The ECB’s dialogue with non-financial companies

Published as part of the ECB Economic Bulletin, Issue 1/2021.

As part of the process of gathering information on the outlook for economic activity and prices, the ECB maintains regular contacts with non‑financial companies. This gathering of business intelligence has become more structured over time and tends to be particularly valuable during exceptional periods, such as those resulting from the coronavirus (COVID-19) pandemic. Therefore, starting with this issue of the Economic Bulletin, the ECB will provide a summary of the main findings from its contacts with leading euro area businesses. This article explains how these interactions contribute to the ECB’s economic analysis and how they are organised and summarised. The main findings from the most recent exchanges with companies, which took place in early January 2021, are summarised in Box 1.

1 Introduction

Like many central banks, the ECB maintains regular contacts with the non‑financial business community. These contacts mainly take the form of regular telephone calls between ECB staff and leading non-financial companies. These exchanges are a means to gather information on the state of the economy in support of the ECB’s monetary policy. High-level contacts are also organised under the umbrella of the Non-Financial Business Sector Dialogue (NFBD).[1] In addition, occasional surveys are carried out on specific topics into which business leaders can provide particular insights. The most recent example is a short survey on the long‑term effects of the COVID-19 pandemic.[2]

2 How contacts with non-financial companies contribute to the ECB’s economic analysis

The ECB’s contacts with non-financial companies provide real-time information on the state of the economy. This helps to anticipate trends which may only become evident in economic data with a lag. The exchanges are also used to gather qualitative insights to supplement the more quantitative information gathered from statistical data and surveys. The ECB makes extensive use of surveys such as the Purchasing Managers’ Index (PMI) Survey and the European Commission Business Survey, which usually provide a timely and informative gauge of movements in economic activity and expectations. However, as they are based on closed questions, these surveys mainly provide quantitative indicators. Moreover, the supporting qualitative information, which aids interpretation of the indicators, can be quite limited.[3] The ECB’s contacts with non-financial companies provide an opportunity to “look behind the numbers” and understand the underlying drivers of current and anticipated future economic trends.

Contacts are maintained over the telephone, as this is an efficient way of gathering information based on a set of open questions. Therefore, these exchanges are also referred to as the Corporate Telephone Survey. Conversations typically start with asking the respondent to provide an initial assessment of overall activity, prices, costs and employment in their sector as well as their expectations about where these indicators are heading. The focus then turns to what is driving these developments, based, for example, on how different segments of the business are performing. The exact content of these conversations is strictly confidential. Confidentiality is protected by ensuring that only the small team of economists working on the survey have access to information identifying individual companies. Any reporting of findings is anonymised so that no figure or statement can be attributed to an individual person or company.

For efficiency and tractability reasons, the companies contacted regularly are generally large entities, most of which have operations spanning the euro area or large parts of it. Many are also active globally. This makes it possible to obtain insights with broad sectoral and geographical coverage from a relatively small number of conversations. Contacts are maintained, as far as possible, with companies active across the entire private non-financial corporate sector. The aim of the conversations is to understand developments at the sectoral level. However, the insights from a conversation are not only limited to the sectors in which the company operates. A company active in one sector will typically have information that aids understanding of developments in other sectors, as its customers and suppliers may operate in different sectors. Piecing together information received from contacts in different sectors and considering the interlinkages between them helps foster an understanding of developments across the economy as a whole.

The ECB’s dialogue with non-financial companies is similar to the business intelligence gathering activities of other central banks. Table 1 provides an overview of some of the more well-known business intelligence gathering exercises carried out by other central banks outside the euro area. In comparative terms, the ECB’s dialogue is small in size, as measured by the number of companies contacted, but the quarterly frequency of its regular contacts has also been adopted by other central banks. An important difference is that the ECB’s contacts are based on telephone conversations, whereas most other central banks maintain contacts through regional agents who carry out on-site, face-to-face interviews. However, the Riksbank’s Business Survey quite closely resembles the approach of the ECB in that Sveriges Riksbank economists carry out interviews with a relatively small number of large companies.

Contacts with businesses are particularly helpful to understand and anticipate sectoral developments that might otherwise be poorly understood. A good example of this was when activity in the automotive industry was affected in autumn 2018 by the introduction of new testing standards (the Worldwide Harmonised Light Vehicle Test Procedure). This resulted in a lull in car production large enough to cause a marked slowdown in GDP growth. The effect of these new standards on economic activity was not well captured by the PMI Survey or the European Commission Business Survey, but was flagged some months in advance by contacts in the automotive sector. More generally, business contacts tend to be particularly helpful for understanding the extent to which developments in a particular sector or geographical area are affected by regulatory changes, natural or man-made disasters, protests, strikes or unusual holiday patterns, among other things. This, in turn, helps economists to judge whether movements in economic data are likely to be temporary or longer lasting.

Table 1

Qualitative business intelligence gathering carried out by selected central banks

How the ECB’s contacts with companies compare with those of other central banks

Sources: With the exception of the information about the ECB, the descriptions are based on information provided on the websites of the respective central banks.

Developments during the COVID-19 pandemic have underscored the importance of maintaining contacts with businesses. Many of the companies with which contacts are maintained have operations throughout the world, including in China. Therefore, at the time when the impact of the virus was not yet apparent in Europe, ECB economists were able to talk to directly affected companies about the implications for global supply chains. When the pandemic spread to Europe it was possible to discuss how and to what extent production was likely to be affected. As the extreme conditions disrupted the usual statistical relationship between survey indicators and GDP, contacts with businesses helped economists fill the gap and quickly gauge in broad, but still reasonably accurate, terms the extent to which activity had contracted in April and how quickly it rebounded in May and June.

3 How the ECB’s contacts with non-financial companies are organised

The ECB seeks to maintain contacts with up to around 150 leading companies and to have conversations with somewhere between 50 and 70 of these companies each quarter. The frequency of contacts with a company varies depending on the focus and breadth of the company’s activities and, crucially, the availability of the contacts during the survey period. The ECB’s contacts in these companies are mostly at management board level. Rounds of calls take place over a period of one to two weeks, usually in early January, April, July and October, so that the findings can feed into the preparation of Governing Council meetings later in those months. Conversations usually focus on developments in the immediately preceding quarter and the outlook for the current quarter and beyond. Contacts on a smaller scale may also be arranged at other times if there is a particular need.

Chart 1

Distribution of participating companies across broad economic sectors

(share of total companies)

Notes: The chart shows the distribution across sectors of companies contacted during 2020. The allocation to sectors refers to the organisation of the survey and not to sectors for statistical classification purposes. Many companies operate in more than one sector (e.g. consumer goods manufacturers may also have retail outlets).

Sectoral coverage is broad, albeit with some overweighting of manufacturing. The average sectoral breakdown of participating companies in 2020 is shown in Chart 1. Compared with the actual structure of the economy, there is a slight over‑representation of manufacturing and an under-representation of parts of the services sector. This largely reflects the nature and organisation of these sectors. In manufacturing, there are many large companies operating across jurisdictions, whereas the services sector is characterised by greater segmentation across national markets and a predominance of smaller firms. Such “bias” is therefore hard to avoid and is also a typical characteristic of business surveys more generally.

Conversations are guided by questions covering activity, prices and employment. The telephone conversations typically last around 20-30 minutes and are based on a questionnaire, which is largely unchanged from one round to the next. Specifically, there are four regular questions.

- How has euro area activity (for instance, output, sales, deliveries, orders...) evolved in recent months in your sector, and what do you expect to happen in the near term? What are the main factors underlying this assessment?

- How have prices in your sector evolved in recent months, and what do you expect to happen in the near term? What are the main reasons behind these developments (for example, input costs, competitive pressures, etc.)? In particular, what is your assessment of labour cost pressures?

- Please comment on recent and expected future employment developments in your sector. What are the main issues affecting employment in your sector at the present time?

- Are there any other issues you would like to flag to the ECB’s policymakers?

The last question offers an opportunity for our contacts to raise awareness of issues that may be of concern to them, relating, for example, to the functioning of financial markets, the effects of the ECB’s policy or broader economic policies. This helps to inform the ECB’s decisions and its dialogue with other EU and international policy institutions and social partners.

Box 1

Main findings from the ECB’s contacts with non-financial companies (January 2021)

This box summarises the results of contacts between ECB staff and representatives of leading non-financial companies operating in the euro area. The exchanges took place between 4 and 11 January 2021.

Contacts reported very divergent trends in the fourth quarter of 2020 in the context of the second wave of the coronavirus (COVID-19) pandemic, but on the whole activity was more resilient than it had been in the spring.

As in previous quarters, during the final quarter of 2020 lockdown restrictions and consequent changes in spending patterns reduced demand for certain goods and services while increasing it for others. This was true not only across different sectors of activity, but also within sectors and, quite often, within different segments of the same business. However, the second wave of the pandemic and the associated lockdowns were having less impact on most businesses than the first wave. Where permitted by regulation, businesses were better able to maintain production (through testing, screening and home working), while consumers had become increasingly familiar with online sales platforms. Export-oriented industries benefited from growth in parts of the world where the virus was less prevalent.

Much of the manufacturing sector experienced a continued recovery in demand, and constraints on production were tilting increasingly to the supply side.

Contacts in industries such as steel, chemicals, automotive and electronics all reported expanding production, sales and orders, recovering towards – or in some cases exceeding – pre-pandemic levels. At the start of the pandemic, businesses had reduced working capital to preserve liquidity. As the recovery in demand for manufactured goods had been stronger than expected since then, both globally and in Europe, restocking and very robust demand for consumer durables were generating strong demand for many intermediate and short-cycle capital goods. Several contacts in these industries said that their businesses were now operating at, or close to, full capacity and/or that limits to production were now primarily on the supply side. This reflected global demand and supply conditions as well as some bottlenecks in transport and logistics.

By contrast, renewed lockdowns were causing further significant declines in sales of personal goods, as well as in travel, tourism, and entertainment services.

For most retailers, booming online sales could not compensate for the periodic closure of brick-and-mortar outlets. This particularly affected manufacturers and retailers of clothes and other personal accessories, as their sales depend on customers being able to try on items. Underlying demand also suffered from the lack of need for business, social event or holiday attire. Following a very limited recovery in the summer, tourism and travel contracted again after many countries reinstated travel restrictions from late-August onwards. The entertainment industry was again hit by closures of theatres from October. By contrast, many other business and consumer services recorded quite normal levels and/or growth in activity.

Little change was expected for the first quarter of 2021, but latent demand for services could give rise to a substantial recovery and to changes in consumption patterns later in the year.

With vaccines being rolled out, there was hope for a significant lifting of pandemic-related restrictions but also uncertainty as to whether this would take place in the second quarter or later on in the year. Contacts in the travel industry were confident of seeing decent demand for travel and tourism services once restrictions are lifted. Clothes retailers and manufacturers were also hopeful about a pick-up in demand after Easter. Conversely, there could be some softening of demand for (other) manufactured goods. The spread of the pandemic and roll-out of vaccines in recent weeks had broadly offsetting effects in terms of the outlook for 2021 overall, while high levels of debt and the need for fiscal retrenchment at some point weighed on the outlook in the medium term.

Adjustments in hours, agency staff and take-up of short-time work schemes were used to adapt labour inputs in the short-term, while permanent employment continued to decline in most companies.

Employment placement agencies observed an uptick in activity in the fourth quarter of 2020 relative to the third quarter, but it was still well below the levels seen a year earlier. The strongest growth segments were logistics, transportation and delivery services, driven by e-commerce. Looking beyond short-term fluctuations, for most companies the downward revision to sales forecasts caused by the pandemic, coupled with productivity gains, implied a downward trend in headcount. For the most part, this could be realised through voluntary redundancy and early retirement. Some contacts saw more scope for recruitment later in the year when, for example, new investment projects would be launched.

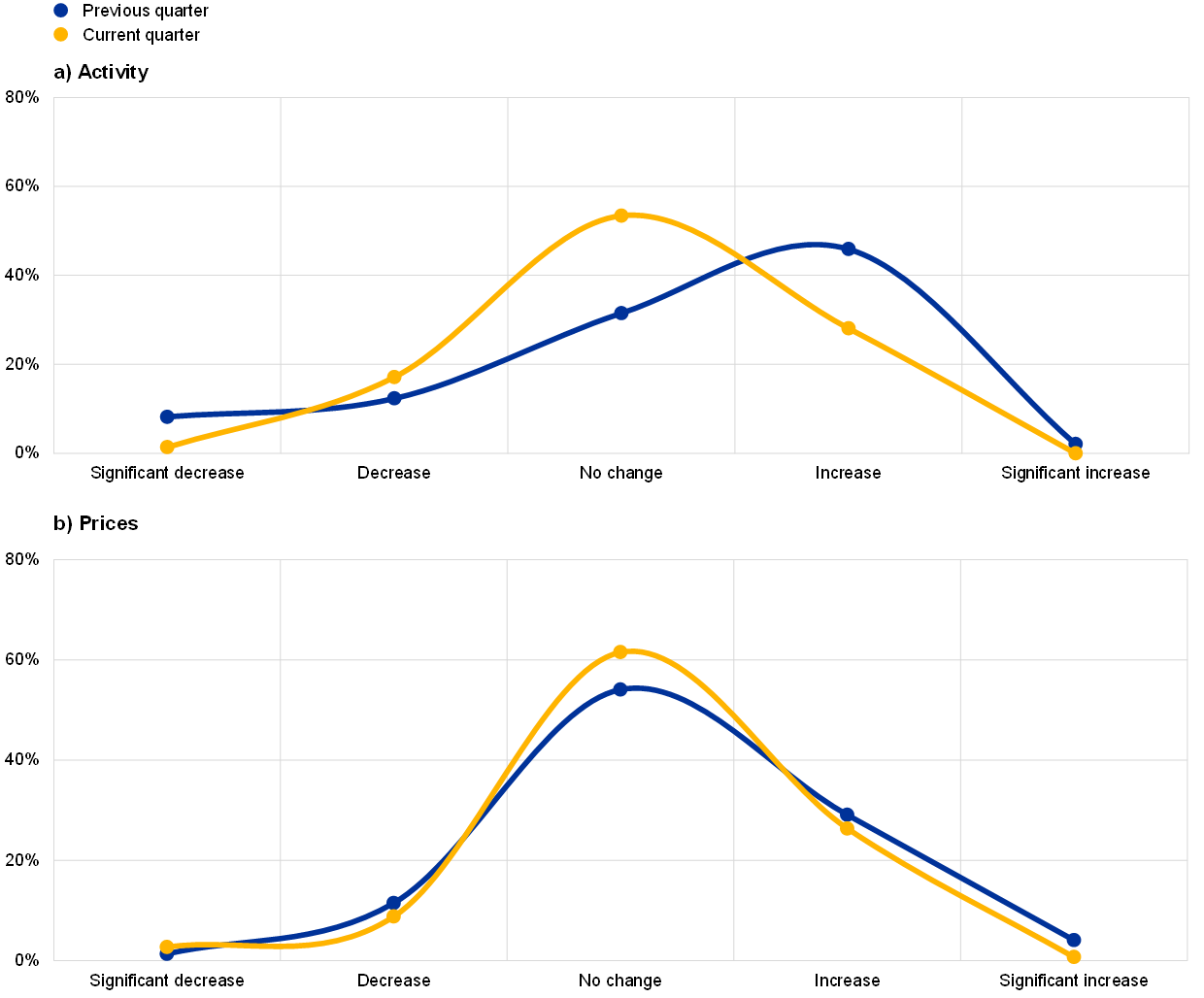

Chart A

Summary of contacts’ views on developments in and the outlook for activity and prices

(percentage of respondents)

Source: ECB.

Notes: The scores for the previous quarter reflect the ECB staff assessment of what contacts said about activity (sales, production, orders) and prices in the fourth quarter of 2020. The scores for the current quarter reflect the assessment of what contacts said about the outlook for activity and prices in the first quarter of 2021.

Following downward pricing pressures during the early phase of the pandemic, the pricing environment in many sectors was gradually improving.

In much of the manufacturing sector the recovery in demand coupled with some initial pass-through from recently rising raw material costs had led companies to raise their prices and/or anticipate further, albeit generally modest, increases in the first quarter of 2021. However, this development tended to be concentrated upstream rather than in final consumer prices. For the most part, consumer goods manufacturers, retailers and business services providers described their pricing environment as stable. The relative strength in demand for consumer goods had to some extent eroded earlier fears of heavy discounting. Moreover, even in sectors acutely affected by the pandemic, price discounting was somewhat limited, as consumers’ spending decisions were driven more by regulatory and safety considerations than by prices.

Input prices were mostly described as increasing, driven by raw materials and transport and logistics costs, while the wage outlook remained moderate.

In the wake of the recovery of global manufacturing, the prices of most raw materials had continued to rise in recent months and in some cases had already reached very high levels. Depending on contract structures and hedging practices, this was either already feeding into actual costs or would do so during 2021. Transport costs (in particular sea and air freight rates) were widely cited as having risen significantly, while businesses also faced increased costs from the implementation of COVID-19-related safety measures. Most contacts described wage developments as moderate, as in many sectors there was greater than usual emphasis on job preservation. The continued availability of short-time work schemes helped transform usually fixed labour costs into variable ones.

- The NFBD is one of three high-level dialogues. The others are the Banking Industry Dialogue and the Institutional Investor Dialogue. The agendas and summaries of NFBD meetings can be found on the ECB’s website.

- See the box entitled “The long-term effects of the pandemic: insights from a survey of leading companies”, Economic Bulletin, Issue 8, ECB, 2020.

- A closed question means that respondents are given a menu of options from which to choose in order to indicate the direction of movement of a particular variable over a given reference period. Unless otherwise provided for, a closed question does not allow subsequent clarification.