- PRESS RELEASE

Euro area monthly balance of payments: November 2022

19 January 2023

- Current account recorded €14 billion surplus in November 2022, following a €1 billion deficit in previous month

- Current account recorded a deficit of €111 billion (0.8% of euro area GDP) in 12 months to November 2022, after a surplus of €305 billion (2.5%) one year earlier

- In financial account, euro area residents’ net sales of non-euro area portfolio investment securities totalled €240 billion and non-residents’ net acquisitions of euro area portfolio investment securities totalled €79 billion in 12 months to November 2022

Chart 1

Euro area current account balance

(EUR billions unless otherwise indicated; working day and seasonally adjusted data)

Source: ECB.

The current account of the euro area recorded a surplus of €14 billion in November 2022, following a deficit of €1 billion in the previous month (Chart 1 and Table 1). Surpluses were recorded for services (€18 billion), goods (€7 billion) and primary income (€3 billion). These were partly offset by a deficit for secondary income (€15 billion).

Table 1

Current account of the euro area

(EUR billions unless otherwise indicated; transactions; working day and seasonally adjusted data)

Source: ECB.

Note: Discrepancies between totals and their components may be due to rounding.

In the 12 months to November 2022, the current account recorded a deficit of €111 billion (0.8% of euro area GDP), compared with a surplus of €305 billion (2.5% of euro area GDP) in the 12 months to November 2021. This change in the balance was largely driven by a switch from a surplus (€318 billion) to a deficit (€63 billion) for goods and, to a lesser extent, by a reduction in the surplus for primary income (down from €61 billion to €9 billion) and a slightly larger deficit for secondary income (up from €162 billion to €167 billion). These developments were partly offset by a larger surplus for services (up from €87 billion to €110 billion).

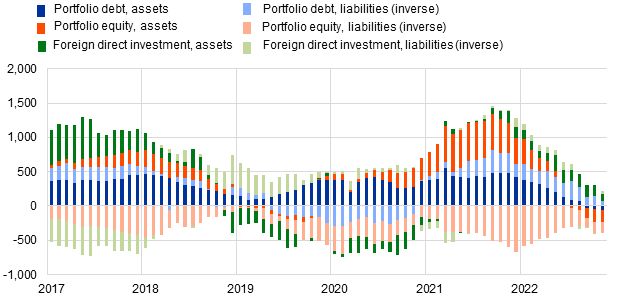

Chart 2

Selected items of the euro area financial account

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: For assets, a positive (negative) number indicates net purchases (sales) of non-euro area instruments by euro area investors. For liabilities, a positive (negative) number indicates net sales (purchases) of euro area instruments by non-euro area investors.

In direct investment, euro area residents made net investments of €107 billion in non-euro area assets in the 12-month period to November 2022, down from €169 billion in the 12 months to November 2021 (Chart 2 and Table 2). Non-residents disinvested €37 billion in net terms from euro area assets in the 12-month period to November 2022, following net disinvestments of €25 billion in the 12 months to November 2021.

In portfolio investment, euro area residents’ net sales of non-euro area equity amounted to €188 billion in the 12 months to November 2022, following net purchases of €431 billion in the 12 months to November 2021. Over the same period, euro area residents’ net sales of non-euro area debt securities amounted to €52 billion, following net purchases of €483 billion in the 12 months to November 2021. Non-residents’ net purchases of euro area equity decreased to €151 billion in the 12-month period to November 2022, down from €600 billion in the 12 months to November 2021. Over the same period, non-residents made net sales of euro area debt securities amounting to €71 billion, decreasing from €294 billion in the 12 months to November 2021.

Table 2

Financial account of the euro area

(EUR billions unless otherwise indicated; transactions; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: Decreases in assets and liabilities are shown with a minus sign. Net financial derivatives are reported under assets. “MFIs” stands for monetary financial institutions. Discrepancies between totals and their components may be due to rounding.

In other investment, euro area residents increased the net acquisitions of non-euro area assets to €271 billion in the 12 months to November 2022 (up from €217 billion in the 12 months to November 2021), while their net incurrence of liabilities decreased to €208 billion (down from €814 billion in the 12 months to November 2021).

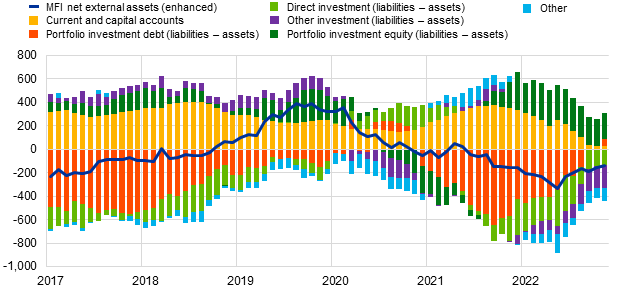

Chart 3

Monetary presentation of the balance of payments

(EUR billions; 12-month cumulated data)

Source: ECB.

Notes: “MFI net external assets (enhanced)” incorporates an adjustment to the MFI net external assets (as reported in the consolidated MFI balance sheet items statistics) based on information on MFI long-term liabilities held by non-residents, available in b.o.p. statistics. B.o.p. transactions refer only to transactions of non-MFI residents of the euro area. Financial transactions are shown as liabilities net of assets. “Other” includes financial derivatives and statistical discrepancies.

The monetary presentation of the balance of payments (Chart 3) shows that the net external assets (enhanced) of euro area MFIs decreased by €134 billion in the 12-month period to November 2022. This decrease was driven by euro area non-MFIs’ net outflows in other investment, direct investment and other flows. These developments were partly offset by euro area non-MFIs’ net inflows in portfolio investment equity and portfolio investment debt and, to a lesser extent, by the current and capital accounts surplus.

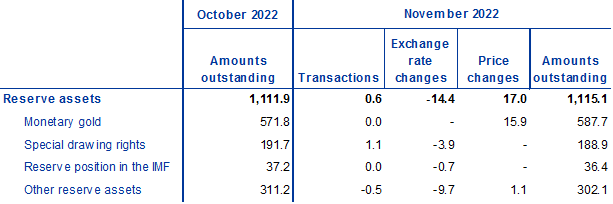

In November 2022 the Eurosystem’s stock of reserve assets increased to €1,115.1 billion, up from €1,111.9 billion in the previous month (Table 3). This increase was driven by positive price changes (€17.0 billion) – largely due to monetary gold price developments – and, to a lesser extent, by net acquisitions of assets (€0.6 billion), which were partly offset by negative exchange rate changes (€14.4 billion).

Table 3

Reserve assets of the euro area

(EUR billions; amounts outstanding at the end of the period, flows during the period; non-working day and non-seasonally adjusted data)

Source: ECB.

Notes: “Other reserve assets” comprises currency and deposits, securities, financial derivatives (net) and other claims. Discrepancies between totals and their components may be due to rounding.

Data revisions

This press release incorporates revisions to the data for October 2022. These revisions did not significantly alter the figures previously published.

Next releases:

- Monthly balance of payments: 17 February 2023 (reference data up to December 2022)

- Quarterly balance of payments and international investment position: 5 April 2023 (reference data up to the fourth quarter of 2022)

For media queries, please contact Philippe Rispal, tel.: +49 69 1344 5482.

Notes

- Current account data are always seasonally and working day-adjusted, unless otherwise indicated, whereas capital and financial account data are neither seasonally nor working day-adjusted.

- Hyperlinks in this press release lead to data that may change with subsequent releases as a result of revisions.

- Balance of payment statistics are now realised using a new dataset (BPS), which includes an additional 17th dimension in its data structure definition to specify the type of resident entity. The previous dataset (BP6) will still be updated in parallel until mid-March 2023.

European Central Bank

Directorate General Communications

- Sonnemannstrasse 20

- 60314 Frankfurt am Main, Germany

- +49 69 1344 7455

- media@ecb.europa.eu

Reproduction is permitted provided that the source is acknowledged.

Media contacts