each bar represents the coefficient from a regression of each variable listed in the x-axis on a dummy for the firm being a young superstar firm and a set of fixed effects controlling for the different countries, sectors and years. Productivity is computed as real value added per employee at the firm level. Intangible intensity is computed as the ratio of intangible capital to number of employees. Investment is computed as the change in real fixed tangible capital over the previous period’s real fixed tangible capital. The period considered begins after the great financial crisis to avoid potential slumps.

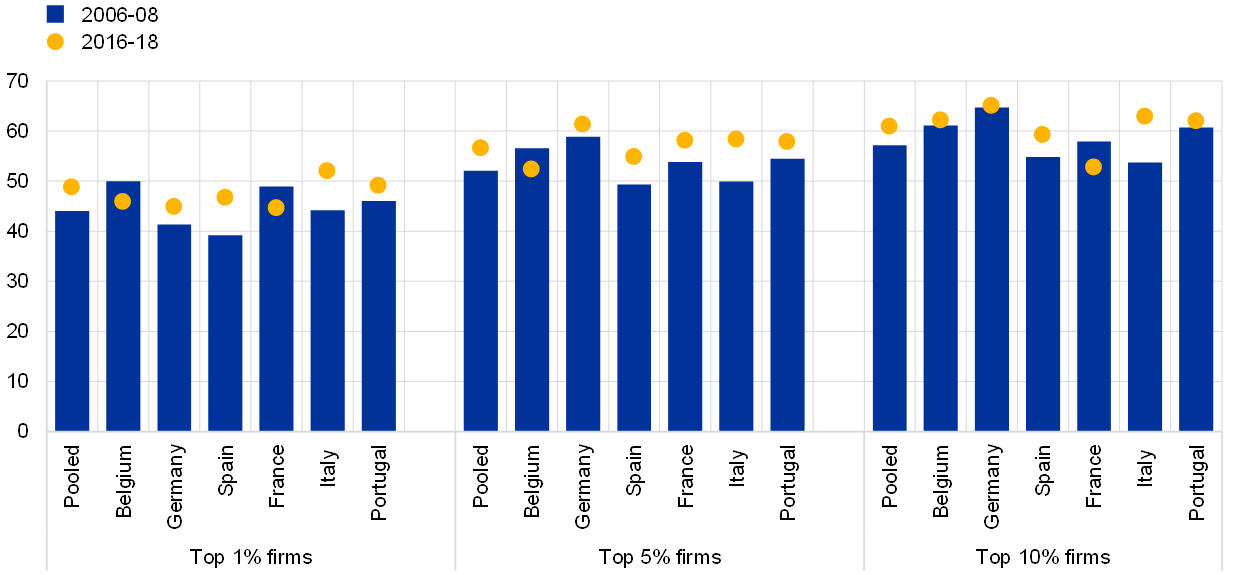

Firm productivity has become less dynamic over time. This is the result of a loss of dynamism at both ends of the productivity distribution. First, there has been a significant decline in the share of low-productivity incumbents that register improvements in their productivity level over time (Chart C, panel a). Second, high-productivity firms were able to stay longer at the frontier in 2016 compared with 2006, although with some heterogeneity across countries (Chart C, panel b). The decline in firm dynamism alongside the productivity distribution is prevalent across low and high-tech sectors. These findings are consistent with an increase in the average age of frontier firms and with declining entry rates.[6]

Chart C

Decline in firm productivity dynamism at the bottom and top of the productivity distribution in six euro area countries

a) Share of firms that registered a productivity ranking improvement of at least five percentiles between 2006 and 2008 or 2016 and 2018

(percentages)

b) Share of firms that were at the productivity frontier for three consecutive years between 2006 and 2008 or 2016 and 2018

(percentage points)

Sources: Bureau van Dijk Orbis, the Bank for the Accounts of Companies Harmonized (BACH) database and ECB staff calculations.

Notes: The productivity ranking is constructed for each sector, country and year. The productivity frontier is defined as the 1%, 5%, or 10% of firms with the highest productivity levels in their sector, country and year groups. The productivity frontier for the 2006-08 cohort tracks the performance of those firms that were leaders in 2006, and the productivity frontier for 2016-18 tracks the performance of the leaders in 2016. The pooled data represent an unweighted average of all firms in the six countries analysed.

The causes of the slowdown in firm productivity dynamism deserve further research. Lower dynamism could be linked to the winner-takes-all dynamics triggered by the particular characteristics of new technologies, such as network effects or high fixed costs. These dynamics could result in higher market concentration and lower entry activity, as some studies that are particularly focused on the United States have shown.[7] However, evidence for the euro area is not clear-cut and therefore deserves further research. As regards the lower firm dynamism in the euro area, recent evidence from the OECD suggests a link between the increases in market concentration, firm mark-ups and the incidence of mergers and acquisitions over the last decade.[8] The slowdown in firm dynamism implies lower productivity growth, and therefore low potential output growth and a lower natural rate of interest. This highlights the important role of structural policies aimed at increasing the durability and resilience of economic growth stemming from firms’ investment in technological innovation, and of strengthening the market mechanism whereby highly productive firms thrive and less-productive firms shrink or exit the market entirely.

- See also Work stream on productivity, innovation and technological progress, “Key factors behind productivity trends in EU countries”, Occasional Paper Series, No 268, ECB, September 2021, and the article entitled “Key factors behind productivity trends in euro area countries”, Economic Bulletin, Issue 7, ECB, 2021.

- There is some heterogeneity in the contribution of “within-firm” productivity growth across countries, sectors and time periods. To compute the contribution of within-firm productivity changes to annual aggregate productivity growth, see Melitz, M.J. and Polanec, S., “Dynamic Olley-Pakes productivity decomposition with entry and exit”, The RAND Journal of Economics, Vol. 46, No 2, 2015, pp. 362-375.

- The productivity growth distribution is skewed across all age groups, with superstar firms driving the productivity growth of surviving firms. This is considerably more pronounced for young firms, however. Superstar firms are generally defined as the top 10% of firms in terms of their productivity growth.

- For further evidence on the relevance of young superstar firms in driving average productivity growth of young surviving firms and on their contribution to the aggregate productivity growth of the euro area economy, see the article entitled “Key factors behind productivity trends in euro area countries”, Economic Bulletin, Issue 7, ECB, September 2021.

- An investment in human capital is an investment by the firm in the education and personal development of workers (e.g. tuition costs or training course fees) with the objective of these workers achieving higher productivity in the future. The results highlighted in the main text are consistent with recent evidence linking the rise in superstar firms to a decline in the level of the labour share. See Autor, D. et al., “The Fall of the Labor Share and the Rise of Superstar Firms”, The Quarterly Journal of Economics, Vol. 135, No 2, May 2020, pp. 645-709, and Kehrig, M. and Vincent, N., “The Micro-Level Anatomy of the Labor Share Decline”, The Quarterly Journal of Economics, Vol. 136, No 2, May 2021, pp. 1031-1087.

- Frontier firms in the euro area had an average of 20 years of activity in 2018, compared with around 14 years in 2006. This increase is shared across countries and could be related to the long-term decrease in firm entry, and thus to less competition from young disruptive firms.

- See Syverson, C., “Macroeconomics and Market Power: Context, Implications, and Open Questions”, Journal of Economic Perspectives, Vol. 33, No 3, Summer 2019, pp. 23-43, and De Loecker, J., Eeckhout, J. and Unger, G., “The Rise of Market Power and the Macroeconomic Implications”, The Quarterly Journal of Economics, Vol. 135, No 2, May 2020, pp. 561-644.

- See Criscuolo, C., “Productivity and business dynamics through the lens of COVID-19: the shock, risks and opportunities”, ECB Forum on Central Banking 2021.